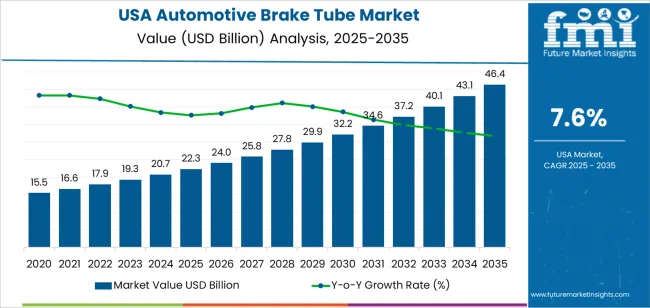

The demand for automotive brake tube in USA is projected to grow from USD 22.3 billion in 2025 to USD 46.4 billion by 2035, reflecting a CAGR of 7.6%. The growth in the automotive brake tube industry is driven by several factors, including the increasing production of passenger and commercial vehicles, the rising emphasis on vehicle safety standards, and the growing replacement cycle for aging vehicle fleets. With automakers becoming more focused on enhanced braking performance, automotive brake tube systems provide critical functionality that ensures reliable hydraulic pressure transmission from master cylinders to brake calipers, allowing drivers to maintain control under diverse driving conditions.

The growth is also driven by advancements in material science, increased consumer preference for durable and corrosion-resistant brake components, and the broadening of brake tube applications from passenger cars to heavy-duty commercial trucks. Additionally, the rising adoption of anti-lock braking systems (ABS) and electronic stability control (ESC) will further support expansion. The increasing focus on regulatory compliance with Federal Motor Vehicle Safety Standards (FMVSS) and the preference for high-performance braking solutions among fleet operators also add to the demand for brake tubes, which offer both reliability and longevity without the frequent maintenance burden of inferior brake line materials.

The share gain analysis for automotive brake tube in USA reveals that the industry is expected to experience significant expansion over the forecast period from 2025 to 2035. The industry will grow from USD 22.3 billion in 2025 to USD 46.4 billion in 2035, reflecting an increase of USD 24.1 billion over the next decade. This growth indicates a strong expansion of the automotive brake tube industry, with more vehicle manufacturers opting for advanced brake tube systems rather than traditional brake line configurations that may compromise safety or durability.

From 2025 to 2030, the industry will grow from USD 22.3 billion to USD 31.4 billion, contributing USD 9.1 billion in growth. This phase will see an initial gain as more automakers adopt high-grade stainless steel and rubber brake tube solutions, driven by an increasing focus on vehicle safety regulations and the need for corrosion-resistant brake components. The demand for brake tubes in passenger vehicles, particularly for sedans, SUVs, and crossovers, will contribute significantly to this growth.

From 2030 to 2035, the industry will expand further from USD 31.4 billion to USD 46.4 billion, contributing USD 15 billion in growth. This phase will see stronger gains as the adoption becomes more widespread, with more fleet operators choosing to upgrade brake tube systems in commercial vehicles, delivery vans, and heavy-duty trucks.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 22.3 billion |

| Industry Forecast Value (2035) | USD 46.4 billion |

| Industry Forecast CAGR (2025-2035) | 7.6% |

Demand for automotive brake tube in USA is rising as vehicle manufacturers and fleet operators increasingly prioritize safety performance over cost minimization, driven by stringent FMVSS requirements and the need for durable hydraulic brake line systems. Many automakers, especially those producing light trucks and passenger vehicles, prefer high-grade stainless steel or rubber-lined brake tubes for new models or when replacing corroded brake lines that may compromise braking efficiency.

OEM suppliers offering direct-fit brake tube kits, pre-flared tube assemblies and corrosion-resistant coatings support this shift by providing ease of installation, precise fitment, and compliance with SAE J1047 specifications. Additionally, commercial vehicle operators and dealership service departments are collaborating with brake tube manufacturers to extend the service life of hydraulic brake systems and enhance driver safety, which further fuels adoption. Industry figures show that the USA automotive brake tube segment is valued at approximately USD 22.3 billion and is expected to grow steadily.

Another key factor is the convergence of vehicle electrification trends, telematics integration for fleet diagnostics and the heightened awareness of brake system failures. Fleet managers increasingly seek to prevent hydraulic brake line ruptures, reduce downtime caused by brake fluid leaks and minimize liability exposure related to brake failures, which make high-quality brake tube systems attractive. Advances in tube bending technology, automated flaring equipment and corrosion-resistant alloy formulations reduce installation complexity and improve long-term reliability, which encourages broader acceptance.

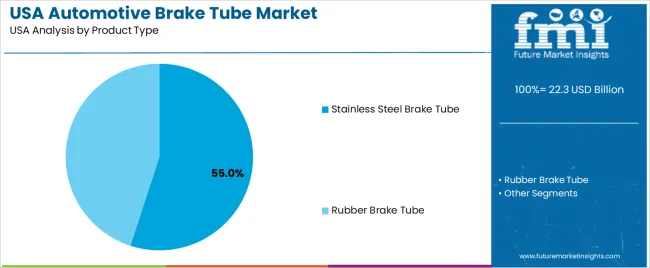

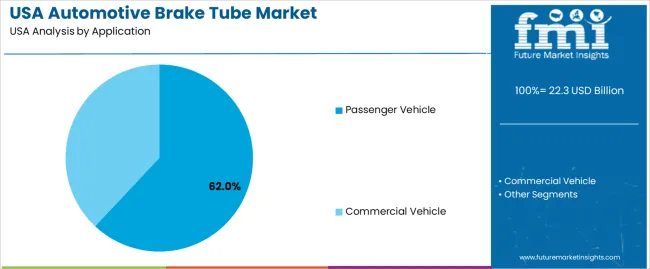

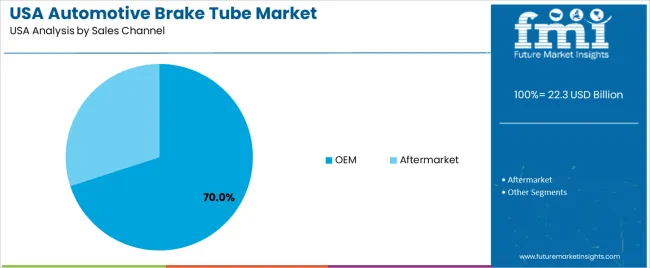

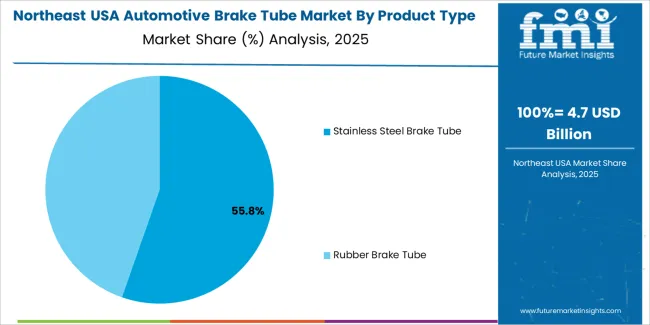

The demand for automotive brake tube systems in USA is primarily driven by product type, application, and sales channel. The leading product type is stainless steel, which holds 55% of the industry share, while passenger vehicles is the dominant application segment, accounting for 62% of the demand, and OEM is the leading sales channel with 70% of the volume.

Automotive brake tube has gained significant traction in both the original equipment and aftermarket sectors due to its critical role in hydraulic brake system integrity, resistance to environmental corrosion, and compliance with federal safety regulations. The brake tube configuration allows automakers and repair facilities to deliver reliable brake line assemblies that withstand high hydraulic pressure, temperature fluctuations, and exposure to road salts, which appeals to various customer bases.

Stainless steel is the leading product type in the automotive brake tube industry, capturing 55% of the industry share. The increasing preference for stainless steel brake tubing among automakers and aftermarket suppliers stems from its superior corrosion resistance, high tensile strength, and extended service life compared to traditional mild steel or copper-nickel alloy tubes. Stainless steel brake tubes resist rust formation even in harsh climates where road salts and moisture accelerate brake line deterioration, which is particularly relevant in northern states with severe winter conditions.

In USA, where vehicle longevity and safety compliance are paramount, stainless steel brake tube assemblies have become the preferred solution for both new vehicle production and brake system restoration projects. The adoption of stainless steel tubing for brake line applications also supports the growing emphasis on reducing warranty claims related to brake fluid leaks and premature brake line failures, as these tubes maintain structural integrity over longer periods.

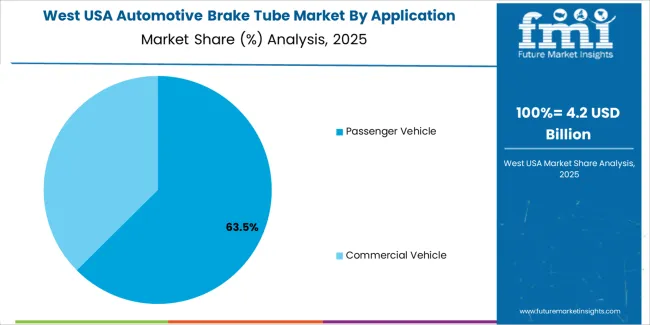

Passenger vehicles is the leading application segment for automotive brake tube in USA, capturing 62% of the industry share. The high volume of passenger vehicle production, including sedans, SUVs, crossovers, and light trucks, drives substantial demand for brake tube assemblies that meet stringent safety and performance requirements. Automakers such as General Motors, Ford, and Stellantis specify brake tube configurations that comply with FMVSS 106 for hydraulic brake hoses and FMVSS 571.135 for light vehicle brake systems, which necessitates the use of high-quality brake tubing materials.

Passenger vehicle operators benefit from reliable brake tube systems that ensure consistent brake pedal feel, rapid hydraulic pressure transmission, and resistance to brake fade under heavy braking conditions. The growing fleet of passenger vehicles on USA roads, combined with the average vehicle age exceeding 12 years, creates ongoing demand for both OEM replacement brake tubes and aftermarket brake line repair kits. Additionally, the increasing adoption of advanced driver-assistance systems (ADAS) and regenerative braking in hybrid and electric passenger vehicles requires brake tube designs that accommodate electronic brake force distribution and stability control modules.

OEM is the leading sales channel for automotive brake tube in USA, capturing 70% of the industry share. In the OEM channel, vehicle manufacturers and Tier 1 automotive suppliers are the primary customers for brake tube assemblies that are integrated during new vehicle production. OEM clients benefit from brake tube systems by ensuring factory-specified brake line routing, precise tube lengths, and pre-flared fittings that reduce assembly time on production lines without the need for field modifications or custom fabrication.

Automotive brake tube suppliers also offer OEM customers the flexibility to scale production volumes seasonally or align with new model launches, which can enhance supply chain efficiency without the financial burden of maintaining large inventories of finished brake tube assemblies. Additionally, the growing emphasis on vehicle safety certifications and reducing product liability has driven many automakers to source brake tubes exclusively from qualified suppliers that meet ISO/TS 16949 quality standards and have demonstrated compliance with SAE J1047 material specifications.

As the OEM sector continues to embrace lean manufacturing principles, just-in-time delivery of brake tube components, and long-term supplier partnerships, the demand for automotive brake tube systems through the OEM channel is expected to grow, further solidifying its position as the dominant sales channel in the industry.

Demand for automotive brake tube in the USA is rising as fleet operators and vehicle manufacturers increasingly prioritize brake system reliability over short-term cost savings, driven by federal safety mandates, rising vehicle complexity and the prevalence of hydraulic brake system architectures. Growth stems from OEM production volumes, aftermarket brake line replacement demand and the adoption of corrosion-resistant materials for brake tube fabrication.

However, operational challenges like raw material price volatility, supply chain constraints for specialty alloys and the fragmentation of aftermarket distribution channels are restraining expansion. Key trends include the integration of pre-coated brake tubes with polymer or zinc plating, the shift toward modular brake line assemblies that simplify installation and the increasing use of stainless steel tubing in both OEM and aftermarket applications rather than traditional mild steel or copper-nickel alloys.

Several factors support growth in the USA industry. First, the continued production of light-duty trucks, SUVs, and passenger cars by domestic automakers such as General Motors, Ford, and Stellantis drives consistent OEM demand for brake tube assemblies that meet FMVSS specifications. Second, the aging USA vehicle fleet, with an average vehicle age exceeding 12 years, generates substantial aftermarket demand for brake line replacement kits due to corrosion-induced brake tube failures in vehicles exposed to road salts and humid climates.

Third, the enforcement of federal safety standards by the National Highway Traffic Safety Administration (NHTSA) and state vehicle inspection programs in regions like the Northeast and Midwest boost demand for compliant brake tube systems that prevent hydraulic brake fluid leaks. Fourth, the expansion of commercial vehicle fleets, including delivery vans operated by logistics companies and heavy-duty trucks used in freight transport, continues to fuel demand for durable brake tube solutions that withstand high-mileage operation and frequent brake system cycling.

Despite momentum, several restraints inhibit growth. Fleet operators and independent repair shops express concerns about the cost premium of stainless steel brake tubing compared to traditional mild steel alternatives, which may limit adoption among price-sensitive segments seeking the lowest-cost brake line repair options.

The cost structure of producing high-grade brake tube assemblies, including raw material procurement, precision tube bending, automated flaring operations, and corrosion-resistant coating applications, can reduce margin and raise wholesale prices, making the offering less compelling versus lower-grade brake tubing for some aftermarket applications. Additionally, the brake tube segment remains dependent on the overall health of automotive production volumes, and any slowdown in new vehicle sales or delays in vehicle replacement cycles can dampen demand.

Major trends include the move from traditional single-wall mild steel brake tubing to double-wall or polymer-coated stainless steel tubes that offer enhanced corrosion resistance and extended service life. There is increasing integration of technology such as automated tube bending systems, computer-aided design (CAD) for custom brake line routing, and laser marking of part numbers on brake tube assemblies, improving traceability and reducing installation errors.

The aftermarket channel is experiencing consolidation, with large automotive parts retailers and online marketplaces expanding their offerings of pre-flared brake tube kits that eliminate the need for specialized flaring tools. Vehicle manufacturers and brake system suppliers are also adopting modular brake line assemblies that combine multiple brake tube sections with pre-installed fittings and brackets, offering hybrid factory-installed and field-replaceable configurations, and promoting compatibility with both hydraulic and electro-hydraulic brake systems to appeal to customers transitioning to advanced braking technologies.

The demand for automotive brake tube in USA is growing as vehicle owners, fleet operators, and automakers increasingly seek reliable, corrosion-resistant, and safety-compliant components for hydraulic brake systems. Automotive brake tube systems allow technicians and manufacturers to install high-quality brake lines that transmit hydraulic pressure with minimal fluid loss, reducing the risk of brake failure and promoting safer vehicle operation. This configuration is particularly attractive to commercial fleet managers who want to minimize downtime caused by brake line ruptures and avoid liability issues associated with brake system malfunctions.

Factors driving this demand include the enforcement of federal vehicle safety standards, the prevalence of harsh winter climates that accelerate brake line corrosion, and the growing adoption of preventative maintenance programs by fleet operators. The increasing focus on extending vehicle service life and reducing total cost of ownership is encouraging commercial vehicle operators to invest in premium brake tube materials that resist rust and withstand high hydraulic pressures, like stainless steel or polymer-coated assemblies.

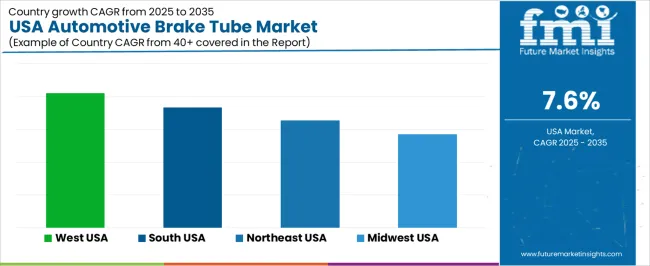

Regional demand varies depending on factors such as climate severity, vehicle fleet composition, and the presence of automotive manufacturing facilities. The West leads in demand, supported by high vehicle ownership rates and the concentration of automotive aftermarket distributors, while the South, Northeast, and Midwest show steady adoption driven by diverse vehicle fleets and the need for cold-weather brake system durability. This analysis explores the factors shaping the demand for automotive brake tube across the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 8.2% |

| South USA | 7.3% |

| Northeast USA | 6.6% |

| Midwest USA | 5.7% |

The West region leads the USA in the demand for automotive brake tube with a CAGR of 8.2%. The region's large vehicle population, particularly in states like California, Texas (western portion), and Arizona, is highly dependent on personal vehicles for transportation, both of which drive the demand for reliable brake tube systems. California, known for its stringent vehicle emission and safety inspection programs administered by the California Bureau of Automotive Repair, is a key geography where the demand for compliant and durable brake tube assemblies is growing.

The West also has a higher concentration of automotive aftermarket distributors, independent repair shops, and dealership service centers that are comfortable with recommending and installing premium brake tube products for customers seeking long-term brake system reliability.

With the region's focus on vehicle longevity and the avoidance of costly brake system failures, automotive brake tube systems offer a viable solution for both preventative maintenance and emergency brake line repairs, enabling vehicle owners to maintain safe braking performance across various driving conditions without the recurring expense of frequent brake line replacements. As the demand for high-quality and corrosion-resistant brake tube assemblies continues to rise in the West, the region remains the leading geography for automotive brake tube systems.

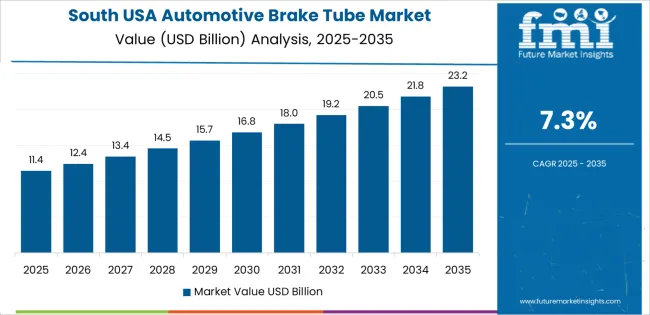

The South shows strong demand for automotive brake tube with a CAGR of 7.3%. The region's expanding automotive manufacturing footprint, combined with a growing population of light trucks and commercial vehicles, contributes to the rising adoption of brake tube systems. States like Texas, Florida, and Georgia have large vehicle fleets and robust automotive service sectors, making them key drivers of demand for reliable and cost-effective brake tube solutions.

The growing number of commercial vehicle operators in the South, including logistics companies, delivery services, and construction fleets, with their higher vehicle utilization rates and greater exposure to brake system wear, further supports the demand for automotive brake tube assemblies. The convenience factor, coupled with the preference for purchasing pre-flared brake tube kits that reduce installation time, is appealing to many fleet maintenance managers in the South. With the rise of e-commerce distribution centers and shifting transportation patterns that increase commercial vehicle activity, the South is expected to continue to see strong demand for brake tube systems.

The Northeast demonstrates steady demand for automotive brake tube with a CAGR of 6.6%. The region, exposed to harsh winter conditions and aggressive road salt application in states like New York, Pennsylvania, and Massachusetts, has a high incidence of brake line corrosion failures that necessitate frequent brake tube replacement. The Northeast's emphasis on vehicle safety inspections, combined with growing awareness of brake system maintenance, is driving the adoption of corrosion-resistant brake tube materials.

In addition, the high cost of vehicle ownership and the preference for maintaining existing vehicles rather than purchasing new ones make brake tube replacement an attractive option for individuals seeking to extend the service life of their cars and trucks without the substantial financial outlay of a new vehicle purchase. While growth is steady compared to the West and South, the Northeast's combination of corrosive environmental conditions and strong automotive repair infrastructure ensure that the demand for automotive brake tube remains a key component of the region's vehicle maintenance landscape.

The Midwest shows moderate growth in the demand for automotive brake tube with a CAGR of 5.7%. While the region may not have the same vehicle density as the West or the rapid fleet expansion of the South, there is a substantial installed base of aging vehicles that require ongoing brake system maintenance. Cities like Chicago, Detroit, and Minneapolis experience severe winter weather that accelerates brake line corrosion, increasing the need for replacement brake tube assemblies.

The Midwest's steady adoption of brake tube systems is driven by the concentration of automotive manufacturing facilities, the presence of major automakers' supplier networks, and the availability of aftermarket parts distribution centers that cater to both retail and commercial customers. As awareness of the long-term cost savings associated with stainless steel brake tubing increases and vehicle owners seek more durable alternatives to factory-original mild steel brake lines, demand for these systems will continue to grow in the Midwest, albeit at a slower pace compared to other regions.

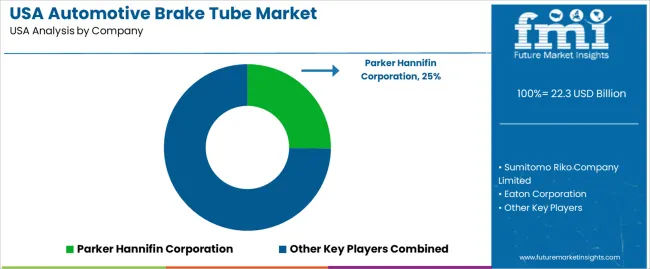

The automotive brake tube industry in the United States is growing as fleet operators, dealership service departments, and vehicle owners increasingly seek more reliable and corrosion-resistant brake line solutions. Companies such as Parker Hannifin (holding approximately 25.2% industry share), Sumitomo Riko Company, Eaton Corporation, Nichirin Co., Ltd., and TI Fluid Systems are key players in this industry, providing customers with access to high-quality, engineered brake tube assemblies and pre-flared brake line kits for both OEM production lines and aftermarket applications. The shift toward preventative maintenance, growing awareness of brake system safety, and the need for compliance with federal vehicle safety regulations are all driving factors behind the industry's expansion.

Competition in the automotive brake tube industry is centered around material quality, product availability, and technical support capabilities. Companies focus on offering a comprehensive selection of brake tube materials, from traditional mild steel with corrosion-resistant coatings to premium stainless steel tubing that meets or exceeds SAE J1047 specifications, and expanding their distribution networks to ensure rapid delivery to automotive assembly plants and aftermarket repair facilities.

Another competitive advantage is technical service, with many companies offering engineering support for custom brake line routing, automated tube bending services, and pre-assembled brake line kits that reduce installation time. Some players are also emphasizing quality certifications, such as ISO/TS 16949 and IATF 16949 compliance, and the availability of domestic manufacturing capacity to reduce lead times. Promotional efforts typically highlight product durability, compliance with FMVSS requirements, and the availability of direct-fit brake tube assemblies that eliminate the need for field modifications.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Stainless Steel, Rubber Brake Tube |

| Application | Passenger Vehicles, Commercial Vehicles |

| Sales Channel | OEM, Aftermarket |

| Key Companies Profiled | Parker Hannifin, Sumitomo Riko Company, Eaton Corporation, Nichirin Co., Ltd., TI Fluid Systems |

| Additional Attributes | Dollar sales by product type, application, and sales channel are evaluated alongside USA demand for corrosion-resistant brake tubes in OEM and aftermarket segments, with competition shaped by safety compliance needs, maintenance longevity, fabrication advances, and premium coating technologies. |

The demand for automotive brake tube in USA is estimated to be valued at USD 22.3 billion in 2025.

The market size for the automotive brake tube in USA is projected to reach USD 46.4 billion by 2035.

The demand for automotive brake tube in USA is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in automotive brake tube in USA are passenger vehicle and commercial vehicle.

In terms of product type, stainless steel brake tube segment is expected to command 55.0% share in the automotive brake tube in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Brake Tube Market Growth - Trends & Forecast 2025 to 2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

Automotive Brake Linings Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Fluid Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Booster and Master Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Actuation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Shims Market Analysis - Size, Share, and Forecast 2025 to 2035

Automotive Brake System Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake Friction Products Market - Trends & Forecast 2025 to 2035

Automotive Brake Pad Market - Growth & Demand 2025 to 2035

Automotive Brake Valve Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Automotive Tube Bending & Assembly Parts Market

Automotive Handbrake And Clutch Cables Market

Automotive Park Brake Lever Market Growth – Trends & Forecast 2024-2034

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Brake Rotors Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA