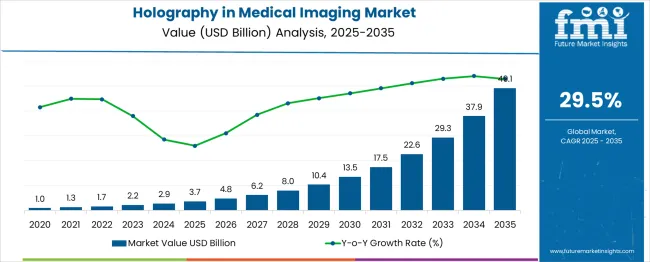

The holography in medical imaging market is projected to expand from USD 3.7 billion in 2025 to USD 49.1 billion by 2035, at a CAGR of 29.5%. Year-on-year growth rises consistently, from USD 1.1 billion in 2026 to USD 6.7 billion by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.7 billion |

| Industry Value (2035F) | USD 49.1 billion |

| CAGR (2025 to 2035) | 29.5% |

This trajectory reflects the compounding effect of increased adoption across clinical diagnostics, surgical pre-planning, and academic training. Key drivers include the application of 3D anatomical modeling, neurosurgical visualization, and high-resolution imaging tools.

Post-2029, growth accelerates further due to declining hardware costs and expanded clinical acceptance. Suppliers that establish early compatibility with radiology platforms and surgical workflow tools are positioned to command substantial revenue share throughout the decade.

On March 7, 2024, Christian Zapf, Head of Digital and Automation at Siemens Healthineers, stated: “Cinematic Reality gives people the opportunity to immerse themselves in a world of photorealistic renderings of the human anatomy.

Apple Vision Pro perfectly presents that three-dimensional experience, combined with great flexibility and standalone use. We see great potential for the technology for clinical as well as educational purposes.”

Holography in medical imaging currently holds a modest share across its parent markets. Within the USD 41.6 billion global medical imaging sector, its share stands at approximately 2-3%, reflecting early-stage clinical adoption. In the broader holographic imaging industry, medical use cases account for nearly 15-20% of total market value.

The biomedical research and diagnostics tools market, valued in tens of billions, sees less than 1% contribution from holographic systems due to limited integration. In medical education and training technologies, holography commands a stronger 20-30% share, driven by immersive simulation tools. In surgical planning and navigation platforms, holography accounts for 5-10%, supporting real-time 3D visualization in preoperative and intraoperative workflows. Growth remains high despite current niche positioning.

The market has been segmented by product, imaging modality, application, and region. Product types include holographic displays, holography microscopes, and holographic prints. Imaging modalities cover computed tomography (CT), ultrasound, X-ray, and magnetic resonance imaging (MRI).

Applications span medical imaging, medical education, and biomedical research. The regional segmentation includes North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, where adoption rates vary based on reimbursement models, diagnostic infrastructure, and academic investment in imaging technologies.

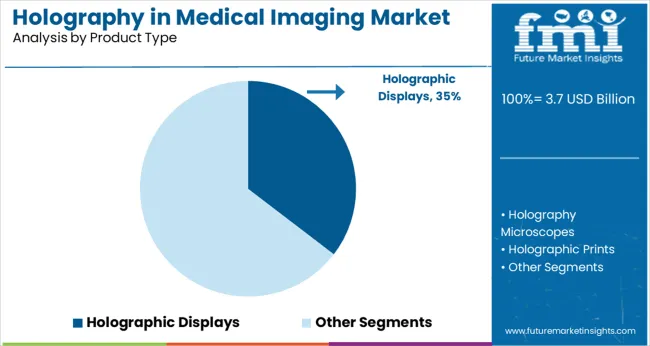

Holographic displays are projected to retain dominance across the medical holography sector, beginning with a 35% share in 2025. Between 2025 and 2027, adoption is driven by academic imaging labs and neurosurgical simulators integrating light field-based visualization.

By 2028, increased precision in digital anatomy renders 3D volumetric imaging standard in radiology training. From 2029 to 2031, cost reductions in AR-compatible holographic panels expand use in secondary hospitals. Between 2032 and 2035, real-time teleholography gains traction in diagnostics, boosting demand for larger-format displays.

Despite competition from holography software, displays maintain over 33% share in 2035, driven by their critical role in physical simulation, surgical planning, and multi-angle visualization in clinical workflows and educational settings.

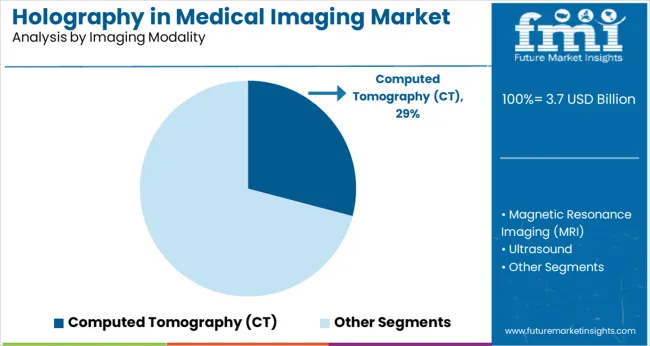

Computed tomography leads imaging modalities in the medical holography segment with a 29.1% share in 2025. From 2025 to 2027, holographic reconstruction from CT slices becomes routine in trauma centers and oncology wards, driven by integration with volumetric rendering platforms. Between 2028 and 2030, multislice CT-based holography enhances cardiac and spinal surgery preplanning, particularly in tertiary hospitals.

Cost-per-scan efficiencies and improved spatial resolution fuel expansion across diagnostic hubs by 2031. From 2032 to 2035, CT-based holography is deployed for remote diagnostics in military and field hospitals, supporting its leadership. Despite MRI and PET gaining ground for soft-tissue contrast, CT remains preferred for bone and structural mapping across clinical, educational, and interventional domains.

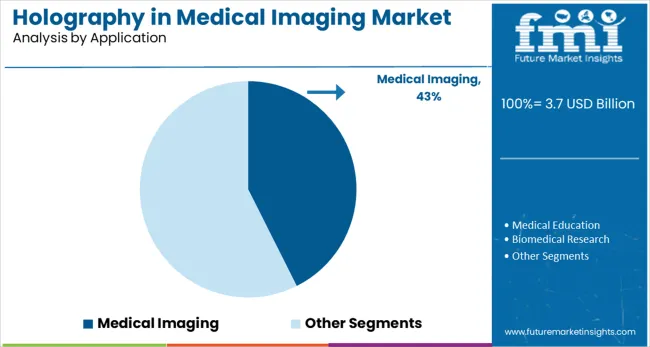

Medical imaging holds the top application share at 43% in 2025, reflecting its role as the principal driver of holography adoption in healthcare. Between 2025 and 2027, integration with radiology workstations supports 3D visualization of tumors, vascular malformations, and orthopedic structures. From 2028 to 2030, hospitals increasingly deploy holographic platforms in pre-surgical planning for neurology and cardiology.

Advancements in holographic segmentation and PACS compatibility further boost diagnostic utility. By 2031, portable holography units enter emergency care, expanding access to spatial visualization in trauma cases. Between 2032 and 2035, real-time imaging overlays using intraoperative scans reinforce usage across surgical suites. Medical imaging stands the largest share due to its cross-specialty relevance and procedural decision-making value.

The industry is undergoing transformation as advanced visualization techniques improve diagnostic clarity, surgical accuracy, and medical education. Holography’s adoption is supported by institutional funding and digital health convergence, but its expansion is limited by high system costs, technical complexity, and infrastructure gaps.

High-Fidelity Visualization Enhancing Clinical Precision

Demand for real-time, non-invasive 3D imaging has strengthened the case for holography across surgical planning, diagnostics, and anatomical education. The technology improves depth perception, spatial orientation, and remote collaboration. Integration with AR/VR systems has enabled holographic workflows in cardiology, neurology, and oncology.

Infrastructure Costs and Workflow Integration Remain Barriers

Widespread deployment has been slowed by the capital investment required for holography hardware and computing infrastructure. Limited compatibility with PACS/RIS systems and lack of reimbursement frameworks impede hospital-level integration. Regulations governing 3D imaging devices differ by region, delaying clearances.

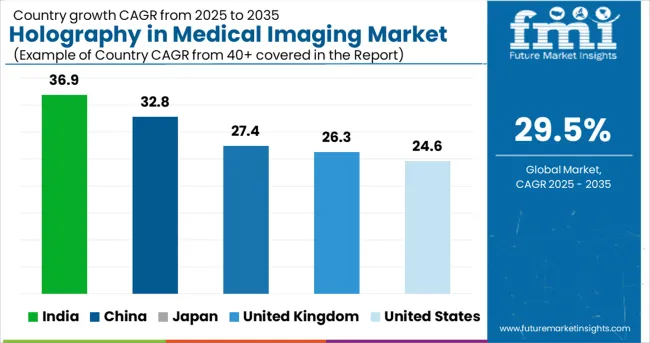

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 24.6% |

| United Kingdom | 26.3% |

| India | 36.9% |

| China | 32.8% |

| Japan | 27.4% |

The global CAGR for holography in medical imaging is projected at 29.5% from 2025 to 2035. India leads at 36.9%, followed by China at 32.8%, both exceeding the global trend due to aggressive medtech scaling, public-private R&D support, and surgical visualization demand. Japan records 27.4%, while the United Kingdom and United States trail at 26.3% and 24.6% respectively.

In India, tertiary care networks and training hospitals are deploying holographic systems for preoperative planning. China is advancing rapidly with AI-linked holography across orthopedics and neurology. USA adoption remains fragmented due to FDA bottlenecks and reimbursement gaps. The United Kingdom and Japan are gradually adopting solutions through institutional pilots and specialist centers.

These five countries serve as benchmarks within the 40+ nations analyzed.

From 2025 to 2035, the holography in medical imaging market in the United States is expected to grow at a CAGR of 24.6%. Broader integration into neurosurgery, interventional cardiology, and remote diagnostics is anticipated. AI-driven platforms and modular holographic units are being embedded into surgical planning systems.

FDA guidance has streamlined device approvals, encouraging clinical adoption. During 2020 to 2024, use was limited to academic pilots and niche radiology centers. Hospitals began testing 3D visualization tools, but large-scale deployment had not occurred. Limited reimbursement and uncertain regulatory classification previously slowed growth.

The United Kingdom market is forecast to grow at a CAGR of 26.3% between 2025 and 2035. NHS digital initiatives and MHRA innovation pathways are driving widespread holography deployment across teaching hospitals. Surgical training, robotic surgery support, and preoperative visualization will dominate clinical applications.

Between 2020 and 2024, usage was limited to research institutions and under 10 NHS trusts. Adoption was experimental, with early trials focusing on static 3D modeling. UKRI increased grant funding post-2021, leading to operational expansion. Clinical validation and trust-level funding approvals became common only after 2022.

India is projected to experience 36.9% CAGR between 2025 and 2035 in its holography in medical imaging industry. Implementation is being led by private hospital chains, metro diagnostic centers, and national medical institutions. Oncology and neurology departments are incorporating holography for treatment planning and education.

From 2020 to 2024, the technology was largely absent from medical infrastructure, with limited exposure outside conferences and feasibility studies. AIIMS and leading multispecialty hospitals began pilot programs only in 2023. State-backed initiatives and capacity-building efforts have since emerged.

China is forecast to register 32.8% CAGR between 2025 and 2035. National innovation programs are scaling holography across provincial hospitals, simulation centers, and trauma units. Integration with surgical robotics and AI diagnostics has been prioritized under Med-Innovate 2025.

Between 2020 and 2024, deployment was restricted to tier-one academic and military-linked institutions. Usage remained research-focused, with clinical evaluations limited by infrastructure gaps and procurement delays. Subsidies and regulatory acceleration have since been introduced to stimulate provincial expansion.

Japan is expected to witness a 27.4% CAGR between 2025 and 2035 for holography in medical imaging. Cardiovascular and orthopedic surgical departments are integrating 3D holography into procedural planning. MHLW has supported pilot reimbursement and curriculum integration across teaching hospitals.

During 2020 to 2024, Japan remained focused on foundational research and limited educational use. Medical universities trialed static 3D modeling tools but avoided clinical transition due to cost and lack of training protocols. The shift began only after 2023 with MHLW policy updates.

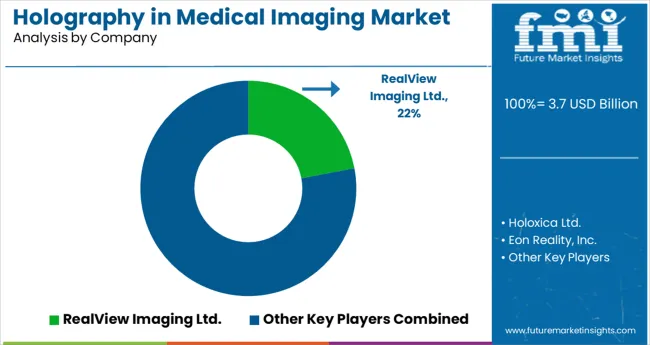

The landscape of the holography in medical imaging market is defined by companies advancing clinical-grade 3D visualization, holographic diagnostics, and simulation-based medical education.RealView Imaging leads with its Holoscope-i system, offering real-time 3D holography for interventional procedures.

EchoPixel’s FDA-cleared True 3D platform supports radiology and surgical planning, while Holoxica focuses on neurological and cardiac holograms. Nanolive SA specializes in live-cell holographic microscopy for biomedical research. Eon Reality and zSpace supply educational holographic tools, widely adopted in anatomy and medical training programs.

Firms like Holografika, Looking Glass Factory, and Leia Inc. drive advancements in light field and autostereoscopic displays for surgical and diagnostic imaging. Mach7 Technologies, while primarily an enterprise imaging platform provider, is positioned to integrate holographic workflows. These companies collectively influence innovation, adoption, and commercialization across education, diagnostics, and clinical visualization.

Leading Company - RealView Imaging Ltd.Industry Share - 22%

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.7 billion |

| Projected Market Size (2035) | USD 49.1 billion |

| CAGR (2025 to 2035) | 29.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand installations for volume |

| Product Types Analyzed (Segment 1) | Holographic Displays, Holography Microscopes, Holographic Prints, Holography Software, Holoscopes |

| Imagin g Modalities Analyzed (Segment 2) | Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, X-ray, Others |

| Applications Analyzed (Segment 3) | Medical Imaging, Ophthalmology, Dentistry, Urology, Otology, Orthopedics, Other Medical Imaging Applications, Medical Education, Biomedical Research |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | RealView Imaging Ltd., Holoxica Ltd., Eon Reality, Inc., EchoPixel Inc., zSpace, Inc., Holografika Kft., Nanolive SA, Looking Glass Factory, Inc., Leia Inc., Mach7 Technologies Ltd. |

| Additional Attributes | Dollar sales, share by product and imaging modality, real-time 3D visualization demand, use in surgical planning and medical education, AI integration in diagnostic platforms, expansion of immersive imaging in clinical settings |

This includes Holographic Displays, Holography Microscopes, Holographic Prints, Holography Software, and Holoscopes.

This includes Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, X-ray, and Others.

The segment covers Medical Imaging, Ophthalmology, Dentistry, Urology, Otology, Orthopedics, Other Medical Imaging Applications, Medical Education, and Biomedical Research.

Regional analysis includes North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The industry is projected to reach USD 3.7 billion in 2025.

The industry is expected to grow at a CAGR of 29.5% from 2025 to 2035.

Medical imaging is expected to capture 43% of the market share in 2025.

India is projected to lead with a CAGR of 36.9% from 2025 to 2035.

The industry is projected to reach USD 49.1 billion by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Holography Market Size and Share Forecast Outlook 2025 to 2035

Medical Holography Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Intensity Microphone Market Size and Share Forecast Outlook 2025 to 2035

Inflatable U Shaped Travel Pillow Market Size and Share Forecast Outlook 2025 to 2035

Induction Brazing Services Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Integrated Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Incline Impact Tester Market Size and Share Forecast Outlook 2025 to 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Internal Anthelmintics for Cats Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Cobalt Blue Pigments Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA