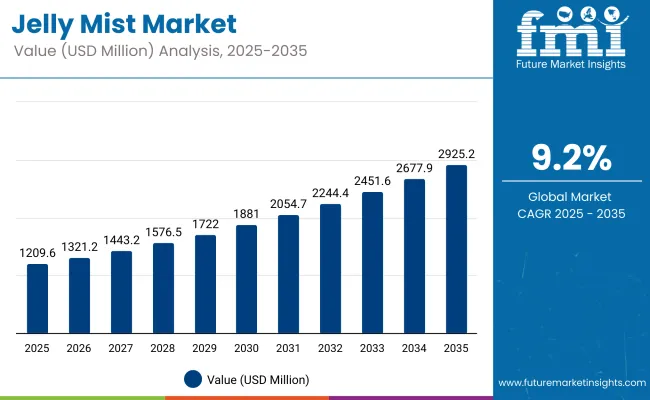

The jelly mist market is expected to record a valuation of USD 1,209.6 million in 2025 and USD 2,925.2 million in 2035, with an increase of USD 1,715.6 million, which equals a growth of 142% over the decade. The overall expansion represents a CAGR of 9.2% and a 2.4X increase in market size.

Global Jelly Mists Market Key Takeaways

| Metric | Value |

|---|---|

| Global Jelly Mists Market Estimated Value in (2025E) | USD 1,209.6 million |

| Global Jelly Mists Market Forecast Value in (2035F) | USD 2,925.2 million |

| Forecast CAGR (2025 to 2035) | 9.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,209.6 million to USD 1,881.0 million, adding USD 671.4 million, which accounts for 39% of the total decade growth. This phase records steady adoption across skincare routines driven by hydration, sensitivity relief, and pore care, with combination skin type formulations catering to over one-third of consumers. Hyaluronic acid-based jelly mists dominate this period as they capture over 28% of the active ingredient market, favored for intense moisturization and skin-plumping effects.

The second half from 2030 to 2035 contributes USD 1,044.2 million, equal to 61% of total growth, as the market jumps from USD 1,881.0 million to USD 2,925.2 million. This acceleration is powered by premium positioning, refillable and sustainable packaging adoption, and expansion in Asia-Pacific markets such as China and India, which record CAGRs of 10.8% and 12.1% respectively. Offline retail remains dominant with more than 54% share in 2025, but online platforms gain ground through K-beauty brand collaborations, influencer-driven marketing, and global shipping capabilities.

From 2020 to 2024, the jelly mist market grew steadily in Asia-Pacific and gained traction globally through K-beauty influence. During this period, the competitive landscape was dominated by South Korean skincare brands controlling the majority of revenue, with leaders such as Nature Republic, Innisfree, and The Face Shop focusing on hydrating, soothing, and brightening formulas in aerosol-free fine mist packaging. Competitive differentiation relied on skin feel, finish, and ingredient purity, while refillable formats had minimal traction, contributing less than 5% of the total market value.

Demand for jelly mists will expand to USD 1,209.6 million in 2025, and the revenue mix will shift as eco-friendly packaging, refill systems, and multi-functional claims grow to a significant share by 2035. Traditional category leaders face rising competition from indie and digital-first beauty brands offering vegan, fragrance-free, and skin-barrier-focused jelly mists.

Major brands are pivoting to hybrid models that merge hydration with treatment actives such as niacinamide and vitamin C to capture premium consumers. The competitive advantage is moving away from product novelty alone toward brand ecosystem strength, sustainability credentials, and omni-channel presence.

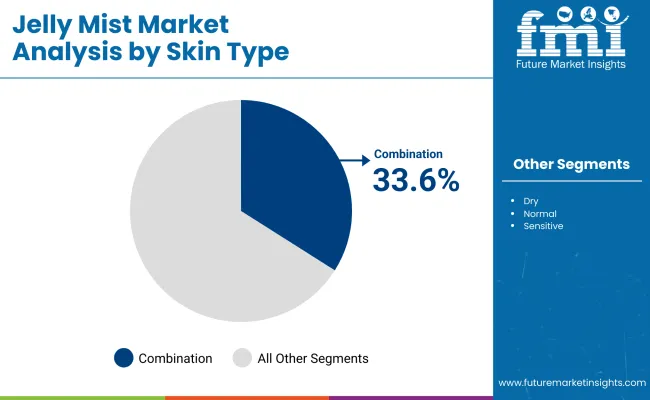

The market is segmented by skin type, skin concern, ingredient actives, texture/finish, packaging/dispensing, distribution channel, and region. Skin type categories include oily, combination, dry, normal, and sensitive, with combination skin type leading adoption in 2025, accounting for 33.6% of market value. Skin concern segmentation covers hydration, sensitivity/soothing, brightening/dark spots, pore/blackhead care, and anti-aging/firming, highlighting diverse consumer needs from daily moisturization to targeted treatment.

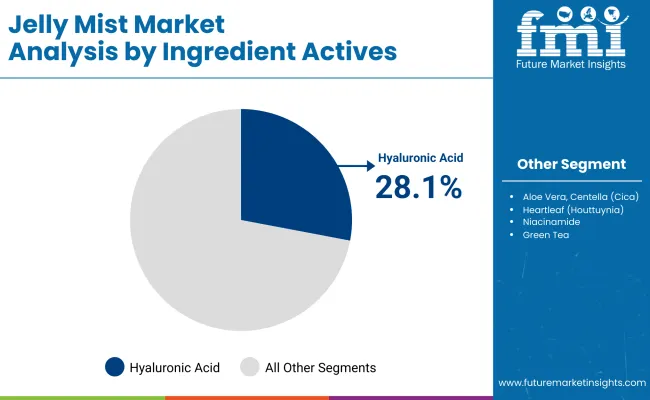

Based on ingredient actives, the segmentation includes hyaluronic acid, aloe vera, centella (cica), heartleaf (houttuynia), niacinamide, green tea, and vitamin C. Hyaluronic acid holds the largest share in 2025 at 28.1% due to its superior water-retention capacity and compatibility across all skin types. Texture/finish classifications feature jelly-to-mist (gelified, micro-mist), watery-jelly (bouncy, quick-set), and essence-jelly (rich, dewy), catering to varying preferences for absorption speed, sensorial feel, and finish.

In terms of packaging/dispensing, the market is divided into fine mist pump (aerosol-free), standard pump/trigger, and refillable pack, with fine mist pumps dominating in 2025, driven by their eco-friendly appeal and enhanced application precision. Distribution channels are segmented into offline retailers and online retailers, with offline retailers accounting for 54.4% of global sales in 2025, supported by in-store experiences and brand-led merchandising.

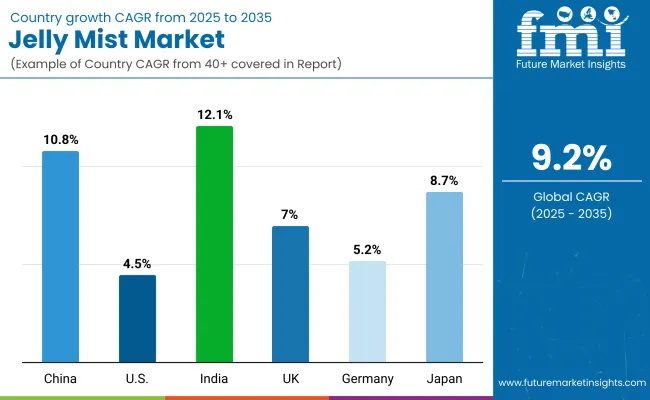

Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa. Among these, China (CAGR 10.8%) and India (CAGR 12.1%) lead growth through 2035, supported by expanding urban populations, strong K-beauty influence, and rapid adoption of premium skincare products, while Japan (CAGR 8.7%) remains a high-value, mature market.

| Skin Type Segment | Market Value Share, 2025 |

|---|---|

| Combination | 33.6% |

| Others | 66.4% |

The combination skin segment is projected to contribute 33.6% of the global jelly mist market revenue in 2025, maintaining its lead as the dominant skin type category. This leadership is driven by the versatility of jelly mist formulations that cater to both oily and dry areas of the face, a key concern for combination skin users.

Brands are increasingly targeting this segment with balanced formulations containing humectants such as hyaluronic acid and soothing botanicals like centellaasiatica, ensuring hydration without excessive oiliness. The segment’s growth is also supported by rising consumer awareness of multi-benefit products that address multiple skin zones in a single application.

As personalized skincare trends expand, combination skin-targeted jelly mists are evolving with adaptive actives that adjust moisture delivery according to skin needs. The combination skin segment is expected to remain a cornerstone of product development in the jelly mist market.

| Ingredient Actives Segment | Market Value Share, 2025 |

|---|---|

| H yaluronic acid | 28.1% |

| Others | 71.8% |

The hyaluronic acid segment is forecasted to hold 28.1% of the market share in 2025, led by its proven efficacy in deep hydration and skin-plumping effects. This active ingredient is favored for its ability to retain moisture in the skin, making it a top choice in both premium and mass-market jelly mist products. Hyaluronic acid’s compatibility with other skincare actives, such as niacinamide and vitamin C, also boosts its popularity among product developers seeking multifunctional formulas.

Its wide applicability across all skin typesespecially in urban environments where dehydration is a common issuehas fueled strong adoption. The segment’s growth is further bolstered by advancements in multi-molecular weight hyaluronic acid technology, enabling deeper skin penetration and longer-lasting results. With hydration remaining the most sought-after benefit in facial mists, hyaluronic acid is expected to maintain its leadership position through the forecast period.

| Distribution Channel Segment | Market Value Share, 2025 |

|---|---|

| offline retail | 54.4% |

| Others | 45.6% |

The offline retail segment is projected to contribute 54.4% of the jelly mist market revenue in 2025, underscoring the enduring importance of physical retail spaces in beauty product sales. This dominance is supported by in-store sampling, beauty advisor consultations, and experiential merchandising that allow consumers to test textures, scents, and packaging before purchase.

Brick-and-mortar retailers, including beauty specialty stores, department stores, and K-beauty outlets, continue to benefit from brand-led promotions and limited-edition launches. The segment’s strength is also reinforced by the role of offline channels in emerging markets, where physical store presence enhances brand trust and visibility. While online platforms are growing rapidly, offline retail’s tactile engagement and immediate product availability are expected to secure its continued lead in the market.

Shift Toward Hybrid Hydration-Treatment Formats in Everyday Skincare

The demand for jelly mists is being driven by a clear consumer shift toward hybrid products that merge hydration with treatment functions, allowing for multi-step benefits in a single application. Unlike conventional facial sprays, jelly mists deliver a bouncy, gel-infused texture that disperses as a fine mist, ensuring deeper adherence of actives to the skin surface.

In your dataset, the combination skin type segment already accounts for 33.6% share in 2025 (USD 406.43 million), highlighting the growing preference for balanced formulations that address both oily and dry facial zones. The market’s expansion is closely linked to the fact that actives like hyaluronic acid (28.1% share in 2025, USD 339.90 million) are being combined with other targeted agentssuch as niacinamide for brightening or centellaasiatica for soothingcreating a differentiated value proposition. This hybrid appeal is particularly resonating in urban Asian markets, where daily hydration is coupled with anti-pollution and skin barrier claims, fueling higher spend per unit.

Offline Retail Engagement Driving High-Value Purchases

While many beauty categories are shifting toward e-commerce, jelly mists benefit disproportionately from offline retail dominance, which in 2025 holds a 54.4% share (USD 658.02 million). This is not merely a distribution choice but a conversion driverbeauty advisors, live in-store demonstrations, and tactile testing help overcome the “new product” barrier in markets unfamiliar with the format.

In emerging Asian markets like India (CAGR 12.1%) and China (CAGR 10.8%), premium jelly mists are often introduced via flagship brand counters, ensuring first exposure is accompanied by expert education. Offline exposure also supports cross-selling within skincare regimes (e.g., pairing jelly mists with matching serums or toners), leading to higher basket sizes. This physical presence is reinforcing brand trust, which is essential for higher-priced SKUs with specialty actives, and will remain a key growth enabler despite rising online penetration.

Price Sensitivity and Cannibalization from Conventional Mists

Jelly mists are priced higher on average than standard water-based facial sprays, due to their gel-infused textures and higher concentration of active ingredients. However, in price-sensitive markets such as parts of Southeast Asia and Latin America, this premium positioning risks cannibalization by established facial mists that retail at 30-50% lower price points.

The performance gap is not always clear to consumers unfamiliar with the format, meaning jelly mists must compete on visible benefit delivery within a short trial period to justify their price. This cost-per-use perception limits penetration in markets where disposable income for skincare is constrained, slowing expansion outside core K-beauty-influenced regions.

Limited Consumer Education Beyond Asia-Pacific

Outside K-beauty strongholds, awareness of jelly mists remains low, and many consumers are unsure how they differ from toners or setting sprays. In Western markets like the USA (CAGR 4.5%), the format has yet to secure mainstream shelf space in mass retailers, making discovery dependent on niche beauty chains or online exposure.

Without targeted influencer partnerships or region-specific positioning (e.g., summer cooling sprays in warm climates), uptake is slow. This lack of education also impacts ingredient-specific adoptionconsumers may recognize hyaluronic acid as a beneficial active but not see the relevance of its delivery through a jelly mist format, reducing impulse and repeat purchases.

Texture Differentiation as a Premiumization Strategy

Within the jelly mist category, brands are increasingly leveraging texture innovation as a way to differentiate and justify premium pricing. Segments like jelly-to-mist and essence-jelly offer distinct sensorial cues that align with high-end skincare expectations.

For instance, jelly-to-mist formats disperse in ultra-fine particles while retaining a cushioned feel on the skin, appealing to consumers seeking a “treatment feel” without cream heaviness. This textural positioning is influencing launch strategiespremium SKUs with complex textures are being placed in flagship offline stores and high-tier e-commerce beauty platforms, driving higher margins.

Ingredient-Led Storytelling Targeted to Regional Concerns

Jelly mists are moving beyond generic hydration claims toward region-specific active ingredient positioning. In urban China, products with heartleaf extract are marketed for anti-inflammatory benefits in pollution-heavy environments. In India, centella and aloe vera variants emphasize skin cooling and after-sun care.

Meanwhile, Western markets are seeing vitamin C and niacinamide mists positioned as brightening solutions to pair with daily SPF routines. This granular targeting not only boosts relevance but also encourages consumers to maintain multiple jelly mists for different needs, effectively increasing purchase frequency.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 10.8% |

| USA | 4.5% |

| India | 12.1% |

| UK | 7.0% |

| Germany | 5.2% |

| Japan | 8.7% |

The global jelly mist market shows pronounced regional disparity in adoption speed, strongly influenced by K-beauty penetration, skincare premiumization, and retail channel maturity. Asia-Pacific emerges as the fastest-growing region, anchored by China at 10.8% CAGR and India at 12.1% CAGR. This acceleration is driven by strong K-beauty influence, high consumer receptivity to innovative skincare formats, and rising demand for multifunctional products.

China’s growth benefits from offline retail dominance (53.5% share in 2025) and premium product adoption in Tier-1 and Tier-2 cities, supported by local influencer marketing and cross-border e-commerce platforms. India’s trajectory reflects growing middle-class purchasing power and rapid adoption of actives like hyaluronic acid and centellaasiatica in jelly mist formulations, with offline specialty beauty stores driving first-time purchases in metropolitan and tier-2 markets. Europe maintains a strong growth profile, led by Germany at 5.2% CAGR, the UK at 7.0% CAGR, and mature markets like France and Italy adopting jelly mists through the premium skincare segment.

The UK’s consumer base is showing growing interest in brightening/dark spot-focused mists, while Germany’s market benefits from clean-label and sustainable packaging innovation. Premium pharmacy chains and department stores remain primary points of sale, reinforced by demand for eco-friendly fine mist pumps and refillable packs.

North America shows moderate expansion, with the USA at 4.5% CAGR, reflecting maturity in core beauty categories and slower adoption compared to Asia-Pacific. Growth in the USA is more e-commerce-driven, with influencer-led brand campaigns and hybrid positioning of jelly mists as both skincare and makeup-prep products. Brands are leveraging bundling strategiespairing mists with serums or sunscreento encourage repeat purchase.

| Year | USA Berberine Market (USD Million) |

|---|---|

| 2025 | 258.82 |

| 2026 | 279.41 |

| 2027 | 301.63 |

| 2028 | 325.62 |

| 2029 | 351.52 |

| 2030 | 379.47 |

| 2031 | 409.65 |

| 2032 | 442.24 |

| 2033 | 477.41 |

| 2034 | 515.38 |

| 2035 | 556.37 |

The jelly mist market in the United States is projected to grow at a 4.5% CAGR from 2025 to 2035, reaching USD 556.37 million by the end of the period. Growth is fueled by increased adoption in hydration and makeup-setting applications, with K-beauty influence gradually permeating mainstream beauty retail. Premium imports from South Korean brands are gaining space in specialty beauty chains and select department store counters, often supported by in-store brand ambassador events to familiarize consumers with the unique gel-to-mist texture.

Mass-market brands are actively experimenting with hybrid mist formulas containing niacinamide and vitamin C, positioned to deliver dual benefitshydration plus brightening or makeup priming. E-commerce is playing a critical role in awareness-building, with subscription beauty boxes and influencer affiliate programs introducing first-time buyers to the format. Seasonal product bundles, particularly hydration and SPF pairings in summer and anti-aging mist kits in winter, are boosting repeat purchase rates.

The jelly mist market in the United Kingdom is expected to grow at a 7.0% CAGR through 2035, driven by hydration, brightening, and anti-aging segments. British consumers, already accustomed to mist products for makeup setting and refreshing during the day, are now upgrading to jelly mist formats for their longer-lasting hydration and enhanced texture feel.

Brightening/dark spot correction mists have emerged as a top-performing sub-category, with active-led SKUs containing vitamin C, niacinamide, and botanical extracts gaining share in premium skincare portfolios. Department store beauty halls and specialty retailers remain crucial channels for product discovery, with K-beauty product demonstrations attracting younger demographics.

Indie beauty brands are carving out a niche by offering refillable, vegan-certified jelly mists packaged in glass bottles, targeting sustainability-conscious millennials and Gen Z buyers. Seasonal promotions, such as summer hydration kits paired with travel-size sunscreens, are also increasing category visibility in holiday retail windows.

India is the fastest-growing jelly mist market globally, with a projected 12.1% CAGR through 2035. Growth is underpinned by a rapidly expanding middle class, rising skincare spending, and strong exposure to K-beauty routines via social media platforms such as Instagram and YouTube.

Offline retail activations by K-beauty brandsparticularly in high-traffic malls and beauty specialty chainsare proving effective in educating first-time buyers about the texture and benefits of jelly mists. Hydration and soothing claims dominate consumer preference, with aloe vera and centella-based variants positioned as climate-appropriate solutions for India’s hot and humid regions. Tier-2 and Tier-3 city expansion is accelerating as mid-range product launches cater to aspirational consumers seeking premium sensorial skincare without prohibitive pricing.

China’s jelly mist market is set to grow at a 10.8% CAGR, making it one of the fastest-expanding markets globally. This momentum is driven by urban consumer demand for hydration, anti-aging, and brightening products, supported by the country’s advanced offline retail infrastructure and dominance of livestream e-commerce. Tier-1 cities such as Beijing, Shanghai, and Guangzhou are leading in premium purchases, while Tier-2 and Tier-3 cities are driving volume growth through affordable yet high-quality domestic brands.

In 2025, offline channels command 53.5% share (USD 70.77 million), with beauty counters and specialty K-beauty retailers serving as key experiential spaces. Ingredient-led storytelling is a major growth leverheartleaf extract is promoted for anti-inflammatory benefits in pollution-heavy cities, while vitamin C-infused mists are positioned for brightening and skin tone correction. Affordable refillable packs from local manufacturers are democratizing access, allowing mass consumers to experiment with premium-style textures.

| Country | 2025 Share (%) |

|---|---|

| USA | 21.4% |

| China | 10.9% |

| Japan | 6.4% |

| Germany | 14.1% |

| UK | 7.4% |

| India | 4.5% |

| Country | 2035 Share (%) |

|---|---|

| USA | 19.0% |

| China | 11.8% |

| Japan | 7.7% |

| Germany | 12.3% |

| UK | 6.7% |

| India | 5.4% |

| Skin Type Segment | Market Value Share, 2025 |

|---|---|

| Combination | 34.5% |

| Others | 65.5% |

The USA jelly mist market is valued at USD 258.82 million in 2025, with combination skin type leading at 34.5% (USD 89.29 million), followed by other skin types collectively at 65.5%. The dominance of the combination skin segment is directly linked to American consumer preference for balanced formulations that address multiple skin zones simultaneously.

These products are designed to provide targeted hydration to dry areas while controlling oiliness in the T-zone, making them ideal for everyday use in varied climates and across diverse ethnic skin profiles. The growth potential lies in premium hybrid formulations combining hydration with secondary benefits like makeup setting, brightening, and barrier repair.

With a strong clean beauty movement in the USA, fragrance-free and hypoallergenic jelly mists formulated for combination skin are gaining traction, particularly in prestige retail and dermatologist-led recommendations. The integration of multifunctional actives such as niacinamide, vitamin C, and hyaluronic acid further positions this segment for premiumization.

| Distribution Channel Segment | Market Value Share, 2025 |

|---|---|

| Offline Retail | 53.5% |

| Others | 46.5% |

The China jelly mist market is valued at USD 132.28 million in 2025, with offline retail leading at 53.5% (USD 70.77 million), followed by other channelsprimarily onlineat 46.5%. Offline’s dominance is rooted in China’s highly developed beauty retail ecosystem, where department stores, mono-brand boutiques, and multi-brand K-beauty outlets serve as primary touchpoints for product trial and purchase.

Consumers often rely on in-store product demonstrations, live beauty consultations, and influencer-driven pop-up events to experience new textures like jelly-to-mist formats. The opportunity lies in offline-to-online integration, leveraging the physical store experience for initial product discovery while using livestream e-commerce and social media marketing to drive repeat purchases.

As domestic and international brands compete for premium shelf space, offline retailers are increasingly curating ingredient-led assortmentssuch as heartleaf for soothing and vitamin C for brighteningto target urban consumers in Tier-1 and Tier-2 cities.

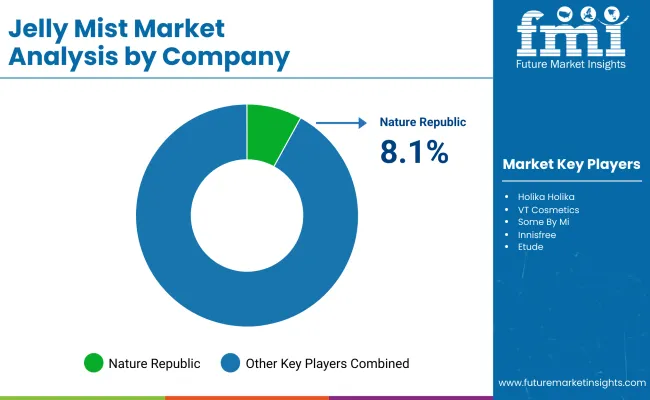

The global jelly mist market is moderately fragmented, with established K-beauty leaders, mid-tier regional brands, and emerging indie players competing across diverse skincare concerns and retail formats. Leading brand Nature Republic holds 8.1% of the global market in 2025, leveraging its strong domestic base in South Korea and extensive distribution through both offline retail chains and online marketplaces.

Its product strategy focuses on hydration and soothing formulations, particularly those featuring aloe vera and hyaluronic acid, supported by eco-conscious packaging initiatives to align with sustainability trends. Established mid-tier players such as Innisfree, Etude, and The Face Shop compete by offering ingredient-led positioningfrom green tea and centellaasiatica to vitamin Ctargeting specific skin concerns like brightening, pore care, and anti-aging.

Their competitive edge comes from integrated brand ecosystems, where jelly mists are cross-promoted alongside complementary skincare lines, enhancing regimen-based adoption. These brands also benefit from robust duty-free and travel retail presence, extending their visibility beyond domestic markets.

Indie and niche-focused brands, including VT Cosmetics, Some ByMi, Peripera, and 3CE (Stylenanda), concentrate on trend-driven product development and youth-oriented branding. They actively engage in limited-edition collaborations, influencer partnerships, and high-frequency product drops to capture younger demographics seeking novelty.

Their flexibility allows them to rapidly adapt to emerging micro-trends such as refillable fine mist pumps and vegan-certified formulations. Competitive differentiation in the jelly mist category is shifting away from simple hydration claims toward multi-functional benefits, texture innovation (e.g., jelly-to-mist, essence-jelly), and sustainability credentials. Brands are increasingly investing in ingredient transparency, social commerce, and region-specific product storytelling to secure consumer loyalty in an expanding but highly competitive global market.

Key Developments in Global Jelly Mists Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,209.6 Million |

| Skin Type | Oily, Combination, Dry, Normal, Sensitive |

| Skin Concern | Hydration, Sensitivity/Soothing, Brightening/Dark Spots, Pore/Blackhead Care, Anti-aging/Firming |

| Ingredient Actives | Hyaluronic Acid, Aloe Vera, Centella ( Cica ), Heartleaf ( Houttuynia ), Niacinamide , Green Tea, Vitamin C |

| Texture / Finish | Jelly-to-Mist ( gelified , micro-mist), Watery-Jelly (bouncy, quick-set), Essence-Jelly (rich, dewy) |

| Packaging / Dispensing | Fine Mist Pump (aerosol-free), Standard Pump / Trigger, Refillable Pack |

| Distribution Channel | Offline Retailers, Online Retailers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nature Republic, Holika Holika , VT Cosmetics, Some By Mi , Innisfree, Etude, The Face Shop, TonyMoly , Peripera , 3CE ( Stylenanda ) |

| Additional Attributes | Dollar sales by skin type, ingredient actives, and distribution channel; adoption trends in hydration and brightening segments; rising demand for refillable and eco-friendly packaging; regional growth drivers led by Asia-Pacific; premiumization through multifunctional claims; increasing adoption in e-commerce beauty platforms; offline retail engagement trends; sustainable material innovation in packaging; and product diversification through seasonal limited editions and influencer collaborations. |

The global jelly mist market is estimated to be valued at USD 1,209.6 million in 2025.

The market size for the jelly mist market is projected to reach USD 2,925.2 million by 2035.

The jelly mist market is expected to grow at a CAGR of 9.2% between 2025 and 2035.

The key product types in the jelly mist market are defined by texture/finish, including jelly-to-mist, watery-jelly, and essence-jelly.

In terms of skin type, combination skin is projected to command a 33.6% share in 2025, valued at USD 406.43 million.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mister Cap Market Size and Share Forecast Outlook 2025 to 2035

Mist Sprayer Pumps Market by Pump Type & Application Forecast 2025 to 2035

Competitive Breakdown of Mist Sprayer Pumps Providers

Chemistry 4.0 Market Growth – Trends & Forecast 2024-2034

Royal Jelly Market Analysis by Type, Form, Application, and Region Forecast Through 2035

Flow Chemistry Market Size and Share Forecast Outlook 2025 to 2035

Immunochemistry Products Market Insights – Growth & Forecast 2025 to 2035

Immunochemistry Analyzer Market Trends and Forecast 2025 to 2035

Portable Misting Fans Market Trends - Growth & Demand Forecast 2025 to 2035

Electrochemistry Meters Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Jelly Market Growth - Trends & Forecast 2025 to 2035

Low-Calorie Jelly Market Growth - Innovations & Market Expansion 2025 to 2035

Clinical Chemistry Analyzers Market Trends – Demand & Forecast 2024 to 2034

Clinical Chemistry Enzymes Market Report – Trends & Forecast 2023-2033

Integrated Chemistry Systems Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Chemistry Analyzer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Immunohistochemistry (IHC) Market Trends – Growth & Industry Outlook 2024-2034

Yellow Petroleum Jelly Market Size and Share Forecast Outlook 2025 to 2035

Instrument Cleaning Chemistries Market – Trends, Size & Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA