The demand for automotive NFC in Japan is valued at USD 64.4 billion in 2025 and is projected to reach USD 103.7 billion by 2035, reflecting a compound annual growth rate of 4.9%. Growth is driven by the rising integration of near-field communication features in passenger and commercial vehicles, supporting functions such as keyless entry, secure authentication, infotainment pairing and personalized in-car settings. As digital interfaces become more common across vehicle platforms, NFC technology strengthens its position due to its reliability, low energy use and ease of implementation. Broader development in connected vehicle architectures also contributes to adoption as manufacturers incorporate NFC modules to enhance user experience and streamline digital access features.

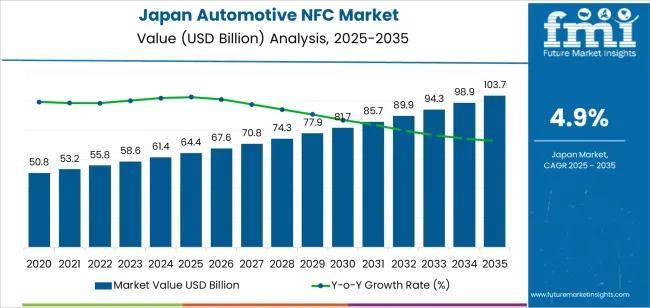

The growth trend shows a stable upward pattern over the forecast horizon, beginning at USD 50.8 billion in earlier years and reaching USD 64.4 billion in 2025 before progressing steadily toward USD 103.7 billion by 2035. Yearly gains remain consistent, with demand rising from USD 67.6 billion in 2026 to USD 70.8 billion in 2027, followed by successive increases across each period. This progression reflects expanding use of digital access and communication functions throughout modern vehicle ecosystems. As automotive platforms evolve to include more personalized and seamless user interfaces, NFC-enabled components continue to gain traction across manufacturing lines, supporting a predictable and sustained rise in demand within Japan’s automotive technology landscape.

Demand in Japan for automotive NFC is projected to rise from USD 64.4 billion in 2025 to USD 103.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 4.9%. This expansion takes place on the back of growing integration of NFC technologies into connected vehicles, where functions such as plug and play smartphone access, digital keys and in vehicle payment systems become standard. Between 2025 and 2030, demand climbs from USD 64.4 billion to around USD 81.7 billion, while beyond 2030 the trajectory brings value toward USD 103.7 billion by 2035 as automotive manufacturers embed NFC modules widely across vehicle segments.

Over this period the uplift of USD 39.3 billion (from USD 64.4 billion to USD 103.7 billion) underscores both volume growth of NFC enabled vehicle platforms and higher per unit content as feature sets expand. In early years the value increase is largely driven by higher vehicle penetration of NFC systems; later years see a greater contribution from enhanced functionalities such as vehicle to device pairing, subscription services and security upgrades that raise average system value. As Japanese automakers target full adoption of digital key ecosystems and seamless connectivity, NFC modules will play a key role in vehicle access and user interface evolution.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 64.4 billion |

| Forecast Value (2035) | USD 103.7 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The demand for automotive NFC in Japan is growing due to the increasing consumer expectation for seamless vehicle access, connectivity and digital services. Japanese automakers are incorporating NFC-enabled smart keys and mobile devices to unlock doors, start engines and personalise in-vehicle settings. This shift reflects both a desire for convenience and a push for enhanced vehicle security in Japan. Furthermore, the rise of connected vehicles and integration with smartphones contribute to the uptake of automotive NFC functionalities within Japanese passenger cars and other vehicle segments.

In addition to access and connectivity, the expansion of electric vehicles (EVs) and related charging infrastructure in Japan supports demand for automotive NFC. NFC technology allows vehicles to authenticate charging sessions, handle contactless payments at charging stations or services and integrate with smart vehicle ecosystems. Manufacturers and service operators are leveraging NFC to enable driver-focused features such as in-car payments for tolls or parking, and vehicle-to-device communication. While the need for compatible hardware, software standards and cross-brand interoperability remain challenges, the growth trajectory for automotive NFC in Japan remains positive as digital vehicle platforms continue to evolve.

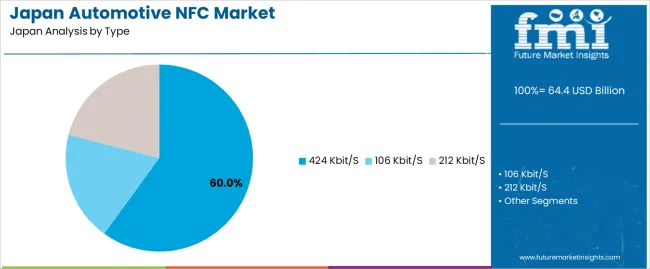

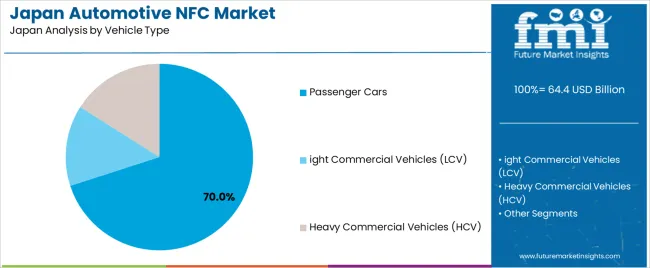

The demand for automotive NFC in Japan is shaped by the data transfer types used in embedded systems and the vehicle categories where these solutions are implemented. NFC types such as 424 Kbit/S, 106 Kbit/S and 212 Kbit/S support functions including keyless entry, smartphone pairing and secure authentication. Vehicle types consist of passenger cars, light commercial vehicles and heavy commercial vehicles, each adopting NFC at different rates based on connectivity needs. As digital integration expands across automotive platforms, the combination of high-speed NFC standards and broad vehicle adoption influences overall demand for in-vehicle communication technologies in Japan.

The 424 Kbit/S type accounts for 60% of total demand for automotive NFC in Japan. This leading role reflects the need for stable, higher-speed data transfer to support functions such as secure car access, device pairing and in-vehicle personalization. Automotive manufacturers select this type because it provides reliable performance for authentication tasks used in premium and mass-market vehicles. Its compatibility with modern infotainment platforms reinforces adoption across multiple model ranges. The preference for systems that improve user convenience and enable fast recognition of external devices contributes to the consistent use of this NFC specification.

Demand for 424 Kbit/S NFC is also influenced by its suitability for integration into advanced electronic architectures. As Japanese automakers continue adopting centralized control units and connected service features, this data rate enables smooth communication between mobile devices and vehicle systems. It supports emerging uses such as digital keys and secure data exchange for mobility services. Manufacturers rely on its consistent operation across varied environmental conditions. These characteristics ensure continued preference for 424 Kbit/S NFC as vehicles incorporate more digital access and identification functions.

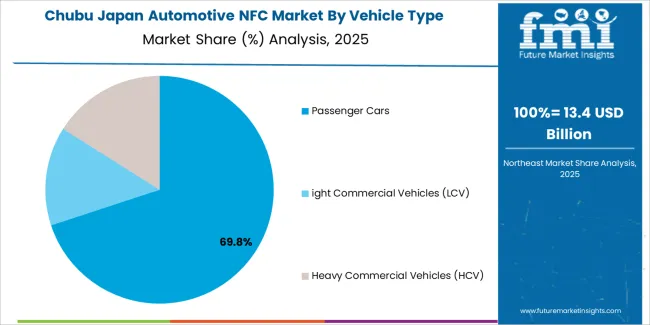

Passenger cars account for 70.0% of demand for automotive NFC in Japan, reflecting the widespread use of connectivity features in personal vehicles. Consumers expect seamless pairing between smartphones and in-car systems for access control, media functions and personalized settings. Automakers integrate NFC to support quick setup, simplified entry and secure identification processes. Passenger car platforms also adopt NFC to streamline interactions within mobility ecosystems. This extensive use across compact, mid-size and premium categories strengthens the segment’s large share of overall NFC adoption.

The demand from passenger cars is supported by growing interest in convenience-oriented features among Japanese drivers. NFC-enabled functions reduce reliance on physical keys and simplify device authentication, fitting the expectations of users who prefer integrated digital experiences. Automakers incorporate NFC to unify access, charging authorization and profile loading routines. As passenger cars remain central in Japan’s transportation landscape, continued emphasis on user-friendly electronic systems secures the segment’s position as the primary adopter of automotive NFC technologies.

In Japan, the demand for automotive near-field communication (NFC) technology is growing as vehicles become more connected and users expect seamless digital experiences. Features such as digital key access, smartphone-to-car pairing, and contactless in-vehicle payments are increasingly relevant and support adoption. At the same time, challenges such as system cost, interoperability and regulatory safety standards slow uptake. The balance between consumer demand for convenience and the technical and certification efforts required influences how rapidly NFC is deployed across Japanese vehicle models.

Japanese consumers increasingly view vehicles as connected devices similar to smartphones, with expectations for features such as digital entry, personal profile recognition and integrated mobile services. Automotive NFC supports these expectations by enabling secure smartphone-based vehicle access, profile loading and media or app pairing. As automakers integrate more infotainment, telematics and connected-car features, NFC plays a role in simplifying user interaction. This shift toward personalized and digitally enabled mobility helps drive NFC inclusion in new Japanese vehicle models.

Growth opportunities in Japan lie in electric vehicles (EVs), shared mobility services and premium vehicles where digital access and connected features are differentiators. NFC can support seamless EV charging interactions, vehicle sharing access and secure keyless entry in fleet or rental services. Japanese automakers and suppliers are positioned to incorporate NFC solutions as part of broader smart-mobility and IoT ecosystems. Suppliers who offer NFC modules, secure elements and integration services may benefit from this expanding application scope in Japan’s automotive sector.

Several constraints restrict faster adoption of automotive NFC in Japan. One major issue is cost: adding NFC hardware, secure elements and software integration increases vehicle system complexity and expense. Another challenge involves interoperability and standards: different manufacturers and devices may use varying protocols, complicating compatibility. Also, regulatory and safety requirements for automotive-grade components and user authentication add development time. These factors moderate how quickly NFC technology becomes standard across all vehicle segments in Japan.

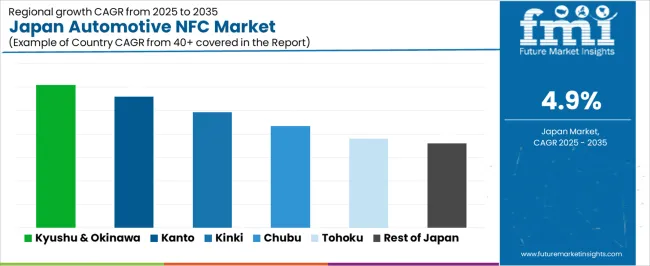

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 6.1% |

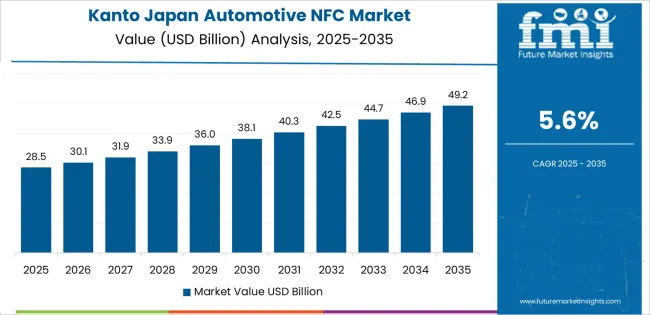

| Kanto | 5.6% |

| Kinki | 4.9% |

| Chubu | 4.3% |

| Tohoku | 3.8% |

| Rest of Japan | 3.6% |

Demand for automotive NFC in Japan is growing across all regions. Kyushu and Okinawa lead at 6.1%, supported by regional automotive production and rising interest in secure digital access features. Kanto follows at 5.6%, where major automakers and technology firms integrate NFC into vehicle platforms for keyless entry and user authentication. Kinki records 4.9%, shaped by its established supplier base and steady adoption of in-car connectivity tools. Chubu grows at 4.3%, driven by its role as a core automotive manufacturing hub. Tohoku reaches 3.8% as regional factories expand electronic component use. The rest of Japan posts 3.6%, reflecting gradual uptake of NFC features across smaller production centers.

Kyushu & Okinawa is projected to grow at a CAGR of 6.1% through 2035 in demand for automotive NFC technologies. The region’s automotive industry, particularly in Fukuoka, is integrating NFC for contactless payments, keyless entry, and secure vehicle authentication. Rising adoption of connected cars and smart mobility solutions accelerates growth. Manufacturers in Kyushu & Okinawa are incorporating NFC-enabled systems to enhance convenience, security, and user experience in vehicles. The focus on integrating digital technologies in automotive design and consumer demand for seamless in-vehicle services supports the steady expansion of NFC adoption in the region.

Kanto is projected to grow at a CAGR of 5.6% through 2035 in demand for automotive NFC technologies. As Japan’s economic and industrial hub, including Tokyo, the region leads in integrating NFC in vehicles for secure authentication, contactless payment, and vehicle-to-device connectivity. Growing consumer preference for digital convenience and smart mobility solutions drives adoption. Automotive manufacturers and suppliers in Kanto are developing NFC-enabled systems to improve user experience, enhance security, and enable connected car functionalities. Rising awareness and adoption of next-generation automotive technology ensure steady growth in the NFC segment.

Kinki is projected to grow at a CAGR of 4.9% through 2035 in demand for automotive NFC technologies. The region’s automotive sector, particularly in Osaka and Kyoto, increasingly integrates NFC for keyless entry, in-vehicle payments, and secure authentication systems. Rising demand for connected car features, mobility convenience, and enhanced user experience drives market growth. Manufacturers in Kinki are investing in NFC-enabled electronics and vehicle software to support secure and seamless operation. The combination of industrial innovation, consumer awareness, and the expansion of smart mobility services accelerates the adoption of automotive NFC technologies in Kinki.

Chubu is projected to grow at a CAGR of 4.3% through 2035 in demand for automotive NFC technologies. The region’s automotive and electronics manufacturing hubs, including Nagoya, are adopting NFC-enabled systems to enhance vehicle connectivity, security, and convenience. Rising demand for keyless entry, contactless payments, and vehicle-to-device interaction drives growth. Manufacturers in Chubu focus on integrating NFC solutions into both passenger and commercial vehicles. Increasing adoption of connected car services, smart mobility infrastructure, and digital vehicle management contributes to steady demand for automotive NFC across the region.

Tohoku is projected to grow at a CAGR of 3.8% through 2035 in demand for automotive NFC technologies. The region’s automotive manufacturing facilities are gradually integrating NFC systems for keyless entry, in-vehicle payments, and connected services. While less industrialized than major hubs, Tohoku’s adoption of smart vehicle technologies is rising due to consumer demand for convenience, security, and enhanced mobility. Manufacturers are implementing NFC-enabled solutions to improve vehicle functionality and provide seamless digital experiences. Regional investment in automotive technology and mobility services supports steady growth in the adoption of NFC systems across passenger and commercial vehicles.

The Rest of Japan is projected to grow at a CAGR of 3.6% through 2035 in demand for automotive NFC technologies. Smaller cities and rural regions are gradually adopting NFC-enabled systems for keyless entry, contactless payments, and in-vehicle connectivity. Rising awareness of connected car services, smart mobility solutions, and digital convenience drives adoption. Manufacturers are providing cost-effective NFC solutions to support local vehicle production and upgrades. The steady expansion of automotive technology infrastructure in non-urban areas, combined with consumer interest in secure and seamless vehicle interactions, supports continued growth in the demand for automotive NFC across the region.

The demand for automotive-grade Near Field Communication (NFC) in Japan is driven by the growing shift toward connected vehicles, digital keys, and seamless in-car functionalities. Japanese automotive manufacturers and suppliers seek solutions that enhance security, convenience and smartphone integration. NFC supports features such as keyless entry, driver profile recognition, in-vehicle payments and vehicle-to-device communication. High smartphone usage, advanced consumer expectations and increasing electrification of vehicles contribute to interest in embedded NFC modules. The infrastructure for digital payments, intelligent mobility and connected services also underpins automotive NFC adoption across Japan’s automotive ecosystem.

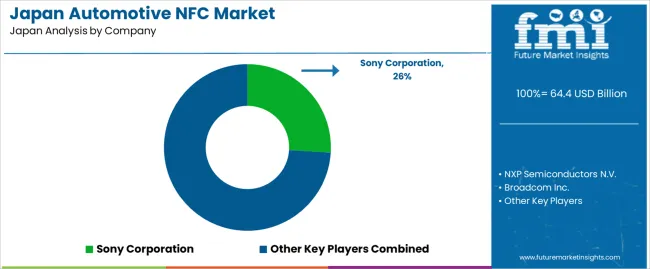

Key players shaping the automotive NFC segment in Japan include Sony Corporation, NXP Semiconductors N.V., Broadcom Inc., Samsung Electronics Co., Ltd. and STMicroelectronics N.V., along with Panasonic Corporation. These firms supply NFC chips, secure elements, antenna modules and integration platforms suited for automotive applications. Sony’s long-standing position in contactless technologies supports automotive authentication systems. NXP, Broadcom and STMicroelectronics deliver integrated NFC/HF ICs designed for automotive requirements. Samsung and Panasonic contribute modules and system-level integration for vehicle OEMs. Together, these companies provide the technological backbone enabling NFC features in Japanese vehicles and support the evolving trend toward fully digital vehicle access and connectivity.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| End Users / Vehicle Type | Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV) |

| NFC Types | 424 Kbit/S, 106 Kbit/S, 212 Kbit/S |

| Applications | Car Keys, Board Value (US$ Mn) & Volume (Units), Other Applications |

| Sales Channels | OEMs, Aftermarket |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Sony Corporation, NXP Semiconductors N.V., Broadcom Inc., Samsung Electronics Co., Ltd., STMicroelectronics N.V., Panasonic Corporation |

| Additional Attributes | Dollar by sales by NFC type, vehicle type, application and sales channel; regional penetration and adoption trends; growth in connected and electrified vehicles; integration with digital key, smartphone, and infotainment ecosystems; aftermarket vs OEM share; adoption by passenger, LCV and HCV segments; role in EV and smart mobility platforms; technology upgrades and module enhancements over time. |

The demand for automotive NFC in Japan is estimated to be valued at USD 64.4 billion in 2025.

The market size for the automotive NFC in Japan is projected to reach USD 103.7 billion by 2035.

The demand for automotive NFC in Japan is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in automotive NFC in Japan are 424 kbit/s, 106 kbit/s and 212 kbit/s.

In terms of vehicle type, passenger cars segment is expected to command 70.0% share in the automotive NFC in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA