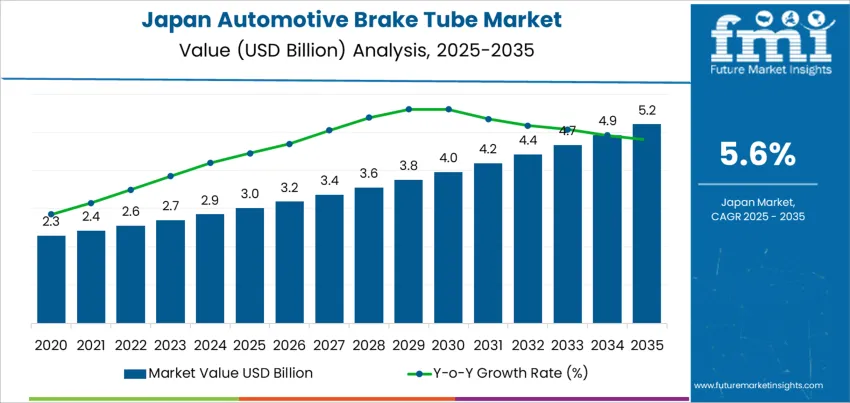

The demand for automotive brake tube in Japan is valued at USD 3.0 billion in 2025 and is projected to reach USD 5.2 billion by 2035, reflecting a CAGR of 5.6%. Growth in the early years comes from recovery in light vehicle production, steady replacement demand, and ongoing safety upgrades across domestic fleets. Japanese OEMs focus on corrosion-resistant, weight-optimized tubing to support compact cars, hybrids, and small commercial vehicles. Regulatory emphasis on braking performance and inspection standards encourages timely replacement in aftermarket channels. Steel and copper nickel tubes dominate, while interest in coated and stainless variants grows in applications exposed to harsh environments such as snow regions and coastal prefectures. Local suppliers coordinate with OEMs on quality programs.

From 2030 onward growth increasingly reflects structural changes in Japan automotive manufacturing and export patterns. Brake tube demand is influenced by higher penetration of hybrids and battery electric vehicles that require precise braking control and corrosion resistant lines. Passenger cars remain the largest segment, followed by light commercial vehicles and buses. Key suppliers include domestic steelmakers, tubing specialists, and global component groups that operate plants in Japan. Strategies center on improving forming accuracy, enhancing internal cleanliness, and reducing weight without sacrificing durability. Many producers invest in automation, non-destructive inspection, and joint development projects with major OEMs. Distribution networks integrate direct supply to assembly plants with strong aftermarket channels serving inspection centers and independent repair workshops. Exports support overall stability.

The Growth Volatility Index for automotive brake tube demand in Japan from 2020 to 2025 indicates a tightly controlled growth band with minimal year over year deviation. Demand rises from USD 2.3 billion in 2020 to USD 3.0 billion in 2025, with annual absolute changes confined between USD 0.1 and 0.2 billion. The implied volatility range during this phase remains structurally low, signaling demand anchored to predictable vehicle production volumes and stable aftermarket replacement cycles. No abnormal spikes appear in the sequence, confirming the absence of speculative demand or supply disruptions. This low early period volatility establishes a stable statistical baseline for forecasting accuracy and inventory planning.

Between 2025 and 2035, the volatility index shifts into a controlled expansion phase rather than erratic fluctuation. Demand increases from USD 3.0 billion to USD 5.2 billion, with yearly increments gradually widening from around USD 0.2 billion to USD 0.3 billion after 2030. This widening does not indicate instability but reflects steady capacity expansion tied to tightening braking safety standards, rising advanced braking system penetration, and gradual electrification of vehicle platforms. Volatility remains structurally moderate due to regulation driven demand rather than discretionary consumption. The consistency of annual step UPS supports long term procurement planning and signals low downside risk across the forecast cycle.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 3.0 billion |

| Forecast Value (2035) | USD 5.2 billion |

| Forecast CAGR (2025–2035) | 5.6% |

The demand for automotive brake tube in Japan reflects questions commonly asked by engineers, buyers and planners. Historically they have focused on how domestic vehicle production, platform localization and safety regulation translate into tubing volumes. Automotive forums and procurement teams often ask which materials perform best in coastal and snowy regions with strong corrosion exposure. Japanese assemblers traditionally specified coated steel tube for cost control and fatigue performance while evaluating stainless or copper nickel options where durability matters most. Another recurring query concerns how inspection rules influence replacement cycles. Roadworthiness checks and strict recall practices have supported steady aftermarket demand because fleet operators prefer preventive tube replacement before visible leakage or burst failures appear in older vehicles under harsh conditions.

Future focused questions in Japan center on how electrification, export platforms and regulatory trends will reshape brake tube needs. Vehicle planners frequently ask whether battery electric models will reduce hydraulic circuits or simply reroute tubing around new underbody layouts. Current designs still rely on hydraulic brakes so engineers emphasize thinner wall, higher strength tube with better forming capability. Purchasing teams increasingly query suppliers about longer corrosion warranties, coating technology and traceability back to steel mills. Another common concern involves price stability and sourcing diversity as copper prices fluctuate and regional steel mills consolidate. Logistics managers also ask how just in time delivery, domestic stockholding and earthquake related disruption planning can secure uninterrupted brake tube supply for assembly plants across Japan.

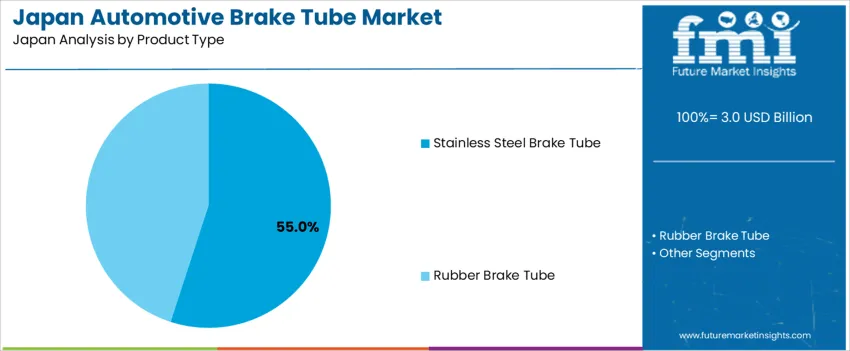

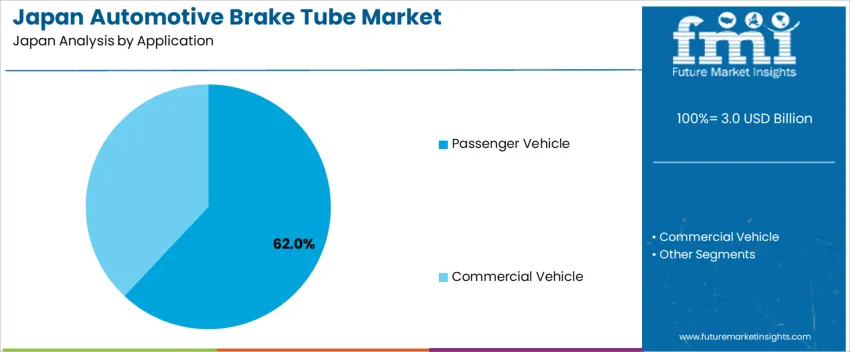

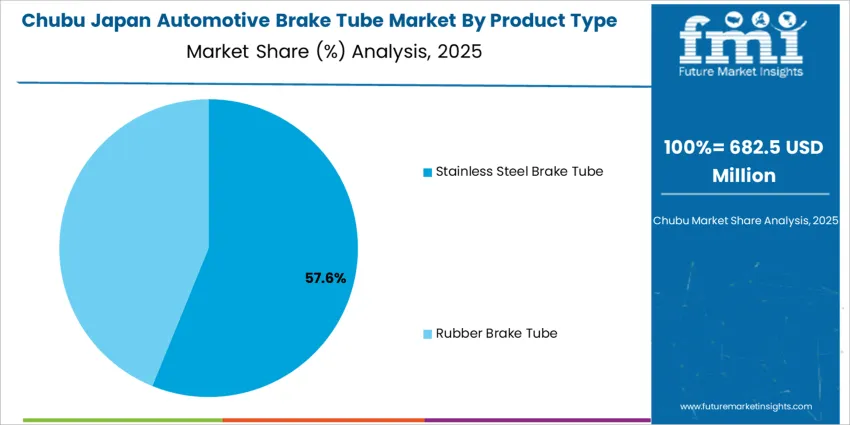

The demand for automotive brake tubes in Japan is shaped by application and product type. Passenger vehicles account for 62% of total demand, reflecting the size of the vehicle parc and steady replacement cycles. Commercial vehicles represent the remaining share, driven by logistics and fleet maintenance needs. By product type, stainless steel brake tubes lead with 55%, followed by rubber brake tubes used in specific low pressure systems. Material selection is guided by safety standards, corrosion resistance, cost, and service life. These segments illustrate how durability requirements and vehicle usage patterns determine purchasing volumes across the brake tube supply chain.

Stainless steel brake tubes hold 55% of total demand in Japan, making them the dominant product type. This position reflects strict safety norms and long service expectations in passenger and commercial vehicles. Stainless steel offers high resistance to corrosion caused by road salt, humidity, and temperature variation. These properties reduce failure risk in braking systems over extended operating periods. Automakers rely on stainless steel lines to meet compliance standards for pressure tolerance and fatigue strength. Replacement demand also supports this segment, as older vehicles require upgraded corrosion resistant tubing during brake system overhauls across both urban and regional vehicle fleets. Fleet operators favor predictable maintenance intervals supported by steel tubing durability under heavy braking loads in delivery, transit, and vehicles.

Supply decisions for stainless steel brake tubes in Japan are shaped by cost stability, fabrication consistency, and established supplier networks. Tube forming and flaring processes for stainless steel are well standardized within domestic component manufacturing. This supports tight dimensional tolerances required for modern brake assemblies. Stainless steel also offers predictable performance under repeated thermal cycling generated during urban stop and start driving. These operating conditions are common in Japanese traffic patterns. The balance between higher unit cost and lower lifetime replacement frequency favors stainless steel in long term ownership economics for consumers and fleet managers alike. The material supports regulatory inspection requirements focused on leak prevention and burst resistance under peak hydraulic pressure within enclosed brake line routing layouts systems.

Passenger vehicles account for 62% of automotive brake tube demand in Japan. This dominance reflects the large installed base of private cars and steady renewal of braking components over vehicle life cycles. Urban driving conditions generate frequent brake usage, which accelerates wear across hydraulic lines and fittings. Regular inspection schedules support consistent aftermarket demand for tube replacements. Passenger vehicle platforms emphasize compact routing, corrosion resistance, and low failure tolerance, which increases specification requirements for brake tubing. These factors combine to place passenger vehicles as the primary consumption segment for both original equipment supply and service replacement volumes nationwide. Consumer expectations for quiet operation and pedal response also tighten quality controls applied to hydraulic tubing geometry and material consistency in production.

Service demand from aging passenger cars further stabilizes brake tube consumption across Japan. Vehicles operating beyond ten years show higher incidence of corrosion related line degradation. Coastal and snowy regions apply additional exposure due to moisture and deicing agents. Repair policies typically require full line replacement rather than localized patching for safety compliance. This raises per vehicle material usage during maintenance events. Domestic parts distribution networks maintain wide inventories of pre formed tube sets for common passenger models, which supports steady shipment volumes throughout the year. Independent workshops and dealership service centers account for the majority of installations, reflecting the structure of the national vehicle maintenance market and regulated inspection cycles across urban and secondary cities with high car densities.

Demand for automotive brake tube in Japan is shaped by domestic vehicle production stability, ageing vehicle fleets, and strict roadworthiness inspection regimes. Replacement demand remains steady due to the large number of high-mileage passenger cars and light commercial vehicles still in operation. Export-oriented vehicle assembly also sustains OEM brake tube consumption. At the same time, cost pressures from specialty metals and slow domestic vehicle ownership growth moderate volume expansion. Material upgrades toward corrosion-resistant tubing and integration with advanced brake systems continue to influence supplier priorities. These factors together define how brake tube demand progresses within the Japanese automotive supply chain.

Japan’s dense urban traffic conditions cause frequent braking cycles that accelerate fatigue on brake lines, especially in compact passenger cars and kei vehicles. Coastal exposure and winter road de-icing in northern regions increase corrosion stress on underbody components, supporting demand for copper-nickel and stainless brake tubes. The rigid shaken vehicle inspection system requires strict brake integrity compliance, which forces proactive tube replacement even before failure occurs. High expectations for vehicle reliability also influence OEM design toward longer-life tubing. These local usage and inspection realities create consistent structural demand for automotive brake tubes across Japan.

Automotive brake tube producers in Japan face constraints linked to rising material costs for stainless steel, copper, and alloy coatings. Weak domestic vehicle ownership growth limits long-term volume upside. Hybrid and electric vehicles reduce friction brake load through regenerative braking, which extends service intervals for brake tubes. Compact vehicle platforms also compress routing space, raising manufacturing complexity and tooling cost. Smaller tier-two suppliers encounter pressure to justify upgrades to bending, flaring, and coating equipment. These structural shifts slow aggressive capacity expansion across the Japanese brake tube manufacturing base.

Brake tube design in Japan is shifting toward high-corrosion-resistance materials with thinner wall profiles to reduce weight without sacrificing pressure performance. Pre-bent, pre-flared modular tube assemblies are gaining traction as vehicle manufacturers push for faster underbody installation and lower takt time. Integration with electronic brake control systems requires tighter dimensional tolerances and vibration resistance. Demand is also rising for brake tubing that maintains sealing integrity under higher hydraulic pressures used in modern safety systems. These material and assembly trends signal a transition toward higher-specification, lower-volume, precision-engineered brake tube demand in Japan.

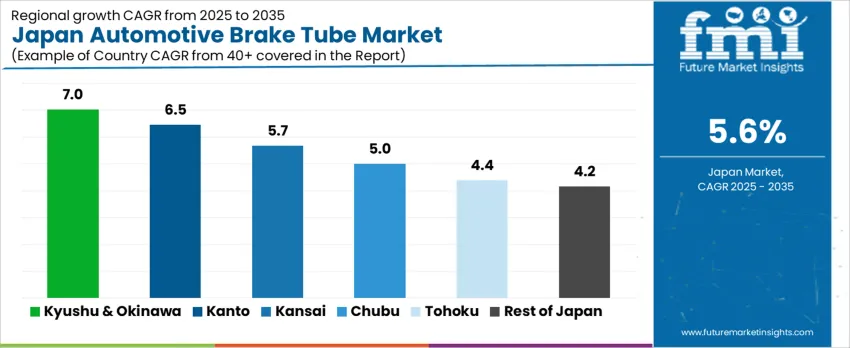

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 7.0% |

| Kanto | 6.5% |

| Kinki | 5.7% |

| Chubu | 5.0% |

| Tohoku | 4.4% |

| Rest of Japan | 4.2% |

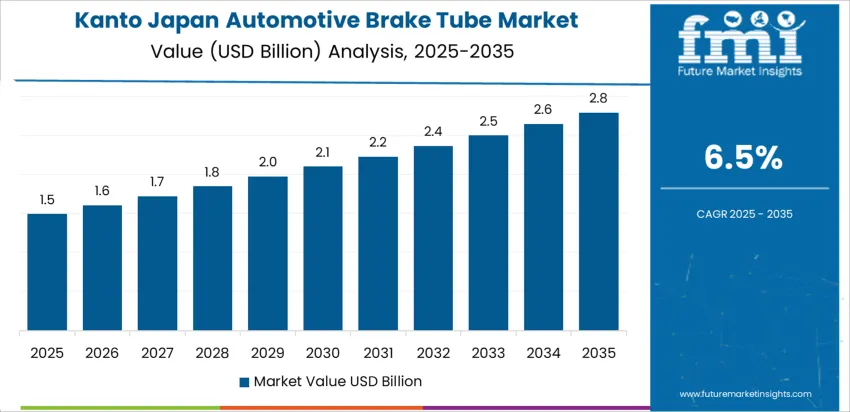

The demand for automotive brake tubes in Japan is expected to increase at varied rates across regions. The highest growth of 7.0% in Kyushu & Okinawa reflects rising vehicle production and increasing adoption of advanced braking systems that prioritize safety. The Kanto region, at 6.5%, benefits from its dense population and concentration of automobile manufacturing and supply-chain activity. Kinki’s 5.7% growth reflects steady demand from regional vehicle assembly plants and component suppliers. The Chubu region’s 5.0% reflects moderate industrial activity and regional auto-component production. Tohoku at 4.4% and the Rest of Japan at 4.2% show slower uptake linked to lower vehicle-manufacturing density and more modest demand for brake-tube supply.

In Kyushu and Okinawa, automotive brake tube demand advances at a CAGR of 7.0% through 2035, reflecting steady vehicle production and aftermarket servicing growth across southern Japan. Regional assembly plants, parts suppliers, and maintenance networks are expanding output to support passenger cars and light commercial vehicles. Corrosion resistance requirements driven by coastal climates influence material selection and replacement cycles. Local suppliers benefit from proximity to export ports and regional logistics hubs. Growth is also supported by rising safety inspection rigor and periodic replacement norms in aging vehicle fleets across island and mainland transport corridors serving urban and interregional freight routes.

In Kanto, automotive brake tube consumption progresses at a CAGR of 6.5% through 2035, supported by dense vehicle ownership, high service intensity, and the concentration of major assembly operations. Strong demand from passenger cars dominates volumes, while commercial fleets sustain steady replacement activity. Supply chains remain tightly integrated with regional steel processing and precision forming centers. Emphasis on braking safety standards, inspection frequency, and recall compliance sustains consistent aftermarket demand. Urban traffic density accelerates wear cycles, reinforcing stable order flow for brake tube suppliers serving metropolitan production, distribution, and maintenance networks that support continuous fleet operation across regional corridors systems.

In Kinki, automotive brake tube demand rises at a CAGR of 5.7% through 2035, aligned with balanced passenger vehicle production and steady commercial transport activity. Manufacturing clusters around Osaka support component machining, tube forming, and assembly integration. Replacement demand remains stable due to urban driving conditions and structured inspection schedules. Regional distributors maintain consistent stock levels for service workshops and fleet operators. Growth is reinforced by ongoing upgrades in vehicle safety compliance and continued reliance on combustion based platforms that sustain mechanical braking system usage across regional transport networks serving bus operators freight carriers and industrial distribution corridors daily operations.

In Chubu, automotive brake tube demand expands at a CAGR of 5.0% through 2035, driven by the concentration of automotive manufacturing and supplier integration across central Japan. High production volumes from major assembly hubs sustain continuous OEM requirements. Tier one and tier two suppliers support tube bending, coating, and testing operations at scale. Aftermarket activity benefits from long distance freight movement and high mileage commercial fleets. Supply stability is supported by local steel availability, standardized specifications, and predictable procurement cycles across vehicle production and maintenance ecosystems serving export oriented manufacturers and domestic distribution with stable fleet replacement demand patterns nationwide.

In Tohoku, automotive brake tube demand advances at a CAGR of 4.4% through 2035, supported by gradual recovery in manufacturing output and steady regional transport requirements. Commercial vehicles serve agriculture, construction, and intercity logistics, sustaining baseline component replacement needs. Passenger vehicle servicing contributes a consistent aftermarket flow aligned with regulated inspection intervals. Supply is coordinated through regional distributors rather than dense manufacturing clusters. Growth remains moderate due to lower vehicle density, yet stable fleet utilization sustains predictable procurement of brake tubing for maintenance operations across rural transport routes municipal service fleets and interregional cargo movement patterns annually within northern prefectures.

In the rest of Japan, automotive brake tube demand progresses at a CAGR of 4.2% through 2035, sustained by steady vehicle servicing activity across secondary cities and rural transport corridors. Local workshops, municipal fleets, and small logistics operators generate consistent replacement demand. Production supply relies on interregional distribution rather than localized manufacturing concentration. Brake tube consumption tracks inspection compliance and aging vehicle stock rather than new vehicle penetration. Growth remains stable due to predictable maintenance cycles, moderate traffic exposure, and gradual fleet renewal across non metropolitan prefectures where service based transport remains dominant for goods movement and local passenger mobility.

The demand for automotive brake tube in Japan is rising because vehicle production remains large and automakers increasingly adopt advanced braking systems that require durable, corrosion resistant brake tubes. As safety regulations grow stricter and vehicle safety becomes more important, demand for high quality brake tubing materials increases. Growth in electric and hybrid vehicle manufacturing also supports demand, owing to their need for reliable brake hydraulics and lighter weight components. Ongoing replacement demand and maintenance of existing vehicles further add to consumption of brake tubes and lines.

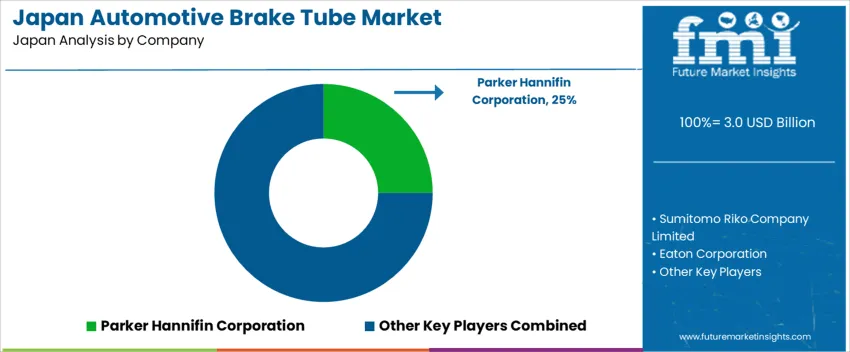

Major companies shaping the brake tube market in Japan include global and domestic firms such as Parker Hannifin Corporation, Sumitomo Riko Company Limited, Eaton Corporation, Nichirin Co., Ltd., and TI Fluid Systems. Sumitomo Riko stands out as a domestic supplier with established relationships to Japanese automakers. Parker Hannifin and Eaton supply globally standard brake tube components, often supplying premium or high performance variants. Nichirin and TI Fluid Systems provide integrated brake line solutions, sometimes focusing on material quality and compatibility with modern braking systems. These firms influence the market through supply capabilities, product quality and responsiveness to evolving regulatory and technical requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Application | Passenger Vehicle, Commercial Vehicle |

| Product Type | Stainless Steel Brake Tube, Rubber Brake Tube |

| Sales Channel | OEM, Aftermarket |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Parker Hannifin Corporation, Sumitomo Riko Company Limited, Eaton Corporation, Nichirin Co., Ltd., TI Fluid Systems |

| Additional Attributes | Dollar by sales by application and product type; regional CAGR and incremental growth; volume and value expansion forecasts; competitive landscape of key suppliers in Japan; material trends (stainless steel, rubber, coated alloys); OEM vs aftermarket demand distribution; electrification impact on brake tube design; regulatory influence on replacement cycles and corrosion resistant specifications; adoption of pre-bent and modular tube assemblies; precision forming, non-destructive testing, and coating technology trends. |

The demand for automotive brake tube in Japan is estimated to be valued at USD 3.0 billion in 2025.

The market size for the automotive brake tube in Japan is projected to reach USD 5.2 billion by 2035.

The demand for automotive brake tube in Japan is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in automotive brake tube in Japan are passenger vehicle and commercial vehicle.

In terms of product type, stainless steel brake tube segment is expected to command 55.0% share in the automotive brake tube in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Brake Tube Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive Brake Tube in USA Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Brake Linings Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Fluid Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Booster and Master Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Actuation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Shims Market Analysis - Size, Share, and Forecast 2025 to 2035

Automotive Brake System Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake Friction Products Market - Trends & Forecast 2025 to 2035

Automotive Brake Pad Market - Growth & Demand 2025 to 2035

Automotive Brake Valve Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA