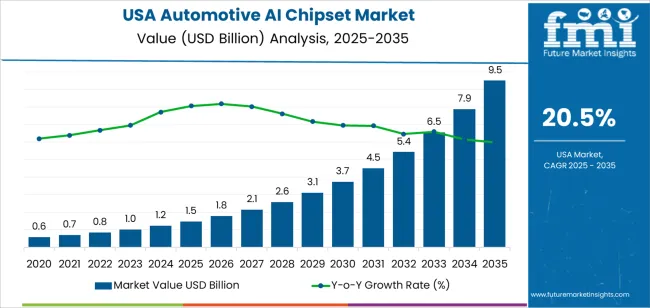

The demand for automotive AI chipsets in the USA is set to grow from USD 1.5 billion in 2025 to USD 9.5 billion by 2035, with a CAGR of 20.5%. Automotive AI chipsets are becoming integral to the development of autonomous driving and advanced driver-assistance systems (ADAS), playing a vital role in processing data from sensors, cameras, and radars to enable smarter, safer, and more efficient vehicles. As the automotive industry accelerates toward electric and autonomous vehicles, the adoption of AI chipsets in vehicles is set to expand significantly.

The primary factors driving the growth of automotive AI chipsets in the USA include the rise of autonomous driving technologies, advancements in ADAS capabilities, the increasing adoption of electric vehicles, and the integration of 5G connectivity and edge computing. AI chipsets will be essential in processing the vast amounts of data generated by sensors and cameras in real-time, enabling vehicles to make quick, accurate decisions to enhance safety and efficiency. Regulatory pressure to improve road safety and reduce accidents will continue to drive investment in AI chipsets as a means of enabling safer driving experiences.

Between 2025 and 2030, the demand for automotive AI chipsets is expected to grow from USD 1.5 billion to USD 3.1 billion. This period will witness steady growth, driven by increasing integration of autonomous driving technologies and ADAS features in vehicles. The adoption of semi-autonomous features such as lane-keeping assist, adaptive cruise control, and automatic emergency braking will continue to boost the demand for AI chipsets. OEMs and Tier 1 suppliers will continue to enhance the computational capabilities of AI chipsets to improve the safety, performance, and reliability of these systems. The ongoing trend toward electric vehicles (EVs) will also contribute to this growth, as more EVs with AI-enabled features enter the industry.

From 2030 to 2035, the industry will experience more rapid growth, with the demand for automotive AI chipsets increasing from USD 3.1 billion to USD 9.5 billion. This sharp rise will be driven by the widespread adoption of full autonomy and next-gen ADAS features, including self-parking, fully autonomous driving, and advanced AI-powered safety systems. As autonomous vehicles become more mainstream, the demand for AI chipsets will expand dramatically, driven by the need for more advanced, high-performance computing capabilities to process vast amounts of data in real-time.

| Metric | Value |

|---|---|

| Demand for Automotive AI Chipset in USA Value (2025) | USD 1.5 billion |

| Demand for Automotive AI Chipset in USA Forecast Value (2035) | USD 9.5 billion |

| Demand for Automotive AI Chipset in USA Forecast CAGR (2025-2035) | 20.5% |

The demand for automotive AI chipsets in the USA is growing rapidly due to the increasing integration of artificial intelligence (AI) and machine learning technologies in modern vehicles. Automotive AI chipsets are crucial for enabling advanced driver-assistance systems (ADAS), autonomous driving, infotainment systems, and vehicle-to-vehicle communication. As the automotive industry moves toward greater automation, connectivity, and intelligent systems, the need for high-performance AI chipsets capable of handling complex algorithms and real-time processing is expanding significantly.

A major driver behind this growth is the accelerated development of autonomous and semi-autonomous vehicles. AI chipsets are essential for processing the vast amounts of data generated by sensors, cameras, and radar systems used in ADAS and autonomous driving applications. These chipsets allow vehicles to process information in real time, enabling features such as automatic braking, lane-keeping assistance, and self-driving capabilities. As automotive manufacturers in the USA invest heavily in autonomous driving technologies, the demand for automotive AI chipsets is expected to continue to rise.

The increasing emphasis on in-car connectivity, personalized experiences, and enhanced infotainment systems is driving the need for advanced AI chipsets in modern vehicles. AI chipsets enable features like voice recognition, natural language processing, and machine learning-based personalized recommendations for drivers and passengers. As consumer preferences shift toward more connected, intelligent vehicles, the demand for automotive AI chipsets is expected to grow rapidly through 2035, supported by advancements in AI and semiconductor technology.

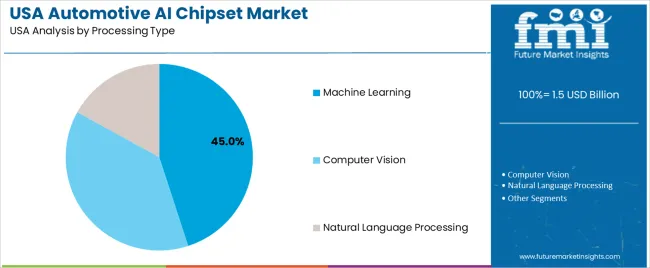

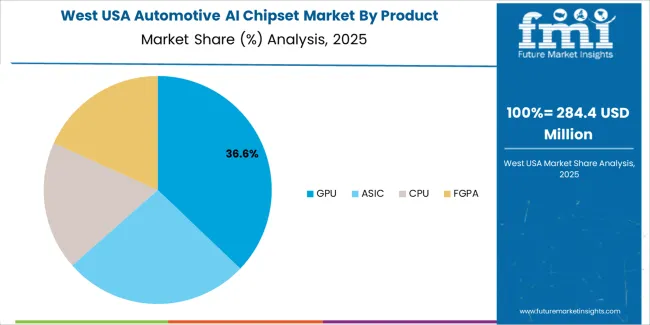

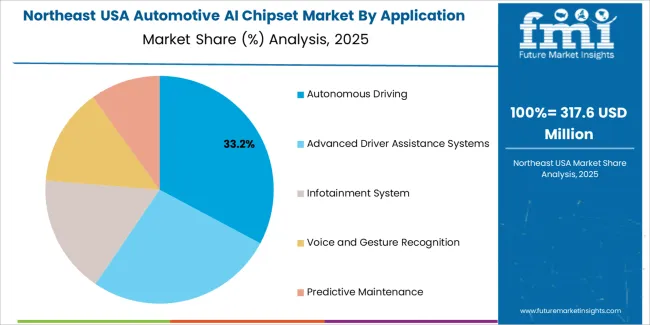

Demand for automotive AI chipsets in the USA is segmented by processing type, application, product, and region. By processing type, demand is divided into machine learning, computer vision, and natural language processing, with machine learning holding the largest share at 45%. In terms of application, the demand is split into autonomous driving, advanced driver assistance systems (ADAS), infotainment systems, voice and gesture recognition, and predictive maintenance, with autonomous driving leading the demand at 32%. The product segmentation includes GPU, ASIC, CPU, and FPGA, with GPUs being the most popular. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Machine learning accounts for 45% of the demand for automotive AI chipsets in the USA. This processing type is essential for applications like autonomous driving, predictive maintenance, and advanced driver assistance systems (ADAS). Machine learning enables vehicles to analyze and process data from various sensors and cameras in real-time, making it possible to adapt to changing road conditions and improve safety. The algorithms learn from the vehicle's surroundings, helping with navigation, collision detection, and decision-making.

Machine learning enhances vehicle performance by enabling more accurate and reliable processing of vast amounts of data, which is crucial for making intelligent driving decisions. As the automotive industry embraces more advanced AI technologies, the reliance on machine learning-based chipsets will continue to grow, making them an integral part of smart vehicle development in the USA. This shift is driving the demand for automotive AI chipsets that can handle the complexities of modern, automated driving systems.

Autonomous driving accounts for 32% of the demand for automotive AI chipsets in the USA. AI chipsets are essential for enabling autonomous vehicles, which rely on real-time processing of data from a variety of sensors, including cameras, LiDAR, and radar. These chipsets allow vehicles to understand their environment, make decisions, and navigate safely without human intervention. The growing investment in autonomous vehicle technology is driving the demand for highly advanced AI chipsets capable of processing large amounts of sensor data quickly and accurately.

These chipsets play a crucial role in ensuring the safety, efficiency, and reliability of self-driving systems by facilitating continuous monitoring, adaptive learning, and obstacle detection. As the shift towards fully autonomous vehicles intensifies, the demand for AI chipsets in this sector is expected to grow, pushing innovation in smart vehicle technologies and solidifying autonomous driving’s place in the future of transportation.

Demand for automotive AI chipsets in USA is surging as automakers and suppliers increasingly integrate advanced driver‑assistance systems (ADAS), semi‑autonomous capabilities, and sensor‑fusion systems (cameras, radar, LiDAR) into modern vehicles. The shift toward connected, electric and “smart” vehicles also fuels demand as these vehicles require powerful on‑board computing for perception, decision‑making, infotainment, and vehicle-to-everything (V2X) communication.

Regulatory pressure and rising expectations around safety, driver aid, and autonomous capabilities further push adoption. On the flip side, high R&D and manufacturing costs for advanced AI chips, thermal and energy management constraints in vehicles, and the complexity of integrating AI hardware into legacy platforms restrain rapid adoption especially in lower-cost vehicle segments.

In USA, demand is rising because consumers and regulators increasingly expect higher vehicle safety, convenience, connectivity and automation. Automakers offer features like automatic emergency braking, lane‑keeping assist, adaptive cruise control, and parking assistance all requiring real‑time data processing by AI chipsets. The growing share of electric vehicles (EVs) and connected vehicles also means cars are increasingly “smart devices on wheels,” demanding powerful computing for functions such as sensor fusion, driver monitoring, predictive maintenance, and over‑the‑air updates. As fleets and ride‑sharing services expand, the need for consistent, high‑performance AI platforms across vehicles strengthens demand for reliable, automotive‑grade AI chipsets.

Recent technological advances are accelerating automotive AI‑chipset uptake. Chips designed for edge inference combining CPU, GPU/AI accelerator, neural processing units (NPUs) offer high compute density with power‑efficiency, making them suitable for real‑time image/video processing and sensor fusion in vehicles. Modular and scalable SoC (system‑on‑chip) and chiplet architectures enable flexible integration of AI hardware for different vehicle grades. Advances in power management, thermal design and in‑vehicle networking (for example, integration with 5G or V2X) make high‑performance AI hardware practical in modern vehicles. As automotive software for perception, autonomous driving and connected services evolves, demand for advanced AI chipsets grows correspondingly.

Despite strong growth, several challenges limit broader adoption. First, high cost of AI‑grade semiconductors and the complexity of integrating them into vehicles balancing compute power, heat dissipation, power draw, and durability can deter automakers, especially in budget segments. Second, the upgrading cycle of vehicles (long product cycles) slows the refresh rate of hardware platforms, delaying adoption in older models. Third, safety and regulatory compliance for autonomous/ADAS systems adds certification and validation burden for chip-enabled features. Supply‑chain risks (semiconductor shortages, lead‑time variability) and competition from simpler electronic control units (ECUs) or legacy architectures may impact investment timing and adoption rates.

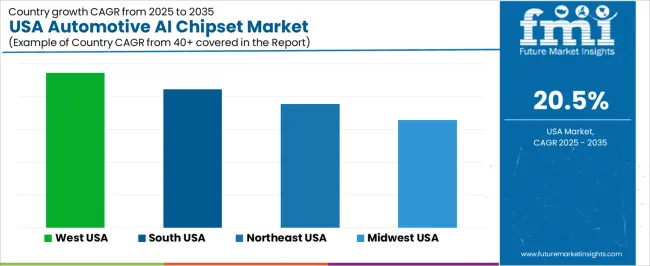

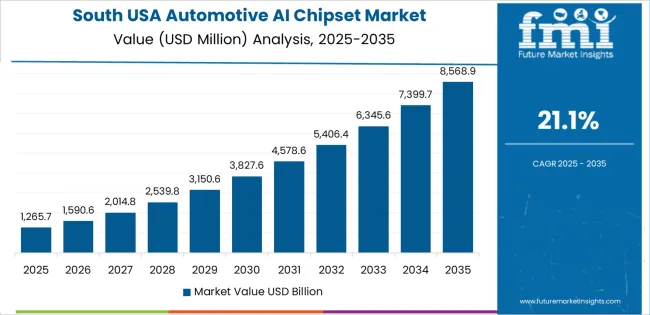

| Region | CAGR (%) |

|---|---|

| West USA | 23.6% |

| South USA | 21.1% |

| Northeast USA | 18.9% |

| Midwest USA | 16.4% |

Demand for automotive AI chipsets in the USA is growing rapidly, with West USA leading the charge at a 23.6% CAGR, driven by the region's technological innovation and strong presence of automotive and semiconductor industries. South USA follows with a 21.1% CAGR, supported by its strong automotive manufacturing sector and increasing adoption of AI in vehicle systems for safety and performance. Northeast USA shows an 18.9% CAGR, with growth fueled by the region's tech-driven automotive industry, which is rapidly integrating AI for smarter and more sustainable vehicles. Midwest USA experiences a 16.4% CAGR, with steady demand driven by its established automotive manufacturing base and the increasing push toward innovation in vehicle technologies.

West USA is leading the demand for automotive AI chipsets, growing at an impressive 23.6% CAGR. The region’s strong technological infrastructure, particularly in Silicon Valley, is a key driver of this growth. West USA is home to several leading companies in the automotive and semiconductor industries, which are increasingly integrating AI technologies into vehicle systems. As autonomous driving, vehicle safety, and in-car entertainment systems continue to evolve, the demand for AI chipsets in automotive applications is expanding rapidly. West USA’s role as a hub for innovation in AI and machine learning technologies supports the ongoing development of advanced automotive solutions that rely heavily on AI chipsets.

The region’s automotive manufacturers are focusing on enhancing vehicle performance, safety, and driver assistance systems, driving up the need for AI chipsets. The growing investment in electric vehicles (EVs) and autonomous vehicles in West USA is expected to further increase the demand for automotive AI chipsets, maintaining the region’s leading position in the industry.

South USA is seeing robust demand for automotive AI chipsets, growing at a 21.1% CAGR. The region’s strong presence in the automotive manufacturing sector, including major automotive hubs in states like Michigan, Tennessee, and Alabama, is driving the demand for AI chipsets in vehicle systems. Automotive manufacturers in South USA are increasingly adopting AI-driven technologies for applications like driver assistance, vehicle safety, and autonomous driving, which rely on advanced AI chipsets for processing complex data in real time. The automotive industry’s shift toward electrification and autonomous driving is also contributing to this rise in demand.

South USA's investments in advanced manufacturing technologies and the expanding EV industry are fueling growth in the automotive AI chipset sector. As the region continues to develop and implement innovative AI technologies in vehicles, the demand for automotive AI chipsets is expected to grow steadily, supported by both traditional automakers and emerging EV manufacturers.

Northeast USA is experiencing significant demand for automotive AI chipsets, with an 18.9% CAGR. The region’s diverse industrial base, including strong automotive and technology sectors, is a key driver of this demand. Companies in the Northeast are increasingly integrating AI into vehicle systems for applications such as advanced driver-assistance systems (ADAS), vehicle navigation, and autonomous driving. As vehicle manufacturers in the region continue to invest in AI technologies to enhance vehicle safety, performance, and in-car experiences, the need for AI chipsets is growing.

The Northeast's position as a hub for tech innovation is contributing to the rise of AI chipsets in the automotive industry. The region’s expanding electric vehicle industry and the growing focus on sustainability are further driving the demand for smart vehicle solutions powered by AI. With continued advancements in AI technologies and the automotive industry’s push toward electrification, the demand for automotive AI chipsets in Northeast USA is expected to maintain steady growth.

Midwest USA is seeing steady demand for automotive AI chipsets, growing at a 16.4% CAGR. The region’s strong automotive manufacturing base, especially in Michigan, Ohio, and Indiana, is a major factor driving the demand for advanced AI technologies in vehicles. As the automotive sector increasingly adopts AI-driven solutions for applications such as safety, driver assistance, and autonomous driving, the need for automotive AI chipsets has grown significantly. With traditional automakers in the Midwest pushing for innovation in vehicle technologies, AI chipsets are playing a critical role in enhancing vehicle performance and safety systems.

The region’s investment in electric vehicle (EV) production and the growing focus on sustainable automotive solutions are further boosting the demand for automotive AI chipsets. As the Midwest’s automotive industry continues to evolve, with an increasing emphasis on AI, electric vehicles, and connected technologies, the demand for automotive AI chipsets is expected to grow steadily, supporting the region’s transition toward more advanced and intelligent vehicle systems.

The demand for automotive AI chipsets in the USA is increasing as the automotive industry rapidly adopts AI technologies to enable autonomous driving, advanced driver assistance systems (ADAS), and enhanced in-car experiences. These chipsets play a crucial role in processing vast amounts of data generated by sensors, cameras, and radar systems, enabling real-time decision-making in vehicles. The growth of electric vehicles (EVs), coupled with the shift towards autonomous and semi-autonomous driving, is significantly driving the demand for AI-powered chipsets. The automotive AI chipset industry is projected to grow substantially, fueled by technological advancements and the industry's push towards smarter, safer, and more efficient vehicles.

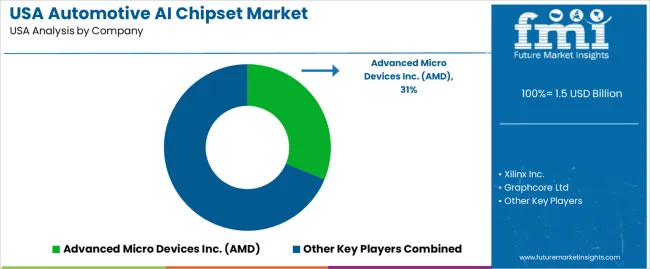

Leading providers in the automotive AI chipset industry in the USA include Advanced Micro Devices Inc. (AMD), Xilinx Inc., Graphcore Ltd, Huawei Technologies Co. Ltd, and IBM Corporation. AMD holds a dominant industry share of 31.3%, offering high-performance AI chipsets optimized for automotive applications, including AI-enabled driver assistance and autonomous systems. Xilinx Inc. provides flexible, high-performance FPGAs (field-programmable gate arrays) that are essential for AI processing in real-time automotive applications.

Graphcore Ltd focuses on developing advanced AI accelerators, specifically for machine learning tasks in autonomous vehicles. Huawei Technologies Co. Ltd supplies automotive chipsets for ADAS and other vehicle applications, while IBM Corporation is known for its AI solutions and processors, supporting automotive innovations in AI-powered systems.

The competitive dynamics in the automotive AI chipset industry are driven by factors such as the increasing need for high-performance, low-latency, and energy-efficient processing in automotive applications. Companies compete by offering innovative chipsets capable of handling complex AI algorithms required for autonomous driving, safety features, and in-car systems. As the demand for autonomous and semi-autonomous vehicles grows, manufacturers are focusing on providing AI solutions that enhance vehicle intelligence, improve driver safety, and reduce operational costs.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product | GPU, ASIC, CPU, FPGA |

| Application | Autonomous Driving, Advanced Driver Assistance Systems, Infotainment System, Voice and Gesture Recognition, Predictive Maintenance |

| Processing Type | Machine Learning, Computer Vision, Natural Language Processing |

| Vehicle Type | Passenger Vehicle, Commercial Vehicle |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Advanced Micro Devices Inc. (AMD), Xilinx Inc., Graphcore Ltd, Huawei Technologies Co. Ltd, IBM Corporation |

| Additional Attributes | Dollar sales by product, application, and processing type; regional CAGR and adoption trends; demand trends in automotive AI chipsets; growth in autonomous driving, ADAS, and infotainment sectors; technology adoption for machine learning, computer vision, and natural language processing; vendor offerings including AI chipsets and solutions for automotive applications; regulatory influences and industry standards |

The demand for automotive AI chipset in USA is estimated to be valued at USD 1.5 billion in 2025.

The market size for the automotive AI chipset in USA is projected to reach USD 9.5 billion by 2035.

The demand for automotive AI chipset in USA is expected to grow at a 20.5% CAGR between 2025 and 2035.

The key product types in automotive AI chipset in USA are gpu, asic, CPU and fgpa.

In terms of application, autonomous driving segment is expected to command 32.0% share in the automotive AI chipset in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

Automotive AI Chipset Market Trends – Growth & Forecast 2025 to 2035

Demand for Automotive Air Compressor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Roof Rails in USA Size and Share Forecast Outlook 2025 to 2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

USA Dairy Blends Market Insights – Demand, Size & Industry Trends 2025–2035

USA Hair Dryer Market Outlook – Size, Trends & Growth 2025-2035

USA Drain Cleaning Equipment Market Analysis – Size, Share & Trends 2025-2035

United States Non-Dairy Creamer Market Insights – Size, Demand & Forecast 2025–2035

USA Mountain and Ski Resort Market Insights – Growth, Trends & Forecast 2025-2035

Automotive Air Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Airbags Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Airbag Controller Unit Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Filter Market Growth - Trends & Forecast 2025 to 2035

Automotive Air Compressor Market Growth - Trends & Forecast 2025 to 2035

Automotive Airbag Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA