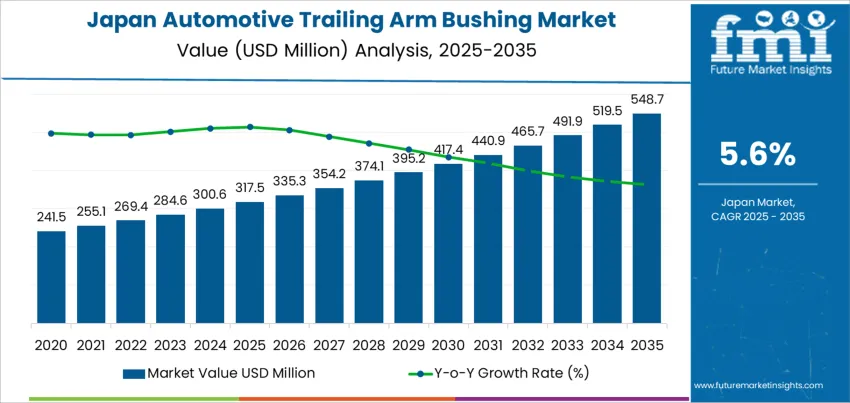

The demand for automotive trailing arm bushings in Japan is expected to grow from USD 317.5 million in 2025 to USD 548.7 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.6%. Trailing arm bushings, integral to vehicle suspension systems, help improve ride quality and stability. The increasing demand for vehicles with advanced suspension systems, particularly in electric vehicles (EVs) and hybrid vehicles, is expected to drive market growth. As the automotive industry continues to prioritize ride comfort and vehicle handling, the need for high-quality suspension components like trailing arm bushings is projected to rise.

The market will experience steady growth, starting at USD 317.5 million in 2025 and increasing to USD 335.3 million in 2026, USD 354.2 million in 2027, and USD 374.1 million in 2028. By 2029, the market is expected to reach USD 395.2 million, continuing to grow through the 2030s. By 2035, the demand for automotive trailing arm bushings is forecasted to reach USD 548.7 million, driven by continued demand in both the OEM and aftermarket segments.

The automotive trailing arm bushing market in Japan is expected to experience steady growth over the next decade. Starting at USD 317.5 million in 2025, the market will rise to USD 335.3 million in 2026, USD 354.2 million in 2027, and USD 374.1 million by 2028. By 2029, demand will reach USD 395.2 million, with continued growth expected throughout the 2030s. By 2035, the demand for automotive trailing arm bushings is forecasted to reach USD 548.7 million, driven by increasing vehicle production, particularly in the light vehicle segment, and the ongoing adoption of advanced suspension systems.

The compound absolute growth analysis reveals a consistent and steady increase in demand for automotive trailing arm bushings over the forecast period. The total absolute growth from 2025 to 2035 is USD 231.2 million, indicating that the market will experience a relatively stable expansion over time. The majority of this growth will be driven by the increasing demand for better-performing suspension systems in both traditional and electric vehicles.

The early years (2025–2029) will see gradual growth, with increases of approximately USD 17–20 million each year. The rate of absolute growth remains consistent, reflecting steady demand in line with overall vehicle production. As the market matures, particularly in the latter half of the forecast period (2030–2035), the compound growth continues, with the market reaching higher growth levels as the demand for advanced automotive components rises. Despite the consistent growth, the analysis highlights that the market will not experience sudden or sharp shifts but will rather expand steadily, driven by ongoing trends in vehicle manufacturing and suspension system advancements.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 317.5 million |

| Industry Forecast Value (2035) | USD 548.7 million |

| Industry Forecast CAGR (2025-2035) | 5.6% |

Demand for trailing arm bushings in Japan is rising as growth in the overall automotive parts and suspension system markets supports higher replacement and OEM demand for suspension components. The Japanese auto parts aftermarket is growing, driven by increased maintenance of an aging vehicle population and a rise in demand for quality replacement parts. As vehicles get older or accumulate mileage, suspension components such as bushings often require replacement to maintain ride comfort and safety. This trend directly supports demand for trailing arm bushings, a key element within the broader suspension bushing category.

At the same time, changes in vehicle types and suspension requirements are contributing to growth. As the market for electric vehicles (EVs), hybrid vehicles, and modern cars expands in Japan, manufacturers and aftermarket providers place greater emphasis on suspension performance, noise and vibration reduction, and ride stability under varying load conditions. These demands raise the need for high quality trailing arm bushings designed to meet modern standards for durability and comfort. The global trend toward advanced suspension systems and improved vehicle dynamics has increased adoption of specialized bushings including trailing arm types. As automakers and consumers prioritize driving comfort and longevity, demand for trailing arm bushings in Japan is expected to grow steadily over coming years.

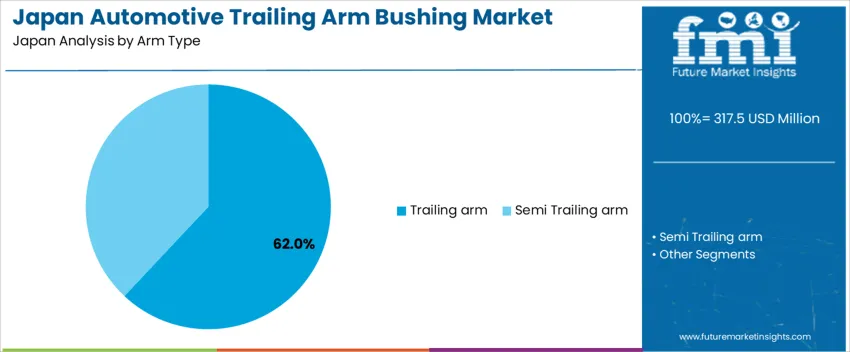

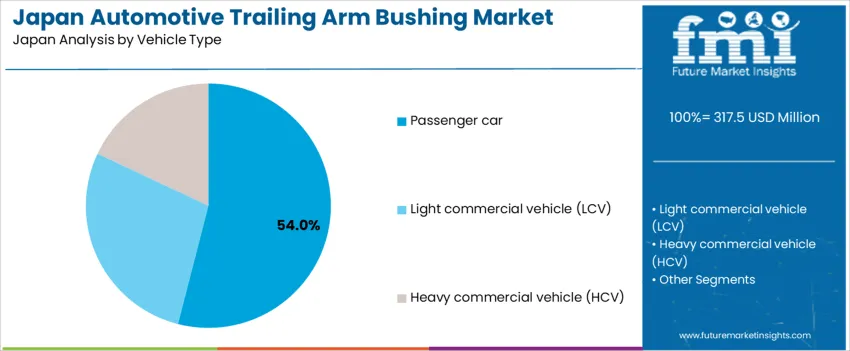

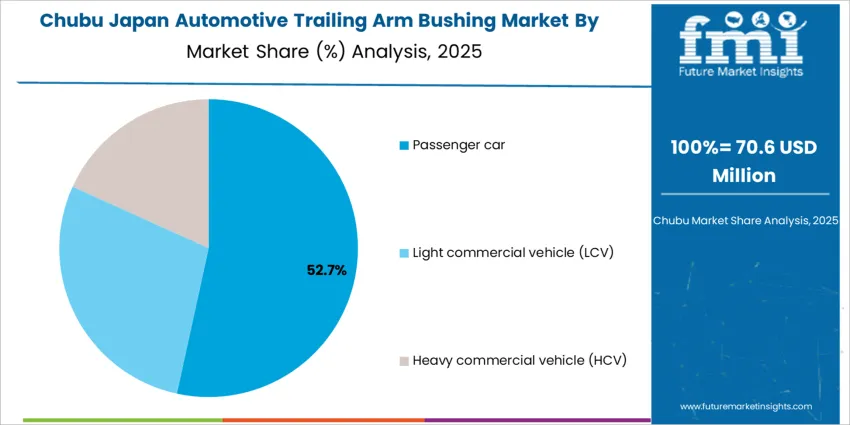

The demand for automotive trailing arm bushings in Japan is primarily driven by arm type and vehicle type. The leading arm type is trailing arm, which accounts for 62% of the market share, while passenger cars are the dominant vehicle type, capturing 54% of the demand. Trailing arm bushings are crucial components in the suspension system, helping to ensure smooth and stable handling of the vehicle. As the demand for enhanced ride quality and vehicle stability continues, the need for high-performance trailing arm bushings remains strong in Japan.

Trailing arm bushings lead the demand for automotive trailing arm bushings in Japan, holding 62% of the market share. Trailing arm bushings are widely used in the rear suspension systems of various vehicles, where they provide flexibility and reduce vibration between the suspension arm and the vehicle chassis. This type of bushing is favored for its ability to support a wide range of vehicle weight and provide better stability, especially in vehicles that experience varied road conditions.

The demand for trailing arm bushings is driven by their critical role in improving ride comfort, handling, and overall vehicle performance. They are particularly essential in passenger vehicles, where ride quality and safety are paramount. As Japanese consumers continue to demand more comfortable and stable vehicles, the popularity of trailing arm bushings remains strong. With the growing focus on vehicle durability and performance, particularly in SUVs and passenger cars, trailing arm bushings are expected to continue to dominate the market in Japan.

Passenger cars are the leading vehicle type for automotive trailing arm bushings in Japan, capturing 54% of the demand. Trailing arm bushings in passenger cars play a significant role in enhancing vehicle ride comfort and suspension performance. These bushings help absorb shocks and vibrations, ensuring smooth driving and stability, which are crucial factors for consumers when choosing vehicles. With the increasing demand for high-performance vehicles that offer a blend of comfort, safety, and handling, trailing arm bushings are essential components for achieving optimal vehicle performance.

The demand for trailing arm bushings in passenger cars is influenced by the growing focus on vehicle performance, especially in terms of handling and comfort. As Japanese consumers continue to prioritize these features, the demand for trailing arm bushings in passenger vehicles will remain strong. The ongoing trend of upgrading suspension systems for better ride quality and durability ensures that passenger cars will continue to be the largest market segment for automotive trailing arm bushings in Japan.

Demand for automotive trailing arm bushings in Japan is expected to grow steadily alongside broader expansion in the automotive suspension parts segment. As vehicles in Japan age and require replacement of suspension components, aftermarket demand for bushings rises. At the same time, production of new passenger cars, light vehicles and hybrid or electric vehicles continues, sustaining OEM demand for suspension bushings. Given the increasing emphasis on ride comfort, stability and durability in Japanese vehicles, demand for trailing arm bushings appears to remain robust both for replacements and new vehicle assembly.

What are the Drivers of Demand for Automotive Trailing Arm Bushing in Japan?

Several factors drive growth in demand for trailing arm bushings in Japan. First, ongoing vehicle production across passenger cars and light vehicles means each new vehicle requires suspension components including bushings. Second, the ageing vehicle fleet in Japan creates regular need for maintenance and replacement parts; trailing arm bushings wear out over time due to road use and must be replaced to maintain suspension integrity. Third, growing consumer awareness and demand for improved ride comfort, handling stability and noise vibration reduction push both manufacturers and aftermarket suppliers to use higher quality bushings. Fourth, the increasing share of hybrid and electric vehicles, often heavier due to battery packs, raises demand for durable suspension components able to handle higher loads-this boosts demand for robust trailing arm bushings optimized for load and durability. Finally, the expanding aftermarket and maintenance culture supports demand as consumers opt to replace worn suspension parts to maintain vehicle performance rather than purchase new vehicles.

What are the Restraints on Demand for Automotive Trailing Arm Bushing in Japan?

Despite supportive factors, certain constraints may limit growth in demand for trailing arm bushings in Japan. One restraint is that improvements in suspension technologies and chassis design may lead to alternative suspension architectures or integrated modules that reduce reliance on traditional trailing arm + bushing setups, especially in newer vehicle designs. Another restraint is cost sensitivity: high quality or performance oriented bushings may be more expensive than basic alternatives, which may deter usage when cost is a key consideration. For older, budget or compact vehicles where ride quality demands are modest, owners may choose cheaper suspension repair options or forego full bushing replacement, limiting demand. Supply chain or raw material price fluctuations for rubber, polyurethane or specialty materials used in bushings could raise costs and affect affordability. Finally, if vehicle production or sales decline-due to economic slowdown or regulatory shifts-the demand for new bushings from OEM channels may be impacted, reducing overall market growth.

What are the Key Trends Influencing Demand for Automotive Trailing Arm Bushing in Japan?

Key trends shaping demand for trailing arm bushings in Japan include increasing adoption of heavier and more feature rich vehicles such as hybrids and electric vehicles, which require more robust suspension components to handle extra weight and load. There is also a growing aftermarket trend: as the average age of vehicles increases, maintenance and replacement cycles become more frequent, creating stable demand for suspension bushings. Demand is rising for bushings made from advanced materials (e.g. polyurethane or other enhanced elastomers) that offer improved durability, noise/vibration damping, and longer life under load-especially in performance or utility vehicles. Manufacturers and aftermarket suppliers are responding by offering higher quality bushings targeting better ride comfort and lower maintenance frequency. Additionally, the broader automotive components market growth in Japan, supported by rising emphasis on vehicle safety, comfort and ride stability, underpins steady demand for suspension components including trailing arm bushings.

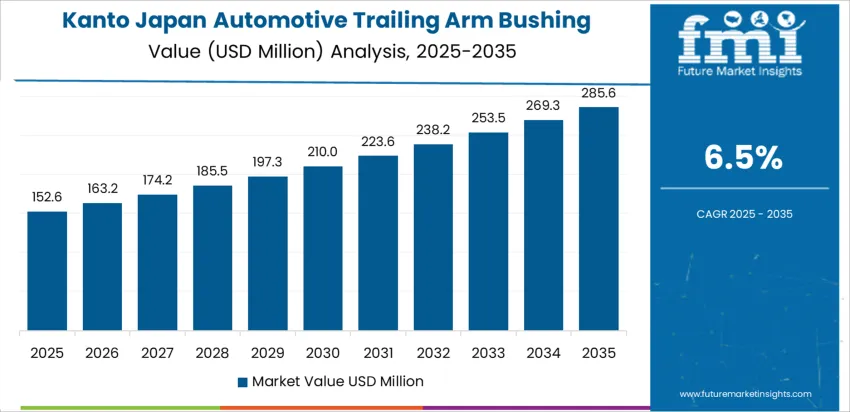

The demand for automotive trailing arm bushing in Japan is expected to show steady growth across regions, with Kyushu & Okinawa leading at a CAGR of 7.0%. Kanto follows closely at 6.5%, driven by high vehicle ownership and the concentration of automotive manufacturing. Kansai is forecast to grow at 5.7%, while Chubu, Tohoku, and the Rest of Japan show more modest growth, with respective CAGRs of 5.0%, 4.4%, and 4.2%. These regional differences reflect variations in automotive production, vehicle fleet size, aftermarket demand, and driving conditions, as well as the intensity of vehicle maintenance needs.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 7.0 |

| Kanto | 6.5 |

| Kansai | 5.7 |

| Chubu | 5.0 |

| Tohoku | 4.4 |

| Rest of Japan | 4.2 |

In Kyushu & Okinawa, the demand for automotive trailing arm bushing is projected to grow at a CAGR of 7.0%, which is the highest among all regions. The region’s automotive market benefits from both OEM production and aftermarket replacement demand. Kyushu & Okinawa have a significant number of vehicles on the road, especially in coastal areas and major urban centers like Fukuoka, where vehicle fleets are subject to regular use. The challenging road conditions, including those in Okinawa’s more rugged areas, place added stress on suspension components like the trailing arm bushing, which are essential for vehicle stability and comfort. Furthermore, the increase in tourism and corresponding transportation needs in Okinawa contribute to higher demand for vehicle maintenance and replacement parts, including trailing arm bushings. As vehicles in the region age and require maintenance, the demand for quality suspension components continues to rise, supporting the region’s high growth rate for automotive parts like trailing arm bushings.

In Kanto, the demand for automotive trailing arm bushing is expected to grow at a CAGR of 6.5%, driven by the region’s dense population, high vehicle ownership, and heavy traffic. Kanto, which includes Tokyo and its surrounding areas, has one of the highest concentrations of vehicles in Japan. Frequent stop-and-go driving, as well as urban road conditions, contribute to accelerated wear of suspension components, including trailing arm bushings. The high demand for vehicle maintenance, repair, and replacement parts in this region is a key driver of growth. Additionally, the presence of major automotive manufacturing and assembly plants in Kanto means that both OEM and aftermarket demand for suspension components is high. Consumers in Kanto also prioritize vehicle safety and performance, contributing to steady replacement cycles for parts like trailing arm bushings. The region’s large automotive market and high fleet turnover ensure sustained demand for these components.

In Kansai, the demand for automotive trailing arm bushing is projected to grow at a CAGR of 5.7%, reflecting steady growth driven by the region’s automotive sector and vehicle fleet maintenance needs. Kansai, home to cities like Osaka and Kyoto, has a well-developed infrastructure and a strong automotive presence. Many vehicles in the region, including those used in commercial and personal transport, require frequent maintenance due to the wear and tear from urban driving conditions. As vehicles age, there is an increasing need for replacement parts such as trailing arm bushings. Additionally, Kansai’s automotive industry is an important hub for both manufacturing and parts distribution, contributing to the region’s demand for high-quality suspension components. The combination of a large vehicle population, consistent aftermarket demand, and the region’s strong automotive infrastructure ensures that Kansai will continue to see moderate growth in trailing arm bushing demand over the forecast period.

In Chubu, the demand for automotive trailing arm bushing is expected to grow at a CAGR of 5.0%, driven by the region’s automotive manufacturing base and increasing vehicle fleet size. Chubu, which includes Nagoya, has a significant presence of automotive manufacturers, including several major players in the automotive industry. As vehicles produced in Chubu reach their replacement cycles, there is increasing demand for parts such as trailing arm bushings. Additionally, Chubu’s strong industrial base means that the region has a large number of commercial and transportation vehicles, which often experience greater wear on suspension components. The region’s growth rate is slower compared to Kanto and Kyushu & Okinawa, but steady demand for aftermarket replacement parts and the ongoing modernization of the vehicle fleet ensure continued consumption of trailing arm bushings.

In Tohoku, the demand for automotive trailing arm bushing is forecast to grow at a CAGR of 4.4%, reflecting a slower pace of adoption compared to more industrialized regions. Tohoku has a lower population density, and the automotive market is less concentrated than in areas like Kanto or Kansai. However, the region still relies heavily on vehicles for transportation, particularly in rural and suburban areas. The demand for trailing arm bushings is driven by the need to replace worn-out suspension components in older vehicles, especially in areas where harsh weather conditions or rough roads accelerate wear. As Tohoku’s vehicle fleet ages and more vehicles are used for both personal and commercial purposes, the demand for replacement parts like trailing arm bushings will increase steadily, albeit at a slower pace than in more urbanized regions.

In the Rest of Japan, the demand for automotive trailing arm bushing is projected to grow at a CAGR of 4.2%, reflecting a moderate increase driven by vehicle maintenance and replacement needs. The Rest of Japan includes rural and smaller urban areas, where the automotive market is less saturated. However, as vehicle ownership grows in these regions, the need for replacement parts like trailing arm bushings also increases. The gradual aging of the vehicle fleet, combined with the ongoing need for maintenance and repairs, drives steady demand for suspension components. The Rest of Japan’s demand for trailing arm bushings is more moderate compared to other regions, but the consistent requirement for vehicle repairs and replacement parts ensures that demand will remain stable over time.

The market for trailing arm bushings in Japan sees several established suppliers competing for original equipment manufacturers and aftermarket demand. The leading firm is ZF Friedrichshafen AG with a share of about 29%. Other recognised suppliers include Continental, Federal Mogul LLC, ACDelco, and Mevotech. These players compete on product reliability, material quality, suitability for diverse vehicle types, and compatibility with evolving suspension systems. Product offerings focus on durability under load, resistance to wear, and performance under noise vibration harshness conditions.

Competition is shaped by distinct strategies. Some manufacturers emphasise advanced materials such as polymer or elastomer compositions to improve longevity and reduce weight. Others prioritise broad product portfolios that cover both passenger and commercial vehicles in OEM and aftermarket segments. Firms investing in research and development aim to meet rising demand for robust suspension components, especially in heavier or electric vehicles. Supplier brochures and spec sheets highlight attributes such as ride comfort, suspension stability, and longevity. Market positioning remains dynamic as suppliers adjust offerings to respond to shifting vehicle design requirements and aftermarket needs.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Arm Type | Trailing arm, Semi Trailing arm |

| Vehicle Type | Passenger car, Light commercial vehicle (LCV), Heavy commercial vehicle (HCV) |

| Sales Channel | OEM, Aftermarket |

| Key Companies Profiled | ZF Friedrichshafen AG, Continental, Federal Mogul LLC, ACDelco, Mevotech |

| Additional Attributes | The demand for automotive trailing arm bushings in Japan is driven by their critical role in vehicle suspension systems, providing stability and comfort. Trailing arm bushings are used in passenger cars, light commercial vehicles (LCV), and heavy commercial vehicles (HCV), with the semi-trailing arm version used in specific vehicle types for improved control. The market is segmented by arm type, with the trailing arm being more common. Sales are distributed between OEM and aftermarket channels, with the OEM segment benefiting from vehicle production and the aftermarket segment driven by replacement demand. Leading companies such as ZF Friedrichshafen, Continental, and Federal Mogul supply high-quality bushings designed for durability and performance across various vehicle categories. The market is expected to grow as the demand for commercial vehicles and passenger cars continues, alongside the increasing need for replacement parts in older vehicles. |

The demand for automotive trailing arm bushing in Japan is estimated to be valued at USD 317.5 million in 2025.

The market size for the automotive trailing arm bushing in Japan is projected to reach USD 548.7 million by 2035.

The demand for automotive trailing arm bushing in Japan is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in automotive trailing arm bushing in Japan are trailing arm and semi trailing arm.

In terms of vehicle type, passenger car segment is expected to command 54.0% share in the automotive trailing arm bushing in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Trailing Arm Bushing Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive Trailing Arm Bushing in USA Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Japan Garment Steamer Market Analysis - Size, Share & Trends 2025 to 2035

Japan Pharmaceutical Packaging Market Report – Demand, Growth & Innovations 2025-2035

Automotive Idler Arm Market

Automotive Rocker Arm Market Growth – Trends & Forecast 2025 to 2035

Automotive Suspension Control Arms Market Growth – Trends & Forecast 2025 to 2035

Demand for Automotive NFC in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Fabrics in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Headliner in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Light Bars in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brake Tube in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA