The global automotive screenwash products market is projected to expand from USD 2,649.0 million in 2025 to USD 10,716.5 million by 2035, registering a compound annual growth rate (CAGR) of 15%. This growth is being driven by increasing environmental compliance mandates, advancements in biodegradable formulations, and evolving consumer demand for eco-efficient car care solutions.

In 2023, Euro Car Parts introduced a new screenwash packaging solution designed to reduce plastic usage by up to 80%. This initiative aligns with the company's broader sustainability goals and responds to growing environmental concerns within the automotive aftermarket industry. The company stated, "This eco-friendly screenwash packaging solution is part of our wider sustainability initiative and supports workshops and drivers who want to lower their carbon footprint."

Similarly, Chela, a UK-based chemical formulation company, has developed all-season screenwash products focusing on non-toxic, biodegradable ingredients. These solutions are designed to perform under freezing temperatures while minimizing impact on surrounding ecosystems. Chela's innovations reflect the industry's shift towards environmentally responsible products.

Brenntag has also contributed to this market trend with its ethanol-based washer fluids containing advanced surfactants. These ingredients enhance performance on insect residue and road film, meeting the requirements of Europe's urban fleet maintenance cycles.

Market uptake is influenced by changing retail patterns. As cited by Forecourt Trader in 2024, "Car care sales are seasonal, with demand peaking for products like screenwash during winter months." This highlights the importance of timely inventory management and regional weather responsiveness in product availability.

As manufacturers continue to invest in circular packaging, alcohol-based solvents, and climate-specific variants, the automotive screenwash market is expected to experience robust expansion. Industry shifts toward cleaner, safer, and recyclable solutions are projected to define product development trends through 2035.

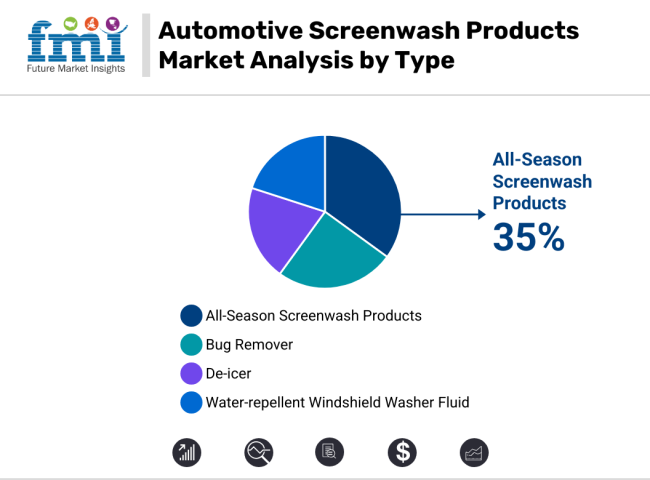

All-season screenwash products are projected to account for nearly 35% of total market sales by 2035. Over the forecast period from 2025 to 2035, this segment is expected to expand at a compound annual growth rate (CAGR) of 14.2%. The increasing need for year-round vehicle visibility and the shift toward convenience-oriented maintenance products have supported the segment’s expansion.

These formulations are being preferred by fleet operators and private vehicle owners due to their adaptability across varying climatic conditions. With temperature-resistant ingredients and anti-freeze components, all-season variants are being adopted to eliminate the need for seasonal changeovers, particularly in temperate and transitional weather zones.

Manufacturers have introduced ready-to-use solutions that comply with environmental safety standards while delivering effective performance against grime, insect residue, and road salts. Companies like Chela have emphasized the role of non-toxic surfactants and biodegradable agents in their all-season formulations, aligning product development with environmental regulations.

As urban traffic density rises and vehicle use becomes increasingly consistent throughout the year, demand for reliable, maintenance-free screenwash solutions is expected to position all-season variants as a dominant category through 2035.

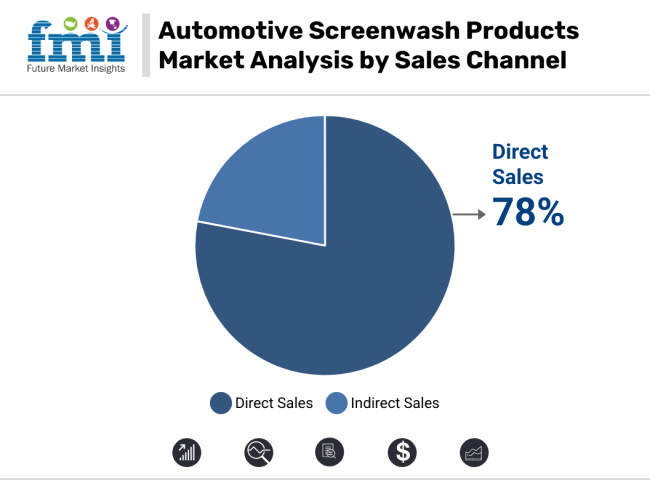

As of 2025, approximately 22% of global screenwash product sales are being generated through online platforms. This share is projected to grow at a compound annual growth rate (CAGR) of 15.3% over the forecast period ending in 2035. The growth of e-commerce platforms, combined with rising consumer preference for convenient, doorstep delivery of vehicle maintenance products, has fueled this trend.

Digital automotive aftermarket retailers have expanded their offerings to include bundled car care kits, subscription-based restocking services, and eco-friendly screenwash alternatives. Direct-to-consumer brands have also leveraged online marketplaces to increase penetration in Tier 2 and Tier 3 urban centers, where retail infrastructure is limited.

Product availability through OEM e-stores, third-party platforms, and independent auto parts aggregators has been supported by improved logistics and digital payment options. Seasonal promotions and targeted digital advertising have further enhanced visibility and sales conversion rates.

As consumer purchasing behavior continues to shift toward digital-first channels, online sales of screenwash products are expected to play a pivotal role in market growth, especially for specialty formulations and bulk commercial orders through 2035.

The North American automotive screenwash market is highly lucrative, owing to the presence of a developed motor vehicle manufacturing base and seasonally changing weather conditions, which leads to the frequent usage of heated windshield cleaners. Demand for de-icing and antifreeze screenwash products thrives in the colder climates of North America, where the United States and Canada experience harsh winters. Squeaky-clean floors and frost-free food appeal to consumers, who also appreciate high-performance, premium products.

Additionally, the presence of sizable automotive aftermarket retailers - like AutoZone and O'Reilly Auto Parts - makes products widely available in the first place. Tight environmental constraints in the region, especially with regard to VOCs in screenwash products, are driving makers to create sustainable, biodegradable alternatives with lower methanol and ethylene glycol concentrations.

Europe has a prominent proportion of the automotive screenwash products industry and among European countries, Germany, the United Kingdom, and France lead demand. Due to the tight environmental regulations in the region by the European Chemicals Agency (ECHA), the demand for bio-based and non-toxic screenwash solutions has been rising. European customers have a taste for high-quality products that perform effectively and, at the same time, are environmentally sustainable.

The rising penetration of hybrid vehicles and electric vehicles, especially in nations such as Norway and the Netherlands, has also affected the market since the manufacturers come up with specialized maintenance products for them. In addition, the continent's diversified climate, from Scandinavian snow in winter to mild conditions in Southern Europe, calls for formulation variations, thus generating high demand for all-season screenwash products.

The automotive screenwash products market in the Asia-Pacific region is expected to grow at a significant rate due to the booming automobile industry, increasing ownership of vehicles, and growing consumer awareness regarding the cleanliness and maintenance of the vehicle. China, India, Japan, and South Korea are important markets, along with China being the overall largest market in terms of size compared to passenger and commercial vehicle parc.

Disposable income rising with urbanization has increased the consumption of these high-end car care products, such as high-performance cleaning fluids for the windshield. Nevertheless, lower awareness about sustainable products, as well as the wide availability of inexpensive chemical-based screenwash products, are factors limiting the potential for sustainable products within the market.

The demand for non-toxic and biodegradable screenwash products is projected to witness significant growth, owing to the government laws pertaining to the release of critical chemicals and the growing use of eco-friendly car care products in the next few years.

Environmental and Chemical Regulations

Regimenting greenhouse emission guidelines for chemical make-up is among the biggest dilemmas facing the automotive screenwash market. Most conventional screenwash products include ethylene glycol and methanol, both dangerous to the human health system as well as to the environment.

North American and European authorities are introducing tougher limits on the use of chemicals, which are compelling manufacturers to reimagine their offerings. The transition to employing less toxic and biodegradable substitutes has the effect of increasing the cost of production, rendering it difficult for low-cost buyers and small producers to make adjustments.

Rising Demand for Eco-Friendly and Specialized Formulations

Increases in environmental concerns provide a huge opportunity for car screenwash manufacturing companies. A high level of investment has been put into biodegradable, non-toxic, and eco-friendly products that meet high regulatory standards and high levels of cleaning ability.

There is also an increasing market demand for specific screenwash products for various vehicles, including hybrids and electric vehicles. Smart screenwashes with water-repellent or self-cleaning properties are becoming ever more popular, with customers seeking convenience and efficiency. With sustainability and vehicle care on the rise, formula innovation for screenwash will be key to advancing the market.

From 2020 to 2024, the market for automotive screenwash products experienced consistent growth due to expanding car ownership, heightened attention to windscreen maintenance, and expansion of the automotive aftermarket industry. Severe weather conditions such as rough winters and dusty climates spurred demand for high-performance screenwash liquids with better cleaning, anti-freeze, and anti-smear functions. Long-range driving and commercial fleet operations also contributed to propelling the market higher.

Regulatory authorities like the Environmental Protection Agency (EPA), European Chemicals Agency (ECHA), and the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) put stronger regulations on screenwash products, specifically on volatile organic compounds (VOCs), methanol level, and the environmental impact.

As a consequence, screenwash manufacturers produced environment-friendly, biodegradable screenwashes with low alcohol levels yet effective in cleaning. The COVID-19 pandemic initially disrupted production and supply chains, but demand gained momentum as vehicle care and hygiene awareness enhanced.

From 2025 to 2035, the automotive screenwash products industry will witness a revolutionary shift with sustainability trends, AI-powered windshield maintenance, and smart vehicle integration. The rising adoption of electric vehicles (EVs) and autonomous vehicles will propel demand for advanced, residue-free screenwash solutions designed specifically for sensor and camera-based driving systems.

Coming screenwash products will incorporate self-cleaning nanotechnology that enables hydrophobic and oleophobic coatings that reduce the need for windshield cleaning. AI-powered automotive windshield monitoring systems will detect dirt, debris, and visibility obstructions in real time and automatically trigger screenwash applications to enhance road safety. Temperature-resistive and UV-resistant screenwash fluids will also give the best performance in extreme climates without the need for excessive additives.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Heightened EPA, REACH, and ECHA regulations regarding VOCs, methanol, and dangerous chemicals. |

| Technological Advancements | Hydrophobic and anti-glare screenwash fluids, enzyme-based cleaners. |

| Industry Applications | Passenger vehicles, commercial fleets, and automotive aftermarket service. |

| Adoption of Smart Equipment | Anti-smear and hydrophobic screenwashes, sensor-safe screenwashes. |

| Sustainability & Cost Efficiency | Bio-based surfactants, reduced alcohol content, and eco-packaging initiatives. |

| Data Analytics & Predictive Modeling | Cloud-based inventory tracking, smart maintenance alerts, and automated refilling in commercial fleets. |

| Production & Supply Chain Dynamics | COVID-19 disruptions, rising raw material costs, and increased demand for all-weather formulations. |

| Market Growth Drivers | Growth through expanding vehicle ownership, rising premium screenwash product demand, and aftermarket expansion. |

| Market Shift | 2025 to 2035 Trends |

|---|---|

| Regulatory Landscape | Screenwash safety regulations are driven by AI, blockchain-based tracking of compliance, and bans on non-biodegradable chemicals. |

| Technological Advancements | Self-cleaning nanotechnology, AI-driven windshield monitoring, and temperature-responsive screenwash formulations. |

| Industry Applications | Invasion of EVs, windshield care for autonomous vehicles, and AI-driven fleet management.. |

| Adoption of Smart Equipment | AI-powered windshield washing automation, smart refill sensors, and wireless IoT-enabled dispensing. |

| Sustainability & Cost Efficiency | Waterless screenwash solutions, refillable pod systems, and blockchain-tracked sustainable sourcing. |

| Data Analytics & Predictive Modeling | Quantum-enhanced screenwash analytics, AI-driven windshield cleanliness assessment, and IoT-based predictive fluid usage modeling. |

| Production & Supply Chain Dynamics | AI-optimized production processes, decentralized bio-based chemical sourcing, and blockchain-enabled quality control. |

| Market Growth Drivers | AI-driven windshield care, sustainability-led product innovations, and expansion into next-generation smart vehicle applications. |

The USA automotive screenwash products market is experiencing strong growth due to increasing vehicle ownership, extreme weather conditions, and rising consumer awareness about vehicle maintenance. The demand for high-performance, all-season screenwash solutions is increasing, particularly in regions with harsh winters and frequent road debris.

The growing number of passenger and commercial vehicles increases screenwash demand. Need for winter-grade and anti-freeze screenwash in colder states. Rising consumer spending on vehicle maintenance products. Demand for non-toxic, ammonia-free formulations. The introduction of hydrophobic and streak-free formulations is one of the major key drivers for this market in the United States.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 14.5% |

The UK automotive screenwash market is growing steadily due to frequent rainfall, regulatory focus on vehicle safety, and consumer preference for premium vehicle care products. The increasing demand for high-performance, streak-free screenwash is a key trend in the market. Increased demand for clear visibility solutions.

Compliance with MOT regulations requiring effective windscreen cleaning. Expansion of eco-friendly and ammonia-free options. Easy availability through online platforms. Preference for convenient, pre-mixed screenwash products is one of the key market drivers for this market in the United Kingdom.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 14.2% |

Strict road safety regulations, extreme seasonal weather variations, and strong demand for eco-friendly vehicle care products drive the EU automotive screenwash products market. Countries like Germany, France, and Sweden lead the market with high consumption of winter-resistant and biodegradable screenwash formulations.

Stricter enforcement of vehicle maintenance standards. High use in countries with harsh winters. Regulatory push for sustainable products. Demand for high-quality, streak-free screenwash. The growth of e-commerce for auto care products is some of the key market growth factors for the market in the European Union.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 15.5% |

Japan’s automotive screenwash products market is expanding due to a strong automotive industry, consumer focus on vehicle upkeep, and technological advancements in screenwash formulations. The market is seeing a shift toward water-repellent and nanotechnology-based screenwash solutions.

Strong demand for screenwash in urban areas. Development of anti-glare and water-repellent formulations. Integration with advanced driver assistance systems (ADAS). Shift toward sustainable screenwash ingredients. Growth in demand for high-end automotive maintenance products is one of the key growth factors of this market in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 14.0% |

South Korea’s automotive screenwash products market is growing rapidly due to rising vehicle ownership, strong aftermarket expansion, and government focus on eco-friendly auto care solutions. The increase in smart and connected vehicle technology is also driving demand for advanced screenwash solutions.

Growth in consumer spending on maintenance. Policies promoting non-toxic and biodegradable screenwash. Demand for high-quality, streak-free cleaning solutions. Innovations in automatic windshield cleaning solutions. Increasing availability of premium screenwash products online is one of the major growth factors in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 14.8% |

The market for Automotive Screenwash Products is growing because of the rise in demand for efficient cleaning agents that improve vision and road safety. Screenwash liquids are a necessity to keep windshields clear of grime, dust, insects, and atmospheric impurities. Vehicle ownership, seasonality, weather, and rising consumer demand for environment-friendly and high-performance cleaning agents are driving market growth.

The market is experiencing innovation in anti-freeze and biodegradable formulations, as well as higher investments in product sustainability. Top players are emphasizing advanced formulations, distribution network development, and strategic alliances to enhance their market share.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Stanley | 16-20% |

| Controls Group | 12-16% |

| Gilson Company, Inc. | 10-14% |

| Humboldt Mfg. Co. | 9-13% |

| Cooper Technology | 7-11% |

| PaveTesting Limited | 5-9% |

| GDS Instruments | 4-8% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Stanley | Manufactures high-performance screenwash solutions with anti-freeze and eco-friendly characteristics. |

| Controls Group | Designs innovative car washing solutions with a focus on biodegradable products. |

| Gilson Company, Inc. | Specializes in high-performance screenwash chemicals for extreme weather. |

| Humboldt Mfg. Co. | Offers a variety of windshield cleaning fluids with anti-smear technology. |

| Cooper Technology | Produces high-efficiency screenwash for commercial and personal use. |

| PaveTesting Limited | Specializes in high-quality windshield washer fluids for heavy-duty and fleets. |

| GDS Instruments | Supplies scientifically developed cleaning agents for maximum windshield clarity.. |

Key Company Insights

Stanley (16-20%)

Market leader Stanley provides top-tier cleaning solutions in screenwash technology for extreme conditions. The brand is extending the product range towards eco-friendly, non-toxic solutions to cope with sustainability pressures.

Controls Group (12-16%)

Control Group specializes in automotive cleaning solution products, but with a stress on biodegradable and low-toxicity screenwash items. Controls Group is committing capital to R&D to improve cleaner agents that not only clean well but also persist longer as windscreen cleaning products.

Gilson Company, Inc. (10-14%)

Gilson is renowned for its excellent screenwash fluids that can withstand harsh conditions, even sub-freezing temperatures. It is broadening its distribution system to service international markets.

Humboldt Mfg. Co. (9-13%)

A major producer of automotive maintenance products, Humboldt is involved in screenwash fluids that inhibit smearing and provide better visibility. Humboldt is constantly adding to its line of products to include all-weather types.

Cooper Technology (7-11%)

Cooper Technology offers high-efficiency windshield washer fluids suitable for commercial and personal vehicles. The company is emphasizing research into sustainable ingredients for eco-friendly solutions.

PaveTesting Limited (5-9%)

PaveTesting focuses on premium screenwash products, catering to fleet and heavy-duty vehicles. The company is working on advanced anti-frost and water-repellent formulations.

GDS Instruments (4-8%)

Specializing in scientifically formulated cleaning agents, GDS Instruments develops windshield washer fluids that maximize clarity and minimize residue build-up.

Other Key Players (30-40% Combined)

Several emerging and regional companies contribute to the growing Automotive Screenwash Products market, including:

The market is estimated to reach a value of USD 2,649.0 Million by the end of 2025.

The market is projected to exhibit a CAGR of 15% over the assessment period.

The market is expected to clock revenue of USD 10,716.5 Million by end of 2035.

Key companies in the Automotive Screenwash Products Market include Stanley, Controls Group, Gilson Company, Inc., Humboldt Mfg. Co., GDS Instruments.

On the basis of sales channel, indirect sales to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Brake Friction Products Market - Trends & Forecast 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA