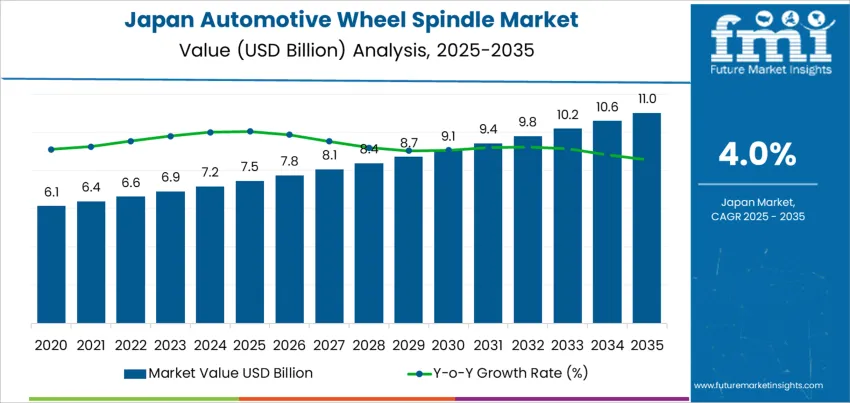

The demand for automotive wheel spindles in Japan is expected to grow from USD 7.5 billion in 2025 to USD 11.0 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.0%. Automotive wheel spindles, which play a critical role in supporting the wheel assembly and facilitating vehicle movement, are essential components in the automotive industry. As Japan’s automotive market continues to develop, driven by both the demand for new vehicles and the maintenance of existing ones, the market for automotive wheel spindles is expected to experience steady growth.

The market will experience consistent growth over the forecast period, starting at USD 7.5 billion in 2025 and increasing to USD 7.8 billion in 2026, and USD 8.1 billion in 2027. By 2028, demand will rise to USD 8.4 billion, continuing its steady growth trajectory. By 2035, the demand for automotive wheel spindles is forecasted to reach USD 11.0 billion, supported by ongoing demand in the automotive sector and advancements in vehicle technology, including electric and hybrid vehicle production.

The automotive wheel spindle market in Japan is expected to experience gradual and steady growth through 2035. Starting at USD 7.5 billion in 2025, the market will rise to USD 7.8 billion in 2026, USD 8.1 billion in 2027, and USD 8.4 billion by 2028. By 2030, the market is projected to reach USD 8.7 billion, continuing to expand at a steady pace. By 2035, the demand for automotive wheel spindles is expected to reach USD 11.0 billion, driven by consistent vehicle production and an ongoing focus on improving vehicle performance.

The early growth curve (2025–2029) for automotive wheel spindles is marked by gradual incremental increases each year, with steady demand driven by the steady pace of vehicle production and parts replacement. This early growth reflects a stable expansion as the automotive sector maintains its demand for essential components like wheel spindles.

In contrast, the late growth curve (2029–2035) is expected to experience more moderate, yet consistent, growth as the market matures. While the growth rate in the later years remains stable, the demand for automotive wheel spindles will be influenced by more advanced automotive technologies, such as electric and autonomous vehicles. The growth rate may begin to slow slightly after 2029 as the market stabilizes, reflecting a more mature and saturated automotive parts sector. However, demand will continue to increase at a steady pace through 2035, driven by ongoing vehicle production and after-market parts needs.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 7.5 billion |

| Industry Forecast Value (2035) | USD 11 billion |

| Industry Forecast CAGR (2025-2035) | 4% |

Demand for automotive wheel spindles in Japan is rising as new vehicle production and demand for advanced suspension and wheel systems increase. Wheel spindles form a core part of the suspension and wheel hub assembly, providing structural support for wheel rotation and connecting wheel hubs to suspension components. As automakers introduce more vehicles-including passenger cars, SUVs, hybrid vehicles, and electric vehicles-the need for reliable, well engineered spindles grows in parallel. Growth in vehicle manufacturing, periodic replacement needs, and upgrades in suspension and wheel assemblies all support rising spindle demand.

At the same time changing vehicle design trends push demand upward. Electric vehicles and hybrid cars impose different load, torque, and weight distribution requirements compared with traditional internal combustion vehicles. These changes call for spindles designed for durability, strength, and compatibility with modern wheel and suspension configurations. As manufacturers invest in lighter and more efficient wheel hub assemblies, demand grows for spindles built from advanced materials or precision engineered steel or alloys. The aftermarket also contributes: wear and tear, periodic maintenance needs, and consumer upgrades of wheel assemblies drive replacement demand for high quality spindles.

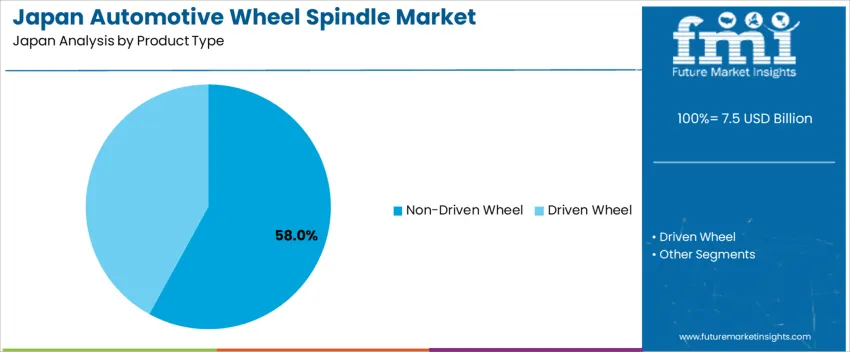

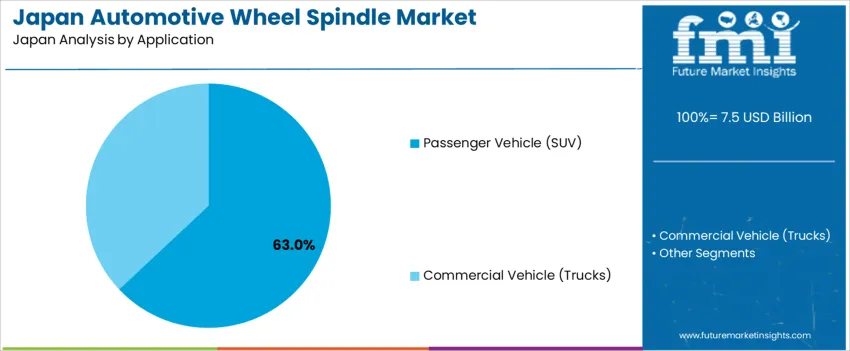

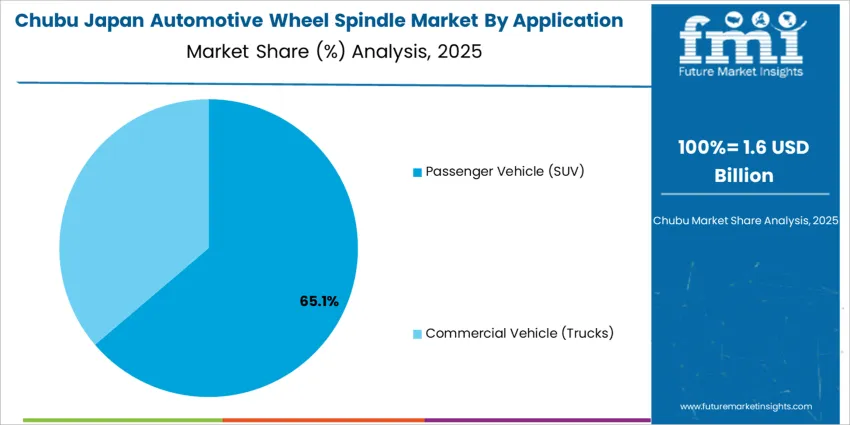

The demand for automotive wheel spindles in Japan is primarily driven by product type and application. The leading product type is non-driven wheel, capturing 58% of the market share, while passenger vehicles (SUV) are the dominant application, accounting for 63% of the demand. Automotive wheel spindles are essential components that provide the pivot point for the vehicle's wheels and are crucial for the proper functioning of the suspension system. As demand for vehicles with enhanced performance and safety features grows, the demand for high-quality wheel spindles continues to rise in Japan.

Non-driven wheel spindles lead the demand for automotive wheel spindles in Japan, holding 58% of the market share. Non-driven wheel spindles are commonly used in the front wheels of most vehicles that do not require power transmission from the wheel to the drivetrain, such as in standard passenger vehicles and some commercial vehicles. These spindles support the weight of the vehicle and allow the wheel to rotate freely while maintaining stability and smooth operation.

The demand for non-driven wheel spindles is driven by their widespread application in passenger vehicles, particularly those that prioritize performance and fuel efficiency. Non-driven spindles are typically found in the front axle of passenger cars, especially in front-wheel-drive and all-wheel-drive vehicles, where the rear wheels are not powered. As demand for passenger vehicles, particularly SUVs, continues to rise in Japan, non-driven wheel spindles are expected to remain the dominant choice, providing essential support and durability for a wide range of vehicle types.

Passenger vehicles (SUVs) lead the application demand for automotive wheel spindles in Japan, accounting for 63% of the demand. SUVs, with their growing popularity in Japan, have driven the need for robust and high-performance wheel spindles that can handle the increased weight and off-road capabilities of these vehicles. Wheel spindles in SUVs are critical for maintaining vehicle stability, enhancing ride comfort, and ensuring safe handling, particularly in rugged or uneven terrain.

The demand for automotive wheel spindles in SUVs is driven by the growing consumer preference for larger, more versatile vehicles. As Japanese consumers increasingly choose SUVs for both urban and outdoor use, the need for durable and high-performance wheel spindles becomes more significant. Given the high demands placed on the suspension and wheel systems of SUVs, spindles must provide superior strength, stability, and longevity. As the SUV market continues to grow, the application of automotive wheel spindles in passenger vehicles is expected to remain the largest demand segment in Japan.

Demand for automotive wheel spindles in Japan is rising gradually due to continuous vehicle production and replacement demand from the existing vehicle fleet. Wheel spindles are essential components in vehicle suspension and steering systems, offering support for wheels and enabling safe rotation. As vehicle ownership remains high and new vehicle production continues, the demand for wheel spindles grows. The demand is supported by the rise in light vehicles, hybrids, and electric vehicles, with the importance of safety, stability, and reliability contributing to the sustained need for wheel spindles in both the OEM and aftermarket sectors.

What are the Drivers of Demand for Automotive Wheel Spindle in Japan?

Several factors drive demand for wheel spindles in Japan. One key driver is the consistent production of passenger cars, light commercial vehicles, and other vehicle types, requiring the supply of suspension and wheel components, including spindles. Another driver is the aging vehicle fleet in Japan, which increases the demand for replacement parts, including spindles, as older vehicles undergo maintenance or overhaul. The growing emphasis on improved ride comfort, driving stability, and safety encourages the use of high-quality spindles, especially in modern vehicles. The shift toward hybrid and electric vehicles also supports the demand for specialized spindles designed for increased load and torque. Lastly, the expansion of the aftermarket segment, fueled by consumer preference for affordable replacement parts, contributes to steady demand for wheel spindles.

What are the Restraints on Demand for Automotive Wheel Spindle in Japan?

Despite the growth drivers, there are a few constraints limiting the demand for wheel spindles in Japan. One restraint is the overall slowdown or moderate growth in the broader auto parts market, which may limit the pace of demand for individual components such as spindles. The increasing complexity of vehicle suspension systems and the integration of advanced technologies may reduce the demand for standalone spindles, as alternative suspension systems or integrated modules become more common. Furthermore, the push for lighter, more efficient, and electric vehicles may result in design changes that reduce the need for traditional spindles. Cost sensitivity among consumers may also delay spindle replacements or encourage the use of cheaper repair alternatives, reducing demand in the aftermarket segment. Additionally, supply chain challenges and rising raw material costs for precision-machined spindles could increase prices and affect affordability.

What are the Key Trends Influencing Demand for Automotive Wheel Spindle in Japan?

Key trends influencing the demand for wheel spindles in Japan include a growing focus on vehicle safety, ride comfort, and stability. As consumers demand smoother rides and better handling, particularly in family cars and SUVs, there is an increased need for high-quality suspension components, including durable spindles. The rising adoption of electric and hybrid vehicles also plays a significant role in driving the demand for spindles designed to handle heavier battery loads and specialized suspension requirements. The expanding aftermarket segment, driven by the aging vehicle fleet, supports steady demand for replacement parts, including wheel spindles. Additionally, the growth of online distribution channels makes it easier for consumers and mechanics to access wheel spindles, contributing to increased replacement and upgrade cycles. Advances in manufacturing and materials technology also make spindles lighter, stronger, and more durable, boosting preference for upgraded components.

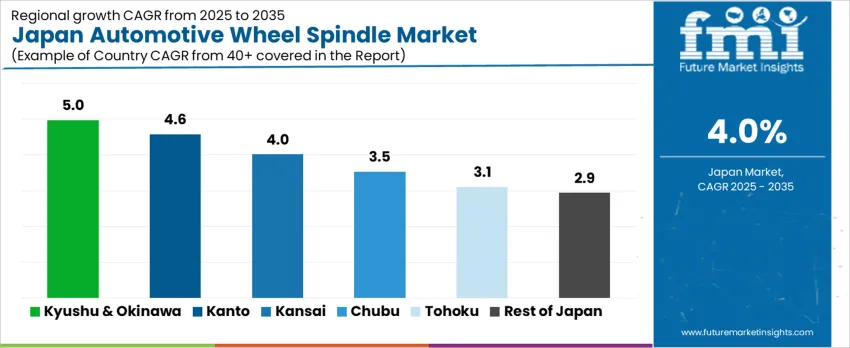

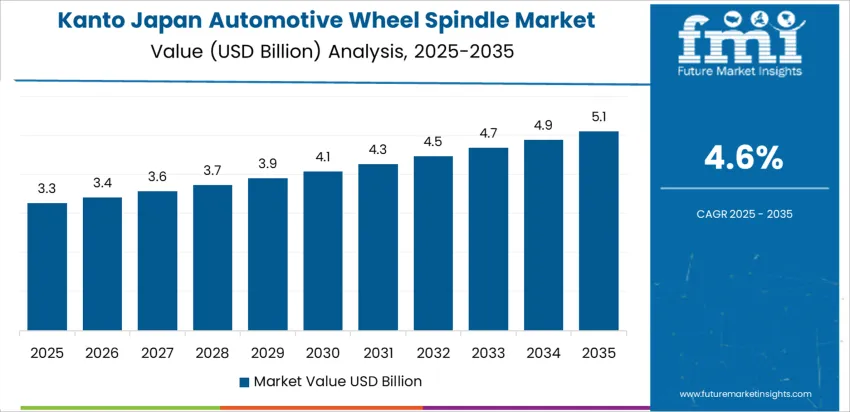

The demand for automotive wheel spindles in Japan is projected to increase steadily across all regions, reflecting both vehicle production and aftermarket replacement trends. The region with the highest growth outlook is Kyushu & Okinawa, at a CAGR of 5.0 %. Kanto follows with 4.6 %, supported by its dense automotive manufacturing and urban vehicle use. The Kansai region shows a CAGR of 4.0 %. Chubu, Tohoku, and the Rest of Japan report more modest growth at 3.5 %, 3.1 %, and 2.9 % respectively. These differences correspond to regional variations in automotive industry concentration, infrastructure renewal demand, and vehicle fleet turnover rates across Japan.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.0 |

| Kanto | 4.6 |

| Kansai | 4.0 |

| Chubu | 3.5 |

| Tohoku | 3.1 |

| Rest of Japan | 2.9 |

In Kyushu & Okinawa, the projected 5.0 % annual growth in demand for automotive wheel spindles reflects a combination of industrial and after market dynamics. Kyushu hosts several automotive assembly plants and suppliers, which contributes to robust original equipment manufacturing (OEM) demand. As these manufacturing facilities continue operations, demand for spindles for new vehicles remains strong. Simultaneously, a considerable number of passenger vehicles and commercial trucks operate in the region’s coastal and mountainous terrain, leading to accelerated wear of suspension and wheel end components. Frequent use on varied road conditions, compounded by weather and road salt in some coastal areas, increases the need for replacement spindles. The aftermarket segment benefits from this wear rate, keeping demand steady. In addition, logistic and distribution hubs in the region serve both domestic and export markets, requiring maintenance fleets that lead to cyclical replacement of spindle assemblies. These combined factors support a relatively high growth rate, indicating sustained demand for wheel spindles in Kyushu & Okinawa over the forecast period.

In Kanto, the expected 4.6 % CAGR for wheel spindles aligns with the region’s dense population, heavy traffic, and extensive vehicle ownership. The region encompasses major urban centers and extensive metropolitan infrastructure, with high usage of personal vehicles, taxis, rideshare cars, and light commercial fleets. Frequent stop and go traffic and urban road conditions place stress on suspension and wheel end components including spindles. As a result, periodic maintenance and replacement of wheel spindles become common. Furthermore, Kanto hosts numerous automotive suppliers and parts distributors, enabling ready availability of replacement components and promoting aftermarket turnover. OEM demand also remains significant as assembly plants supplying commuter and commercial vehicles often source spindles for new builds. Regulatory emphasis on vehicle safety and roadworthiness inspections adds impetus for replacement of worn or damaged spindles. Taken together, these factors drive consistent growth in demand for automotive wheel spindles in Kanto.

In the Kansai region, the 4.0 % projected demand growth for wheel spindles reflects a mix of OEM manufacturing, domestic vehicle use, and aftermarket replacement. Kansai—including major cities such as Osaka and Kobe—hosts several automotive component suppliers and intermediate goods manufacturers. While full vehicle assembly may be less concentrated than in other regions, component fabrication and subassembly, including spindles, remain active. This industrial base supports steady demand for spindles for both new vehicles and replacement markets. Additionally, urban and peri urban commuting as well as commercial vehicle operation contribute to wear on suspension systems. As older vehicles undergo inspection or refurbishment, replacement of wheel end components like spindles becomes necessary. The region’s logistics and transport networks, including port traffic and freight vehicles, generate demand from heavy duty usage. These factors combine to support moderate but stable growth in demand for automotive wheel spindles in Kansai.

In Chubu, a projected 3.5 % CAGR for wheel spindles reflects a measured growth driven by mixed industrial and regional automotive use. The region includes industrial cities and manufacturing hubs where component suppliers and parts distributors operate. Demand from OEMs remains present, though at lower intensity compared with major automotive clusters. Replacement demand is driven by usage in commercial and private vehicles, particularly in rural and suburban zones. As older vehicles in Chubu age, owners increasingly opt for spindle and suspension replacements during maintenance or safety checks. The aftermarket network has gained traction, offering replacement parts for a variety of vehicle makes and models. While growth is slower than in coastal or metropolitan regions, rising vehicle age and fleet maintenance needs ensure ongoing demand. The moderate growth rate suggests steady but gradual adoption rather than rapid expansion.

In Tohoku, the projected 3.1 % CAGR indicates modest but persistent demand for automotive wheel spindles. The region has fewer major automotive manufacturing operations, and vehicle ownership rates tend to be lower compared with urban centers. Nonetheless, rural road conditions, longer travel distances, and seasonal weather variations can contribute to wear and tear on suspension and wheel components. Vehicles used for agriculture, forestry, and regional transport often demand more robust maintenance, which includes periodic replacement of spindles. As infrastructure improves and vehicle ownership rises among rural households, demand for replacement parts increases. Growing awareness of vehicle safety standards encourages timely replacement of worn wheel end components. Although not a major hub for OEM production, Tohoku’s maintenance-driven demand supports a stable increase in spindle consumption over time.

In the Rest of Japan—comprising smaller prefectures and rural areas outside major industrial or metropolitan zones—the demand for automotive wheel spindles is forecast to grow at a CAGR of 2.9 %. This modest growth reflects lower vehicle concentrations, less frequent replacement cycles, and limited automotive manufacturing activity. Nonetheless, maintenance needs among older vehicles continue to drive replacement spindle demand. Rural and semi-urban populations often rely on older cars and utility vehicles, which, over time, require parts replacement due to wear or corrosion. As aftermarket distribution networks expand, availability of replacement spindles improves even in remote areas. Gradual increases in vehicle ownership, combined with rising awareness of vehicle safety, contribute to incremental but stable demand growth. While overall volumes remain lower than major regions, a baseline market persists across the Rest of Japan, making it a long term segment for spindle replacement and parts supply.

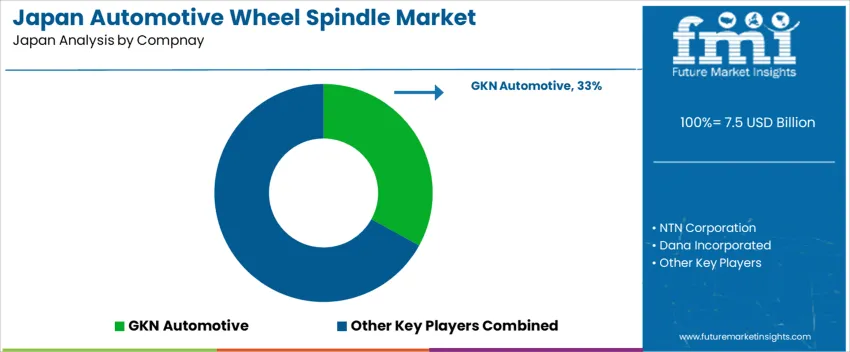

Demand for automotive wheel spindles in Japan is driven by steady vehicle production, regular maintenance cycles, and demand for durable components that ensure safe steering and suspension performance. Key suppliers in this market include GKN Automotive (with roughly 33 % share among the main providers), NTN Corporation, Dana Incorporated, Nexteer Automotive, and Hyundai Wia Corporation. These firms supply spindles for passenger cars, light trucks and SUVs-including both domestic Japanese models and imported vehicles.

Competition among suppliers centers on material strength, manufacturing precision, and reliability under load and varied driving conditions. Companies focus on producing spindles that meet strict tolerances in dimensions, bearing fit, and fatigue resistance. High-quality steel processing, heat treatment, and surface finishing are important to ensure long service life and safety. Another axis of competition is the ability to supply to original equipment manufacturers (OEMs) as well as aftermarket parts distributors-firms able to meet both specifications and delivery schedules tend to gain more traction. Spare parts availability and logistic support also influence supplier selection, especially in Japan where parts replacement and maintenance standards are rigorous. By delivering strong technical performance, compliance with automotive standards, and reliable supply chains, these companies aim to maintain or expand their share in Japan’s automotive wheel spindle market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Product Type | Non-Driven Wheel, Driven Wheel |

| Application | Passenger Vehicle (SUV), Commercial Vehicle (Trucks) |

| Sales Channel | OEM, Aftermarket |

| Key Companies Profiled | GKN Automotive, NTN Corporation, Dana Incorporated, Nexteer Automotive, Hyundai-Wia Corporation |

| Additional Attributes | The demand for automotive wheel spindles in Japan is driven by the increasing production of both passenger vehicles and commercial vehicles, particularly SUVs and trucks. The market is segmented by product type, with non-driven wheel spindles used in the front of most vehicles, and driven wheel spindles being employed in the rear of vehicles with driven axles. Sales are split between OEMs and aftermarket, with OEM demand largely influenced by vehicle production volumes, while aftermarket demand is driven by replacement needs. Leading companies like GKN Automotive, NTN Corporation, and Dana Incorporated dominate the market, offering high-performance wheel spindles that meet the demand for vehicle durability, efficiency, and safety. The market is expected to grow as demand for SUVs and trucks continues to rise, particularly in commercial vehicle segments. |

The demand for automotive wheel spindle in Japan is estimated to be valued at USD 7.5 billion in 2025.

The market size for the automotive wheel spindle in Japan is projected to reach USD 11.0 billion by 2035.

The demand for automotive wheel spindle in Japan is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in automotive wheel spindle in Japan are non-driven wheel and driven wheel.

In terms of application, passenger vehicle (suv) segment is expected to command 63.0% share in the automotive wheel spindle in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Wheel Spindle Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive Wheel Coating in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Bearing Aftermarket Analysis - Size, Share, and Forecast 2025 to 2035

Automotive Wheel Rims Market Growth - Trends & Forecast 2025 to 2035

Automotive Wheel Hub Bearing Aftermarket Analysis by Product Type, Inner Diameter, Vehicle Type, Sales Channel, and Region Forecast through 2035

Automotive Wheel Bearings Market

Automotive In-Wheel Motors Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive Wheel Coating in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive NFC in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Fabrics in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Headliner in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA