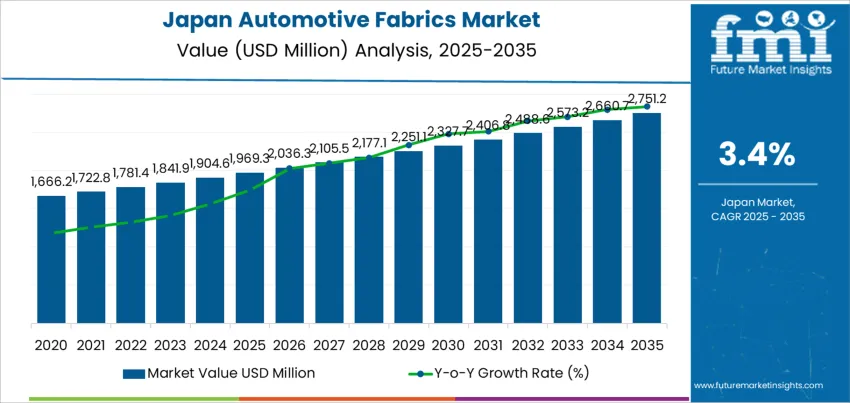

The demand for automotive fabrics in Japan attains USD 1,969.3 million in 2025, progressing toward USD 2,755.7 million by 2035 with a compound annual growth rate of 3.4%. This advancement originates from Japan's automotive production resilience, interior material quality upgrades, and vehicle comfort enhancement priorities. Automobile manufacturers throughout Japan integrate premium fabric technologies into seat upholstery, door panels, headliners, and floor covering applications that elevate cabin aesthetics while maintaining durability standards. Component suppliers prioritize fabric innovations supporting weight reduction, acoustic performance, and fire retardant properties essential for Japanese automotive safety regulations. These material evolution trends establish sustained growth momentum across the forecast period.

The development path reveals continuous progression from foundational levels of USD 1,723.7 million in 2020, ascending through USD 1,770.3 million in 2021 and USD 1,818.1 million in 2022 before achieving USD 1,969.3 million in 2025. Future projections indicate USD 2,022.5 million for 2026, USD 2,077.1 million for 2027, advancing through USD 2,310.7 million in 2030 and USD 2,502.9 million in 2033. This consistent upward trajectory reflects automotive production stability, material specification improvements, and premium interior trends driving fabric consumption across Japan's vehicle manufacturing ecosystem. The pattern demonstrates reliable growth anchored in automotive industry recovery and quality enhancement initiatives.

Demand in Japan for automotive fabrics is projected to increase from USD 1,969.3 million in 2025 to USD 2,755.7 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 3.4%. Originating at USD 1,723.7 million in 2020, values advance through USD 1,867.1 million in 2023, USD 1,917.6 million in 2024, reaching USD 1,969.3 million in 2025. Between 2025 and 2030, demand climbs toward USD 2,310.7 million, culminating at USD 2,755.7 million by 2035. Growth derives from Japan's automotive production stabilization, premium interior material adoption, vehicle electrification trends requiring specialized fabrics, and export vehicle quality standards across Japanese automotive manufacturing networks.

Throughout the forecast timeframe, the value enhancement from USD 1,969.3 million to USD 2,755.7 million generates an incremental opportunity of USD 786.4 million. Initial growth (2025–2030) relies primarily on volume recovery as automotive production normalizes and manufacturers specify improved fabric qualities for seat systems, interior panels, and acoustic applications. Subsequent periods (2030–2035) emphasize value creation through high-performance fabrics, antimicrobial treatments, recycled material integration, and premium surface textures commanding higher pricing. Suppliers developing flame-resistant fabrics, lightweight composite materials, and smart textiles with embedded sensors position themselves to capture growing demand across Japan's innovation-focused automotive sector.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1,969.3 million |

| Forecast Value (2035) | USD 2,755.7 million |

| Forecast CAGR (2025–2035) | 3.4% |

The demand for automotive fabrics in Japan has strengthened through Japan's automotive industry adaptation, where vehicle manufacturers pursued interior differentiation strategies emphasizing cabin comfort and material quality. Japanese automakers concentrated on fabric innovations that reduce vehicle weight while maintaining safety performance standards required for domestic and export applications. Luxury vehicle segments adopted premium fabric technologies for seat upholstery, door trim, and headliner applications that communicate craftsmanship and attention to detail. Component suppliers developed fabric solutions meeting Japan's stringent flammability standards and durability requirements for extended vehicle lifecycles. These operational priorities established consistent demand patterns aligned with Japan's automotive manufacturing excellence and export competitiveness.

Future advancement reflects Japan's shift toward electric vehicle production, autonomous driving interior concepts, and integration of functional fabrics within vehicle architectures. Automotive manufacturers increasingly specify fabrics with electromagnetic shielding properties for electric vehicle applications requiring electronic component protection. Premium brands require fabric technologies that support heated seats, massage functions, and integrated sensor systems for occupant detection and comfort optimization. Emerging applications include antimicrobial fabric treatments, air filtration capabilities, and recyclable material compositions supporting automotive industry environmental objectives. Japan's aging population drives demand for fabric innovations supporting accessibility features, ease of cleaning, and ergonomic support across vehicle interior applications.

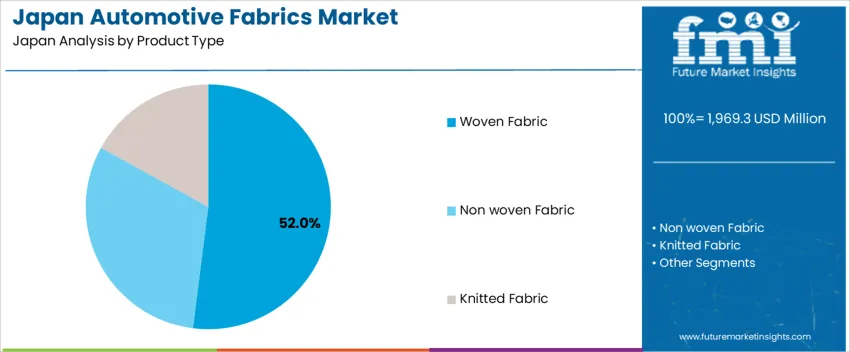

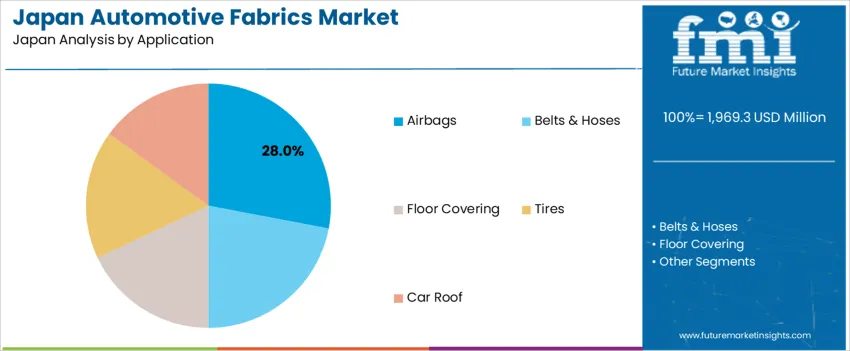

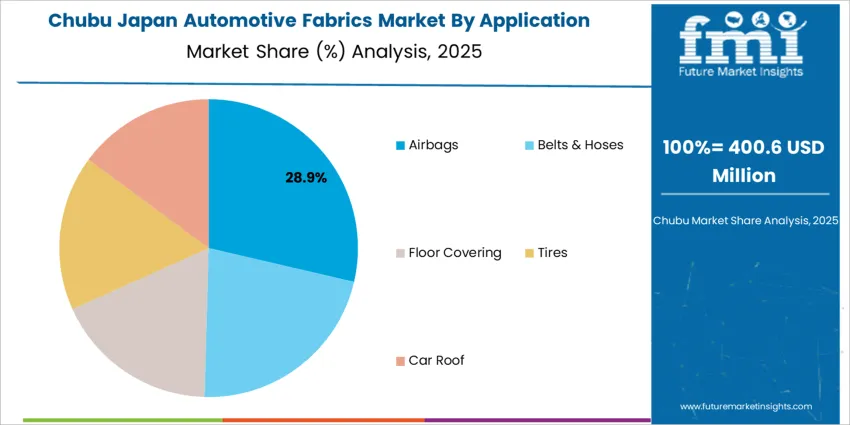

The demand for automotive fabrics in Japan fluctuates according to product types that define fabric construction and applications that determine usage locations within vehicle interiors. Product type categories include woven fabrics, non-woven fabrics, and knitted fabrics, each providing distinct performance characteristics for automotive interior applications. Application segments encompass airbags, belts and hoses, floor coverings, tires, and car roof systems that require specific fabric properties for safety, durability, and aesthetic requirements. As Japanese automotive manufacturers emphasize interior quality and safety compliance across passenger vehicles and commercial transportation, the combination of fabric construction methods and application requirements influences material selection throughout Japan's automotive production networks.

Woven fabrics account for 52% of total demand across product type categories in Japan. This dominant position reflects woven fabric's superior structural integrity, dimensional stability, and versatility across multiple automotive interior applications. Japanese automotive manufacturers value woven fabrics for seat upholstery requiring durability, comfort, and aesthetic appeal that maintains appearance throughout vehicle service life. Luxury vehicle producers rely on woven fabric technology for door panel inserts, dashboard coverings, and pillar trim where precise pattern definition and surface texture contribute to premium interior perception. The product type supports complex weaving patterns that incorporate functional fibers for flame resistance, stain protection, and UV stability.

Demand for woven fabrics expands as Japanese automakers pursue interior customization options that differentiate vehicle models across competitive segments. The product type enables intricate design capabilities including color gradations, textural variations, and brand-specific patterns that support vehicle interior themes. Commercial vehicle manufacturers appreciate woven fabric durability for fleet applications requiring extended service intervals and resistance to wear patterns. Automotive suppliers favor woven fabrics for consistent quality control and predictable performance characteristics that support lean manufacturing principles. As vehicle interior complexity increases with integrated electronics and comfort features, woven fabrics provide reliable foundation materials that accommodate functional requirements while maintaining aesthetic standards.

Airbags account for 28% of total demand across application categories in Japan. Their leading share stems from stringent automotive safety regulations, expanding airbag deployment locations, and continuous safety technology advancement throughout Japanese vehicles. Japanese automotive manufacturers specify specialized fabrics for driver airbags, passenger airbags, side-impact airbags, and curtain airbags that protect occupants during collision events. Commercial vehicle producers require airbag fabrics meeting heavy-duty performance standards for truck and bus applications where occupant protection requirements exceed passenger car specifications. The application demands fabrics with precise tear strength, gas permeability, and deployment timing characteristics.

Demand for airbag application fabrics grows as Japanese vehicle safety systems incorporate additional airbag locations including knee airbags, rear passenger airbags, and external pedestrian airbags for comprehensive occupant protection. The application requires fabrics with consistent manufacturing quality that ensures reliable deployment performance across temperature ranges encountered in Japanese climate conditions. Automotive safety suppliers value airbag fabrics with predictable aging characteristics that maintain performance throughout vehicle operational life. Export-oriented production demands airbag fabrics meeting international safety standards across diverse regulatory environments. As autonomous driving systems advance, airbag applications evolve toward interior configurations accommodating flexible seating arrangements while maintaining occupant protection capabilities.

Demand for automotive fabrics in Japan adapts to automotive production recovery, electric vehicle transition requirements, and premium interior industry positioning across domestic and export vehicle segments. Japan's automotive sector emphasizes fabric technologies that support weight reduction objectives while maintaining safety performance and comfort standards essential for competitive positioning. Vehicle manufacturers require fabric solutions that integrate with advanced interior systems including heated surfaces, massage functions, and embedded sensor networks for occupant monitoring. Regulatory environments mandate fabric specifications for flammability, emissions, and recyclability that position automotive fabrics as critical components rather than decorative elements. These operational demands create sustained requirements based on technical performance and regulatory compliance.

How Are Japan's Automotive Innovation and Quality Standards Encouraging New Applications?

Automotive fabrics gain prominence because Japan's vehicle development philosophy prioritizes occupant safety, manufacturing precision, and long-term reliability over cost minimization strategies. Vehicle manufacturers integrate fabric testing into comprehensive quality assurance systems that validate performance across extended durability cycles and environmental exposure conditions. Japanese premium brands leverage fabric innovations to differentiate interior experiences where material quality directly supports brand positioning and customer satisfaction metrics. Electric vehicle manufacturers require fabric solutions with electromagnetic compatibility for sensitive electronic systems and thermal management properties for battery temperature control applications. These implementations reflect Japan's commitment to technical excellence and systematic validation across automotive manufacturing operations.

Where Are Strategic Growth Opportunities for Automotive Fabrics in Japan?

Opportunities emerge within electric vehicle interior design, autonomous driving cabin concepts, commercial vehicle comfort upgrades, and aftermarket customization applications across Japan's diverse automotive sector. Electric vehicle production creates demand for fabrics with specialized properties including electromagnetic shielding, thermal management, and lightweight construction that support electric powertrain efficiency. Autonomous vehicle development requires fabric solutions for flexible seating configurations, enhanced comfort features, and integrated technology interfaces supporting passenger experience during automated driving modes. Commercial transportation modernization drives fabric adoption for driver comfort, passenger safety, and interior durability across bus, truck, and specialty vehicle applications. Manufacturers offering fabric technologies combining performance capabilities with environmental benefits align with Japanese automotive industry advancement toward electrification and automation.

What Technical Factors Are Constraining Wider Adoption of Advanced Automotive Fabrics in Japan?

Constraints develop from complex certification requirements, extensive testing protocols, and established supplier relationships within Japan's automotive supply chain networks. Japanese automotive manufacturers require comprehensive validation testing that demonstrates fabric performance across safety, durability, and environmental standards before production approval. Technical integration challenges with existing seat manufacturing processes and interior assembly systems extend development timelines for advanced fabric technologies. Cost pressures from global automotive competition limit acceptance of premium fabric solutions across price-sensitive vehicle segments. Additionally, supply chain complexity and quality assurance requirements favor established fabric suppliers with proven track records, creating barriers for innovative fabric technologies requiring extensive validation and production scale-up investments.

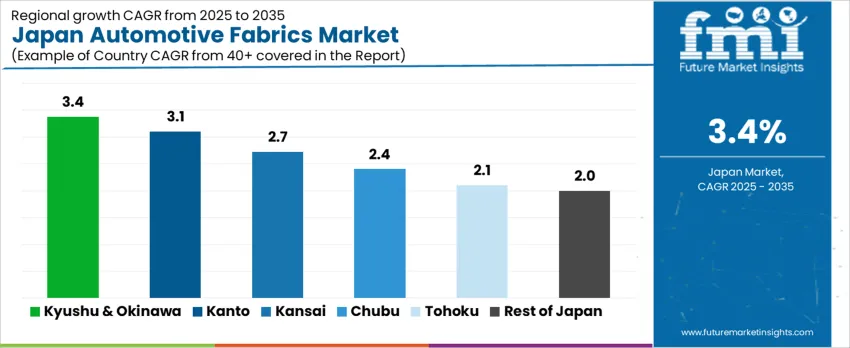

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.4% |

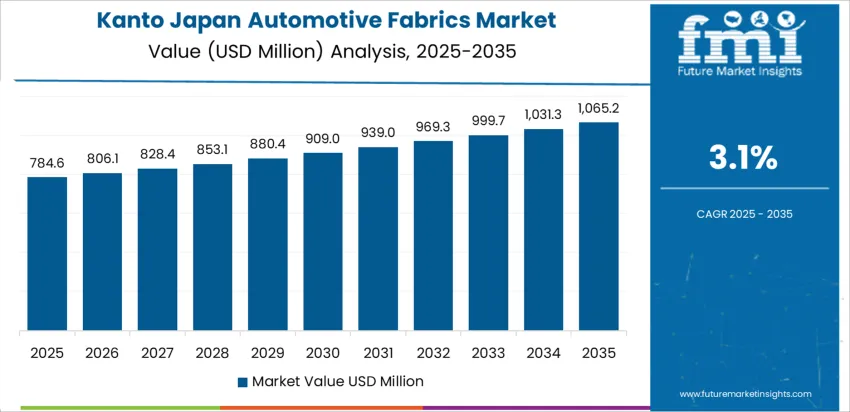

| Kanto | 3.1% |

| Kinki | 2.7% |

| Chubu | 2.4% |

| Tohoku | 2.1% |

| Rest of Japan | 2.0% |

Demand for automotive fabrics in Japan progresses across regions, with Kyushu & Okinawa leading at 3.4%. Growth in this region reflects automotive production concentration, component manufacturing facilities, and export-oriented vehicle assembly operations requiring premium fabric specifications. Kanto follows at 3.1%, supported by automotive research centers, luxury vehicle production, and component supplier networks demanding advanced fabric technologies. Kinki records 2.7%, driven by established automotive manufacturing infrastructure and fabric supplier clusters serving domestic and international automotive assembly operations. Chubu advances at 2.4%, influenced by major automotive production centers and integrated supply chain networks requiring consistent fabric quality and delivery performance. Tohoku achieves 2.1%, showing steady fabric consumption across automotive assembly facilities and component manufacturing operations. The rest of Japan posts 2.0%, reflecting broader automotive industry fabric requirements across smaller production centers and aftermarket applications.

Kyushu & Okinawa is projected to advance at a CAGR of 3.4% through 2035 in demand for automotive fabrics. Toyota Motor Kyushu and Nissan Motor Kyushu production facilities increasingly specify premium fabric technologies for luxury vehicle interiors, export vehicle quality standards, and component manufacturing excellence. Growing focus on automotive export quality, premium interior materials, and production efficiency drives fabric adoption. Manufacturers provide high-performance woven fabrics, flame-resistant materials, and automotive-grade textile solutions suitable for luxury vehicle production and export applications. Distributors ensure availability across automotive assembly facilities, component manufacturers, and fabric processing operations. Expansion in luxury vehicle production, automotive exports, and component manufacturing supports steady adoption of automotive fabrics in Kyushu & Okinawa.

Kanto is projected to advance at a CAGR of 3.1% through 2035 in demand for automotive fabrics. Tokyo automotive research facilities and surrounding production centers increasingly adopt advanced fabric technologies for premium vehicle development, electric vehicle interior design, and automotive innovation projects. Rising focus on automotive research, electric vehicle materials, and premium interior development drives fabric adoption. Manufacturers provide innovative textile solutions, electric vehicle compatible fabrics, and research-grade materials suitable for automotive development and premium vehicle applications. Distributors ensure accessibility across automotive research centers, vehicle development facilities, and premium vehicle manufacturers. Growth in automotive research, electric vehicle development, and premium vehicle production supports steady adoption of automotive fabrics across Kanto.

Kinki is projected to advance at a CAGR of 2.7% through 2035 in demand for automotive fabrics. Osaka and surrounding manufacturing regions increasingly integrate automotive fabrics into vehicle production, component manufacturing, and supplier network operations serving domestic and export channels. Rising demand for automotive production support, component quality, and manufacturing efficiency drives fabric adoption. Manufacturers provide standard automotive fabrics, component-grade materials, and production-suitable textile solutions for automotive manufacturing and component applications. Distributors ensure accessibility across automotive manufacturers, component suppliers, and textile processing facilities. Growth in automotive manufacturing, component production, and supplier network operations supports steady adoption of automotive fabrics across Kinki.

Chubu is projected to advance at a CAGR of 2.4% through 2035 in demand for automotive fabrics. Nagoya automotive production centers increasingly adopt fabric technologies for major vehicle assembly operations, supplier manufacturing, and automotive parts production requiring interior material specifications. Rising focus on automotive production volumes, supplier quality standards, and manufacturing integration drives fabric adoption. Manufacturers provide volume production fabrics, automotive-standard materials, and supplier-grade textile solutions suitable for major automotive assembly and parts manufacturing applications. Distributors ensure availability across automotive assembly plants, parts manufacturers, and textile supplier networks. Expansion in automotive assembly, parts manufacturing, and supplier operations supports steady adoption of automotive fabrics across Chubu.

Tohoku is projected to advance at a CAGR of 2.1% through 2035 in demand for automotive fabrics. Regional automotive manufacturing and component production facilities gradually adopt fabric technologies for vehicle assembly support, parts manufacturing, and automotive supplier operations. Rising focus on automotive manufacturing support, regional production, and component quality drives fabric adoption. Manufacturers provide reliable automotive fabrics, component materials, and production-suitable textiles for regional automotive and component manufacturing applications. Distributors ensure accessibility across regional automotive facilities, component manufacturers, and automotive suppliers. Expansion in regional automotive production, component manufacturing, and supplier operations supports steady adoption of automotive fabrics across Tohoku.

The Rest of Japan is projected to advance at a CAGR of 2.0% through 2035 in demand for automotive fabrics. Smaller automotive facilities and regional manufacturing operations gradually adopt fabric solutions for automotive support applications, component production, and specialized vehicle manufacturing. Rising demand for regional automotive support, specialized applications, and component production drives fabric adoption. Manufacturers provide standard fabric solutions, regional automotive materials, and specialized textile products suitable for regional automotive and component applications. Distributors ensure accessibility across regional automotive facilities, specialized manufacturers, and automotive support operations. Expansion in regional automotive support, specialized manufacturing, and component production supports steady adoption of automotive fabrics across the Rest of Japan.

The demand for automotive fabrics in Japan is driven by automotive production recovery, premium interior industry growth, and electric vehicle material requirements across passenger and commercial vehicle segments. Vehicle manufacturers seek fabric solutions that enhance interior aesthetics, support safety compliance, and contribute to weight reduction objectives essential for fuel efficiency and electric vehicle range optimization. Premium vehicle brands emphasize fabric innovations that differentiate interior experiences while maintaining durability standards for extended vehicle service life. Commercial vehicle operators require fabric technologies that withstand heavy-duty usage patterns while providing driver comfort and passenger safety across transportation applications. Technological developments including antimicrobial treatments, flame-resistant properties, and recyclable material compositions enhance fabric performance while addressing Japanese automotive industry environmental and safety priorities.

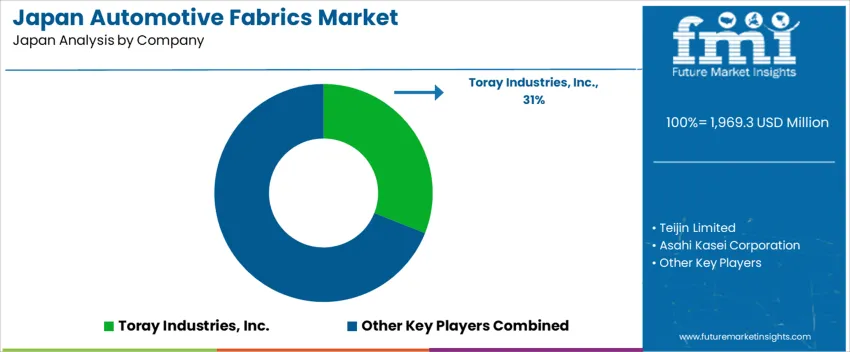

Key companies operating in Japan's automotive fabrics sector include fiber technology leader Toray Industries, Inc., advanced materials specialist Teijin Limited, chemical innovation company Asahi Kasei Corporation, textile manufacturer Toyobo Co., Ltd., and automotive fabric specialist Seiren Co., Ltd. Toray Industries provides high-performance synthetic fibers and automotive fabric solutions serving major Japanese automakers with advanced material technologies. Teijin Limited supplies aramid fibers, carbon fiber reinforced fabrics, and specialty automotive textiles supporting vehicle safety and performance requirements. Asahi Kasei Corporation contributes innovative fiber technologies and fabric treatments for automotive interior and safety applications. Toyobo offers automotive fabric solutions combining durability, comfort, and environmental compatibility for diverse vehicle applications. Seiren specializes in automotive interior fabrics with advanced processing capabilities and customization options for premium vehicle segments. This combination of material science leadership and automotive industry expertise ensures Japan's automotive fabric advancement through domestic innovation capabilities and international competitiveness.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Woven Fabrics, Non-woven Fabrics, Knitted Fabrics |

| Application | Airbags, Belts and Hoses, Floor Coverings, Tires, Car Roof |

| Vehicle Type | Compact Cars, Mid-Sized Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Toray Industries, Inc., Teijin Limited, Asahi Kasei Corporation, Toyobo Co., Ltd., Seiren Co., Ltd. |

| Additional Attributes | Dollar sales by product type and application, regional CAGR and consumption trends, and volume–value shares are assessed alongside passenger vs. commercial fabric needs, woven vs. non-woven penetration, EV-driven performance innovation, certification constraints, and domestic vs. international automotive textile competition in Japan. |

The demand for automotive fabrics in Japan is estimated to be valued at USD 1,969.3 million in 2025.

The market size for the automotive fabrics in Japan is projected to reach USD 2,751.2 million by 2035.

The demand for automotive fabrics in Japan is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in automotive fabrics in Japan are woven fabric, non woven fabric and knitted fabric.

In terms of application, airbags segment is expected to command 28.0% share in the automotive fabrics in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Fabrics Market Trends 2025 to 2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Automotive Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive NFC in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Headliner in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Light Bars in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brake Tube in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive AI Chipset in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Racing Seats in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Spindle in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Coating in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA