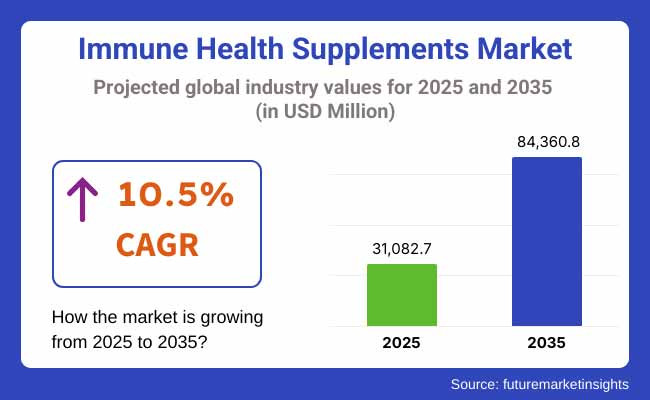

The Immune Health Supplements Market is expected to experience significant expansion between 2025 and 2035, driven by rising health consciousness, increasing demand for preventive healthcare, and growing awareness about immunity-boosting products. The market is projected to reach USD 31,082.7 million in 2025 and is anticipated to expand to USD 84,360.8 million by 2035, reflecting a compound annual growth rate (CAGR) of 10.5% throughout the forecast period.

One of the major drivers of this market is the increased consumer focus on immunity enhancement due to the rising prevalence of infectious diseases and lifestyle-related health disorders. The COVID-19 pandemic has further accelerated the demand for immune-boosting supplements, with consumers actively seeking vitamins, minerals, and herbal-based products to strengthen their immune systems. Additionally, growing geriatric populations, evolving dietary preferences, and increased sports and fitness participation are further fueling the market expansion.

In terms of Product Type segmentation, Vitamin & Mineral Supplements holds the largest market share, mainly due to the sound consumer confidence, widespread usage and proven scientific health benefits. Vitamins C, D and E, and some essential minerals, like zinc and selenium, have long been touted as supporting the immune system.

They are widely available in pharmacies, supermarkets, and online, and therefore, they are usually most available and preferred by consumers. Moreover, their foothold is further tightened by the continuous product innovations such as fortified multivitamin blends (formulated for different age group and lifestyles).

From Form segmentation, Capsules & Soft Gels are dominant in the market owing to their improved bioavailability, extended shelf life, and convenience. Capsules and soft gels offer accurate dosing delivery, which is an important driver of consumer preference, particularly for immune health programs.

Advancements in pharmaceutical efforts such as sustained-release and enteric-coated capsule technology enables maximum nutrient absorption and minimal gastro-intestinal upset and keep them a popular form for the health-oriented consumer.

Immune health supplements are a premium market in North America owing to the rising awareness regarding health and wellness, the growing aging population, and the availability of an established nutraceuticals industry. Wellness-oriented product demand (vitamins, minerals, herbal extracts and probiotics promoting immune function) has been growing significantly in the United States and Canada in the wake of the COVID-19 pandemic.

Owing to preventive healthcare products, Consumer pursuing these are showing higher demand for natural and organic supplements. Additionally, these regulatory authorities such as the FDA and Health Canada, are known for demanding some of the strictest quality and safety standards, thus forcing producers to innovate with clinically supported formulations. Additionally, the rising prominence of functional foods and beverages containing immune-boosting ingredients also augments the growth of this market.

Europe holds a major share in the global immune health supplements market, where major demand arises from countries including Germany, France, and the United Kingdom. A strong culture of botanical and herbal medicine with high consumer health awareness of preventive health has fueled the use of immune-boosting supplements in this region.

The imposing rules on health claims in Europe are enforced by the European Food Safety Authority (EFSA), which prevents the market from being flooded with ingredients that have not been proven to support the immune system.

Equally, burgeoning rates of people going vegetarian or vegan are driving the health and wellness landscape, and are consequently also stimulating market demand of natural, organic and plant-based immunology supplements. Online store platforms are also witnessing an explosive growth with respect to sale of supplements, so e-commerce and digital channels also help expand the market opportunity.

Asia-Pacific is predicted to witness the quickest rise in the immune health supplements market, driven by rising disposable income, changing dietary habits, and increasing focus over holistic wellness. Countries like China, India, Japan and South Korea are some of the major consumers of immune-boosting products, along with traditional healthcare systems (Ayurveda, Traditional Chinese Medicine (TCM) guiding supplement formulation.

Strong demand for vitamin C, zinc, elderberry and probiotic supplements is being driven by an expanding middle class and urbanization with increasing health consciousness. Increasing consumer demand for immunity boosting products also pushed the market growth owing to COVID-19 pandemic. Differences in the regulatory framework between countries act as a challenge for the market to grow, as companies have to follow different compliance standards.

Challenge

Regulatory Complexity and Quality Control

One of the biggest hurdles in the immune health supplements industry is regulatory complexity across regions. Global standardization is difficult because governments impose strict regulation on everything from labeling to health claims, and health, safety and other laws apply force both to ingredients and to how these are stored.

In addition, the need for trust of the consumer has led to difficulties around authenticity of products combined with the problem of counterfeit products available in the market. So compliance with regulation and protecting brand reputation comes with a cost that businesses have to incur by investing in robust quality assurance systems and truthful labelling.

Opportunity

Innovation in Personalized Nutrition

The high growth in the popularity of personalized nutrition is an active opportunity for the immune health supplements market. Genetic types, lifestyle practices, and unique immune health needs have all led consumers to desire more personalized health options.

Nutrigenomics and digital health technologies are enabling pro-active digitized personal supplements from a reduction of supplementation per individual needs. In addition, there is an increasing consumer interaction and product innovation in supplement recommendation systems using artificial intelligence (AI). Businesses can distinguish themselves and enlarge their market by hitting the surf on the back of personalized nutrition.

Between 2020 and 2024, the immune health supplements market experienced significant growth, fueled by heightened consumer awareness regarding immunity, the COVID-19 pandemic, and increased adoption of natural and plant-based supplements. The demand for vitamins C, D, zinc, probiotics, and herbal extracts such as elderberry and echinacea surged as consumers prioritized preventive healthcare. The expansion of e-commerce platforms and direct-to-consumer (DTC) brands further accelerated market accessibility.

Between 2025 and 2035, the immune health supplements market will undergo a transformation driven by AI-powered personalized nutrition, biotechnology-driven immune modulation, and sustainability-focused supplement production. The adoption of precision nutraceuticals, microbiome-based immunity boosters, and gene-optimized dietary supplements will redefine how consumers manage immune health.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter FDA and EFSA regulations on supplement labeling, ingredient sourcing, and efficacy claims. |

| Technological Advancements | AI-driven supplement formulation, nanotechnology-enhanced nutrient delivery, and gummy/effervescent formats. |

| Industry Applications | Functional foods, over-the-counter (OTC) supplements, sports nutrition, and elderly immunity support. |

| Adoption of Smart Equipment | AI-assisted dietary recommendations, wearable-integrated nutrient tracking, and automated supplement dispensers. |

| Sustainability & Cost Efficiency | Organic, non-GMO, plant-based supplements, and local ingredient sourcing to reduce carbon footprint. |

| Data Analytics & Predictive Modeling | AI-powered supplement recommendations, personalized nutrigenomics insights, and real-time dietary tracking. |

| Production & Supply Chain Dynamics | COVID-19-driven ingredient shortages, increased demand for natural extracts, and expansion of DTC supplement brands. |

| Market Growth Drivers | Increased consumer focus on preventive health, pandemic-driven supplement demand, and functional food integration. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven supplement safety compliance, blockchain-based ingredient traceability, and personalized dosage standardization. |

| Technological Advancements | AI-powered personalized nutrition, microbiome-based immune optimization, and 3D-printed customized supplement tablets. |

| Industry Applications | Expansion into biotech-engineered immune peptides, real-time metabolic tracking supplements, and AI-assisted immune health optimization. |

| Adoption of Smart Equipment | Fully automated AI-driven immune monitoring, real-time microbiome feedback, and bioengineered adaptive probiotics. |

| Sustainability & Cost Efficiency | Lab-grown vitamins, blockchain-verified sustainability in sourcing, and AI-optimized supply chain logistics for cost efficiency. |

| Data Analytics & Predictive Modeling | Quantum-assisted immune system modeling, predictive biofeedback-driven supplementation, and decentralized AI-based dietary analytics. |

| Production & Supply Chain Dynamics | AI-optimized ingredient sourcing, decentralized 3D-printed supplement production, and blockchain-enabled supply chain transparency. |

| Market Growth Drivers | AI-powered proactive immune health management, next-gen immune modulating peptides, and precision-based immune health tracking solutions. |

The USA immune health supplements market is expanding due to rising consumer awareness of preventive healthcare and increasing demand for immunity-boosting products. The growing aging population, high prevalence of chronic diseases, and rising healthcare costs are encouraging consumers to invest in vitamins, probiotics, and herbal supplements. Additionally, strong e-commerce growth and product innovations in functional foods and beverages are driving market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.2% |

Growth in organic and natural supplements consumption, increasing health-awareness, and government policies focusing on wellness are driving the immune health supplements market in the UK Potentially limiting factors for the market growth are the growth of retail channels for online sales of supplements and the rising demand for plant-based and clean-label elements. There has also been a long-term increase in demand for immune-boosting products owing to the COVID-19 pandemic.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.4% |

The EU immune health supplements sector is witnessing growth due to a growing focus on preventive health and increased demand for dietary supplements along with strict regulations in place that ensure the safety and efficacy of the products. Germany, France, and Italy are at the forefront of this growth with a strong consumer demand for probiotics, herbal extracts, and functional foods. Other factors include an aging population and growing health care consciousness that have been boosting the market demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 10.7% |

The market for immune health supplements in Japan is driven by an ageing population, strong functional food government support and customer desire for high quality and science-supported supplements. Demand is especially high for probiotic supplements, vitamin C and other plant-derived ingredients, such as green tea and ginseng. Innovation in nutraceuticals and developed product formats are also driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.1% |

Rising Health Awareness, Increasing Disposable Incomes, and Popularity of K-health Products All Aid the Growth of South Korea's Functional Food Market for Immune Health Supplements Others: Probiotics and herbal preparations like ginseng-based supplements are popular. The rise of online health tools and strong online sales are bringing these products to a broader population. The growth of the market is further augmented by government assistance for functional food.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.6% |

The fastest growth segment in overall immune health supplements occurs in vitamin & mineral supplements - which deliver specific nutritional support through key micronutrients, such as vitamin C, vitamin D, zinc and selenium. Unlike other categories, vitamin & mineral supplements aim to deliver scientifically validated active ingredients that have an immediate role in enhancing immune function, placing them high among health-aware consumer segments.

The growing incidence of infectious diseases and flu episodes has progressively increased the consumption of vitamin & mineral-based supplements, thereby driving the demand for immune-enriching supplements. This trend is further driven by the emergence of fortified multivitamins, boasting advanced comprehensive immune-supporting formulations equipped with antioxidants, adaptogens, and botanicals that have increased access and appeal for consumers alike.

The development of AI-driven dietary supplement personalization platforms, backed by data-led health assessments and screenings, genetic traits testing, and trial & error of bioactive for specific nutrients to get precisely what the body requires, may have further boosted adoption of immune strengtheners, designed for resolving immune challenges we all face, but based on the needs of each individual.

The development of green and clean-label vitamin & mineral supplements with organic, plant-based, and non-GMO formulations has created an opportunity for maximal market growth by aligning with the evolution of consumer demand for natural and transparent ingredients.

The integration of novel delivery systems, with microencapsulation for better bioavailability, extended-release technology, and combination products with probiotics for gut-immune synergy, has ensured stronger market growth, with higher efficacy and absorption.

Despite accessibility benefits, scientific certification, and widespread consumer confidence, the vitamin & mineral supplements market is threatened by regulatory scrutiny over supplement claims, competition from functional foods, and misinformation on efficacy. But developing breakthroughs in precision nutrition, AI-sourced ingredients, and block chain-verified supplement authenticity are enhancing safety, credibility, and efficacy, which will sustain growth for vitamin & mineral-based immune health supplements globally.

Capsules & soft gels have registered high market penetration, especially with busy professionals, older consumers, and those wanting easy-to-swallow, highly bioavailable immune health products. In contrast to powders and liquids, capsules & soft gels offer exact dosage, increased shelf stability, and low taste interference, so they are an increasingly popular form in immune health supplementation.

Growing need for on-the-go immunity supplements with travel-friendly packaging, high-absorption soft gels, and quick-acting immunity boosters has driven adoption of capsule-based supplements as consumers look for convenience without sacrificing efficacy.

The growth of gelatin-free and vegetarian soft gel products, with plant-based substitutes like hydroxypropyl methylcellulose (HPMC), has consolidated market demand, making it more inclusive for vegan and vegetarian consumers.

The incorporation of sophisticated lipid-based delivery systems, with Nano emulsions, liposomal encapsulation, and self-emulsifying drug delivery systems (SEDDS), has further accelerated adoption, providing better nutrient absorption and long-term immune benefits.

The formation of hybrid products, with dual-action capsules delivering immune-enhancing vitamins and adapt genic herbs, prebiotic fiber, or antioxidant polyphenols, has maximized market growth by providing complete immune modulation.

The use of intelligent tracking technologies, with RFID-equipped supplement bottles, AI-based dosage reminders, and mobile-engaged adherence monitoring, has solidified market growth, ensuring enhanced compliance and tailored immune health management.

With the benefits of accurate dosing, convenience of use, and enhanced bioavailability, the capsules & soft gels segment remains challenged by issues like gelatin sourcing issues, greater production costs than tablets, and formulation stability for some bioactive nutrients. Nevertheless, new advances in plant-based encapsulation, 3D-printed personalized supplements, and biodegradable soft gel technologies are enhancing sustainability, efficacy, and consumer acceptance, guaranteeing long-term growth for capsule-based immune health supplements globally.

The segment of powder supplements has become one of the most used immune health supplement forms, with consumers having the ease of incorporating immunity-enhancing preparations into smoothies, drinks, and functional foods. As compared to traditional supplement pills, powder-based immunity enhancers offer more flexibility, faster absorption, and larger dosages of important nutrients.

Growth in demand for personalized immune nutrition, including build-your-own supplement blends, flavor-enhanced products, and functional beverage boosters, has driven uptake of powder-based supplements as health-oriented buyers opt for personalized wellness solutions.

In spite of benefits of dosage flexibility, quicker absorption, and increased personalization, the powder supplements category has its own challenges like ingredient stability, masking difficulties, and possible mixability issues. Yet, some new trends in microencapsulation for flavor improvement, formulation optimization through AI, and prebiotic-spiked immune powders are enhancing palatability, effectiveness, and customer satisfaction, thereby ensuring sustained growth for immune health powder supplements globally.

The gummies segment has gained strong market adoption, particularly among younger consumers, families, and individuals seeking an enjoyable alternative to traditional pills and capsules. Unlike tablets, gummy supplements offer improved taste, chew ability, and fun formats, making them an attractive option for daily immune support.

The rising demand for sugar-free and functional gummies, featuring added fiber, collagen, or antioxidant polyphenols, has driven adoption of this segment, as health-conscious consumers seek guilt-free indulgence combined with immune health benefits.

Despite advantages in palatability, user engagement, and ease of compliance, the gummies segment faces challenges such as sugar content concerns, formulation limitations for certain bioactive ingredients, and higher production costs. However, emerging innovations in low-sugar formulations, plant-based gummy matrices, and precision gummy dosing technologies are improving health benefits, sustainability, and consumer preference, ensuring continued expansion for gummy-based immune health supplements worldwide.

The Immune Health Supplements Market is experiencing significant growth due to increasing consumer awareness about the importance of immunity-boosting products. The demand for vitamins, minerals, herbal supplements, and probiotics has surged, driven by concerns over infectious diseases and overall health maintenance. Factors such as aging populations, changing dietary habits, and the rise of preventive healthcare are propelling market expansion. Companies are focusing on innovation, strategic acquisitions, and expanding their product portfolios to strengthen their competitive position in the industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bayer AG | 18-22% |

| Pfizer Inc. | 14-18% |

| Sun Pharmaceuticals Industries Ltd. | 10-14% |

| Swisse Wellness Pty Ltd. | 8-12% |

| GlaxoSmithKline Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bayer AG | Provides a broad range of immune health supplements, including multivitamins and probiotics. |

| Pfizer Inc. | Develops pharmaceutical-grade immune boosters, vitamins, and minerals. |

| Sun Pharmaceuticals Industries Ltd. | Specializes in herbal and natural immune health formulations. |

| Swisse Wellness Pty Ltd. | Focuses on premium, scientifically backed immune supplements. |

| GlaxoSmithKline Inc. | Offers immunity-enhancing vitamins, probiotics, and functional foods. |

Key Company Insights

Bayer AG (18-22%)

As a dominant player in the immune health supplements market, Bayer AG offers a diverse portfolio of immunity-boosting products, including multivitamins and functional supplements. The company invests heavily in research and development to introduce innovative formulations that cater to evolving consumer preferences.

Pfizer Inc. (14-18%)

Pfizer, with its historical roots in pharmaceutical is a pioneer in being able to provide high quality immune health solutions like vitamins and minerals which help support immune function. The company is expanding its footprint in the dietary supplement industry with acquisitions and partnerships.

Sun Pharmaceuticals Industries Ltd. (10-14%)

Sun Pharmaceuticals introduced its herbal and natural immunogenic products, which are produced according to traditional medicine as extract products. The company has a strong presence in emerging markets and continues to innovate plant-based supplements.

Swisse Wellness Pty Ltd. (8-12%)

Swisse Wellness deals in high-end immune supplements with a focus on natural ingredients and scientific support. The robust marketing and international expansion strategy of the brand have helped the company increase its market share.

GlaxoSmithKline Inc. (6-10%)

GlaxoSmithKline (GSK) deals in immunity-boosting products in the form of probiotics, functional foods, and vitamins. The company lays stress on clinical trials and consumer confidence, presenting itself as a market leader for scientifically supported immune health products.

Other Key Players (30-40% Combined)

The immune health supplements market also includes numerous regional and emerging companies contributing to overall industry growth. Key players in this segment include:

The overall market size for immune health supplements market was USD 31,082.7 Million in 2025.

The immune health supplements market is expected to reach USD 84,360.8 Million in 2035.

The rising health consciousness, increasing demand for preventive healthcare, and growing awareness about immunity-boosting products fuels Immune health supplements Market during the forecast period.

The top 5 countries which drives the development of Immune health supplements Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of product type, Vitamin & Mineral Supplements to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Unit Pack) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Global Market Volume (Unit Pack) Forecast by Form, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Customer Orientation, 2018 to 2033

Table 8: Global Market Volume (Unit Pack) Forecast by Customer Orientation, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Unit Pack) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Unit Pack) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: North America Market Volume (Unit Pack) Forecast by Form, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Customer Orientation, 2018 to 2033

Table 18: North America Market Volume (Unit Pack) Forecast by Customer Orientation, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Unit Pack) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Unit Pack) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 26: Latin America Market Volume (Unit Pack) Forecast by Form, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Customer Orientation, 2018 to 2033

Table 28: Latin America Market Volume (Unit Pack) Forecast by Customer Orientation, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Unit Pack) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Unit Pack) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: Western Europe Market Volume (Unit Pack) Forecast by Form, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Customer Orientation, 2018 to 2033

Table 38: Western Europe Market Volume (Unit Pack) Forecast by Customer Orientation, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Unit Pack) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Unit Pack) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: Eastern Europe Market Volume (Unit Pack) Forecast by Form, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Customer Orientation, 2018 to 2033

Table 48: Eastern Europe Market Volume (Unit Pack) Forecast by Customer Orientation, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Unit Pack) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Unit Pack) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Unit Pack) Forecast by Form, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Customer Orientation, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Unit Pack) Forecast by Customer Orientation, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Unit Pack) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Unit Pack) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 66: East Asia Market Volume (Unit Pack) Forecast by Form, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Customer Orientation, 2018 to 2033

Table 68: East Asia Market Volume (Unit Pack) Forecast by Customer Orientation, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Unit Pack) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Unit Pack) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Unit Pack) Forecast by Form, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Customer Orientation, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Unit Pack) Forecast by Customer Orientation, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Unit Pack) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Customer Orientation, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Unit Pack) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Unit Pack) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 15: Global Market Volume (Unit Pack) Analysis by Form, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Customer Orientation, 2018 to 2033

Figure 19: Global Market Volume (Unit Pack) Analysis by Customer Orientation, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Customer Orientation, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Customer Orientation, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Unit Pack) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Form, 2023 to 2033

Figure 28: Global Market Attractiveness by Customer Orientation, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Customer Orientation, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Unit Pack) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 45: North America Market Volume (Unit Pack) Analysis by Form, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Customer Orientation, 2018 to 2033

Figure 49: North America Market Volume (Unit Pack) Analysis by Customer Orientation, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Customer Orientation, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Customer Orientation, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Unit Pack) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Form, 2023 to 2033

Figure 58: North America Market Attractiveness by Customer Orientation, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Customer Orientation, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Unit Pack) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 75: Latin America Market Volume (Unit Pack) Analysis by Form, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Customer Orientation, 2018 to 2033

Figure 79: Latin America Market Volume (Unit Pack) Analysis by Customer Orientation, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Customer Orientation, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Customer Orientation, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Unit Pack) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Customer Orientation, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Customer Orientation, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Unit Pack) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 105: Western Europe Market Volume (Unit Pack) Analysis by Form, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Customer Orientation, 2018 to 2033

Figure 109: Western Europe Market Volume (Unit Pack) Analysis by Customer Orientation, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Customer Orientation, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Customer Orientation, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Unit Pack) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Form, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Customer Orientation, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Customer Orientation, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Unit Pack) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Unit Pack) Analysis by Form, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Customer Orientation, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Unit Pack) Analysis by Customer Orientation, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Customer Orientation, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Customer Orientation, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Unit Pack) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Form, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Customer Orientation, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Customer Orientation, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Unit Pack) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Unit Pack) Analysis by Form, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Customer Orientation, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Unit Pack) Analysis by Customer Orientation, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Customer Orientation, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Customer Orientation, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Unit Pack) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Form, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Customer Orientation, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Customer Orientation, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Unit Pack) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 195: East Asia Market Volume (Unit Pack) Analysis by Form, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Customer Orientation, 2018 to 2033

Figure 199: East Asia Market Volume (Unit Pack) Analysis by Customer Orientation, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Customer Orientation, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Customer Orientation, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Unit Pack) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Customer Orientation, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Customer Orientation, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Unit Pack) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Unit Pack) Analysis by Form, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Customer Orientation, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Unit Pack) Analysis by Customer Orientation, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Customer Orientation, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Customer Orientation, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Unit Pack) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Customer Orientation, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Immune Checkpoint Inhibitors Market

Autoimmune Disease Therapeutics Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Autoimmune Disease Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Chronic immune thrombocytopenia treatment Market Size and Share Forecast Outlook 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Neuro-Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Veterinary Auto-Immune Therapeutics Market Growth - Trends & Forecast 2025 to 2035

Kinase Inhibitor in Autoimmune Diseases Market Size and Share Forecast Outlook 2025 to 2035

Demand for Lactoferrin Premiumization in Immune SKUs in EU

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Health and Fitness Club Market Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA