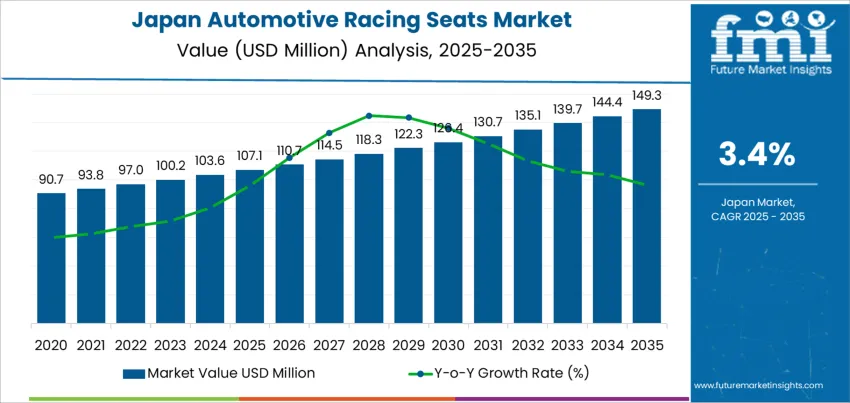

The Japan automotive racing seats demand is valued at USD 107.1 million in 2025 and is forecasted to reach USD 149.3 million by 2035, reflecting a CAGR of 3.4%. Demand is influenced by motorsport participation, performance-vehicle customization, and replacement installations in sports cars, tuner models, and enthusiast-owned vehicles. Increased adoption of lighter seating structures that enhance driver support and crash safety continues to expand applications across street-legal performance cars and dedicated track vehicles.

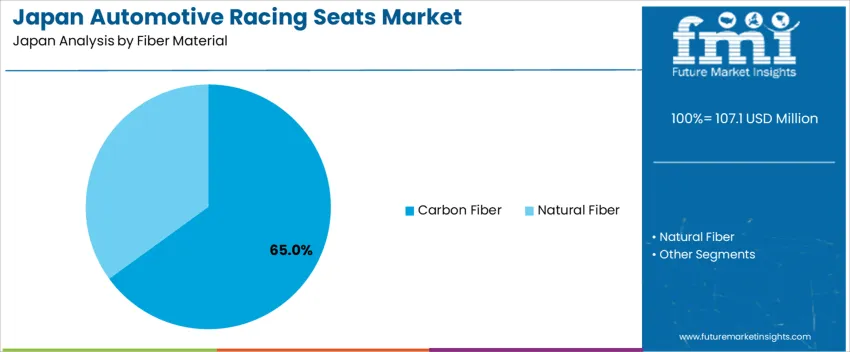

Carbon fiber remains the leading fiber material due to its superior strength-to-weight ratio, contribution to vehicle weight reduction, and high torsional rigidity. These seats are selected to improve cornering stability, reduce driver fatigue, and enhance cockpit safety during high-G maneuvers. Design advancements focus on ergonomic bolstering, fire-resistant upholstery, compatibility with multi-point harnesses, and compliance with international motorsport specifications.

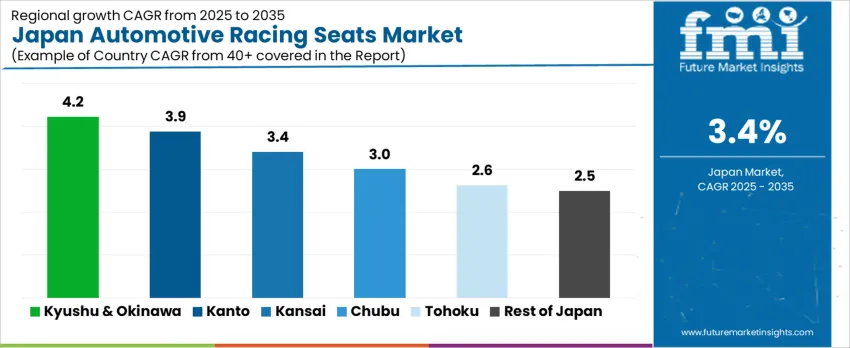

Kyushu & Okinawa, Kanto, and Kansai record the highest adoption due to the presence of automotive tuning hubs, motorsport circuits, and specialist aftermarket workshops. Performance-vehicle ownership is concentrated in these regions, supporting consistent product replacement and customization cycles. Key suppliers include Bride Co., Ltd., RECARO Japan, BRIDE/Stradia, Sparco Japan, and OMP Japan. Their portfolios enable tailored seat configurations for both professional motorsport and high-performance consumer vehicles.

Demand for automotive racing seats in Japan demonstrates intermittent acceleration aligned with motorsport participation, performance-vehicle customization, and enthusiast-driven aftermarket upgrades. Early acceleration is influenced by interest in tuning culture, circuit driving, and automotive-sport events concentrated in key regions. These activities create periodic spikes in demand as consumers invest in weight-reduction components and improved driver support.

Deceleration appears during economic slowdowns or when discretionary spending softens. Since racing seats serve a non-essential function, purchase timing is sensitive to personal income and hobby budgets. Regulatory certification requirements for road-legal installations can also moderate adoption, creating stable but slower uptake phases. The professional motorsport segment offers consistent baseline volume, although its contribution does not offset variability in the enthusiast industry.

The pattern indicates controlled acceleration when performance customization gains visibility and deceleration when spending caution increases or regulatory constraints limit upgrade choices. The growth remains niche and cyclical, driven by passion-based consumption rather than structural demand expansion in Japan’s transportation sector.

| Metric | Value |

|---|---|

| Japan Automotive Racing Seats Sales Value (2025) | USD 107.1 million |

| Japan Automotive Racing Seats Forecast Value (2035) | USD 149.3 million |

| Japan Automotive Racing Seats Forecast CAGR (2025-2035) | 3.4% |

Demand for automotive racing seats in Japan is increasing because motorsport participation, performance car ownership and aftermarket tuning culture remain active across major regions. Racing seats provide improved support, reduced body movement and enhanced safety during high speed driving, which appeals to enthusiasts who modify vehicles for track use or performance styling. Growth in motorsport events, including local circuit days and amateur racing series, reinforces purchases among hobby drivers seeking compliance with safety guidelines.

Automakers offering sport oriented trims also contribute to adoption by integrating lightweight seats that improve driving posture and reduce vehicle weight. Demand extends to simulation setups in households where high rigidity and side bolstering enhance the virtual driving experience. Retailers and workshops support installation services and offer a wide range of materials including fiber reinforced shells and cushioned fabric choices suited to long distance driving. Constraints include regulations on seat compatibility with airbags and approval requirements for on road use. Small vehicle interiors common in Japan can limit seat size options. Pricing for premium reinforced models may delay upgrades for drivers who participate in events only occasionally.

Demand for automotive racing seats in Japan is shaped by strong motorsport culture, performance tuning activities, and increasing track-day participation among enthusiasts. Manufacturers emphasize safety compliance, lightweight construction, and ergonomic shaping that improves driver stability during high-G maneuvers. Styling preferences also influence adoption in street-legal performance cars. Industry behavior remains linked to racing leagues, professional motorsport engineering, and steady customization trends within Japan’s aftermarket ecosystem.

Carbon fiber accounts for 65.0%, reflecting its superior strength-to-weight profile and rigidity required for professional and enthusiast racing applications. Weight reduction supports handling precision, acceleration stability, and improved driver seating confidence during competitive maneuvers. The material also withstands vibration and high-temperature stress common in track environments. Natural fiber constructions represent 35.0%, incorporating reinforced bio-composites that offer cost efficiency and increasing sustainability alignment. These seats serve mid-range tuning needs where structural performance remains important but extreme lightweighting is not mandatory. Material selection depends on regulatory compliance, vehicle modification objectives, and driver comfort priorities in Japanese motorsport culture.

Key Points:

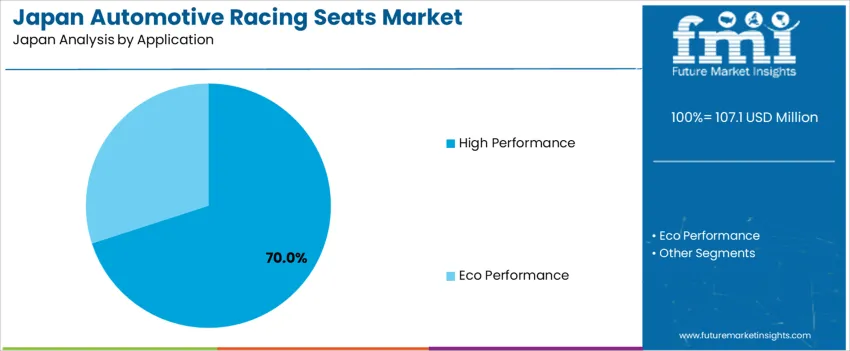

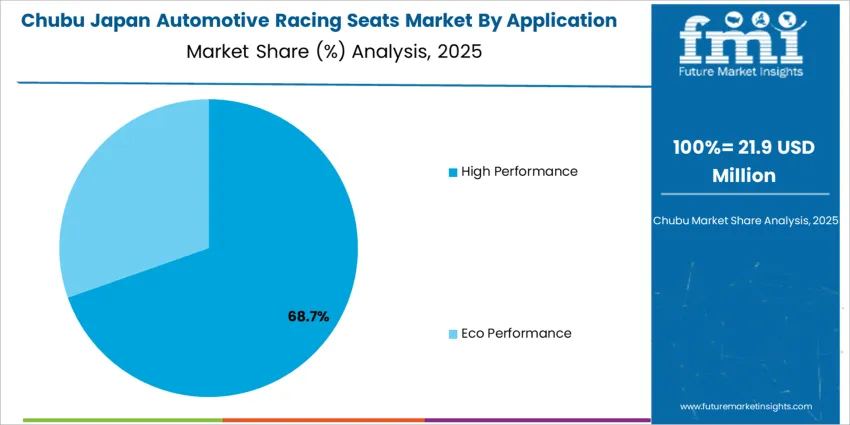

High-performance use accounts for 70.0%, driven by applications in GT cars, rally builds, and dedicated track vehicles where seating geometry supports improved control and safety harness integration. These installations enhance driver feedback and posture in aggressive driving dynamics. Eco-performance applications represent 30.0%, focusing on energy-efficient vehicles upgraded for performance styling without significant chassis modification. This segment reflects interest in personalization and sporty aesthetics among everyday drivers. Application decisions depend on intended racing class, cabin comfort balance, and adherence to Japan’s vehicle inspection regulations regarding aftermarket seating.

Key Points:

Growth of motorsport participation, expansion of performance vehicle customization and rising interest in track-day activities are driving demand.

In Japan, racing seats gain traction among motorsport enthusiasts who compete in grassroots road racing, gymkhana and drifting events held at circuits such as Fuji Speedway and Suzuka. Performance customization culture remains strong, particularly in the Kanto and Kansai regions where aftermarket tuning shops upgrade seating to improve lateral support and driver posture. Track-day programs promoted by vehicle manufacturers and local clubs attract increasing participation, creating demand for fixed-back and FIA-compliant seats suitable for amateur competition. Rally and autocross groups also procure specialized seats designed to withstand off-road vibration and frequent load shifts, supporting diverse usage across motorsport categories.

High product cost, limited use in daily commuting and regulatory constraints on installation restrain demand.

Racing seats made from carbon fiber or reinforced materials carry premium pricing that restricts adoption to dedicated hobbyists. Many vehicles used for daily commuting prioritize comfort and adjustable seating, making fixed-back racing seats less practical for regular driving in urban Japan. Road-use regulations require proper airbag and seatbelt integration, adding installation complexity and certification steps that discourage casual upgrades. These economic and compliance considerations limit widespread installation outside enthusiast circles.

Shift toward lightweight modular designs, increased compatibility with modern safety electronics and rising demand in simulator and esports applications define key trends.

Manufacturers introduce lighter racing seats engineered for compatibility with factory seat rails and occupant detection systems used in modern vehicles. Collaboration with roll-cage and harness suppliers supports seamless installation for dual road-track setups. Growth in motorsport-themed entertainment and esports drives demand for racing seats used in home simulators and driving arcades across major cities. Limited-edition designs tied to Japanese performance brands and motorsport events maintain strong collector interest. These trends indicate stable, enthusiast-driven demand for racing seats across Japan’s automotive aftermarket and competition community.

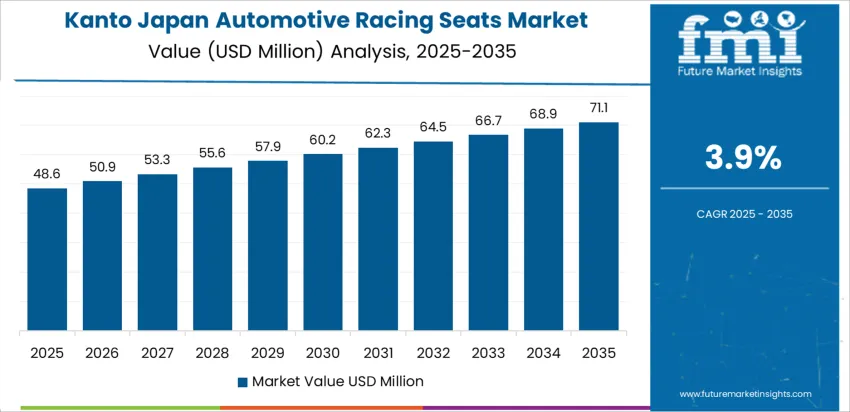

Demand for automotive racing seats in Japan is influenced by vehicle-performance upgrades, motorsport participation, interior styling enhancements, and reinforced safety designs for competitive or enthusiast driving. Interest varies by region, with Kyushu & Okinawa leading at 4.2%, followed by Kanto (3.9%), Kansai (3.4%), Chubu (3.0%), Tohoku (2.6%), and the Rest of Japan (2.5%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.2% |

| Kanto | 3.9% |

| Kansai | 3.4% |

| Chubu | 3.0% |

| Tohoku | 2.6% |

| Rest of Japan | 2.5% |

Kyushu & Okinawa posts 4.2% CAGR, supported by vehicle-modification culture centered in Fukuoka and strong motorsport engagement linked to local racetrack venues. Performance workshops pursue racing seats compatible with lightweight sport-compact models commonly driven in the region. Procurement emphasizes seat frames with lateral-support reinforcement for improved driver stability during cornering. Consumer purchasing behavior frequently focuses on interior upgrades that enhance visual appeal without extensive mechanical modification. Okinawa’s road conditions and tourism-driven rental fleets introduce demand where premium seating options support brand positioning. Reliability of seat-mount systems influences compatibility decision-making across models from Japanese manufacturers. Distribution partners maintain stock for scheduled installations linked to customer appointments. Component handling safety and fabric durability guide selection decisions for long-term daily driving.

Kanto records 3.9% CAGR, driven by high-density enthusiast communities in Tokyo and Kanagawa with access to aftermarket suppliers and motorsport facilities. Consumer priorities include ergonomic seating designed for controlled posture during extended commuting and recreational driving. Retail demand extends to reinforced bucket seats used in tuning events and display vehicles at specialty shops. Procurement teams consider side-airbag compatibility and structural safety alignment with transport regulations. Upholstery trends include fabric and synthetic leather combinations providing affordable entry points for modification. E-commerce plays an important role in part selection, providing visibility into fitment details and regional service scheduling. Manufacturers adapt models for compact interior layouts found in popular urban hatchbacks.

Kansai posts 3.4% CAGR, centered around Osaka and Kobe performance garages serving drivers seeking balanced styling and support improvements. Retail assortments include sport-focused seats with adjustable reclining mechanisms for mixed road usage. Track-day participation at regional venues encourages procurement of lightweight frames to improve handling responses. Interior-care preferences influence fabric selection designed to withstand frequent entry and exit cycles. Automotive parts suppliers streamline ordering processes linked to scheduled installation windows. Local shops maintain knowledge of steel and aluminum mounting brackets tailored to model-specific configurations found across Kansai roadways.

Chubu posts 3.0% CAGR, influenced by production proximity and tuning communities connected to legacy automotive clusters in Aichi Prefecture. Regional activity favors reliable seating upgrades for endurance-focused use on local tracks. Performance-seat suppliers cater to owners requesting bolstering that improves precision under high lateral load while supporting comfortable seating for daily travel. Logistics networks deliver competitive availability for both domestic and imported products, enabling purchasing flexibility based on design preferences and compatibility. Workshops offer structured installation guided by standardized seat-rail alignment to maintain inspection adherence. Chubu buyers review product longevity and reinforcement characteristics where metal frames and composite shells are assessed for fatigue resistance. Mid-cycle replacements occur when padding compression affects posture clarity during dynamic maneuvering.

Tohoku records 2.6% CAGR with a steady yet smaller consumer base focused on practical performance upgrades for vehicles driven across variable terrain and seasonal conditions. Enthusiasts value seating configurations that retain comfort during long inter-city travel while adding structural lateral support for spirited driving. Motion stability improvement encourages adoption of reinforced bucket seats where side-padding geometry maintains position control during changes in acceleration. Procurement decisions evaluate durability of fabrics against extended use under temperature shifts. Local availability of tuning shops varies, so many customers rely on standardized installation kits that support proper alignment in self-install applications. Product selection focuses on tested compatibility rather than bespoke customization, incorporating familiar brands with domestic warehousing. Seasonal motorsport activities stimulate short-term demand around event schedules.

The Rest of Japan posts 2.5% CAGR with demand emerging from dispersed tuning communities and owners prioritizing selective interior enhancements. Procurement often accompanies broader maintenance or vehicle refresh projects where seating replacements improve functional feel. Racing-seat adoption emphasizes adaptability to different body profiles and cost alignment with moderate modification budgets. Lightweight materials are chosen to reduce fatigue accumulation in dual-use cars supporting occasional motorsport participation. Buyers evaluate product certifications that enable use in regulated track environments. Distribution relies on e-commerce fulfillment and delivery scheduling rather than centralized retail browsing. Export-focused suppliers maintain outreach through catalog visibility featuring specifications for mounting and buckle compatibility. Consumer decisions are measured, ensuring upgrades deliver seat stability and resilience without compromising daily comfort.

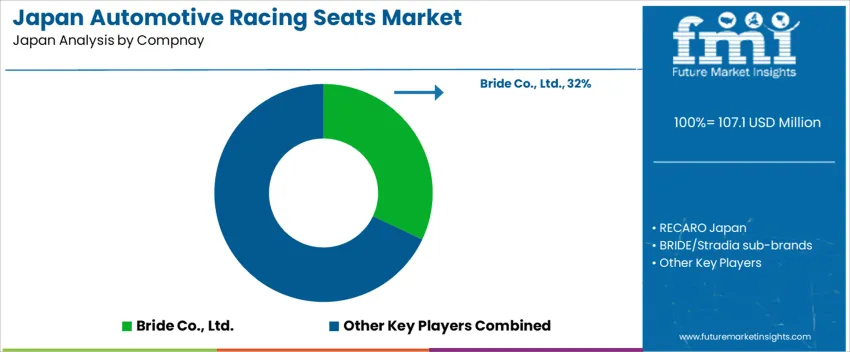

Demand for automotive racing seats in Japan is driven by suppliers supporting motorsport categories, street-legal tuning, and performance-focused aftermarket installation. Bride Co., Ltd. holds an estimated 32.0% share, supported by controlled shell-strength construction, stable weight-to-rigidity ratios, and certified side-mount compatibility used by Japanese circuit and rally drivers. Its seats provide secure lateral support and impact-load reliability consistent with national motorsport regulations.

RECARO Japan maintains significant participation through FIA-rated seats and reinforced shells used in professional and semi-professional competition. Its seating systems deliver consistent ergonomics and verified belt-pass-through tolerances for harness integrity. Sparco Japan contributes selective demand from track-day and drift users requiring predictable structural durability and seat-mount adaptability within common tuner platforms.

OMP Japan adds availability in specialized motorsport programs where shell geometry must support flexible cockpit configurations. Technician support and fitting accuracy remain critical in adoption. Competition in Japan centers on impact-load tolerance, FIA compliance, shell rigidity, weight optimization, and installation precision with domestic vehicle platforms. Demand persists in motorsport and enthusiast channels where controlled body support and regulated safety standards are mandatory across Japanese performance-vehicle segments.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Fiber Material | Carbon Fiber, Natural Fiber |

| Application | High Performance, Eco Performance |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Bride Co., Ltd., RECARO Japan, BRIDE/Stradia sub-brands, Sparco Japan, OMP Japan |

| Additional Attributes | Analysis includes carbon composite lightweight seat integration for motorsports and tuning vehicles; ergonomic safety compliance with FIA and JAF standards; rising installation in street-legal sports models and aftermarket customization; product demand aligned with EV sports development and competitive racing culture mainly concentrated in Kanto and Kansai circuits; evaluation of OEM-affiliated vs aftermarket distribution channels. |

The demand for automotive racing seats in Japan is estimated to be valued at USD 107.1 million in 2025.

The market size for the automotive racing seats in Japan is projected to reach USD 149.3 million by 2035.

The demand for automotive racing seats in Japan is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in automotive racing seats in Japan are carbon fiber and natural fiber.

In terms of application, high performance segment is expected to command 70.0% share in the automotive racing seats in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Racing Seats Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive Racing Seats in USA Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Demand for Automotive NFC in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Fabrics in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Headliner in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Light Bars in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brake Tube in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive AI Chipset in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Spindle in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Coating in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Grade Inductor in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA