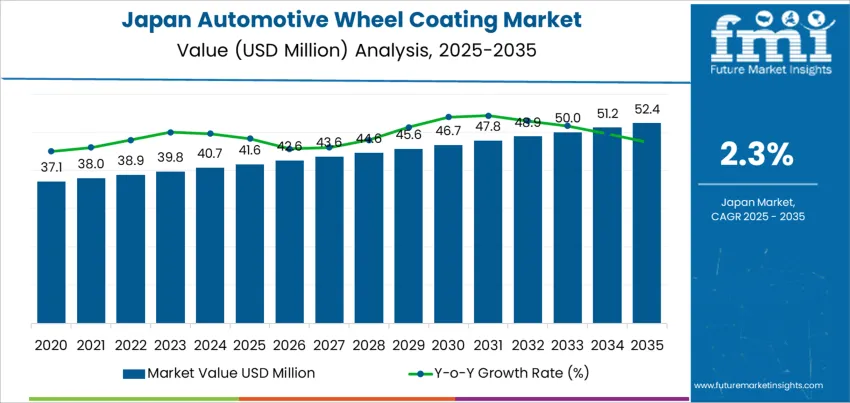

The demand for automotive wheel coating in Japan is expected to grow from USD 41.6 million in 2025 to USD 52.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 2.3%. Automotive wheel coatings are crucial for enhancing the appearance of vehicle wheels while providing protection against corrosion, scratches, and environmental factors like UV rays, road salts, and chemicals. These coatings contribute to improving the longevity and aesthetic appeal of wheels, making them an essential component in automotive design, particularly for premium and high-performance vehicles.

The increasing demand for luxury vehicles, sports cars, and electric vehicles (EVs) is a major driver of growth in the wheel coating industry. As consumers become more focused on the appearance of their vehicles, there is a greater need for coatings that not only enhance visual appeal but also offer long-lasting protection. The rise in popularity of electric vehicles is also contributing to this trend, as these vehicles often incorporate advanced materials and require more durable and protective coatings for various components, including wheels.

Growing concerns around environmental resposibility are prompting the automotive industry to adopt eco-friendly coatings. These coatings are designed to reduce environmental impact while maintaining the performance and quality required in the competitive automotive industry.

Between 2025 and 2030, the demand for automotive wheel coating in Japan is expected to grow from USD 41.6 million to USD 42.6 million. This period will experience moderate growth, driven by a steady rise in consumer interest in vehicle aesthetics and durability. The growth during this phase will be primarily influenced by the automotive industry's focus on enhancing vehicle longevity and performance through advanced coating technologies. As consumers increasingly demand eco-friendly solutions, the adoption of innovative and environmentally friendly coatings will support the gradual increase in demand during this period.

From 2030 to 2035, the demand for automotive wheel coatings will see accelerated growth, rising from USD 42.6 million to USD 52.4 million. This significant increase will be driven by the growing adoption of luxury vehicles, electric vehicles (EVs), and the expanding high-performance wheel industry. As the automotive industry focuses on providing wheels that are both visually appealing and durable, the demand for advanced coatings with improved performance and longevity will rise. The emphasis on electric vehicle (EV) production and increasing consumer awareness of vehicle aesthetics will contribute to the surge in demand for automotive wheel coatings.

| Metric | Value |

|---|---|

| Demand for Automotive Wheel Coating in Japan Value (2025) | USD 41.6 million |

| Demand for Automotive Wheel Coating in Japan Forecast Value (2035) | USD 52.4 million |

| Demand for Automotive Wheel Coating in Japan Forecast CAGR (2025-2035) | 2.3% |

The demand for automotive wheel coatings in Japan is increasing due to the growing focus on vehicle aesthetics, durability, and performance. Automotive wheel coatings offer several benefits, including improved resistance to corrosion, abrasion, and wear, while also enhancing the overall appearance of the vehicle. As Japanese consumers and automotive manufacturers continue to prioritize high-quality, durable, and visually appealing vehicles, the demand for advanced wheel coatings is expected to grow steadily.

A key driver of this growth is the increasing adoption of high-performance coatings that offer greater protection against harsh environmental conditions, including road salts, chemicals, and extreme weather. Automotive wheels are exposed to these elements, making corrosion resistance a top priority. With Japan’s focus on quality and long-lasting vehicle performance, both car manufacturers and consumers are turning to advanced coatings that can withstand these conditions and maintain the visual appeal of the wheels over time.

The growing trend of customization in the automotive sector is further fueling the demand for wheel coatings. Consumers are seeking to personalize their vehicles with unique finishes and colors, and automotive wheel coatings allow for greater customization while providing protection. As Japan continues to lead in automotive innovation, including the development of electric vehicles (EVs), the demand for specialized coatings that enhance both aesthetics and functionality is expected to increase. The automotive wheel coating industry in Japan is anticipated to grow steadily through 2035, driven by both performance requirements and consumer preferences for stylish, durable vehicles.

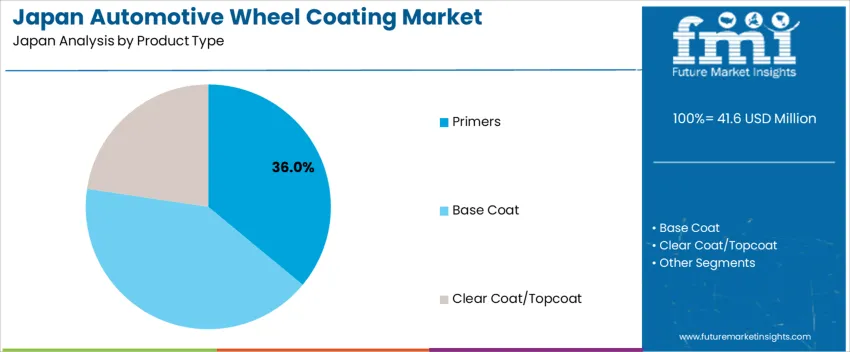

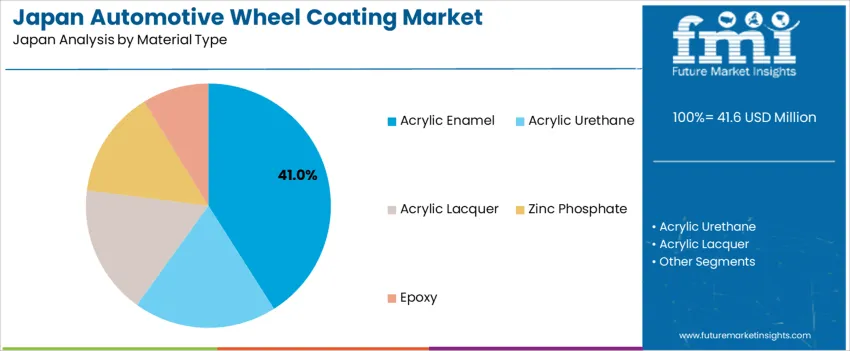

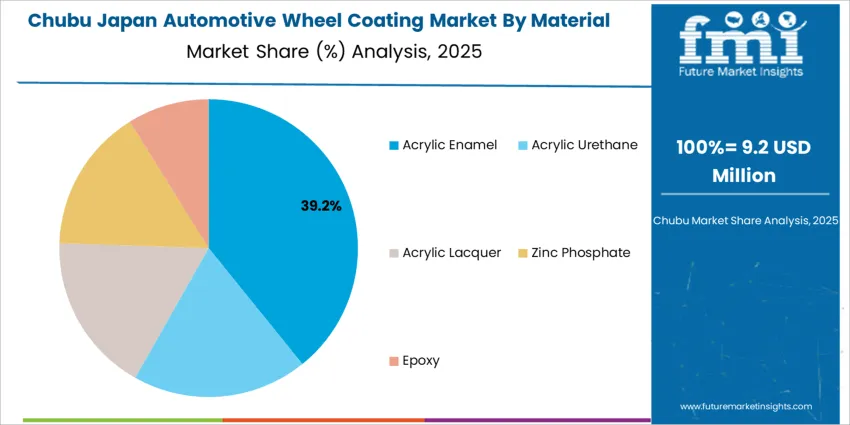

Demand for automotive wheel coating in Japan is segmented by product type, material type, and region. By product type, demand is divided into primers, base coat, and clear coat/topcoat, with primers leading the demand at 36%. The demand is also segmented by material type, including acrylic enamel, acrylic urethane, acrylic lacquer, zinc phosphate, and epoxy, with acrylic enamel holding the largest share at 41%. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and the Rest of Japan.

Primers account for 36% of the demand for automotive wheel coatings in Japan. Primers are essential for preparing the wheel surface and ensuring proper adhesion of the topcoat layers. They create a solid foundation that enhances the durability and resistance of the entire coating system to environmental challenges like corrosion, moisture, and UV radiation. The application of primers improves the overall effectiveness of automotive wheel coatings by promoting stronger bonds between the wheel and the topcoat. This is especially important in automotive wheel applications, where wheels face constant exposure to harsh driving conditions such as road salts, dirt, and temperature fluctuations. As manufacturers focus on providing wheels with enhanced longevity and performance, the demand for primers remains high. Their role in improving the durability and aesthetic of automotive wheels ensures they maintain their dominant position in the industry.

Acrylic enamel accounts for 41% of the demand for automotive wheel coatings in Japan. This material is highly valued for its exceptional durability, resistance to weathering, and its ability to retain a glossy finish over time. Acrylic enamel coatings are particularly popular in automotive wheel applications because of their superior color retention and UV resistance, which helps maintain the wheel’s appearance even in harsh conditions. The material's ability to withstand exposure to moisture, road salts, and other environmental factors makes it ideal for protecting automotive wheels. Acrylic enamel is also easy to apply, providing a smooth, durable, and visually appealing finish. As the automotive industry focuses on high-quality finishes that can endure extreme conditions, acrylic enamel continues to lead the demand for automotive wheel coatings. Its superior performance in protecting wheels from wear and enhancing their aesthetic appeal guarantees its ongoing dominance in the industry.

In Japan, demand for automotive wheel coatings is rising as both OEMs and aftermarket services place more emphasis on wheel aesthetics, corrosion resistance, and long‑term durability. Growth in overall vehicle production (including passenger cars and light vehicles) and rising sales of alloy‑wheeled models support coating demand. As more vehicles move to premium trims and customization including alloy wheels with special finishes demand for quality coatings for wheels and hubs increases. On the flip side, raw material price volatility, cost pressures on automakers, and competition from cheaper finishing or painting alternatives restrain the uptake of high‑performance coatings. Compliance with environmental and VOC‑regulation standards influences the choice of coating technologies, which can add to cost and complexity.

Why is Demand for Wheel Coatings Growing in Japan?

Demand for wheel coatings in Japan is growing because wheel finish quality and longevity have become key determinants for consumer satisfaction and resale value. As Japanese consumers increasingly favor alloy wheels and custom finishes, OEMs and aftermarket suppliers opt for durable coatings that offer corrosion resistance, protective layers against road salt and weather, and enhanced aesthetics. The trend toward premium and customized vehicles even in compact and mid‑segment cars boost uptake of coated wheels. Stricter regulatory and quality standards for automotive components push manufacturers to adopt better coatings for safety and durability, which supports increased demand for modern wheel‑coating solutions in Japan.

How are Technological and Material Innovations Driving Growth of Wheel Coatings in Japan?

Material and process innovations are playing a key role. Use of advanced powder coatings, water‑borne or low‑VOC finishes, and improved corrosion‑resistant formulas make wheel coatings more durable, eco‑compliant and visually appealing. These innovations meet both regulatory requirements and consumer demand for high-spec finishing. Coating techniques tailored for alloy or light‑metal wheels often used in modern passenger cars allow for strong adhesion, better heat and abrasion resistance, which is important for Japanese driving conditions (urban use, mixed weather). Improved manufacturing processes, better coating uniformity, and efficient finishing lines help OEMs and aftermarket suppliers maintain quality while keeping costs in check.

What are the Key Challenges Limiting Wider Adoption of High‑Performance Wheel Coatings in Japan?

Higher cost of premium coating materials and specialized finishing processes compared with basic paint or standard finishes can deter budget‑sensitive OEMs or buyers. Volatility in raw material prices (metals, pigments, resins) adds uncertainty to costs and may reduce margin attractiveness. Compliance with environmental and emissions regulations (VOC limits, waste disposal) may require additional investment in coating technology and waste‑management systems. For aftermarket service providers, ensuring consistent coating quality, adherence to safety/standards for wheels, and managing labour or equipment costs may be challenging. Finally, competition from simpler, lower‑cost finishing alternatives may limit the penetration of high‑end coatings in cost‑conscious segments.

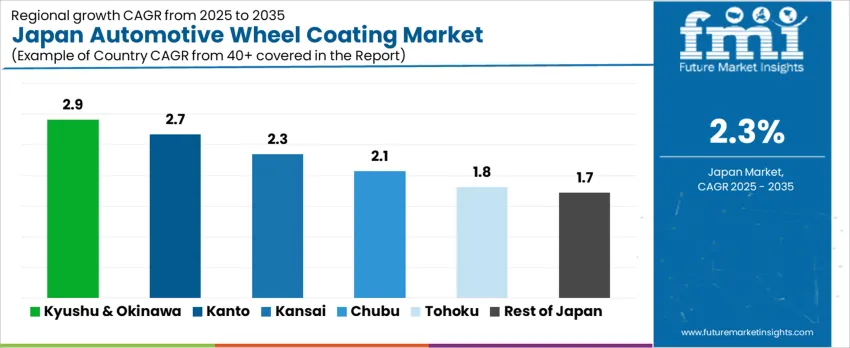

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 2.9% |

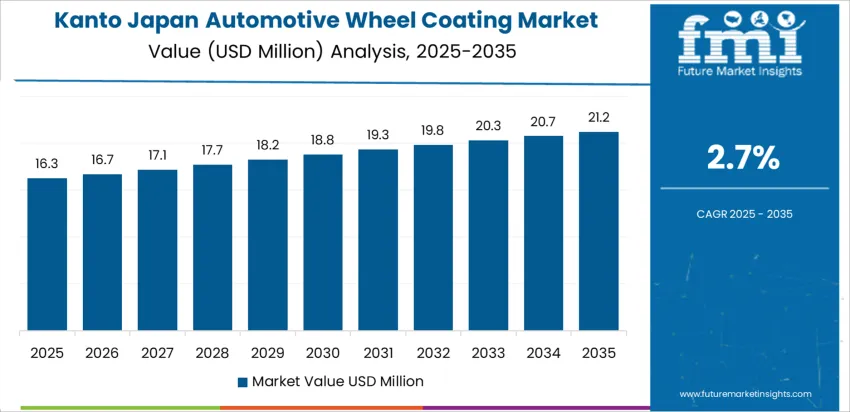

| Kanto | 2.7% |

| Kinki | 2.3% |

| Chubu | 2.1% |

| Tohoku | 1.8% |

| Rest of Japan | 1.7% |

Demand for automotive wheel coating in Japan is growing steadily, with Kyushu & Okinawa leading at a 2.9% CAGR, driven by the region’s focus on automotive manufacturing and innovation. The Kanto region follows closely with a 2.7% CAGR, supported by its robust automotive sector, including major manufacturing hubs. Kinki shows a 2.3% CAGR, driven by its strong automotive and industrial base, which has a high demand for durable and aesthetic coatings for vehicle components. Chubu experiences a 2.1% CAGR, with demand fueled by the region’s automotive manufacturers looking for high-performance coatings. Tohoku and the Rest of Japan see slower growth at 1.8% and 1.7%, respectively, as the automotive sector in these regions continues to develop.

Kyushu & Okinawa is leading the demand for automotive wheel coating in Japan, growing at a 2.9% CAGR. This growth is driven by the region’s robust automotive manufacturing sector, where high-quality wheel coatings are essential for both aesthetic and functional purposes. Kyushu is home to several automotive manufacturers that require durable coatings to improve the appearance and corrosion resistance of vehicle wheels. Okinawa’s growing automotive aftermarket sector is contributing to the demand, as consumers and businesses increasingly look for long-lasting and visually appealing wheel coatings. The region’s focus on enhancing manufacturing capabilities, particularly in advanced automotive technologies, is also pushing for the use of innovative and durable coatings. As the automotive industry in Kyushu & Okinawa continues to grow, demand for automotive wheel coatings is expected to remain strong, with a steady increase in both production and aftermarket needs.

Kanto, home to Tokyo and major automotive hubs, is seeing steady demand for automotive wheel coating, growing at a 2.7% CAGR. The region’s extensive automotive industry, including global and local manufacturers, relies on advanced wheel coatings to enhance the durability and appearance of their products. Kanto’s automotive manufacturers are continuously adopting new technologies to improve the performance of vehicle parts, and wheel coatings play a crucial role in this process, ensuring resistance to environmental elements like corrosion and wear. The region’s large consumer market is also driving demand for aftermarket coatings, as car owners seek to improve the aesthetics and longevity of their vehicle wheels. Kanto’s central role in automotive innovation and manufacturing, along with its vast consumer base, ensures that demand for automotive wheel coatings will remain strong. As the automotive industry evolves, Kanto’s demand for durable and functional coatings is expected to grow steadily.

In Kinki, the demand for automotive wheel coating is growing at a 2.3% CAGR, driven by the region’s strong automotive and industrial base. Kinki, which includes major automotive centers like Osaka and Kobe, has a large number of manufacturers that require high-performance wheel coatings to enhance the aesthetic appeal and durability of their products. As the automotive sector in Kinki continues to expand, especially in the production of high-end and performance vehicles, the demand for advanced wheel coatings is rising. Manufacturers in this region are increasingly looking for coatings that provide superior corrosion resistance and high visual quality. Kinki’s automotive aftermarket sector is growing, with consumers increasingly opting for specialized wheel coatings to improve the appearance and longevity of their vehicle wheels. As these trends continue, the demand for automotive wheel coatings in Kinki is expected to remain strong, driven by both production and aftermarket needs.

Chubu is seeing moderate demand for automotive wheel coating, growing at a 2.1% CAGR. This growth is driven by the region’s strong automotive manufacturing sector, particularly in cities like Nagoya, which is home to major automotive manufacturers. Chubu’s automotive industry requires high-quality coatings for vehicle wheels, focusing on durability, corrosion resistance, and visual appeal. The demand for wheel coatings in Chubu is closely tied to the region’s focus on improving manufacturing processes and enhancing the quality of vehicle components. As the automotive industry continues to prioritize advanced manufacturing technologies, there is a growing need for durable and aesthetically pleasing coatings for wheels and other automotive parts. As more consumers look to customize and protect their vehicles, the demand for aftermarket wheel coatings is also rising. As Chubu’s automotive sector grows, demand for automotive wheel coatings is expected to follow suit, with steady growth projected in the coming years.

Tohoku is experiencing steady growth in demand for automotive wheel coatings, growing at a 1.8% CAGR. While Tohoku is not as heavily industrialized as some of Japan’s other regions, the automotive sector in this area is expanding, driving the need for high-quality wheel coatings. As Tohoku’s automotive industry develops, there is an increasing focus on improving the durability and appearance of vehicle components, including wheels. The region is also seeing growth in the automotive aftermarket, where consumers are seeking coatings that offer enhanced protection against wear and corrosion. Tohoku’s push toward upgrading its industrial infrastructure and adopting new manufacturing technologies is contributing to this demand. As consumers become more aware of the benefits of durable wheel coatings for vehicle maintenance and aesthetics, the demand in Tohoku is expected to rise gradually. Although the growth rate is slower compared to other regions, Tohoku is witnessing steady development in the automotive wheel coating market.

The Rest of Japan is seeing moderate demand for automotive wheel coatings, with a 1.7% CAGR. The demand in these regions is driven by the growth of the automotive industry in smaller, regional manufacturing centers. As Japan’s automotive sector expands, there is a rising need for coatings that enhance the durability, functionality, and appearance of vehicle wheels. The Rest of Japan’s automotive aftermarket sector is also growing, with consumers increasingly interested in improving the aesthetics and longevity of their vehicle wheels. Regional manufacturers are adopting advanced technologies to improve the performance and quality of their products, including wheel coatings. While the growth rate is slower compared to more industrialized regions, the Rest of Japan is seeing steady demand for automotive wheel coatings. As the automotive industry continues to develop and regional consumers become more focused on vehicle maintenance and customization, the demand for wheel coatings is expected to continue rising.

The demand for automotive wheel coatings in Japan is growing due to increasing consumer preferences for aesthetic appeal, durability, and long-lasting protection of vehicle wheels. With the rise in automotive customization and the need for wheels to withstand harsh environmental conditions, automotive wheel coatings are crucial in enhancing the appearance and performance of vehicles. These coatings provide corrosion resistance, UV protection, and maintain a sleek, shiny finish, which is essential in the automotive sector. As Japan continues to lead in automotive manufacturing and innovation, demand for high-quality, durable wheel coatings is expected to continue rising.

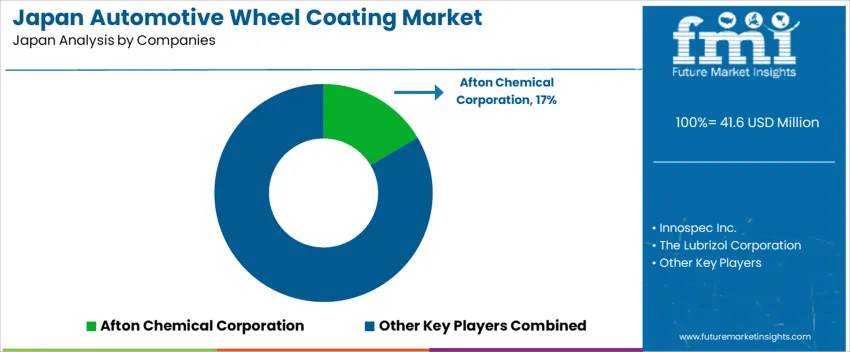

Leading companies in the automotive wheel coating industry in Japan include Afton Chemical Corporation, Innospec Inc., The Lubrizol Corporation, Chevron Oronite Company LLC, and BASF SE. Afton Chemical Corporation holds a significant share of 16.5%, offering specialized automotive wheel coatings that ensure durability and resistance to environmental factors. Innospec Inc. provides a range of coating solutions designed to protect wheels while enhancing their appearance. The Lubrizol Corporation supplies innovative coating technologies that cater to the high-performance needs of automotive manufacturers. Chevron Oronite Company LLC offers advanced chemical solutions, including coatings, designed for automotive applications. BASF SE is a key player, offering comprehensive coating products that provide corrosion protection and improve wheel aesthetics for a variety of vehicle types.

Competition in the automotive wheel coating industry is driven by the demand for high-performance, durable, and visually appealing coatings that meet the strict standards of the automotive industry. Companies compete by offering innovative solutions that provide enhanced protection against corrosion, UV rays, and wear-and-tear while maintaining a high-quality finish. As the automotive industry continues to prioritize design and durability, manufacturers are focusing on creating coatings that are not only functional but also environmentally friendly. The ability to offer customizable, cost-effective, and eco-friendly solutions is becoming a key differentiator in the competitive landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Primers, Base Coat, Clear Coat/Topcoat |

| Material Type | Acrylic Enamel, Acrylic Urethane, Acrylic Lacquer, Zinc Phosphate, Epoxy |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Afton Chemical Corporation, Innospec Inc., The Lubrizol Corporation, Chevron Oronite Company LLC, BASF SE |

| Additional Attributes | Dollar sales by product type and material; regional CAGR and adoption trends; demand trends in automotive wheel coatings; growth in automotive manufacturing, maintenance, and aftermarket sectors; technology adoption for coating solutions; vendor offerings including automotive coating products and services; regulatory influences and industry standards |

The demand for automotive wheel coating in Japan is estimated to be valued at USD 41.6 million in 2025.

The market size for the automotive wheel coating in Japan is projected to reach USD 52.4 million by 2035.

The demand for automotive wheel coating in Japan is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in automotive wheel coating in Japan are primers, base coat and clear coat/topcoat.

In terms of material type, acrylic enamel segment is expected to command 41.0% share in the automotive wheel coating in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Coating in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Spindle in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Wheel Bearing Aftermarket Analysis - Size, Share, and Forecast 2025 to 2035

Automotive Wheel Rims Market Growth - Trends & Forecast 2025 to 2035

Automotive Wheel Spindle Market Growth - Trends & Forecast 2025 to 2035

Automotive Wheel Hub Bearing Aftermarket Analysis by Product Type, Inner Diameter, Vehicle Type, Sales Channel, and Region Forecast through 2035

Automotive Wheel Bearings Market

Automotive In-Wheel Motors Market Growth - Trends & Forecast 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Paints & Coatings Market Size and Share Forecast Outlook 2025 to 2035

Automotive Underbody Coatings Market

Africa Automotive Refinish Coatings Market Analysis by Product Type, Technology, Material Type, Vehicle Type, End Use, and Region Forecast Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA