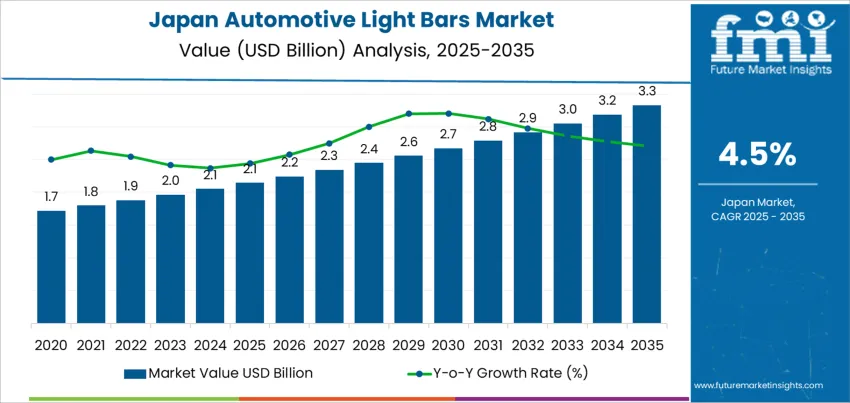

The demand for automotive light bars in Japan is projected to grow from USD 2.1 billion in 2025 to USD 3.3 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.5%. Automotive light bars, commonly used in vehicle lighting systems for enhanced visibility and aesthetic appeal, are increasingly being adopted in both passenger and commercial vehicles. As automotive technology continues to evolve, particularly with the growing demand for advanced lighting systems in electric and autonomous vehicles, the market for automotive light bars is expected to experience steady growth over the forecast period.

The market will see gradual growth, with demand rising from USD 2.1 billion in 2025 to USD 2.2 billion in 2026, and USD 2.3 billion in 2027. The growth will continue steadily, reaching USD 2.6 billion by 2029, and USD 2.7 billion by 2030. By 2035, the demand for automotive light bars is forecasted to reach USD 3.3 billion, driven by the ongoing demand for advanced, energy-efficient lighting solutions in modern vehicles, as well as increased consumer interest in vehicle customization.

The automotive light bars market in Japan is expected to experience steady growth through 2035. Starting at USD 2.1 billion in 2025, the market will rise to USD 2.2 billion in 2026 and USD 2.3 billion in 2027. By 2029, demand will reach USD 2.6 billion, with further growth expected in the following years, reaching USD 3.0 billion by 2032 and USD 3.3 billion by 2035. This growth will be driven by the expanding use of advanced lighting systems, including LED and OLED technology, in new vehicle models and aftermarket solutions.

The market share erosion or gain analysis indicates a steady gain in the market, with no significant erosion of demand from one segment to another. The growth trajectory reflects the continued adoption of automotive light bars in new vehicle models, especially in the electric vehicle and autonomous vehicle sectors. While traditional lighting solutions may experience some level of market share loss, the demand for energy-efficient, customizable, and technologically advanced light bars will drive overall market expansion. The consistent demand for innovative lighting solutions across various vehicle categories ensures that the market will continue to grow without significant disruption or decline in key segments.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 2.1 billion |

| Industry Forecast Value (2035) | USD 3.3 billion |

| Industry Forecast CAGR (2025-2035) | 4.5% |

Demand for automotive light bars in Japan is rising as vehicle owners and manufacturers increasingly look for enhanced lighting solutions for safety, aesthetics, and customisation purposes. The overall growth of the Japanese automotive aftermarket supports accessory purchases including light bars. As more consumers show interest in personalising their vehicles-through exterior modifications or off road styling-light bars have become a preferred add on. Light bars offer improved illumination for night driving, inclement weather or rural road conditions. Their decorative appeal and ability to give vehicles a more rugged or distinctive look also attract younger buyers and enthusiasts. The expanding aftermarket trend in Japan reflects higher per vehicle accessory spending, contributing to greater demand for light bars.

At the same time advances in lighting technology and shifts in vehicle usage patterns support rising adoption. LED based light bars have gained popularity because they offer brighter, more energy efficient illumination than traditional lights. Manufacturers and aftermarket suppliers are offering modern LED light bars that combine durability, better light output and lower power consumption. Use of such light bars is increasing not only in off road or recreational vehicles but also in commercial fleets, light trucks, SUVs and urban utility vehicles. Moreover interest in aftermarket accessories remains robust amid broader automotive sector growth and increasingly accessible e commerce for vehicle parts. These factors make it likely that demand for automotive light bars in Japan will continue its steady rise over the coming years.

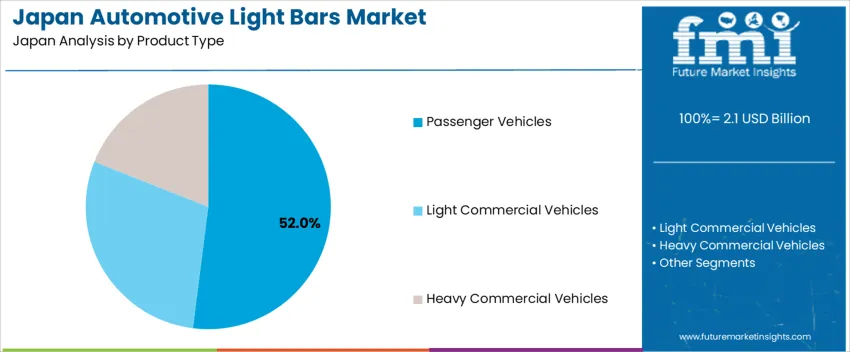

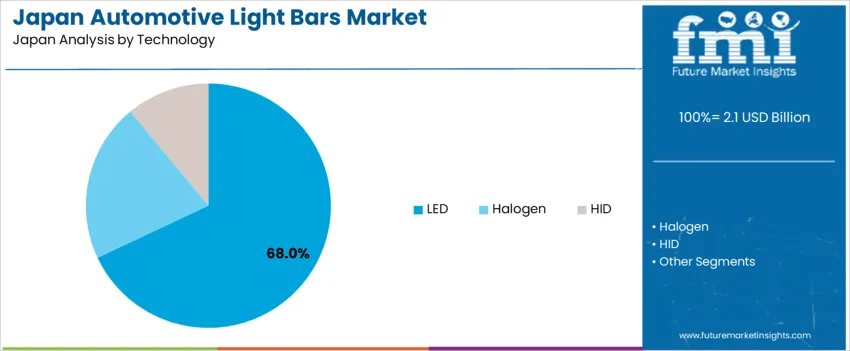

The demand for automotive light bars in Japan is primarily driven by product type and technology. The leading product type is passenger vehicles, which captures 52% of the market share, while LED technology dominates the market, accounting for 68% of the demand. Automotive light bars are increasingly used to enhance visibility and improve the aesthetic appeal of vehicles, and their application spans across passenger cars, light commercial vehicles, and heavy-duty trucks. As vehicle safety and design features continue to evolve, the demand for advanced lighting solutions in Japan remains robust.

Passenger vehicles lead the demand for automotive light bars in Japan, holding 52% of the market share. Light bars in passenger vehicles are primarily used for enhancing the vehicle's visibility, both for safety and for design purposes. These light bars are commonly installed in the front of vehicles, offering brighter illumination and improving the driver's ability to see in low-light conditions. They are increasingly being integrated into the design of high-end, off-road, and performance vehicles.

The demand for automotive light bars in passenger vehicles is driven by their growing popularity in vehicle customization and safety features. As consumers demand more stylish, functional, and technologically advanced vehicles, automotive manufacturers are increasingly incorporating light bars as part of their vehicle offerings. Additionally, with the rise in the popularity of SUVs and off-road vehicles in Japan, light bars are often considered a key feature for improving both aesthetic appeal and functionality. As the trend for safer, more capable vehicles continues, passenger vehicles will remain the leading product type for automotive light bars in Japan.

LED technology leads the demand for automotive light bars in Japan, accounting for 68% of the market share. LED light bars are highly preferred due to their energy efficiency, long lifespan, and superior brightness compared to other technologies like halogen and HID. LED lights offer more focused, consistent, and longer-range illumination, which is especially important in off-road, performance, and safety applications.

The demand for LED automotive light bars is driven by the ongoing shift toward energy-efficient and durable lighting solutions in the automotive industry. LED lights consume less power, generate less heat, and last much longer than halogen or HID lights, making them an ideal choice for modern vehicles. Their ability to deliver bright, clear lighting in a variety of conditions makes them especially attractive in off-road and safety-focused applications. With advancements in LED technology and increasing demand for vehicles equipped with energy-efficient features, LED light bars are expected to maintain their dominant position in Japan's automotive lighting market.

Demand for automotive light bars in Japan is increasing as consumers and vehicle owners show growing interest in exterior customisation, improved visibility, and enhanced off-road capability. The broader increase in automotive LED lighting adoption supports demand for supplementary lighting accessories such as light bars. As vehicle customisation culture in Japan remains strong, light bars see usage in SUVs, off-road vehicles, and utility vehicles. Demand is driven by both OEM adoption of LED lighting and aftermarket upgrades for safety and aesthetic purposes. The market outlook suggests continued growth in demand for light bars in line with rising acceptance of LED automotive lighting.

What are the Drivers of Demand for Automotive Light Bars in Japan?

One driver is growing popularity of LED lighting in vehicles. As LED systems become standard for headlamps and exterior lighting, consumers and manufacturers look for supplementary lighting options such as light bars for improved visibility and energy efficiency. Another driver is the rising interest in vehicle customisation and aftermarket upgrades among private owners. Exterior accessories demand in Japan is growing as vehicle owners seek to differentiate their cars or enhance off-road or utility capacity. Use of SUVs, off-road vehicles, and utility vehicles fosters demand for robust auxiliary lighting solutions; for such vehicles, light bars offer better visibility under challenging conditions. Finally, broader growth in the automotive lighting market, including increased regulatory and consumer emphasis on safety, visibility under low light or adverse weather, encourages adoption of auxiliary lighting accessories like light bars in addition to standard lighting.

What are the Restraints on Demand for Automotive Light Bars in Japan?

One restraint arises from regulatory and compliance challenges associated with aftermarket lighting modifications. Installation of non-standard lighting may be subject to vehicle lighting regulations or inspection requirements, which could deter some buyers from adding light bars. Another restraint is cost sensitivity. Light bars, especially high-quality LED types, represent an additional cost over standard lighting. For cost-conscious buyers or budget-oriented vehicle segments, this may limit adoption. A further restraint is that many vehicles in Japan are compact or designed for urban use; such vehicles may not benefit from auxiliary light bars, limiting demand to niche segments such as off-road or utility users. Finally, as original equipment manufacturers (OEMs) increasingly integrate LED lighting into new vehicles, some buyers may consider add-on light bars unnecessary, preferring factory-installed lighting solutions, which may limit aftermarket demand growth.

What are the Key Trends Influencing Demand for Automotive Light Bars in Japan?

A key trend is the rise in LED-based automotive lighting across passenger cars and utility vehicles, which raises interest in complementary lighting accessories like light bars. This shift toward energy-efficient, high-performance lighting makes auxiliary light bars more attractive. Another trend is increased aftermarket customisation and accessory adoption as part of broader exterior car-accessory demand in Japan. As the exterior accessory market grows, light bars become part of common upgrade packages for SUVs, off-road vehicles, and recreational vehicles. Use of light bars is also rising in vehicles used for outdoor, utility, or rural applications where extra illumination helps, enhancing safety and practicality. Growing urban interest in vehicle individuality and aesthetics supports adoption even in non-utility segments. A further trend is gradual improvement in light bar technology, including higher lumen output, more efficient LEDs, durable build quality, and easier aftermarket installation, which lowers barriers to adoption. Lastly, the broader global increase in demand for automotive light bars influences the Japanese market as international designs and accessories become more available and accepted domestically.

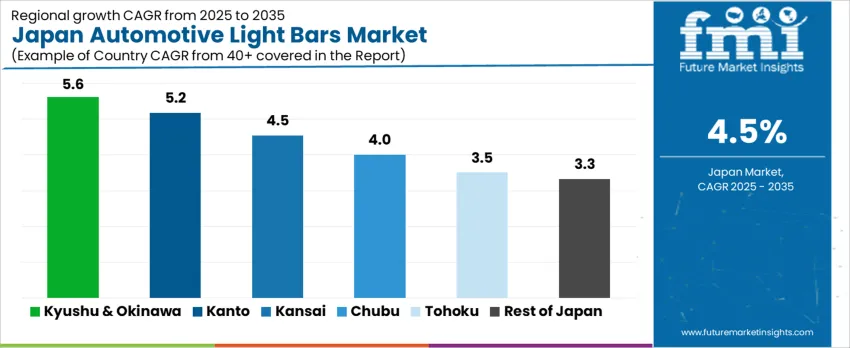

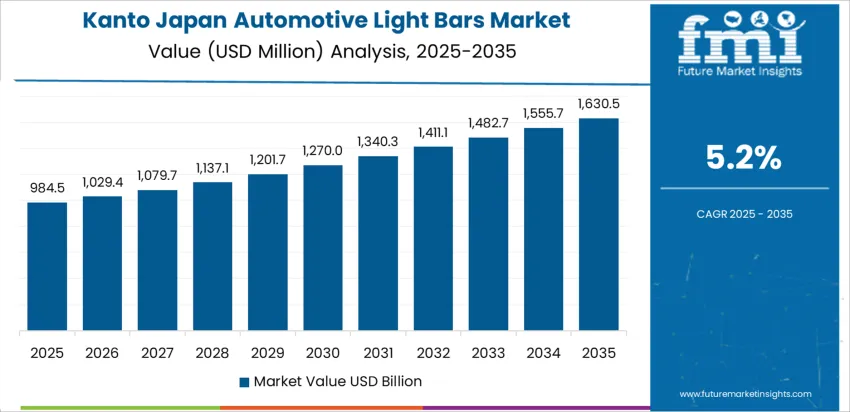

The demand for automotive light bars in Japan is expected to grow steadily across regions, with Kyushu & Okinawa leading at a CAGR of 5.6%. Kanto follows with a CAGR of 5.2%, supported by its strong automotive and technology industries. The Kinki region shows moderate growth at 4.5%, while Chubu, Tohoku, and the Rest of Japan exhibit slower growth, with respective CAGRs of 4.0%, 3.5%, and 3.3%. These differences are influenced by regional automotive production activities, technological advancements, and consumer preferences for advanced lighting solutions in vehicles.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.6 |

| Kanto | 5.2 |

| Kinki | 4.5 |

| Chubu | 4.0 |

| Tohoku | 3.5 |

| Rest of Japan | 3.3 |

The demand for automotive light bars in Kyushu & Okinawa is projected to grow at a CAGR of 5.6%, driven by the region's focus on innovation in the automotive industry and increasing adoption of advanced lighting solutions. Kyushu & Okinawa are home to several automotive manufacturers, and the region's automotive sector continues to innovate with the incorporation of LED lighting technologies for improved vehicle visibility and safety. Additionally, the rise in popularity of off-road vehicles and light trucks in Kyushu & Okinawa, coupled with consumer demand for stylish and functional vehicle lighting, is fueling growth in the automotive light bar market. As these technologies become more common in new vehicle models, demand for automotive light bars is expected to continue rising rapidly in the region.

In Kanto, the demand for automotive light bars is expected to grow at a CAGR of 5.2%, supported by the region’s strong automotive and technology industries. Kanto, which includes Tokyo and surrounding areas, has a large concentration of automotive manufacturers and related businesses. As automotive companies in Kanto continue to adopt advanced lighting technologies, such as LED and adaptive lighting systems, the demand for automotive light bars is increasing. These technologies are favored for their energy efficiency, long lifespan, and ability to enhance vehicle safety, particularly in low visibility conditions. Kanto’s increasing focus on vehicle safety standards and the rise of electric vehicles (EVs) with advanced lighting features contribute to the growing adoption of automotive light bars in the region.

The demand for automotive light bars in Kinki is projected to grow at a CAGR of 4.5%, driven by the region’s well-established automotive industry. Kinki, home to Osaka and Kyoto, is a key hub for automotive manufacturing, including both domestic and international vehicle brands. As consumer preferences for advanced vehicle lighting systems increase, automakers in the region are incorporating automotive light bars in new vehicle designs to meet safety standards and improve the aesthetic appeal of vehicles. Additionally, Kinki’s automotive aftermarket industry is seeing growing demand for light bars for vehicle customization, particularly in off-road vehicles. The region’s focus on high-quality vehicle production, along with the increasing popularity of advanced lighting solutions, ensures steady demand for automotive light bars.

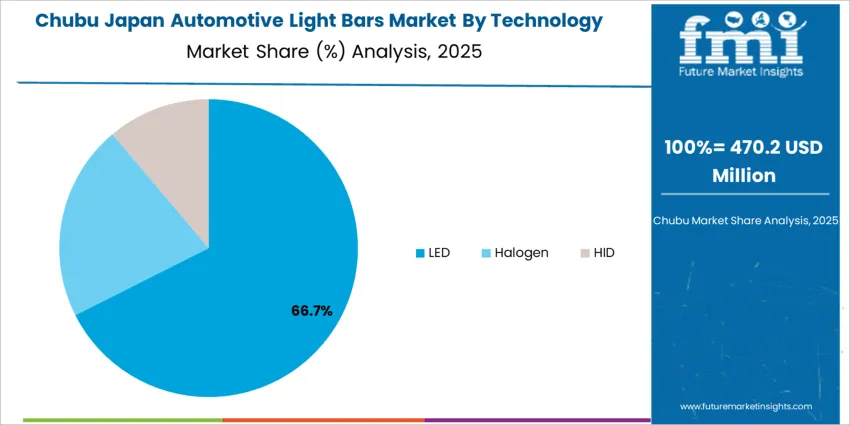

The demand for automotive light bars in Chubu is expected to grow at a CAGR of 4.0%, supported by the region’s automotive and industrial sectors. Chubu, which includes Nagoya and surrounding areas, is a major center for automotive production, with several prominent manufacturers and suppliers based in the region. As vehicle manufacturers in Chubu continue to focus on innovation and meet consumer demand for high-performance lighting solutions, the adoption of automotive light bars is expected to rise. These light bars are increasingly incorporated into both factory-installed and aftermarket products, particularly in off-road and commercial vehicles. The region’s strong automotive presence, coupled with the growing trend toward vehicle safety enhancements, drives the demand for automotive light bars, though growth is more moderate compared to regions like Kyushu & Okinawa and Kanto.

In Tohoku, the demand for automotive light bars is projected to grow at a CAGR of 3.5%, reflecting slower adoption compared to more industrialized regions. While Tohoku has a smaller automotive industry, there is still demand for light bars in the region’s growing vehicle customization market. Additionally, as Tohoku’s automotive manufacturers and consumers increasingly focus on safety and performance features, the demand for advanced lighting systems, including automotive light bars, is gradually rising. The region’s strong interest in off-road vehicles, along with the growing trend toward energy-efficient and aesthetically appealing vehicle lighting, supports this steady increase in demand. Though growth is slower than in larger markets, Tohoku’s adoption of automotive light bars is expected to continue growing steadily over time.

In the Rest of Japan, the demand for automotive light bars is expected to grow at a CAGR of 3.3%, reflecting gradual adoption in smaller cities and rural areas. The Rest of Japan includes areas with lower concentrations of large-scale automotive production, but the increasing interest in vehicle customization and safety across these regions is contributing to the growing use of light bars. As more consumers in rural areas seek to enhance their vehicles' appearance and functionality, the demand for automotive light bars continues to rise. Furthermore, the increasing adoption of energy-efficient and safety-focused vehicle features in both new models and the aftermarket sector is driving demand for automotive light bars in the Rest of Japan, although the growth rate remains moderate compared to more urbanized regions.

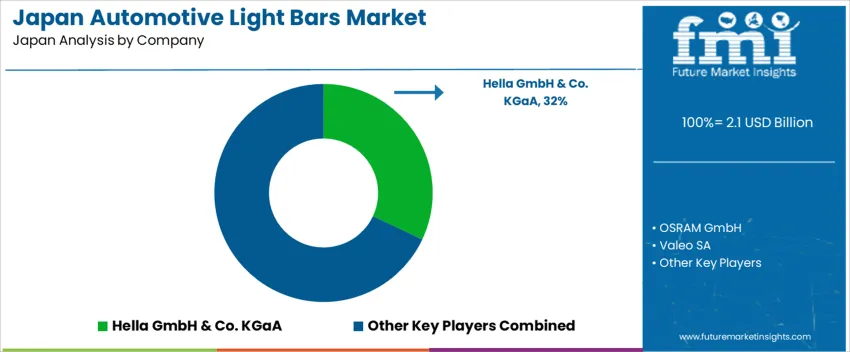

Demand for automotive light bars in Japan is growing as vehicle owners and specialty vehicle manufacturers seek enhanced lighting solutions for safety, off road performance, and aesthetic customization. Leading suppliers in this sector include Hella GmbH & Co. KGaA (holding approximately 32% market share), OSRAM GmbH, Valeo SA, Stanley Electric Co., Ltd., and KC HiLiTES. These firms supply LED, halogen, and hybrid light bar systems for SUVs, trucks, off road vehicles, and specialty automotive applications, adapting to Japan’s regulatory environment and consumer preferences.

Competition in the light bar market is driven by lighting performance, build quality, and regulatory compliance. Companies develop light bars that offer high luminosity, uniform beam patterns, durability against weather and vibration, and energy efficiency. Another competitive factor is design versatility: low profile, slim-line, or modular bars that can fit various vehicle models-including compact SUVs popular in Japan-appeal to a broader customer base. Suppliers also compete on ease of installation, corrosion-resistant housing, and warranty or after sales service. Firms that balance brightness, durability, and compliance with Japanese automotive lighting standards tend to gain preference among consumers and aftermarket retailers. By aligning their products with performance demands, safety standards, and vehicle design preferences, these companies aim to strengthen their position in Japan’s automotive light bars market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Product Type | Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Technology | LED, Halogen, HID |

| Sales Channel | OEMs, Aftermarket |

| Installation | Front, Rear, Interior, Side |

| Key Companies Profiled | Hella GmbH & Co. KGaA, OSRAM GmbH, Valeo SA, Stanley Electric Co., Ltd., KC HiLiTES |

| Additional Attributes | The market analysis includes dollar sales by product type, technology, sales channel, installation, and company categories. It also covers regional demand trends in Japan, driven by the increasing use of automotive light bars in passenger, light commercial, and heavy commercial vehicles. The competitive landscape highlights key manufacturers focusing on innovations in lighting technology, particularly LED, for enhanced efficiency, durability, and visibility. Trends in the growing demand for vehicle customization, safety, and aesthetic enhancements are explored, along with advancements in light bar designs for various vehicle installations, including front, rear, interior, and side lighting systems. |

The demand for automotive light bars in Japan is estimated to be valued at USD 2.1 billion in 2025.

The market size for the automotive light bars in Japan is projected to reach USD 3.3 billion by 2035.

The demand for automotive light bars in Japan is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in automotive light bars in Japan are passenger vehicles, light commercial vehicles and heavy commercial vehicles.

In terms of technology, led segment is expected to command 68.0% share in the automotive light bars in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Automotive Light Bars Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive Light Bars in USA Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Lighting Actuators Market Size and Share Forecast Outlook 2025 to 2035

Automotive Lightweight Materials Market Size and Share Forecast Outlook 2025 to 2035

Automotive Lighting Market Size, Growth, and Forecast for 2025 to 2035

Automotive Lighting Accessories Market Growth - Trends & Forecast 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fog Lights Market Size and Share Forecast Outlook 2025 to 2035

Automotive Backlight Moldings Market

Automotive Adaptive Lighting Market

Automotive Cigarette Lighters Market

Korea Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Automotive Door Impact Bars Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA