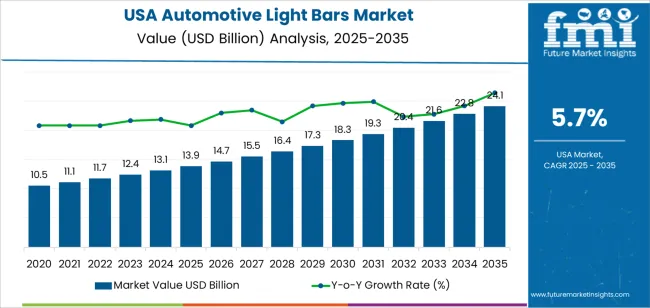

The demand for automotive light bars in the USA is expected to grow from USD 13.9 billion in 2025 to USD 24.1 billion by 2035, representing a compound annual growth rate (CAGR) of 5.7%. Automotive light bars are vital components in modern vehicles, enhancing both safety and visual appeal. These light bars are increasingly used in a range of vehicles, including off-road and on-road models, to improve visibility in low-light conditions, thus contributing to safer driving. With rising consumer preferences for vehicles with modern, sleek designs and advanced safety features, the automotive light bar industry is set for steady growth in the coming decade.

Between 2025 and 2030, the demand for automotive light bars will grow gradually, driven by ongoing advancements in lighting technology and the incorporation of light bars into more vehicle models. Vehicle manufacturers are prioritizing energy-efficient lighting systems such as LEDs, and consumer demand for high-performance, aesthetically designed vehicles is pushing manufacturers to adopt these technologies. From 2030 to 2035, demand will accelerate significantly, driven by the increasing popularity of off-road vehicles, where light bars are essential for safety and performance. The rise of electric and autonomous vehicles, with their need for advanced lighting systems, will fuel the demand for automotive light bars, ensuring the continued growth of this segment throughout the next decade.

Between 2025 and 2030, the demand for automotive light bars will grow from USD 13.9 billion to USD 14.7 billion, driven by the ongoing integration of light bars into vehicles for better lighting efficiency, visibility, and modern styling. The automotive industry’s push toward adopting cutting-edge lighting technologies, such as LED and adaptive lighting systems, will further boost industry demand. As more consumers seek vehicles equipped with advanced safety features and modern designs, automotive light bars will play a key role in meeting these preferences.

From 2030 to 2035, the demand for automotive light bars will accelerate, increasing from USD 14.7 billion to USD 24.1 billion. This rapid growth will be fueled by the rise in off-road and adventure vehicle sales, where light bars are essential for improving night time visibility. Stricter regulations on vehicle safety and lighting standards, along with technological advancements in light bar designs, will significantly contribute to the accelerated growth. The expansion of electric and autonomous vehicles, which often feature more advanced lighting systems, will also play a major role in driving demand.

| Metric | Value |

|---|---|

| Demand for Automotive Light Bars in USA Value (2025) | USD 13.9 billion |

| Demand for Automotive Light Bars in USA Forecast Value (2035) | USD 24.1 billion |

| Demand for Automotive Light Bars in USA Forecast CAGR (2025-2035) | 5.7% |

The demand for automotive light bars in the USA is increasing as automakers and consumers seek to enhance vehicle safety, aesthetics, and functionality. Automotive light bars, typically mounted on the front or rear of vehicles, offer superior visibility in low-light conditions, which is especially crucial for off-road vehicles, trucks, and emergency response vehicles. These light bars provide powerful illumination for drivers navigating challenging environments, improving safety and reducing the risk of accidents.

A significant driver of this growth is the increasing adoption of off-road vehicles, SUVs, and trucks, where light bars are often used as an essential accessory. With the growing popularity of outdoor activities such as camping, hiking, and off-roading, consumers are looking for products that improve visibility and performance in rugged environments. Automotive light bars are also gaining traction in the commercial vehicle sector, where they are used to enhance visibility for drivers of trucks, delivery vehicles, and emergency service vehicles.

Advancements in LED technology are contributing to the rising demand for automotive light bars. LED light bars offer superior brightness, longer lifespan, and energy efficiency compared to traditional lighting solutions, making them an attractive option for both manufacturers and consumers. As the demand for customized and high-performance automotive lighting solutions continues to grow, the industry for automotive light bars in the USA is expected to expand steadily through 2035.

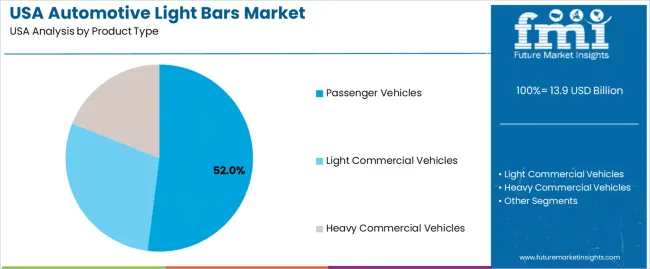

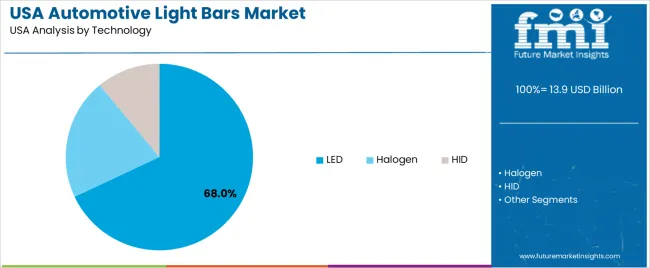

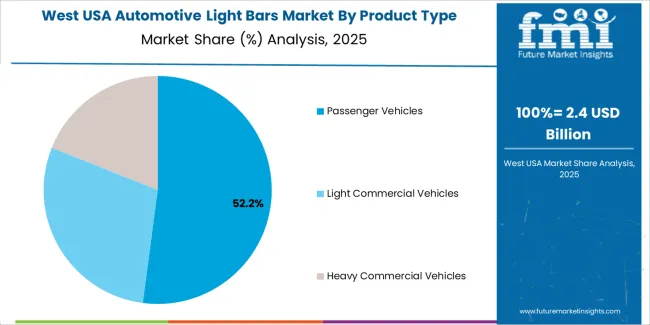

Demand for automotive light bars in the USA is segmented by product type, technology, sales channel, installation, and region. By product type, demand is divided into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. The demand is also segmented by technology, including LED, halogen, and HID. In terms of sales channel, demand is split between OEMs and aftermarket. Regarding installation, automotive light bars are used in various parts of vehicles, including the front, rear, interior, and side. Regionally, demand is spread across the West, South, Northeast, and Midwest USA.

Passenger vehicles account for 52% of the demand for automotive light bars in the USA. These light bars are widely used in passenger vehicles, especially SUVs, trucks, and off-road vehicles, for enhancing visibility and safety, particularly in rugged conditions. As outdoor activities and off-roading become increasingly popular, the demand for additional lighting solutions that improve nighttime visibility and provide better navigation has risen.

Light bars installed on passenger vehicles help illuminate areas that standard headlights cannot, significantly reducing blind spots and making driving safer in low-light environments. They serve as aesthetic enhancements, allowing consumers to personalize their vehicles while improving their functionality. With the ongoing popularity of adventure-ready vehicles and rising consumer preference for high-performance lighting, passenger vehicles will continue to lead the demand for automotive light bars, ensuring their dominance in the industry.

LED technology accounts for 68% of the demand for automotive light bars in the USA. LEDs are favored for their energy efficiency, long lifespan, and bright, clear illumination, making them ideal for automotive applications. They consume less power compared to halogen and HID alternatives while offering superior performance in terms of brightness and clarity. LED light bars are especially valued for their durability and low maintenance, providing excellent illumination for both on-road and off-road use.

They are commonly installed in passenger vehicles, commercial trucks, and off-road vehicles to enhance safety and visibility in challenging driving conditions. Furthermore, LED light bars are resistant to vibrations and extreme weather conditions, making them a reliable choice for vehicles exposed to harsh environments. As consumer demand for energy-efficient, high-performance lighting solutions grows, LED technology will remain the dominant choice for automotive light bars in the USA, driving industry demand.

Demand for automotive light bars in USA is climbing as consumers and manufacturers increasingly value enhanced vehicle visibility, safety, and aesthetic appeal. The growth of off‑road, utility, and adventure‑vehicle segments alongside rising popularity of personalized/customised vehicles supports higher adoption of light bars. Advances in LED and efficient lighting technologies make light bars more power‑efficient, durable, and suitable for both on‑road and off‑road use, boosting their appeal. Higher cost compared with standard lighting, regulatory or compliance restrictions (on brightness, use of auxiliary lights on public roads), and variability in consumer safety/acceptance limit full mass‑industry penetration, especially in budget or economy‑segment vehicles.

In USA, demand is rising because many vehicle owners and fleets including off‑road enthusiasts, utility trucks, emergency vehicles, and outdoor‑activity users require better illumination for safety and performance. Light bars provide stronger lighting for nighttime driving, off‑road navigation, rural roads, and adverse weather conditions. Customization and vehicle‑personalisation culture encourage buyers to add light bars for style, rugged looks, and perceived value. As trucks, SUVs and off‑road vehicles remain popular, demand for both aftermarket and OEM‑fitted light bars continues to increase across consumer and commercial segments.

Technological innovations have significantly boosted light‑bar adoption. The shift to advanced LED (and in some cases OLED or laser‑based) lighting improves brightness, energy efficiency, lifespan, and durability making light bars more practical for every day, off‑road, or utility use. Improved manufacturing, modular designs, waterproofing and rugged construction make them suitable for harsh conditions. Increased availability of ready‑to‑install aftermarket light‑bar kits (plug‑and‑play, universal‑fit LED bars) lowers installation barriers, making customization easier and more accessible for individual buyers and smaller fleet operators.

Despite growing demand, several factors limit wider adoption. Cost remains a major barrier high‑quality light bars are more expensive than standard headlights or basic auxiliary lights, which hurts adoption among price‑sensitive buyers. Regulatory or legal restrictions on auxiliary lighting (brightness limits, use on public roads, approval/inspection requirements) can deter some buyers or complicate installation for vehicles used both on‑ and off‑road. Some consumers may perceive light bars as unnecessary for regular commuting, limiting demand to niche segments (off‑road, utility, custom‑vehicle owners). Cheaper, lower‑performance off‑brand products may suffer reliability or safety concerns, which can undermine consumer confidence in those segments.

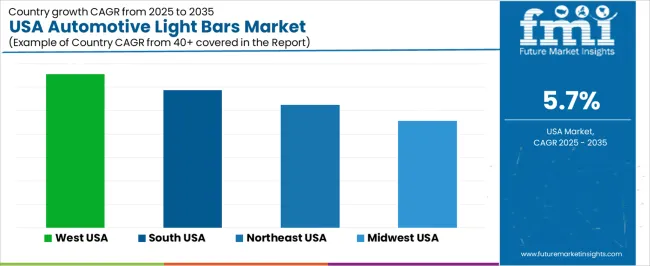

| Region | CAGR (%) |

|---|---|

| West USA | 6.6% |

| South USA | 5.9% |

| Northeast USA | 5.2% |

| Midwest USA | 4.6% |

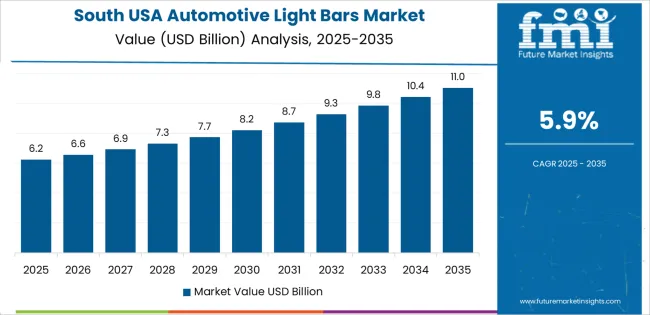

Demand for automotive light bars in the USA is growing steadily, with West USA leading at a 6.6% CAGR, driven by off-road and recreational vehicle culture, along with strong commercial use in construction, agriculture, and remote work. South USA follows with a 5.9% CAGR, supported by a large base of trucks, SUVs, and utility vehicles used for work and off-road activities. Northeast USA shows a 5.2% CAGR, with demand driven by commercial fleets, emergency service vehicles, and recreational vehicle owners needing enhanced lighting. Midwest USA experiences a 4.6% CAGR, with steady demand in agricultural, industrial, and logistics sectors where light bars improve visibility and safety.

West USA is leading the demand for automotive light bars, growing at a 6.6% CAGR. The region’s diverse terrain, from deserts to mountains, and a strong outdoor recreation culture drive demand for off-road vehicles like SUVs and trucks. These vehicles often require enhanced lighting for safety, visibility, and off-road performance. Light bars are also popular in commercial and utility vehicles used for construction, agriculture, and other industries that operate in remote areas with low light.

The rising popularity of vehicle customization further boosts demand, as consumers often upgrade their vehicles for both style and functionality. The West's focus on innovative LED technology, which offers better brightness, energy efficiency, and durability, is driving adoption. As off-road and recreational activities continue to grow, West USA remains the primary industry for automotive light bars, especially for safety and performance purposes in challenging environments.

South USA is seeing strong demand for automotive light bars, with a 5.9% CAGR, driven by the region's growing use of trucks, SUVs, and utility vehicles. The agricultural, construction, and logistics industries require vehicles with reliable lighting for safety and efficiency, especially when working at night or in poorly lit areas. The demand for light bars is fueled by both functional needs and lifestyle preferences, with many vehicle owners seeking enhanced visibility for off-road adventures and long-haul driving.

In states like Texas and Florida, light bars are also commonly used by emergency vehicles and commercial fleets. The warm climate and large rural areas further support the use of light bars in both personal and commercial vehicles. As LED lighting technology continues to improve in terms of energy efficiency and cost-effectiveness, more consumers and businesses are adopting light bars, contributing to steady growth in the region.

Northeast USA shows a 5.2% CAGR for automotive light bars, driven by a combination of urban, suburban, and rural driving conditions. The region’s demand is largely influenced by commercial vehicles, including emergency service vehicles, commercial fleets, and work trucks. These vehicles require auxiliary lighting to ensure safety during nighttime operations or adverse weather conditions, particularly in regions with long winters and snow.

Light bars are popular among SUV and truck owners who want enhanced visibility for off-road driving and recreational activities. The growing adoption of LED technology in the Northeast’s automotive sector is helping meet the demand for durable, energy-efficient lighting solutions. As vehicle customization trends continue and the need for improved visibility increases, demand for automotive light bars is expected to grow steadily. Northeast USA’s combination of functional, safety, and recreational vehicle use makes it a key industry for light bars.

Midwest USA is experiencing moderate growth in demand for automotive light bars, with a 4.6% CAGR. The region’s strong agricultural and industrial base drives the use of utility vehicles and trucks that benefit from auxiliary lighting. These vehicles are commonly used in farming, construction, and logistics, where workers often operate during low light conditions in rural and remote areas. The demand for light bars in the Midwest is fueled by practical needs, including improving safety and visibility in the agricultural sector.

With the region’s focus on efficient transportation and logistics, light bars are increasingly being adopted in commercial fleets for better night-time navigation. While growth is more moderate compared to coastal regions, the need for enhanced lighting in work vehicles and the continued popularity of off-road driving ensure steady demand for light bars. As the region embraces more energy-efficient technologies, LED light bars are likely to become the standard.

The demand for automotive light bars in the USA is increasing as consumers and manufacturers prioritize enhanced vehicle visibility, safety, and aesthetics. Automotive light bars, particularly LED-based solutions, are widely used in off-road vehicles, trucks, and emergency vehicles to provide superior lighting in low-visibility conditions. As the automotive industry continues to evolve with an emphasis on both functionality and design, light bars are becoming a key component of modern vehicles, supporting both practical safety applications and aesthetic customization. The demand is also driven by regulatory changes and the growing popularity of off-road and adventure vehicles

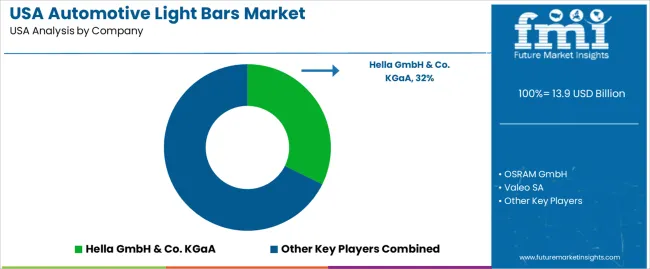

Leading companies in the automotive light bars industry in the USA include Hella GmbH & Co. KGaA, OSRAM GmbH, Valeo SA, Stanley Electric Co., Ltd., and KC HiLiTES. Hella GmbH & Co. KGaA holds the largest industry share of 32.3%, providing high-quality automotive lighting solutions, including LED light bars for a wide range of vehicles. OSRAM GmbH is a prominent player, offering innovative lighting technologies for automotive applications, including light bars that enhance visibility and performance. Valeo SA specializes in advanced lighting solutions, with a focus on energy efficiency and design. Stanley Electric Co., Ltd. and KC HiLiTES also offer automotive light bars, catering to different segments, including off-road and commercial vehicles, with products known for durability and high performance.

Competition in the automotive light bars industry is driven by factors such as technological advancements in LED and laser lighting, growing consumer demand for both functional and stylish vehicle accessories, and the increasing popularity of off-road vehicles. Companies compete by offering innovative light bars that combine high efficiency, long lifespan, and rugged durability for various automotive applications. Price sensitivity and product differentiation through features such as adjustable mounting options, weather resistance, and customizable designs are key competitive factors in this growing industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Technology | LED, Halogen, HID |

| Sales Channel | OEMs, Aftermarket |

| Installation | Front, Rear, Interior, Side |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Hella GmbH & Co. KGaA, OSRAM GmbH, Valeo SA, Stanley Electric Co., Ltd., KC HiLiTES |

| Additional Attributes | Dollar sales by product type, technology, and installation; regional CAGR and adoption trends; demand trends in automotive light bars; growth in passenger, commercial, and heavy vehicles; technology adoption for LED, halogen, and HID lighting solutions; vendor offerings including light bars for OEMs and aftermarket; regulatory influences and industry standards |

The demand for automotive light bars in USA is estimated to be valued at USD 13.9 billion in 2025.

The market size for the automotive light bars in USA is projected to reach USD 24.1 billion by 2035.

The demand for automotive light bars in USA is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in automotive light bars in USA are passenger vehicles, light commercial vehicles and heavy commercial vehicles.

In terms of technology, led segment is expected to command 68.0% share in the automotive light bars in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Light Bars Market Growth - Trends & Forecast 2025 to 2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

Automotive Lighting Actuators Market Size and Share Forecast Outlook 2025 to 2035

Automotive Lightweight Materials Market Size and Share Forecast Outlook 2025 to 2035

Automotive Lighting Market Size, Growth, and Forecast for 2025 to 2035

Automotive Lighting Accessories Market Growth - Trends & Forecast 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fog Lights Market Size and Share Forecast Outlook 2025 to 2035

Automotive Backlight Moldings Market

Automotive Adaptive Lighting Market

Automotive Cigarette Lighters Market

Korea Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Automotive Door Impact Bars Market

Automotive Dynamic Spotlight Market

Automotive License Plate Light Market

Automotive Interior Ambient Lighting Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive Lighting in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA