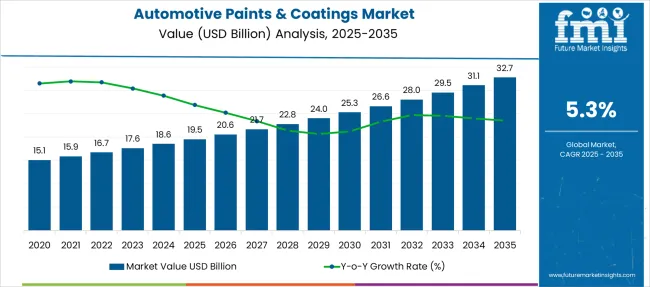

The Automotive Paints & Coatings Market is estimated to be valued at USD 19.5 billion in 2025 and is projected to reach USD 32.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Paints & Coatings Market Estimated Value in (2025 E) | USD 19.5 billion |

| Automotive Paints & Coatings Market Forecast Value in (2035 F) | USD 32.7 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The automotive paints and coatings market is advancing steadily due to the resurgence of automotive production and growing emphasis on aesthetics, durability, and environmental compliance. OEMs and aftermarket players are focusing on surface performance and corrosion resistance while balancing environmental regulations related to VOC emissions.

Technological shifts toward waterborne formulations and advanced curing techniques are becoming mainstream as regulatory bodies enforce stricter environmental norms globally. Innovation in color personalization, scratch-resistant layers, and heat-reflective pigments is creating new opportunities across luxury and mid-range vehicle segments.

As automotive design complexity increases, coating manufacturers are investing in modular solutions capable of delivering uniform finishes on varied substrates including aluminum and composite materials. Additionally, the growth of electric vehicles and smart mobility trends is prompting new coating requirements such as electromagnetic shielding and thermal management, ensuring long-term expansion opportunities across both conventional and emerging automotive ecosystems.

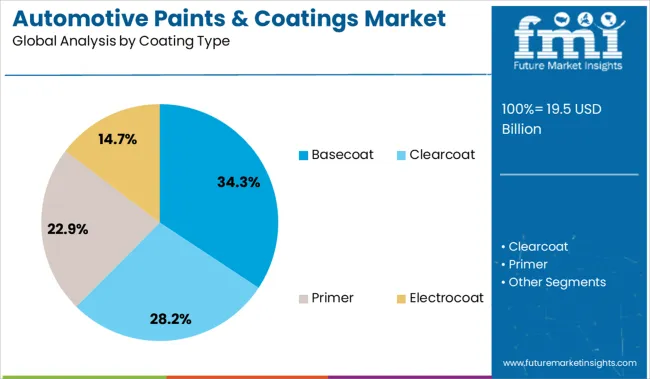

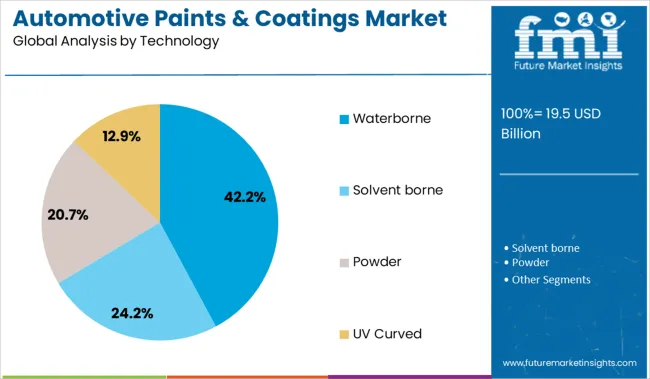

The market is segmented by Vehicle, Coating Type, Technology, Texture, Distribution Channel, and Raw Material and region. By Vehicle, the market is divided into Passenger Cars, Light commercial vehicles, and Heavy commercial vehicles. In terms of Coating Type, the market is classified into Basecoat, Clearcoat, Primer, and Electrocoat. Based on Technology, the market is segmented into Waterborne, solvent-borne, Powder, and UV-curable. By Texture, the market is divided into Solid, Metallic, and Matte. By Distribution Channel, the market is segmented into OEM and Aftermarket. By Raw Material, the market is segmented into Polyurethane, Acrylic, Epoxy, and Other resins. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger cars segment is forecast to contribute 54.3% of the total market revenue in 2025, establishing it as the most dominant vehicle category. This leadership is being driven by high production volumes globally, with a significant share coming from densely populated regions where consumer vehicle demand remains strong.

The growing preference for personal mobility, increased disposable income, and the rise of urbanization have collectively supported the sustained need for quality automotive finishes in this segment. Additionally, automakers are investing in design differentiation and color innovation to meet diverse consumer expectations, reinforcing demand for advanced paint systems.

The segment’s influence is further amplified by its role in driving OEM and aftermarket sales for both conventional and electric vehicles, cementing passenger cars as the core revenue driver within the automotive paints and coatings market.

The basecoat segment is anticipated to account for 34.3% of total revenue in the coating type category in 2025. This prominence is attributed to its essential function in delivering color styling and visual appeal while serving as the foundation for advanced effects such as metallic and pearlescent finishes.

As OEMs focus on enhancing brand identity through distinctive color palettes and finishes, demand for high-performance basecoats with strong adhesion and UV stability has increased. Furthermore, innovations in pigment dispersion and compatibility with both waterborne and solventborne systems have improved application efficiency and surface aesthetics.

The role of basecoats in facilitating smooth layering and enhancing the final appearance of clearcoat systems continues to make them a critical component in automotive finishing processes, supporting their sustained market leadership.

Waterborne coatings are projected to hold a 42.2% share of the technology segment in 2025, marking them as the leading formulation type. This leadership is being fueled by escalating regulatory pressure to reduce volatile organic compound emissions and align with sustainable manufacturing practices.

Waterborne coatings offer environmental benefits without compromising performance, making them increasingly preferred by OEMs and tier-1 suppliers. Advancements in drying efficiency, corrosion resistance, and color matching have addressed prior limitations and enabled wider adoption across diverse automotive production lines.

Additionally, consumer awareness around environmentally responsible vehicles has encouraged OEMs to integrate greener technologies throughout the supply chain. These factors have collectively accelerated the adoption of waterborne technology, positioning it as the standard for compliance-driven and performance-aligned automotive coatings.

OEM collaboration, advanced formulation techniques, and expanding refinishing operations have reinforced demand for automotive paints and coatings across factory lines and aftermarket channels. Waterborne systems, electrocoat primers, and UV-resistant clearcoats are being adopted for enhanced durability and compliance.

Customized color preferences, rising two-tone applications, and surface compatibility with lightweight materials have increased product complexity. Growth remains supported by automated application technologies, digital color tools, and functional coating innovations targeting EVs and ADAS-equipped vehicles.

Vehicle production lines and body repair operations have continued to drive consistent demand for multi-functional automotive coatings. OEMs have adopted systemized coating sequences comprising pretreatment, e-coat, basecoat, and clearcoat to deliver optimized corrosion resistance and long-lasting aesthetic quality.

Increased vehicle density on roads has elevated the frequency of minor collisions, supporting growth in refinishing volumes. Aftermarket demand has been reinforced by insurance-led repair cycles, restoration trends, and vehicle wrapping alternatives. Manufacturers have developed adaptable coatings for aluminum panels, fiber-reinforced plastics, and other lightweight body materials.

Refinish centers now utilize digital color-matching tools, advanced application guns, and accelerated drying ovens to boost productivity. As automotive finishes evolve to reflect design trends, coatings have played a central role in achieving visual differentiation, panel durability, and adhesion on diverse substrates.

Advanced coating chemistries and modular application platforms have enabled manufacturers to pursue aesthetic innovation and material compatibility. Waterborne basecoats and UV-curable clearcoats have replaced solvent-heavy formulations in several OEM lines and custom paint shops.

Coatings with scratch-healing, infrared reflectivity, and anti-microbial features have been piloted for next-generation vehicles, including electric models and shared mobility fleets. EV manufacturers are adopting new coating stacks to ensure electromagnetic compatibility for radar, lidar, and camera-based sensors.

The expansion of franchise refinish networks and mobile paint services has democratized access to premium paint repairs. Predictive maintenance tools and AI-driven defect recognition are also being integrated into robotic spray booths to minimize wastage. As functional coatings intersect with automotive electronics, opportunities are emerging in segments previously limited to basic aesthetic or protective roles.

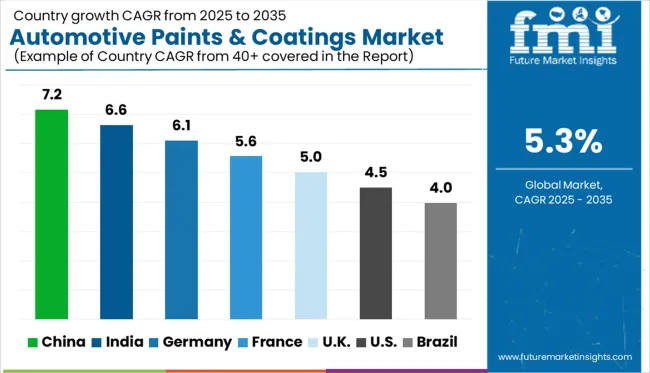

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global automotive paints and coatings market is projected to grow at a CAGR of 5.3% from 2025 to 2035, driven by expanding OEM production, evolving refinish demand, and adoption of low-VOC, performance-focused formulations. China leads with a 7.2% CAGR, supported by waterborne system adoption and robotic spray line expansion across domestic assembly plants.

India follows at 6.6%, influenced by rising two-wheeler coating needs, service center innovations, and primer-level material upgrades. Germany grows at 6.1%, shaped by UV-curable basecoats, smart spray automation, and luxury finish integration. France posts 5.6%, led by low-cure clearcoats and modular coating kits for energy reduction.

The United Kingdom, growing at 5.0%, reflects refinisher-centric upgrades, rapid-cure refinishing systems, and compatibility with lightweight mixed-material bodies. These five countries collectively reflect a blend of efficiency-led innovation and formulation customization drawn from a 40+ nation analysis.

Demand for automotive paints and coatings in China is forecast to grow at a CAGR of 7.2%, driven by increased vehicle restoration demand, localized OEM production, and a growing portfolio of high-durability coatings. Domestic paint manufacturers have expanded offerings to meet evolving performance specifications across economy and luxury segments.

Waterborne and low-VOC coatings have been prioritized in factory refinishing and authorized service center applications. Demand has shifted toward dual-layer systems and scratch-resistant clearcoats in mid-to-high-end vehicles. Advanced robotic application lines have been deployed in production facilities to ensure consistency in finish and reduce overspray. The market in China continues to be shaped by regulatory alignment and global export alignment for finish quality.

Sale of automotive paints and coatings in India is projected to expand at a CAGR of 6.6%, supported by strong aftermarket activity, expansion of component-level coating, and growing adoption of eco-friendly technologies. Domestic suppliers are investing in color-matching technologies and fast-curing clearcoats for higher throughput in collision repair centers.

Demand for chip-resistant primers has increased due to variable road conditions. Partnerships between vehicle assemblers and paint formulators are shaping factory-level coating innovations. Segment-specific coatings are being introduced for two-wheelers, utility vehicles, and electric vehicle bodies. Cost-sensitive coatings remain relevant, though mid-segment buyers are gradually shifting toward premium finishes.

The automotive paints and coatings market in Germany is expected to grow at a CAGR of 6.1%, backed by advancements in functional coatings, eco-regulations, and strategic positioning in luxury automotive manufacturing. Multi-layer coating systems with self-healing and anti-pollution properties are being developed to extend exterior longevity.

Demand for UV-curable coatings and solvent-free basecoats has increased in OEM plants and Tier 1 vendor facilities. German manufacturers are integrating intelligent spray control and advanced robotics in high-volume lines to reduce waste and maximize material efficiency. The market continues to emphasize consistency, gloss retention, and corrosion protection tailored to high-speed mobility conditions.

France market is forecast to expand at a CAGR of 5.6%, shaped by the move toward lower-emission paint technologies, streamlined service models, and increased preference for hybrid application methods. Coating systems have shifted toward modular kits with high transfer efficiency and reduced curing time.

French automotive assemblers are optimizing coating layers to meet design-led consumer expectations while minimizing process energy. Water-dispersible technologies are becoming standard across new line installations. Material reformulation is being driven by compliance with domestic chemical limits and the growing presence of next-generation color additives. Clearcoats offering matte and semi-gloss finishes are increasingly integrated into boutique production.

The United Kingdom automotive paints and coatings market is projected to grow at a CAGR of 5.0%, driven by refinishing demand, lightweight substrate compatibility, and shift toward automated repair line formats. High-volume vehicle service centers are adopting rapid-cure formulations and electrostatic spray equipment to reduce dwell time.

Paint booths are being reconfigured to accommodate mixed-material bodies using carbon fiber, aluminum, and advanced steels. The market in the UK places emphasis on texture uniformity, paint fade resistance, and color consistency under varied lighting conditions. Application system retrofits and multi-bay operations are supporting refinisher efficiency in both independent and brand-linked facilities.

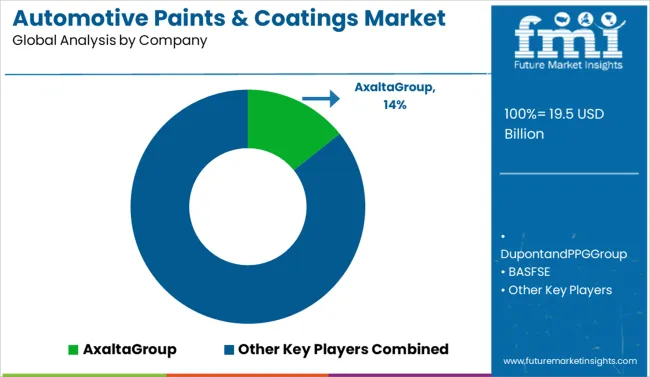

The automotive paints and coatings industry is led by Axalta Group, holding a significant market share through its strong OEM partnerships and advanced coating technologies tailored for performance, durability and color precision.

DuPont and PPG Group maintain competitive positions by offering eco-efficient basecoats and high-solids clearcoats for automotive refinishing and manufacturing. BASF SE and AkzoNobel focus on waterborne and UV-curable formulations aligned with evolving emission norms and finish consistency. Sherwin-Williams and Berger Paints serve aftermarket and regional assembly markets with tailored repair coatings.

Covestro AG and Clariant AG support the sector with resins, pigments, and additives that enhance adhesion and gloss. Current competition is shaped by curing efficiency, corrosion resistance, and compatibility with lightweight and electric vehicle substrates.

In 2025, AkzoNobel introduced a new waterborne basecoat for vehicle repainting in North America, designed to enhance body-shop efficiency and performance while meeting eco-friendly standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.5 Billion |

| Vehicle | Passenger Cars, Light commercial vehicle, and Heavy commercial vehicle |

| Coating Type | Basecoat, Clearcoat, Primer, and Electrocoat |

| Technology | Waterborne, Solvent borne, Powder, and UV Curved |

| Texture | Solid, Metallic, and Matte |

| Distribution Channel | OEM and Aftermarket |

| Raw Material | Polyurethane, Acrylic, Epoxy, and Other resins |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AxaltaGroup, DupontandPPGGroup, BASFSE, BergerPaints, AkzoNobel, CovestroAG, ClariantAG, TheSherwin-WilliamsCompany, and Eastman |

| Additional Attributes | Dollar sales are segmented by coating type basecoat, clearcoat, primers, and functional coatings with waterborne formulations gaining rapidly. Demand is rising for low-VOC, self-healing, and UV-protective coatings. OEMs and CDMOs offer turnkey color systems. North America, Europe, and Asia-Pacific lead adoption, driven by EV growth, sustainability mandates, and corrosion resistance requirements. |

The global automotive paints & coatings market is estimated to be valued at USD 19.5 billion in 2025.

The market size for the automotive paints & coatings market is projected to reach USD 32.7 billion by 2035.

The automotive paints & coatings market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in automotive paints & coatings market are passenger cars, light commercial vehicle and heavy commercial vehicle.

In terms of coating type, basecoat segment to command 34.3% share in the automotive paints & coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA