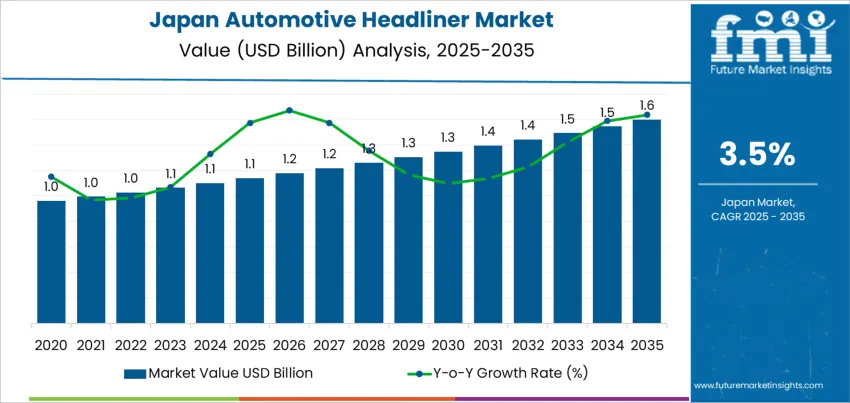

The Japan automotive headliner demand is valued at USD 1.1 billion in 2025 and is forecasted to reach USD 1.6 billion by 2035, recording a CAGR of 3.5%. Demand reflects continuous upgrades in cabin comfort, acoustic performance, and lightweight structural components used in passenger vehicles. Adoption aligns with broader shifts toward enhanced noise reduction, improved thermal insulation, and reduced vehicle weight to support fuel-efficiency and electrification requirements. Headliners also integrate lighting modules, wiring channels, and sensor mounts that support ADAS and in-cabin electronics.

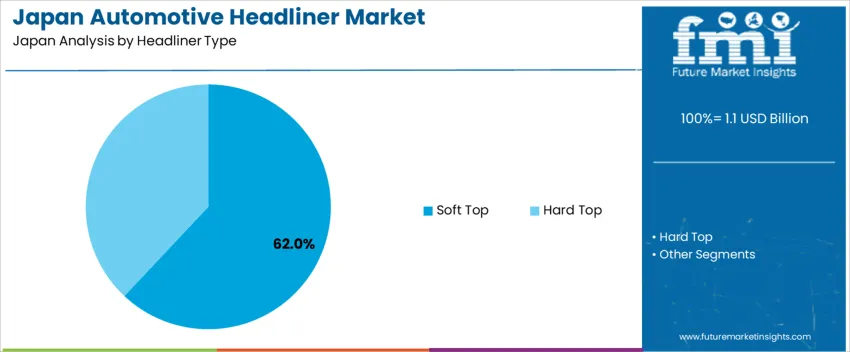

Soft-top headliners represent the leading product category. Their selection is influenced by flexibility, cost-efficiency, and compatibility with moulded substrate structures used in mass-production passenger vehicles. Development priorities include material stiffness consistency, textile durability, and processing performance in automated assembly environments. Increased utilization of recycled and bio-based fibres contributes to regulatory alignment on sustainability and end-of-life vehicle recovery.

Kyushu & Okinawa, Kanto, and Kansai record the highest deployment levels. These regions maintain the strongest presence of OEM assembly plants, supplier clusters, and engineering centers responsible for interior component localization. Collaboration between automakers and tier-1 suppliers supports design optimization tailored to domestic manufacturing requirements. Key suppliers include Toyota Boshoku Corporation, Grupo Antolin, Kasai Kogyo Co., Ltd., International Automotive Components (IAC), and Howa Co., Ltd. Their offerings include soft-top, hard-top, and composite headliners engineered for acoustic damping, structural stability, and seamless integration with in-vehicle electronics.

Demand for automotive headliners in Japan follows a two-phase growth curve shaped by material innovation and market dynamics within the domestic vehicle industry. In the early period, growth is moderate as headliner demand aligns closely with stable automobile production volumes. Lightweight composite materials and improved sound insulation provide incremental uplift, but expansion remains tied to routine model updates rather than structural change.

In the later phase, growth strengthens as electric vehicles and premium cabin features gain broader adoption. Enhanced acoustic performance, thermal control, and interior design aesthetics support more frequent headliner redesigns. Additionally, sustainability targets encourage transitions toward recycled fibers and bio-based substrates, generating replacement-driven demand within manufacturing supply chains. Export-linked production also contributes more significantly in the later period as global platforms adopt Japanese interior-component standards.

The comparison indicates a gradual acceleration over time. Early growth reflects standard automotive production cycles, while late growth benefits from technology requirements and upgraded interior expectations. The growth profile transitions from manufacturing stability to feature-led adoption as Japan’s mobility environment shifts toward comfort and efficiency priorities.

| Metric | Value |

|---|---|

| Japan Automotive Headliner Sales Value (2025) | USD 1.1 billion |

| Japan Automotive Headliner Forecast Value (2035) | USD 1.6 billion |

| Japan Automotive Headliner Forecast CAGR (2025-2035) | 3.5% |

Demand for automotive headliners in Japan is increasing because vehicle manufacturers require lightweight interior components that support comfort, acoustic performance and aesthetic quality. Headliners help reduce cabin noise and improve thermal insulation, which aligns with consumer expectations for quiet driving conditions in compact and mid-size vehicles commonly sold in Japan. Electrification trends in hybrid and battery electric vehicles reinforce the need for interior materials that optimize cabin acoustics by minimizing motor and road noise.

Automakers also focus on refined cabin design as a differentiator in a competitive market, encouraging adoption of headliners with premium fabrics, clean finishes and integration of lighting or electronic modules. Safety requirements contribute to the use of advanced composites that maintain dimensional stability and meet fire-resistance standards. Constraints include pressure to reduce material cost while meeting environmental goals, especially as recycling processes for multi-layer headliner structures continue to evolve. Space limitations in vehicle platforms require careful engineering to balance thickness, durability and wire routing. Production planning may also shift based on fluctuating domestic vehicle output and consumer demand cycles.

Demand for automotive headliners in Japan is driven by vehicle interior comfort upgrades, lightweight acoustic insulation, and improved ride quality expectations. OEMs focus on premium textures, noise reduction capabilities, and materials that support weight reduction for EVs and fuel-efficient models. Consumer preference for refined cabin ambience and sustainability also influences procurement. Supply aligns with Japan’s strong passenger vehicle production and aftermarket replacement needs across domestic fleets.

Soft top headliners hold 62.0%, driven by strong adoption in mass-produced passenger vehicles where fabric-covered laminates offer flexibility, cost performance, and enhanced acoustic insulation. These structures help maintain roof contouring in compact cars and hybrid vehicles, common across Japan’s urban mobility fleet. Hard top formats represent 38.0%, preferred in commercial vehicles and luxury models requiring higher structural rigidity and long-term durability. OEMs select headliner types based on vehicle class, vibration control requirements, and integration with lighting and electronic roof modules.

Key Points:

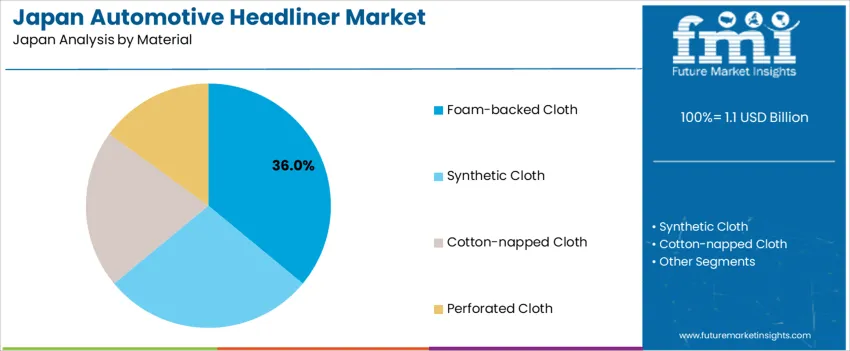

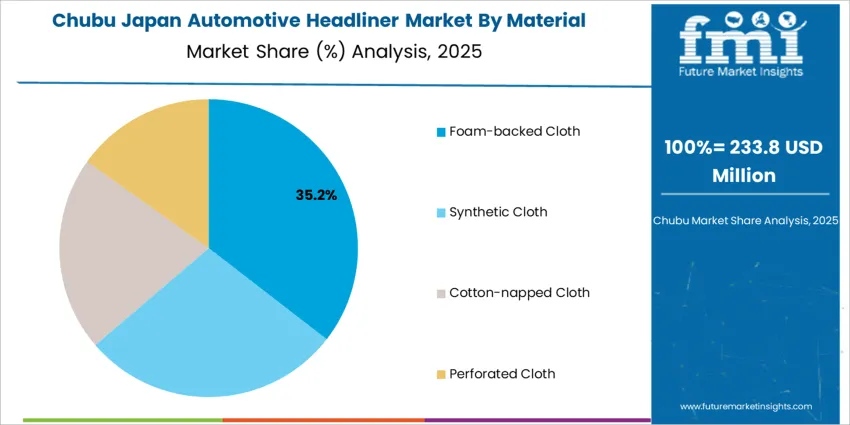

Foam-backed cloth accounts for 36.0%, valued for cushioning, formability, and sound-absorbing capability supporting quiet cabin experiences. Synthetic cloth represents 28.0%, widely used for cost efficiency, stain resistance, and greater design consistency. Cotton-napped cloth at 21.0% supports premium tactile finishes in higher-end trims. Perforated cloth holds 15.0%, installed in sport and luxury models requiring improved ventilation and upscale styling. Material choices in Japan reflect NVH (noise, vibration, harshness) optimization, recyclability efforts, and weight-saving targets aligned with electrified vehicle expansion.

Key Points:

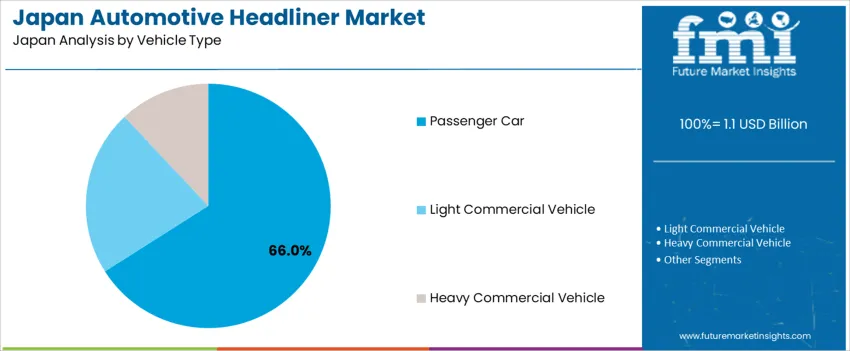

Passenger cars represent 66.0% of demand, supported by Japan’s dominant compact and hybrid vehicle segment where interior refinement drives purchase decisions. Light commercial vehicles account for 22.0%, including delivery vans used in e-commerce logistics requiring durable yet comfortable interiors. Heavy commercial vehicles represent 12.0%, with fleet operators adopting headliners for insulation and driver comfort during extended operation. Vehicle segment influence aligns with Japan’s fleet structure prioritizing efficient passenger mobility and growing last-mile distribution services.

Key Points:

Expansion of EV and hybrid vehicle production, increased focus on cabin comfort and rising demand for lightweight interior materials are driving demand.

In Japan, automotive headliner demand grows as major OEMs in Aichi, Tochigi and Kyushu update interior designs for EV and hybrid models that require noise reduction and improved cabin acoustics. Consumers prioritize comfort during long commutes on highways and dense urban roads, supporting the use of headliners with enhanced sound absorption and thermal insulation. Interior styling remains a key differentiator in competitive domestic vehicle segments, leading to investment in premium fabrics and clean-surface aesthetics. Localization of parts production within regional supplier networks supports reliable procurement and adherence to strict quality standards demanded by Japanese automakers.

Cost control requirements, slow replacement cycles and limited customization in economy models restrain demand.

Headliners are long-life components that rarely require replacement during the vehicle’s service period, constraining aftermarket demand. Mass-market vehicle lines prioritize cost efficiency, which limits the adoption of high-end materials except in upper trims. Additional production steps for laminated or molded headliners increase manufacturing expense and may be restricted when OEMs focus on price competition in kei and compact car categories. These budget-driven constraints moderate rapid upgrades across the full fleet.

Shift toward recycled and bio-based materials, increased integration of lighting and electronics and rising design optimization for EV acoustics define key trends.

Suppliers expand headliners made from recycled polyester and natural fibers to support Japanese sustainability targets and resource-circulation initiatives. Automakers are integrating LED lighting modules and hidden speaker components into headliner structures to support immersive cabin experiences. EV platforms prioritize vibration dampening and cabin quietness, encouraging headliner solutions engineered for acoustic insulation around battery and motor zones. Modular production methods that reduce assembly time are gaining traction in domestic plants with limited labor availability. These trends indicate steady, technology-aligned demand for automotive headliners across Japan’s evolving vehicle lineup.

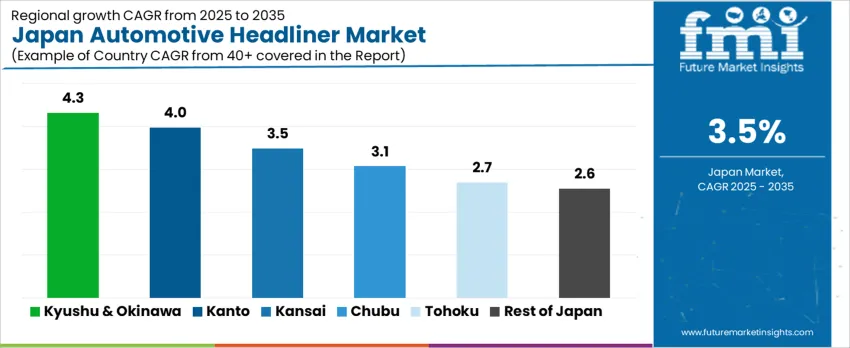

Automotive headliner demand in Japan is influenced by evolving cabin comfort expectations, upgraded acoustic performance requirements, and manufacturer focus on lightweight interior materials to improve vehicle fuel efficiency. Growth is strongest in regions with established automotive assembly operations and supplier networks. Between 2025 and 2035, projections indicate Kyushu & Okinawa achieves 4.3% CAGR, followed by Kanto (4.0%), Kansai (3.5%), Chubu (3.1%), Tohoku (2.7%), and the Rest of Japan (2.6%). These variations reflect differences in OEM footprint, consumer segment demand, component engineering, and export-driven manufacturing concentration.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.3% |

| Kanto | 4.0% |

| Kansai | 3.5% |

| Chubu | 3.1% |

| Tohoku | 2.7% |

| Rest of Japan | 2.6% |

Kyushu & Okinawa posts the highest expected growth at 4.3% CAGR due to its strong automotive manufacturing base centered around Fukuoka and Kumamoto. Headliner installations support expanding production of passenger vehicles and compact SUVs where cabin noise reduction and material durability contribute to brand differentiation. Suppliers focus on delivering headliners integrating lightweight composite substrates that improve fuel efficiency and align with tightening automotive efficiency regulations. Increased interior personalization in standard trims encourages use of fabric-laminated and molded solutions tailored to acoustics and appearance consistency. Tier-one and tier-two suppliers prioritize predictable lead times and dimensional stability that supports automated roof-panel assembly lines. Rising fleet renewal in suburban areas ensures continuous aftermarket replacement demand. Transportation links to nearby export hubs support shipment of headliner modules to facilities within Japan and selected international destinations.

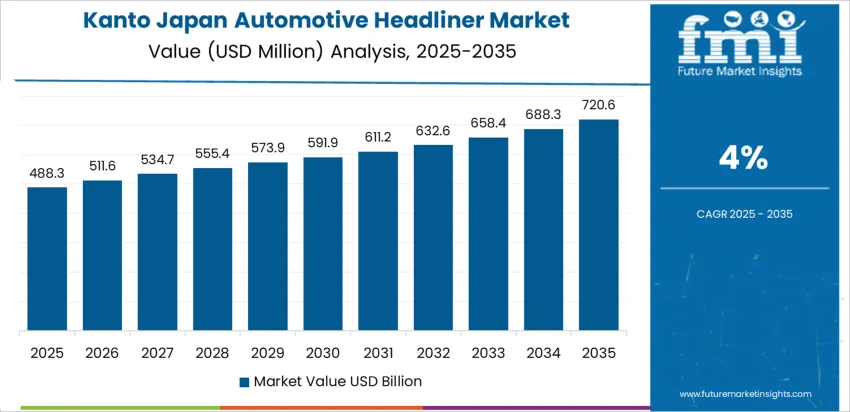

Kanto is projected to grow near 4.0% annually, driven by Tokyo-area engineering centers coordinating interior component design for domestic and export vehicle programs. Headliner testing in this region considers acoustic response, substrate rigidity, and compatibility with embedded electronics such as cabin lighting and connectivity sensors. Assembly plants within commuting distance rely on consistent interior-panel supply to sustain production schedules across varied trim levels. Consumer expectations for premium cabin environments increase requirements for uniform surface finishes and odor-control treatments during manufacturing. Logistics hubs support scheduled delivery of modular headliner units that fit within just-in-sequence workflows. The region’s extensive public-transport commuter culture shapes growth toward quieter interior environments in hybrid and electric vehicles, encouraging adoption of noise-dampening materials. Supplier collaboration ensures updated specifications align with OEM design changes deploying gradually throughout vehicle refresh cycles.

In Kansai, demand is expanding at 3.5% CAGR as Osaka and Hyogo concentrate mixed manufacturing operations that support both commercial and passenger vehicles. Headliner procurement patterns reflect cost-managed interior development across mid-range models that depend on durable substrates and stable adhesives. Local supply chains favor modular production that reduces interior noise pathways while meeting dimensional conformity metrics required for automated installation. Interior components must ensure compatibility with safety elements such as side-curtain airbags and overhead sensor arrays integrated into vehicle roofs. Procurement groups evaluate suppliers on repeatability of stitching or forming processes to maintain consistent quality across long production runs. Aftermarket replacement supports structural repairs following interior moisture exposure or wear in older vehicles. Kansai’s focus remains steady and incremental, reflecting established vehicle output maintained across varied consumer categories.

Chubu demonstrates about 3.1% annual growth, supported by Nagoya-centered automotive clusters specializing in component engineering and large-scale model production. Headliner suppliers serve assembly lines that prioritize vibration-damping materials suited to high-performance drivetrain environments. Structural integrity and attachment reliability remain central quality measures during procurement evaluations. Export-oriented models increase emphasis on climate-resistant materials that maintain performance under humidity and temperature fluctuations. Lightweight substrates support powertrain efficiency objectives in hybrid vehicles widely manufactured in the region. Assembly planners value packaging formats optimized for high-volume logistics corridors connecting component facilities with major vehicle plants across Aichi and nearby prefectures. Incremental increases in EV adoption contribute to a gradual shift toward acoustics-focused interior innovations.

Tohoku records around 2.7% CAGR as interior component demand follows the expansion of parts production supporting national assembly networks. Facilities in Miyagi and Fukushima focus on headliner elements for interior refinements where durability and assembly reliability outweigh rapid technology turnover. Workforce training supports consistent product handling and defect-prevention across mixed-scale operations. Temperature performance is monitored due to regional climate variability, ensuring dimensional stability during cold-weather logistics. Buyers evaluate adhesive and lamination strength to limit delamination risks during long-term vehicle ownership. Procurement criteria emphasize lifecycle durability where vehicles operate across rural routes and heavy-use commercial fleets. Steady maintenance activity creates reliable replacement demand in older units.

The Rest of Japan is forecast to grow 2.6% annually, with smaller assembly operations and supplier workshops fulfilling targeted production commitments. Headliner usage is directed by replacement schedules and upgrades in utility vehicles continuing service in regional and municipal fleets. Local procurement balances cost and compatibility for established interior designs with minimal trim enhancements. Distribution relies on national logistics rather than localized warehouses, so packaging durability protects surface texture and shape integrity in transport. Growth is gradual as output remains tied to stable but moderate automotive production volumes across geographically dispersed assembly points. Standardized form factors reduce complexity and help maintain efficient fulfillment of recurring orders.

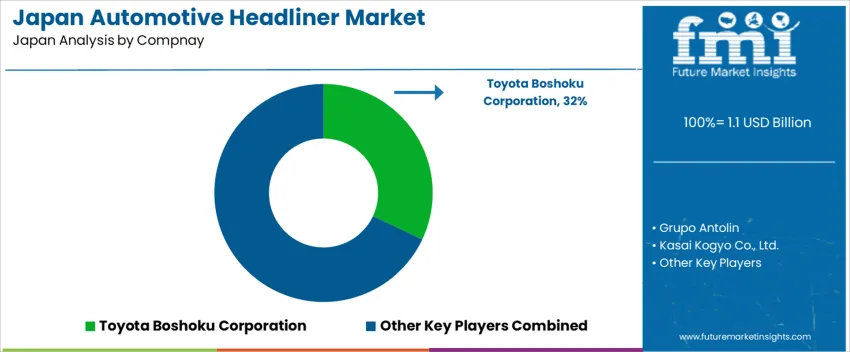

Demand for automotive headliners in Japan is shaped by suppliers delivering lightweight structures, surface consistency, acoustic absorption, and precise fit across passenger-vehicle programs. Toyota Boshoku Corporation holds an estimated 32.0% share, supported by strong integration with domestic OEM platforms and consistent production quality across compact, sedan, and minivan segments. Its supply position benefits from established design collaboration and reliable delivery performance within Japan’s just-in-time assembly environment.

Grupo Antolin participates through localized manufacturing that supports headliner systems, focusing on material stiffness control and dimensional accuracy. Kasai Kogyo Co., Ltd. maintains presence in door-trim and headliner modules for selected Japanese and international OEM lines, delivering stable adhesion and fabric finishing. International Automotive Components (IAC) contributes supply to specific imported and joint-production models, offering headliner components designed for efficient assembly and predictable sustainability properties. Howa Co., Ltd. adds competition in acoustic-engineered headliners where noise-reduction targets and controlled surface appearance are required.

Competition in Japan centers on weight reduction, recyclability, controlled thermal expansion, and alignment with in-cabin comfort expectations. Production requirements emphasize low defect tolerance, seamless integration with overhead systems, and durable performance under daily climate variation. Demand continues as Japanese manufacturers extend use of composite substrates and eco-efficient liners that support fuel-efficiency improvements and long-term cabin-comfort reliability.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Headliner Type | Soft Top, Hard Top |

| Material | Foam-backed Cloth, Synthetic Cloth, Cotton-napped Cloth, Perforated Cloth |

| Vehicle Type | Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Toyota Boshoku Corporation, Grupo Antolin, Kasai Kogyo Co., Ltd., International Automotive Components (IAC), Howa Co., Ltd. |

| Additional Attributes | Dollar sales by headliner type and vehicle category; interior light weighting and acoustic performance trends; thermal and NVH insulation requirements for Japanese automakers; supply chain alignment with domestic OEMs such as Toyota, Nissan, Honda, and commercial vehicle manufacturers; advances in molded substrate materials, recyclability, and eco-efficient laminates; impact of electrification and premium trim adoption on interior component demand across Japan. |

The demand for automotive headliner in Japan is estimated to be valued at USD 1.1 billion in 2025.

The market size for the automotive headliner in Japan is projected to reach USD 1.6 billion by 2035.

The demand for automotive headliner in Japan is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in automotive headliner in Japan are soft top and hard top.

In terms of material, foam-backed cloth segment is expected to command 36.0% share in the automotive headliner in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Headliners Market Size and Share Forecast Outlook 2025 to 2035

Automotive Headliner Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive Headliner in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive NFC in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Fabrics in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Light Bars in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brake Tube in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive AI Chipset in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Racing Seats in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Spindle in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Coating in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA