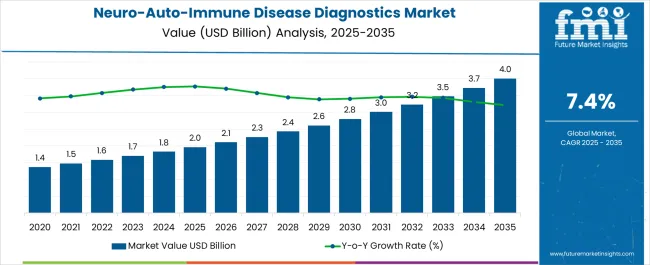

The Neuro-Auto-Immune Disease Diagnostics Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Neuro-Auto-Immune Disease Diagnostics Market Estimated Value in (2025 E) | USD 2.0 billion |

| Neuro-Auto-Immune Disease Diagnostics Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The Neuro-Auto-Immune Disease Diagnostics market is witnessing strong expansion as early detection and accurate diagnosis of complex immune-related neurological disorders become increasingly important for effective treatment outcomes. Conditions such as multiple sclerosis, neuromyelitis optica, and autoimmune encephalitis are being diagnosed more frequently due to heightened awareness and advancements in diagnostic technologies. The demand for precise and rapid testing is rising, with laboratories and hospitals focusing on improving diagnostic accuracy through the use of advanced immunoassays and molecular testing platforms.

Growth is also supported by increasing investments in healthcare infrastructure, the expansion of clinical laboratories, and the integration of digital diagnostic tools that provide enhanced efficiency. Patients are seeking timely diagnoses to prevent disease progression, and clinicians are emphasizing evidence-based decisions supported by advanced diagnostics.

Stringent regulatory frameworks and reimbursement policies are reinforcing adoption, while the growing prevalence of autoimmune neurological conditions globally highlights the need for scalable and reliable testing solutions As innovation continues in biomarker discovery and laboratory automation, the Neuro-Auto-Immune Disease Diagnostics market is positioned for robust long-term growth.

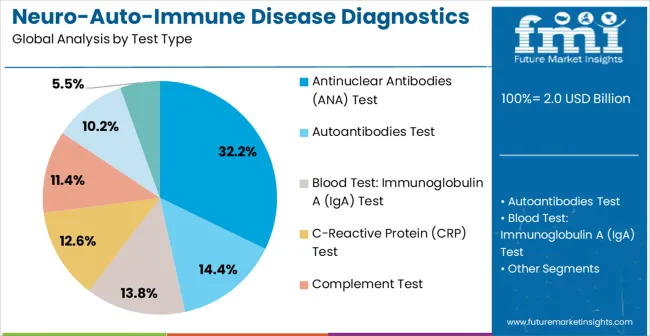

The neuro-auto-immune disease diagnostics market is segmented by test type, end user, and geographic regions. By test type, neuro-auto-immune disease diagnostics market is divided into Antinuclear Antibodies (ANA) Test, Autoantibodies Test, Blood Test: Immunoglobulin A (IgA) Test, C-Reactive Protein (CRP) Test, Complement Test, ESR (Erythrocyte Sedimentation Rate) Test, and Protein Electrophoresis Test Or Immunofixation Electrophoresis Test. In terms of end user, neuro-auto-immune disease diagnostics market is classified into Hospitals, Neurological Diagnostics Test Centers, and Others. Regionally, the neuro-auto-immune disease diagnostics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Antinuclear Antibodies (ANA) test type segment is projected to hold 32.2% of the market revenue share in 2025, making it a leading test type in this field. The widespread use of ANA tests is being driven by their importance in detecting autoimmune activity that impacts neurological conditions. Clinicians rely on ANA tests to screen and monitor patients suspected of neuro-auto-immune disorders, as the test provides critical insights into immune system dysfunction.

The cost-effectiveness, accessibility, and established clinical relevance of ANA testing make it a first-line diagnostic tool in many healthcare settings. Rising prevalence of autoimmune diseases and the increasing need for early intervention are further fueling demand. Additionally, advancements in laboratory automation and assay sensitivity have improved diagnostic accuracy and turnaround time, enhancing their clinical value.

The scalability of ANA testing across both small laboratories and large hospital systems is reinforcing its adoption With increasing global emphasis on early diagnosis of neurological autoimmune disorders, the ANA test segment is expected to maintain its significant contribution to market revenues.

The hospitals end user segment is anticipated to account for 55.8% of the market revenue share in 2025, solidifying its role as the dominant end user. Hospitals are at the forefront of diagnosing and managing neuro-auto-immune diseases, where comprehensive infrastructure and specialized expertise are required for effective patient care. The presence of advanced diagnostic laboratories within hospitals allows for the integration of ANA testing and other immunoassays into clinical workflows, ensuring timely and accurate diagnoses.

Increasing patient inflow for neurological and autoimmune conditions is driving hospital reliance on these diagnostic procedures. Hospitals also benefit from streamlined reimbursement systems, strong collaboration with research institutions, and adoption of cutting-edge diagnostic technologies. The ability to handle large patient volumes, coupled with in-house laboratory facilities, reinforces hospitals’ position as the preferred setting for such diagnostics.

Growing demand for multidisciplinary care and the role of hospitals in both acute and chronic disease management are further boosting their importance As healthcare systems continue investing in specialized diagnostic capabilities, hospitals are expected to remain the dominant end user segment in this market.

Neurological autoimmunity has a specific ability to target effectively any structure within the peripheral or central nervous system in an extremely specific way and targeting a very specific cell population, for example-the purkinje cells of the cerebellum. The neuro-auto-immune diseases diagnostics market involve the clinical features, pathophysiology and the treatment of various neuro-auto-immune diseases.

When the targeted cell type occurs in different CNS structures, the syndrome diverse in concomitant with myelitis, optic neuritis and attack of brain edema in neuromyelitis optica. The neuro-auto-immune diseases basically caused by the damage in central and peripheral nervous system which helps in supplying the blood vessels, internal organs and skin.

The IQIsolate technology used to help and identify the auto-immune- diseases during its early stage.To treat with these type of disorders some of the diagnostic tests are performed that includes antinuclear antibodies (ANA) test, that is performed when auto-immune-disorders effect many tissues and organs throughout the body.

This test helps to diagnose the systemic lupus erythematosus (SLE). The autoantibodies test is performed to test the Sjogren syndrome, lupus, autoimmune hepatitis, and rheumatoid arthritis. The immunoglobulin A (IgA) test is performed to test the blood level of immunoglobulin A. The C-reactive protein (CRP) test is a kind of blood test which measures the amount of protein in the blood which is known as C-reactive protein.

The complement test is performed to test the activity of protein group in serum. The ESR (erythrocyte sedimentation rate) test is a hematology test that includes the rate at which blood cells sediment. The protein electrophoresis test measures the specific protein in the blood that helps to identify neuro-auto-immune diseases.

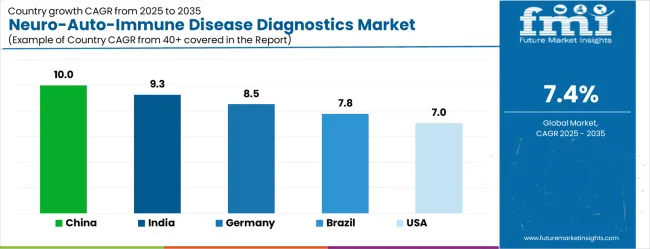

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| Brazil | 7.8% |

| USA | 7.0% |

| UK | 6.3% |

| Japan | 5.6% |

The Neuro-Auto-Immune Disease Diagnostics Market is expected to register a CAGR of 7.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.0%, followed by India at 9.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.6%, yet still underscores a broadly positive trajectory for the global Neuro-Auto-Immune Disease Diagnostics Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.5%. The USA Neuro-Auto-Immune Disease Diagnostics Market is estimated to be valued at USD 695.3 million in 2025 and is anticipated to reach a valuation of USD 695.3 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 92.8 million and USD 51.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Test Type | Antinuclear Antibodies (ANA) Test, Autoantibodies Test, Blood Test: Immunoglobulin A (IgA) Test, C-Reactive Protein (CRP) Test, Complement Test, ESR (Erythrocyte Sedimentation Rate) Test, and Protein Electrophoresis Test Or Immunofixation Electrophoresis Test |

| End User | Hospitals, Neurological Diagnostics Test Centers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

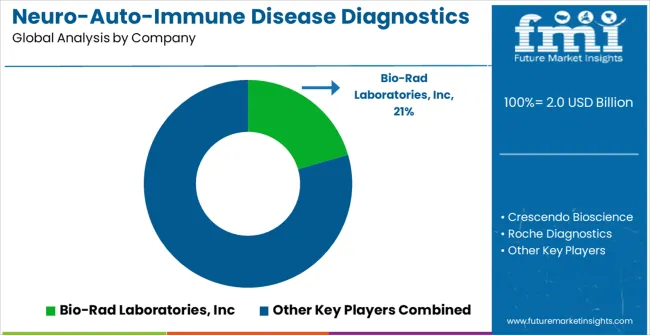

| Key Companies Profiled | Bio-Rad Laboratories, Inc, Crescendo Bioscience, Roche Diagnostics, Quest Diagnostics, Abbott Diagnostics, Beckman Coulter, Inc, and SQI Diagnostic and Euroimmun |

The global neuro-auto-immune disease diagnostics market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the neuro-auto-immune disease diagnostics market is projected to reach USD 4.0 billion by 2035.

The neuro-auto-immune disease diagnostics market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in neuro-auto-immune disease diagnostics market are antinuclear antibodies (ana) test, autoantibodies test, blood test: immunoglobulin a (iga) test, c-reactive protein (crp) test, complement test, esr (erythrocyte sedimentation rate) test and protein electrophoresis test or immunofixation electrophoresis test.

In terms of end user, hospitals segment to command 55.8% share in the neuro-auto-immune disease diagnostics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disease Resistant Mask Market Analysis - By Type, Material, End-User, Distribution Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Rare Disease Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Rare Disease Gene Therapy Market

Swine Disease Diagnostic Kit Market Size and Share Forecast Outlook 2025 to 2035

Fabry Disease Market Size and Share Forecast Outlook 2025 to 2035

Byler Disease Market

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Celiac Disease Diagnostics Market Analysis - Size, Share & Forecast 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

The Addison Disease Testing Market Is Segmented by Test Type, and End User from 2025 To 2035

Pleural Diseases Therapeutics Market – Drug Trends & Future Outlook 2025 to 2035

Crohn’s Disease (CD) Treatment Market Analysis & Forecast by Drug Type, Distribution Channel and Region through 2035

Shrimps Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Sandhoff Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Zoonotic Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Wilson’s Disease Diagnostics Market Analysis – Size, Share & Forecast 2023-2033

Predictive Disease Analytics Market Size and Share Forecast Outlook 2025 to 2035

Autoimmune Disease Therapeutics Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA