The demand for automotive air compressor in USA is expected to grow from USD 13.7 billion in 2025 to USD 18.7 billion by 2035, reflecting a CAGR of 3.2%. This expansion is tied to the ongoing evolution of vehicle propulsion systems, where pneumatic components remain essential for braking, suspension adjustment, and cabin pressurization across commercial fleets and passenger vehicles. American trucking operations depend heavily on air brake systems, which require reliable compressors to maintain stopping power under heavy loads and diverse road conditions.

The shift toward advanced driver-assistance features, including automated emergency braking and adaptive air suspension, is raising the performance bar for compressor units, as these systems demand faster response times and more consistent pressure delivery.

Electric vehicle platforms are introducing new design challenges and opportunities for air compressor suppliers. Unlike internal combustion engines, which traditionally powered compressors through belt drives, electric vehicles require standalone electric compressors that draw power directly from the battery pack. This transition is prompting engineers to develop more efficient motor designs and lightweight materials that minimize energy consumption and extend vehicle range.

The rise of autonomous delivery vans and electric semi-trucks in logistics networks is accelerating the adoption of electronically controlled air compressor systems that integrate with vehicle telematics, enabling predictive maintenance and remote diagnostics. As vehicle architectures diversify and performance requirements intensify, the USA remains a critical testing ground for next-generation automotive air compressor technologies.

The financial trajectory for automotive air compressor in USA demonstrates steady expansion, with the sector adding USD 5.0 billion in absolute value between 2025 and 2035. This growth reflects the dual pressures of fleet modernization and regulatory compliance, as aging commercial vehicles are replaced with models that meet stricter emissions standards and incorporate electronic stability controls. In 2025, the installed base is valued at USD 13.7 billion, anchored by the massive Class 8 trucking fleet that crisscrosses American highways, delivering goods from coast to coast and requiring robust air brake systems for safe operation.

From 2025 to 2030, the industry will advance from USD 13.7 billion to USD 15.8 billion, adding roughly USD 2.1 billion in incremental revenue. This phase captures the initial wave of electric commercial vehicle deployments, particularly in last-mile delivery segments where battery-electric vans are replacing diesel-powered counterparts in urban environments. These new platforms require electric air compressors that operate independently of the drivetrain, driving demand for compact, high-efficiency units that can cycle frequently without draining the battery. The passenger vehicle segment also contributes, as luxury automakers integrate air suspension systems that adjust ride height based on road conditions and driving modes, requiring dedicated compressor assemblies with sophisticated control algorithms.

From 2030 to 2035, the industry will expand from USD 15.8 billion to USD 18.7 billion, contributing an additional USD 2.9 billion. This second phase sees the maturation of autonomous trucking corridors in states like Texas and Arizona, where driverless heavy-duty trucks equipped with advanced pneumatic systems operate on designated routes. The need for redundancy and fail-safe operation in autonomous vehicles elevates compressor specifications, as any loss of air pressure could compromise braking or suspension stability.

Simultaneously, the retrofitting of existing diesel fleets with hybrid powertrains introduces new compressor configurations that balance mechanical and electric operation. The convergence of electrification, automation, and connectivity in commercial transportation drives sustained demand for automotive air compressor systems that deliver reliability, efficiency, and intelligent monitoring across the USA vehicle parc.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 13.7 billion |

| Industry Forecast Value (2035) | USD 18.7 billion |

| Industry Forecast CAGR (2025-2035) | 3.2% |

Demand for automotive air compressor in USA is anchored in the operational requirements of the nation's commercial trucking fleet, which relies on compressed air for critical safety systems including brakes, suspension, and trailer connections. Federal Motor Carrier Safety Administration regulations mandate minimum air pressure thresholds for commercial vehicles, ensuring that compressors must deliver consistent performance under diverse loads and environmental conditions. The American Trucking Associations estimate that over 3.9 million Class 8 trucks operate in USA, each equipped with air compressor systems that require periodic replacement due to wear from continuous cycling and exposure to road debris, temperature extremes, and vibration.

The transition toward cleaner propulsion technologies is reshaping compressor design and deployment. Electric trucks and buses entering service in California, Oregon, and Washington require electric air compressors that operate without the mechanical linkages found in traditional diesel engines, where compressors are driven by serpentine belts connected to the crankshaft. This shift demands new supplier capabilities in electric motor integration, battery load management, and thermal control, as electric compressors generate heat that must be dissipated without compromising vehicle range.

The rise of air suspension in passenger vehicles, particularly in full-size pickup trucks and luxury SUVs, creates additional demand for compact compressor units capable of rapid inflation and deflation to adjust ride height for towing, off-road navigation, or aerodynamic optimization at highway speeds. Despite these growth drivers, challenges persist: component shortages for electric motors and control electronics have constrained production capacity, while warranty concerns around compressor durability in electric vehicle applications require extensive field testing before mass adoption. Still, the imperative to maintain braking safety and enhance ride comfort ensures that automotive air compressor demand in USA will continue its upward climb.

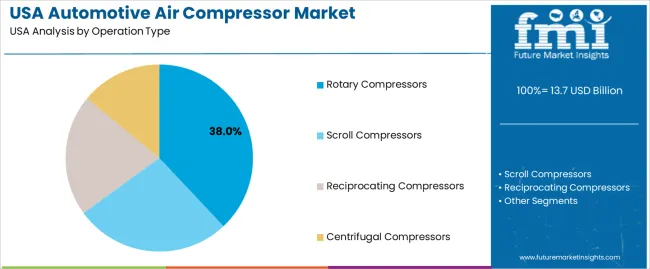

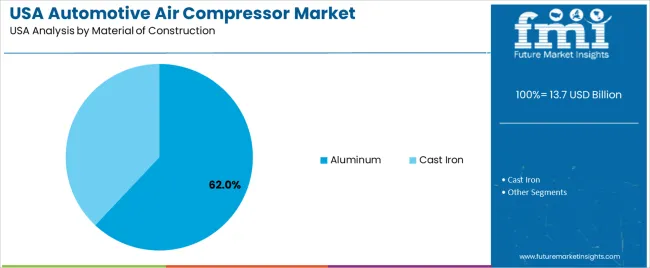

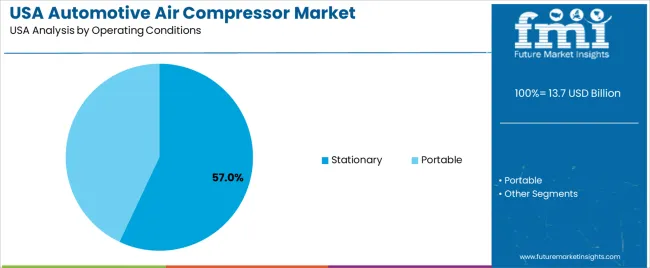

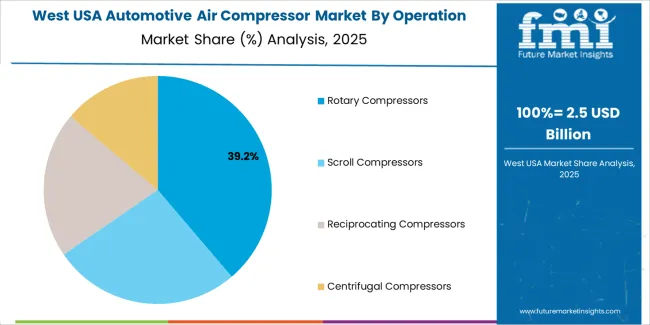

The demand for automotive air compressor in USA is defined by operation type, application, material of construction, and operating condition. The leading operation type is rotary compressor, which holds 38% share, while automotive passenger cars dominate the application segment at 30.0%. Aluminum accounts for 62.0% of the material of construction category, and stationary operating condition captures 57% of the installed base. Automotive air compressor systems have become indispensable across vehicle classes, driven by safety regulations for air brakes in commercial vehicles, the proliferation of adjustable air suspension in passenger models, and the electrification of powertrains that require standalone pneumatic solutions.

Rotary compressor operation type commands 38% of the automotive air compressor sector, reflecting its superior efficiency and compact packaging compared to reciprocating designs. Rotary compressors utilize rotating vanes or screws to compress air continuously, generating less vibration and noise than piston-based alternatives, which is critical in passenger vehicles where cabin refinement is paramount. In commercial truck applications, rotary compressors deliver the sustained airflow required to charge large reservoir tanks that supply air brakes, trailer connections, and pneumatic suspension systems across long-haul routes that can exceed 500 miles without engine shutdown.

The rotary configuration also offers advantages in electric vehicle applications, where compressor weight and energy consumption directly impact battery range. By eliminating the reciprocating motion that requires balancing masses and generates mechanical losses, rotary compressors achieve higher volumetric efficiency and require fewer maintenance intervals, reducing total cost of ownership for fleet operators. In USA, where commercial vehicles accumulate 100,000 miles or more annually, compressor reliability is non-negotiable, and rotary designs have proven their durability in demanding conditions ranging from the heat of Texas summers to the cold of Dakota winters.

Automotive passenger cars represent 30.0% of the application segment for automotive air compressor, driven by the growing adoption of air suspension systems in luxury sedans, performance coupes, and crossover SUVs. Air suspension allows drivers to adjust ride height for improved aerodynamics at highway speeds, increased ground clearance for rough roads, and enhanced comfort by isolating occupants from road irregularities. Brands such as Mercedes-Benz, Audi, and Cadillac offer air suspension as standard equipment on flagship models, while American pickup trucks like the Ram 1500 and GMC Sierra have introduced rear air suspension to improve load leveling when towing trailers.

The passenger car segment also benefits from the electrification trend, as battery-electric sedans and crossovers require onboard air compressors for functions beyond suspension, including tire inflation systems that monitor and adjust pressure in real time to optimize range and tire longevity. The proliferation of run-flat tire alternatives, which use compressor-driven inflation kits instead of spare tires, further drives demand in passenger vehicles where cargo space is at a premium. As consumers prioritize ride comfort, convenience features, and vehicle efficiency, passenger cars are adopting air compressor systems once reserved for commercial and luxury segments, positioning this application category for sustained growth in USA.

Aluminum accounts for 62.0% of the material of construction category for automotive air compressor, valued for its lightweight properties, corrosion resistance, and thermal conductivity. Compressor housings and cylinder blocks fabricated from aluminum alloys reduce overall vehicle weight, contributing to improved fuel economy in conventional vehicles and extended range in electric models. The material's ability to dissipate heat efficiently is critical for compressor longevity, as repeated compression cycles generate temperatures that can exceed 200 degrees Fahrenheit, requiring robust thermal management to prevent premature wear and seal degradation.

In USA, where commercial vehicles operate in environments ranging from humid Gulf Coast ports to arid Southwestern deserts, aluminum's resistance to rust and oxidation ensures reliable operation over the typical 10-year service life of heavy-duty trucks. The material's recyclability also aligns with corporate sustainability targets and federal procurement guidelines that favor components with lower lifecycle carbon footprints. As compressor designs evolve toward higher pressure outputs and faster cycling rates to support advanced driver-assistance systems, aluminum's favorable strength-to-weight ratio enables thinner-walled constructions that maintain structural integrity while shedding unnecessary mass.

Stationary operating condition captures 57% of the automotive air compressor category, referring to fixed installations within the vehicle's engine bay or chassis, as opposed to portable or auxiliary units. The vast majority of compressors in commercial trucks and passenger vehicles are permanently mounted components that integrate with the vehicle's electrical and mechanical systems, receiving power from the engine or battery and delivering compressed air to dedicated reservoirs and distribution lines. This stationary configuration offers several advantages, including secure mounting that withstands road vibration and impact forces, optimized plumbing that minimizes pressure losses, and centralized control through the vehicle's electronic architecture.

In USA, where federal safety standards govern commercial vehicle braking systems, stationary compressors undergo rigorous testing for pressure retention, cycling endurance, and cold-start performance to ensure compliance with FMVSS 121 air brake regulations. Fixed installations also enable advanced diagnostics, where onboard computers monitor compressor runtime, discharge temperature, and pressure buildup rates to predict maintenance needs and prevent roadside failures. The trend toward integrated vehicle platforms, where air supply serves multiple systems including brakes, suspension, transmission, and emissions control, reinforces the dominance of stationary compressors that can meet the cumulative demand of these pneumatic loads.

Demand for automotive air compressor in the United States is shaped by the imperatives of commercial vehicle safety, the transition to electric powertrains, and the proliferation of pneumatic comfort features in passenger vehicles. Growth originates from federal brake safety regulations that mandate air systems in heavy-duty trucks, the adoption of air suspension in luxury and work vehicles, and the electrification of compressor drives to eliminate mechanical dependencies on internal combustion engines. However, constraints such as supply chain bottlenecks for electric motors, warranty concerns around compressor durability in high-cycle applications, and cost pressures from fleet operators seeking to minimize total ownership expenses are moderating expansion.

Several factors support the rising demand for automotive air compressor across the United States. First, the commercial trucking sector continues to expand in response to e-commerce growth, with the American Trucking Associations projecting freight tonnage to increase by over 30% by 2032, necessitating a larger fleet of Class 8 trucks equipped with air brake systems. Second, federal and state regulations mandating electronic stability control and collision mitigation technologies in commercial vehicles require more sophisticated pneumatic systems that can respond to rapid control inputs, driving demand for higher-performance compressors with faster pressure recovery rates.

Third, the passenger vehicle segment is seeing air suspension adoption broaden beyond luxury models into mainstream pickup trucks and SUVs, where consumers value the ability to adjust ride height for towing, off-roading, and fuel economy optimization. Fourth, the electrification of vehicle platforms eliminates the traditional belt-driven compressor architecture, creating a retrofit opportunity as legacy vehicles are converted to hybrid or battery-electric configurations, requiring new electric compressor installations.

Despite robust fundamentals, several constraints limit the pace of adoption for automotive air compressor systems. Component shortages, particularly for the electric motors and power electronics required in battery-electric compressor units, have delayed production schedules and increased lead times for automakers and commercial vehicle manufacturers.

The complexity of integrating electric compressors into vehicle thermal management systems, where waste heat from compression cycles must be managed without overtaxing battery cooling circuits, adds engineering challenges and development costs. Fleet operators express concerns about the total cost of ownership for electric compressors, as early-generation units have exhibited higher failure rates compared to mechanical designs, leading to increased warranty claims and unscheduled maintenance events.

Major trends include the convergence of air compressor and thermal management functions, where compressor waste heat is captured and redirected for cabin heating in electric vehicles, improving overall energy efficiency. Predictive maintenance platforms are being deployed by fleet operators, using telematics data to monitor compressor discharge pressure, cycling frequency, and temperature profiles, enabling condition-based servicing that reduces downtime and extends component life. Lightweight composite materials are being evaluated for compressor housings and air reservoirs, offering further weight reduction without compromising structural integrity or pressure ratings.

Dual-compressor architectures are emerging in heavy-duty electric trucks, where redundant systems ensure braking capability even if one unit fails, addressing safety concerns around single-point failures in autonomous and long-haul applications. Automakers are also experimenting with variable-speed compressors that modulate output based on real-time demand, reducing parasitic losses during low-load conditions such as highway cruising, and delivering maximum flow during high-demand events like repeated brake applications on mountain grades.

The demand for automotive air compressor in USA is propelled by the critical role these components play in ensuring vehicle safety, comfort, and operational flexibility across diverse vehicle classes. In commercial transportation, air compressors are the heart of pneumatic brake systems that enable multi-ton trucks to stop safely, even when hauling maximum payloads down steep grades.

Federal regulations require commercial vehicles to maintain minimum air pressure thresholds, and any failure to meet these standards results in immediate vehicle grounding, making compressor reliability a top priority for fleet operators. The passenger vehicle sector is experiencing its own compressor-driven transformation, as automakers deploy air suspension systems that allow drivers to tailor ride characteristics for different driving conditions, from smooth highway cruising to aggressive off-road crawling.

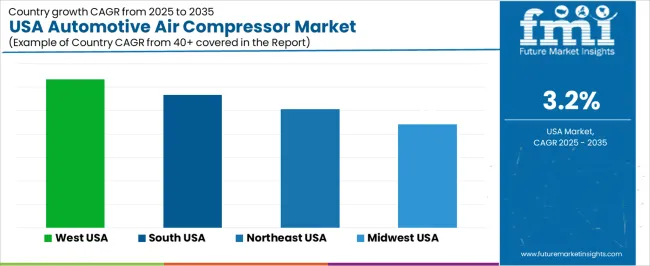

Regional demand patterns reflect the distribution of commercial activity, vehicle preferences, and infrastructure development across the USA. The West leads in adoption, driven by California's stringent emissions regulations that are accelerating the transition to electric trucks and buses, all of which require electric air compressor systems. The South shows robust growth, supported by major logistics hubs in Texas and Florida where commercial vehicle fleets are expanding to meet distribution demands.

The Northeast benefits from dense urban corridors where stop-and-go traffic places heavy demands on brake systems, requiring frequent compressor cycling. The Midwest, with its concentration of manufacturing and agriculture, maintains steady demand for compressors in vocational trucks and specialty vehicles. This analysis explores the regional dynamics shaping demand for automotive air compressor across the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 3.2% |

| South USA | 2.8% |

| Northeast USA | 2.5% |

| Midwest USA | 2.2% |

The West USA region leads the nation in demand for automotive air compressor with a CAGR of 3.2%, propelled by California's ambitious transition to zero-emission vehicles and the state's outsized influence on national automotive standards. California's Advanced Clean Trucks regulation requires manufacturers to sell increasing percentages of electric trucks starting in 2024, with a target of 100% zero-emission sales for certain vehicle classes by 2036.

Electric trucks require standalone electric air compressors that operate independently of the drivetrain, creating a wholesale replacement cycle as diesel-powered fleets are retired. The state's major ports in Los Angeles and Long Beach, which handle roughly 40% of containerized imports entering the USA, are driving demand for electric drayage trucks equipped with advanced compressor systems that can handle the frequent stop-start cycles of intermodal operations.

The West also benefits from strong passenger vehicle adoption of air suspension, particularly in the luxury SUV and pickup truck segments that are popular in affluent industries like San Francisco, Seattle, and Denver. These vehicles use air compressors to adjust ground clearance for ski trips, beach outings, and urban parking, appealing to consumers who value versatility. The region's challenging geography, from Sierra Nevada mountain passes to Arizona desert highways, tests compressor durability under temperature extremes and altitude variations, making it an ideal proving ground for next-generation technologies. As the West continues to lead in vehicle electrification and regulatory innovation, demand for automotive air compressor will maintain its rapid growth trajectory.

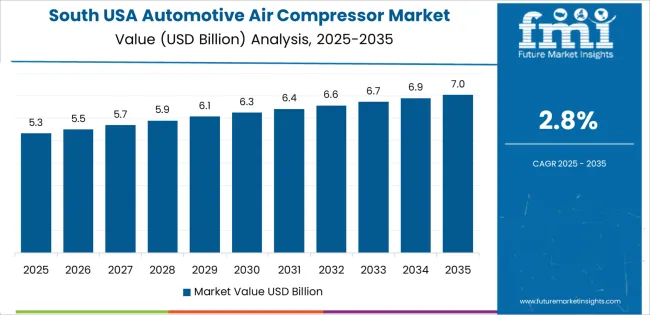

The South USA demonstrates strong demand for automotive air compressor with a CAGR of 2.8%, driven by the region's booming logistics sector and the concentration of commercial vehicle manufacturing facilities. Texas alone accounts for over 10% of all heavy-duty truck registrations in USA, reflecting the state's role as a major freight crossroads with extensive highway networks connecting Gulf Coast ports, manufacturing centers, and distribution hubs. The expansion of nearshoring initiatives, where companies relocate production from overseas to Mexico and the southern USA, is increasing trucking activity along Interstate 35 and Interstate 10 corridors, driving replacement demand for air compressor systems that wear out after several hundred thousand miles of service.

The South's preference for full-size pickup trucks, which dominate sales in states like Texas, Louisiana, and Georgia, is also supporting compressor demand as manufacturers offer air suspension options that improve towing capability and ride comfort. The region's hot, humid climate places additional stress on compressor seals and lubricants, shortening service intervals and accelerating replacement cycles compared to more temperate regions.

Florida's growing population and construction activity are driving vocational truck sales, including dump trucks, concrete mixers, and utility vehicles, all of which rely on air compressors for brake operation and auxiliary functions such as dump bed actuation. As the South continues to attract manufacturing investment and population growth, the region's automotive air compressor demand will remain robust.

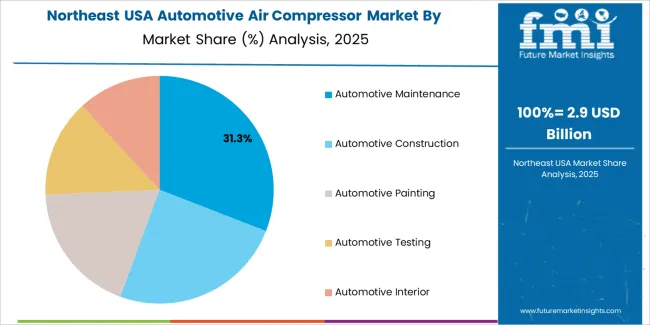

The Northeast USA exhibits steady demand for automotive air compressor with a CAGR of 2.5%, reflecting the region's mature vehicle parc and the harsh operating conditions that accelerate component wear. The region's dense urban corridors, particularly the Boston-Washington megalopolis, generate heavy commercial vehicle traffic for last-mile delivery, waste collection, and municipal services, all of which require reliable air brake systems. The Northeast's extreme seasonal temperature swings, from sub-zero winter nights to humid summer days, challenge compressor performance, as cold starts require higher motor torque and moisture condensation can corrode internal components if not properly managed through air dryers and filtration systems.

The region's aging infrastructure, including pothole-riddled roads and corroded bridges, subjects vehicles to severe vibration and impact loads that can loosen compressor mountings and damage pneumatic lines, increasing maintenance frequency. Fleet operators in the Northeast prioritize compressor reliability and cold-weather performance, often specifying premium units with enhanced thermal insulation and low-temperature lubricants.

The passenger vehicle segment in affluent industries like New York, Boston, and Philadelphia shows continued uptake of luxury sedans and SUVs with air suspension, supporting steady compressor demand even as overall vehicle sales moderate. While growth rates trail the West and South, the Northeast's vehicle replacement cycles and harsh operating environment ensure sustained demand for automotive air compressor systems.

The Midwest USA shows moderate growth in demand for automotive air compressor with a CAGR of 2.2%, underpinned by the region's agricultural economy and manufacturing base that support substantial commercial vehicle activity. The Midwest operates large fleets of vocational trucks for agriculture, construction, and mining, including grain haulers, livestock trailers, and heavy equipment transporters, all of which depend on air brake systems for safe operation on rural highways and farm-to-market roads. The region's agricultural cycle creates seasonal demand spikes, as compressor failures during harvest season can sideline trucks when they are needed most, driving preventive replacement strategies among fleet operators.

The Midwest's automotive manufacturing heritage continues to influence local demand, as Detroit's Big Three produce commercial trucks and vans that are tested extensively in Michigan's variable climate and rough road conditions. The region's four-season weather, with cold winters that challenge compressor cold-start performance and hot summers that stress cooling systems, requires robust designs that can maintain consistent output across temperature extremes.

The Midwest is also seeing growth in food distribution and e-commerce fulfillment, with major hubs in Chicago, Indianapolis, and Columbus driving demand for medium-duty delivery trucks equipped with air brake systems. As the region's logistics infrastructure modernizes and agricultural operations mechanize further, automotive air compressor demand will gradually accelerate, supported by the replacement of aging vehicle fleets and the adoption of electric vocational vehicles in urban applications.

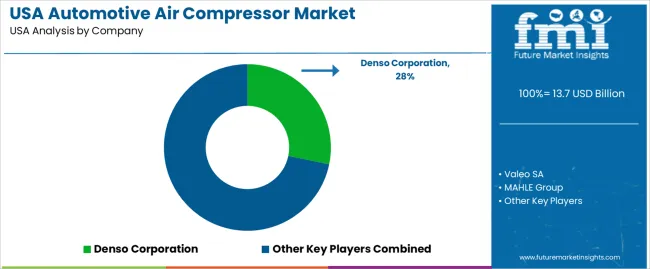

The automotive air compressor industry in the United States is characterized by intense competition among established suppliers such as Denso Corporation (holding 28.2% share), Valeo SA, MAHLE Group, Hanon Systems, and WABCO (ZF), who are navigating the transition from mechanically driven compressors in internal combustion vehicles to electrically powered units in battery-electric platforms.

These suppliers must balance the need for backward compatibility with existing truck fleets, which have decades of service life remaining, while simultaneously developing next-generation electric compressors that meet the stringent efficiency and weight requirements of zero-emission vehicles. The commercial vehicle segment remains the largest revenue source, but passenger vehicle applications are growing rapidly as air suspension migrates from luxury models into mainstream pickup trucks and SUVs.

Competition revolves around technological innovation, manufacturing efficiency, and global supply chain capabilities. Suppliers invest in brushless DC motor technologies, advanced control algorithms, and integrated power electronics to deliver electric compressors that minimize battery drain while maintaining rapid pressure buildup. Vertical integration strategies, where compressor manufacturers also supply air dryers, reservoirs, and distribution valves, offer advantages in system optimization and cost reduction.

Companies emphasize their automotive-grade certifications, including TS 16949 quality standards and FMVSS compliance for brake systems, in technical documentation aimed at OEM procurement teams. Partnerships with electric truck startups and established commercial vehicle manufacturers are critical for securing design-in positions on next-generation platforms.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Operation Type | Rotary Compressor, Scroll Compressor, Reciprocating Compressor, Centrifugal Compressor |

| Application | Automotive Passenger Cars, Automotive Light Commercial Vehicles, Automotive Heavy Commercial Vehicles, Automotive Off-Highway Vehicles, Automotive Electric Vehicles |

| Material of Construction | Aluminum, Cast Iron |

| Operating Condition | Stationary, Portable |

| Key Companies Profiled | Denso Corporation, Valeo SA, MAHLE Group, Hanon Systems, WABCO (ZF) |

| Additional Attributes | Dollar sales by operation type, application, construction material, and operating conditions are evaluated alongside USA demand driven by safety regulations, fleet electrification, and air suspension adoption, with competition focused on electric compressors, predictive maintenance, lightweight materials, and autonomous-ready thermal management. |

The demand for automotive air compressor in USA is estimated to be valued at USD 13.7 billion in 2025.

The market size for the automotive air compressor in USA is projected to reach USD 18.7 billion by 2035.

The demand for automotive air compressor in USA is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in automotive air compressor in USA are rotary compressors, scroll compressors, reciprocating compressors and centrifugal compressors.

In terms of application, automotive maintenance segment is expected to command 30.0% share in the automotive air compressor in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

Automotive Air Compressor Market Growth - Trends & Forecast 2025 to 2035

Air Compressor Filters and Compressed Air Dryers Market Growth - Trends & Forecast 2025 to 2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

USA Dairy Blends Market Insights – Demand, Size & Industry Trends 2025–2035

USA Hair Dryer Market Outlook – Size, Trends & Growth 2025-2035

United States Non-Dairy Creamer Market Insights – Size, Demand & Forecast 2025–2035

Automotive Air Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Airbags Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Airbag Controller Unit Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Filter Market Growth - Trends & Forecast 2025 to 2035

USA Scroll Compressor Market Growth - Trends & Forecast 2025 to 2035

Automotive Airbag Market Growth - Trends & Forecast 2025 to 2035

Automotive Air Intake Manifold Market

Automotive Air Vent Assembly Market

Automotive E-Compressor Market Analysis by Type, Application, Electric Vehicle, and Region Forecast Through 2035

Automotive AC Compressor Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA