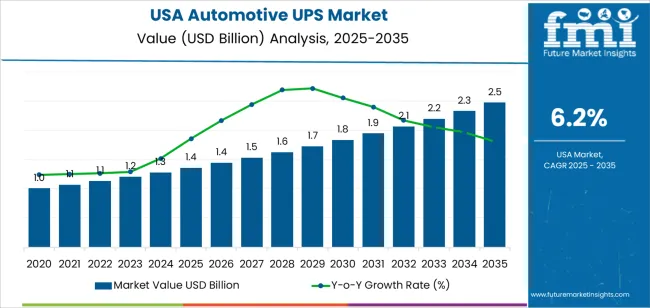

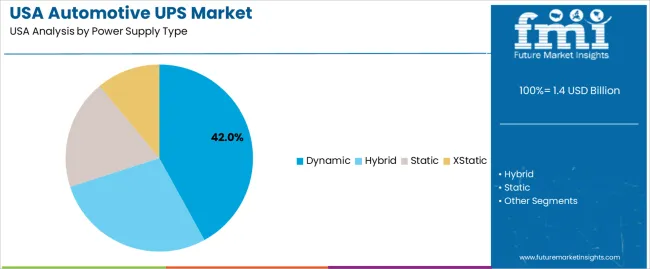

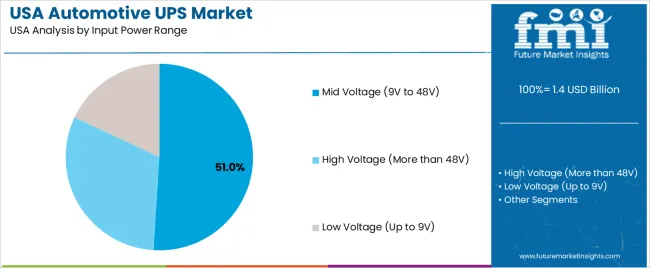

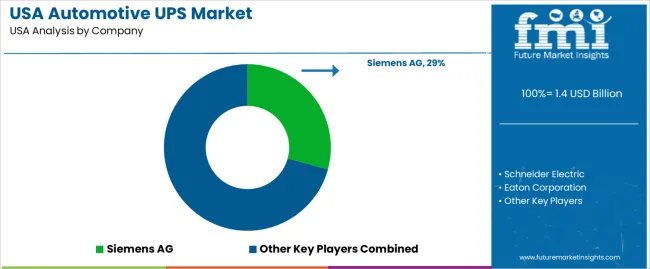

In 2025, demand for automotive in vehicle UPS systems in the USA is assessed at USD 1.4 billion and is projected to reach USD 2.5 billion by 2035 at a CAGR of 6.2%. Growth reflects rising electronic load inside passenger vehicles, fleet digitization, and increasing dependence on uninterrupted power for safety and control systems. Passenger cars account for 38% of installations, followed by electric vehicles at 27% and light commercial vehicles at 20%. Mid voltage input systems between 9V and 48V represent the largest share at 51%, aligned with conventional and hybrid architectures. Dynamic UPS designs lead with 42% share due to fast response under voltage fluctuation.

Beyond 2030, demand expansion in the USA is shaped by electrification depth and higher ampere requirements for power dense platforms. Systems rated above 40 Amp represent 61% of installations as vehicles integrate advanced driver assistance, infotainment clusters, and redundant safety electronics. Electric vehicles raise demand for high voltage UPS units above 48V, which already account for 31% share. Hybrid UPS designs hold 28% of the market, reflecting mixed electrical architectures across fleets. Key suppliers active in the USA include Siemens AG, Schneider Electric, Eaton Corporation, ABB Ltd, and Delta Electronics. Supplier strategy centers on thermal management performance, compact form factors, and integration with vehicle power management modules under long term OEM supply agreements.

The overall demand for automotive UPS in USA increases from USD 1.4 billion in 2025 to USD 1.8 billion by 2030, adding USD 0.4 billion in absolute value. This phase reflects the transition of in vehicle UPS from a fleet focused backup component into a broader electronic stability layer across passenger vehicles and light commercial platforms. Growth is driven by rising electronic load per vehicle, increasing dependence on continuous power for ADAS, telematics, and infotainment systems, and wider deployment of power buffering for connected vehicle platforms. The growth curve during this phase remains steady and controlled, indicating that UPS integration is becoming a planned design standard within vehicle electrical architectures.

From 2030 to 2035, the market expands from USD 1.8 billion to USD 2.5 billion, adding a larger USD 0.7 billion despite a similar five-year time span. This back weighted pattern reflects structural escalation in power resilience requirements rather than simple vehicle production expansion. Electric vehicles, software defined vehicle architectures, and autonomous ready platforms increase the need for uninterrupted auxiliary power for sensors, control units, braking redundancy, and vehicle communication systems. As a result, automotive UPS shifts from a protective subsystem to a core power management layer, raising value per vehicle and accelerating demand growth.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.4 billion |

| Forecast Value (2035) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

Demand for in vehicle uninterruptible power supply systems in the USA emerged as automotive electronics shifted from support functions to core operating systems. Early need was limited to emergency fleets and specialized service vehicles where radios and control modules required stable backup power. As passenger vehicles added dense networks of sensors, cameras, infotainment processors, and driver assistance controls, voltage drops and transient power loss became operational risks rather than inconveniences. Start stop systems, idle shutdown, and growing accessory loads increased electrical instability in conventional platforms. OEM engineers began using compact UPS units to buffer sensitive controllers during cranking, battery aging, and load spikes. Replacement demand followed fleet operators once electronic failures were traced to unstable low voltage events in service.

Future demand for automotive UPS in the USA will hinge on how quickly vehicles transition into software defined platforms where uninterrupted power becomes central to safety and USAbility. Electric vehicles, hybrids, and 48 volt architectures create multiple power domains that must remain synchronized under fault conditions. UPS systems will increasingly be used to protect braking control, steering assist, over the air update cycles, cybersecurity firewalls, and autonomous sensing stacks. Growth will be strongest in commercial fleets, delivery vehicles, emergency services, and premium passenger cars where downtime carries direct operational cost. Barriers remain in unit cost, thermal management inside crowded dashboards, and integration complexity across mixed voltage systems. Adoption will depend on standardization and clear cost to reliability justification across platforms.

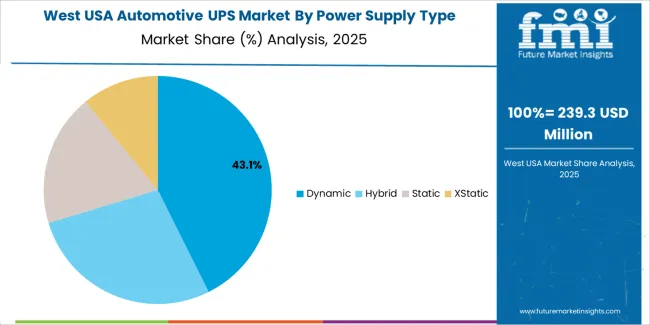

The demand for automotive UPS systems in the USA is structured by power supply type and input power range. Dynamic systems hold a 42% share, followed by hybrid, static, and xStatic configurations. By input power range, mid voltage systems operating between 9V and 48V account for 51.0% of total demand, followed by high voltage systems above 48V and low voltage systems up to 9V. Adoption patterns are shaped by vehicle electrification levels, backup power requirements for safety electronics, and compatibility with evolving electrical architectures. These segments reflect how reliability needs and power management strategies define UPS deployment across passenger and commercial vehicle platforms.

Dynamic automotive UPS systems account for 42% of total demand in the USA. Their leadership reflects the ability to deliver immediate power stabilization during voltage drops and transient load conditions. Modern vehicles rely on uninterrupted power supply to support advanced driver assistance systems, infotainment, braking electronics, and data processing units. Dynamic UPS designs respond rapidly to fluctuations, which makes them suitable for real time vehicle control environments where delays in backup activation are not acceptable.

Dynamic systems also align well with the electrical architectures used in passenger vehicles, sport utility vehicles, and light commercial fleets. These platforms experience frequent load variations from start stop systems, electric steering, and active safety modules. Integration with battery management systems remains relatively straightforward compared with hybrid alternatives. Replacement demand from fleet service operations also supports this segment, as dynamic systems show clear failure detection and predictable service intervals. These operational and integration advantages sustain dynamic UPS as the dominant power supply type in the USA automotive UPS landscape.

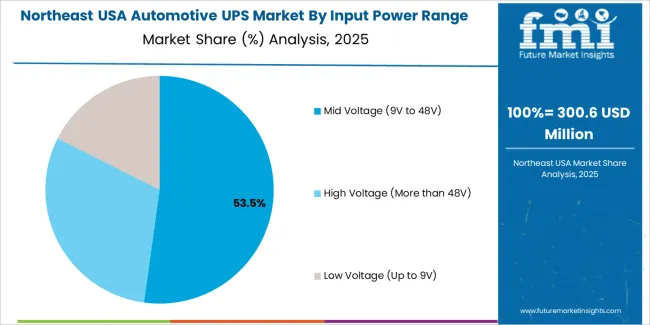

Mid voltage input systems operating between 9V and 48V represent 51.0% of total automotive UPS demand in the USA. This dominance reflects the transition of vehicle electrical architectures from conventional 12V systems toward mixed 12V and 48V platforms. Mid voltage ranges support power delivery for advanced infotainment, active safety, electric braking assist, and partial electrification components without requiring full high voltage system isolation.

Mid voltage UPS systems also serve a broad mix of internal combustion, hybrid, and mild hybrid vehicles. OEMs favor this range due to manageable insulation requirements, standardized connectors, and ease of integration into existing wiring harnesses. Aftermarket demand is also concentrated in this band because retrofit solutions for fleet vehicles and specialty applications predominantly operate within the 9V to 48V range. These manufacturing, deployment, and service advantages position mid voltage input systems as the core demand segment for in vehicle UPS installations across the USA.

Demand for in-vehicle UPS systems in the USA is expanding as vehicles become rolling power-dependent platforms rather than purely transportation tools. Modern cars and trucks support continuous operation of telematics, navigation, cameras, ADAS sensors, and real-time data communication. Power interruptions during start-stop cycles, idle shutdowns, or voltage dips create risk for these systems. Public safety vehicles, mobile broadcast units, mobile repair vans, and refrigerated delivery fleets all require stable backup power during engine-off conditions. These USAge realities convert the automotive UPS from optional electronics into core electrical reliability infrastructure.

How Do Commercial Fleets and Emergency Applications Shape USA UPS Demand?

USA fleet operators depend heavily on power continuity for routing software, telematics, refrigeration units, mobile POS terminals, and diagnostic systems. UPS units maintain power during refueling, loading, driver changeovers, and emergency shutdowns. Ambulances, fire trucks, police vehicles, and disaster-response units require uninterrupted power for radios, medical devices, and data transmission even during engine loss. Utility service trucks and telecom maintenance fleets rely on in-vehicle UPS to stabilize delicate electronics at worksites. These mission-critical fleet and emergency use cases form the most structurally stable demand segment for automotive UPS in the USA.

What Economic and Engineering Barriers Limit Wider UPS Adoption in USA Vehicles?

In-vehicle UPS penetration in the USA is constrained by cost, space, battery lifecycle limitations, and system integration complexity. OEM-grade UPS requires advanced thermal management, wiring protection, and safety validation. Weight penalties discourage adoption in fuel-sensitive platforms. Aftermarket installations vary widely in quality and often raise warranty concerns. Battery degradation under high temperature and deep discharge cycles increases replacement cost. Passenger car buyers rarely perceive direct value from UPS systems, limiting mass-market pull. These financial and engineering barriers keep adoption concentrated in professional and performance-sensitive vehicle applications.

How Are Power Management, Electrification, and Smart Energy Control Reshaping UPS Design?

Automotive UPS systems in the USA are shifting toward lithium battery architectures with intelligent monitoring, fast charge recovery, and predictive fault detection. Software-managed switching enables seamless power transfer without disrupting vehicle electronics. In electric vehicles, UPS functions increasingly integrate within auxiliary battery subsystems rather than as standalone units. Cloud-connected UPS platforms allow fleet operators to monitor power health remotely. Compact modular UPS formats designed for under-seat and cargo-wall mounting support retrofit adoption. These developments signal in-vehicle UPS evolving into a software-defined reliability layer within USA vehicle electrical ecosystems.

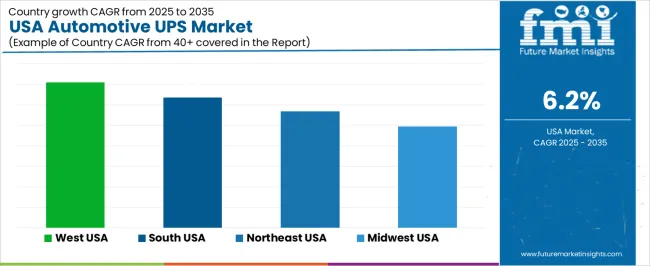

| Region | CAGR (%) |

|---|---|

| West | 7.1% |

| South | 6.4% |

| Northeast | 5.7% |

| Midwest | 4.9% |

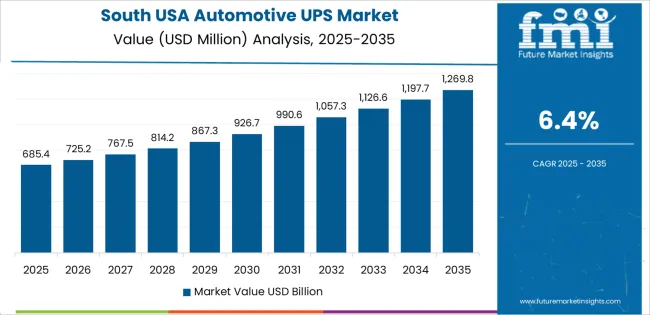

The demand for in-vehicle UPS systems in the USA is rising across all regions, with the West region showing the highest growth at 7.1% CAGR. This growth is driven by increased adoption of electrified and hybrid vehicles, growing consumer demand for onboard power for electronics and infotainment, and expanded after-market upgrades for power backup in recreational and commercial vehicles. The South, at 6.4%, benefits from robust vehicle manufacturing and recreational vehicle (RV) USAge, which often require reliable onboard power sources. The Northeast, at 5.7%, sees growth due to dense urban vehicle populations and rising demand for power backup solutions in passenger and commercial cars. The Midwest, at 4.9%, exhibits slower growth, likely reflecting a more moderate rate of new vehicle purchases and lower proportion of premium or specialty vehicle use.

Growth in the West reflects a CAGR of 7.1% through 2035 for automotive UPS in vehicle UPS demand, supported by high electric vehicle USAge, advanced driver assistance adoption, and strong reliance on uninterrupted onboard power for telematics and safety systems. Technology intensive fleets depend on continuous power for navigation, data logging, and in vehicle computing. Ride sharing and delivery fleets strengthen demand for backup power reliability. Wildfire related grid outages also reinforce demand for onboard redundancy. Demand remains both OEM driven and aftermarket supported across passenger, fleet, and specialty mobility segments.

The South advances at a CAGR of 6.4% through 2035 for automotive UPS in vehicle UPS demand, driven by expanding logistics fleets, construction vehicle operations, and long distance freight movement. Fleet operators equip vehicles with backup power to support refrigeration units, tracking systems, and communication hardware. Disaster vulnerability from storms and hurricanes strengthens the need for continuous power during operations. Regional assembly output also contributes to OEM level integration. Demand remains utility focused, with reliability and durability guiding procurement across commercial and light industrial mobility platforms.

The Northeast records a CAGR of 5.7% through 2035 for automotive UPS in vehicle UPS demand, shaped by dense urban transport, winter reliability needs, and strong public service fleet Usage. Cold weather increases electrical load instability, raising the need for resilient power continuity. Emergency response fleets, transit maintenance vehicles, and municipal service units depend on backup power for communications and onboard equipment. Urban congestion also increases idle time power demand. Growth remains steady through public sector procurement and structured fleet upgrade programs.

The Midwest expands at a CAGR of 4.9% through 2035 for automotive UPS in vehicle UPS demand, supported by agricultural transport, long haul trucking, and utility service vehicle operations. Extended driving distances and remote routing increase dependence on continuous onboard power for navigation, refrigeration, and communication systems. Power continuity supports safety monitoring in fleet vehicles operating outside urban coverage. Manufacturing centered demand also contributes steady OEM sourcing. Growth remains practical and service driven, with purchasing guided by endurance and failure tolerance rather than advanced infotainment requirements.

Demand for automotive UPS systems worldwide is rising as modern vehicles integrate more electronics, advanced driver assistance systems, infotainment, and safety features. The shift toward electric vehicles intensify the need for reliable backup power solutions. As vehicles evolve into mobile computing and connected platforms, uninterrupted power becomes essential to maintain critical functions during voltage fluctuations or battery transitions. Automotive UPS systems help ensure power continuity for control units, sensors, communications, and safety modules. Growing regulatory attention on vehicle safety and rising consumer demand for reliability support this trend across global markets.

Major multinational firms competing in this segment include Siemens AG, Schneider Electric, Eaton Corporation, ABB Ltd, and Delta Electronics. These companies supply in vehicle power solutions, backup modules, and integrated power management hardware tailored to automotive needs. Their global reach and engineering expertise allow them to support both OEMs and aftermarket suppliers. As automakers increasingly demand robust power management systems for electric and connected vehicles, these players influence supply-chain standards, system reliability expectations, and adoption rates globally.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Power Supply Type | Dynamic, Hybrid, Static, XStatic |

| Input Power Range | Mid Voltage (9V to 48V), High Voltage (More than 48V), Low Voltage (Up to 9V) |

| Vehicle Type | Passenger Cars, Electric Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Ampere Rating | Above 40 Amp, Below 40 Amp |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Siemens AG, Schneider Electric, Eaton Corporation, ABB Ltd, Delta Electronics |

| Additional Attributes | Dollar-value breakdown by power supply type, input range, vehicle type, and ampere rating; regional CAGR projection; growing adoption across electric, hybrid, and conventional vehicles; demand driven by electrification, fleet digitization, and safety-critical electronics; OEM and aftermarket channels supported; emphasis on thermal management, compact design, and integration with vehicle power modules. |

The demand for automotive UPS in USA is estimated to be valued at USD 1.4 billion in 2025.

The market size for the automotive UPS in USA is projected to reach USD 2.5 billion by 2035.

The demand for automotive UPS in USA is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in automotive UPS in USA are dynamic, hybrid, static and xstatic.

In terms of input power range, mid voltage (9v to 48v) segment is expected to command 51.0% share in the automotive UPS in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

Automotive UPS (In Vehicle UPS) Market Growth - Trends & Forecast 2025 to 2035

Automotive Cups and Glass Holder Market

Demand for Automotive NFC in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Door Sills in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive AI Chipset in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brake Tube in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Roof Rails in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Display Units in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Coating in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Grade Inductor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Air Compressor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Convertible Top in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Dynamic Map Data in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Upstream Bioprocessing Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Deep Groove Ball Bearings in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA