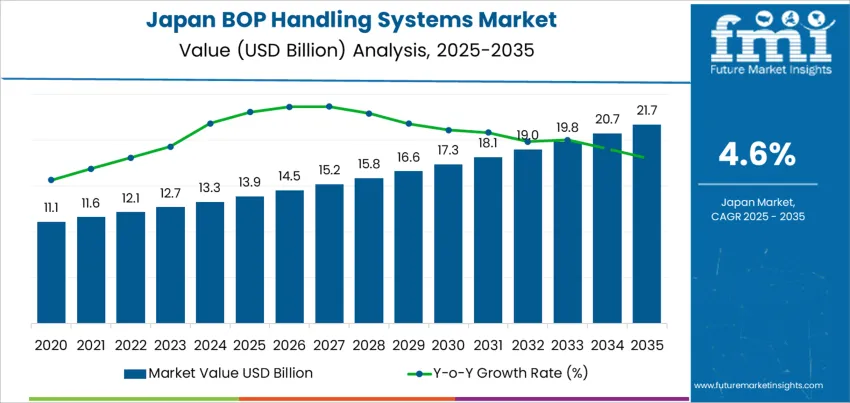

The demand for BOP (Blowout Preventer) handling systems in Japan is expected to grow from USD 13.9 billion in 2025 to USD 21.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.6%. BOP handling systems are critical in the oil and gas industry for ensuring safety during drilling operations. As the Japanese oil and gas sector continues to invest in advanced technologies and safety measures, the demand for reliable BOP handling systems is expected to rise. Additionally, stricter safety regulations and the growing focus on risk mitigation in offshore and onshore drilling operations will drive demand for these systems.

The market will experience steady, gradual growth, starting at USD 13.9 billion in 2025, increasing to USD 14.5 billion in 2026, and reaching USD 15.2 billion in 2027. By 2029, demand for BOP handling systems will rise to USD 16.6 billion, and by 2035, it is expected to reach USD 21.7 billion. This growth is driven by sustained activity in oil and gas exploration and production, as well as the continuous push for enhanced safety and efficiency in drilling operations.

The BOP handling systems market in Japan is expected to grow steadily over the forecast period. Starting at USD 13.9 billion in 2025, the market will increase to USD 14.5 billion in 2026 and USD 15.2 billion in 2027. By 2028, the market will grow to USD 15.8 billion, and by 2029, it will reach USD 16.6 billion. The market will continue to rise, with demand increasing to USD 17.3 billion by 2030 and USD 18.1 billion by 2031. By 2035, the demand for BOP handling systems is forecasted to reach USD 21.7 billion.

The inflection point mapping highlights the key stages of accelerated growth in the market. The initial phase from 2025 to 2028 shows steady increases, with moderate growth. However, after 2029, the market will experience an acceleration in demand as the need for advanced safety systems and BOP technologies becomes more critical. This inflection point, occurring around 2029, marks a shift toward a more significant upward movement, driven by technological advancements, increasing regulatory pressure, and the expanding scope of oil and gas operations in Japan. The market will continue to grow steadily, with the greatest acceleration occurring toward the latter part of the forecast period.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 13.9 billion |

| Industry Forecast Value (2035) | USD 21.7 billion |

| Industry Forecast CAGR (2025-2035) | 4.6% |

The demand for blowout preventer (BOP) handling systems in Japan is rising as offshore oil and gas operators seek improved safety, efficiency, and regulatory compliance. Offshore drilling and deep water exploration impose stringent requirements on well control, safety and handling of heavy BOP stacks. In Japan, modernization of offshore drilling infrastructure and increased maintenance of existing wells contribute to demand for reliable BOP handling systems. Operators prefer mechanized and purpose built handling systems to lift, transport, install, and remove large BOP stacks rather than employing manual or ad hoc methods. Reliable handling systems reduce risk to workers, minimise downtime, and ensure safe operations under high pressure and corrosive offshore conditions. As long as Japan’s offshore energy sector maintains focus on safety and rig integrity, demand for BOP handling systems remains supported.

Growing adoption of automation, improved hydraulic and electric powered handling equipment, and stricter enforcement of safety and environmental regulations further drive the demand for advanced BOP handling systems. Global trends toward remote operated, hydraulically or electrically actuated handling systems enable safer, faster and more precise operations in deepwater conditions, and these solutions increasingly appeal to Japanese operators. As regulators and industry operators in Japan emphasise environmental protection, accident prevention and operational reliability, BOP handling systems with robust design and automation features see growing adoption. Given ongoing offshore activity, maintenance cycles, and increasing technical demands of modern rigs, demand for BOP handling systems in Japan is likely to rise steadily in the coming years.

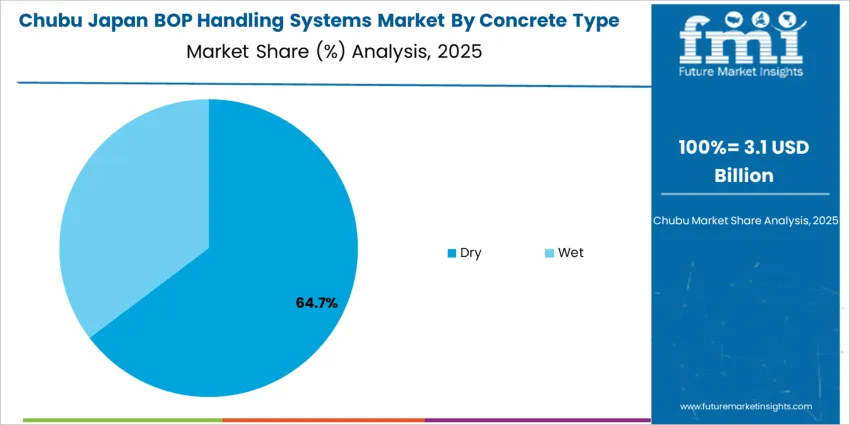

The demand for BOP (Blowout Preventer) handling systems in Japan is primarily driven by type and concrete type. The leading type is mounted, which captures 55% of the market share, while dry concrete is the dominant concrete type, accounting for 65% of the demand. BOP handling systems are essential in the oil and gas industry for ensuring the safe handling and installation of blowout preventers, which are critical to preventing uncontrolled well pressure. As safety regulations become more stringent and operational efficiency improves, the demand for these handling systems remains strong in Japan’s energy sector.

Mounted BOP handling systems lead the demand in Japan, holding 55% of the market share. These systems are typically mounted directly on drilling rigs or other equipment, which ensures stability and precision during the handling and positioning of blowout preventers. Mounted BOP handling systems are favored in offshore and onshore drilling operations for their ability to provide continuous, reliable performance in high-pressure, high-stakes environments.

The demand for mounted BOP handling systems is driven by their efficiency, safety, and ability to integrate seamlessly into the existing drilling infrastructure. Mounted systems offer greater control, which minimizes the risk of accidents and operational downtime. As the oil and gas industry in Japan continues to focus on improving safety standards and operational productivity, mounted BOP handling systems will remain the preferred choice. Their reliability in safely managing blowout preventers under challenging conditions ensures their dominant position in the market.

Dry concrete is the leading concrete type for BOP handling systems in Japan, accounting for 65% of the demand. Dry concrete is commonly used in BOP handling systems because it provides a stable, solid foundation that can withstand the weight and stress of heavy equipment used in drilling operations. The dry mix is ideal for applications where consistency, durability, and strength are required, particularly in environments subject to vibration and mechanical load.

The demand for dry concrete in BOP handling systems is driven by its superior performance and ability to form a durable, stable base for equipment. As the oil and gas industry continues to emphasize safety and efficiency in drilling operations, dry concrete remains the material of choice for ensuring that BOP handling systems perform optimally. With the increasing focus on reducing operational risks and enhancing system longevity, dry concrete is expected to maintain its dominant role in supporting BOP handling systems in Japan.

Demand for handling systems for blowout preventers (BOP) in Japan remains moderate but shows signs of gradual growth. Existing offshore and deep water drilling efforts, along with periodic maintenance or upgrades of well control equipment, sustain baseline demand for handling solutions. The market appears to be driven more by maintenance, retrofit and compliance activity than by large volumes of new well construction. Given limited domestic upstream activity, demand growth is likely to remain steady but modest under current conditions. Expansion of Japanese involvement in foreign offshore projects and deep sea drilling research may contribute to incremental growth in demand for BOP handling systems.

What are the Drivers of Demand for BOP Handling Systems in Japan?

One driver is ongoing deep sea drilling research and offshore exploration tied to Japanese firms or partnerships. Such efforts create demand for full well control solutions including BOP handling equipment. Another driver stems from maintenance, retrofitting and replacement of existing BOP systems on older wells or rigs, which require safe handling systems for installation, removal or servicing. Regulatory focus on safety and well control standards compels operators to adopt handling systems to meet compliance and risk management requirements. The need for reliable handling of heavy, high pressure BOP stacks under harsh offshore conditions also encourages adoption of engineered handling solutions. Finally, Japanese involvement in regional or international drilling ventures fuels demand for handling systems as part of comprehensive BOP packages.

What are the Restraints on Demand for BOP Handling Systems in Japan?

A major restraint is the relatively small scale of domestic upstream oil and gas production, which limits the number of new wells and thus reduces demand for new handling-system installations. The limited scale of onshore and offshore drilling activity means that many rigs may not justify the cost of advanced handling equipment. Economic pressures or fluctuations in oil and gas markets may lead operators to postpone maintenance or upgrade of handling systems. Another constraint is the availability of imported BOP equipment and standardized global solutions which may reduce reliance on locally supplied handling systems. Where wells or rigs operate under simpler or older infrastructure, operators might prefer manual or simpler handling methods, limiting uptake of modern handling systems. Finally, demand is tied to periodic maintenance or retrofit cycles rather than continuous production growth, which reduces long term demand momentum.

What are the Key Trends Influencing Demand for BOP Handling Systems in Japan?

One trend is gradual increase in deep sea and offshore well control operations involving Japanese firms, which raises demand for complete BOP and handling system packages. Another trend is growing emphasis on safety and regulatory compliance for drilling operations, which motivates use of engineered handling systems instead of manual handling. Maintenance and retrofitting of existing rigs and platforms creates recurring demand for handling equipment over time rather than sporadic demand tied to new wells. Adoption of standardized global BOP solutions means that Japanese operators may increasingly procure integrated BOP plus handling system packages rather than separate or custom built solutions. Finally, involvement of Japanese companies in regional and international offshore projects could blend domestic demand with export or cross border demand, shaping a more stable but modest growth path for BOP handling system demand linked to international drilling activity.

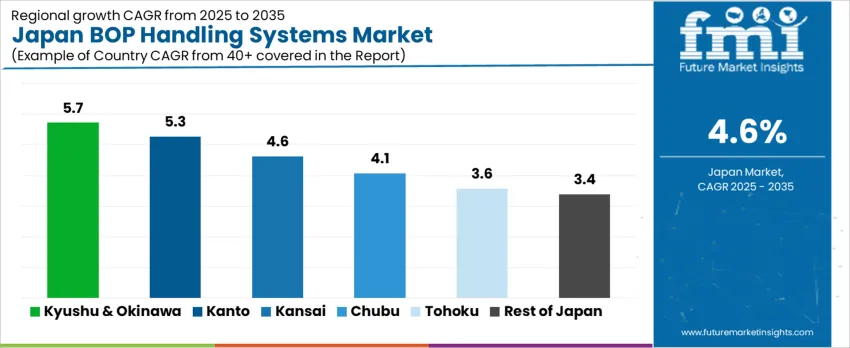

The demand for BOP (Blowout Preventer) handling systems in Japan shows steady growth across regions, with Kyushu & Okinawa leading at a CAGR of 5.7%. Kanto follows with a CAGR of 5.3%, driven by its robust energy infrastructure and oil and gas operations. The Kinki region shows moderate growth at 4.6%, while Chubu, Tohoku, and the Rest of Japan exhibit slower growth, with respective CAGRs of 4.1%, 3.6%, and 3.4%. These regional differences are influenced by factors such as the intensity of oil and gas extraction activities, offshore drilling operations, and infrastructure development in each region.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.7 |

| Kanto | 5.3 |

| Kinki | 4.6 |

| Chubu | 4.1 |

| Tohoku | 3.6 |

| Rest of Japan | 3.4 |

The demand for BOP handling systems in Kyushu & Okinawa is projected to grow at a CAGR of 5.7%, driven by the region's offshore oil and gas exploration and production activities. Kyushu & Okinawa are key players in Japan's offshore drilling operations, and as such, the demand for reliable BOP handling systems is crucial for maintaining safe and efficient drilling operations. The region's efforts to expand and optimize its energy infrastructure, particularly in offshore oil fields, contribute to the rising demand for these critical systems. Additionally, the region's focus on improving the safety and efficiency of offshore drilling platforms, coupled with an increasing regulatory emphasis on safety standards, ensures continued demand for BOP handling systems in Kyushu & Okinawa.

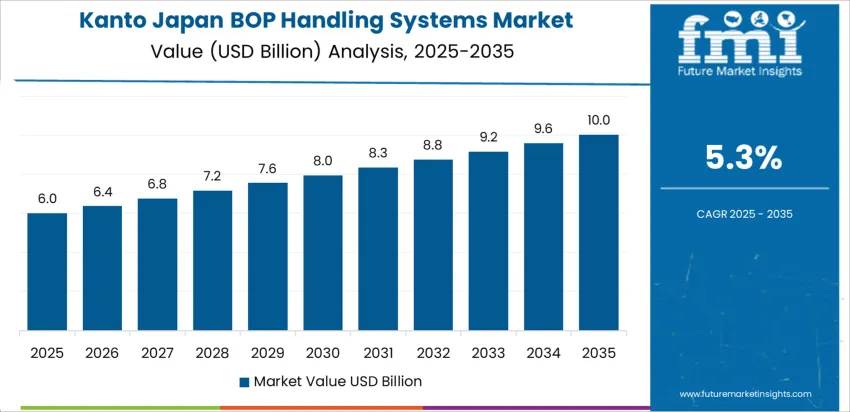

In Kanto, the demand for BOP handling systems is expected to grow at a CAGR of 5.3%, supported by the region's strong energy infrastructure and its role as a key hub for oil and gas operations. Kanto, which includes Tokyo, plays a significant role in Japan’s energy market, with several oil refineries, petrochemical facilities, and offshore drilling operations. The region’s focus on expanding its offshore drilling capabilities and improving energy security is driving the need for advanced BOP handling systems that can ensure the safety and reliability of these operations. As Japan continues to modernize and improve its energy sector, particularly in offshore oil and gas production, the demand for BOP handling systems in Kanto is expected to rise steadily.

The demand for BOP handling systems in Kinki is projected to grow at a CAGR of 4.6%, driven by the region’s industrial activities and ongoing energy sector developments. Kinki, which includes Osaka and Kyoto, has a strong manufacturing base and is home to several critical energy infrastructure projects. While the region is not as heavily involved in offshore oil and gas exploration as Kyushu & Okinawa or Kanto, the demand for BOP handling systems is growing due to the increasing need for safety and reliability in offshore drilling and extraction activities. The region’s focus on improving energy production systems and its investments in renewable and non-renewable energy sources further support the demand for these systems. As Kinki continues to modernize its energy infrastructure, the demand for BOP handling systems will continue to grow, albeit at a more moderate pace compared to other regions.

The demand for BOP handling systems in Chubu is expected to grow at a CAGR of 4.1%, supported by the region’s industrial activity and growing energy sector. Chubu, which includes Nagoya and surrounding areas, has a diverse industrial base, including automotive, manufacturing, and energy. Although Chubu is not a major player in offshore oil drilling, its role in Japan’s energy infrastructure and its need for safe and efficient drilling operations contribute to the moderate demand for BOP handling systems. As offshore drilling activities expand and safety standards continue to tighten, the region’s need for reliable blowout prevention systems is expected to rise. While the growth rate in Chubu is slower than in more oil-intensive regions like Kyushu & Okinawa and Kanto, demand for BOP handling systems remains steady as energy infrastructure development continues.

In Tohoku, the demand for BOP handling systems is projected to grow at a CAGR of 3.6%, reflecting gradual adoption driven by the region's growing energy sector and increasing focus on offshore drilling. While Tohoku is less involved in oil and gas production compared to other regions, its increasing interest in offshore drilling and the need for improved energy infrastructure contribute to the rising demand for BOP handling systems. The region’s growing commitment to energy efficiency, coupled with safety regulations and a focus on offshore drilling optimization, supports the demand for these systems. Although Tohoku is not a primary hub for oil and gas exploration, the demand for BOP systems is steadily increasing as the region strengthens its role in Japan’s energy production efforts.

In the Rest of Japan, the demand for BOP handling systems is expected to grow at a CAGR of 3.4%, reflecting modest growth due to the region’s limited involvement in offshore oil and gas extraction activities. This region, which includes rural and less industrialized areas, has smaller oil and gas production activities, but it still faces a growing need for BOP systems due to infrastructure maintenance and safety improvements. As Japan continues to expand its offshore drilling capabilities and strengthen its energy infrastructure across all regions, the Rest of Japan’s demand for BOP handling systems will rise gradually, ensuring steady growth despite the region's smaller scale of oil and gas operations.

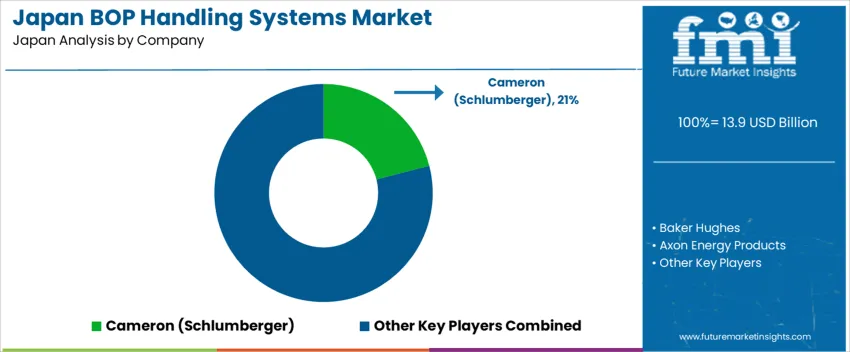

Demand for BOP (blowout preventer) handling systems in Japan is linked to offshore drilling, geothermal well development, and well control safety requirements. Key suppliers include Cameron (Schlumberger) with about 21 % share, Baker Hughes, Axon Energy Products, and MH Wirth. These firms offer systems that lift, deploy, retrieve, and service BOP stacks for offshore or onshore wells. The need for reliable handling systems increases when wells reach greater depth or involve challenging conditions, including deep sea or geothermal drilling, where precise, safe BOP operations are required.

Competition in this sector in Japan centers on reliability, automation, compliance with safety standards, and adaptability to different rig or well types. Suppliers emphasize designs that support automated or hydraulic lifting, reduce manual interventions, and ensure secure handling of heavy BOP stacks. Systems that meet international standards for lifting capacity, corrosion resistance, and certification tend to be preferred. Another factor is service support: firms that offer maintenance, spare part availability, and on site technical assistance find greater acceptance among Japanese operators. Marketing materials often highlight lifting capacity, safety features, rig compatibility, and ease of installation. By matching the needs of Japanese drilling and geothermal projects for safe, efficient well control, these companies aim to secure and grow their share in Japan’s BOP handling systems market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Type | Mounted, Walk-behind, Hand-held, Vacuums |

| Concrete Type | Dry, Wet |

| Power Source | Hydraulic, Electric, Pneumatic, Battery-Powered, Gas-Powered |

| Power Range | Up to 10 HP, 10 to 25 HP, 25 to 50 HP, 50 to 75 HP, Above 75 HP |

| Key Companies Profiled | Cameron (Schlumberger), Baker Hughes, Axon Energy Products, MH Wirth |

| Additional Attributes | The market analysis includes dollar sales by type, concrete type, power source, power range, and company categories. It also covers regional demand trends in Japan, driven by the increasing use of BOP (Blowout Preventer) handling systems in oil and gas operations. The competitive landscape highlights key manufacturers focusing on innovations in handling systems for improved safety, efficiency, and reliability. Trends in the growing demand for versatile and energy-efficient BOP handling systems, particularly for dry and wet concrete applications, are explored, along with advancements in system design and power integration for higher performance. |

The demand for BOP handling systems in Japan is estimated to be valued at USD 13.9 billion in 2025.

The market size for the BOP handling systems in Japan is projected to reach USD 21.7 billion by 2035.

The demand for BOP handling systems in Japan is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in BOP handling systems in Japan are mounted, walk-behind, hand-held and vacuums.

In terms of concrete type, dry segment is expected to command 65.0% share in the BOP handling systems in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

BOP Handling Systems Market Growth - Trends & Forecast 2025 to 2035

Demand for BOP Handling Systems in USA Size and Share Forecast Outlook 2025 to 2035

Crate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Japan Sleep Apnea Diagnostic Systems Market Report – Size, Demand & Outlook 2025-2035

Demand for VRF Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Sachet and Pouch Handling Systems Market

Automated Liquid Handling Systems Market

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Automated Microplate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Demand for Palletizing Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Self-checkout Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Vibration Control Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Distributed Antenna Systems (DAS) in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Ultra Short Base Line (USBL) Positioning Systems in Japan Size and Share Forecast Outlook 2025 to 2035

BOPP Laminated Woven Sacks Market Size and Share Forecast Outlook 2025 to 2035

BOPP Coated Sacks Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

BOPP Bag Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA