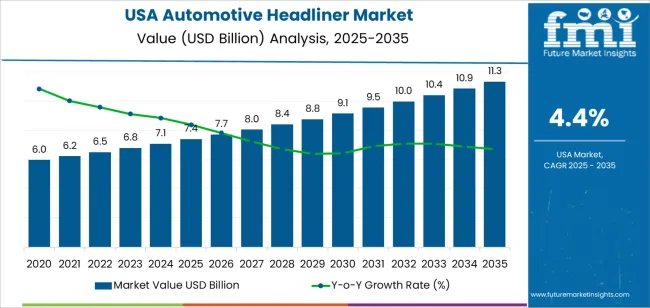

The demand for automotive headliners in the USA is expected to grow from USD 7.4 billion in 2025 to USD 11.3 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.4%. Automotive headliners, which are interior roof linings in vehicles, play a crucial role in noise reduction, insulation, and enhancing the overall aesthetic appeal of vehicle interiors. The increasing demand for comfort, luxury, and advanced features in automobiles is expected to drive steady market growth. Moreover, the growing adoption of electric vehicles (EVs), which require enhanced cabin comfort, further supports the increasing demand for headliners.

The market will experience steady growth, starting at USD 7.4 billion in 2025 and rising to USD 7.7 billion in 2026, USD 8.0 billion in 2027, and USD 8.4 billion in 2028. By 2029, demand for automotive headliners will increase to USD 8.8 billion, with continued growth expected throughout the 2030s. By 2035, the demand for automotive headliners is forecasted to reach USD 11.3 billion, driven by increasing vehicle production and the growing focus on vehicle interiors.

The market growth curve for automotive headliners in the USA is expected to show a consistent upward trend with a relatively smooth and linear progression. The early years (2025 to 2029) will see steady, incremental growth, with demand increasing at a moderate pace. The growth rate will be fairly stable, reflecting steady vehicle production, increasing demand for comfort features, and the continued integration of advanced materials in headliners.

From 2029 onwards, the growth curve will maintain its upward trajectory but may see a slight acceleration as the automotive industry continues to focus on enhancing interior quality, particularly in electric vehicles and premium models. As consumer preferences for high-quality vehicle interiors rise, the demand for automotive headliners will grow more robustly in the latter part of the forecast period. This indicates that while the overall growth is gradual, it will continue to expand steadily, reflecting the ongoing importance of interior comfort and noise reduction features in modern vehicles.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 7.4 billion |

| Industry Forecast Value (2035) | USD 11.3 billion |

| Industry Forecast CAGR (2025-2035) | 4.4% |

Demand for automotive headliners in the USA is rising as vehicle buyers increasingly value interior comfort, aesthetics, and cabin quality. Headliners the fabric or material lining on the interior roof of cars contribute to sound insulation, thermal comfort, and overall feel of the interior. As automakers compete on cabin quality and consumers expect more comfortable, quieter rides, demand for well finished headliners grows. Growth in production of passenger vehicles and light vehicles further supports demand for headliners as standard interior components. Manufacturers are also under pressure to meet safety, insulation, and noise reduction standards, boosting adoption of high quality headliner materials.

At the same time trends in vehicle technology and design reinforce demand. The shift toward electric vehicles, SUVs, crossovers, and premium trim levels encourages use of lightweight, high performance interior materials including advanced headliners. Automakers are increasingly using improved composites, foams, fabrics and sound insulating materials to deliver better cabin comfort and meet regulatory or consumer expectations. Demand is also driven by aftermarket replacements and upgrades, particularly for older vehicles needing refurbished interiors or improved cabin comfort. As long as consumer demand for comfort, noise reduction, and refined interiors remains high and as vehicle production remains robust demand for automotive headliners in the USA is likely to grow steadily in coming years.

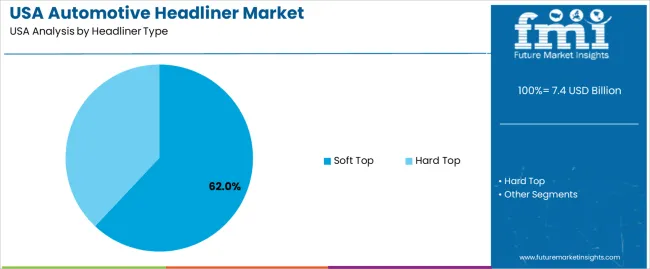

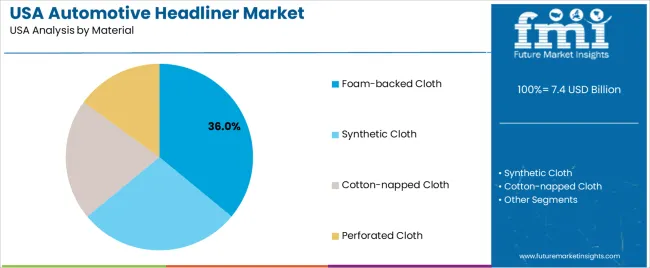

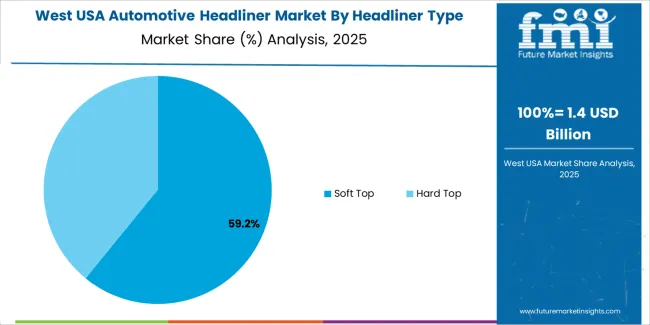

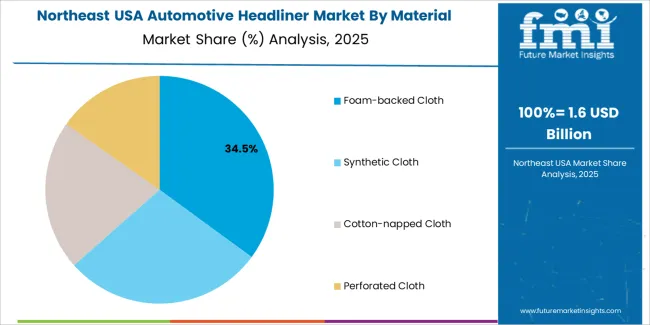

The demand for automotive headliners in the USA is driven by headliner type and material. The leading headliner type is soft top, accounting for 62% of the market share, while the dominant material is foam-backed cloth, capturing 36% of the demand. Automotive headliners, which are an essential component of vehicle interiors, provide comfort, insulation, and aesthetic appeal. As the automotive industry continues to prioritize vehicle interior design and passenger comfort, the demand for high-quality headliners continues to grow, particularly in soft-top configurations and foam-backed cloth materials.

Soft top headliners lead the demand in the USA, holding 62% of the market share. Soft top headliners are commonly used in vehicles such as convertibles, sedans, and SUVs, where the design prioritizes comfort, aesthetics, and noise reduction. Soft top headliners are lightweight and provide better sound absorption, making them popular in passenger vehicles where interior acoustics and comfort are important. Additionally, the soft material used in soft top headliners allows for more flexibility in design, contributing to the overall style and comfort of the vehicle interior.

The demand for soft top headliners is driven by the popularity of vehicles that emphasize passenger experience, particularly in higher-end and luxury models. As consumers continue to prioritize interior comfort and noise reduction in their vehicles, the demand for soft top headliners is expected to remain strong. Moreover, as automakers seek to enhance the overall driving experience with more comfortable and aesthetically appealing interiors, soft top headliners are likely to continue being the preferred choice in the automotive industry in the USA.

Foam-backed cloth leads the material demand for automotive headliners in the USA, accounting for 36% of the market share. Foam-backed cloth is favored for its excellent sound insulation, lightweight properties, and durability, making it ideal for use in vehicle interiors. The foam layer provides additional comfort and insulation, reducing noise and improving the overall acoustic experience within the cabin. This material is commonly used in a wide range of vehicles, including sedans, SUVs, and trucks, where interior comfort and durability are essential.

The demand for foam-backed cloth in automotive headliners is driven by the growing focus on passenger comfort and the need for enhanced soundproofing in modern vehicles. As consumers increasingly value quiet, comfortable cabin environments, foam-backed cloth headliners provide an effective solution to meet these expectations. Additionally, foam-backed cloth is versatile, allowing for customization in terms of texture, color, and design, further contributing to its popularity. As the automotive industry continues to prioritize comfort, noise reduction, and interior aesthetics, foam-backed cloth will remain a leading material choice for automotive headliners in the USA.

Demand for automotive headliners in the USA is growing steadily. As more passenger vehicles, including cars, SUVs, and light trucks, are produced or used, the need for interior components like headliners increases. Headliners play a key role in vehicle comfort, noise insulation, thermal insulation, and aesthetics. Both OEMs for new vehicles and the aftermarket for replacements or upgrades contribute to this demand. Increased consumer preference for better cabin comfort and premium interior features in vehicles also supports the growth of this market.

What are the Drivers of Demand for Automotive Headliner in the USA?

Key drivers of demand for automotive headliners include the continued growth in vehicle production and sales. As more vehicles are produced, each requires a headliner. The growing demand for comfort, style, and noise reduction from consumers also drives the adoption of high-quality headliners. Modern headliners provide better acoustic insulation and thermal comfort, improving the cabin environment. Additionally, the rise in electric and hybrid vehicles, where lightweight and efficient interior materials are required, supports demand for headliners. The aftermarket demand for replacements and upgrades also contributes to the market's growth.

What are the Restraints on Demand for Automotive Headliner in the USA?

One restraint is the cost of high-quality headliner materials, which may be prohibitive for lower-cost vehicle segments. Durability and maintenance concerns also play a role, as headliner fabrics and foams can degrade over time, especially in harsh environments. Consumers may be reluctant to replace them due to the cost and inconvenience. Additionally, changing vehicle design trends, such as minimalist interiors or the use of alternative materials, may reduce the demand for traditional headliner systems. For commercial or budget vehicles, comfort and aesthetics are less of a priority, limiting the share of advanced headliners in those segments.

What are the Key Trends Influencing Demand for Automotive Headliner in the USA?

A key trend is the increasing adoption of lightweight materials for headliners to support fuel economy and meet electrification goals. Manufacturers are using advanced fabrics, foams, and composites that reduce weight while offering insulation benefits. Another trend is rising consumer demand for better interior comfort, which boosts the demand for premium headliners in higher trim levels, SUVs, and luxury cars. There is also growth in the aftermarket for headliner replacement and customization as vehicles age. Finally, as vehicles become more technologically advanced, headliners are being designed to integrate features like lighting, wiring, and enhanced acoustic systems, driving demand for more sophisticated headliners in new models.

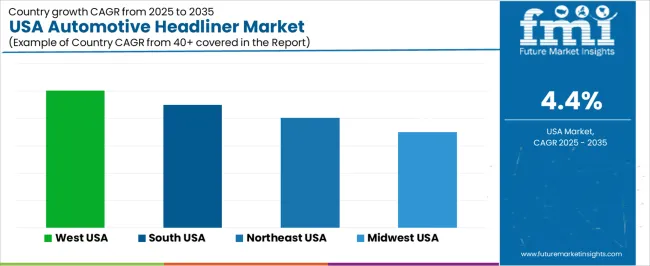

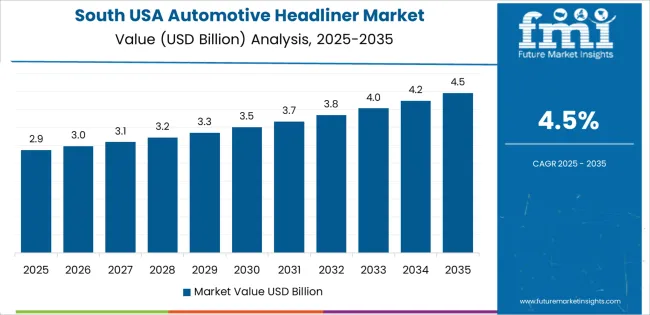

The demand for automotive headliner components in the USA is projected to grow steadily across all regions. The highest growth is expected in the West USA with a forecast CAGR of 5.0%. The South USA follows at 4.5%, supported by increasing vehicle production and aftermarket demand. The Northeast USA shows a moderate CAGR of 4.0%, while the Midwest USA exhibits a somewhat slower growth of 3.5%. These regional differences reflect variations in automotive manufacturing presence, vehicle replacement cycles, consumer preferences for vehicle comfort and interior trim, and regional economic conditions influencing purchases and upgrades.

| Region | CAGR (%) |

|---|---|

| West USA | 5.0 |

| South USA | 4.5 |

| Northeast USA | 4.0 |

| Midwest USA | 3.5 |

In the West USA, the demand for automotive headliner components is projected to grow at a CAGR of 5.0%. This region includes states with significant automotive manufacturing and assembly plants, especially along the Pacific coast and inland industrial zones. New vehicle assembly creates demand for original equipment headliners. Also, the West has substantial aftermarket activity as vehicle owners frequently customize or upgrade interiors especially urban drivers who value comfort, sound insulation, and aesthetic upgrades.

Climatic diversity in the region, from coastal humidity to desert heat, drives consumer interest in headliners that offer better thermal insulation and noise control. In addition, high turnover of rental vehicles and fleet vehicles in Western states creates recurring demand for replacement headliner parts. The combination of OEM production, aftermarket upgrades, and maintenance needs supports robust growth for automotive headliner demand in the West USA.

In the South USA, the demand for automotive headliner components is forecast at a CAGR of 4.5%. The South hosts a mixture of domestic and foreign automotive manufacturing facilities, supplying a broad base of light trucks, SUVs, and passenger vehicles. These vehicle types often include interior upgrades and comfort features where quality headliners matter. Additionally, warmer climates in many southern states create demand for headliner materials that offer heat resistance and improved cabin comfort.

The region’s growing population and increasing vehicle ownership drive replacement and upgrade cycles. Growth in commercial vehicles, rideshare, and fleet vehicles also contributes to aftermarket demand for headliners. As consumer awareness of vehicle comfort and noise reduction rises, manufacturers and parts suppliers respond by providing improved headliner options. These factors combine to sustain steady demand growth for automotive headliners in the South USA.

In the Northeast USA, the projected CAGR for automotive headliner demand is 4.0%. This region includes dense urban areas and older vehicle fleets, which creates demand for replacement and refurbishment of interior components. Harsh seasonal weather cold winters and humid summers puts strain on vehicle interiors, prompting owners to replace worn or damaged headliners as part of maintenance or restoration projects. The Northeast also has a significant presence of used car markets, rental fleets, and fleet maintenance operations that require frequent component replacement.

Consumers in this region value features such as sound insulation, fabric quality, and interior aesthetics, which drives demand for high quality headliners. Additionally, small automotive repair and upholstery shops across the region contribute to steady aftermarket demand. As long as vehicle turnover and upkeep continue, demand for automotive headliner components in the Northeast USA is likely to remain stable.

In the Midwest USA, the demand for automotive headliner components is expected to grow at a CAGR of 3.5%. The region has a significant presence of automotive assembly and parts manufacturing, but much of market growth comes from replacement demand in aging vehicles used for personal, commercial, and agricultural purposes. Road conditions, seasonal temperature variations, and wear and tear from long distance driving contribute to the degradation of interior materials such as headliners.

As a result, vehicle owners replace or upgrade headliners during maintenance or refurbishment. Additionally, light trucks and utility vehicles common in the Midwest require durable interior components, which supports demand for robust headliner materials. While growth is slower compared to coastal or highly urbanized regions, the steady demand across OEM supply, fleet maintenance, and consumer replacement ensures a stable market for automotive headliners in the Midwest USA.

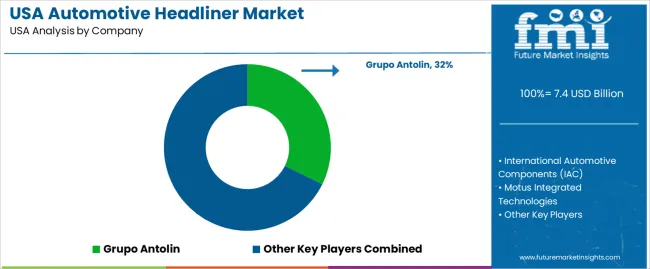

The automotive headliner market in the USA benefits from increasing vehicle production and demand for improved interior comfort, styling, and lightweight materials. The leading supplier is Grupo Antolin with about 32.3% share. Other important suppliers include International Automotive Components (IAC), Motus Integrated Technologies, Toyota Boshoku Corporation and Kasai Kogyo Co., Ltd.. These firms deliver headliner systems for passenger vehicles and light commercial vehicles.

Headliners combine a rigid or semi rigid substrate covered with foam backed fabric to offer interior styling, sound insulation, thermal comfort, and structural finishing for vehicle roofs. The US market reflects global trends toward lighter, more fuel efficient autos, increasing the appeal of modern headliner materials. Demand is particularly strong in passenger vehicles, where aesthetic appeal and cabin comfort drive adoption.

Competition among these suppliers centres on innovation, material quality, manufacturing flexibility, and sustainability. Grupo Antolin distinguishes itself with lightweight headliners and acoustic performance, along with efforts to integrate smart features, recyclable substrates, and sustainable materials. IAC and Motus often emphasise material variety and ability to supply both fabric backed and composite plastic headliners suited to different vehicle types.

Toyota Boshoku and Kasai focus on comfort, insulation, and reliability, aiming to meet automaker requirements for NVH (noise, vibration, harshness) and durability. OEM relationships, scale, and ability to deliver consistent quality underpin competitive advantage. Suppliers routinely use brochures and spec sheets to highlight attributes such as weight reduction, acoustic insulation, environmental compliance, and material resilience. The market remains dynamic as automakers increase demand for lightweight, comfortable, and sustainable interior components.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Headliner Type | Soft Top, Hard Top |

| Material | Foam-backed Cloth, Synthetic Cloth, Cotton-napped Cloth, Perforated Cloth |

| Vehicle Type | Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle |

| Key Companies Profiled | Grupo Antolin, International Automotive Components (IAC), Motus Integrated Technologies, Toyota Boshoku Corporation, Kasai Kogyo Co., Ltd. |

| Additional Attributes | Dollar sales by headliner type, material, and vehicle segment reveal strong demand for foam-backed and synthetic cloth headliners, with passenger cars leading. Soft top headliners are commonly used in light commercial and heavy commercial vehicles. Major suppliers like Grupo Antolin and IAC dominate, providing advanced solutions for interior comfort and aesthetics. The market is expected to grow with increasing vehicle production and demand for high-quality, durable interior materials. |

The demand for automotive headliner in USA is estimated to be valued at USD 7.4 billion in 2025.

The market size for the automotive headliner in USA is projected to reach USD 11.3 billion by 2035.

The demand for automotive headliner in USA is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in automotive headliner in USA are soft top and hard top.

In terms of material, foam-backed cloth segment is expected to command 36.0% share in the automotive headliner in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

Automotive Headliners Market Size and Share Forecast Outlook 2025 to 2035

Automotive Headliner Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive UPS in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive NFC in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Light Bars in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive HVAC Ducts in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Door Sills in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive AI Chipset in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brake Tube in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Roof Rails in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Racing Seats in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Display Units in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Coating in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Grade Inductor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Air Compressor in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA