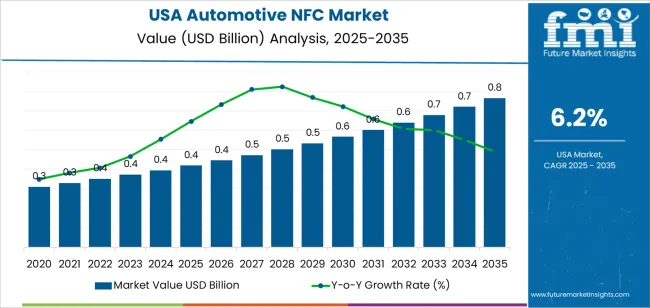

The demand for automotive near-field communication (NFC) solutions in the USA is expected to grow steadily from USD 0.4 billion in 2025 to USD 0.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.2%. This growth is driven by the increasing integration of NFC technologies in the automotive sector, which enable enhanced features such as keyless entry, secure in-car payment solutions, and improved infotainment connectivity. As consumers prioritize convenience and security in them in-car experiences, NFC technology has become a vital part of modern vehicle systems. With its ability to provide fast, secure, and user-friendly solutions, NFC is becoming a standard feature in many new car models, helping to drive its adoption across the industry.

As the demand for smarter, more connected vehicles rises, NFC is playing an increasingly central role in enabling seamless interactions between consumers and their vehicles. Automakers are integrating NFC technology into a range of applications, from vehicle access to enabling secure digital payments and connectivity with smartphones and other devices. With innovations in technology and growing consumer expectations for convenience, the use of NFC solutions in vehicles is set to expand. The industry is expected to experience steady growth over the next decade, with NFC becoming an integral part of the automotive landscape, improving user experiences and contributing to the evolution of connected vehicles.

Between 2025 and 2030, the demand for automotive NFC in the USA is expected to grow from USD 0.4 billion to USD 0.6 billion, adding USD 0.2 billion. This early phase will experience steady growth driven by the adoption of NFC technology in keyless entry systems and integration into infotainment systems. As consumers continue to seek greater convenience and security in their vehicles, the demand for NFC solutions is expected to increase. The early growth period will be characterized by gradual expansion as automakers continue to integrate NFC solutions into their vehicle offerings.

From 2030 to 2035, the demand will accelerate sharply, rising from USD 0.6 billion to USD 0.8 billion, adding USD 0.2 billion. This phase will be marked by significant advancements in NFC technology, including the incorporation of contactless payment systems, secure vehicle access features, and seamless connectivity with smartphones and other devices. As NFC adoption increases and becomes a standard feature in new vehicles, demand will surge, driven by both consumer preferences and technological advancements. The latter part of the forecast period will see widespread adoption of NFC solutions, further driving industry growth.

| Metric | Value |

|---|---|

| Demand for Automotive NFC in USA Value (2025) | USD 0.4 billion |

| Demand for Automotive NFC in USA Forecast Value (2035) | USD 0.8 billion |

| Demand for Automotive NFC in USA Forecast CAGR (2025 to 2035) | 6.2% |

The demand for automotive NFC in the USA is growing as vehicle manufacturers and tech‑suppliers increasingly seek to integrate seamless, secure connectivity into cars. NFC (Near Field Communication) enables touch‑and‑go functions such as digital key access, smartphone vehicle pairing, and in‑car payments, all of which enhance user convenience and security. As consumers expect more features akin to their smartphones within vehicles, NFC becomes a vital interface for modern vehicle ecosystems.

Another key driver is the expansion of connected and electric vehicles, where digital key functionality, mobile‑based access, and in‑car digital services are becoming standard. NFC allows vehicles to handle secure authentication, personalization of driver settings, and access sharing between multiple users all important for ride‑sharing, multi‑user ownership and fleet applications. The automotive OEMs are actively pushing these features as differentiators in competitive industries.

Technology advancements and industry collaborations are further accelerating adoption. Improved NFC hardware tailored for automotive durability, enhanced security protocols, and alignment with global digital‑key standards make integration easier and more reliable. With regulations and consumer preferences moving toward digital, connected, and contactless systems, the demand for automotive NFC solutions in the USA is poised for steady growth through 2035.

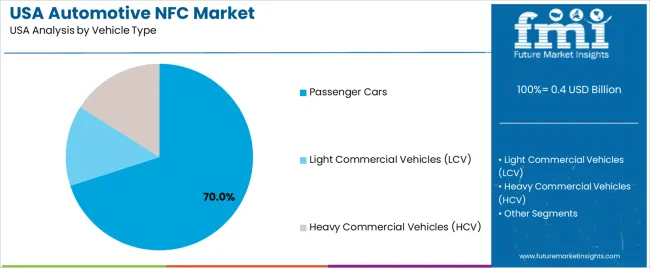

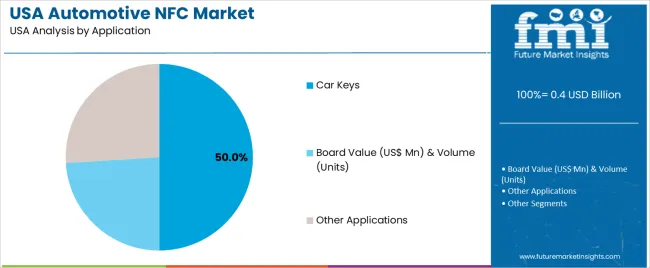

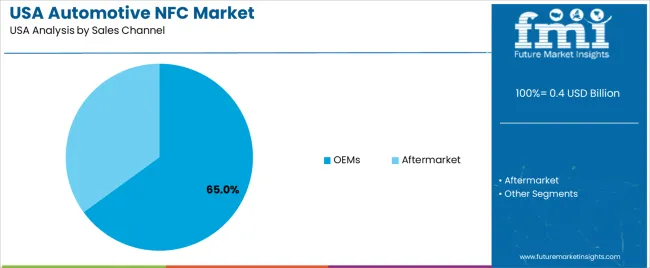

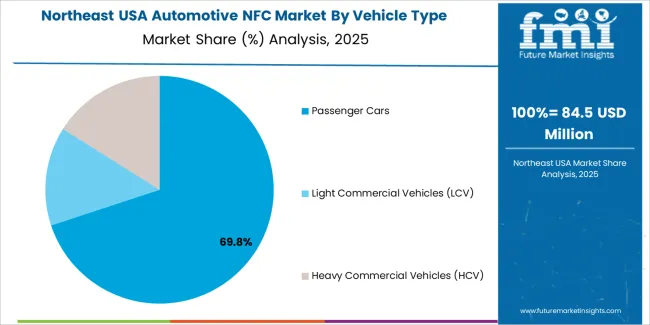

Demand is segmented by vehicle type, application, and sales channel. By vehicle type, demand is divided into passenger cars, light commercial vehicles (LCV), and heavy commercial vehicles (HCV), with passenger cars leading the demand. In terms of application, the industry is categorized into car keys, other applications, with car keys accounting for the largest share. The industry is also segmented by sales channel, including OEMs (Original Equipment Manufacturers) and aftermarket. Regionally, demand is divided into West, South, Northeast, and Midwest.

Passenger cars account for 70% of the demand for automotive NFC in the USA. NFC technology is increasingly being integrated into vehicles for convenience, safety, and enhanced user experience. In passenger cars, NFC is most commonly used for car key applications, where it allows for easy access and secure starting of the vehicle with just a tap of the key or smartphone.

The demand for automotive NFC in passenger cars is driven by the growing adoption of advanced features such as keyless entry, remote vehicle unlocking, and secure access. Consumers increasingly seek seamless and secure ways to interact with their vehicles, driving the widespread use of NFC technology. As the automotive industry continues to innovate with smart car features, the demand for automotive NFC in passenger cars is expected to grow, reinforcing their dominant position in the industry.

Car keys account for 50% of the demand for automotive NFC in the USA. The use of NFC-enabled car keys provides a secure, convenient, and modern alternative to traditional physical keys. NFC car keys enable features like keyless entry, remote unlocking, and the ability to store multiple vehicle access credentials on a single device, such as a smartphone or smart fob.

The demand for NFC car keys is driven by the increasing consumer preference for convenience and advanced technology in their vehicles. As more vehicles are equipped with NFC-enabled systems, drivers can enjoy enhanced security and improved user experience, further promoting the adoption of automotive NFC in car key applications. With the automotive industry moving towards more integrated and tech-savvy vehicles, NFC technology in car keys will continue to drive demand and play a crucial role in the industry’s future.

OEMs account for 65% of the demand for automotive NFC in the USA. Original Equipment Manufacturers (OEMs) are the primary suppliers of NFC technology in new vehicles, as automakers integrate NFC solutions into their vehicles at the manufacturing stage. OEMs are adopting NFC technology to provide advanced features such as keyless entry, hands-free access, and secure vehicle interaction, which are becoming standard in modern vehicles.

The dominance of OEMs in the sales channel is driven by the increasing demand for high-tech vehicles that meet consumer expectations for convenience, security, and connectivity. Automakers are incorporating automotive NFC directly into their production processes, ensuring that NFC technology is available as part of the original equipment in new models. As consumer interest in connected and intelligent vehicle features continues to grow, the role of OEMs in driving the adoption of automotive NFC technology will remain crucial in shaping the industry.

NFC is being used for digital car keys, personalized driver profiles, in‑vehicle payments, and seamless device pairing. Key drivers include rising consumer expectations for convenience and digital features, growth in electric vehicle (EV) and mobility‑sharing platforms, and auto OEMs differentiating via smart access and connectivity. Restraints include high incremental hardware and software cost, slow fleet replacement rates meaning many vehicles lack NFC, issues around standardization and interoperability of digital key technologies, and cybersecurity/ privacy concerns which can slow adoption of new NFC systems.

In the USA, demand for automotive NFC is increasing because car buyers expect more than just transportation they want a connected experience. Digital keys and mobile‑based vehicle access eliminate the need for physical keys and open new service possibilities (such as driver profile sharing or peer‑to‑peer car access). The growth of EVs and shared‑mobility fleets pushes NFC adoption because the infrastructure and service layers (charging stations, usage authentication) align with NFC’s convenience and security. Also, car manufacturers are embedding NFC from the factory (OEM rather than aftermarket), helping to shift the vehicle value proposition toward technology features and away from mechanical hardware.

Technological innovations are helping accelerate automotive NFC uptake in the USA by improving performance, security, and versatility. Advances include secure element chips designed for automotive use, smartphone‑based digital key standards (e.g., Car Connectivity Consortium’s Digital Key protocol), integration with mobile wallets and wearables, and software platforms enabling over‑the‑air updates and remote vehicle access. NFC is being embedded into vehicle entry systems, infotainment setups, payment terminals for services (parking, tolls, charging), and driver‑authentication systems. These innovations raise consumer appeal, enable OEMs to offer new services, and help vehicles meet evolving technology expectations.

First, the cost of integrating NFC hardware, software, security modules, and ensuring compliance adds to vehicle bill of materials and complexity. Second, the slow turnover of vehicles means older models remain in use for many years, limiting the addressable installed‑base for NFC upgrades. Third, standardization is still evolving differences in protocols, mobile‑OS compatibility (iOS vs Android), and vehicle‑maker ecosystems can fragment the user experience. Fourth, concerns around vehicle‑cybersecurity, data privacy, and liability for digital access mechanisms can slow OEM rollout. Consumer education and trust in digital key systems still lag behind expectations, meaning uptake may be slower than technical capability alone suggests.

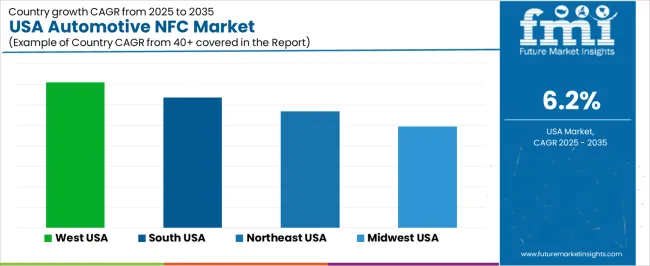

| Region | CAGR (%) |

|---|---|

| West | 7.1% |

| South | 6.4% |

| Northeast | 5.7% |

| Midwest | 4.9% |

The demand for automotive Near Field Communication (NFC) in the USA is growing across all regions, with the West leading at a 7.1% CAGR. Growth is driven by increasing vehicle connectivity, digital‑key functionality, and enhanced in‑car user experience. The South follows with a 6.4% CAGR, supported by rising adoption of connected vehicle technologies and mobile‑device integration in vehicles. The Northeast displays a 5.7% CAGR, influenced by its tech‑savvy consumer base and strong presence of automotive OEMs and mobility services. The Midwest grows at 4.9% CAGR, driven by incremental upgrades of vehicle connectivity and the automotive manufacturing ecosystem.

The West is experiencing the highest demand for automotive NFC in the USA, with a 7.1% CAGR. The region has a strong base of technology companies, connected‑vehicle innovators and early adopters of mobility services. Cities like San Francisco, Los Angeles and Seattle are hubs for automotive digital‑key and in‑car connectivity developments, which drive interest in NFC solutions that enable smartphone‑based vehicle access, personalization of driver settings and seamless smartphone‑vehicle integration.

West‑coast consumers tend to adopt new digital experiences faster, and automakers field more premium or connected models in this region, which often include NFC functionality. As shared mobility, ride‑hailing and vehicle‑as‑a‑service expand, the demand for secure, hands‑free, and contact‑less access solutions like NFC increases. With the convergence of automotive and smart‑device ecosystems, the West remains the leading region in the USA for automotive NFC adoption and growth. Allied Industry Research+2Future Industry Insights+2

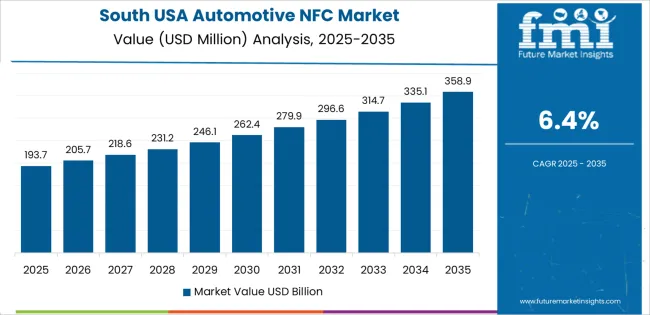

The South is experiencing strong demand growth for automotive NFC, with a 6.4% CAGR. This region benefits from an expanding automotive manufacturing and mobility infrastructure, especially in states such as Texas, Georgia and Florida. Automakers and suppliers located in the South are increasingly equipping vehicles with connectivity features, including NFC‑based digital keys, enabling mobile phone access and vehicle personalization.

The growth of ride‑sharing and fleet services in the South accelerates demand for NFC solutions that allow shared access and portable digital keys. The region’s increasing mobile‑device penetration and consumer willingness to adopt connected‑car features support the rise in automotive NFC. With automobile production and vehicle launches continuing in the South, the demand for NFC modules and related systems is set to grow steadily in this region.

The Northeast is seeing moderate growth in demand for automotive NFC, with a 5.7% CAGR. The region has a dense concentration of automotive aftermarket services, tech firms and early‑adopter consumer segments in states like New York, Massachusetts and Pennsylvania. These factors contribute to the uptake of vehicle access, infotainment integration and smart‑device features areas where NFC is increasingly relevant.

Premium and luxury vehicle industry penetration is high in the Northeast, and these vehicles often include the latest connectivity functions including NFC‑enabled digital keys and secure vehicle pairing. As automakers continue to enhance vehicle electronic architectures and connectivity suites, the Northeast will see ongoing adoption of NFC solutions. While growth is slower than in the West and South, it remains significant due to the region’s emphasis on advanced vehicle features and consumer willingness to pay for connected experiences.

The Midwest is experiencing moderate growth in demand for automotive NFC, with a 4.9% CAGR. The region is home to large automotive manufacturing hubs (e.g., Michigan, Ohio) where production of vehicles with connected features is increasing. As vehicles built in the Midwest incorporate more advanced connectivity and digital‑key functions, the demand for NFC systems rises accordingly.

While consumers in the Midwest may adopt new vehicle technologies at a slower pace compared with coastal regions, the ongoing refresh of vehicle fleets, increased support for connected car features and a gradual shift toward digital‑key systems are driving NFC growth. Also, aftermarket upgrades and retrofit solutions for digital entry and smartphone‑vehicle pairing are becoming more available in the region’s large service ecosystem. Hence, the Midwest remains an important but more moderate growth area for automotive NFC deployment.

The demand for automotive Near‑Field Communication (NFC) technology in the United States is growing robustly, as automakers and consumers alike lean into connected‑vehicle experiences that emphasize convenience, security, and seamless smartphone integration. NFC enables functionalities such as digital vehicle keys, plug‑and‑charge interactions for electric vehicles (EVs), contactless payments at tolls or parking, and fast pairing of in‑car devices elements that align with the evolving expectations of tech‑savvy drivers and smart‑mobility ecosystems.

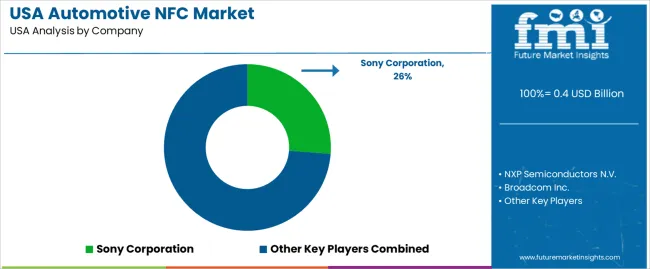

In the USA market landscape, Sony Corporation holds an estimated 26.2% share of demand within automotive NFC technology, underscoring its strong positioning as a supplier of foundational NFC chipsets, hardware modules, and ecosystem support for vehicle‑grade applications. Other major contributors include NXP Semiconductors N.V., Broadcom Inc., Samsung Electronics Co. Ltd., STMicroelectronics N.V., and Panasonic Corporation, each supplying key components such as NFC controllers, secure elements, antenna systems, and integrated modules used by vehicle OEMs and tier‑one suppliers.

Key drivers for the USA demand include the rapid growth of connected and electric vehicles, which increasingly require secure, user‑friendly access and in‑vehicle interactions; manufacturer roll‑outs of digital key platforms that rely on NFC for encrypted access and personalization; and the consumer shift toward mobile‑first device control of vehicle functions. Challenges remain, such as cost and complexity of integration, competition from alternate connectivity standards (e.g., ultra‑wideband or Bluetooth Low Energy), and the need for consistent interoperability across devices and vehicle models.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

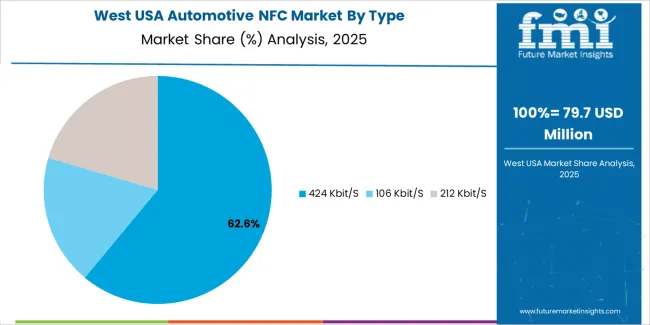

| Type | 424 Kbit/S, 106 Kbit/S, 212 Kbit/S |

| Vehicle Type | Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV) |

| Application | Car Keys, Board Value (US$ Mn), Other Applications |

| Sales Channel | OEMs, Aftermarket |

| Key Players Profiled | Sony Corporation, NXP Semiconductors N.V., Broadcom Inc., Samsung Electronics Co. Ltd., STMicroelectronics N.V., Panasonic Corporation |

| Regions Covered | West, South, Northeast, Midwest |

| Additional Attributes | Dollar sales by type, vehicle type, application, and sales channel trends focusing on automotive and OEM sectors |

The global demand for automotive NFC in USA is estimated to be valued at USD 0.4 billion in 2025.

The market size for the demand for automotive NFC in USA is projected to reach USD 0.8 billion by 2035.

The demand for automotive NFC in USA is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in demand for automotive NFC in USA are 424 kbit/s, 106 kbit/s and 212 kbit/s.

In terms of vehicle type, passenger cars segment to command 70.0% share in the demand for automotive NFC in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA NFC Reader ICs Market Insights – Trends, Growth & Forecast 2025-2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

Automotive NFC Market Growth – Trends & Forecast 2025-2035

Demand for Automotive NFC in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Roof Rails in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Dynamic Map Data in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Deep Groove Ball Bearings in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Hoses and Assemblies for OEM in USA Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA