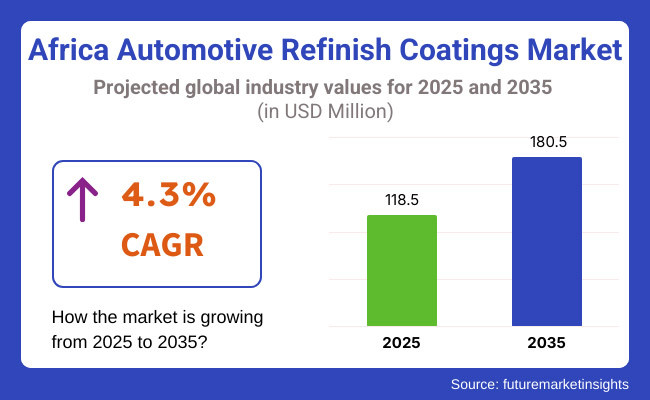

The Africa automotive refinish coatings market is anticipated to be valued at USD 118.5 million in 2025. It is expected to grow at a CAGR of 4.3% during the forecast period and reach a value of USD 180.5 million in 2035.

In 2024, the automotive refinish coatings market in Africa showed steady growth due to rising vehicle ownership, road accidents, and increasing demand from consumers for personalizing their vehicles. The two key markets remained Egypt and South Africa, where traffic density and the frequency of road mishaps created the need for refinishing solutions

Urbanization, the growing association of ride-hailing services, and the continued growth of commercial fleet operations catalyzed the demand for repair and maintenance coatings. However, eco-friendly coatings such as waterborne refinish solutions gained increasing traction as governments and manufacturers pursued sustainability-oriented alternatives to solvent-based products.

The market is expected to reach USD 180.5 million in 2035. Both the automotive sector's continued growth and growing aftermarket support from key players, as well as the introduction of more polishes and premium coatings, will further drive demand. Innovations associated with low-VOC, water-based formulations will be sustained by environmental regulations and consumer preferences for sustainability. Furthermore, economic development and increased industry investments in Africa’s automotive repair ecosystem will create new revenue streams for coating manufacturers.

A recent survey conducted by Future Market Insights with key stakeholders in the industry revealed several critical trends shaping the industry. Body shops, repair centers, and automotive aftermarket players emphasized the growing preference for high-durability and fast-drying coatings to enhance vehicle aesthetics and reduce downtime.A significant portion of respondents also highlighted the increasing adoption of waterborne and low-VOC coatings, driven by regulatory policies and growing environmental awareness among consumers.

Stakeholders identified road accidents and vehicle aging as primary demand drivers for refinish coatings. In regions like South Africa and Egypt, frequent collisions and the need for vehicle restorations have led to higher consumption of advanced coatings with enhanced scratch resistance. Additionally, fleet operators and ride-hailing service providers are actively seeking cost-effective refinishing solutions to maintain their vehicles' appearance and longevity.

Market participants also pointed to aftermarket support programs and training initiatives as key factors influencing brand loyalty and product selection. Leading manufacturers investing in technical assistance, training workshops, and localized distribution networks are gaining a competitive edge.

Furthermore, industry players expect a rise in premium coatings and customization trends as consumers increasingly demand personalized vehicle finishes.To gain deeper insights into evolving market dynamics and explore strategic opportunities, request a detailed report from Future Market Insights today.

| Country | Regulatory Impact & Mandatory Certifications |

|---|---|

| South Africa | Strict VOC (Volatile Organic Compound) regulations under environmental laws are pushing manufacturers toward waterborne and low-VOC coatings. The South African Bureau of Standards (SABS) ensures compliance with SANS 10265:2009, which governs vehicle refinishing materials. |

| Egypt | The government is enforcing stricter air pollution and environmental safety norms, aligning with global standards. Import restrictions on high-VOC solvent-based coatings are increasing demand for eco-friendly alternatives. Companies must comply with Egyptian Organization for Standardization and Quality (EOS) regulations. |

| Nigeria | Regulations under the National Environmental Standards and Regulations Enforcement Agency (NESREA) are promoting lead-free and eco-friendly coatings. Certification from the Standards Organisation of Nigeria (SON) is required for imported and locally produced coatings. |

| Kenya | Compliance with National Environment Management Authority (NEMA) regulations is necessary for coating manufacturers. The focus is on reducing air pollutants and encouraging the adoption of waterborne and UV-cured coatings. Companies must meet KEBS (Kenya Bureau of Standards) certification for product approval. |

| Morocco | Morocco is gradually aligning its automotive refinishing standards with EU environmental policies. While the country encourages the adoption of low-VOC coatings, it has not officially mandated a complete phase-out of high-VOC coatings. The Moroccan Institute for Standardization (IMANOR) oversees compliance with eco-friendly product standards. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The market saw steady growth post-COVID-19 disruptions, driven by rising vehicle ownership and increased road accidents. Economic recovery efforts supported automotive aftermarket expansion. | The industry is expected to expand steadily, supported by eco-friendly innovations, increased fleet maintenance demand, and growing automotive refinishing services. |

| Traditional solvent-borne coatings continued to hold a significant share, though regulatory pressure and environmental concerns began pushing for alternatives. | Stricter VOC regulations and sustainability trends will drive higher adoption of waterborne and UV-cured coatings, reducing reliance on solvent-based options. |

| Acrylic-based coatings largely dominated the industry due to their cost-effectiveness, UV resistance, and durability. | Acrylic coatings will remain dominant but will evolve with improved formulations for higher efficiency and sustainability. |

| The refinish coatings market was primarily fueled by passenger car repairs and repainting, with commercial vehicles holding a smaller but stable share. | The increasing number of ride-hailing services, logistics companies, and commercial fleets will contribute to higher demand for coatings in fleet maintenance and refurbishment. |

| Increased collision repair work, customization trends, and used-car industry expansion drove demand for refinish coatings. | The growing need for cost-effective vehicle restoration will solidify the aftermarket segment’s dominance over OEM coatings. |

| Despite challenges like supply chain disruptions and economic slowdowns, the market maintained stable expansion. | The industry is projected to witness higher-value innovations, enhanced durability coatings, and smart refinish solutions for better performance and longevity. |

Acrylic remains the most preferred material for automotive refinish coatings, accounting for 57.7% of the total market share in 2023. This dominance is driven by its glossy finish, UV resistance, and durability, making it the top choice for vehicle refinishing.

Acrylic coatings also offer quick drying time and ease of application, further fueling their adoption across both OEMs and the aftermarket. The segment is projected to maintain its leadership position, benefiting from continuous innovations in high-performance acrylic formulations.

Waterborne coatings are emerging as the fastest-growing category, projected to account for 36.6% of the market share in 2023. Their low VOC emissions, high corrosion resistance, and eco-friendly nature drive increased adoption, especially as environmental regulations tighten.

The shift from solvent-based to water-based formulations is supported by automakers and repair shops looking to reduce their ecological footprint. With ongoing research into advanced waterborne technologies, this segment is set for rapid expansion through 2035.

Among product types, clear coats and base coats experience significant demand. Clear coats protect against environmental factors, enhancing the vehicle’s appearance and longevity. Meanwhile, base coats form the foundational color layer, crucial for refinishing work. With growing consumer preferences for glossy and metallic finishes, these two product categories will continue to dominate the industry.

Passenger cars remain the largest segment, especially in urban regions where vehicle refinishing is frequently required due to higher road traffic and accident rates. Within this category, midsize and compact cars account for a significant share, as they make up a large portion of Africa’s vehicle fleet. However, commercial vehicles, particularly light commercial vehicles (LCVs), are expected to drive growth as businesses seek cost-effective refinishing solutions to maintain fleet aesthetics and durability.

The aftermarket segment leads the industry, driven by increased collision repair needs and vehicle personalization trends. As car owners opt for custom paint jobs and refinishing services, the demand for high-quality coatings continues to surge. While OEMs contribute significantly to new vehicle coatings, the aftermarket sector will outpace OEM growth, driven by Africa’s expanding used-car market and rising road accident cases.

As of 2024, the Africa automotive refinish coatings market has seen significant activity among major companies, with companies focusing on strategically expanding, partnering, and investing in new technologies that will help them strengthen their position in the industry. Major players like PPG Industries, Axalta Coating Systems, BASF SE, AkzoNobel N.V., and Kansai Paint are all aggressively pursuing strategies to capture a larger share of this growing industry.

All these companies leverage their coatings technology expertise to address the emerging demand for high-quality, durable, and environmentally friendly refinish coatings in Africa. PPG Industries is the largest market shareholder at approximately 20-25% because of its strong distribution and innovative waterborne refinish coating systems designed for Africa's unique climatic and regulatory conditions.

PPG Industries holds the largest market share at approximately 20-22%, driven by its strong distribution network and advanced waterborne refinish coating systems tailored for Africa’s unique climatic and regulatory conditions. The company launched a new waterborne refinish coating system in 2024 to address environmental concerns and strengthen its sustainability portfolio.

Axalta Coating Systems follows with a 15-18% market share, focusing on key African markets such as South Africa, Nigeria, and Kenya. The company has expanded its reach by entering a strategic partnership with a leading automotive distributor in South Africa to enhance supply chain efficiency and customer accessibility.

BASF SE commands around 12-18% of the market, emphasizing innovation and sustainability through low-VOC (volatile organic compound) refinish coatings intended to meet the strict environmental regulations of Africa. Likewise, the company has invested in local production facilities to cut costs and improve delivery times, thus creating a more responsive supply chain.

AkzoNobel N.V. captures 10-15% of the market with an agenda that focuses on customer engagement and digital transformation. In 2024, the company also launched a mobile application that allows automotive repair shops to access technical support, color-matching tools, and training resources, strengthening customer loyalty and streamlining the refinishing process.

Kansai Paint holds about 5-10% of the market as it seeks to build its footprint in East Africa. There are reports of interest from parties toward the acquisition of regional players, but no official confirmation accompanies such disclosures. Industry sources suggest that such moves align with Kansai Paint's efforts to grow its footprint in the African market.

Sherwin-Williams has an approximately 5-8% share but is increasingly oriented towards emerging markets, even though there is little in the way of regional production facilities. Jotun, Berger Paints, and National Paints make up around 15-20% of the market, comprising regional and local players.

Like other industrial trends, the current trends in automotive refinish coatings and fixtures for Africa fall within the automotive aftermarket and specialty chemicals industry in terms of vehicle maintenance, repair, and aesthetic improvements. This industry is greatly affected by macroeconomic conditions, the state of the automotive industry, and various regulatory policies.

The growth trend of Africa's automotive industry has continued since 2020 and will extend to 2024. This is driven by increasing vehicle ownership, urbanization, and rising disposable incomes, among others. Conversely, inflation, currency fluctuations, and supply chain disruptions have negatively impacted the price of raw materials and, by extension, the refinish coatings price. Additionally, the proliferation of used-car markets and fleet-based transportation services has created a sustained demand for automotive refinishing solutions.

Between 2025 and 2035, the industry is set to grow significantly. This will be supported by economic development, infrastructure investments, and regulatory changes that will favor sustainable coatings. Many African governments are implementing VOC emission regulations and environmental standards, prompting a shift toward waterborne and low-VOC coatings. Furthermore, the rise of e-commerce and digitalization in the automotive aftermarket will enhance the accessibility and distribution of refinish coatings across Africa.

However, the market will grow because of an expanding vehicle fleet, rising accident rates, and consumers' preference for vehicle customization despite currency volatility, import dependency on raw materials, and other challenges. Long-term growth will depend on regulatory harmonization, incentives for local production, and innovation in eco-friendly coatings.

Expansion into Sustainable and Eco-Friendly Coatings

The growing VOC regulations and concerns about the environment make it clear that the demand for waterborne and UV-cured coatings will rise across Africa, driven by stricter VOC regulations and environmental concerns. Companies should invest in their research and development departments to develop low-VOC, very-low-VOC, or no-VOC formulations.

Strengthening Local Manufacturing & Distribution Networks

Africa’s high dependency on imported raw materials and coatings leads to price volatility and supply chain disruptions. Establishing local production units and sourcing raw materials domestically can reduce costs and improve profitability. Strategic partnerships with local distributors and auto repair networks will enhance industry reach, especially in high-growth regions like Egypt, South Africa, and Nigeria.

Targeting Commercial Vehicle Fleets & Ride-Hailing Services

The rise of ride-hailing platforms (Uber, Bolt) and logistics companies is fueling demand for fleet maintenance solutions. Offering bulk refinish coating contracts, tailored fleet packages, and mobile refinishing services will unlock new revenue streams. Developing fast-drying, high-durability coatings suited for heavy commercial vehicle fleets can further drive adoption.

Digital Transformation & E-Commerce Integration

The automotive aftermarket is shifting online, with businesses and consumers purchasing coatings via digital platforms. Companies should invest in B2B and B2C e-commerce platforms, offering direct-to-consumer sales, digital color-matching tools, and online consultation services. Building a strong regional e-commerce presence can boost sales and enhance brand visibility.

Aftermarket Service Expansion & Training Initiatives

The aftermarket segment dominates the African market, but a shortage of skilled refinishers limits growth. Companies should establish training programs for auto body shops, offering certification courses in advanced refinishing techniques. Partnering with vocational institutes and repair chains will build brand loyalty and ensure higher-quality coating applications.

Mergers, Acquisitions & Joint Ventures

To scale operations and gain industry share, companies should explore M&A opportunities with local automotive paint manufacturers, auto body shop chains, and distribution firms. Joint ventures with global players entering the African market can provide access to new technologies and R&D capabilities. A strategic focus on country-specific collaborations will accelerate industry penetration.

The market is segmented into primer, base coat, top coat, clear coat, and fillers.

The market is segmented into solvent borne, water borne, and uv cure.

The market is segmented into polyurethanes, acrylics, alkyd, and nitrocellulose.

The market is segmented into passenger cars and commercial vehicles.

The market is segmented into OEM and aftermarket.

Increasing vehicle ownership, accident rates, and demand for personalization are key growth drivers.

They offer low VOC emissions, high durability, and comply with evolving environmental regulations.

South Africa, Egypt, Nigeria, Kenya, and Morocco are key contributors due to their automotive sector growth.

It drives demand through repainting, refinishing, and fleet maintenance, especially in the used-car sector.

They are developing low-VOC, waterborne, and UV-cured coatings while promoting eco-friendly solutions.

Table 01: Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 02: Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 03: Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 04: Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 05: Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 06: Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 07: Market Size Volume (Tons) Analysis and Forecast by Country, 2018 to 2033

Table 08: Market Size (US$ Million) Analysis and Forecast by Country, 2018 to 2033

Table 09: Egypt Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 10: Egypt Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 11: Egypt Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 12: Egypt Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 13: Egypt Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 14: Egypt Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 15: South Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 16: South Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 17: South Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 18: South Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 19: South Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 20: South Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 21: Algeria Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 22: Algeria Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 23: Algeria Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 24: Algeria Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 25: Algeria Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 26: Algeria Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 27: Morocco Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 28: Morocco Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 29: Morocco Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 30: Morocco Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 31: Morocco Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 32: Morocco Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 33: Kenya Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 34: Kenya Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 35: Kenya Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 36: Kenya Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 37: Kenya Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 38: Kenya Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 39: Ethiopia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 40: Ethiopia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 41: Ethiopia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 42: Ethiopia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 43: Ethiopia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 44: Ethiopia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 45: Ghana Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 46: Ghana Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 47: Ghana Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 48: Ghana Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 49: Ghana Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 50: Ghana Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 51: Nigeria Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 52: Nigeria Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 53: Nigeria Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 54: Nigeria Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 55: Nigeria Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 56: Nigeria Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 57: Tunisia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 58: Tunisia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 59: Tunisia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 60: Tunisia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 61: Tunisia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 62: Tunisia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 63: Democratic Republic of Congo Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 64: Democratic Republic of Congo Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 65: Democratic Republic of Congo Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 66: Democratic Republic of Congo Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 67: Democratic Republic of Congo Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 68: Democratic Republic of Congo Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 69: Uganda Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 70: Uganda Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 71: Uganda Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 72: Uganda Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 73: Uganda Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 74: Uganda Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 75: Liberia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 76: Liberia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 77: Liberia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 78: Liberia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 79: Liberia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 80: Liberia Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Table 81: Rest of Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Material Type, 2018 to 2033

Table 82: Rest of Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 83: Rest of Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Technology, 2018 to 2033

Table 84: Egypt Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 85: Egypt Automotive Refinish Coatings Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Vehicle Type, 2018 to 2033

Table 86: Rest of Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by End Use, 2018 to 2033

Figure 01: Market Historical Volume (Tons), 2018 to 2023

Figure 02: Market Current and Forecast Volume (Tons), 2023 to 2033

Figure 03: Market Historical Value (US$ Million), 2018 to 2023

Figure 04: Market Current and Forecast Value (US$ Million), 2023 to 2033

Figure 05: Market Incremental $ Opportunity (US$ Million), 2023 to 2033

Figure 06: Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 07: Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 08: Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 09: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Polyurethane Segment, 2018 to 2033

Figure 10: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Acrylics Segment, 2018 to 2033

Figure 11: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Alkyd Segment, 2018 to 2033

Figure 12: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Nitrocellulose Segment, 2018 to 2033

Figure 13: Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 14: Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 15: Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 16: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Primer Segment, 2018 to 2033

Figure 17: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Base Coat Segment, 2018 to 2033

Figure 18: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Top Coat Segment, 2018 to 2033

Figure 19: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Clear Coat Segment, 2018 to 2033

Figure 20: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Fillers Segment, 2018 to 2033

Figure 21: Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 22: Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 23: Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 24: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Solvent Borne Segment, 2018 to 2033

Figure 25: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Water Borne Segment, 2018 to 2033

Figure 26: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by UV Care Segment, 2018 to 2033

Figure 27: Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 28: Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 29: Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 30: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Passenger Cars Segment, 2018 to 2033

Figure 31: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Commercial Vehicles Segment, 2018 to 2033

Figure 32: Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 33: Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 34: Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 35: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by OEM Segment, 2018 to 2033

Figure 36: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Aftermarket Segment, 2018 to 2033

Figure 37: Market Share and BPS Analysis by Country, 2023 and 2033

Figure 38: Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 39: Market Attractiveness Analysis by Country, 2023 to 2033

Figure 40: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Egypt Segment, 2018 to 2033

Figure 41: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by South Africa Segment, 2018 to 2033

Figure 42: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Algeria Segment, 2018 to 2033

Figure 43: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Morocco Segment, 2018 to 2033

Figure 44: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Kenya Segment, 2018 to 2033

Figure 45: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Ethiopia Segment, 2018 to 2033

Figure 46: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Ghana Segment, 2018 to 2033

Figure 47: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Nigeria Segment, 2018 to 2033

Figure 48: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Tunisia Segment, 2018 to 2033

Figure 49: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Democratic Republic of Congo Segment, 2018 to 2033

Figure 50: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Uganda Segment, 2018 to 2033

Figure 51: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Liberia Segment, 2018 to 2033

Figure 52: Egypt Automotive Refinish Coating Market Absolute $ Opportunity by Rest of Africa Segment, 2018 to 2033

Figure 53: Egypt Automotive Refinish Coatings Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 54: Egypt Automotive Refinish Coatings Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 55: Egypt Automotive Refinish Coatings Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 56: Egypt Automotive Refinish Coatings Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 57: Egypt Automotive Refinish Coatings Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 58: Egypt Automotive Refinish Coatings Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 59: Egypt Automotive Refinish Coatings Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 60: Egypt Automotive Refinish Coatings Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 61: Egypt Automotive Refinish Coatings Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 62: Egypt Automotive Refinish Coatings Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 63: Egypt Automotive Refinish Coatings Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 64: Egypt Automotive Refinish Coatings Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 65: Egypt Automotive Refinish Coatings Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 66: Egypt Automotive Refinish Coatings Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 67: Egypt Automotive Refinish Coatings Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 68: South Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 69: South Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 70: South Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 71: South Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 72: South Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 73: South Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 74: South Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 75: South Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 76: South Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 77: South Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 78: South Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 79: South Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 80: South Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 81: South Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 82: South Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 83: Algeria Automotive Refinish Coatings Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 84: Algeria Automotive Refinish Coatings Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 85: Algeria Automotive Refinish Coatings Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 86: Algeria Automotive Refinish Coatings Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 87: Algeria Automotive Refinish Coatings Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 88: Algeria Automotive Refinish Coatings Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 89: Algeria Automotive Refinish Coatings Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 90: Algeria Automotive Refinish Coatings Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 91: Algeria Automotive Refinish Coatings Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 92: Algeria Automotive Refinish Coatings Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 93: Algeria Automotive Refinish Coatings Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 94: Algeria Automotive Refinish Coatings Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 95: Algeria Automotive Refinish Coatings Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 96: Algeria Automotive Refinish Coatings Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 97: Algeria Automotive Refinish Coatings Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 98: Morocco Automotive Refinish Coatings Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 99: Morocco Automotive Refinish Coatings Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 100: Morocco Automotive Refinish Coatings Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 101: Morocco Automotive Refinish Coatings Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 102: Morocco Automotive Refinish Coatings Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 103: Morocco Automotive Refinish Coatings Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 104: Morocco Automotive Refinish Coatings Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 105: Morocco Automotive Refinish Coatings Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 106: Morocco Automotive Refinish Coatings Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 107: Morocco Automotive Refinish Coatings Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 108: Morocco Automotive Refinish Coatings Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 109: Morocco Automotive Refinish Coatings Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 110: Morocco Automotive Refinish Coatings Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 111: Morocco Automotive Refinish Coatings Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 112: Morocco Automotive Refinish Coatings Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 113: Kenya Automotive Refinish Coatings Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 114: Kenya Automotive Refinish Coatings Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 115: Kenya Automotive Refinish Coatings Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 116: Kenya Automotive Refinish Coatings Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 117: Kenya Automotive Refinish Coatings Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 118: Kenya Automotive Refinish Coatings Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 119: Kenya Automotive Refinish Coatings Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 120: Kenya Automotive Refinish Coatings Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 121: Kenya Automotive Refinish Coatings Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 122: Kenya Automotive Refinish Coatings Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 123: Kenya Automotive Refinish Coatings Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 124: Kenya Automotive Refinish Coatings Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 125: Kenya Automotive Refinish Coatings Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 126: Kenya Automotive Refinish Coatings Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 127: Kenya Automotive Refinish Coatings Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 128: Ethiopia Automotive Refinish Coatings Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 129: Ethiopia Automotive Refinish Coatings Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 130: Ethiopia Automotive Refinish Coatings Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 131: Ethiopia Automotive Refinish Coatings Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 132: Ethiopia Automotive Refinish Coatings Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 133: Ethiopia Automotive Refinish Coatings Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 134: Ethiopia Automotive Refinish Coatings Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 135: Ethiopia Automotive Refinish Coatings Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 136: Ethiopia Automotive Refinish Coatings Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 137: Ethiopia Automotive Refinish Coatings Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 138: Ethiopia Automotive Refinish Coatings Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 139: Ethiopia Automotive Refinish Coatings Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 140: Ethiopia Automotive Refinish Coatings Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 141: Ethiopia Automotive Refinish Coatings Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 142: Ethiopia Automotive Refinish Coatings Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 143: Ghana Automotive Refinish Coatings Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 144: Ghana Automotive Refinish Coatings Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 145: Ghana Automotive Refinish Coatings Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 146: Ghana Automotive Refinish Coatings Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 147: Ghana Automotive Refinish Coatings Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 148: Ghana Automotive Refinish Coatings Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 149: Ghana Automotive Refinish Coatings Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 150: Ghana Automotive Refinish Coatings Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 151: Ghana Automotive Refinish Coatings Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 152: Ghana Automotive Refinish Coatings Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 153: Ghana Automotive Refinish Coatings Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 154: Ghana Automotive Refinish Coatings Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 155: Ghana Automotive Refinish Coatings Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 156: Ghana Automotive Refinish Coatings Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 157: Ghana Automotive Refinish Coatings Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 158: Nigeria Automotive Refinish Coatings Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 159: Nigeria Automotive Refinish Coatings Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 160: Nigeria Automotive Refinish Coatings Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 161: Nigeria Automotive Refinish Coatings Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 162: Nigeria Automotive Refinish Coatings Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 163: Nigeria Automotive Refinish Coatings Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 164: Nigeria Automotive Refinish Coatings Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 165: Nigeria Automotive Refinish Coatings Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 166: Nigeria Automotive Refinish Coatings Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 167: Nigeria Automotive Refinish Coatings Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 168: Nigeria Automotive Refinish Coatings Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 169: Nigeria Automotive Refinish Coatings Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 170: Nigeria Automotive Refinish Coatings Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 171: Nigeria Automotive Refinish Coatings Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 172: Nigeria Automotive Refinish Coatings Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 173: Tunisia Automotive Refinish Coatings Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 174: Tunisia Automotive Refinish Coatings Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 175: Tunisia Automotive Refinish Coatings Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 176: Tunisia Automotive Refinish Coatings Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 177: Tunisia Automotive Refinish Coatings Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 178: Tunisia Automotive Refinish Coatings Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 179: Tunisia Automotive Refinish Coatings Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 180: Tunisia Automotive Refinish Coatings Market Y-o-Y Growth Projections by Technology, 2033 to 2033

Figure 181: Tunisia Automotive Refinish Coatings Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 182: Tunisia Automotive Refinish Coatings Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 183: Tunisia Automotive Refinish Coatings Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 184: Tunisia Automotive Refinish Coatings Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 185: Tunisia Automotive Refinish Coatings Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 186: Tunisia Automotive Refinish Coatings Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 187: Tunisia Automotive Refinish Coatings Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 188: Democratic Republic of Congo Automotive Refinish Coatings Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 189: Democratic Republic of Congo Automotive Refinish Coatings Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 190: Democratic Republic of Congo Automotive Refinish Coatings Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 191: Democratic Republic of Congo Automotive Refinish Coatings Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 192: Democratic Republic of Congo Automotive Refinish Coatings Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 193: Democratic Republic of Congo Automotive Refinish Coatings Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 194: Democratic Republic of Congo Automotive Refinish Coatings Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 195: Democratic Republic of Congo Automotive Refinish Coatings Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 196: Democratic Republic of Congo Automotive Refinish Coatings Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 197: Democratic Republic of Congo Automotive Refinish Coatings Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 198: Democratic Republic of Congo Automotive Refinish Coatings Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 199: Democratic Republic of Congo Automotive Refinish Coatings Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 200: Democratic Republic of Congo Automotive Refinish Coatings Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 201: Democratic Republic of Congo Automotive Refinish Coatings Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 202: Democratic Republic of Congo Automotive Refinish Coatings Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 203: Uganda Automotive Refinish Coatings Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 204: Uganda Automotive Refinish Coatings Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 205: Uganda Automotive Refinish Coatings Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 206: Uganda Automotive Refinish Coatings Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 207: Uganda Automotive Refinish Coatings Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 208: Uganda Automotive Refinish Coatings Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 209: Uganda Automotive Refinish Coatings Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 210: Uganda Automotive Refinish Coatings Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 211: Uganda Automotive Refinish Coatings Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 212: Uganda Automotive Refinish Coatings Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 213: Uganda Automotive Refinish Coatings Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 214: Uganda Automotive Refinish Coatings Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 215: Uganda Automotive Refinish Coatings Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 216: Uganda Automotive Refinish Coatings Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 217: Uganda Automotive Refinish Coatings Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 218: Liberia Automotive Refinish Coatings Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 219: Liberia Automotive Refinish Coatings Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 220: Liberia Automotive Refinish Coatings Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 221: Liberia Automotive Refinish Coatings Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 222: Liberia Automotive Refinish Coatings Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 223: Liberia Automotive Refinish Coatings Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 224: Liberia Automotive Refinish Coatings Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 225: Liberia Automotive Refinish Coatings Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 226: Liberia Automotive Refinish Coatings Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 227: Liberia Automotive Refinish Coatings Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 228: Liberia Automotive Refinish Coatings Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 229: Liberia Automotive Refinish Coatings Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 230: Liberia Automotive Refinish Coatings Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 231: Liberia Automotive Refinish Coatings Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 232: Liberia Automotive Refinish Coatings Market Attractiveness Analysis by End Use, 2023 to 2033

Figure 233: Rest of Market Share and BPS Analysis by Material Type, 2023 and 2033

Figure 234: Rest of Market Y-o-Y Growth Projections by Material Type, 2023 to 2033

Figure 235: Rest of Market Attractiveness Analysis by Material Type, 2023 to 2033

Figure 236: Rest of Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 237: Rest of Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 238: Rest of Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 239: Rest of Market Share and BPS Analysis by Technology, 2023 and 2033

Figure 240: Rest of Market Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 241: Rest of Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 242: Rest of Market Share and BPS Analysis by Vehicle Type, 2023 and 2033

Figure 243: Rest of Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 244: Rest of Market Attractiveness Analysis by Vehicle Type, 2023 to 2033

Figure 245: Rest of Market Share and BPS Analysis by End Use, 2023 and 2033

Figure 246: Rest of Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 247: Rest of Market Attractiveness Analysis by End Use, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Africa’s Zero Liquid Discharge System Market - Size, Share, and Forecast 2025 to 2035

Africa Adventure Tourism Market Analysis - Growth & Forecast 2025 to 2035

African Horse Sickness Treatment Market

Africa LED & OLED Market Report – Growth & Forecast 2016-2026

South Africa Faith-Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

South Africa Casino Tourism Market Size and Share Forecast Outlook 2025 to 2035

South Africa Safari Tourism Market Analysis – Growth, Trends & Forecast 2025-2035

Middle East & Africa Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Hydrolyzed Bovine Collagen Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Data Storage Market Report – Trends & Industry Forecast 2025–2035

MEA Stick Packaging Machines Market Growth – Trends & Forecast 2023-2033

Middle East and Africa Bio-Stimulants Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Latex Foil Balloons Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Rough Terrain Cranes Market Growth - Trends & Forecast 2025 to 2035

Middle East and Africa (MEA) Tourism Security Market Analysis 2025 to 2035

Safari Tourism in Africa Market Size and Share Forecast Outlook 2025 to 2035

Middle East/North Africa (MENA) Commercial Vehicles Market Analysis - Size, Share, and Forecast 2025 to 2035

Adventure Tourism in Africa Market Size and Share Forecast Outlook 2025 to 2035

Middle East and North Africa Frozen Food Market Size and Share Forecast Outlook 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA