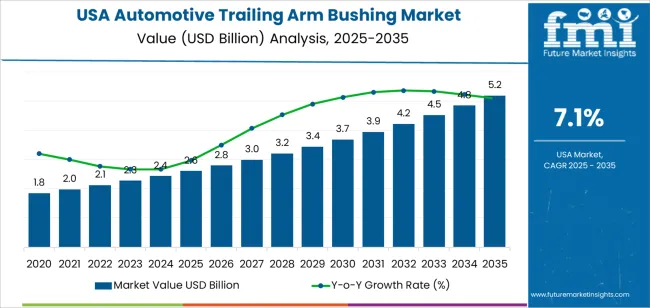

In 2025, demand for automotive trailing arm bushings in the USA is estimated at USD 2.6 billion and is forecast to reach USD 5.2 billion by 2035 at a CAGR of 7.1%. Growth in the first half of the period is anchored in high suspension wear rates across pickup trucks, sport utility vehicles, and delivery vans that dominate the USA vehicle mix. Trailing arm bushings face continuous stress from uneven road surfaces, towing loads, and urban stop start driving, which sustains strong replacement demand. Independent repair shops and fleet maintenance centers account for a large share of consumption. Rubber bonded metal bushings remain standard in mass market vehicles, while polyurethane variants gain relevance in performance and heavy duty applications.

After 2030, demand growth is shaped more by vehicle weight and ride control requirements than by unit production alone. Electric vehicles add incremental load on rear suspension systems due to battery mass, which raises bushing fatigue rates and service frequency. Light commercial fleets continue to expand with e commerce and last mile logistics activity, supporting steady aftermarket turnover. Key suppliers include North America based suspension component manufacturers and global elastomer specialists with USA production operations. Competitive positioning centers on noise and vibration control, tear resistance, and consistency under thermal cycling. Long term supply agreements with OEMs and regional distribution strength across service networks support stable value expansion through 2035.

The overall demand for automotive trailing arm bushing in USA increases from USD 2.6 billion in 2025 to USD 2.8 billion by 2030, adding USD 0.2 billion in absolute value. This phase reflects structurally steady growth tied to stable suspension system designs and consistent vehicle production across passenger cars, SUVs, and light commercial vehicles. Demand remains closely linked to routine replacement cycles and OEM fitment volumes rather than major shifts in suspension architecture. Material formulations and bushing geometries evolve incrementally to improve durability and noise isolation, but the value per unit remains largely stable. Growth during this phase is volume anchored and reflects controlled expansion without structural acceleration.

From 2030 to 2035, the market expands from USD 2.8 billion to USD 5.2 billion, adding a significantly larger USD 2.4 billion within the second half of the decade. This back weighted acceleration reflects rising mechanical loads from heavier electric vehicles, higher torque platforms, and increased adoption of multi-link rear suspension systems in mass and premium vehicle segments. Trailing arm bushing specifications shift toward higher performance elastomers, improved vibration isolation, and longer service life. As a result, both unit volume and value density increase, transforming the demand curve from steady replacement driven growth to performance driven value expansion.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 2.6 billion |

| Forecast Value (2035) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

Demand for trailing arm bushings in the USA has grown in step with increased production and use of rear-suspension vehicles such as SUVs, light trucks and crossovers. As these vehicles became more common, suspension systems required bushings that deliver reliable damping, ride comfort and wheel alignment under heavier loads and varied road conditions. Original equipment demand rose with new vehicle builds, while the aftermarket segment gained strength because bushings wear over time from stress, road salt, and rough roads. Rear-suspension designs using trailing arms require regular inspection; wear or failure in these bushings can lead to vehicle instability, uneven tyre wear, and poor ride comfort, prompting replacements.

Looking ahead, demand will be shaped by shifting vehicle architectures, material innovations, and changing ownership patterns. Growth in electric and hybrid powertrains may change rear-axle load distribution yet still rely on trailing-arm designs, which keeps bushings relevant. Manufacturers are also likely to adopt higher-durability materials such as polyurethane or advanced elastomers to meet expectations for longer service life and better ride quality. On the other hand, increased use of independent suspension designs, modular chassis architectures, and lighter-weight under-body components may reduce the frequency of bushing replacements or change specifications. Market growth will thus depend on how vehicle design evolves and how repair and maintenance culture adapts to newer suspension systems.

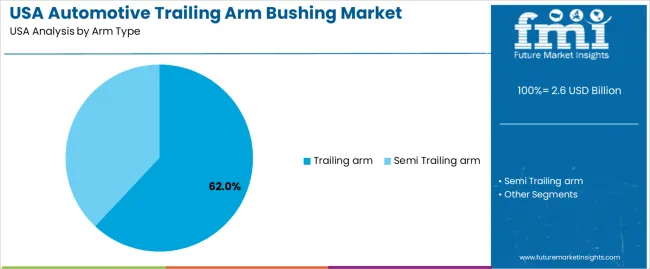

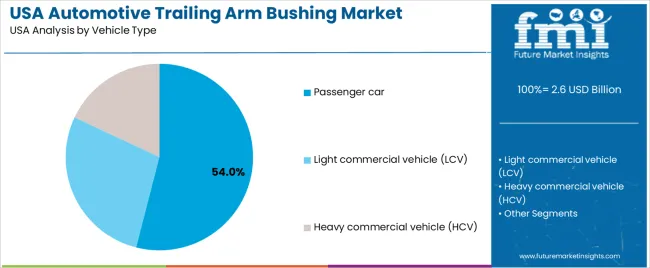

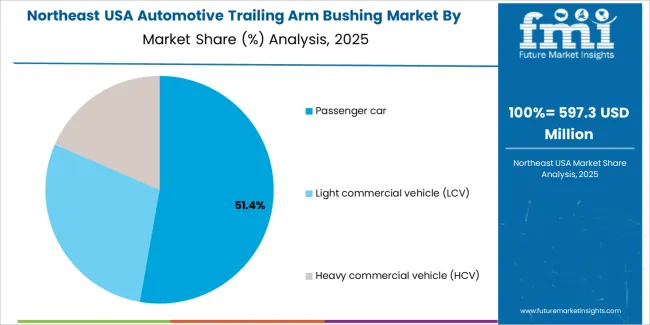

The demand for automotive trailing arm bushings in the USA is structured by arm type and vehicle type. Trailing arm bushings account for 62% of total demand, followed by semi trailing arm bushings used in selected suspension architectures. By vehicle type, passenger cars represent 54.0% of total consumption, followed by light commercial vehicles and heavy commercial vehicles. Demand patterns are shaped by suspension design preferences, ride comfort expectations, and vehicle load profiles. These segments reflect how underbody architecture and vehicle usage intensity define bushing specification choices across original equipment manufacturing and aftermarket service networks in the USA.

Trailing arm bushings account for 62% of total demand in the USA. Their dominance reflects widespread use of trailing arm suspension layouts in rear axle systems across a broad range of passenger cars and crossovers. Trailing arm designs provide stable wheel alignment control, predictable handling behavior, and effective isolation of road vibration. These functional advantages support consistent adoption across volume vehicle platforms.

Trailing arm bushings also exhibit steady replacement demand due to exposure to road shock, thermal cycling, and long term material fatigue. Rubber and elastomer degradation under repeated suspension movement leads to predictable service intervals. Independent repair workshops stock trailing arm bushings as fast moving suspension components due to frequent wear related failures. These production scale and service driven factors sustain trailing arm bushings as the leading arm type segment within the USA automotive suspension bushing landscape.

Passenger cars account for 54.0% of total automotive trailing arm bushing demand in the USA. This leadership reflects the size of the domestic passenger vehicle fleet and the frequency of suspension maintenance across daily use vehicles. Passenger cars operate under continuous stop start traffic, variable road surfaces, and diverse climate conditions that accelerate bushing wear. These operating patterns create recurring aftermarket replacement demand.

New passenger vehicle production also contributes materially to bushing volumes through original equipment installation. Suspension tuning requirements for comfort and noise isolation remain more stringent in passenger cars compared with commercial platforms. Higher sensitivity to ride quality drives more frequent bushing replacement to restore handling response and vibration isolation. These fleet size, usage intensity, and comfort driven factors position passenger cars as the dominant vehicle type segment for trailing arm bushing demand across the USA.

Demand for automotive trailing arm bushings in the USA is driven by high vehicle ownership, long driving distances, and sustained stress on rear suspension systems. SUVs, pickup trucks, and crossovers dominate USA roads and place continuous load on trailing arms during towing, hauling, and uneven road travel. Fleet vehicles and ride-hailing platforms accumulate mileage rapidly, which accelerates bushing wear. Growth in independent rear suspension systems across mid-size and premium vehicles also increases bushing count per vehicle. These structural vehicle and usage patterns sustain strong OEM and aftermarket demand.

USA driving conditions place repeated mechanical and vibrational stress on trailing arm bushings. Rough urban pavement, highway expansion joints, and uneven rural roads create constant torsional loading. Winter freeze-thaw cycles in northern states harden rubber compounds and promote early cracking. Heavy braking, sharp acceleration, and frequent lane changes in congested metro corridors increase rear suspension articulation. Towing boats, trailers, and RVs further amplifies rear axle movement. These combined roads and driving behaviors accelerate bushing fatigue and shorten replacement intervals across much of the USA vehicle fleet.

Trailing arm bushing demand in the USA is restrained by integrated suspension designs that bundle multiple components into single replacement modules. In some platforms, full trailing arm replacement is favored over individual bushing service, which reduces standalone bushing sales. Price sensitivity in older vehicles leads some owners to defer suspension maintenance. Rising rubber compound and synthetic elastomer costs pressure supplier margins. Labor cost also affects replacement frequency, as bushing installation often requires press fitting and alignment. These economic and design factors moderate aggressive volume expansion.

Automotive trailing arm bushings in the USA are shifting toward advanced rubber compounds, hydraulic bushings, and hybrid elastomer designs to improve vibration isolation without sacrificing durability. Luxury SUVs and electric vehicles demand quieter suspension response, which raises use of fluid-filled bushings. Corrosion-resistant sleeves and bonded metal inserts improve service life in salt-exposed regions. Performance-focused aftermarket segments adopt polyurethane bushings for tighter handling. These trends show trailing arm bushings evolving from basic wear parts into tuned ride-comfort and noise-control components within modern USA suspension systems.

| Region | CAGR (%) |

|---|---|

| West USA | 8.2% |

| South USA | 7.3% |

| Northeast USA | 6.6% |

| Midwest USA | 5.7% |

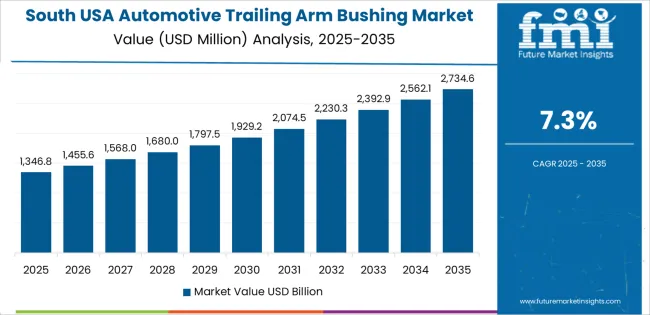

The demand for automotive trailing arm bushings in the USA is forecast to grow across regions, with the West leading at 8.2% CAGR. This growth is likely driven by rising production of vehicles requiring robust suspension components, increasing sales of SUVs and pickup trucks, and demand for replacement bushings in after-market maintenance and repairs. The South shows 7.3% growth supported by strong automotive manufacturing and high vehicle usage. The Northeast at 6.6% benefits from urban and suburban vehicle fleets undergoing maintenance cycles. The Midwest, with 5.7% growth, reflects steady demand through new vehicle output and replacement-part demand in older vehicle fleets.

Growth in the West reflects a CAGR of 8.2% through 2035 for automotive trailing arm bushing demand, supported by high electric vehicle penetration, dense urban driving, and strong performance vehicle usage. Increased vehicle weight from battery systems adds stress to suspension joints, accelerating bushing wear. Mountain terrain, coastal highways, and frequent stop and go traffic raise vibration exposure. Aftermarket servicing remains highly active due to lifestyle vehicle preferences. Demand stays balanced between OEM installation and replacement driven aftermarket activity across passenger vehicles, light commercial fleets, and premium utility platforms operating in western transport corridors.

The South advances at a CAGR of 7.3% through 2035 for automotive trailing arm bushing demand, driven by high pickup truck usage, continuous fleet operations, and heavy towing activity. Rural roads, construction access routes, and agricultural transport increase suspension articulation and joint wear. Assembly plants across southern states maintain steady OEM sourcing for chassis components. Commercial fleets generate predictable replacement cycles due to constant road exposure. Purchasing priorities emphasize durability and heat resistance rather than comfort tuning across fleets, utility vehicles, and mass market passenger models serving regional transport needs.

The Northeast records a CAGR of 6.6% through 2035 for automotive trailing arm bushing demand, shaped by harsh winters, road salt exposure, and dense urban driving conditions. Moisture ingress and corrosion accelerate rubber and elastomer degradation at suspension joints. Frequent braking and uneven road surfaces raise articulation cycles. Aging vehicle fleets in metropolitan areas support strong aftermarket replacement activity. Municipal service vehicles and ride share fleets add institutional demand. Demand remains replacement led, with service oriented purchasing dominating across urban repair networks and regional vehicle maintenance corridors.

The Midwest expands at a CAGR of 5.7% through 2035 for automotive trailing arm bushing demand, supported by freight hauling, agricultural transport, and long distance rural driving conditions. Heavy payloads and uneven surfaces impose sustained mechanical loads on rear suspension systems. Seasonal temperature swings increase material expansion and contraction stress. Fleet dominated vehicle usage shapes predictable replacement intervals. Manufacturing centered demand remains stable through continued passenger vehicle and truck production. Growth stays maintenance driven, aligned with structured fleet service schedules and long mileage operating environments.

Demand for trailing arm bushings in the USA is rising as automakers and consumers increasingly value ride comfort, vehicle stability, and lower noise vibration harshness (NVH). Rear suspension designs using trailing arms remain common among many passenger cars and light trucks. As vehicle production including SUVs and electric vehicles expands, the need for reliable bushings that absorb shock, reduce vibration, and maintain proper wheel alignment grows accordingly. Replacement demand from ageing vehicles and the robust aftermarket culture in the USA further sustains demand for trailing arm bushings, for both OEM spec and replacement applications.

Key companies supplying trailing arm bushings in the USA include ZF Friedrichshafen AG, Continental, Federal Mogul LLC, ACDelco, and Mevotech. ZF Friedrichshafen and Continental leverage global supply chain strength and deep engineering capabilities to serve OEMs and aftermarket. Federal Mogul and ACDelco cater mainly to replacement and maintenance segments, offering compatible bushing solutions for a broad range of vehicles. Mevotech focuses on performance oriented and heavy duty bushings for demanding use cases. These firms shape the market by supplying a mix of high quality OEM grade components and aftermarket alternatives.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Arm Type | Trailing arm, Semi trailing arm |

| Vehicle Type | Passenger car, Light commercial vehicle (LCV), Heavy commercial vehicle (HCV) |

| Sales Channel | OEM, Aftermarket |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | ZF Friedrichshafen AG, Continental, Federal Mogul LLC, ACDelco, Mevotech |

| Additional Attributes | Dollar-value distribution by arm type and vehicle type; regional CAGR projections; trailing arm bushings dominate due to widespread use in rear suspension designs; replacement demand driven by wear, road conditions, and vehicle load; semi trailing arm bushings serve specialized suspension configurations; post-2030 growth anchored in EV adoption, heavier torque platforms, and multi-link suspension uptake; supplier focus on vibration isolation, durability, thermal cycling resistance, and OEM/aftermarket service network coverage; demand driven by ride comfort, NVH control, and fleet maintenance cycles across passenger, light, and heavy commercial vehicles. |

The demand for automotive trailing arm bushing in USA is estimated to be valued at USD 2.6 billion in 2025.

The market size for the automotive trailing arm bushing in USA is projected to reach USD 5.2 billion by 2035.

The demand for automotive trailing arm bushing in USA is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in automotive trailing arm bushing in USA are trailing arm and semi trailing arm.

In terms of vehicle type, passenger car segment is expected to command 54.0% share in the automotive trailing arm bushing in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Trailing Arm Bushing Market Growth - Trends & Forecast 2025 to 2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

USA Pharmaceutical Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Automotive Idler Arm Market

Automotive Rocker Arm Market Growth – Trends & Forecast 2025 to 2035

Automotive Suspension Control Arms Market Growth – Trends & Forecast 2025 to 2035

Demand for Automotive UPS in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive NFC in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Headliner in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Light Bars in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive HVAC Ducts in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Door Sills in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive AI Chipset in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brake Tube in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Roof Rails in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Racing Seats in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA