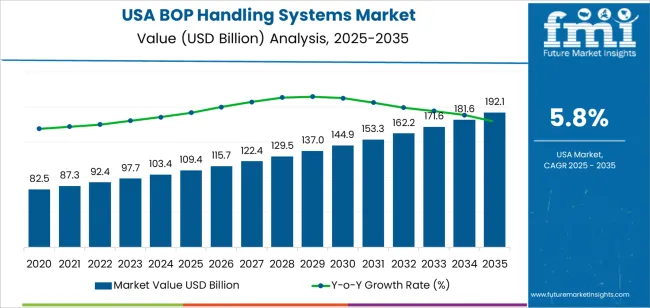

The demand for BOP (Blowout Preventer) handling systems in the USA is expected to grow from USD 109.4 million in 2025 to USD 192.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.8%. BOP handling systems play a vital role in ensuring safety during drilling operations in the oil and gas industry. As exploration and production activities continue to increase, driven by rising global energy demands, the need for reliable blowout prevention systems remains essential. Stringent regulatory standards and a growing focus on operational safety further bolster demand for these systems.

The market is expected to see consistent growth over the forecast period. Starting at USD 109.4 million in 2025, the demand for BOP handling systems will gradually rise, reaching USD 115.7 million in 2026 and USD 122.4 million in 2027. The market will continue to expand, with demand increasing to USD 137.0 million by 2029 and USD 153.3 million by 2030. By 2035, the market is forecasted to reach USD 192.1 million, driven by advancements in technology and increased investments in drilling operations.

The BOP handling systems industry in the USA is expected to experience steady growth throughout the forecast period. Starting at USD 109.4 million in 2025, the market will steadily increase each year, reaching USD 115.7 million in 2026 and USD 122.4 million in 2027. By 2028, demand is projected to reach USD 129.5 million, followed by USD 137.0 million in 2029. The industry will continue to grow, reaching USD 153.3 million by 2030, with consistent upward movement through to 2035. By the end of the forecast period, demand for BOP handling systems will be USD 192.1 million, reflecting continued growth driven by the expanding need for enhanced safety and blowout prevention in drilling activities.

The growth rate volatility index indicates that while the market will see a generally stable upward trend, there may be slight fluctuations in the pace of growth at certain points. From 2025 to 2028, growth will be steady, with gradual increments each year. However, after 2029, an acceleration in demand is anticipated as exploration and drilling activity intensifies. The volatility index suggests that while growth will remain consistent, shifts in energy market dynamics, regulatory changes, and technological advancements may introduce periods of accelerated growth or slight deceleration in the later years.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 109.4 billion |

| Industry Forecast Value (2035) | USD 192.1 billion |

| Industry Forecast CAGR (2025-2035) | 5.8% |

The demand for Blowout Preventer (BOP) handling systems in the USA is rising as upstream oil and gas drilling and production activity expands, particularly in onshore and offshore developments that require robust well control safety systems. BOP handling systems enable safe lifting, transport, and installation of large BOP stacks on drilling rigs and completion sites. As domestic production and exploration efforts increase, companies investing in new wells or refurbishing older wells rely on handling systems to support safe and efficient operations. Enhanced regulatory and safety standards for well control also encourage operators to deploy modern handling systems rather than rely on manual or outdated handling methods. Moreover, growth in deepwater and unconventional resource extraction raises technical complexity and safety requirements - conditions under which reliable BOP handling systems become essential components of drilling infrastructure.

Simultaneously, technological improvements and automation trends are supporting demand growth. Modern BOP handling systems offer improved load handling capacity, more precise control, and compatibility with heavy, high pressure BOP stacks used in deep wells. Advances in materials, hydraulics and mechanical design reduce risk of equipment failure and increase operational efficiency. The shift toward modular rigs and frequent moves between wells further increases demand for portable, reliable handling equipment. In addition, increasing emphasis on reducing downtime and improving rig turnaround times makes efficient BOP handling systems more attractive economically. As the upstream sector continues to expand or maintain production and as safety and efficiency standards tighten, demand for BOP handling systems in the USA is expected to grow steadily over the next decade.

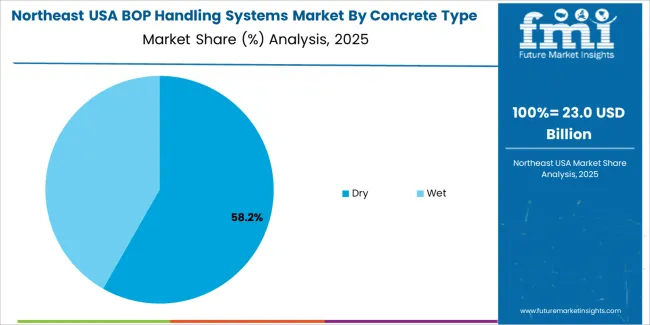

The demand for BOP (Blowout Preventer) handling systems in the USA is driven by type and concrete type. The leading type is mounted, which captures 50% of the market share, while dry concrete is the dominant concrete type, accounting for 60% of the demand. BOP handling systems are critical in the oil and gas industry to ensure safety during drilling operations, preventing uncontrolled fluid and gas releases. As the demand for enhanced safety and operational efficiency grows, the need for BOP handling systems continues to rise across various sectors.

Mounted BOP handling systems lead the market for BOP handling systems in the USA, holding 50% of the demand share. These systems are typically mounted onto rigs or other equipment to facilitate the safe handling of BOPs during drilling operations. Mounted BOP handling systems are highly valued for their ability to provide stability and precision when moving and positioning blowout preventers, which are essential safety components in oil and gas drilling.

The demand for mounted BOP handling systems is driven by the need for more efficient, reliable, and safe handling procedures in oil and gas drilling operations. Mounted systems are particularly advantageous because they can be integrated directly into the rig, allowing for greater control and minimizing the risk of accidents during handling. As oil and gas companies continue to prioritize safety and efficiency in their operations, mounted BOP handling systems are expected to remain the preferred solution, ensuring the continued dominance of this type in the market.

Dry concrete leads the demand for BOP handling systems in the USA, capturing 60% of the market share. Dry concrete is commonly used in the construction and oil and gas sectors for various applications, including drilling operations where blowout preventers are used. The compatibility of dry concrete with BOP handling systems is critical for effective cementing and drilling operations, where precision and consistency are essential.

The demand for BOP handling systems with dry concrete is driven by its widespread use in well cementing and other drilling processes. Dry concrete provides the necessary structural integrity to secure blowout preventers in place, ensuring that they can perform effectively in critical drilling operations. As the oil and gas industry continues to expand and drilling operations become more complex, the use of dry concrete in combination with BOP handling systems will remain a key driver of market growth in the USA.

Demand for handling systems for blowout preventers (BOPs) in the USA has been rising in parallel with upstream oil and gas exploration, onshore and offshore drilling, and increased well control safety requirements. As drilling activity extends into deeper, more challenging formations and as aging wells require maintenance or upgrade, the need for robust handling systems for BOP stacks has grown. These systems support safe lifting, installation, retrieval and transport of BOPs under high pressure well conditions. The trend toward modern, automated and remotely operated handling solutions has contributed to rising demand. The overall outlook suggests continued growth, driven by both new drilling projects and replacement or upgrade of existing BOP equipment.

What are the Drivers of Demand for BOP Handling Systems in USA?

One driver is expansion of oil and gas extraction, including rising offshore and onshore drilling activity in the United States. As more wells are drilled or reworked, demand for systems that safely manage BOP stacks has increased. Another driver is heightened regulatory and industry emphasis on safety and well control. BOP handling systems help meet stringent safety regulations and minimize risks during installation, maintenance, or retrieval of BOP equipment. Growing complexity in drilling operations - including deepwater, ultra deepwater, and unconventional resource wells — raises the need for high performance handling systems capable of enduring pressure, load and operational stress. Additionally, shift toward automation, real time monitoring, and remote operation in handling solutions has made handling apparatus more reliable and efficient, making them more attractive to operators. Finally, maintenance and upgrade cycles of existing wells and BOP systems create a steady demand base for handling equipment beyond new drilling projects.

What are the Restraints on Demand for BOP Handling Systems in USA?

Cost remains a key restraint on broader adoption of advanced BOP handling systems. High capital expenditure and maintenance costs can discourage operators, especially for smaller firms or wells with marginal economic returns. Complexity of operating and maintaining automated or hydraulically sophisticated handling systems may raise operational challenges and demand skilled manpower. In some drilling operations where simpler rigs or older infrastructure are used, manual or basic handling methods may still suffice and reduce impetus to upgrade. Market volatility in oil prices can dampen drilling activity and postpone investments in new handling systems when operators seek cost reductions. Finally, variation in well types - shallow, low pressure onshore wells may not require heavy-duty or advanced handling systems - limits uniform demand across all segments of the oil and gas sector.

What are the Key Trends Influencing Demand for BOP Handling Systems in USA?

A major trend is the shift toward automated and remotely operated BOP handling systems that reduce manual intervention. These systems often include condition monitoring, adaptive load control, and energy efficient configurations, improving safety and operational precision. Another trend is rising use of electric driven systems instead of hydraulically powered ones, favored for energy efficiency and ease of maintenance. The trend toward deeper and more complex wells, including deepwater and ultra deepwater drilling, drives demand for heavy duty handling systems capable of managing large, high pressure BOP stacks. Further, as regulatory oversight and well control standards tighten, operators increasingly upgrade or retrofit existing rigs with modern handling systems to remain compliant. Finally, modular and scalable handling solutions that can adapt to varied rig sizes or well types are gaining popularity, expanding demand beyond large offshore rigs to smaller onshore operations as well.

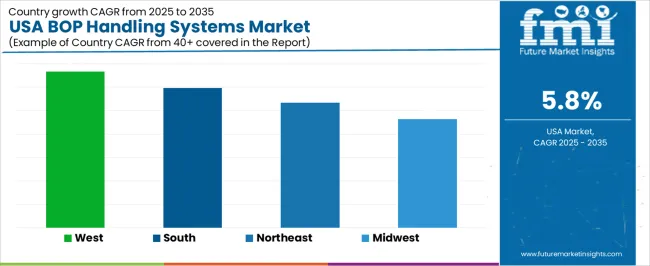

The demand for BOP (Blowout Preventer) handling systems in the USA shows steady growth across regions, with the West leading at a CAGR of 6.7%. The South follows closely with a CAGR of 6.0%, supported by its large oil and gas industry. The Northeast shows moderate growth at 5.3%, driven by the region's growing oil and gas exploration activities. The Midwest has the lowest growth rate at 4.6%, reflecting a more stable demand for BOP systems in comparison to other regions. These regional differences are influenced by factors such as regional oil and gas production levels, infrastructure investments, and exploration activities.

| Region | CAGR (%) |

|---|---|

| West | 6.7 |

| South | 6.0 |

| Northeast | 5.3 |

| Midwest | 4.6 |

The demand for BOP handling systems in the West is projected to grow at a CAGR of 6.7%, driven by the region’s strong oil and gas exploration and production activities. The West, particularly states like California, Alaska, and Texas, is home to some of the largest and most advanced oilfields in the USA, where the safety and reliability of BOP systems are crucial for preventing blowouts during drilling operations. As offshore and onshore drilling activities continue to expand and evolve, the need for efficient and reliable BOP handling systems is growing. Additionally, increasing regulatory scrutiny and safety standards in the region further support the demand for advanced BOP handling systems to ensure compliance and operational safety. As the West continues to focus on optimizing drilling technologies and enhancing safety, demand for these systems is expected to remain strong.

In the South, the demand for BOP handling systems is expected to grow at a CAGR of 6.0%, supported by the region’s major role in oil and gas production, particularly in states like Texas, Louisiana, and Oklahoma. The South’s oil and gas industry, including both offshore and onshore drilling, is a significant driver of demand for BOP handling systems. As the oil and gas market in the region continues to recover and grow, there is an increasing need for reliable blowout prevention systems to ensure safe drilling operations. The region’s focus on deepwater drilling, along with the growth of unconventional oil extraction methods such as hydraulic fracturing, is driving the demand for advanced BOP systems. Additionally, stricter safety regulations and a heightened focus on environmental protection contribute to the rising demand for BOP handling systems in the South.

In the Northeast, the demand for BOP handling systems is projected to grow at a CAGR of 5.3%, supported by the region’s increasing oil and gas exploration activities, particularly in the Appalachian Basin and offshore operations. While the Northeast does not have the same level of oil and gas production as the South or West, the growth in shale gas production and the expansion of offshore drilling in the Atlantic are contributing to the increasing need for BOP systems. As drilling operations continue to scale and more stringent safety measures are enforced, the demand for BOP handling systems is rising. Furthermore, the Northeast's emphasis on adopting the latest technology for safe and efficient drilling further supports the growth in demand for advanced blowout prevention systems.

The demand for BOP handling systems in the Midwest is expected to grow at a CAGR of 4.6%, reflecting more gradual growth compared to other regions. The Midwest has a significant oil and gas industry, but it is not as heavily involved in offshore drilling activities as the South or West, and the demand for BOP systems is largely driven by onshore operations. The region’s focus on conventional oil extraction and shale gas production results in a more stable, if slower, demand for blowout preventers. As the industry continues to prioritize safety and efficiency, the Midwest's steady adoption of advanced BOP handling systems will ensure consistent growth in the demand for these critical components, though at a slower rate compared to more oil-rich regions.

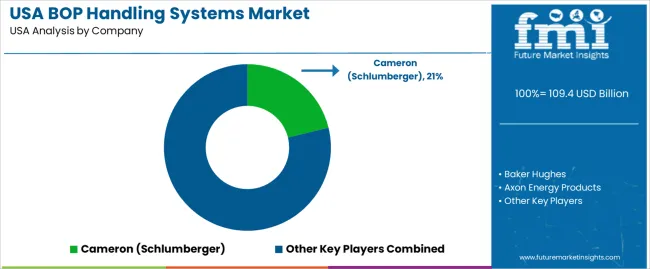

Demand for blowout preventer (BOP) handling systems in the United States remains substantial as offshore drilling and deep water oil and gas projects continue, requiring reliable well control equipment and safe handling operations. Leading firms in this sector include Cameron (Schlumberger), with about 21.2% market share, along with Baker Hughes, Axon Energy Products, and MH Wirth. These companies supply BOP handling systems, riser systems, and related hoisting equipment that support drilling rigs and subsea installations. Operators and contractors prioritize systems that ensure safety, reduce rig time, and meet regulatory standards for offshore operations.

Competition in the BOP handling systems market is centered on equipment reliability, safety features, and service support. Suppliers focus on delivering handling systems that offer precise load control, redundancy, and fail safe mechanisms to manage heavy BOP stacks under challenging offshore conditions. Another competitive factor is modularity and ease of integration with diverse rig configurations and subsea equipment. Firms that provide global service networks, rapid mobilization, and compliance documentation gain preference among oil companies with tight safety and scheduling requirements. Product materials typically emphasise lifting capacity, mechanical integrity, certification compliance, and compatibility with existing well control infrastructure. By aligning their offerings with industry requirements for safety, operational efficiency, and regulatory compliance, these companies aim to maintain or grow their share in the USA BOP handling systems market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Type | Mounted, Walk-behind, Hand-held, Vacuums |

| Concrete Type | Dry, Wet |

| Power Source | Hydraulic, Electric, Pneumatic, Battery-Powered, Gas-Powered |

| Power Range | Up to 10 HP, 10 to 25 HP, 25 to 50 HP, 50 to 75 HP, Above 75 HP |

| Key Companies Profiled | Cameron (Schlumberger), Baker Hughes, Axon Energy Products, MH Wirth |

| Additional Attributes | The market analysis includes dollar sales by type, concrete type, power source, power range, and company categories. It also covers regional demand trends in the USA, particularly driven by the increasing adoption of BOP (Blowout Preventer) handling systems in oil and gas operations. The competitive landscape highlights key manufacturers focusing on innovations in handling systems for improved safety, efficiency, and reliability. Trends in the growing demand for versatile and energy-efficient BOP handling systems, particularly for dry and wet concrete applications, are explored, along with advancements in system design and power integration for higher performance. |

The demand for bop handling systems in USA is estimated to be valued at USD 109.4 billion in 2025.

The market size for the bop handling systems in USA is projected to reach USD 192.1 billion by 2035.

The demand for bop handling systems in USA is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in bop handling systems in USA are mounted, walk-behind, hand-held and vacuums.

In terms of concrete type, dry segment is expected to command 60.0% share in the bop handling systems in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

BOP Handling Systems Market Growth - Trends & Forecast 2025 to 2035

Crate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

USA HVDC Transmission Systems Market Insights – Size, Growth & Forecast 2025-2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Sachet and Pouch Handling Systems Market

Automated Liquid Handling Systems Market

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Automated Microplate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Demand for Palletizing Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Self-checkout Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Vibration Control Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Distributed Antenna Systems (DAS) in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Gas & Dual-Fuel Injection Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for AGV Intelligent Management Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Ultra Short Base Line (USBL) Positioning Systems in USA Size and Share Forecast Outlook 2025 to 2035

BOPP Laminated Woven Sacks Market Size and Share Forecast Outlook 2025 to 2035

BOPP Coated Sacks Market Size and Share Forecast Outlook 2025 to 2035

BOPP Bag Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA