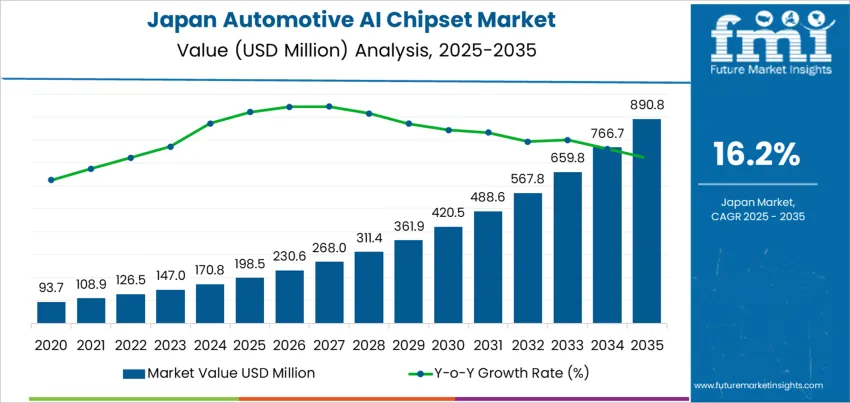

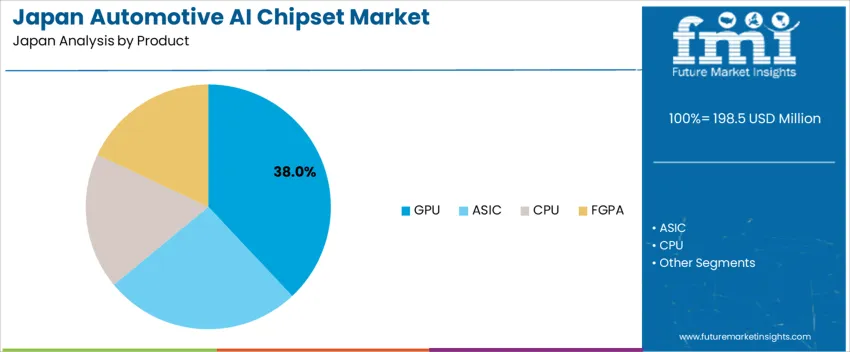

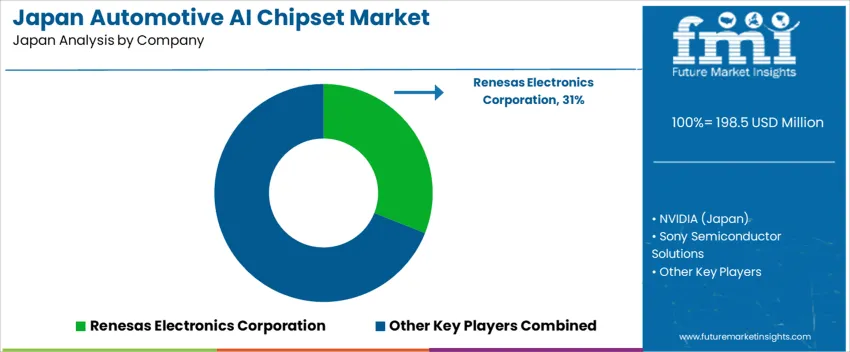

The Japan automotive AI chipset demand is valued at USD 198.5 million in 2025 and is forecasted to reach USD 890.8 million by 2035, reflecting a CAGR of 16.2%. Growth is supported by increased integration of artificial intelligence capabilities into advanced driver-assistance systems, in-vehicle control modules, and connected mobility platforms. Autonomous functions, real-time perception, and safety-related decision-making processes are strengthening chipset requirements in new vehicle programmes. GPUs lead the chipset landscape due to high parallel-processing efficiency, suitability for visual recognition workloads, and ability to support machine-learning inference. Their adoption aligns with rising deployment of camera-based sensing and predictive analytics in passenger and commercial models. Improvements in energy efficiency and thermal performance continue to influence manufacturer selection.

Kyushu & Okinawa, Kanto, and Kinki record highest implementation levels, driven by automotive production centers, semiconductor development hubs, and investment in electric and intelligent mobility programmes. Collaboration between automotive OEMs and semiconductor suppliers sustains ongoing innovation in onboard computing architecture. Key suppliers include Renesas Electronics Corporation; NVIDIA (Japan); Sony Semiconductor Solutions; Toshiba Electronic Devices & Storage Corporation; and NXP (Japan). Their portfolios support applications in perception processing, control-unit integration, and autonomous mobility functions used across future-generation automotive platforms.

Demand for automotive AI chipsets in Japan demonstrates an advancing growth momentum tied to electrification, advanced driver-assistance systems, and connected-vehicle deployment. Early momentum is shaped by premium vehicle manufacturers integrating perception, decision, and safety-monitoring processors into flagship models. These applications form the core volume contribution as regulatory frameworks encourage collision-avoidance technologies and lane-support functions.

The next momentum layer is driven by autonomous-capable architectures in commercial and public-transport fleets. Field trials in urban corridors and controlled zones add incremental uptake, though volume scale is paced by validation requirements. Semiconductor innovation supports continued acceleration as local producers strengthen design for thermal reliability, cybersecurity, and low-latency processing. Momentum moderation may occur when upgrade cycles stabilize and non-AI electronics reach efficiency thresholds that limit unit proliferation.

Despite these shifts, trajectory remains clearly positive. Automotive electrification and intelligent-mobility programs expand the chipset addressable base, sustaining mid-term acceleration followed by a controlled maturity phase rooted in mandated safety and operational-efficiency needs.

| Metric | Value |

|---|---|

| Japan Automotive AI Chipset Sales Value (2025) | USD 198.5 million |

| Japan Automotive AI Chipset Forecast Value (2035) | USD 890.8 million |

| Japan Automotive AI Chipset Forecast CAGR (2025-2035) | 16.2% |

Demand for automotive AI chipsets in Japan is increasing because vehicle manufacturers are integrating advanced driver assistance functions that require real time processing of data from cameras, radar and lidar sensors. Japan focuses on safety technologies that support automated braking, lane keeping and congestion assistance, which strengthens the need for high performance processors inside new vehicles. Electrification and the growth of hybrid and battery electric vehicles also contribute, since power management and predictive control systems depend on continuous data analysis.

Japanese suppliers invest in smart mobility platforms where connected vehicles exchange information with road infrastructure. This encourages adoption of chipsets capable of fast communication and traffic prediction. Robotics and factory automation expertise in Japan influences automotive production, expanding the role of semiconductor intelligence in quality and drive control systems. Government programmes promoting domestic semiconductor capability support investment in automotive grade chip development. Constraints include high development cost, long safety certification cycles and competition for secure supply of advanced process nodes. Some smaller automakers delay introducing full AI functionality until economic conditions and regulatory expectations make the investment more practical.

Demand for automotive AI chipsets in Japan is influenced by expanding electrification, government support for road-safety innovations, and integration of intelligent driver-assistance capabilities in locally manufactured vehicles. Automakers emphasize reduced power consumption, high-speed data handling, and functional safety compliance to support decision-making in dynamic driving environments. Domestic production benefits from semiconductor ecosystem maturity and collaborations between electronics firms and mobility OEMs. Adoption aligns with automated driving initiatives, continuous sensor data analysis, and infotainment personalization.

GPUs represent 38.0%, driven by strong demand for parallel computing required in perception tasks such as object detection and sensor fusion. These units support real-time processing for advanced navigation and on-road visibility systems. ASICs account for 26.0%, offering power-efficient execution in specialized safety applications. CPUs hold 18.0%, supporting system coordination and vehicle control logic. FPGAs represent 18.0%, valued for reconfigurable hardware adaptable to model updates during vehicle life cycles. Product selection emphasizes processing efficiency, thermal management, and compatibility with ADAS architectures deployed by Japanese automakers.

Key points:

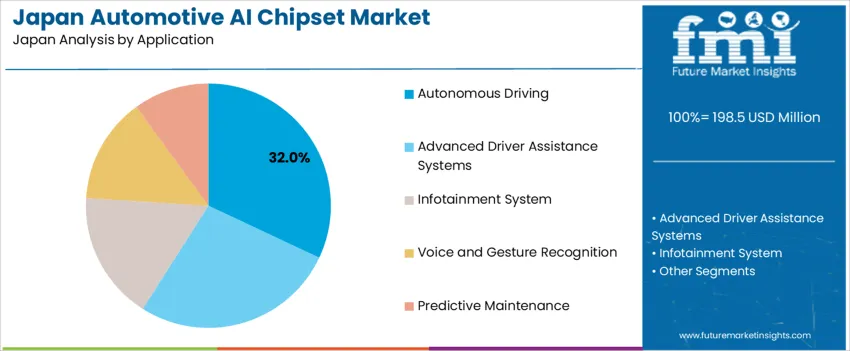

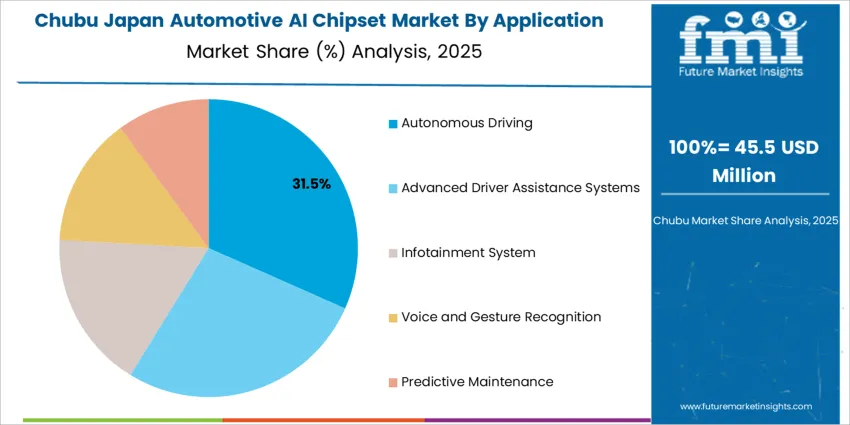

Autonomous driving accounts for 32.0%, supported by continuous testing of higher-level automation functions on Japanese roads. These chipsets enable navigation, obstacle classification, and decision-support logic across complex urban environments. ADAS represents 27.0%, reflecting installation of lane-keeping, adaptive cruise control, and collision-avoidance systems in mass-market vehicles. Infotainment systems hold 17.0%, enhancing personalized digital interfaces. Voice and gesture recognition represent 14.0%, supporting hands-free interaction. Predictive maintenance accounts for 10.0%, enabling efficient fault detection. Application distribution reflects regulatory focus on safety and differentiated driving-assistance features.

Key points:

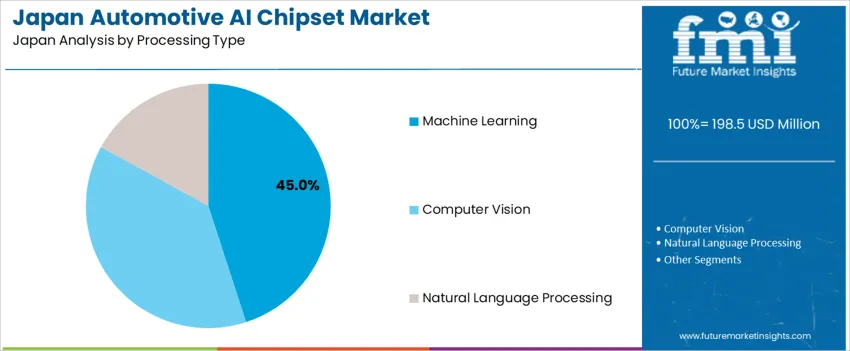

Machine learning accounts for 45.0%, enabling adaptive decision-making, behavior prediction, and response optimization across high-traffic scenarios. Computer vision holds 38.0%, driven by camera-dependent perception for lane marking detection and environmental awareness. Natural language processing represents 17.0%, supporting voice-command functions integrated into infotainment systems. Processing selection focuses on low-latency inference, neural-network acceleration, and compatibility with multimodal sensor input. System evolution emphasizes model-training efficiency, cyber-secure learning deployment, and scalable upgrades aligned with maturing automation capabilities in Japan’s passenger-vehicle fleet.

Key points:

Expansion of advanced driver-assistance systems, increased EV and hybrid development and strong OEM presence in automated driving R&D are driving demand.

In Japan, automotive AI chipset usage increases as automakers enhance ADAS functions such as lane-keeping, blind-spot monitoring and parking assistance in models targeted for domestic roads. EV and hybrid platforms developed in Aichi, Hiroshima and Tochigi require onboard computing for safety monitoring, powertrain control and sensor fusion. OEMs and Tier-1 suppliers collaborate on automated driving pilots in Tokyo and highway corridors, supporting demand for chipsets that process camera, radar and lidar data in real time. Commercial fleet operators in logistics and public transport also explore AI-enabled safety features that reduce collision risk in congested urban environments. These applications strengthen procurement among Japanese vehicle manufacturers adapting to stricter safety expectations and mobility innovation policies.

High certification requirements, long vehicle development cycles and limited availability of advanced domestic semiconductor fabs restrain adoption.

Automotive chipsets must meet safety and reliability standards that lengthen validation processes, slowing rollout in vehicles designed for mass production. The multiyear development timelines of Japanese OEMs limit rapid platform upgrades once architecture decisions are set. Japan continues to expand advanced semiconductor capacity, yet reliance on overseas fabrication for leading-edge nodes increases supply chain exposure, especially for compute-intensive AI chips. Cost-sensitive vehicle segments may delay introduction of high-performance chipsets until integration benefits are clearly proven. These structural and economic constraints temper large-scale deployment outside premium and commercial models.

Shift toward centralized vehicle computing, increased collaboration with domestic sensor manufacturers and rising demand for over-the-air optimization define key trends.

Automakers are transitioning from multiple distributed ECUs to centralized compute units that require high-efficiency AI chipsets capable of managing multiple perception tasks. Suppliers integrate chipsets closely with Japanese-made cameras and radar modules to support compact vehicle designs common in kei and mid-size segments. Over-the-air software updates are gaining traction, requiring chipsets optimized for continuous learning and field performance improvements. Pilot deployments of automated logistics vehicles in ports and warehouse hubs increase demand for robust AI computing suitable for controlled-route autonomy. These trends indicate expanding adoption of automotive AI chipsets aligned with Japan’s mobility innovation priorities.

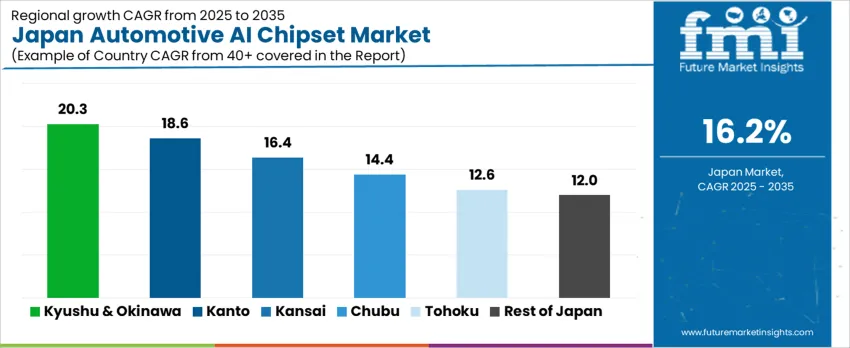

Automotive AI chipsets support advanced driver-assistance systems, autonomous navigation features, predictive maintenance analytics, and electric vehicle power optimization. Demand aligns with automotive R&D clusters, semiconductor capabilities, and vehicle electrification pathways across Japan. Kyushu & Okinawa leads at 20.3% CAGR, driven by semiconductor foundry proximity, while Kanto (18.6%), Kinki (16.4%), Chubu (14.4%), Tohoku (12.6%), and Rest of Japan (12.0%) follow with differentiated adoption drivers.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 20.3% |

| Kanto | 18.6% |

| Kinki | 16.4% |

| Chubu | 14.4% |

| Tohoku | 12.6% |

| Rest of Japan | 12.0% |

Kyushu & Okinawa maintains 20.3% CAGR, influenced by semiconductor ecosystem concentration in Fukuoka and Kumamoto, along with expanding collaborations with Japanese automotive manufacturers integrating semi-autonomous platforms. Vehicle-chip production pilots focus on low-power neural processors applied to real-time driving decisions, pedestrian detection, and adaptive cruise control stabilization. Fleet electrification across logistics operations increases requirements for e-powertrain control chips embedded in battery modulation systems. Suppliers ensure radiation-resistant architectures for reliability under variable weather and road conditions. AI microcontrollers used in onboard diagnostics support predictive maintenance features distributed through service networks across Kyushu. Startup initiatives backed by regional funds contribute to high-performance edge computing chips packaged for compact automotive modules.

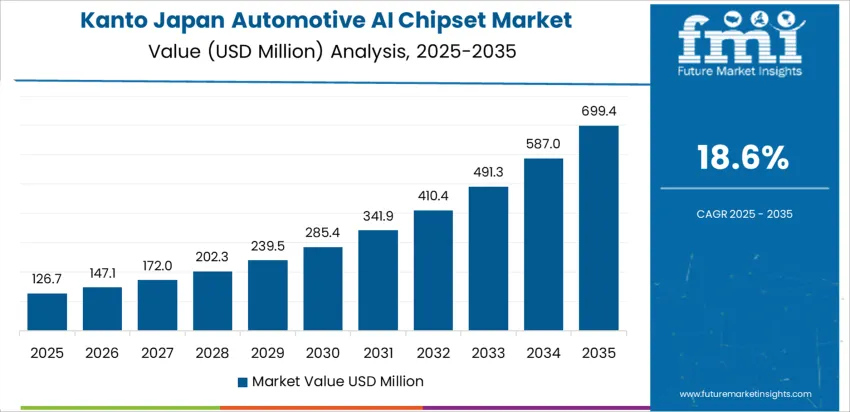

Kanto posts 18.6% CAGR, driven by Tokyo-Yokohama automotive innovation programs, fleet connectivity deployments, and continuous rollouts of high-precision safety automation. Manufacturers apply AI chips to fusion-sensor modules interpreting radar, LiDAR, and camera inputs for driver-assistance features. Connectivity infrastructure enables real-time decision computing integrated with maps updated through cloud services. Chipset characteristics prioritized in procurement include thermal stability, low-latency processing, and seamless compatibility with existing automotive control frameworks. Software-defined vehicle initiatives in R&D labs contribute to new chip adoption during platform refresh cycles.

Kinki expands at 16.4% CAGR, supported by development in Osaka and Kobe automotive supply networks. Vehicle electronics manufacturers implement AI-enabled software to refine parking automation and lane monitoring. Suppliers prioritize chips designed for compact component enclosures, benefiting passenger and commercial vehicles with tight sensor arrangements. Local testing facilities validate chipset consistency under road vibration, prioritizing zero-latency braking responses. Procurement teams consider lifecycle security provisions to maintain protected data environments within vehicles.

Chubu reaches 14.4% CAGR, driven by automotive production strength in Aichi Prefecture. AI chipsets support efficiency improvements in electric powertrains, regenerative braking optimization, and localized manufacturing automation. Component developers seek hardware that withstands sustained high temperatures common in engine-bay installations. Production lines adopt embedded diagnostic chips for assembly verification and calibration tasks, lowering error margins. Demand shows alignment with export vehicle platforms, requiring scalable chip variants adaptable to international navigation policies.

Tohoku reaches 12.6% CAGR, driven by specialty automotive component production and material manufacturing supporting EV platforms. Regional plants contributing to national supply chains increasingly integrate AI chipsets that enhance system automation, including battery thermal management, charging optimization, and regenerative braking alignment. Winter driving conditions in Aomori, Akita, and Iwate require advanced collision-avoidance units that maintain stable computation and visual detection in low-visibility environments. Neural processors embedded within ADAS modules support lane-keeping and object recognition during adverse weather, improving operational continuity across commuter and logistics vehicles. Procurement teams prioritize robust thermal cycling endurance and vibration resistance, ensuring electronics remain reliable during snow-season fleet use. Regional workforce programs expand technician familiarity with automotive semiconductor systems, enabling smooth deployment across assembly lines. Connectivity projects under gradual rollout provide support for chipsets coordinating real-time mapping and hazard alerts.

Rest of Japan grows at 12.0% CAGR, representing structured modernization among smaller manufacturing hubs and regional vehicle fleets. Demand is broadly linked to phased automation improvements that include blind-spot assistance, adaptive lighting, and driver-monitoring systems. Buyers emphasize chipset cost-efficiency and integration flexibility with vehicles already in service. Transport authorities encourage incremental adoption of enhanced safety controls without major drivetrain modifications, which supports ongoing deployment of compact neural processors. Regional automotive workshops benefit from standardized chip architecture, simplifying replacement and calibration workflows. Commercial fleets transitioning to EV operations add AI chipsets for charge-route planning and vehicle-health monitoring. Data security features embedded within chipsets gain relevance as digital connectivity expands across regional highways. Procurement maintains risk-managed investment pacing, aligning adoption with proven reliability outcomes observed in larger manufacturing clusters.

Demand for automotive AI chipsets in Japan is driven by electronic-control units supporting ADAS functions, automated-driving features, and perception systems across domestic vehicle platforms. Renesas Electronics Corporation holds an estimated 31.0% share, supported by controlled performance-efficiency ratios, functional-safety compliance, and deep integration within Japanese automotive-electronics architectures. Its AI-embedded processors deliver consistent real-time performance in constrained thermal environments. NVIDIA Japan maintains strong participation through GPU-accelerated SoCs used in higher-complexity autonomous-driving programs that require advanced sensor fusion and neural-network execution. Sony Semiconductor Solutions contributes presence in imaging-linked AI processing where stable edge inference and camera-system coordination support Japanese mobility applications.

Toshiba Electronic Devices & Storage Corporation supplies processors and accelerators designed for energy-efficient machine-vision workloads deployed in light-commercial and passenger vehicles. NXP Japan adds stable availability of safety-qualified processors enabling structured ADAS functionality with predictable verification paths. Competition in Japan centers on real-time perception accuracy, functional-safety certification, power-efficiency, silicon-node reliability, and supply-chain continuity. Demand expands where AI-enabled control units enhance driving-assistance capabilities and support progressive automation across vehicles produced for Japan’s regulated transportation environment.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product | GPU, ASIC, CPU, FPGA |

| Application | Autonomous Driving, Advanced Driver Assistance Systems, Infotainment System, Voice and Gesture Recognition, Predictive Maintenance |

| Processing Type | Machine Learning, Computer Vision, Natural Language Processing |

| Vehicle Type | Passenger Vehicle, Commercial Vehicle |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Renesas Electronics Corporation, NVIDIA (Japan), Sony Semiconductor Solutions, Toshiba Electronic Devices & Storage Corporation, NXP (Japan) |

| Additional Attributes | Dollar demand across processing and application segments; growth driven by Level 2+ and Level 3 autonomy adoption; integration with sensor fusion modules, edge computing, and real-time decision systems; focus on power-efficient chipsets tailored for Japanese automotive OEMs; increasing semiconductor localization and collaboration with EV manufacturers across major industrial hubs in Chubu and Kanto. |

The demand for automotive AI chipset in Japan is estimated to be valued at USD 198.5 million in 2025.

The market size for the automotive AI chipset in Japan is projected to reach USD 890.8 million by 2035.

The demand for automotive AI chipset in Japan is expected to grow at a 16.2% CAGR between 2025 and 2035.

The key product types in automotive AI chipset in Japan are gpu, asic, CPU and fgpa.

In terms of application, autonomous driving segment is expected to command 32.0% share in the automotive AI chipset in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Automotive AI Chipset Market Trends – Growth & Forecast 2025 to 2035

Demand for Automotive AI Chipset in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Trailing Arm Bushing in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Aircraft Ground Support Equipment Market Analysis & Forecast by Equipment, Ownership, Power, Application, and Region Through 2025 to 2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Drain Cleaning Equipment Market Report – Trends, Demand & Outlook 2025-2035

Automotive Air Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Airbags Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Airbag Controller Unit Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Filter Market Growth - Trends & Forecast 2025 to 2035

Japan Mountain and Ski Resort Market Trends – Demand, Size & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA