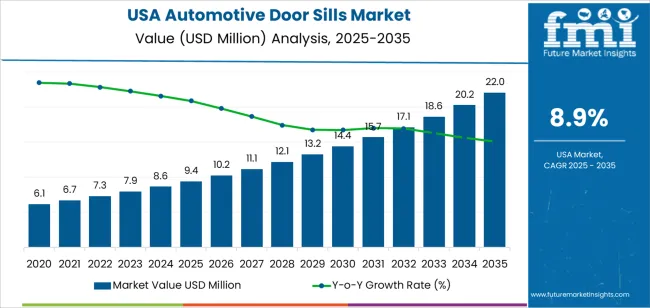

The demand for automotive door sills in USA is expected to expand from USD 9.4 billion in 2025 to USD 21 billion by 2035, registering a CAGR of 8.9%. Growth in the automotive door sills industry stems from the accelerating shift toward vehicle lightweighting, stricter federal safety mandates under NHTSA regulations, and the proliferation of electric vehicle platforms that require reinforced structural components.

Door sills serve as critical load-bearing elements that absorb side-impact forces, protect battery packs in EVs, and contribute to overall vehicle rigidity. As automakers redesign chassis architectures to accommodate electrification and meet IIHS crashworthiness standards, the integration of advanced door sill designs has become non-negotiable.T

he expansion is further propelled by the resurgence of domestic vehicle production, with major assembly plants in Michigan, Ohio, Tennessee, and Texas ramping up output of SUVs, pickup trucks, and crossover models that demand robust door sill solutions. The replacement cycle in the aftermarket segment is accelerating, driven by the aging vehicle fleet with average vehicle age in USA reaching 12.5 years and rising consumer investment in vehicle refurbishment and collision repair.

The adoption of multi-material construction techniques, combining stainless steel, aluminum, and advanced plastics, is enabling manufacturers to meet conflicting demands for weight reduction, structural integrity, and cost efficiency. The growing emphasis on pedestrian protection regulations and the increasing complexity of side-impact crash tests are pushing OEMs to specify higher-grade door sill assemblies, further supporting demand across both passenger and commercial vehicle segments.

The share gain trajectory for automotive door sills in USA reveals that the industry will experience substantial expansion over the forecast period from 2025 to 2035. The industry will grow from USD 9.4 billion in 2025 to USD 21 billion in 2035, reflecting an increase of USD 11.6 billion over the next decade. This growth signals robust demand as vehicle production rebounds, electric vehicle adoption accelerates, and the aftermarket replacement cycle intensifies across the aging vehicle population in USA.

From 2025 to 2030, the industry will expand from USD 9.4 billion to USD 14.3 billion, contributing USD 4.9 billion in growth. This phase captures the initial surge in EV platform rollouts from Detroit's Big Three automakers General Motors, Ford, and Stellantis alongside new entrants like Rivian and Lucid Motors, all of which require reinforced door sill structures to protect high-voltage battery systems. The regulatory push from NHTSA's updated side-impact crash test protocols, effective from 2026, will compel automakers to upgrade door sill specifications across model lineups. The reshoring of automotive component manufacturing under the CHIPS and Science Act and Inflation Reduction Act incentives will boost domestic production capacity for door sill assemblies, particularly in the Midwest and South regions.

From 2030 to 2035, the industry will advance further from USD 14.3 billion to USD 21 billion, contributing USD 6.7 billion in growth. This phase reflects the maturation of the EV transition, with battery-electric vehicles projected to account for over 50% of new vehicle sales by 2035 in states like California, New York, and Washington, which have adopted Advanced Clean Cars II regulations. The proliferation of autonomous vehicle testing and deployment, particularly in urban corridors, will drive demand for enhanced structural components that meet higher safety thresholds.

The aftermarket segment will experience stronger momentum as vehicles from the 2020 to 2025 production years enter their collision repair and refurbishment cycles. The strong growth acceleration in the latter half of the forecast period reflects the convergence of electrification, regulatory tightening, and the ongoing premiumization of vehicle interiors and safety features across the USA automotive landscape.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 9.4 billion |

| Industry Forecast Value (2035) | USD 21 billion |

| Industry Forecast CAGR (2025-2035) | 8.9% |

Demand for automotive door sills in USA is rising as automakers respond to federal safety mandates, electrification timelines set by EPA and CARB, and the structural requirements of new vehicle architectures. The Insurance Institute for Highway Safety (IIHS) has progressively tightened small overlap front and side-impact crash test criteria, compelling manufacturers to reinforce A-pillar and rocker panel assemblies, of which door sills are integral components.

The shift toward body-on-frame and unibody EV platforms where battery packs are mounted beneath the passenger compartment necessitates door sills that can withstand higher torsional loads and protect against intrusion during side collisions. Major automakers like GM, Ford, and Tesla have invested heavily in gigacasting and hot-stamping technologies to produce door sill structures that meet these stringent requirements while minimizing weight penalties.

Another key factor is the resurgence of domestic vehicle assembly, spurred by legislative incentives under the Infrastructure Investment and Jobs Act and supply chain reshoring initiatives. Assembly plants in Kentucky, Alabama, Georgia, and South Carolina are expanding capacity for SUV and pickup truck production, vehicle classes that require reinforced door sill assemblies due to their higher ride height and increased vulnerability to side-impact scenarios.

The aftermarket segment is expanding, fueled by collision repair activity in states with high vehicle density. California, Texas, Florida, and New York collectively account for over 35% of the nation's registered vehicles. Independent repair shops and dealership service centers are sourcing replacement door sills at higher rates as vehicle owners opt to extend vehicle lifespan rather than purchase new units amid elevated financing costs and insurance premiums.

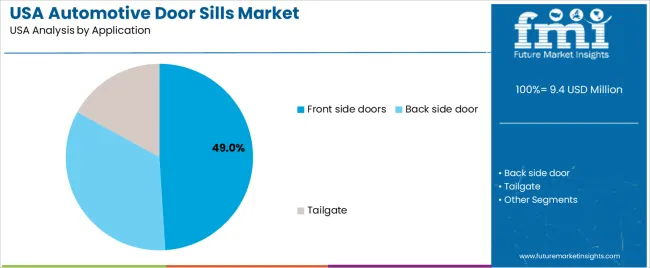

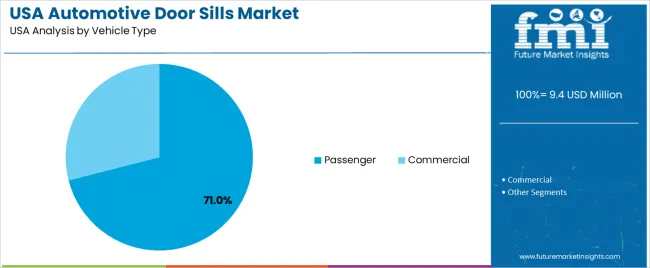

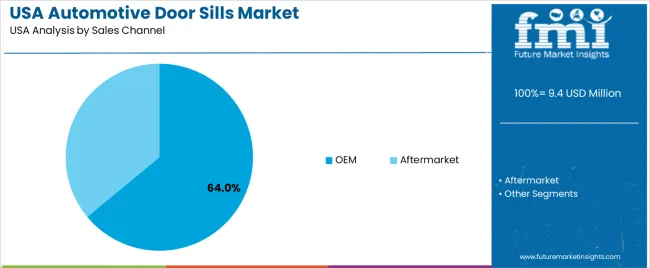

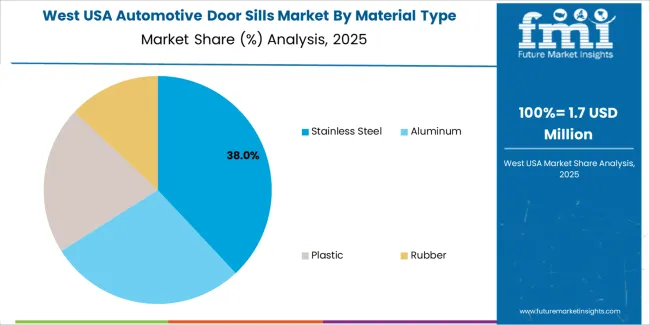

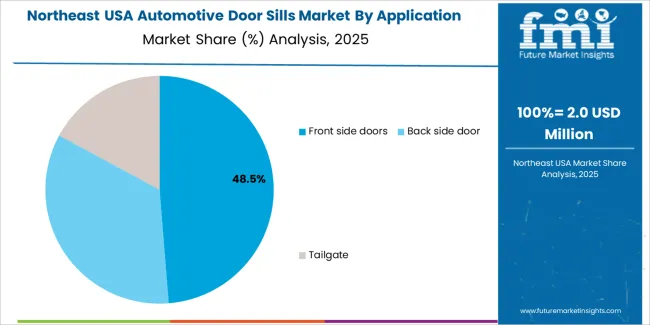

The demand for automotive door sills in USA is primarily driven by material type, application, vehicle type, and sales channel. The leading material type is stainless steel, which holds 38% of the share, while front side door is the dominant application segment, accounting for 49.0% of demand. Passenger vehicles represent 71.0% of the vehicle type category, and the OEM channel accounts for 64% of sales. Automotive door sills have gained significant traction across both original equipment manufacturing and aftermarket channels due to their role in structural integrity, occupant safety, and aesthetic differentiation. The component's dual function as a load-bearing structural member and a visible interior element has driven innovation in materials, coatings, and manufacturing processes across the USA automotive supply base.

Stainless steel is the leading material type in the automotive door sills industry, capturing 38% of the share. The dominance of stainless steel stems from its superior corrosion resistance, high tensile strength, and ability to withstand repeated impact without permanent deformation. In USA, where road salt application during winter months is widespread across northern and midwestern states, stainless steel door sills offer extended service life compared to mild steel or coated alternatives. Automakers specify stainless steel for both structural inner door sills and decorative scuff plates, particularly in premium and luxury vehicle segments where durability and aesthetic appeal are non-negotiable.

Stainless steel grades such as 304 and 316 are commonly used for outer scuff plates, providing a polished or brushed finish that resists scratching and wear from passenger ingress and egress. The material's work-hardening properties make it suitable for deep-drawing and roll-forming operations, enabling complex geometries that accommodate modern vehicle designs. In the EV segment, stainless steel door sills are favored for their ability to integrate with aluminum and composite body structures without galvanic corrosion issues, a critical consideration given the 15 to 20-year design life targets for electric platforms. The material's recyclability aligns with corporate environmental commitments from major OEMs, who are targeting closed-loop manufacturing systems by 2030.

Front side door is the leading application segment for automotive door sills in USA, capturing 49.0% of demand. The front side door experiences the highest frequency of use, with passengers entering and exiting the vehicle through these access points multiple times per trip. This repeated stress necessitates robust door sill assemblies that can withstand cyclic loading, abrasion, and impact from footwear, cargo, and environmental debris. Front door sills must meet stringent crashworthiness requirements under IIHS small overlap and NHTSA side-impact tests, where the component serves as a primary energy-absorbing structure that prevents intrusion into the occupant compartment.

In USA, where pickup trucks and SUVs account for over 80% of new vehicle sales, front side door sills are engineered to accommodate higher step-in heights and increased door aperture sizes. These vehicles often feature reinforced door sill beams fabricated from ultra-high-strength steel or aluminum extrusions, with cross-sectional designs optimized for bending and torsional rigidity. The front door sill integrates with the B-pillar and rocker panel to form a continuous load path that distributes crash forces across the vehicle structure.

In crew-cab pickup configurations, front door sills must support the weight of rear-hinged rear doors, requiring additional structural reinforcement. The proliferation of illuminated and logo-branded scuff plates in the front door area has created a secondary demand stream, with aftermarket suppliers offering customized stainless steel and aluminum scuff plates that enhance vehicle personalization.

Passenger vehicles are the leading vehicle type segment for automotive door sills in USA, capturing 71.0% of demand. Passenger vehicles encompass sedans, SUVs, crossovers, and hatchbacks, which collectively represent the majority of the 278 million registered vehicles in USA. The passenger vehicle segment benefits from higher annual production volumes compared to commercial vehicles, with major assembly plants in Michigan, Ohio, Kentucky, and Tennessee producing millions of units annually. Each passenger vehicle requires four to five door sill assemblies depending on body configuration, creating substantial per-unit demand for structural and decorative door sill components.

The shift toward SUVs and crossovers within the passenger vehicle category has altered door sill design requirements, with taller ride heights necessitating stepped or contoured door sill profiles that facilitate easier ingress and egress. Premium passenger vehicles feature illuminated door sills with LED lighting integrated into the scuff plate, activated by door opening sensors.

These decorative elements have become standard in luxury brands such as Cadillac, Lincoln, and Lexus, which maintain significant production volumes in USA. The aging vehicle fleet in the passenger segment is driving aftermarket demand for replacement door sills, particularly in rust-prone regions where corrosion compromises structural integrity. Insurance claims data indicate that side-impact collisions account for approximately 25% of all crash types in USA, resulting in frequent door sill replacement through collision repair channels.

OEM sales channel is the leading distribution pathway for automotive door sills in USA, capturing 64% of demand. The OEM channel encompasses direct supply relationships between Tier 1 component manufacturers and vehicle assemblers, where door sills are integrated during the initial vehicle build process at assembly plants. OEM demand is driven by new vehicle production volumes, which reached approximately 15.6 million units in 2024 across light-duty passenger and commercial vehicles. Each vehicle platform requires engineered door sill assemblies that meet specific crashworthiness, dimensional tolerance, and corrosion resistance specifications defined by the automaker.

Major Tier 1 suppliers such as Magna International, Gestamp Automoción, and Martinrea International operate dedicated stamping and assembly facilities in proximity to OEM plants, enabling just-in-time delivery of door sill components. The OEM channel benefits from long-term supply agreements that span vehicle platform lifecycles, typically five to seven years, providing revenue visibility and volume predictability for component manufacturers. The transition to electric vehicle platforms has intensified OEM collaboration with door sill suppliers, as new designs must accommodate battery pack integration, altered crash load paths, and reduced component weight targets.

The OEM channel's dominance reflects the complexity and regulatory scrutiny associated with structural automotive components. Door sills must undergo extensive validation testing, including finite element analysis, physical crash testing, and corrosion exposure protocols before receiving production approval. This barrier to entry limits aftermarket competition in the new vehicle segment.

The reshoring of automotive production under federal incentive programs is expanding domestic OEM supply chains, with new stamping plants announced in Georgia, Tennessee, and Texas to support EV platform rollouts from GM, Ford, Hyundai, and Rivian. As OEMs continue to prioritize vertical integration and supply chain resilience, the OEM sales channel is expected to maintain its leading position, accounting for the majority of automotive door sill demand throughout the forecast period.

Demand for automotive door sills in USA is rising as automakers navigate the transition to electrified powertrains, comply with evolving crash safety standards, and respond to consumer preferences for durable, aesthetically differentiated vehicle interiors. Growth stems from the proliferation of EV platforms that require reinforced underbody structures, the expansion of domestic vehicle assembly capacity under federal manufacturing incentives, and the aging vehicle fleet driving aftermarket replacement activity. Operational challenges include rising raw material costs, the technical complexity of multi-material joining, and supply chain constraints affecting specialty steel and aluminum availability.

Several factors support growth in USA automotive door sills industry. First, the regulatory environment is tightening, with NHTSA implementing updated side-impact crash test procedures in 2026 that mandate higher intrusion resistance thresholds for door sill structures. The IIHS has introduced more stringent small overlap crash tests that evaluate door sill performance in oblique impact scenarios, compelling automakers to upgrade component specifications across model lineups. Second, the electrification wave is accelerating, with over 1.4 million EVs sold in USA in 2024 and projections indicating 50% EV penetration by 2035 in states with zero-emission vehicle mandates.

EV platforms require door sills that protect battery packs from side intrusion while maintaining weight efficiency to preserve driving range. Third, domestic manufacturing capacity is expanding under the Inflation Reduction Act, which provides tax credits for vehicles assembled in North America with high domestic content percentages. This policy shift is driving capital investment in stamping and hot-forming facilities across the Midwest and South, creating demand for locally sourced door sill components. Fourth, the aftermarket replacement cycle is intensifying as the average age of vehicles in operation reaches 12.5 years, with corrosion and collision damage driving door sill replacement in independent repair shops and dealership service centers.

Despite momentum, several restraints inhibit growth in USA automotive door sills industry. Raw material costs remain volatile, with stainless steel and aluminum prices subject to global supply-demand imbalances and trade policy fluctuations. The technical complexity of multi-material door sill assemblies, which combine steel, aluminum, and composite materials, requires specialized welding, adhesive bonding, and mechanical fastening techniques that increase manufacturing costs and quality control requirements. Laser welding equipment and hot-stamping presses represent significant capital expenditures for Tier 1 suppliers, creating barriers to capacity expansion.

The shift toward mega-casting and single-piece structural designs pioneered by Tesla threatens traditional multi-component door sill assemblies, potentially reducing part counts and supplier opportunities. Labor availability constraints in key manufacturing states such as Michigan, Ohio, and Alabama are limiting production capacity, with skilled trades positions in stamping and welding proving difficult to fill. Warranty and liability exposure associated with structural components creates risk for suppliers, particularly as crash safety standards become more stringent.

Major trends include the integration of hot-stamped boron steel into door sill designs, enabling tensile strengths exceeding 1,500 MPa while reducing component weight by 15 to 20% compared to conventional high-strength steel. Mega-casting techniques are being adopted by legacy OEMs, with Ford and GM announcing investments in die-casting equipment capable of producing single-piece door sill and rocker panel assemblies. This manufacturing shift reduces part counts from 50 to 70 components down to single castings, streamlining assembly processes and improving structural rigidity.

Decorative scuff plates are evolving beyond passive trim pieces, with LED illumination, proximity sensing, and customizable branding becoming standard features in premium vehicle segments. The aftermarket channel is experiencing growth in carbon fiber and anodized aluminum scuff plates, targeting enthusiast and customization buyers who prioritize visual differentiation. Circular economy initiatives are gaining traction, with OEMs establishing take-back programs for end-of-life vehicles and partnering with steel mills to create closed-loop recycling systems for door sill components.

Demand for automotive door sills in the United States is rising as manufacturers emphasize crash safety, weight reduction, and brand differentiation. Door sills function as structural energy-absorbing members that protect occupants in side-impact events, while also acting as visible interior trim that reinforces perceived vehicle quality. Growth is supported by the shift toward electric vehicles, where battery housings require additional reinforcement and optimized sill architecture. Advances in hot-stamping and hydroforming enable high-strength, lightweight profiles, helping automakers meet CAFE fuel-efficiency rules.

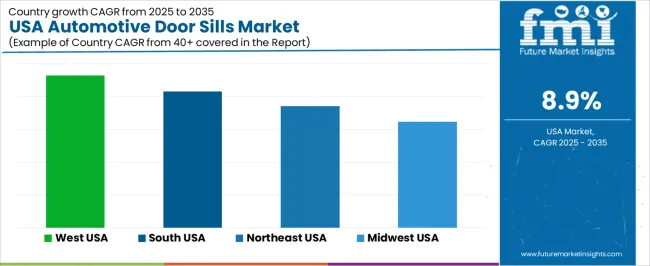

Domestic production incentives and new assembly capacity are strengthening the need for locally sourced components, while an aging vehicle fleet supports a steady aftermarket pull through collision repair and refurbishment. Regional demand reflects manufacturing geography and climate exposure. The West holds the strongest growth momentum due to high EV penetration and its role as a design and innovation hub.

Meanwhile, the South, Midwest, and Northeast maintain consistent uptake driven by new plant investments, Tier-1 supplier presence, and large vehicle output volumes. Corrosion resistance, crash performance, and long-term durability remain core purchasing criteria, pushing suppliers toward multi-material solutions and improved coatings. Overall, evolving powertrain platforms, safety expectations, and supply chain localization are reshaping the demand landscape across the country.

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 9.3% |

| South USA | 8.3% |

| Northeast USA | 7.4% |

| Midwest USA | 6.2% |

The West USA leads national demand for automotive door sills with a 9.3% CAGR, driven primarily by aggressive electrification policies. California’s Advanced Clean Cars II mandate for 100% zero-emission vehicle sales by 2035 accelerates EV platform development, requiring reinforced sill structures to shield high-voltage batteries. California accounts for more than 40% of USA EV sales, supported by production hubs such as Tesla Fremont and Lucid Casa Grande.

Southern California’s concentration of design studios for GM, Ford, Toyota, and Honda makes the region the core zone where new sill technologies are engineered and validated. Proximity to the ports of Los Angeles, Long Beach, and Oakland enables efficient sourcing of high-strength steel and aluminum extrusions, while advanced manufacturing capacity from Gestamp, Martinrea, and Tower International strengthens supply. The West also benefits from a strong aftermarket culture, driving demand for premium carbon-fiber sills and illuminated interior trims, solidifying its long-term dominance.

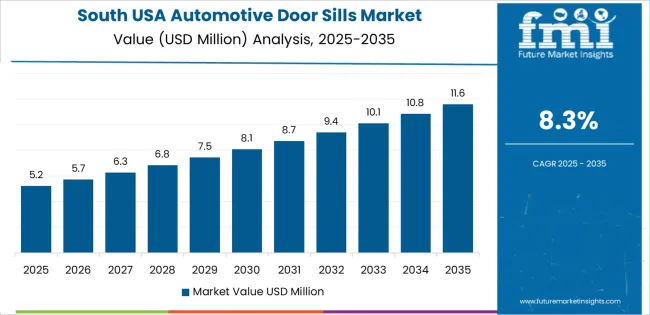

The South USA shows strong demand for automotive door sills with a CAGR of 8.3% due to its dense network of assembly plants in Alabama, Tennessee, Kentucky, Georgia, and South Carolina, which together produce more than 5 million vehicles per year. OEM requirements are driven by Mercedes-Benz Tuscaloosa, Volkswagen Chattanooga, Toyota Georgetown, Hyundai-Kia West Point, and BMW Spartanburg. The region is rapidly scaling EV production through Ford’s BlueOval City, Hyundai’s Georgia EV facility, and Rivian’s upcoming plant, increasing the need for reinforced sills designed for battery integration and crash safety.

Competitive labor environments, right-to-work policies, and incentive programs continue to attract Tier-1 stamping and fabrication facilities, while steel supply from Alabama and Arkansas supports large-scale production. Pickup trucks and SUVs, over 85% of new sales, boost demand for heavy-duty sill structures. A growing population further strengthens aftermarket replacement volumes, ensuring sustained growth through 2035.

The Northeast USA demonstrates steady demand for automotive door sills with a CAGR of 7.4%. The region's performance reflects its mature automotive ecosystem, anchored by established assembly plants, a dense network of Tier 1 and Tier 2 suppliers, and a large installed vehicle base exceeding 50 million units. States such as New York, Pennsylvania, and New Jersey have adopted California's zero-emission vehicle standards, creating regulatory alignment that drives EV adoption and corresponding demand for advanced door sill structures.

The region hosts major stamping and metal forming facilities operated by Magna, Tower International, and Metalsa, which supply door sill assemblies to nearby assembly plants and serve as export hubs for components shipped to plants in other regions. The Northeast's concentration of luxury vehicle sales, particularly in metropolitan areas such as New York City, Boston, and Washington DC, drives demand for premium door sill assemblies featuring stainless steel construction, LED illumination, and custom branding. The region's emphasis on vehicle safety, reflected in high insurance premiums and stringent state inspection requirements, encourages vehicle owners to invest in collision repair and component replacement to maintain structural integrity.

The Midwest USA shows moderate growth in demand for automotive door sills with a CAGR of 6.2%. The region's performance reflects its position as the historical center of American automotive manufacturing, with Michigan, Ohio, and Indiana hosting major assembly plants operated by GM, Ford, Stellantis, and Honda. The Midwest's mature supplier base, including hundreds of stamping shops, metal formers, and assembly facilities, provides comprehensive coverage of door sill manufacturing from raw material processing through final assembly and delivery.

The Midwest is experiencing a renaissance in automotive manufacturing investment, spurred by federal incentive programs and the transition to EV production. GM's announcement of over USD 7 billion in EV-related investments across Michigan, Ohio, and Tennessee includes capacity for next-generation door sill assemblies using hot-stamped steel and aluminum extrusions. The region's aging vehicle fleet, with average vehicle age exceeding 13 years in states such as Michigan and Ohio, generates substantial replacement demand for corroded door sill components through independent repair shops and dealership service centers.

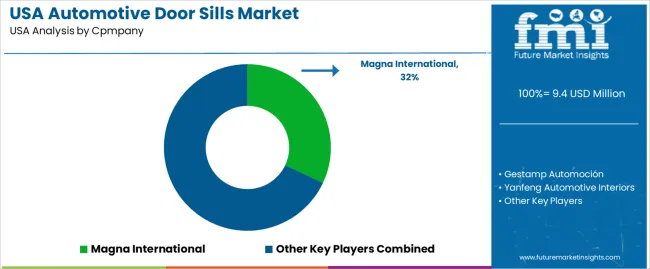

The automotive door sills industry in the United States is experiencing growth as vehicle manufacturers prioritize structural integrity, weight reduction, and interior aesthetics in response to regulatory pressures and consumer expectations. Companies such as Magna International (holding approximately 32.0% share), Gestamp Automoción, Yanfeng Automotive Interiors, Plastic Omnium, and Toyoda Gosei are key players in this industry, providing automakers with engineered door sill assemblies that meet crashworthiness requirements while supporting lightweighting objectives.

Competition in the automotive door sills industry centers on engineering capabilities, manufacturing technology, and supply chain proximity to assembly plants. Companies focus on offering advanced materials including hot-stamped boron steel, aluminum extrusions, and fiber-reinforced composites that deliver strength-to-weight optimization. Another competitive differentiator is manufacturing process innovation, with leading suppliers investing in mega-casting equipment, laser welding systems, and automated assembly lines that reduce production costs while improving quality consistency.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Material Type | Stainless Steel, Aluminum, Plastic, Rubber |

| Application | Front Side Door, Back Side Door, Tailgate |

| Vehicle Type | Passenger, Commercial |

| Sales Channel | OEM, Aftermarket |

| Key Companies Profiled | Magna International, Gestamp Automoción, Yanfeng Automotive Interiors, Plastic Omnium, Toyoda Gosei |

| Additional Attributes | Dollar sales by material, application, vehicle type, and sales channel are assessed alongside USA demand driven by EV expansion, safety regulations, and aftermarket aging fleets. Competition centers on hot-stamping, mega-casting, multi-material door sills, LED scuff plates, and closed-loop recycling strategies. |

The demand for automotive door sills in USA is estimated to be valued at USD 9.4 million in 2025.

The market size for the automotive door sills in USA is projected to reach USD 22.0 million by 2035.

The demand for automotive door sills in USA is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in automotive door sills in USA are stainless steel, aluminum, plastic and rubber.

In terms of application, front side doors segment is expected to command 49.0% share in the automotive door sills in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Door Sills Market Growth – Trends & Forecast 2025 to 2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

Automotive Door Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Door Hinges Market Growth - Trends & Forecast 2025 to 2035

Automotive Door Latch Market Trends - Growth & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Automotive Door Latch and Hinges Market Analysis by Type, Application, and Region Forecast Through 2035

Automotive Door Impact Bars Market

Automotive Door Stabilizer Market

Demand for Automotive UPS in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive NFC in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive AI Chipset in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brake Tube in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Roof Rails in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Display Units in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Coating in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA