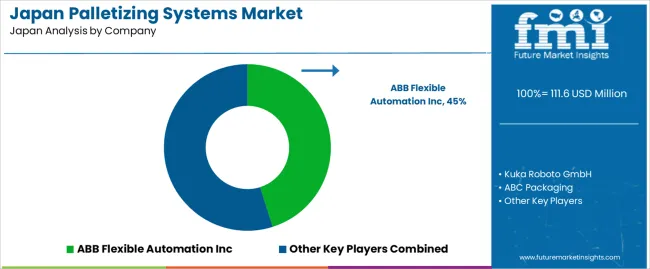

The demand for palletizing systems in Japan is valued at USD 111.6 million in 2025 and is projected to reach USD 158.9 million by 2035, reflecting a compound annual growth rate of 3.6%. Growth is shaped by steady automation needs across food processing, consumer goods, chemicals and logistics operations. As production lines expand throughput and require consistent stacking accuracy, palletizing systems remain central to packaging efficiency. Both robotic and conventional units retain relevance as manufacturers balance flexibility, load stability and floor space optimization. Routine upgrades and integration of higher-speed handling equipment further support adoption, reinforcing stable demand throughout the forecast window.

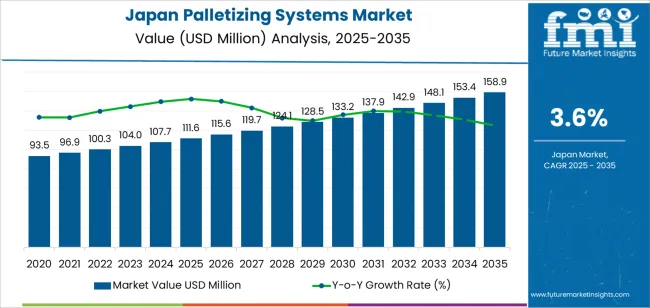

The growth curve shows a gradual upward pattern, beginning at USD 93.5 million in earlier years and rising to USD 111.6 million in 2025 before progressing toward USD 158.9 million by 2035. Yearly increases follow predictable spacing, with values moving from USD 115.6 million in 2026 to USD 119.7 million in 2027 and continuing through USD 137.9 million in 2031 and USD 148.1 million in 2033. This uniform progression reflects a mature automation segment driven by regular replacement cycles and incremental expansion across production facilities. As palletizing roles diversify and uptime expectations increase, demand for reliable stacking and handling systems maintains consistent momentum across Japan’s industrial and warehousing landscape.

Demand in Japan for palletizing systems is projected to grow from USD 111.6 million in 2025 to USD 158.9 million by 2035, representing a compound annual growth rate (CAGR) of approximately 3.6%. Starting at USD 93.5 million in 2020, the value rises steadily to USD 111.6 million in 2025, driven by growth in automated warehousing, logistics modernisation, and manufacturing automation. Between 2025 and 2030, demand increases to about USD 133.2 million, supported by upgrades in materialhandling systems and rising ecommerce fulfilment needs. From 2030 to 2035 the value continues its upward trend, reaching USD 158.9 million as robotics, smart palletising solutions and integration with Industry 4.0 architectures become mainstream.

Over the forecast decade the uplift of USD 47.3 million is supported by both volume growth and highervalue system upgrades. In the early part of the period (20252030), growth is largely volumeled as more facilities install palletizing systems to replace manual or semiautomated solutions. In the latter half (20302035), value growth becomes increasingly important driven by advanced palletising systems with higher throughput, multiformat capability, enhanced robotics and IoT connectivity boosting average selling prices. Suppliers focusing on highspec, automated and flexible palletising solutions are best placed to capture the bulk of demand as the market transitions from USD 111.6 million to USD 158.9 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 111.6 million |

| Forecast Value (2035) | USD 158.9 million |

| Forecast CAGR (2025 to 2035) | 3.6% |

The demand for palletizing systems in Japan arises from different sets of drivers when comparing historical and future scenarios. Historically, the demand was driven by stable manufacturing output in sectors such as food & beverage, automotive parts and consumer goods, which required efficient pallet handling at end-of-line packaging. Companies sought automated palletizing cells to replace manual stacking, improve throughput and reduce injury risk. The logistics networks supporting domestic and export flows added incremental uptake of palletizing machines as distribution volumes grew steadily.

Looking ahead, future growth is being shaped by labour-shortage pressures, e-commerce expansion and logistics modernisation in Japan. With a declining workforce and tighter hours for drivers, logistics operators and manufacturers are investing in palletizing systems that integrate robotics, vision systems and flexible patterns for mixed SKU pallets. The growth of direct-to-consumer channels and smaller batch sizes increases demand for palletizing solutions that can switch formats quickly. While high capital cost and integration complexity remain constraints, the urgency of automation and supply-chain agility points to continued expansion in demand for palletizing systems in Japan.

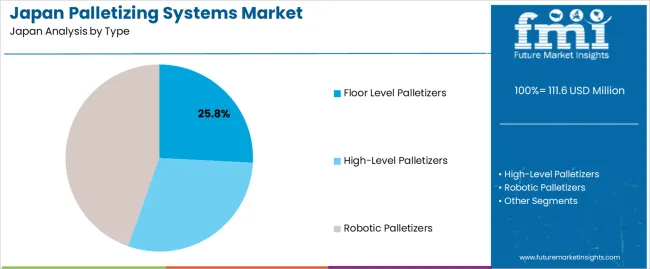

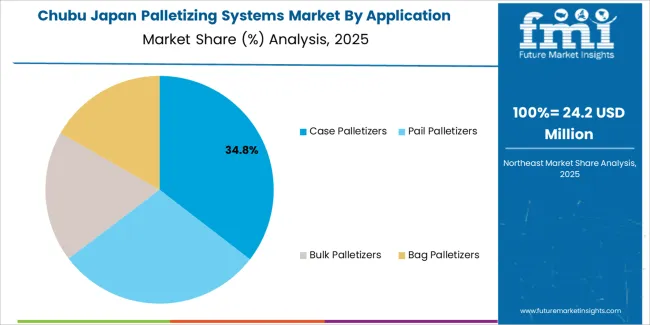

The demand for palletizing systems in Japan is shaped by the types of palletizers used across production environments and the applications that determine how goods are organized for transport. Types include floor level palletizers, high-level palletizers and robotic palletizers, each offering different handling speeds, footprint requirements and integration options. Applications span case, pail, bulk and bag palletizing, reflecting diverse product formats in manufacturing, food processing and materials handling. As facilities emphasize predictable stacking, stable load formation and efficient end-of-line operations, the combination of palletizer type and application requirement influences equipment selection across Japan.

Floor level palletizers account for 26% of total demand across palletizer types in Japan. Their leading share reflects the suitability of these systems for facilities needing dependable performance with manageable installation requirements. Floor level units operate at accessible heights, allowing straightforward maintenance and integration into existing layouts without extensive structural changes. Many producers value the balance of controlled throughput and predictable stacking patterns. These systems suit small and medium operations that handle varied product lines and prioritize equipment that offers steady, user-friendly operation while supporting daily production schedules.

Demand for floor level palletizers grows as manufacturers adopt systems that limit downtime and maintain consistent load formation without complex control requirements. Facilities working with mixed case sizes rely on these units for their adaptable design and precise orientation control. The systems support reliable pallet stability and help streamline shipping preparation. Their compact footprint serves locations with limited space while ensuring strong load integrity during transport. As companies refine end-of-line workflows to maintain steady performance, floor level palletizers continue to hold a central role across Japan.

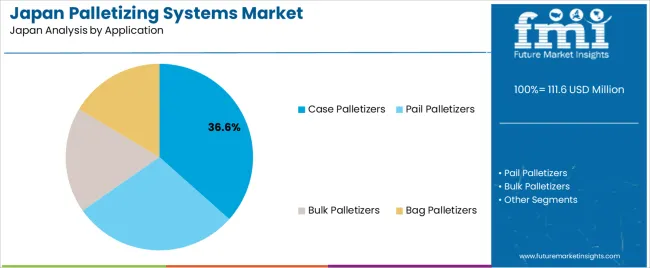

Case palletizers account for 36.6% of total demand across application categories in Japan. Their leading position reflects widespread reliance on boxed goods across consumer products, food processing and industrial materials. Case palletizing supports predictable load geometry, enabling efficient stacking, stable shipping and simplified warehouse handling. Many operations use standardized case dimensions, which align well with automated case palletizing systems. These characteristics contribute to steady adoption among facilities that prioritize orderly stacking and consistent pallet quality for downstream logistics activities.

Demand for case palletizers continues to rise as production lines increase output and require end-of-line equipment capable of managing consistent case flow. The systems help reduce manual handling while supporting uniform patterns that optimize pallet space. Facilities rely on them to maintain reliable throughput during peak cycles and support efficient load preparation. Their compatibility with automated conveyors and packing systems enhances workflow continuity. As Japan’s packaged goods sector maintains stable demand, case palletizing remains the primary application shaping palletizing system use across the country.

Demand for palletizing systems in Japan is influenced by labour shortages, rising automation in manufacturing and logistics, and the country’s emphasis on compact, precise and space-efficient machinery. Companies in food processing, chemicals, electronics and warehouse operations adopt palletizing lines to maintain productivity with a shrinking workforce. At the same time, high installation costs, strict safety standards and limited floor space shape how quickly firms upgrade legacy handling systems. These conditions define the current trajectory of palletizing system adoption in Japan.

Japan’s ongoing labour shortage pushes manufacturers and logistics operators to automate end-of-line tasks. Many facilities operate in compact urban sites, so palletizing systems must be space-efficient, low vibration and easy to integrate with existing conveyors. Japanese firms also expect repeatable movement accuracy suited to electronics, chemical packaging and food processing. As factories modernise to maintain output with fewer workers, demand rises for palletizers that deliver steady throughput, minimal manual handling and compatibility with Japan’s dense industrial layouts.

Opportunity emerges in mid-sized factories upgrading older handling equipment, regional logistics hubs adopting robotics and food processors investing in hygienic palletizing cells. Japan’s surge in parcel throughput and warehouse automation expands demand for robotic palletizers that handle mixed SKU loads. Compact palletizers designed for narrow aisles, low-ceiling warehouses and urban distribution centres also hold potential. Vendors offering short-footprint layouts, quick setup, and local service support can address needs specific to Japanese production and distribution sites.

Cost remains a significant restraint, as many Japanese SMEs operate on tight budgets and hesitate to invest in fully automated lines. Limited floor space in older plants complicates installation, requiring structural changes that increase expense. Strict safety requirements and careful integration with existing equipment extend project timelines. Some operations with frequent product changeovers still rely on manual labour due to setup complexity. These conditions reduce the pace at which palletizing systems achieve broad penetration across Japan’s manufacturing and logistics sectors.

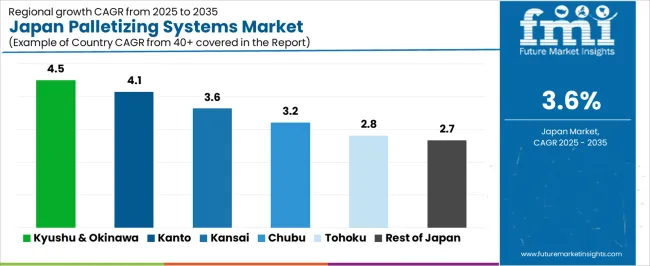

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.5% |

| Kanto | 4.1% |

| Kinki | 3.6% |

| Chubu | 3.2% |

| Tohoku | 2.8% |

| Rest of Japan | 2.7% |

Demand for palletizing systems in Japan is rising steadily across regions, with Kyushu and Okinawa leading at 4.5%. Growth in this region reflects the expansion of food processing, logistics, and manufacturing facilities that rely on automated pallet handling. Kanto follows at 4.1%, supported by dense industrial clusters and widespread adoption of automation solutions in packaging and warehousing. Kinki records 3.6%, shaped by strong commercial activity and consistent investment in material handling upgrades. Chubu grows at 3.2%, influenced by its automotive and electronics production base, where palletizing systems support throughput. Tohoku reaches 2.8% as regional factories modernize operations. The rest of Japan posts 2.7%, indicating stable but moderate adoption across smaller industrial zones.

Kyushu & Okinawa is projected to grow at a CAGR of 4.5% through 2035 in demand for palletizing systems. Fukuoka and surrounding industrial regions are increasingly adopting robotic and semi-automatic palletizers for food, beverage, and pharmaceutical production. Rising focus on operational efficiency, labor reduction, and warehouse automation drives adoption. Manufacturers provide high-quality systems suitable for various product sizes and weights. Distributors ensure accessibility across urban, semi-urban, and industrial facilities. Expansion in industrial production, packaging automation, and logistics modernization supports steady adoption of palletizing systems in Kyushu & Okinawa.

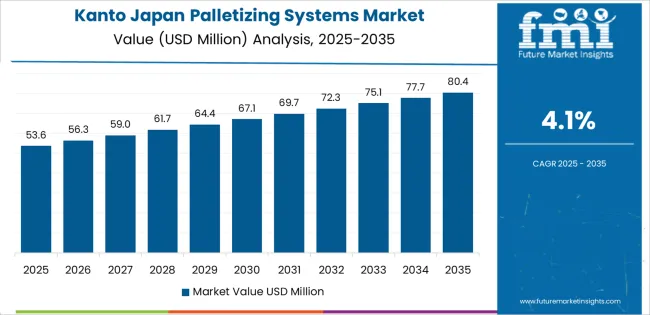

Kanto is projected to grow at a CAGR of 4.1% through 2035 in demand for palletizing systems. Tokyo and neighboring prefectures are increasingly adopting automated palletizers for food, beverage, and industrial production lines. Rising demand for labor efficiency, packaging optimization, and warehouse automation drives adoption. Manufacturers provide systems suitable for various product dimensions and weights. Distributors ensure availability across urban industrial and warehouse facilities. Expansion in manufacturing, logistics, and packaging technology supports steady adoption of palletizing systems across Kanto.

Kinki is projected to grow at a CAGR of 3.6% through 2035 in demand for palletizing systems. Osaka, Kyoto, and surrounding areas are gradually adopting robotic and semi-automatic palletizers for food, beverage, and industrial operations. Rising demand for labor reduction, operational efficiency, and process automation drives adoption. Manufacturers provide systems suitable for multiple product types and packaging formats. Distributors ensure accessibility across urban and semi-urban industrial regions. Industrial growth, logistics modernization, and packaging upgrades support steady adoption of palletizing systems across Kinki.

Chubu is projected to grow at a CAGR of 3.2% through 2035 in demand for palletizing systems. Nagoya and surrounding regions are increasingly adopting automated palletizers for food, beverage, and industrial production. Rising focus on warehouse automation, labor efficiency, and packaging productivity drives adoption. Manufacturers supply palletizing systems compatible with diverse product sizes and weights. Distributors ensure accessibility across urban and semi-urban facilities. Industrial expansion, logistics upgrades, and production modernization support steady adoption of palletizing systems across Chubu.

Tohoku is projected to grow at a CAGR of 2.8% through 2035 in demand for palletizing systems. Sendai and surrounding areas are gradually adopting robotic and semi-automatic palletizers for industrial, food, and beverage production lines. Rising demand for operational efficiency, labor reduction, and process automation drives adoption. Manufacturers provide systems suitable for various product sizes and packaging requirements. Distributors ensure availability across urban and semi-urban industrial facilities. Industrial growth, packaging automation, and logistics modernization support steady adoption of palletizing systems across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 2.7% through 2035 in demand for palletizing systems. Smaller towns and rural industrial regions gradually adopt automated and robotic palletizers for food, beverage, and industrial production. Rising demand for labor efficiency, warehouse optimization, and operational productivity drives adoption. Manufacturers supply systems compatible with various product types and packaging formats. Distributors ensure accessibility across urban, semi-urban, and rural industrial facilities. Industrial expansion, packaging modernization, and logistics upgrades support steady adoption of palletizing systems across the Rest of Japan.

The demand for palletizing systems in Japan is rising as manufacturers and logistics operators respond to persistent labour shortages, growing e-commerce activity and the need for greater end-of-line efficiency. Japan’s ageing workforce and high operating costs encourage companies to automate manual pallet loading to maintain throughput and improve workplace safety. Food, beverage and consumer goods producers increasingly depend on palletizing solutions that handle frequent product changes, varied packaging formats and rapid order cycles. Logistics providers also adopt palletizing systems to manage expanding parcel volumes and reduce human error in distribution centres. As factories modernise under digital transformation initiatives, palletizers become central to integrated production lines, supporting data-driven operations and consistent output quality. These trends collectively strengthen demand across Japanese industrial and logistics environments.

Key players shaping Japan’s palletizing system landscape include global suppliers and influential domestic automation firms. International manufacturers such as ABB Flexible Automation Inc, KUKA Roboter GmbH, ABC Packaging, Intelligrated Inc and Cermex Group supply robotic and conventional palletizing lines used by major Japanese producers. Domestic firms such as Fuji Robotics and Murata Machinery hold strong positions by offering machines tailored to Japan’s space-constrained facilities, local service expectations and industry-specific needs. These Japanese companies provide customised systems with energy-efficient operation, compact footprints and high reliability suited to local factory layouts. Their presence ensures that competition reflects both global technology leadership and domestic engineering strength, balancing imported capabilities with home-grown solutions across the palletizing segment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Floor Level Palletizers, High-Level Palletizers, Robotic Palletizers |

| Application | Case Palletizers, Pail Palletizers, Bulk Palletizers, Bag Palletizers |

| Technology | Semi-automated Palletizing, Automatic Palletizing |

| End-Use Industry | Food and Beverage, E-Commerce and Retail, Pharmaceuticals, Consumer Goods, Automotive, Other End-Use Industry |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | ABB Flexible Automation Inc, KUKA Roboter GmbH, ABC Packaging, Intelligrated Inc, Cermex Group, Fuji Robotics, Murata Machinery |

| Additional Attributes | Dollar by sales by type, application, technology, and end-use industry; regional CAGR and adoption trends; usage in food processing, e-commerce, pharmaceuticals, and industrial logistics; volume vs. value contribution over forecast period; growth in robotics, smart palletizing, IoT-enabled systems, and flexible automation; projected increase to USD 158.9 million by 2035; challenges include high capital cost, space constraints, integration complexity, and labor adoption pressures; opportunities in mid-sized factories, regional hubs, and compact automated solutions. |

The demand for palletizing systems in japan is estimated to be valued at USD 111.6 million in 2025.

The market size for the palletizing systems in japan is projected to reach USD 158.9 million by 2035.

The demand for palletizing systems in japan is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in palletizing systems in japan are floor level palletizers, high-level palletizers and robotic palletizers.

In terms of application, case palletizers segment is expected to command 36.6% share in the palletizing systems in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Palletizing Systems Market Growth - Trends & Forecast 2025 to 2035

Japan Sleep Apnea Diagnostic Systems Market Report – Size, Demand & Outlook 2025-2035

Demand for Self-checkout Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Ultra Short Base Line (USBL) Positioning Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Palletizing Robot Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Palletizing Robots Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA