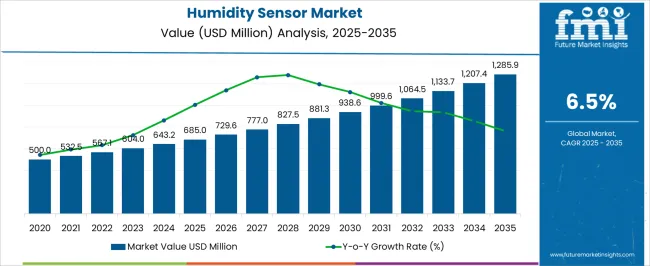

The Humidity Sensor Market is estimated to be valued at USD 685.0 million in 2025 and is projected to reach USD 1285.9 million by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. The humidity sensor market is projected to generate an absolute dollar opportunity of USD 600.9 million over the forecast period. This growth reflects a multiplier of 1.88x, supported by a steady CAGR of 6.5%, driven by increasing demand for environmental monitoring in HVAC systems, manufacturing processes, and agricultural applications.

In the first five-year phase (2025 to 2030), the market is expected to reach approximately USD 950 million, adding USD 265 million, which accounts for 44.1% of the total incremental growth, driven by increased adoption in smart buildings and industrial applications.

The second phase (2030 to 2035) contributes USD 335.9 million, representing 55.9% of incremental growth, signaling steady growth driven by innovations in IoT-enabled devices and the increasing integration of humidity sensors in consumer electronics, automotive, and healthcare sectors. Annual increments will rise from USD 52 million in the early years to nearly USD 67 million by 2035, as demand increases in emerging markets. Manufacturers focusing on low-power sensors, smart sensor technologies, and integration with digital systems will capture the largest share of this USD 600.9 million opportunity, particularly in Asia-Pacific and Europe.

| Metric | Value |

|---|---|

| Humidity Sensor Market Estimated Value in (2025 E) | USD 685.0 million |

| Humidity Sensor Market Forecast Value in (2035 F) | USD 1285.9 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The humidity sensor market is witnessing accelerated adoption, driven by increasing demand for precise environmental monitoring across automotive, industrial, and consumer electronics sectors. Growing integration of HVAC systems, air quality monitors, and smart home devices has intensified the need for compact and reliable humidity sensing solutions.

Advancements in MEMS technology, improved calibration standards, and miniaturization have enabled cost-effective deployment across mass-market applications. Industry regulations focused on emissions, safety, and energy efficiency have further strengthened market fundamentals, especially in transportation and industrial automation.

The rise in electric vehicles, smart farming, and health-focused wearables is expected to create new avenues for sensor manufacturers, with real-time data accuracy and digital connectivity emerging as key differentiators.

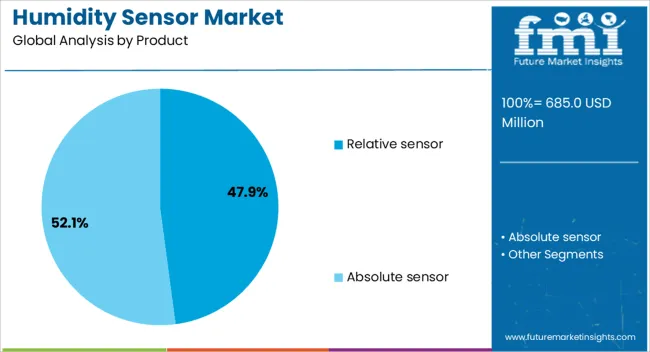

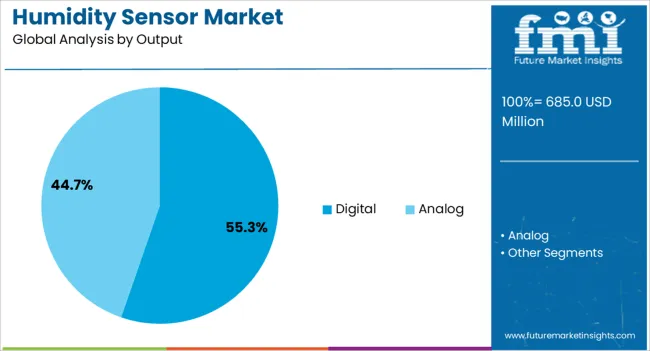

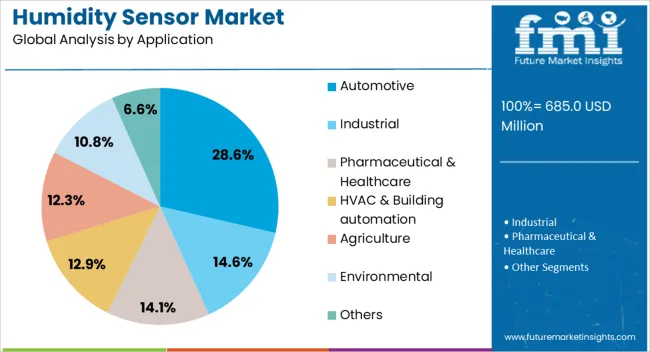

The humidity sensor market is segmented by product, output, application, and geographic regions. By product, the humidity sensor market is divided into Relative sensors and Absolute sensors. The output of the humidity sensor market is classified into Digital and Analog. Based on the application, the humidity sensor market is segmented into Automotive, Industrial, Pharmaceutical & Healthcare, HVAC & Building automation, Agriculture, Environmental, and Others. Regionally, the humidity sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Relative humidity sensors are projected to dominate with a 47.9% revenue share in 2025, positioning them as the leading product type. This leadership is being attributed to their widespread suitability for diverse applications, including climate control, weather monitoring, and industrial automation.

The segment has benefited from improvements in polymer-based capacitive sensing elements that allow for high accuracy and fast response times. Lower production costs, combined with ease of integration into electronic control units, have expanded their adoption across both consumer and industrial environments.

Their non-intrusive sensing method and long operational lifespan further support their deployment in systems that require stable, continuous performance with minimal recalibration.

Digital output humidity sensors are anticipated to hold a 55.3% market share in 2025, establishing themselves as the dominant output type. This trend is being driven by the rapid shift toward digitally connected ecosystems in both consumer and industrial settings.

The segment’s rise is supported by the demand for high-resolution data acquisition and seamless microcontroller interfacing, which are essential for real-time monitoring applications. Digital sensors offer advantages such as noise immunity, simplified circuit design, and enhanced compatibility with IoT and embedded systems.

Additionally, they facilitate predictive analytics by integrating with cloud platforms, making them ideal for smart building management, HVAC optimization, and connected automotive systems.

The automotive sector is expected to contribute 28.6% of the overall revenue share in 2025, making it the leading application area for humidity sensors. The integration of cabin climate control, defogging systems, battery management units, and air quality modules within modern vehicles is propelling this growth.

Regulatory emphasis on occupant comfort, emission reduction, and electrical component safety has increased the reliance on precise humidity-sensing technologies. Advanced driver assistance systems and EV thermal management architectures are further accelerating adoption.

The need for rugged, compact sensors that maintain performance across temperature and humidity extremes has positioned automotive applications as a critical revenue-generating segment for sensor manufacturers.

The humidity sensor market is experiencing significant growth due to increasing demand in industrial, consumer electronics, and automotive sectors. In 2024 and 2025, growth drivers include the need for precise environmental control and automation. Opportunities are emerging in the development of compact, cost-effective sensors for IoT applications. Emerging trends focus on wireless and smart humidity sensors for smart home and industrial applications. However, high costs and limited awareness in some regions act as restraints, hindering market penetration.

The major growth driver for the humidity sensor market is the increasing demand for precise environmental control in various industries. In 2024, industries such as pharmaceuticals, agriculture, and manufacturing required accurate humidity levels for product quality and process optimization. Additionally, the automotive sector utilized humidity sensors to enhance passenger comfort and safety. As more industries adopt automation and precision-driven technologies, the demand for advanced humidity sensors is expected to continue growing.

Opportunities in the market lie in the development of compact and cost-effective humidity sensors for Internet of Things (IoT) applications. In 2025, the rapid expansion of smart homes and IoT devices provided a significant market for small, efficient humidity sensors that can easily integrate with connected devices. These sensors not only ensure a comfortable living environment but also play a key role in energy efficiency. The growing use of wireless humidity sensors in residential and commercial buildings offers major opportunities for sensor manufacturers.

Emerging trends in the humidity sensor market include the increasing popularity of wireless and smart humidity sensors. In 2024, sensors with wireless capabilities gained traction in smart homes and industrial automation, offering users more flexibility and control. These sensors, integrated with home automation systems or industrial equipment, enabled real-time monitoring and predictive maintenance. The trend of making sensors more adaptable and accessible, particularly through mobile and cloud connectivity, will likely continue to drive market growth and innovation.

The key market restraints include high costs and limited awareness in some regions. In 2024 and 2025, the high manufacturing costs of advanced humidity sensors, particularly for IoT-enabled systems, hindered their widespread adoption in price-sensitive markets. Additionally, a lack of awareness in certain regions about the benefits of humidity control systems slowed the market's growth. These barriers emphasize the need for cost-effective, highly adaptable sensor solutions that can be widely adopted across industries and geographies.

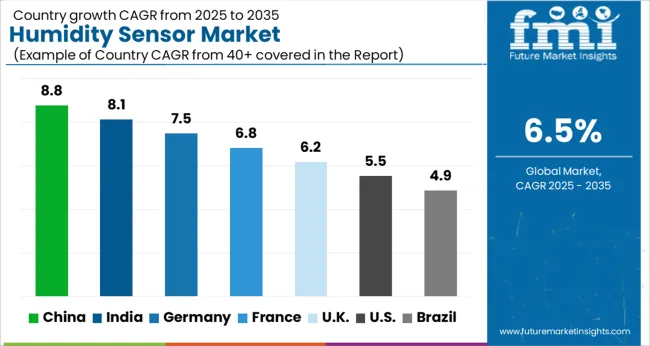

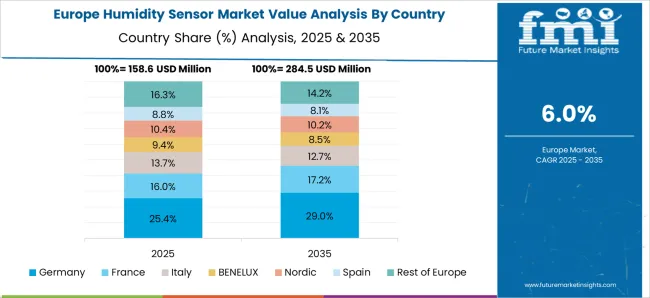

The global humidity sensor market is projected to grow at 6.5% CAGR from 2025 to 2035. China leads with 8.8% CAGR, driven by the rapid growth of industries requiring humidity control, such as manufacturing, automotive, and HVAC systems. India follows at 8.1%, supported by the increasing demand for humidity sensors in the agriculture, pharmaceuticals, and consumer electronics sectors.

France records 6.8% CAGR, fueled by advancements in smart buildings and industrial automation. The United Kingdom grows at 6.2%, while the United States posts 5.5%, reflecting steady demand in mature markets, with a growing focus on precision and energy-efficient systems.

Asia-Pacific leads market growth due to industrial and agricultural demands, while Europe and North America focus on technology advancements and automation solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The humidity sensor market in China is forecasted to grow at 8.8% CAGR, driven by the country’s expanding industrial base and increasing adoption of automation technologies. With a growing need for precise humidity control in the manufacturing, automotive, and agriculture industries, China sees a rise in demand for high-performance humidity sensors. Additionally, the government’s focus on sustainable energy solutions and smart infrastructure further accelerates the use of advanced humidity sensors across various sectors.

The humidity sensor market in India is projected to grow at 8.1% CAGR, supported by the increasing demand for humidity control systems in agriculture, food processing, and pharmaceuticals. The rise in urbanization and the expanding middle class have led to greater adoption of energy-efficient technologies and climate control systems, contributing to the growth of humidity sensors. Additionally, the government’s focus on improving agricultural productivity and healthcare infrastructure further drives the demand for humidity sensors.

The humidity sensor market in France is expected to grow at 6.8% CAGR, driven by the country’s focus on industrial automation, smart buildings, and energy-efficient systems. With increasing demand for climate control in commercial and residential buildings, as well as advancements in the automotive and aerospace industries, France experiences steady growth in the adoption of humidity sensors. The country's commitment to sustainability and green building standards further boosts the market for these technologies.

The humidity sensor market in the United Kingdom is projected to grow at 6.2% CAGR, supported by the rising demand for energy-efficient systems and the growing adoption of smart technologies in buildings. As the UK focuses on reducing energy consumption and improving environmental conditions, the need for advanced humidity control systems rises. Additionally, the country’s industrial sectors, such as food and pharmaceuticals, increase their adoption of precise humidity sensors for improved production processes.

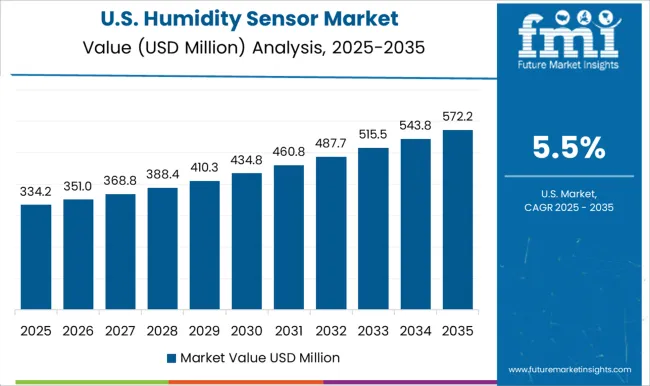

The humidity sensor market in the United States is projected to grow at 5.5% CAGR, reflecting steady demand in a mature market with a focus on improving operational efficiency, sustainability, and energy management. The USA continues to lead in advanced humidity sensor technologies for applications in HVAC systems, smart buildings, and industrial automation. The increasing demand for precision humidity control, particularly in industries such as pharmaceuticals and electronics, further drives market growth.

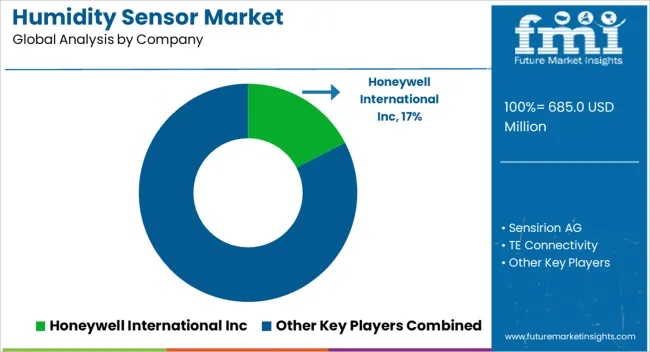

The humidity sensor market is dominated by Honeywell International Inc., a global leader in industrial and consumer electronics, known for its high-quality humidity sensors that provide precise measurements for a wide range of applications, including HVAC systems, automotive, and industrial automation. Honeywell strengthens its market leadership with innovative products designed to enhance efficiency, energy savings, and safety.

The company’s extensive portfolio and strong focus on R&D, combined with its established reputation in the sensor market, contribute to its dominance. Honeywell typically holds a significant share of the market, often accounting for a substantial percentage due to its broad customer base and global distribution network. In addition to Honeywell, other key players in the humidity sensor market include Sensirion AG, TE Connectivity, Amphenol, Schneider Electric, and Texas Instruments Incorporated.

These companies play critical roles in the market, providing reliable and advanced humidity sensing technologies for diverse sectors, including healthcare, automotive, and consumer electronics. Sensirion and TE Connectivity are known for their high-performance sensors, while Amphenol and Texas Instruments focus on offering integrated solutions with enhanced connectivity features.

Market growth is driven by the increasing demand for accurate environmental monitoring, smart home devices, and energy-efficient systems. Innovations in sensor technology and miniaturization are expected to further shape competitive dynamics in this sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 685.0 Million |

| Product | Relative sensor and Absolute sensor |

| Output | Digital and Analog |

| Application | Automotive, Industrial, Pharmaceutical & Healthcare, HVAC & Building automation, Agriculture, Environmental, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc, Sensirion AG, TE Connectivity, Amphenol, Schneider Electric, and Texas Instruments Incorporated |

| Additional Attributes | Dollar sales by sensor type and application, demand dynamics across HVAC, automotive, and consumer electronics sectors, regional trends in humidity sensor adoption, innovation in low-power and high-accuracy sensors, impact of regulatory standards on indoor air quality, and emerging use cases in smart home systems and industrial automation. |

The global humidity sensor market is estimated to be valued at USD 685.0 million in 2025.

The market size for the humidity sensor market is projected to reach USD 1,285.9 million by 2035.

The humidity sensor market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in humidity sensor market are relative sensor, _capacitive, _resistive and absolute sensor.

In terms of output, digital segment to command 55.3% share in the humidity sensor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Humidity Testers Market Size and Share Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensor Patches Market Analysis - Growth, Applications & Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Sensor Cable Market

Humidity Indicator Plugs Market

Sensormatic Labels Market

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

CP Sensor for Consumer Applications Market – Growth & Forecast 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

NOx Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA