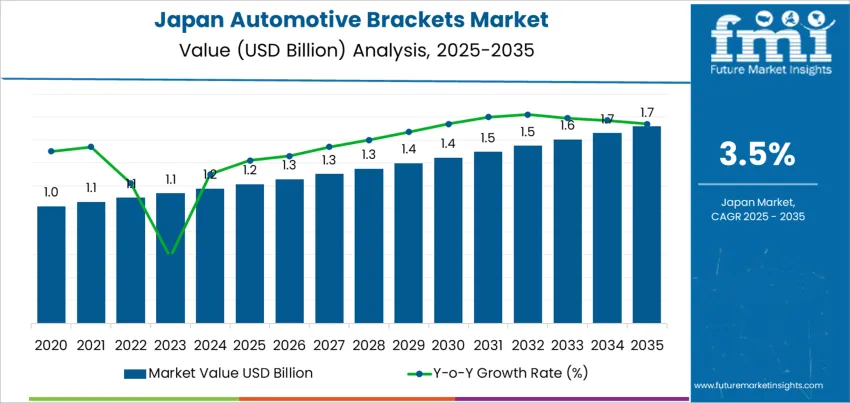

In 2025, the demand for automotive brackets in Japan is valued at USD 1.2 billion and is expected to reach USD 1.7 billion by 2035, with a CAGR of 3.5%. The initial growth phase from 2025 to 2030 will see steady increases in demand, driven by the continuous production of passenger vehicles and commercial vehicles, along with the increasing complexity of vehicle structures. Automotive brackets, which are critical components for mounting various systems such as exhaust systems, radiators, and suspension units, will see a rise in demand due to regulatory pressures for improved vehicle safety and performance. The growth of electric vehicles (EVs) and the need for lightweight materials further support the demand for high-strength, corrosion-resistant brackets.

From 2030 to 2035, demand for automotive brackets will continue to grow at a steady pace, reaching USD 1.7 billion by 2035. This period is marked by the increased adoption of advanced materials like aluminum and high-strength steel to reduce vehicle weight and enhance fuel efficiency. As the automotive industry shifts towards greater electrification, new design specifications will drive innovation in bracket manufacturing, particularly for battery systems and powertrain components in EVs. The key players in this sector, including local Japanese manufacturers and global automotive suppliers, will focus on providing precision-engineered solutions that meet the evolving demands of both traditional and electric vehicle platforms.

The demand for automotive brackets in Japan from 2020 to 2025 displays a stable and gradual growth pattern, with a steady increase from USD 1.0 billion in 2020 to USD 1.2 billion in 2025. Annual increases are modest, ranging between USD 0.1 and 0.2 billion each year. This indicates a relatively low volatility environment, with the market driven by steady automotive production and the need for brackets in various vehicle segments. The demand fluctuations are primarily tied to incremental increases in vehicle manufacturing output and minor shifts in design requirements, with no significant disruptions or market swings.

Between 2025 and 2035, the demand for automotive brackets is projected to rise from USD 1.2 billion to USD 1.7 billion, marking a moderate but steady increase over the decade. The Growth Volatility Index during this period remains low, with annual growth gradually widening from about USD 0.1 billion to USD 0.2 billion towards the end of the period. This steady rise reflects the continued development of automotive technologies, including increased demand for lightweight materials and advanced manufacturing techniques. The absence of sharp market fluctuations suggests stable growth, driven by long-term industry trends rather than short-term market volatility.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.2 billion |

| Forecast Value (2035) | USD 1.7 billion |

| Forecast CAGR (2025–2035) | 3.5% |

The demand for automotive brackets in Japan reflects underlying strength in the broader auto parts sector, which is growing as a response to evolving vehicle complexity, regulatory change, and replacement demand. The national auto parts market is expanding, supported by ongoing vehicle production and a robust aftermarket servicing base. Suppliers produce brackets for multiple applications engine mounts, chassis supports, suspension attachments, and body-to-frame connections with Japanese automakers maintaining strict quality and precision standards. Demand for durable, corrosion-resistant and lightweight bracket designs remains high, especially in traditional internal-combustion, hybrid, and commercial vehicles that dominate the domestic fleet.

Looking ahead, future demand for automotive brackets in Japan will be shaped by several emerging trends. Transition toward lighter, more fuel-efficient vehicles encourages use of high-strength steel, aluminum, and composite brackets that reduce weight while maintaining structural integrity. Growth in hybrid and electric vehicles adds bracket requirements for battery, motor mountings and structural reinforcements, even as traditional engine-mount brackets decline. Rising aftermarket activity tied to vehicle maintenance and replacement of worn brackets will sustain demand. Suppliers offering modular, multi-material brackets, and complying with stricter emissions and safety norms, are likely to capture a growing share of Japanese automotive bracket demand into the next decade.

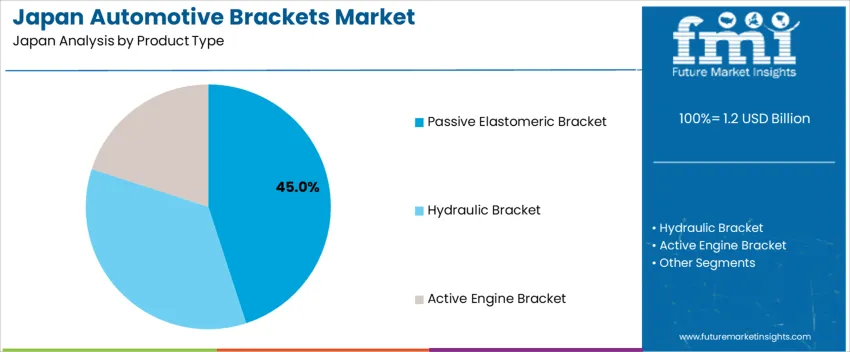

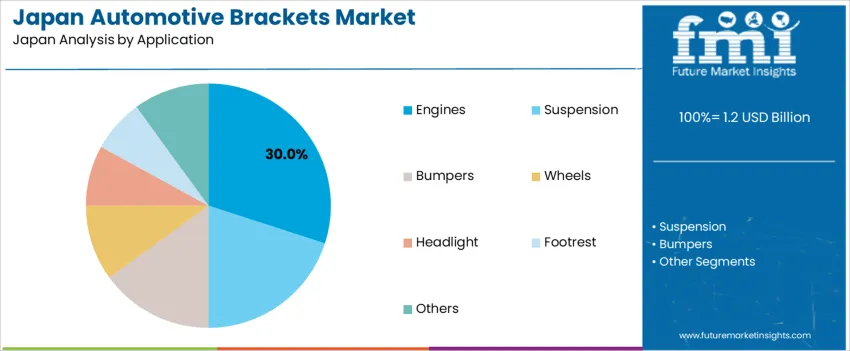

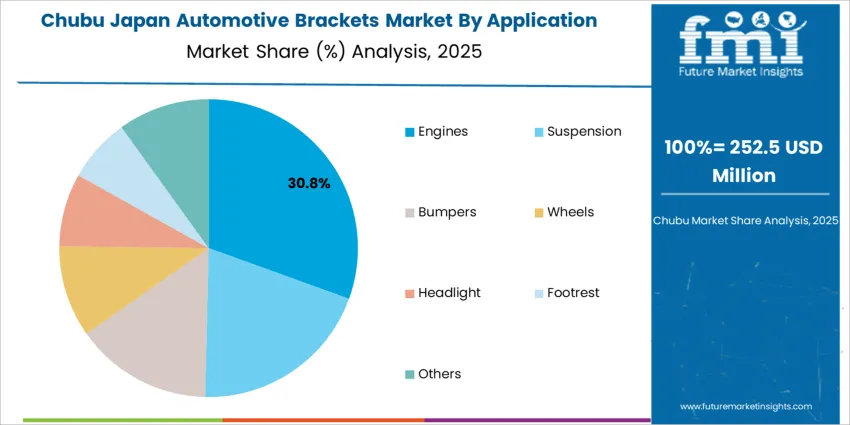

The demand for automotive brackets in Japan is influenced by both product type and application. The primary product types include passive elastomeric brackets, hydraulic brackets, and active engine brackets, with passive elastomeric brackets accounting for 45% of the total demand. In terms of application, automotive brackets are used in a variety of systems, including engines (30%), suspension, bumpers, wheels, headlights, footrests, and other parts. The choice of bracket type is determined by factors such as vibration damping, load-bearing requirements, and the specific role within the vehicle. Applications in critical areas like the engine and suspension systems account for a larger portion of the market, driven by the need for high durability and precision.

Passive elastomeric brackets lead the demand in Japan, accounting for 45% of the total market. These brackets are highly valued for their ability to absorb vibrations and reduce noise, which is essential in automotive applications. Passive elastomeric brackets are commonly used in engine and suspension systems, where vibration control is critical for performance and comfort. The material properties of elastomers, which provide flexibility and resilience, make these brackets ideal for applications that require durability under high stress, such as engine mounts and suspension components. Their effectiveness in damping vibrations and their ability to withstand harsh operating conditions further contribute to their widespread adoption in the Japanese automotive market.

The demand for passive elastomeric brackets is also driven by the increasing emphasis on comfort, safety, and performance in modern vehicles. As Japanese automakers continue to innovate with quieter, smoother-driving vehicles, passive elastomeric brackets play a key role in achieving these goals. Additionally, their cost-effectiveness and ease of integration into manufacturing processes make them a preferred choice in mass production. The automotive industry's growing focus on reducing vehicle noise and enhancing driving comfort ensures that passive elastomeric brackets will remain a dominant product type in the Japanese market.

Engine applications account for 30% of the total demand for automotive brackets in Japan. This demand is primarily driven by the need for robust, durable components that can withstand high temperatures, vibrations, and mechanical stresses. Automotive brackets used in engines are critical for securing various engine components, such as the engine block, exhaust systems, and cooling systems. The high-performance requirements in engine applications necessitate the use of brackets that provide stability, precise alignment, and secure mounting, which is why products like passive elastomeric and hydraulic brackets are commonly used in these systems.

The demand for automotive brackets in engine applications is also influenced by the increasing performance and efficiency expectations in modern vehicles. As automakers in Japan focus on improving engine efficiency, reducing weight, and meeting strict emissions standards, the need for high-quality brackets to support engine components becomes even more crucial. Additionally, with the shift toward electric vehicles (EVs) and hybrid powertrains, the demand for specialized brackets to support new engine and powertrain technologies continues to rise. The consistent need for reliable and high-performance brackets in engine applications ensures that this segment remains a key driver in the automotive bracket market.

In Japan, the demand for automotive brackets is primarily driven by the country’s continued leadership in automotive manufacturing, especially for domestic brands like Toyota, Honda, and Nissan. These manufacturers rely heavily on highly engineered brackets for the assembly of critical components such as powertrains, suspension systems, and interior fittings. Japan’s push towards fuel efficiency in its car designs, with a strong emphasis on lightweighting and enhanced vehicle safety, has led to increased use of aluminum and high-strength steel for brackets. Additionally, as hybrid and electric vehicles (EVs) gain traction, demand for specialized, lightweight brackets to support complex battery packs and electrical components has seen significant growth.

While the automotive sector in Japan is vast, the growth of the automotive bracket market is constrained by several factors. The first significant constraint is the high cost of raw materials like aluminum, magnesium, and high-strength steels used in manufacturing lightweight brackets. This can increase overall production costs for automakers. Moreover, with Japan’s aging population and lower birth rates, domestic car ownership is on the decline in urban areas, potentially leading to stagnation in the number of vehicles being manufactured. Finally, while the demand for EVs is increasing, the relatively slow shift to mass adoption of electric vehicles means that there’s still considerable reliance on traditional combustion engine designs, which limits some of the innovative bracket opportunities seen in EV manufacturing.

A prominent trend in Japan’s automotive bracket market is the shift towards lightweighting. As automakers aim to meet stricter fuel efficiency regulations and reduce CO2 emissions, they are increasingly adopting lightweight materials for components like brackets. Aluminum and magnesium alloys are preferred due to their high strength-to-weight ratios. Additionally, with the advent of electric vehicles, there’s a push for more advanced bracket designs that integrate well with high-voltage components, battery management systems, and regenerative braking systems. Another key trend is the rise of additive manufacturing, which allows for more complex and efficient bracket designs while reducing material waste. Japanese manufacturers are also focusing on the integration of these brackets within the overall vehicle safety and performance system, further enhancing their role in crash safety, vibration reduction, and component durability.

Japan’s automotive innovation, especially in hybrid and electric vehicle technologies, plays a crucial role in the evolving demand for automotive brackets. As automakers in Japan lead the charge in electric mobility, there’s an increased need for brackets that can support and secure complex battery packs, electric motors, and high-performance cooling systems. These systems require brackets with specialized designs that not only reduce weight but also ensure the structural integrity of EV components during intense driving conditions. Moreover, with Japan being a hub for automotive innovation, manufacturers are constantly seeking ways to integrate new materials like carbon fiber composites and high-strength steel into their bracket designs, further influencing market demand. The development of autonomous driving technologies and their associated components (such as sensor systems) also drives the demand for brackets that can securely hold these high-tech systems in place.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.4% |

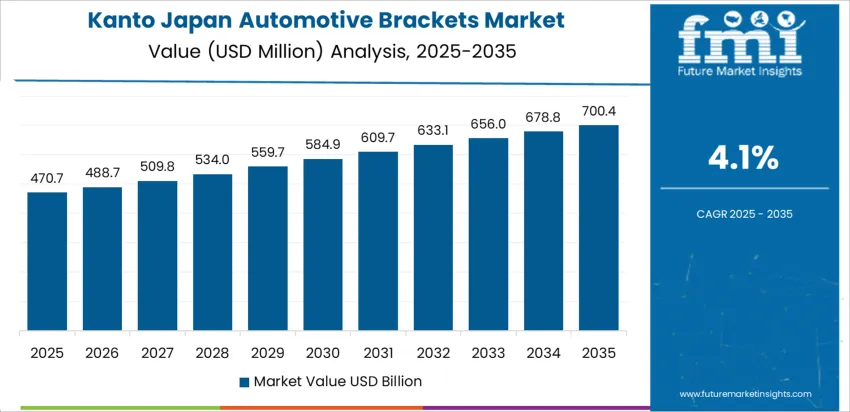

| Kanto | 4.1% |

| Kinki | 3.6% |

| Chubu | 3.1% |

| Tohoku | 2.7% |

| Rest of Japan | 2.6% |

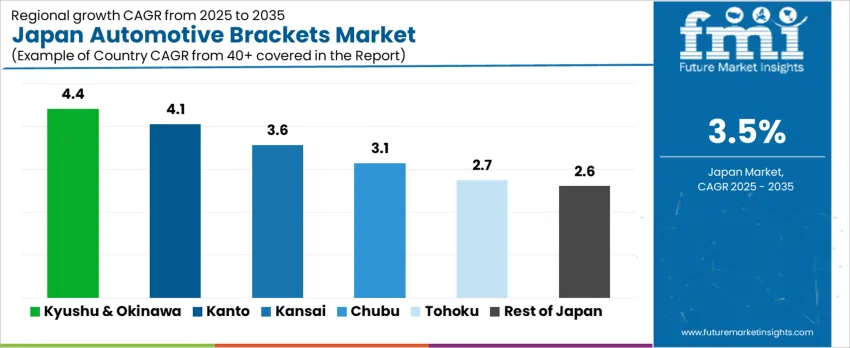

The demand for automotive brackets in Japan is expected to grow unevenly across regions. Kyushu & Okinawa lead with a CAGR of 4.4 %, supported by robust vehicle and component manufacturing facilities in that region and by supply chain strengths in auto parts production. The Kanto region follows at 4.1 %, where high concentration of assemblers and tier 1 suppliers sustains steady demand for brackets. The Kinki region’s 3.6 % growth reflects moderate manufacturing activity and parts sourcing. Chubu’s 3.1 % rate corresponds with regional automotive sub supplier presence. Tohoku and Rest of Japan show slower growth at 2.7 % and 2.6 %, reflecting lower assembly density, fewer auto parts suppliers, and more limited demand for structural components in these regions.

In Kyushu and Okinawa, the demand for automotive brackets is growing at a CAGR of 4.4% through 2035. The automotive sector in this region is primarily driven by the production of light commercial vehicles and passenger cars, with a steady increase in vehicle assembly. As local manufacturers focus on enhancing vehicle safety and performance, the need for strong, durable automotive brackets has risen. Additionally, Okinawa’s focus on eco-friendly transportation options and growing local manufacturing capabilities further fuels the demand for automotive brackets.

In Kanto, the demand for automotive brackets is projected to grow at a CAGR of 4.1% through 2035. As Japan’s largest automotive manufacturing region, Kanto is home to major global and domestic automotive manufacturers. The region’s focus on producing high-performance, fuel-efficient vehicles increases the demand for advanced automotive components, including brackets. Kanto’s robust automotive supply chain, which spans from production to aftermarket, also ensures steady demand for these components. With rising vehicle production and high export volumes, the need for automotive brackets continues to grow across various vehicle segments.

In Kinki, the demand for automotive brackets is expected to grow at a CAGR of 3.6% through 2035. The region’s automotive industry, particularly in Osaka and Kyoto, continues to grow, with an increasing number of both domestic and international manufacturers. As the focus shifts towards advanced vehicle technologies and lightweight materials, the demand for automotive brackets that support structural integrity and vehicle performance increases. Additionally, the growing emphasis on eco-friendly vehicle solutions further drives the need for durable, high-quality brackets to meet evolving automotive standards.

In Chubu, the demand for automotive brackets is projected to grow at a CAGR of 3.1% through 2035. The region, with a strong automotive presence in Aichi Prefecture, plays a crucial role in the production of commercial vehicles and parts. As commercial vehicle production rises and manufacturing standards become more stringent, there is an increasing need for robust and reliable automotive brackets. Additionally, the growing adoption of electric and hybrid vehicles in the region is driving demand for new, lightweight, and energy-efficient automotive components, including brackets.

In Tohoku, the demand for automotive brackets is expected to grow at a CAGR of 2.7% through 2035. Although the automotive industry in Tohoku is smaller compared to other regions, steady demand persists due to vehicle servicing and replacement needs. Commercial vehicles and mid-range passenger vehicles remain essential to the region’s economy, contributing to the ongoing need for automotive brackets. As vehicle safety standards continue to evolve and the demand for reliable parts increases, the need for durable automotive brackets in the region grows steadily.

In the rest of Japan, the demand for automotive brackets is projected to grow at a CAGR of 2.6% through 2035. While the automotive sector in these regions is not as large as in other major hubs, steady demand arises from vehicle maintenance, replacement cycles, and smaller-scale manufacturing. As vehicle fleets age and require more frequent servicing, the need for automotive components such as brackets grows. Additionally, the rest of Japan’s focus on improving fuel efficiency and vehicle safety continues to drive the adoption of advanced, durable automotive brackets for all vehicle types.

The demand for automotive brackets in Japan is driven by the country's ongoing innovation in vehicle design, with an increasing focus on lightweight materials and advanced structural components. Japanese automakers are incorporating more hybrid and electric vehicles into their fleets, which require specialized mounting systems and structural components, including high-quality brackets. These components are essential for securing various parts such as engines, suspension systems, and battery packs, particularly in the growing EV market. The automotive industry in Japan also places high demands on precision and durability, which further drives the need for high-performance brackets that can withstand heavy use and environmental factors.

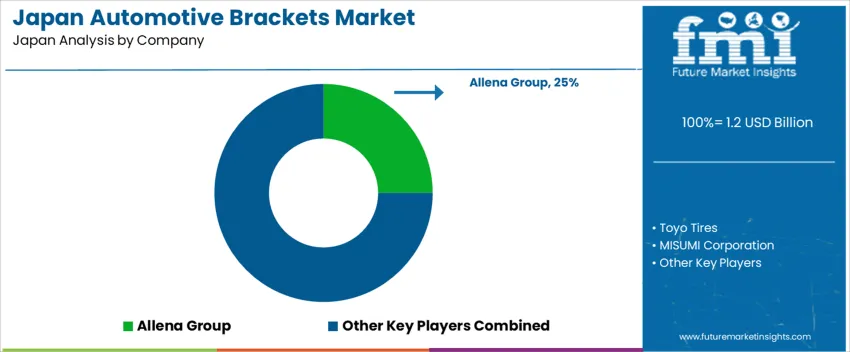

Key players in the Japanese automotive bracket market include Allena Group, Toyo Tires, MISUMI Corporation, Cooper-Standard Holdings Inc., and Hangzhou Ekko Auto Parts Co., Ltd. Allena Group and MISUMI Corporation play significant roles in the domestic market by providing high-precision brackets and related components tailored to Japanese manufacturers' needs. Toyo Tires contributes by offering related parts that support automotive assemblies, including bracket applications for suspension systems. Cooper-Standard and Hangzhou Ekko also influence the market with their global supply networks, providing a variety of brackets for international OEMs and aftermarket needs. These companies are shaping the landscape by meeting the evolving demands of vehicle manufacturers for more sophisticated, lightweight, and durable bracket solutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Passive Elastomeric Bracket, Hydraulic Bracket, Active Engine Bracket |

| Application | Engines, Suspension, Bumpers, Wheels, Headlight, Footrest, Others |

| Vehicle Type | Passenger Car, Commercial Vehicle |

| Sales Channel | Original Equipment Manufacturers, Aftermarket |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Allena Group, Toyo Tires, MISUMI Corporation, Cooper-Standard Holdings Inc., Hangzhou Ekko Auto Parts Co., Ltd. |

| Additional Attributes | Dollar by sales by product type and application; regional growth breakdown; CAGR and volume growth projections; vehicle segment penetration and role of hybrid/EV platforms; material and weight trends (high-strength steel, aluminum, composites); focus on performance, safety, and environmental considerations; integration of advanced manufacturing techniques; supplier strategies on modular and multi-material brackets; aftermarket vs OEM demand; shift towards sustainable materials and lightweighting. |

The demand for automotive brackets in Japan is estimated to be valued at USD 1.2 billion in 2025.

The market size for the automotive brackets in Japan is projected to reach USD 1.7 billion by 2035.

The demand for automotive brackets in Japan is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in automotive brackets in Japan are passive elastomeric bracket, hydraulic bracket and active engine bracket.

In terms of application, engines segment is expected to command 30.0% share in the automotive brackets in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Brackets Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive Brackets in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive NFC in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Fabrics in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Headliner in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Light Bars in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brake Tube in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive AI Chipset in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Racing Seats in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Spindle in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Coating in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Grade Inductor in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA