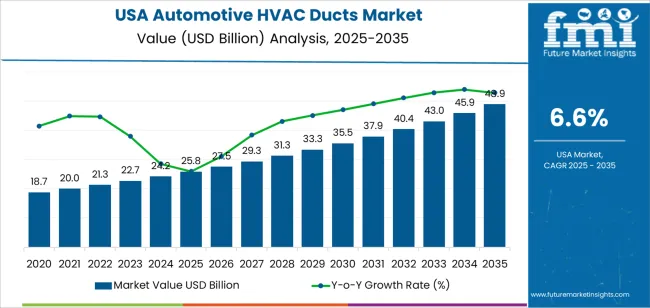

The demand for automotive HVAC ducts in USA is projected to climb from USD 25.8 billion in 2025 to USD 48.9 billion by 2035, reflecting a CAGR of 6.6%. This trajectory is fueled by the increasing complexity of vehicle climate control systems, where occupants expect multi-zone temperature regulation, rapid defrosting capabilities, and whisper-quiet airflow across all seating positions.

American consumers purchasing vehicles in climates ranging from Florida's humidity to Minnesota's freezing winters demand robust ductwork that delivers consistent thermal comfort without rattling or leaking. The shift toward larger cabin volumes in popular SUVs and pickup trucks necessitates longer duct runs and more sophisticated routing to reach third-row passengers, driving both unit volume and revenue per vehicle.

Electric vehicle adoption is reshaping HVAC duct design fundamentally. Unlike internal combustion engines that generate abundant waste heat for cabin warming, battery-electric vehicles must rely on electric resistance heaters or heat pumps, both of which require optimized duct geometry to minimize energy consumption and preserve driving range. Automakers are investing in computational fluid dynamics simulations to reduce airflow restrictions within ducts, allowing smaller blowers to achieve the same climate control performance while drawing less power from the battery pack.

The rise of autonomous vehicle concepts introduces new design challenges, as occupants may face rearward or inward rather than forward, requiring flexible duct architectures that can direct conditioned air to unconventional seating configurations. As vehicle interiors evolve and thermal efficiency becomes a competitive differentiator, the USA remains a proving ground for advanced automotive HVAC duct technologies.

The financial outlook for automotive HVAC ducts in USA reveals accelerating expansion, with the sector adding USD 23.1 billion in absolute value between 2025 and 2035. This near-doubling of revenue reflects the convergence of vehicle electrification, cabin premiumization, and regulatory pressures for improved air quality. In 2025, the installed base is valued at USD 25.8 billion, supported by strong vehicle production volumes and the continued popularity of light trucks, which feature more extensive duct networks than passenger cars due to their larger interior volumes and multiple seating rows.

From 2025 to 2030, the industry will advance from USD 25.8 billion to approximately USD 35.2 billion, adding roughly USD 9.4 billion in incremental revenue. This phase captures the widespread adoption of multi-zone climate control systems, even in mid-tier vehicle segments, as automakers respond to consumer expectations for personalized comfort. The introduction of cabin air filtration systems with HEPA-grade filters, driven by heightened awareness of airborne pathogens and particulates, requires redesigned duct paths that accommodate larger filter housings without compromising airflow. Electric vehicle launches during this period necessitate weight reduction efforts, pushing suppliers to develop thinner-walled ducts with reinforced ribs that maintain structural integrity while shedding grams throughout the system.

From 2030 to 2035, the industry will surge from USD 35.2 billion to USD 48.9 billion, contributing an additional USD 13.7 billion. This second phase sees the maturation of heat pump technology in electric vehicles, which reverses refrigerant flow to extract heat from ambient air during cold weather, requiring bidirectional duct designs with integrated dampers and flow sensors. Autonomous vehicle deployments introduce lounge-style seating arrangements where occupants face each other, demanding flexible duct systems with adjustable outlets that can redirect airflow as seats rotate or recline.

The convergence of advanced materials, including bio-based polymers and recycled composites, with digital manufacturing techniques such as additive manufacturing for low-volume luxury applications, drives innovation and value creation. As vehicle cabins become more sophisticated and energy efficiency becomes paramount, the USA automotive HVAC duct sector will sustain its robust growth trajectory.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 25.8 billion |

| Industry Forecast Value (2035) | USD 48.9 billion |

| Industry Forecast CAGR (2025-2035) | 6.6% |

Demand for automotive HVAC ducts in USA is driven by the fundamental requirement to deliver conditioned air from centralized heating and cooling units to every corner of the vehicle cabin, ensuring occupant comfort across diverse climate zones and driving conditions. American consumers expect rapid defrosting on winter mornings, instant cooling during summer heat waves, and the ability to set different temperatures for driver and passenger zones, all of which depend on sophisticated duct networks that route airflow with minimal noise and pressure loss. The popularity of three-row SUVs and crew-cab pickup trucks in USA creates unique challenges, as rear passengers seated far from the HVAC unit require dedicated duct branches that maintain sufficient airflow velocity without generating turbulence or whistling sounds.

The electrification of vehicle fleets is introducing new constraints and opportunities for HVAC duct design. Electric vehicles cannot rely on engine waste heat for cabin warming, forcing automakers to deploy electric heaters or heat pumps that must operate efficiently to avoid draining the battery. This energy scarcity makes duct optimization critical, as any restriction or leakage directly reduces climate control effectiveness and shortens vehicle range. Suppliers are developing ducts with smooth internal surfaces and minimal bends to reduce friction losses, while incorporating lightweight materials that lower overall vehicle mass.

Regulatory developments around cabin air quality, particularly in California where stricter standards for volatile organic compound emissions and particulate filtration are under consideration, are pushing automakers to redesign duct systems to accommodate larger filters and recirculation paths. Despite these growth drivers, challenges persist: the complexity of routing ducts through increasingly crowded engine bays and dashboards, where electronic components, wiring harnesses, and structural reinforcements compete for space, constrains design freedom.

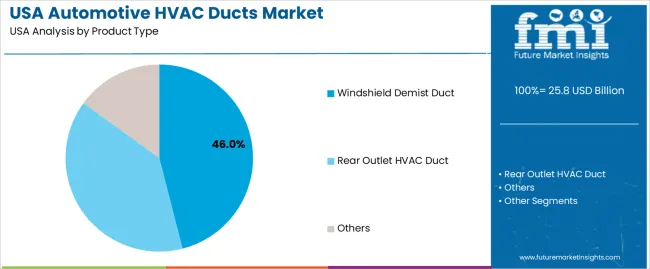

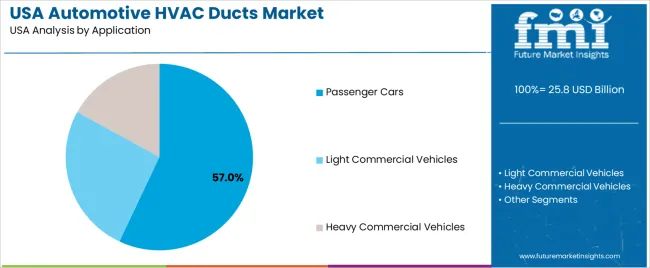

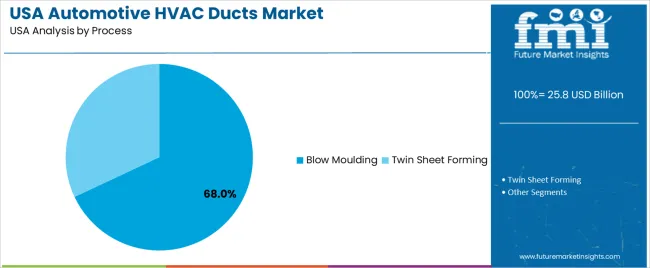

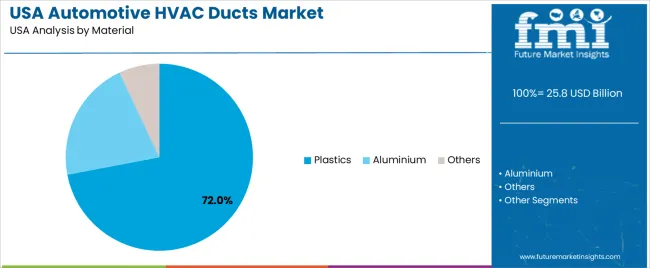

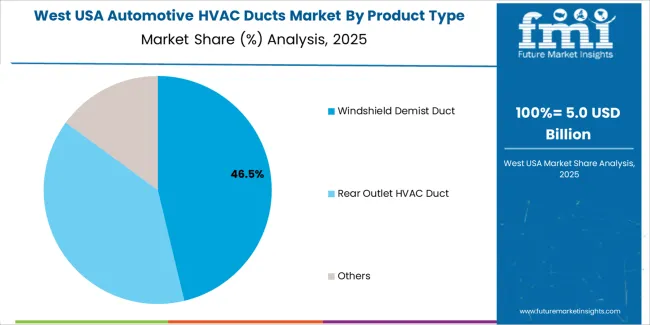

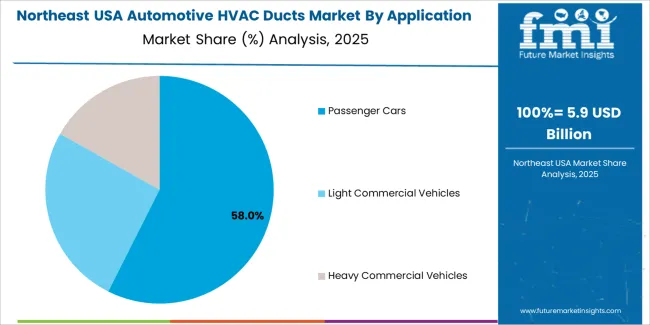

The demand for automotive HVAC ducts in USA is characterized by product type, application, process, and material. The leading product type is windshield defrost ducts, which hold 46% share, while passenger vehicles dominate the application segment at 57.0%. Blow molding accounts for 68.0% of the process category, and plastics capture 72% of the material composition. Automotive HVAC ducts have become essential components across vehicle classes, driven by consumer expectations for rapid climate adjustment, the need for clear visibility through defogging systems, and the transition to electric powertrains that demand energy-efficient airflow management.

Windshield defrost ducts command 46% of the automotive HVAC duct sector, reflecting their critical role in vehicle safety and regulatory compliance. Federal Motor Vehicle Safety Standard 103 mandates that all passenger vehicles sold in USA must clear a specified portion of the windshield from frost or condensation within a defined timeframe, making effective defrost ducts a non-negotiable design requirement. These ducts must deliver high-velocity airflow across the full width of the windshield, requiring precise outlet positioning and internal vane geometries that distribute air evenly without creating dead zones where ice or fog can persist.

In USA, where drivers in northern states regularly face sub-zero temperatures and freezing precipitation, windshield defrost performance is a key purchase consideration. Consumers expect near-instant clearing when starting cold-soaked vehicles, pushing automakers to oversize defrost ducts relative to other cabin outlets and prioritize airflow to the windshield during initial startup sequences.

The transition to electric vehicles complicates defrost performance, as electric heaters take longer to reach operating temperature compared to internal combustion engines that generate immediate waste heat. This lag time is driving innovations in duct design, including integrated electric heating elements within the duct walls and reflective coatings that direct radiant heat toward the glass. As vehicle windshields grow larger and more steeply raked for aerodynamic efficiency, defrost duct complexity increases, reinforcing this product type's leadership in USA automotive HVAC duct sector.

Passenger vehicles represent 57.0% of the application segment for automotive HVAC ducts, encompassing sedans, hatchbacks, coupes, and crossover SUVs that prioritize occupant comfort and cabin refinement. This category drives demand through sheer production volumes, as passenger vehicles account for millions of annual sales despite the ongoing shift toward light trucks. Consumers shopping for passenger vehicles prioritize quiet cabins and precise temperature control, both of which depend on well-designed duct systems that minimize airflow noise and deliver consistent thermal output to front and rear occupants.

The passenger vehicle segment leads in the adoption of dual-zone and tri-zone climate control systems, where driver, front passenger, and rear passengers can set independent temperature preferences. These systems require complex duct architectures with electronically controlled dampers that blend hot and cold airflow in varying proportions, demanding tight manufacturing tolerances to prevent air leakage between zones.

The rise of premium compact vehicles and electric sedans, which compete on interior quality and technology content, is driving investment in advanced duct materials and geometries that enhance perceived luxury. As automakers seek to differentiate their passenger car offerings in a industry increasingly dominated by trucks and SUVs, superior HVAC performance enabled by optimized duct design becomes a key competitive weapon.

Blow molding accounts for 68.0% of the process category for automotive HVAC ducts, valued for its ability to produce hollow, complex geometries in a single manufacturing step. The blow molding process begins with a heated plastic parison that is inflated within a mold cavity, creating seamless ducts with smooth internal surfaces that minimize airflow resistance. This technique is particularly well-suited for producing the curved, branching duct shapes required to navigate around vehicle structural components, wiring harnesses, and other obstacles within the dashboard and floor console.

In USA, where production volumes are high and cost pressures are intense, blow molding offers significant economic advantages. The process generates minimal material waste compared to machining or thermoforming, and cycle times are measured in seconds, enabling high-throughput manufacturing that matches automotive assembly line speeds. Blow-molded ducts also exhibit excellent durability, as the absence of seams or joints eliminates potential leak paths and weak points that could fail under thermal cycling or vibration. The technique accommodates a wide range of thermoplastic materials, including polypropylene, polyethylene, and thermoplastic elastomers, allowing suppliers to tailor material properties for specific performance requirements such as temperature resistance, flexibility, or acoustic damping.

Plastics capture 72% of the material category for automotive HVAC ducts, prized for their lightweight properties, design flexibility, and resistance to corrosion and moisture. Thermoplastic materials such as polypropylene and acrylonitrile butadiene styrene allow engineers to create complex duct shapes with integral mounting bosses, snap-fit features, and acoustic baffles that would be prohibitively expensive to fabricate from metal. The weight advantage is critical in an era where every kilogram removed improves fuel economy in conventional vehicles and extends range in electric models, with a typical vehicle containing several kilograms of duct material distributed throughout the cabin.

In USA, where vehicles are subjected to temperature extremes ranging from Death Valley summers exceeding 120 degrees Fahrenheit to Dakota winters plunging below minus 30, plastics must maintain dimensional stability and mechanical properties across this entire spectrum. Modern engineering thermoplastics incorporate additives such as UV stabilizers, impact modifiers, and flame retardants to meet automotive durability and safety standards. The material's inherent acoustic damping reduces airflow noise, contributing to the quiet cabins that American consumers expect in modern vehicles. Plastics also enable rapid design iteration, as changes to duct geometry can be implemented through mold modifications rather than requiring retooling of metal stamping or welding equipment.

Demand for automotive HVAC ducts in the United States is accelerating as vehicle cabins grow larger and more sophisticated, requiring extensive duct networks to deliver climate-controlled air to every seating position while meeting stringent energy efficiency and noise standards. Growth originates from the proliferation of multi-zone climate control systems, the electrification of vehicle fleets that demands optimized airflow to preserve battery range, and consumer expectations for rapid defrosting and cooling performance.

However, challenges such as packaging constraints in increasingly crowded vehicle interiors, material cost volatility for engineering thermoplastics, and the need to balance airflow performance with weight reduction goals are tempering expansion. Key trends include the integration of air quality sensors and filtration systems within duct assemblies, the adoption of 3D-printed ducts for low-volume luxury applications, and the development of smart dampers that adjust airflow based on occupant detection and thermal imaging.

Several factors underpin the rising demand for automotive HVAC ducts across the United States. First, the ongoing shift toward larger vehicles, particularly three-row SUVs and extended-cab pickup trucks, creates longer duct runs and more outlet points to serve rear passengers who are seated farther from the central HVAC unit. Second, consumer expectations for personalized comfort are driving the standardization of dual-zone and tri-zone climate control across all vehicle segments, requiring more complex duct networks with electronically controlled mixing dampers and separate temperature sensors.

Third, federal safety regulations mandating rapid windshield defrosting ensure that every vehicle includes dedicated high-capacity ducts for the windshield, establishing a baseline demand that grows with vehicle production volumes. Fourth, the electrification of powertrains eliminates the abundant waste heat previously available from internal combustion engines, forcing automakers to optimize duct designs to minimize energy consumption while maintaining occupant comfort, which drives investment in advanced computational fluid dynamics modeling and lightweight materials.

Despite strong fundamentals, several constraints limit the pace of adoption for advanced automotive HVAC duct systems. Packaging space within vehicle interiors is increasingly constrained as automakers incorporate larger batteries, more airbags, advanced electronics, and structural reinforcements, leaving less room for duct routing and necessitating more complex, expensive geometries. Material cost pressures, particularly for engineering-grade thermoplastics that must withstand continuous thermal cycling from minus 40 to plus 80 degrees Celsius without warping or embrittlement, squeeze supplier margins and limit the pace of innovation.

The challenge of reducing duct weight while maintaining structural rigidity and acoustic performance requires expensive material development and testing, which can delay new product introductions. Additionally, the shift toward simplified, minimalist vehicle interiors in some electric vehicle designs is prompting experiments with radiant heating and localized air curtains that could potentially reduce the scope of traditional duct networks, creating uncertainty around long-term demand trajectories.

Major trends include the integration of cabin air quality monitoring systems, where sensors within the duct network detect particulates, volatile organic compounds, and carbon dioxide levels, triggering automatic adjustments to recirculation modes and filtration intensity. Automakers are experimenting with personalized airflow systems that use facial recognition and thermal cameras to direct conditioned air toward occupied seats while reducing flow to empty positions, improving energy efficiency in electric vehicles. Additive manufacturing is enabling the production of organic, topology-optimized duct shapes that minimize material usage and airflow resistance, though these techniques remain limited to low-volume applications due to production speed constraints.

Antimicrobial coatings and self-cleaning surfaces are being applied to duct interiors to reduce mold and bacteria growth, addressing consumer concerns about air quality and system hygiene. Flexible duct sections using corrugated thermoplastic elastomers are being deployed in areas requiring articulation, such as ducts serving adjustable second-row seats or deployable third-row benches. Suppliers are also developing modular duct systems with standardized interfaces that allow automakers to mix and match components across multiple vehicle platforms, reducing engineering costs and accelerating time-to-market for new models.

The demand for automotive HVAC ducts in USA is propelled by the need to deliver consistent thermal comfort across increasingly spacious vehicle interiors, where occupants expect personalized temperature control, rapid response to climate adjustments, and whisper-quiet operation. American vehicle designs favor large cabins with generous headroom and legroom, particularly in the dominant SUV and pickup truck segments, creating long air pathways from centralized HVAC units to rear seating areas.

Federal safety standards require effective windshield defrosting systems, ensuring every vehicle includes robust duct networks capable of clearing ice and condensation quickly. The transition to electric powertrains introduces new performance imperatives, as HVAC energy consumption directly impacts driving range, making efficient duct design a competitive differentiator.

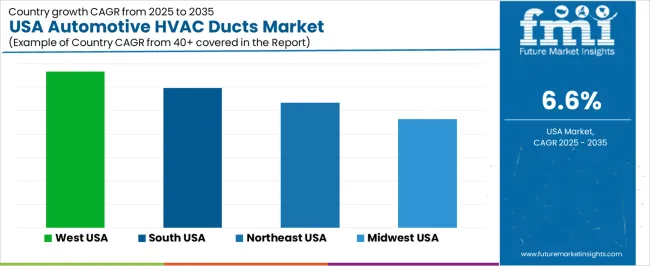

Regional demand patterns reflect climate diversity, vehicle preferences, and infrastructure development across the USA. The West leads in growth, driven by California's vehicle electrification mandates and the state's large population centers where temperature extremes from coastal fog to inland heat require versatile HVAC systems. The South shows robust expansion, supported by hot, humid conditions that place heavy demands on air conditioning systems and the region's preference for large pickup trucks with extensive duct networks.

The Northeast benefits from harsh winters where defrost performance is critical and affluent consumers prioritize cabin comfort features. The Midwest, with its temperature extremes and agricultural vehicle demand, maintains steady growth as manufacturers upgrade HVAC systems to meet evolving consumer expectations. This analysis explores the regional dynamics shaping demand for automotive HVAC ducts across the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 6.7% |

| South USA | 6.0% |

| Northeast USA | 5.3% |

| Midwest USA | 4.6% |

The West USA region leads the nation in demand for automotive HVAC ducts with a CAGR of 6.7%, propelled by California's outsized influence on vehicle technology adoption and the state's aggressive electrification timeline. California's Advanced Clean Cars II regulation requires 100% of new passenger vehicle sales to be zero-emission by 2035, creating a wholesale shift toward electric vehicles that necessitates optimized HVAC duct designs to minimize energy consumption and preserve battery range. Electric vehicles in California must perform across diverse microclimates, from the chilly Pacific coast to the scorching Central Valley, demanding duct systems that can efficiently heat and cool cabins without overtaxing the battery.

The West's affluent demographics and technology-forward consumer base drive adoption of premium vehicles equipped with advanced climate control features, including tri-zone systems, air quality sensors, and seat-level ventilation, all of which require sophisticated duct architectures. California's stringent air quality regulations are also pushing automakers to incorporate cabin air filtration systems with larger HEPA-grade filters, necessitating redesigned duct paths that accommodate these components without compromising airflow.

The region's sprawling metropolitan areas, where residents spend hours in traffic, place a premium on cabin comfort and air quality, reinforcing demand for high-performance HVAC systems. As the West continues to lead in vehicle electrification and regulatory innovation, automotive HVAC duct demand will maintain its rapid growth pace.

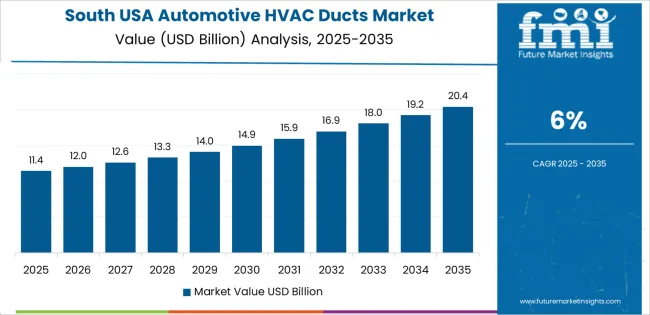

The South USA demonstrates robust demand for automotive HVAC ducts with a CAGR of 6.0%, driven by the region's hot, humid climate that places extraordinary demands on air conditioning systems for most of the year. Summer temperatures regularly exceed 95 degrees Fahrenheit with high humidity levels in states like Texas, Louisiana, and Florida, requiring HVAC systems that can cool large cabin volumes quickly and maintain comfortable conditions during extended drives. The South's preference for full-size pickup trucks and three-row SUVs creates demand for extensive duct networks that must deliver cold air to rear passengers seated far from the dashboard-mounted HVAC unit.

The region's rapid population growth, particularly in Sun Belt cities like Austin, Houston, and Atlanta, is driving vehicle sales and replacement cycles, with consumers prioritizing vehicles equipped with powerful air conditioning and rear climate zones.

The South's construction and energy sectors support large fleets of work trucks that require durable HVAC systems capable of operating continuously in dusty, hot environments, driving aftermarket replacement demand for duct components. Florida's retirement communities represent another growth driver, as older adults prioritize cabin comfort and air quality features. The increasing frequency of extreme heat events is raising consumer awareness of vehicle cooling performance, making HVAC effectiveness a key selling point for dealers and a priority for manufacturers designing vehicles for southern climates.

The Northeast exhibits steady demand for automotive HVAC ducts with a CAGR of 5.3%, reflecting the region's four-season climate where both heating and cooling performance are critical to occupant comfort. Winter conditions require effective defrosting systems to maintain windshield visibility, while humid summers demand capable air conditioning, making HVAC system performance a year-round concern for consumers. The region's affluent suburbs surrounding New York, Boston, and Philadelphia show strong uptake of luxury vehicles equipped with advanced climate control features, including heated and cooled seats, heated steering wheels, and multi-zone temperature regulation, all of which increase duct complexity and content per vehicle.

The Northeast's harsh road conditions, including freeze-thaw cycles that create potholes and road salt that accelerates corrosion, place stress on vehicle components including HVAC ducts, driving replacement demand through collision repairs and major service events. The region's environmental consciousness is driving interest in electric vehicles, which require optimized duct designs to balance cabin comfort with battery range preservation. Fleet operators in dense urban corridors prioritize driver comfort in delivery vans and service vehicles that may idle in traffic for extended periods, supporting demand for efficient HVAC systems. While growth rates trail the West and South, the Northeast's vehicle replacement cycles and demanding climate conditions ensure sustained demand for automotive HVAC duct systems.

The Midwest USA shows moderate growth in demand for automotive HVAC ducts with a CAGR of 4.6%, underpinned by the region's extreme seasonal temperature swings that test HVAC system performance across the widest range of any USA region. Midwestern winters can see temperatures plunge to minus 20 degrees Fahrenheit, requiring powerful heating systems and effective defrost ducts, while summers regularly exceed 90 degrees with high humidity, demanding capable air conditioning. This climate variability pushes automakers to design robust duct systems that maintain performance across the full temperature spectrum.

The Midwest's agricultural economy supports substantial vocational vehicle demand, including farm trucks and equipment that operate in dusty environments where HVAC filtration and cabin pressurization are critical to operator comfort and air quality. The region's automotive manufacturing heritage continues to influence local demand, as Detroit's automakers test vehicles extensively in Michigan's variable climate and use the feedback to refine HVAC duct designs.

The Midwest's moderate income levels compared to coastal regions make consumers more price-sensitive, but the severe climate ensures that HVAC performance remains a non-negotiable feature rather than an optional upgrade. As the region's vehicle parc modernizes and multi-zone climate control becomes standard across more vehicle segments, automotive HVAC duct demand will gradually accelerate, supported by the replacement of aging vehicles with designs that feature more sophisticated thermal management systems.

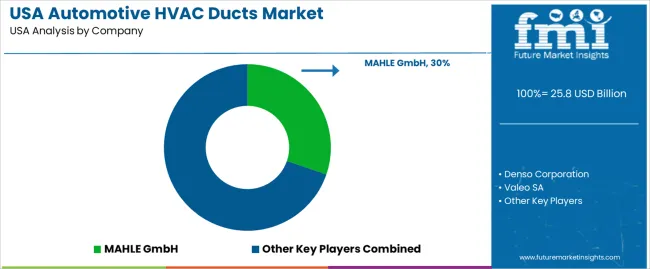

The automotive HVAC ducts industry in the United States is marked by competition among established suppliers such as MAHLE Group (holding approximately 30.3% share), Denso Corporation, Valeo SA, Hanon Systems, and Continental AG, who are navigating the transition from conventional internal combustion vehicle architectures to electric platforms that demand lighter, more efficient duct designs. These suppliers must balance cost pressures from automakers seeking to reduce bill-of-material expenses with performance requirements for airflow, noise reduction, and durability across extreme temperature ranges. The industry is consolidating around suppliers with capabilities in computational fluid dynamics simulation, advanced polymer processing, and just-in-time delivery to assembly plants scattered across the USA.

Competition centers on technological innovation in materials and manufacturing processes, supply chain efficiency, and the ability to support automaker design cycles with rapid prototyping and testing. Suppliers invest in lightweight thermoplastic composites, acoustic damping treatments, and anti-static coatings that reduce dust accumulation within duct interiors. Vertical integration strategies, where duct suppliers also provide HVAC modules, blowers, and control electronics, offer advantages in system-level optimization and cost reduction.

Companies emphasize their expertise in blow molding, injection molding, and increasingly, additive manufacturing for complex geometries in technical documentation aimed at automotive OEM procurement teams. Strategic partnerships with material science companies enable access to next-generation polymers with improved temperature resistance and recyclability. By aligning product development roadmaps with automaker electrification timelines and lightweighting targets, these suppliers position themselves to capture long-term growth in the USA automotive HVAC duct sector.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Windshield Defrost Ducts, Rear Outlet Ducts, Others |

| Application | Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Process | Blow Molding, Twin Sheet Thermoforming |

| Material | Plastics, Aluminium, Others |

| Key Companies Profiled | MAHLE Group, Denso Corporation, Valeo SA, Hanon Systems, Continental AG |

| Additional Attributes | Dollar sales by product type, application, process, and material are analyzed alongside USA demand driven by vehicle electrification, climate-control premiumization, and defrost compliance. Competition centers on HVAC duct innovation, lightweight thermoplastics, multi-zone control, air-quality systems, and blow-molding advances. |

The demand for automotive HVAC ducts in USA is estimated to be valued at USD 25.8 billion in 2025.

The market size for the automotive HVAC ducts in USA is projected to reach USD 48.9 billion by 2035.

The demand for automotive HVAC ducts in USA is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in automotive HVAC ducts in USA are windshield demist duct, rear outlet HVAC duct and others.

In terms of application, passenger cars segment is expected to command 57.0% share in the automotive HVAC ducts in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive HVAC Ducts Market Growth - Trends & Forecast 2025 to 2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Automotive HVAC Blower Market Trends - Size, Share & Growth 2025 to 2035

USA Hyaluronic Acid Products Market Insights – Growth, Demand & Forecast 2025-2035

USA Meal Replacement Products Market Insights – Size, Share & Forecast 2025-2035

Automotive Screenwash Products Market Growth - Trends & Forecast 2025 to 2035

USA Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Reusable Incontinence Products Market Analysis - Size, Share & Forecast 2025 to 2035

USA and Canada Pet Care Products Market Analysis – Size, Share and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

Automotive Brake Friction Products Market - Trends & Forecast 2025 to 2035

Demand for HVAC Software in USA Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive UPS in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive NFC in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Headliner in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA