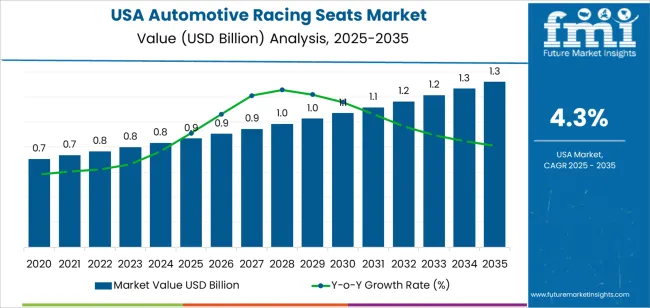

In 2025, demand for automotive racing seats in the USA is valued at USD 0.9 billion and is projected to reach USD 1.3 billion by 2035 at a CAGR of 4.3%. Growth in the first half of the forecast reflects stable demand from motorsports participation, performance car ownership, and track focused vehicle modifications. High performance applications account for 70% of installations, supported by racing clubs, time attack events, and amateur motorsports leagues. Carbon fiber seats dominate with a 65% material share due to strength to weight advantages and safety compliance in sanctioned racing. Demand also benefits from strong aftermarket sales tied to performance tuning culture concentrated in California, Texas, and Florida.

From 2030 onward, market expansion is shaped more by product specialization than by volume growth. Eco performance applications account for 30%, using natural fiber and hybrid composites in lightweight road legal performance cars. Growth is supported by premium customization demand and rising adoption of modular racing seats suited for both street and track use. Key suppliers active in the USA include Recaro Holding GmbH, Sparco S.p.A, Faurecia SE, Cobra Seats, and OMP Racing S.p.A. Competitive strategies center on FIA certification coverage, shell rigidity tuning, and ergonomic fit across different driver profiles. Distribution remains concentrated in performance retailers, motorsport distributors, and direct to consumer sales tied to vehicle build communities.

The overall demand for automotive racing seats in USA increases from USD 0.9 billion in 2025 to USD 1.0 billion by 2030, adding USD 0.1 billion in absolute value. This phase reflects controlled growth anchored in motorsports participation, performance aftermarket upgrades, and stable adoption across track-day vehicles and modified passenger cars. Demand is supported by consistent interest in lightweight seating, improved lateral support, and safety-focused seat designs among enthusiasts. Growth during this period remains volume anchored, with limited pricing escalation as competition among seat manufacturers and distributors keeps unit prices stable. The segment continues to be driven by discretionary performance spending rather than mass OEM integration.

From 2030 to 2035, the market expands from USD 1.0 billion to USD 1.3 billion, adding a larger USD 0.3 billion in the second half of the decade. This back weighted acceleration reflects rising integration of racing-style seats into factory performance trims, electric performance vehicles, and premium sport utility segments. Increasing focus on weight reduction, ergonomic optimization, and advanced composite materials raises value per unit. At the same time, simulation racing, motorsport brand crossovers, and premium interior customization trends extend demand beyond traditional racing applications, shifting the market from niche aftermarket dependence toward broader performance-driven value expansion.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 0.9 billion |

| Forecast Value (2035) | USD 1.3 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

Demand for automotive racing seats in the USA originates from enthusiasts, motorsport participants, and niche aftermarket modifiers who prioritize performance, safety, and driver engagement over standard comfort. Over time, proliferation of tuning culture and track-day activities increased demand for seats that offer superior lateral support, harness compatibility, and reduced weight compared with regular OEM seating.

Aftermarket shops and specialty builders replaced factory seats with racing seats to improve handling feedback and driver posture under High-G cornering. Demand also came from restoration and customization markets where classic and performance vehicles were outfitted for racing or spirited driving. Limited-run sports cars and dedicated track cars maintained steady OEM demand for racing-style seats designed to meet occupant safety while delivering performance feel.

Future demand in the USA will be shaped by evolving automotive segments and shifting consumer interest rather than volume growth alone. As electric vehicles and performance-oriented compact cars emerge, some drivers may seek racing seats to compensate for silent power delivery and reduced engine feedback. Motorsports participation, amateur track days, and simulation-inspired driving experiences may sustain niche demand.

Seat manufacturers may respond with lightweight composite shells, modular harness-ready seat structures and adjustable seat ergonomics compatible with road and track use. Barriers include regulatory requirements for passenger safety, comfort, and airbag integration; reluctance among average consumers to trade convenience for performance; and higher cost compared with standard seats. Racing seats will likely remain a segmented market catering to enthusiasts and specialty builders rather than mainstream car buyers.

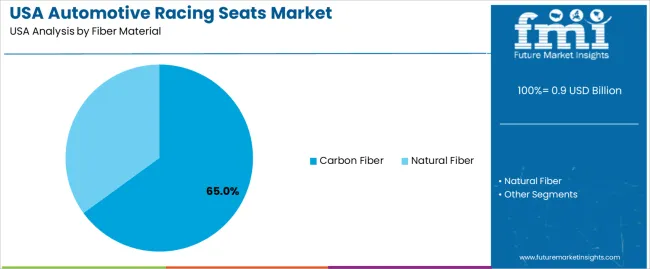

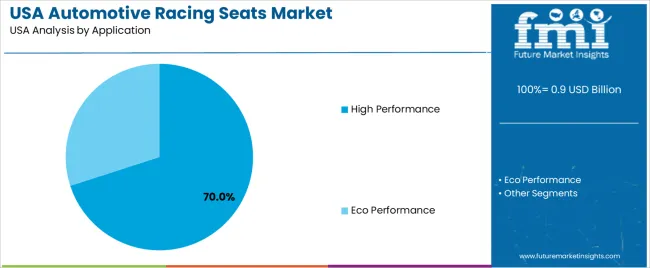

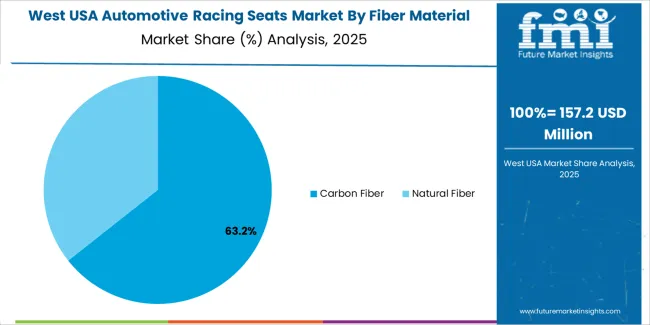

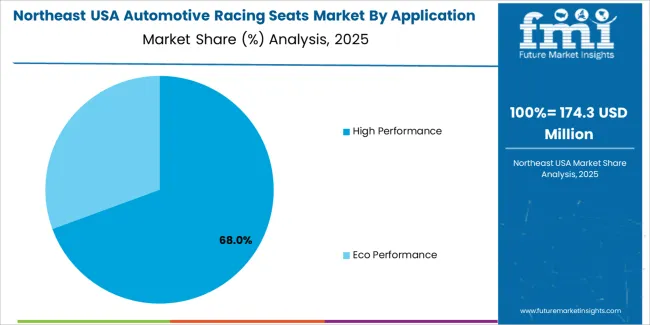

The demand for automotive racing seats in the USA is structured by fiber material and application. Carbon fiber accounts for 65% of total demand, followed by natural fiber used in limited performance focused eco applications. By application, high performance vehicles represent 70.0% of total consumption, while eco performance categories account for the remaining share. Demand behavior is shaped by weight reduction targets, structural strength requirements, driver safety regulations, and thermal stability under racing conditions. These segments reflect how material engineering priorities and vehicle performance positioning define racing seat selection across motorsports, track focused vehicles, and specialty performance builds in the USA.

Carbon fiber accounts for 65% of total automotive racing seat demand in the USA. This leadership reflects its exceptional strength to weight ratio, high impact resistance, and superior structural rigidity under extreme load conditions. Racing applications require seats that protect drivers during high speed maneuvers and collisions while maintaining minimal overall vehicle mass. Carbon fiber structures meet these performance constraints with consistent dimensional stability under vibration and thermal stress.

Carbon fiber seats also support the integration of multi point harness systems and head restraint elements without compromising shell strength. Their fatigue resistance under long race durations supports use in circuit racing, time attack, and endurance motorsports. Manufacturing precision and repeatable mold accuracy allow consistent fitment across performance vehicle platforms. These safety, durability, and weight reduction advantages sustain carbon fiber as the dominant material in the USA racing seat segment.

High performance applications account for 70.0% of total demand for automotive racing seats in the USA. This dominance reflects the concentration of racing seat installations in track focused vehicles, competition builds, and performance tuned road cars. These vehicles operate under high lateral loads, rapid deceleration forces, and aggressive cornering conditions that require secure driver restraint and body positioning.

Motorsports participation across amateur track days, professional racing series, and performance driving schools sustains consistent demand for FIA compliant racing seats. High performance aftermarket builds further expand this segment through modified sports cars and muscle vehicles. Safety regulations and competition standards mandate rigid seat structures in many racing formats, which drives regular upgrade and replacement cycles. These performance intensity and regulatory factors position high performance applications as the primary demand driver for automotive racing seats across the USA.

Demand for automotive racing seats in the USA is driven by strong motorsports culture, performance vehicle ownership, and a large enthusiast aftermarket. Track-day participation, amateur racing leagues, drift events, and drag racing communities sustain continuous upgrade demand. Sports cars, muscle cars, and performance-oriented pickups form the core customer base for fixed-back and reclinable racing seats. Growth in simulator training, vehicle personalization, and performance branding also supports seat replacement beyond competition use. These cultural and recreational factors keep racing seats relevant across both professional and consumer segments.

The USA hosts a wide spectrum of racing formats including NASCAR feeder series, SCCA club racing, off-road racing, time attack, and drift competitions. Each format demands different seat specifications for lateral support, safety harness integration, and vibration control. Outside formal racing, vehicle modification culture strongly influences demand, as many owners install racing seats for aesthetic and handling feel rather than competition. Social media, car shows, and tuner events drive visual standards that favor aggressive seat designs. These participation patterns expand demand beyond professional circuits into lifestyle-driven customization markets.

Racing seat adoption in the USA is limited by comfort trade-offs, regulatory compliance, and price sensitivity. Fixed-back fiberglass and carbon composite seats reduce daily driving comfort, which restricts use in commuter vehicles. Safety certification requirements for sanctioned racing series raise development and approval cost. Improper installation can affect airbag systems and seat sensors, discouraging some buyers. Premium racing seats involve high material and tooling expense, limiting access for entry-level enthusiasts. These comfort, safety, and economic constraints keep the market concentrated in performance-focused ownership groups.

Automotive racing seats in the USA are shifting toward lightweight composite shells, improved fire-retardant fabrics, and energy-absorbing foam structures. Carbon-fiber and hybrid composite seats reduce mass while improving rigidity. Integration with six-point harness systems and head-and-neck restraint compatibility is becoming standard. Adjustable side bolsters and modular padding support adapt fit for different driving styles. Electric vehicle racing platforms introduce new mounting and thermal considerations. These trends show racing seats evolving from rigid competition hardware into engineered safety and performance interfaces.

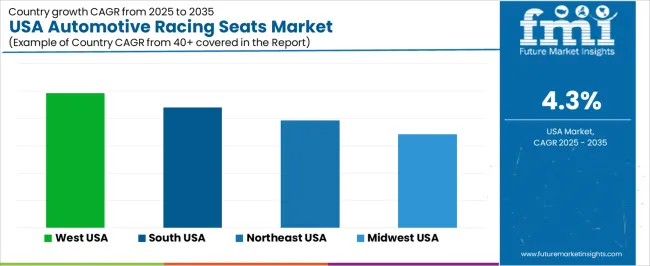

| Region | CAGR (%) |

|---|---|

| West | 4.9% |

| South | 4.4% |

| Northeast | 3.9% |

| Midwest | 3.4% |

The demand for automotive racing seats in the USA is rising across regions, with the West leading at 4.9% CAGR. Growth in that region reflects strong interest in performance vehicles, motorsports participation, and aftermarket customizations. The South at 4.4% benefits from a large base of car enthusiasts, regional racing culture, and aftermarket tuning markets. The Northeast at 3.9% shows moderate growth, supported by urban motorsport interest and renovation of older vehicles. The Midwest at 3.4% exhibits the slowest growth, likely due to lower concentration of performance-car buyers and fewer aftermarket customizations relative to other regions.

Growth in the West reflects a CAGR of 4.9% through 2035 for automotive racing seat demand, supported by strong motorsports culture, aftermarket customization activity, and premium performance vehicle ownership. Track day participation, amateur racing leagues, and off road performance events sustain steady demand for lightweight and reinforced seating systems. Electric performance vehicles also contribute to interior sport customization trends. Coastal urban centers support a higher density of specialty tuning workshops. Demand remains enthusiast driven rather than mass production driven, with purchasing linked closely to discretionary spending and performance oriented vehicle modification activity.

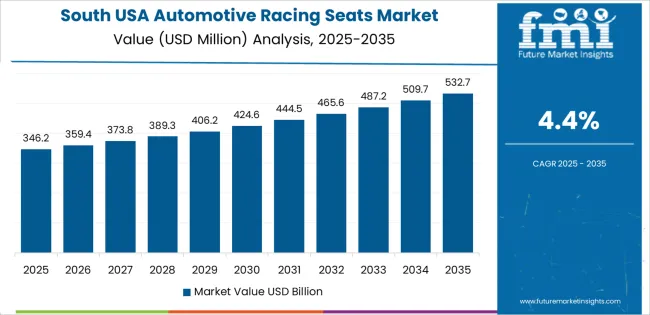

The South advances at a CAGR of 4.4% through 2035 for automotive racing seat demand, driven by strong pickup based motorsports, drag racing culture, and expanding enthusiast vehicle communities. Regional racing circuits and off road parks support steady demand for safety oriented seating upgrades. Warm climate conditions allow year round event participation, increasing seat wear cycles. Custom fabrication shops and installation garages play a key role in demand conversion. Growth remains hobby driven rather than daily use driven, with discretionary upgrades guiding most of the regional purchasing behavior.

The Northeast records a CAGR of 3.9% through 2035 for automotive racing seat demand, shaped by seasonal motorsports activity, compact performance vehicle ownership, and strong urban car enthusiast communities. Winter conditions limit year round racing participation, compressing purchasing into spring and summer seasons. Track focused upgrades and sim racing inspired builds sustain niche demand. Urban storage limitations restrict multi vehicle ownership, moderating growth volume. Demand remains centered on private enthusiasts and club level racing rather than professional motorsports programs across metropolitan and suburban tuning markets.

The Midwest expands at a CAGR of 3.4% through 2035 for automotive racing seat demand, supported by grassroots racing circuits, dirt track motorsports, and strong classic car restoration activity. Rural racing events and hobbyist vehicle builds maintain steady but moderate seat adoption. Cost sensitivity remains higher than in coastal regions, influencing preference for entry level racing seats. Installation activity is concentrated among small performance workshops. Growth remains participation driven rather than brand driven, with purchasing tied closely to local racing calendars and enthusiast community activity.

Demand for automotive racing seats in the USA is rising as motorsports, car tuning culture, and performance vehicle ownership remain strong. Enthusiasts and professional racers both value seats that offer enhanced driver stability, safety, and comfort under high lateral forces. The broader adoption of performance cars and retrofitted vehicles fuels aftermarket demand. Growing focus on vehicle handling, suspension tuning, and driver control in sports cars and modified vehicles further supports uptake of racing grade seats. Rising interest in track days, club racing, and performance upgrades drives consistent demand for seats designed for harness compatibility, side bolstering, and lightweight construction.

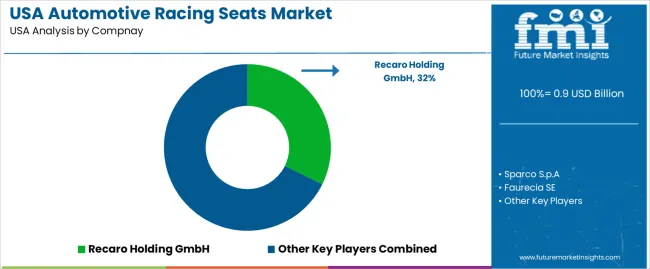

Key firms shaping the USA racing seat market include Recaro Holding GmbH, Sparco S.p.A., Faurecia SE, Cobra Seats, and OMP Racing S.p.A. Recaro remains a leading name in performance and racing seating, supplying premium aftermarket and OEM grade seats. Sparco and OMP Racing are prominent among motorsport enthusiasts and track day communities, offering seats with strong safety and harness compatibility. Cobra Seats focuses on cost effective racing and sport oriented seats for both street and track use. Faurecia, as a large automotive seating supplier, contributes through its performance seat offerings and OEM ties. Together these firms support both aftermarket and OEM demand, sustaining a diversified but competitive market for racing seats in the USA.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Fiber Material | Carbon Fiber, Natural Fiber |

| Application | High Performance, Eco Performance |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Recaro Holding GmbH, Sparco S.p.A, Faurecia SE, Cobra Seats, OMP Racing S.p.A |

| Additional Attributes | Dollar value distribution by fiber material and application; regional CAGR projections; carbon fiber leads with 65% share due to strength-to-weight advantages and safety compliance; high performance vehicles dominate at 70% of total demand due to motorsport, track, and performance car adoption; growth in 2030 to 2035 driven by integration into factory performance trims, modular seat design, electric performance vehicles, and premium sport utility vehicles; OEM and aftermarket adoption concentrated in California, Texas, Florida; value growth tied to advanced composites, ergonomic fit, FIA certification, and lightweighting; distribution channels include performance retailers, motorsport distributors, and direct to consumer. |

The demand for automotive racing seats in USA is estimated to be valued at USD 0.9 billion in 2025.

The market size for the automotive racing seats in USA is projected to reach USD 1.3 billion by 2035.

The demand for automotive racing seats in USA is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in automotive racing seats in USA are carbon fiber and natural fiber.

In terms of application, high performance segment is expected to command 70.0% share in the automotive racing seats in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Racing Seats Market Growth - Trends & Forecast 2025 to 2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

Demand for Automotive UPS in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive NFC in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Headliner in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Light Bars in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive HVAC Ducts in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Door Sills in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive AI Chipset in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brake Tube in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Roof Rails in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Display Units in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Coating in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Grade Inductor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Air Compressor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Convertible Top in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA