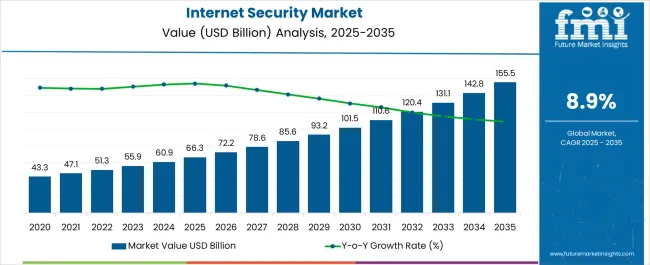

The Internet Security Market is estimated to be valued at USD 66.3 billion in 2025 and is projected to reach USD 155.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

| Metric | Value |

|---|---|

| Internet Security Market Estimated Value in (2025 E) | USD 66.3 billion |

| Internet Security Market Forecast Value in (2035 F) | USD 155.5 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The internet security market is witnessing steady expansion as organizations and individuals increase investments in safeguarding digital infrastructure from sophisticated cyber threats. The growing reliance on cloud computing, mobile applications, and connected devices has significantly elevated exposure to vulnerabilities, which has accelerated the need for advanced internet security solutions. Heightened regulatory frameworks across multiple regions, combined with stricter compliance requirements, are influencing enterprises to prioritize cybersecurity as a strategic necessity rather than a discretionary investment.

Rising incidents of data breaches, phishing attacks, and ransomware are further stimulating adoption of multi-layered defense mechanisms that incorporate artificial intelligence, machine learning, and behavioral analytics. Continuous advancements in encryption, authentication, and intrusion prevention technologies are creating scalable solutions that meet the demands of diverse industries.

The integration of cybersecurity platforms into enterprise IT and operational workflows is enhancing efficiency while reducing the cost of risk management As digital transformation deepens across global economies, the internet security market is expected to maintain a strong growth trajectory, underpinned by innovation, awareness, and increasing demand for resilience against evolving cyber risks.

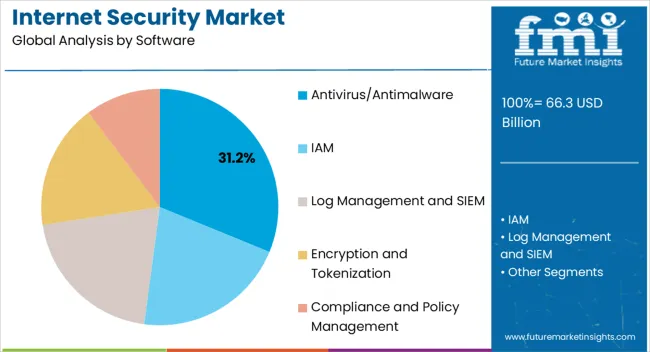

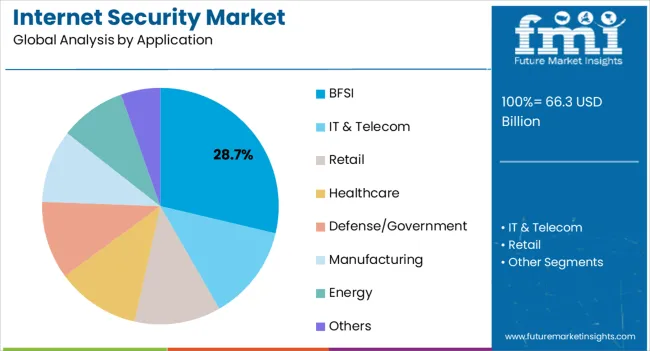

The internet security market is segmented by software, application, and geographic regions. By software, internet security market is divided into Antivirus/Antimalware, IAM, Log Management and SIEM, Encryption and Tokenization, and Compliance and Policy Management. In terms of application, internet security market is classified into BFSI, IT & Telecom, Retail, Healthcare, Defense/Government, Manufacturing, Energy, and Others. Regionally, the internet security industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The antivirus and antimalware software segment is projected to hold 31.2% of the internet security market revenue share in 2025, making it the leading software category. This dominance is being driven by the critical role these solutions play in detecting, preventing, and removing malicious software that threatens individual users and enterprise networks. The segment benefits from its wide applicability across operating systems and devices, providing a foundational layer of security that is often mandated by organizations for compliance and risk reduction.

Continuous innovation has enhanced real-time detection and automated response capabilities, ensuring greater protection against zero-day attacks and evolving malware strains. The integration of cloud-based scanning and AI-powered behavioral analysis has significantly improved accuracy and speed, reinforcing its adoption across both consumer and enterprise environments.

Additionally, the segment’s accessibility and cost-effectiveness make it a preferred choice, particularly for small and medium-sized businesses that seek reliable protection without large-scale infrastructure investment The enduring necessity of antivirus and antimalware solutions ensures their continued relevance and strong market leadership in the overall internet security landscape.

The BFSI application segment is anticipated to account for 28.7% of the internet security market revenue share in 2025, establishing itself as the leading industry application. This leadership is being reinforced by the sector’s reliance on digital platforms for financial transactions, data storage, and customer engagement, which makes it a primary target for cyberattacks. The increasing sophistication of threats such as phishing, ransomware, and advanced persistent attacks has compelled banks, insurers, and financial institutions to adopt robust internet security frameworks.

Regulatory requirements governing data protection, privacy, and financial compliance are also intensifying, driving consistent investment in advanced threat detection, multi-factor authentication, and secure transaction platforms. The rapid expansion of digital banking, mobile payments, and fintech innovations has further accelerated demand for industry-specific solutions that address high transaction volumes and sensitive data environments.

The sector’s critical need for trust and reliability ensures that cybersecurity remains a top strategic priority As digital ecosystems in BFSI expand globally, internet security adoption in this segment is expected to grow further, reinforcing its position as the leading application area in the market.

The internet security market is estimated to grow at a CAGR of 8.9% for the forecast period of 2025 to 2035, in comparison to the 5.4% growth of internet security for the historic period 2025 to 2025.

There are several factors driving the growth of the internet security market such as increasing cyber-attacks owing to the rise in sophisticated cyber threats and hacking techniques resulting in the increased demands for internet security solutions.

With the growing reliance on digital technology, more businesses & individuals are using digital technology. The number of potential targets for cyber-attacks has increased, allowing the demand for internet security solutions to grow over the forecast period.

Enterprises rely on various solutions and services for their regular work activities that are supported by the internet. Several solutions cannot be completely used without internet connection. Internet based software and solutions are not restricted to enterprises and are also used by individuals.

This creates an opening for various cyber-threats that could attack the users device via the internet, creating the demand for internet security solutions.

Small and emerging businesses in developing economies must be mindful of their budgets. Otherwise, it will result in a large sum, potentially slowing the growth of the cyber security market. Budgets set aside to meet cybersecurity needs are not keeping pace with the market's growth in attacks. Emerging businesses in MEA, Latin America, and APAC frequently struggle to find the money and the right funds to implement cybersecurity solutions.

A lack of capital finance and security professionals can be a significant barrier to adopting a cybersecurity approach for certain small and medium-sized businesses.

The internet security market in North America is one of the largest and most developed markets in the world. The region is home to some of the largest and most technologically advanced companies globally, the countries in North America are often targeted by cyber-criminals because of the prosperity in this region and hence, it becomes important for the enterprises in this region to implement internet security solutions.

North America, is dominating the internet security market and is estimated to have the highest share value 24.5% in 2025. South Asia & Pacific region is estimated to be the fastest growing region for the internet security market because of the overall economical and industrial growth estimated to occur in this region over the forecast period, allowing the market to grow at a CAGR of 13.4%.

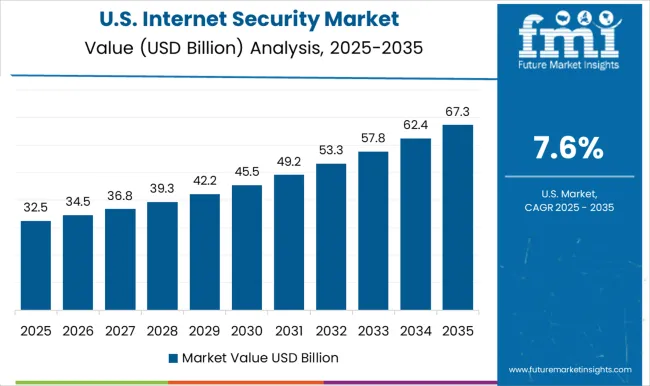

The USA has strict regulations in place to protect sensitive data, such as HIPAA and the California Consumer Privacy Act (CCPA), which have increased the need for internet security solutions.

As a result, the internet security market in the USA is expected to continue to grow in the coming years as businesses and individuals become more aware of the need to protect their digital assets.

The USA estimated market share value was 18.4% in 2025, and grow with an 8.2% CAGR over the forecast period.

The adoption of digital technology and internet usage has been rapidly increasing in India, driving demand for internet security solutions to protect against cyber threats.

The government of India has been promoting the use of digital technology and has also been taking steps to increase cyber security awareness and strengthen the country's cyber security infrastructure.

This allowed India to have held the market to grow at a CAGR of 12.5%.

China has a high adoption rate for cloud and IoT technologies, which has created new susceptibilities that need to be protected. China's rapidly growing economy has enabled many companies and individuals to invest in internet security solutions.

With an increasing number of cyber-attacks, the need for internet security solutions has become a major part of China.

Due to the above-mentioned reasons, China was estimated to have held a market share of 16.2% in 2025.

The government stores far more data than the private sector and more often keep it on older, less secure systems. Even as governments attempt to protect themselves from attackers, employees and citizens alike want their data to be easily accessible. It's no surprise then that those who envision digital government transformation face significant cybersecurity challenges.

For these reasons, the government segment is estimated to have a higher share value of 20.7%. as of 2025.

Tokenization converts data into a random code that cannot be reversed, whereas encryption can be reversed by experts.

Tokenization occurs with card numbers, security numbers, and so on, whereas encryption occurs with files and emails. Payments made over the phone or in person are examples of encrypted data, and the use cases of tokenization include card-on-file payments, recurring payments, and storing customer data in multiple locations.

The demand for tokenization and encryption is estimated to grow because of the high importance they maintain for creating secure environments for the clients and servers, that can be crucial for rising number of e-commerce businesses and the application of blockchain technology for various industrial purposes.

Based upon the above-mentioned reasons, it is estimated that encryption and tokenization CAGR is 11.5% for the forecast period.

Rising end-user investment and high demand for enterprise security solutions drive security solution adoption. Global market players like Palo Alto Networks, Inc., Microsoft Corporation, IBM Corporation, and others are investing in advanced network security solutions.

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

The Internet Security Market is expected to register a CAGR of 8.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.0%, followed by India at 11.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.7%, yet still underscores a broadly positive trajectory for the global Internet Security Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.2%. The USA Internet Security Market is estimated to be valued at USD 24.7 billion in 2025 and is anticipated to reach a valuation of USD 51.2 billion by 2035. Sales are projected to rise at a CAGR of 7.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 3.6 billion and USD 1.7 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 66.3 Billion |

| Software | Antivirus/Antimalware, IAM, Log Management and SIEM, Encryption and Tokenization, and Compliance and Policy Management |

| Application | BFSI, IT & Telecom, Retail, Healthcare, Defense/Government, Manufacturing, Energy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

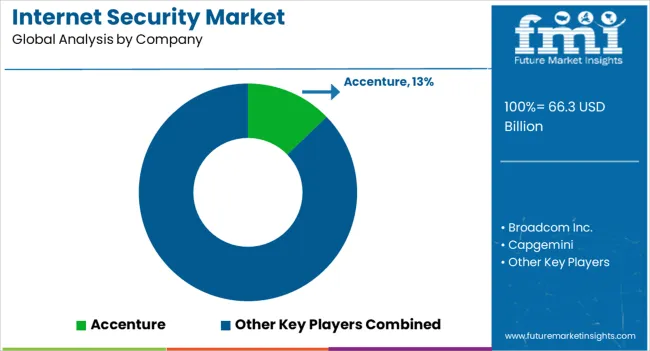

| Key Companies Profiled | Accenture, Broadcom Inc., Capgemini, Cognizant, F5 Networks Inc., FireEye Inc., HCL Technologies Limited, IBM Corporation, Infosys Limited, L&T Technology Services Limited, PwC International Limited, Tata Consultancy Services, Tech Mahindra Limited, and Wipro Limited |

The global internet security market is estimated to be valued at USD 66.3 billion in 2025.

The market size for the internet security market is projected to reach USD 155.5 billion by 2035.

The internet security market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in internet security market are antivirus/antimalware, iam, log management and siem, encryption and tokenization and compliance and policy management.

In terms of application, bfsi segment to command 28.7% share in the internet security market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IoT Security Product Market Report – Growth & Forecast 2017 to 2027

Embedded Security for IoT Market Report – Trends & Forecast 2017-2027

Internet Protocol Television Market Size and Share Forecast Outlook 2025 to 2035

Internet Of Things In Farm Management Market Size and Share Forecast Outlook 2025 to 2035

Internet Of Things IoT Monetization Market Size and Share Forecast Outlook 2025 to 2035

Internet Protocol Television (IPTV) CDN Market Size and Share Forecast Outlook 2025 to 2035

Internet of Robotics Things - Market Trends & Forecast 2025 to 2035

Internet of Everything (IoE) Market Analysis – Size, Share & Forecast 2025-2035

Internet of Things Vehicle-to-Vehicle Communication Market

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

In-flight Internet Market Size and Share Forecast Outlook 2025 to 2035

Dedicated Internet Access Market

Voice Over Internet Protocol (VoIP) Over WLAN (VoWLAN) Market Size and Share Forecast Outlook 2025 to 2035

Voice over Internet Protocol (VoIP) Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Enterprise Internet Reputation Management Market Share

Enterprise Internet Reputation Management Market Growth – Trends & Forecast 2025 to 2035

Automotive Internet of Things (IoT) Market

UK Enterprise Internet Reputation Management Market Growth – Demand, Trends & Forecast 2025-2035

USA Enterprise Internet Reputation Management Market Analysis – Size, Share & Innovations 2025-2035

Japan Enterprise Internet Reputation Management Market Report – Size, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA