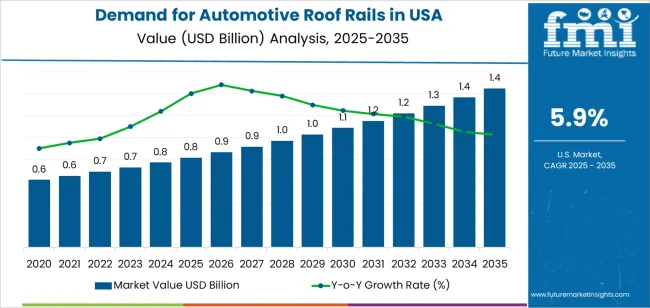

The USA automotive roof rails demand is valued at USD 0.8 billion in 2025 and is forecasted to reach USD 1.4 billion by 2035, advancing at a CAGR of 5.9%. Growth is supported by rising production of SUVs and crossovers, increased adoption of outdoor recreation equipment, and expanding use of roof-mounted cargo solutions across consumer vehicle segments. Roof rails remain essential for transporting luggage carriers, bike mounts, kayak racks, and utility storage systems, reinforcing consistent demand from OEMs and aftermarket channels.

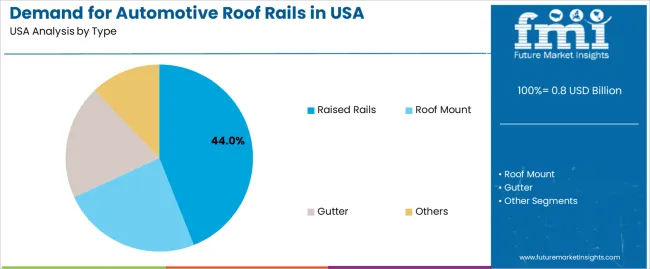

Raised rails represent the leading type, favored for their compatibility with a wide range of crossbar systems and their straightforward installation on factory roof structures. They provide strong load-bearing capability, corrosion resistance, and stable anchoring across diverse weather conditions. Improvements in aluminum extrusion, surface finishing, and integrated fastening systems continue to enhance durability, weight reduction, and aesthetic integration with vehicle designs.

Demand is strongest in the West, South, and Northeast, where outdoor recreation participation, vehicle customization, and light-truck sales are highest. These regions also support strong aftermarket activity driven by consumer preference for multipurpose utility vehicles. Key companies supplying roof rails include VDL Hapro B.V., Thule Group, BOSAL, Magna International, and Rhino-Rack, focusing on structural reliability, aerodynamic design, and compatibility with OEM and accessory platforms.

Growth momentum analysis shows a firm upward trajectory during the early period from 2025 to 2029, supported by steady production of SUVs and crossovers, the vehicle categories most commonly equipped with roof-rail systems. Increased consumer preference for outdoor travel, cargo versatility, and accessory compatibility will reinforce early momentum. Manufacturers’ adoption of lightweight aluminum and advanced polymer designs will also support procurement across OEM channels.

From 2030 to 2035, momentum will moderate slightly as the segment moves into a stable maturity phase. Growth will be anchored in replacement demand, incremental design updates, and integration with aerodynamic and modular cargo systems in new vehicle platforms. Electric-vehicle adoption will contribute to gradual gains as roof-rail compatibility becomes standardized across emerging models. The overall momentum pattern reflects a reliable automotive-accessory segment shaped by consistent SUV production, steady aftermarket activity, and long product lifecycles that support predictable demand within the USA automotive ecosystem.

| Metric | Value |

|---|---|

| USA Automotive Roof Rails Sales Value (2025) | USD 0.8 billion |

| USA Automotive Roof Rails Forecast Value (2035) | USD 1.4 billion |

| USA Automotive Roof Rails Forecast CAGR (2025-2035) | 5.9% |

Demand for automotive roof rails in the USA is increasing as more consumers choose SUVs, crossovers and adventure-oriented vehicles that need additional cargo and equipment carrying capacity. Roof rails support accessories such as cargo boxes, bikes and kayaks which align with growing participation in outdoor activities, road trips and lifestyle mobility trends. The shift toward higher vehicle ownership and aftermarket upgrades further drives demand for roof rail systems as both factory-installed options and retrofit accessories.

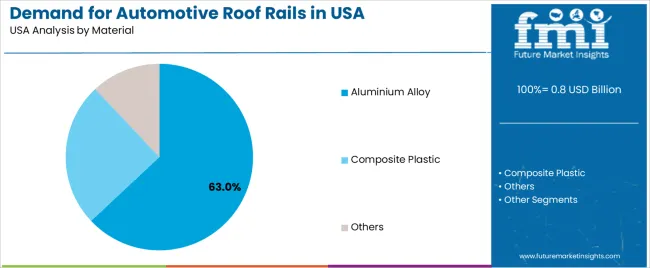

Innovations in materials, such as aluminium alloy and lightweight composites, enhance fuel efficiency and aesthetic appeal which encourages adoption in both OEM and aftermarket channels. E-commerce growth and enhanced distribution networks make roof rail systems more accessible to consumers across the USA. Constraints include higher cost of premium roof rail systems, installation compatibility with different vehicle models and concerns about added weight and aerodynamic drag which may affect vehicle efficiency. Some consumers may opt for alternative transport solutions or skip factory options to reduce vehicle purchase cost.

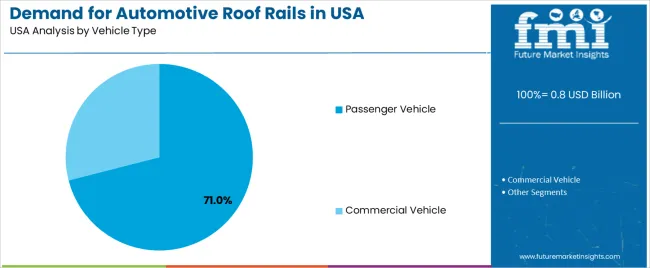

Demand for automotive roof rails in the United States is shaped by installation structure, material selection, and vehicle segmentation. Buyers prioritize durability, load capability, corrosion resistance, and compatibility with OEM and aftermarket requirements. The distribution of demand across type, material, and vehicle categories reflects USAge patterns, consumer expectations, and design considerations across passenger and commercial vehicle platforms.

Raised rails hold an estimated 44.0% share, making them the leading type category. These rails offer convenient attachment points, straightforward installation, and broad compatibility with crossbars and cargo systems. Their design supports widespread use across passenger vehicles, including SUVs, crossovers, and wagons. Roof-mount rails account for 28.0%, used in vehicles where integrated styling, flush aesthetics, and structural rigidity are priorities. Gutter rails hold 18.0%, serving older platforms and specialized vehicles requiring traditional mounting. The remaining 10.0% includes niche formats used in limited-production or customized vehicles. Type preferences are shaped by load requirements, design trends, and integration with aerodynamic profiles.

Key drivers and attributes:

Aluminium alloy accounts for 63.0% of USA demand and represents the dominant material category. It offers high strength-to-weight performance, corrosion resistance, and structural stability, supporting use in both OEM and replacement channels. Aluminium rails maintain rigidity while reducing vehicle weight, aligning with fuel-efficiency and durability requirements. Composite plastic materials represent 25.0%, valued for lower cost, formability, and resistance to environmental degradation. They are frequently used in lighter-duty applications and budget segments. The remaining 12.0% includes steel and composite hybrids used where higher load-bearing capacity or specific design features are required. Material selection reflects performance expectations, cost efficiency, and compatibility with roof structures.

Key drivers and attributes:

Passenger vehicles represent an estimated 71.0% share of USA demand for automotive roof rails. SUVs, crossovers, and wagons rely heavily on roof-mounted storage systems for recreational equipment, luggage, and activity-based transport. Consumer preference for outdoor and travel-related functionality reinforces demand in this segment. Commercial vehicles hold 29.0%, including vans and utility vehicles used for logistics, fleet operations, and service applications that require roof-mounted cargo support. Demand variations reflect differences in payload expectations, vehicle design, and USAge intensity across personal and commercial transportation.

Key drivers and attributes:

Growing SUV/crossover vehicle sales, expansion of outdoor-recreation activities, and increased consumer interest in vehicle utility enhancements are driving demand.

Demand for automotive roof rails in the United States rises as more consumers buy SUVs, crossovers and utility vehicles which more often feature roof rails either as standard or as an option. Roof rails allow attachment of cargo boxes, bikes, kayaks and other outdoor gear, aligning with the rising participation in outdoor sports and weekend travel. Home-to-vehicle lifestyle convenience and multi-use vehicle trends increase interest in accessories that improve vehicle flexibility. Customisation and aftermarket upgrades attract buyers who want to enhance vehicle appearance and functionality beyond factory specifications.

Material cost fluctuations, aerodynamic/fuel-efficiency concerns, and vehicle design integration challenges are restraining growth.

Add-on roof rail systems add weight and alter vehicle airflow, which can raise fuel consumption or reduce electric-vehicle range, creating consumer hesitation especially in fuel-sensitive or EV owner segments. Raw-material prices (e.g., aluminium alloy, composites) vary and may raise manufacturing cost of roof rails, leading to higher prices or margin pressure. Some vehicle designs integrate roof rails internally or conceal them for aesthetics and aerodynamics, which reduces aftermarket upgrade opportunities and may slow overall rail demand.

Shift toward lightweight aluminium and composite rails, integration with EV platforms, and expansion of aftermarket sales through e-commerce define industry trends.

Manufacturers are increasing the use of lightweight aluminium alloys and composite materials in roof rail design to reduce weight, improve corrosion resistance and better suit fuel-efficient or electric vehicles. As EVs become more prevalent in the USA, roof rails designed for EV-specific vehicle top-loads or modular accessories are becoming more common. The aftermarket segment is expanding via online retail and direct-to-consumer platforms, offering broader roof-rail options for older vehicles and custom builds. These trends support a sustained increase in demand for roof rails across new vehicle production and replacement/upgrading cycles.

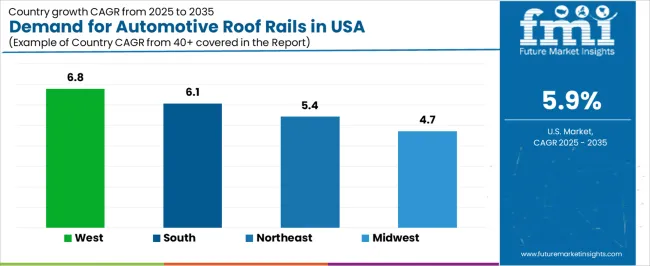

Demand for automotive roof rails in the United States is increasing through 2035, supported by rising sales of SUVs and crossovers, broader adoption of outdoor and travel-oriented vehicle accessories, and steady growth in aftermarket customization. Manufacturers integrate roof rails into new vehicle models to enhance utility for cargo carriers, bike mounts, and luggage solutions. The aftermarket segment remains important due to replacement cycles and installation upgrades across older vehicles. The West leads with a 6.8% CAGR, followed by the South (6.1%), the Northeast (5.4%), and the Midwest (4.7%). Growth reflects regional vehicle preferences, lifestyle patterns, and transportation needs.

| Region | CAGR (2025-2035) |

|---|---|

| West | 6.8% |

| South | 6.1% |

| Northeast | 5.4% |

| Midwest | 4.7% |

The West grows at 6.8% CAGR, supported by strong consumer interest in outdoor recreation, widespread SUV ownership, and high adoption of aftermarket roof-mounted accessories. States such as California, Washington, Colorado, and Oregon report steady demand for roof rails used in camping, cycling, skiing, and road-travel applications. New vehicle models sold in the region frequently include factory-installed rails due to preference for utility-oriented configurations. Aftermarket suppliers see consistent sales through specialty automotive retailers and outdoor-equipment stores. Regional driving patterns involving long-distance travel contribute to the consistent use of roof-mounted cargo systems.

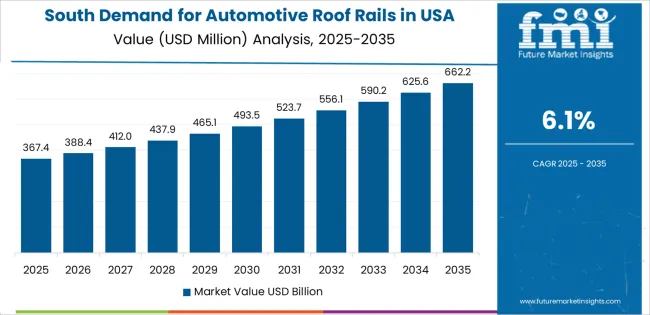

The South grows at 6.1% CAGR, driven by expanding vehicle ownership, increasing demand for SUVs and crossovers, and broader adoption of roof-rail-equipped models in suburban and semi-rural industries. States including Texas, Florida, Georgia, and North Carolina record strong sales across new vehicles that include integrated roof rails as part of utility-focused trim packages. Aftermarket demand rises from consumers installing rails for travel, cargo management, and recreational use. Warm-weather travel patterns and regional tourism contribute to consistent utilization of rail-compatible accessories, supporting year-round activity in both OEM and aftermarket channels.

The Northeast grows at 5.4% CAGR, supported by established SUV ownership patterns, strong interest in travel-focused accessories, and consistent demand for roof-mounted cargo systems used during seasonal travel. States such as New York, Massachusetts, Pennsylvania, and New Jersey report steady installation of roof rails due to varied weather conditions that encourage use of cargo boxes, ski racks, and equipment carriers. Urban and suburban commuters also adopt aftermarket rails for additional cargo flexibility. Both OEM and aftermarket suppliers maintain stable sales through automotive dealerships and specialty accessory retailers.

The Midwest grows at 4.7% CAGR, supported by consistent SUV and pickup-truck ownership and steady use of roof rails for seasonal travel and equipment hauling. States including Michigan, Illinois, Wisconsin, and Minnesota show reliable demand through factory-installed rails on new vehicles and moderate aftermarket purchases. Winter travel, camping, fishing, and transportation of outdoor equipment reinforce the need for roof-mounted carriers. Industrial and utility vehicle users also adopt roof rails for tool and cargo attachments, though growth remains moderate due to stable vehicle-replacement cycles across the region.

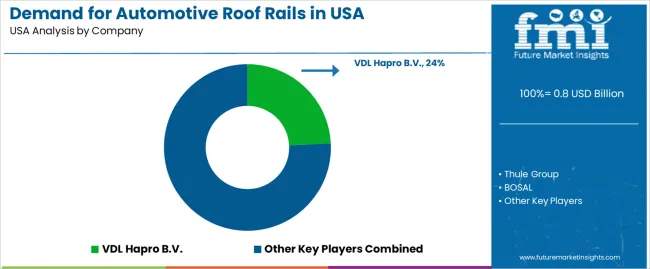

Demand for automotive roof rails in the USA is shaped by a concentrated group of suppliers producing load-bearing and aerodynamic rail systems for passenger vehicles, SUVs, and light trucks. VDL Hapro B.V. holds the leading position with an estimated 24.2% share, supported by its long-running expertise in aluminum and composite rail structures and consistent supply to vehicle manufacturers and aftermarket distributors. Its position is reinforced by controlled production processes, stable corrosion-resistant finishes, and reliable load specifications.

Thule Group and Rhino-Rack follow as prominent participants, focusing on accessory-oriented roof rail solutions with modular compatibility for bike carriers, cargo boxes, and crossbar systems. Their competitive strengths include durable clamping mechanisms, broad fitment coverage, and extensive presence in outdoor retail channels. BOSAL contributes to original-equipment supply through established metal-forming capability and rail assemblies designed for integrated rooflines used in European and North American vehicle platforms. Magna International maintains a notable presence through vertically integrated design and manufacturing of structural roof components, supporting high-volume OEM programs requiring consistent dimensional accuracy and validated crash-performance characteristics.

Competition across this segment centers on material strength, aerodynamic performance, corrosion resistance, installation precision, and compliance with vehicle-specific load ratings. Demand is sustained by the continued popularity of SUVs and crossover vehicles, steady growth in outdoor recreation activity that relies on roof-mounted transport capability, and OEM preference for lightweight aluminum systems that support fuel-efficiency and structural integrity requirements.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Type | Roof Mount, Gutter, Raised Rails, Others |

| Material | Aluminium Alloy, Composite Plastic, Others |

| Vehicle Type | Passenger Vehicle, Commercial Vehicle |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | VDL Hapro B.V., Thule Group, BOSAL, Magna International, Rhino-Rack |

| Additional Attributes | Dollar sales by type, material, and vehicle categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of automotive roof rail manufacturers; advancements in lightweight alloy and composite plastic technologies; integration with OEM vehicle designs, aftermarket accessories, and aerodynamic load-carrying solutions. |

The global demand for automotive roof rails in USA is estimated to be valued at USD 0.8 billion in 2025.

The market size for the demand for automotive roof rails in USA is projected to reach USD 1.4 billion by 2035.

The demand for automotive roof rails in USA is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in demand for automotive roof rails in USA are raised rails, roof mount, gutter and others.

In terms of material, aluminium alloy segment to command 63.0% share in the demand for automotive roof rails in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA