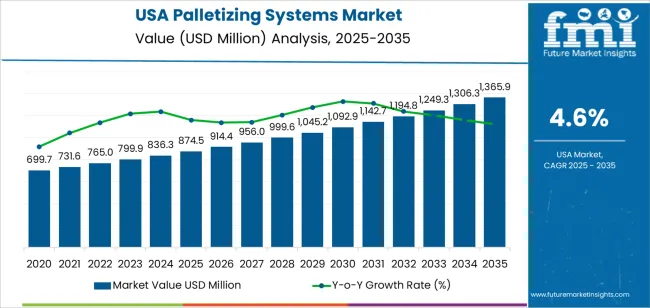

The demand for palletizing systems in USA is valued at USD 874.5 million in 2025 and is projected to reach USD 1,365.9 million by 2035, reflecting a compound annual growth rate of 4.6%. Growth is shaped by sustained automation needs across food processing, consumer goods, chemicals, and logistics facilities where consistent stacking, load stability, and throughput efficiency remain essential. As production lines expand and shift toward higher-speed packaging, both robotic and conventional palletizers maintain relevance. Manufacturers upgrade equipment to support greater flexibility, tighter placement accuracy, and integration with conveyor and sorting systems. These operational drivers reinforce stable adoption across USA’s industrial and warehousing networks throughout the forecast window.

The growth curve shows a smooth upward progression, beginning at USD 699.7 million in earlier years and rising to USD 874.5 million in 2025 before reaching USD 1,365.9 million by 2035. Annual values increase in predictable steps, advancing from USD 914.4 million in 2026 to USD 956.0 million in 2027 and continuing through USD 1,092.9 million in 2031 and USD 1,249.3 million in 2033. This pattern reflects a mature automation category sustained by routine replacement cycles, incremental capacity additions, and broader adoption of handling systems across distribution sites. As operators pursue higher reliability, improved uptime, and better alignment with automated packaging lines, palletizing systems maintain consistent year-to-year growth across USA.

Demand in USA for palletizing systems is projected to grow from USD 874.5 million in 2025 to USD 1,365.9 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 4.6%. Starting from USD 699.7 million in 2020, the value rises steadily through USD 836.3 million in 2024 and reaches USD 874.5 million in 2025. Between 2025 and 2030 the demand increases to about USD 1,092.9 million, and by 2035 it is forecast to reach USD 1,365.9 million. Growth is driven by heightened automation in logistics, increasing e commerce fulfilment demands, and the rising adoption of smart palletising systems across warehousing and manufacturing sectors.

Over the forecast period the total value uplift is USD 491.4 million (from USD 874.5 million in 2025 to USD 1,365.9 million in 2035). In the earlier years the increase is largely volume led new installations and expansion of palletising lines in response to higher throughput needs. In the latter half of the decade, value growth becomes more pronounced as systems incorporate advanced features such as robotics, AI enabled pattern optimisation, mixed load palletising and flexible modular designs allowing higher average selling prices. Suppliers focusing on high spec, intelligent palletising solutions are best positioned to capture the incremental opportunity toward USD 1,365.9 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 874.5 million |

| Forecast Value (2035) | USD 1,365.9 million |

| Forecast CAGR (2025–2035) | 4.6% |

Historical demand for palletizing systems in USA has been influenced by growth in manufacturing, warehousing and distribution. Manufacturers of consumer goods, foods and beverages invested in automated palletizing machines during periods of high-volume production to replace manual labour, mitigate repetitive-motion injuries and cut throughput times. Distribution centres supporting retail chains and e-commerce also adopted palletizers to handle large loads, standardize stacking patterns and reduce damage during transport. These operations relied on established SKU volumes and predictable pallet configurations, which aligned with existing palletizing equipment designs and supported consistent demand.

Looking ahead, future demand in USA is shaped by e-commerce growth, labour constraints and the rise of mixed-SKU palletization. Warehouses face pressure to fulfil more frequent, smaller orders and respond to rapid product turnover, which increases demand for flexible palletizing systems that can handle varied package types and formats. Labour shortages and automation incentives encourage adoption of robotic or vision-guided palletizers. Additionally, sustainability goals and optimization of truck loading drive more efficient pallet patterns, further boosting system uptake. While initial investment cost and integration complexity remain challenges, the convergence of logistics evolution and manufacturing flexibility points to ongoing growth in demand for palletizing systems in USA.

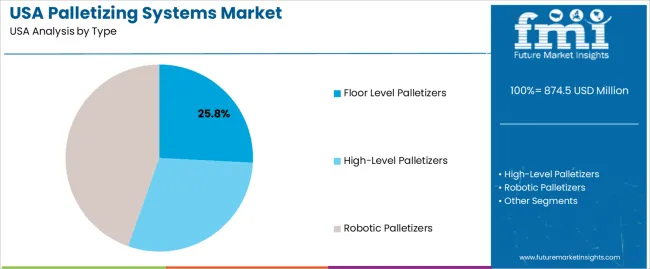

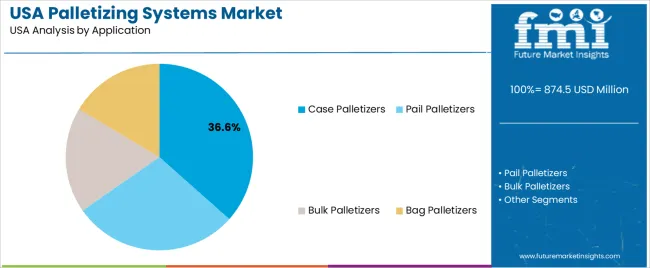

The demand for palletizing systems in USA is shaped by the types of palletizers used in end-of-line operations and the applications that determine load configuration. Type categories include floor level palletizers, high-level palletizers and robotic palletizers, each offering different throughput capacities, footprint needs and integration options. Application categories include case, pail, bulk and bag palletizers, which support varied packaging formats across food, beverage, chemical and consumer goods industries. As facilities emphasize predictable stacking, stable load formation and efficient handling, the combination of palletizer type and application requirement guides purchasing patterns across USA.

Floor level palletizers account for 26% of total demand across palletizer types in USA. Their leading share reflects the advantage of straightforward installation, accessible maintenance and manageable capital requirements for small and mid-sized facilities. Floor level machines fit easily into existing production layouts without the need for significant structural adjustments. Manufacturers value the predictable handling performance and controlled stacking these systems provide for varied case sizes. Their reliability supports routine operations in warehouses and processing plants that prioritize steady output and clear process visibility during pallet formation.

Demand for floor level palletizers continues to grow as companies seek equipment that balances cost efficiency with dependable function. These systems support smooth transitions between different product runs and align well with moderate throughput lines. Facilities appreciate their consistent layer pattern control and compatibility with conveyors already in place. The manageable footprint suits operations working within space limitations. As producers maintain emphasis on practical automation solutions, floor level palletizers remain central to palletizing choices in USA.

Case palletizers account for 36.6% of total demand across application categories in USA. Their leading position reflects widespread use of boxed products across food processing, household goods and industrial supplies. Case palletizing supports uniform stacking, predictable load geometry and efficient warehouse handling. Operations benefit from the stability and consistency these systems provide during transport preparation. Many industries use standardized case dimensions, making automated case palletizing a practical choice that supports continuous production flow.

Demand for case palletizers increases as facilities expand high-volume packaging lines that require reliable end-of-line equipment. Case palletizers help reduce manual labor, improve throughput and maintain pallet consistency across extended shifts. Their integration with upstream packing and inspection systems enhances efficiency. Facilities rely on stable stacking patterns to support efficient storage and smoother distribution logistics. As USA’s packaged goods sector continues to grow, case palletizing remains the most influential application shaping palletizing system demand.

Demand for palletizing systems in the USA is influenced by automation needs across food, beverage, consumer goods and logistics facilities. Labour shortages, higher fulfilment volumes and tighter safety requirements push facilities to replace manual pallet stacking with automated units. Growth is strongest in regions with dense distribution networks and expanding cold-chain activity. Adoption is steady, yet cost sensitivity among mid-sized plants and integration challenges in older warehouses affect pace. These conditions define how widely palletizing systems are deployed across USA operations.

How Are USA Labour Conditions and Distribution Pressures Creating New System Requirements?

Labour turnover, rising wages and staffing gaps across warehouses give companies strong incentive to adopt palletizing systems. USA distributors handle heavy outbound volumes for retail, e-commerce and grocery channels, which increases need for consistent stacking and fewer manual-handling risks. Facilities in states with strict worker-safety rules turn to automation to reduce strain injuries. The shift toward mixed-SKU pallet building in national distribution centres also supports interest in flexible robotic palletizers that handle variable package sizes and formats.

Where Are Growth Opportunities Emerging for Palletizing Systems in USA?

Growth opportunities appear in food and beverage plants upgrading lines to meet cold-chain distribution volumes, third-party logistics providers expanding national fulfilment networks and regional manufacturers modernising end-of-line operations. High activity in states with strong warehousing clusters, such as California, Texas, Illinois and Pennsylvania, supports investment. Smaller factories adopting compact robotic palletizers for short production runs also represent opportunity. Vendors offering quick-installation systems and support for multi-line operations can capture demand in these expanding USA segments.

What Factors Are Slowing Broader Adoption of Palletizing Systems in USA?

Adoption is slowed by high upfront costs, long approval cycles for capital budgets and integration challenges within ageing USA warehouses. Some mid-sized manufacturers hesitate due to space constraints or concerns about line downtime during installation. Variation in packaging formats across domestic plants increases complexity and can require custom grippers or programming. Limited technician availability in rural states also affects support and maintenance planning. These factors limit how quickly palletizing systems spread across all USA facilities.

| Region | CAGR (%) |

|---|---|

| West USA | 5.2% |

| South USA | 4.7% |

| Northeast USA | 4.2% |

| Midwest USA | 3.6% |

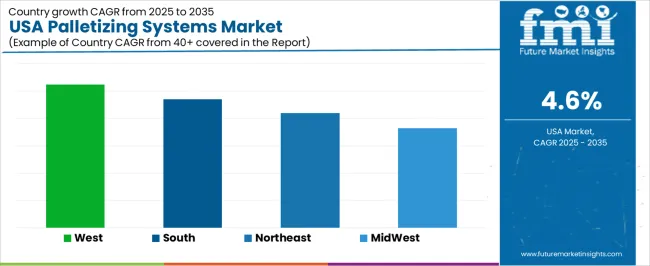

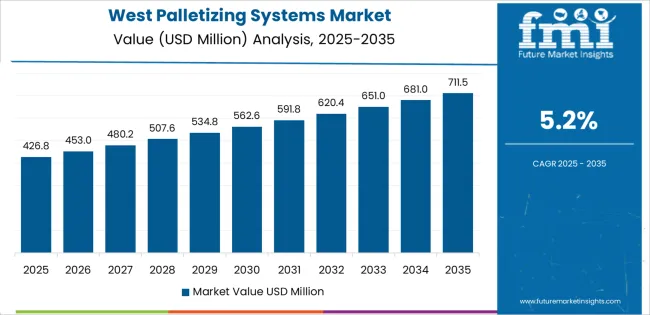

Demand for palletizing systems in the USA is rising steadily across all regions, with the West leading at 5.2%. Growth in this region reflects strong warehousing expansion, active food and beverage processing, and broad adoption of automated material handling. The South follows at 4.7%, supported by regional manufacturing growth and increasing reliance on palletizing technologies in logistics and distribution hubs. The Northeast records 4.2%, shaped by dense commercial activity and continuous modernization of packaging lines. The Midwest grows at 3.6%, where established industrial facilities integrate automated palletizing to improve throughput. These regional trends highlight consistent national movement toward automation in handling and shipping operations.

West USA is projected to grow at a CAGR of 5.2% through 2035 in demand for palletizing systems. California, Washington, and surrounding industrial regions are increasingly adopting automated and semi-automated palletizing systems for warehouses, manufacturing, and logistics operations. Rising focus on operational efficiency, material handling speed, and workforce optimization drives adoption. Manufacturers provide robotic, conveyor-integrated, and modular palletizing systems suitable for multiple industries. Distributors ensure accessibility across warehouses, manufacturing plants, and logistics hubs. Expansion in e-commerce fulfillment, industrial manufacturing, and supply chain automation supports steady adoption of palletizing systems in West USA.

South USA is projected to grow at a CAGR of 4.7% through 2035 in demand for palletizing systems. Texas, Florida, and surrounding industrial regions are increasingly using automated palletizing solutions for manufacturing, logistics, and warehouse operations. Rising demand for workflow optimization, labor efficiency, and high-speed material handling drives adoption. Manufacturers provide flexible, robotic, and conveyor-integrated palletizing systems suitable for multiple sectors. Distributors ensure accessibility across warehouses, manufacturing facilities, and logistics centers. Expansion in industrial manufacturing, e-commerce, and supply chain automation supports steady adoption of palletizing systems across South USA.

Northeast USA is projected to grow at a CAGR of 4.2% through 2035 in demand for palletizing systems. New York, Pennsylvania, and surrounding regions are gradually adopting robotic and automated palletizing solutions for manufacturing, logistics, and warehouse operations. Rising focus on high-speed material handling, labor productivity, and operational efficiency drives adoption. Manufacturers provide modular and conveyor-integrated palletizing systems suitable for diverse industries. Distributors ensure accessibility across warehouses, industrial facilities, and logistics hubs. Expansion in supply chain automation, industrial manufacturing, and warehouse operations supports steady adoption of palletizing systems across Northeast USA.

Midwest USA is projected to grow at a CAGR of 3.6% through 2035 in demand for palletizing systems. Illinois, Ohio, and surrounding regions are gradually adopting automated and robotic palletizing solutions for manufacturing, logistics, and warehouse operations. Rising demand for operational efficiency, labor optimization, and material handling speed drives adoption. Manufacturers provide high-quality, flexible, and modular palletizing systems suitable for industrial and commercial applications. Distributors ensure accessibility across warehouses, manufacturing plants, and logistics facilities. Expansion in supply chain automation, industrial production, and warehouse operations supports steady adoption of palletizing systems across Midwest USA.

Demand for palletizing systems in USA is increasing as manufacturers and logistics operators respond to labor shortages, rising throughput expectations and tighter delivery schedules. Many facilities upgrade end-of-line operations to reduce manual handling and support consistent stacking quality across varied packaging formats. Growth in e-commerce distribution centers strengthens interest in systems that manage mixed SKU flows and frequent changeovers. Food, beverage and consumer goods producers adopt palletizers to improve hygiene control and ensure predictable case handling in high-volume plants. Automation programs within warehouses also expand, integrating palletizing systems with conveyors, vision tools and warehouse management software. These needs collectively push companies toward reliable solutions that improve productivity, reduce operating costs and create safer working conditions within American manufacturing and logistics settings.

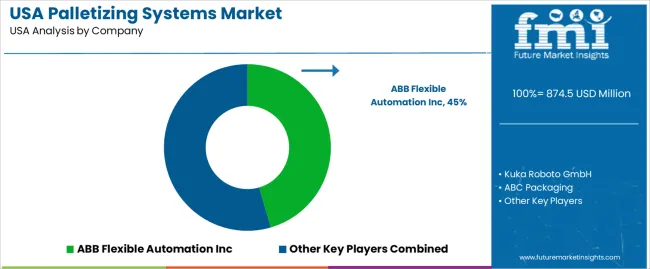

Key players shaping USA’s palletizing landscape include ABB Flexible Automation Inc, KUKA Roboter GmbH, ABC Packaging, Intelligrated Inc and Cermex Group, alongside important domestic integrators that adapt equipment for American facilities. ABB and KUKA supply robotic palletizers suited to high-speed lines, while ABC Packaging provides conventional units for consumer goods and industrial products. Intelligrated supports large distribution centers with integrated material-handling systems, and Cermex Group offers palletizing solutions aligned with packaging-line requirements. Within the United States, regional integrators contribute engineering, installation and support services that tailor palletizers to space constraints, safety standards and system-level automation programs. This combined presence of global robotics firms and USA service specialist’s shapes equipment selection, deployment and long-term performance across American production and distribution environments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Floor Level Palletizers, High-Level Palletizers, Robotic Palletizers |

| Application | Case Palletizers, Pail Palletizers, Bulk Palletizers, Bag Palletizers |

| Technology | Semi-automated Palletizing, Automatic Palletizing |

| End Use Industry | Food & Beverage, E-Commerce & Retail, Pharmaceuticals, Consumer Goods, Automotive, Other End-Use Industry |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | ABB Flexible Automation Inc, KUKA Roboter GmbH, ABC Packaging, Intelligrated Inc, Cermex Group |

| Additional Attributes | Dollar by sales by type, application, technology, and end-use; regional CAGR and adoption trends; volume and value growth projections; integration with conveyor, vision, and warehouse management systems; adoption across food processing, consumer goods, logistics, and e-commerce sectors; semi-automated and fully automatic palletizing solutions; support for mixed-SKU, high-throughput, and high-precision stacking; labor-saving benefits and operational efficiency; deployment in distribution centers, manufacturing plants, and cold-chain facilities; modular and robotic systems for flexible layouts; supplier technical support, installation, and maintenance services; market influenced by labor shortage, e-commerce growth, and automation incentives. |

The demand for palletizing systems in usa is estimated to be valued at USD 874.5 million in 2025.

The market size for the palletizing systems in usa is projected to reach USD 1,365.9 million by 2035.

The demand for palletizing systems in usa is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in palletizing systems in usa are floor level palletizers, high-level palletizers and robotic palletizers.

In terms of application, case palletizers segment is expected to command 36.6% share in the palletizing systems in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Palletizing Systems Market Growth - Trends & Forecast 2025 to 2035

USA HVDC Transmission Systems Market Insights – Size, Growth & Forecast 2025-2035

Demand for Palletizing Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Self-checkout Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Vibration Control Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Gas & Dual-Fuel Injection Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for AGV Intelligent Management Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Ultra Short Base Line (USBL) Positioning Systems in USA Size and Share Forecast Outlook 2025 to 2035

Palletizing Robot Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Palletizing Robots Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA