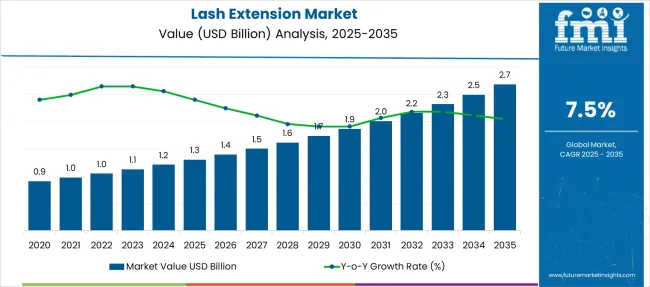

The Lash Extension Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Lash Extension Market Estimated Value in (2025 E) | USD 1.3 billion |

| Lash Extension Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The lash extension market is experiencing accelerated growth driven by evolving beauty standards, increasing consumer spending on cosmetic enhancements, and the rising popularity of semi permanent makeup solutions. Demand for lash extensions is being amplified by the influence of social media, beauty influencers, and fashion trends that emphasize bold eye aesthetics and low maintenance glamour.

Salons and beauty studios are expanding their service offerings to include a wider range of lash styles and customization options, while consumers are seeking longer lasting alternatives to mascara and strip lashes. Product innovation in materials, adhesives, and lash care solutions is supporting broader adoption across diverse demographic groups.

The market is poised for continued expansion as beauty preferences shift toward convenience, personalization, and premium quality lash aesthetics.

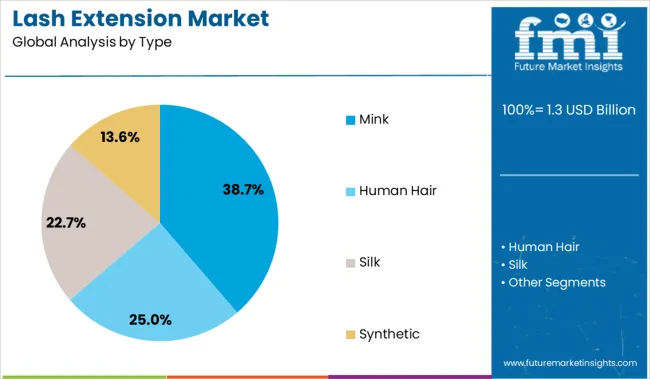

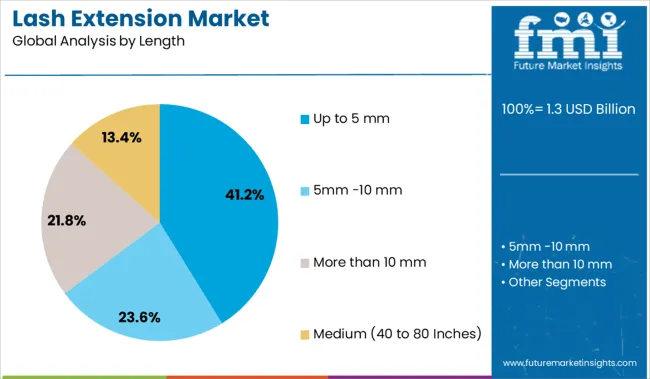

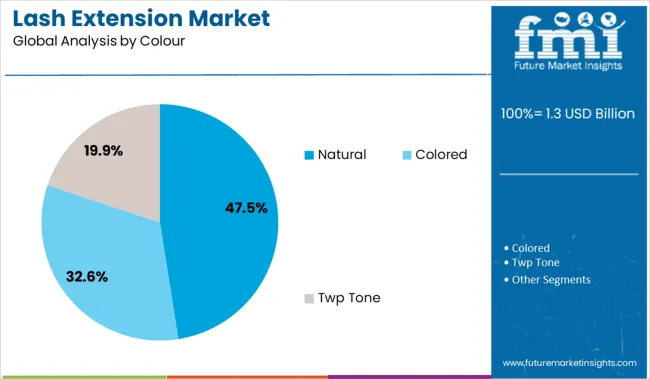

The lash extension market is segmented by type, length, colour, price, end-use, and distribution channel and geographic regions. The lash extension market is divided by type into Mink, Human Hair, Silk, and Synthetic. In terms of length, the lash extension market is classified into Up to 5 mm, 5mm-10 mm, More than 10 mm, and Medium (40 to 80 Inches). Based on the colour of the lash extension, the market is segmented into Natural, Colored, and Twp Tone. The lash extension market is segmented by price into Low, Medium, and High. The end-use of the lash extension market is segmented into Individual and Commercial. The distribution channel of the lash extension market is segmented into Online and Offline. Regionally, the lash extension industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mink segment is projected to account for 38.70 percent of the total market revenue by 2025 within the type category, making it the leading segment. This dominance is driven by the segment’s reputation for delivering a soft natural look with lightweight texture and enhanced comfort.

Mink lashes are preferred for their realistic appearance and ability to blend seamlessly with natural lashes, offering a luxurious experience that appeals to premium beauty consumers. Salons and professionals frequently select mink for clients seeking a high end finish without compromising on wearability.

The balance of comfort, flexibility, and visual appeal has elevated mink’s popularity, sustaining its leadership within the type segment.

The up to 5 millimeters segment is expected to hold 41.20 percent of market revenue by 2025 under the length category, establishing it as the most prominent length range. This is due to growing demand for subtle lash enhancement that prioritizes volume and definition over dramatic length.

These shorter extensions are often selected by clients aiming for a naturally fuller lash line suitable for daily wear and professional settings. Their ease of maintenance and compatibility with a wide range of eye shapes further support widespread adoption.

Additionally, first time users tend to opt for this length to achieve a more conservative enhancement, reinforcing its position as the preferred segment in lash length.

The natural colour segment is projected to contribute 47.50 percent of overall market revenue by 2025 within the colour category, positioning it as the dominant preference. This is attributed to the universal appeal of black and brown tones that align with most natural lash shades and eye types.

Natural colours are favored for their versatility and ability to deliver understated elegance, which aligns with both everyday and professional aesthetics. Clients seeking enhancement without overt dramatization consistently choose natural tones, making them the most requested option in salons.

As the market continues to favor custom yet subtle beauty solutions, natural coloured lash extensions remain the top choice for both first time users and loyal clients.

Demand for lash extensions is accelerating due to rising salon-based services and DIY application kits. Sales of premium faux mink and silk lashes are surging, while training academies and lash-certified technicians expand across Tier 2 and Tier 3 cities globally.

Demand for lash extension DIY kits grew 34% in 2025, driven by Gen Z consumers and content creators seeking salon-quality looks at home. USA and UK marketplaces reported a 29% spike in sales of self-adhesive lash segments with bond-and-seal systems. YouTube and TikTok tutorials pushed conversion rates higher, while lash glue removers with fewer irritants gained popularity in sensitive-skin demographics. Brands offering full starter kits under $30 saw 42% more reviews and repeat purchases. In Southeast Asia, mobile-first beauty retailers launched virtual try-ons for lash styles, increasing cart completions by 19%. User-friendly innovations and price accessibility continue to expand the DIY consumer base.

Sales of lash extension services grew 26% across Tier 2 cities in 2025, with lash technicians expanding reach beyond metros in Brazil, India, and South Africa. Semi-permanent volume lashes and hybrid styles saw growing popularity, especially for events and bridal segments. Lash academies offering short-term certification reported a 37% jump in enrollments, indicating a shift toward professionalization of the service. Russian volume technique gained market share, while salons using cruelty-free and hypoallergenic fibers raised their service rates by 18% without affecting booking volume. Franchised lash studios with centralized booking platforms captured growing urban demand while reducing no-show rates by 22%.

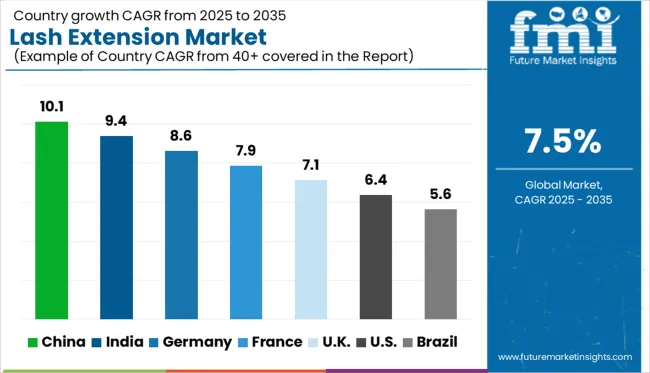

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The global lash extension market is set to grow at a CAGR of 7.5% from 2025 to 2035. China (BRICS) leads with a strong CAGR of 10.1%, exceeding the global average by 2.6 percentage points, driven by rising beauty standards, influencer-led consumer demand, and growth in premium salon chains. India (BRICS) follows at 9.4% (+1.9 pp), supported by increasing disposable income, younger demographics, and expanding e-commerce beauty platforms. Among OECD countries, Germany posts 8.6% (+1.1 pp), reflecting demand for semi-permanent beauty solutions and a growing number of professional technicians. The UK records a CAGR of 7.1% (–0.4 pp), maintaining steady growth from boutique salons and hybrid lash trends, while the USA lags slightly at 6.4% (-1.1 pp), as the market becomes more saturated and reliant on repeat customers. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a CAGR of 10.1% between 2025 and 2035, supported by rising beauty consciousness among Gen Z consumers and increasing salon penetration in Tier 2 and Tier 3 cities. From 2020 to 2024, demand was concentrated in urban hubs like Shanghai and Shenzhen. Moving forward, the expansion of e-commerce beauty platforms and influencer-driven aesthetics will accelerate market development.

India is expected to register a CAGR of 9.4% from 2025 to 2035 due to surging interest in beauty services among millennials and Tier 1 city professionals. During 2020–2024, adoption remained limited to high-end salons in metros. In the next decade, increased affordability and franchising of beauty studios will improve access in Tier 2 and Tier 3 locations.

Germany is set to achieve a CAGR of 8.6% over the 2025–2035 period, led by increasing demand for natural-looking beauty enhancements and cruelty-free lash alternatives. From 2020 to 2024, consumer preferences trended toward minimalism and lash lifts. Between 2025 and 2035, sustained innovation in glue technology and lash types will drive growth.

The UK market is forecast to expand at a CAGR of 7.1% from 2025 to 2035, supported by increasing acceptance of lash enhancements across age groups. In 2020–2024, professional lash extension services rebounded post-pandemic. In the coming years, lash subscription boxes and salon loyalty programs will encourage repeat usage.

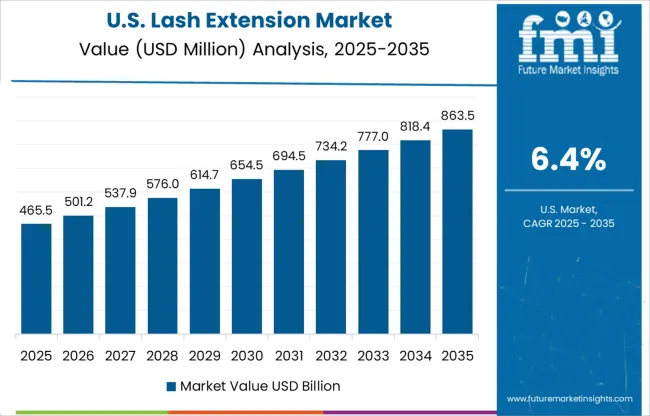

The USA market is predicted to grow at a CAGR of 6.4% between 2025 and 2035, driven by increased spending on beauty services and the rise of Instagram-driven self-care culture. From 2020 to 2024, lash bars saw growing customer retention through loyalty schemes. Future demand will be steered by innovations in lash adhesives and maintenance products.

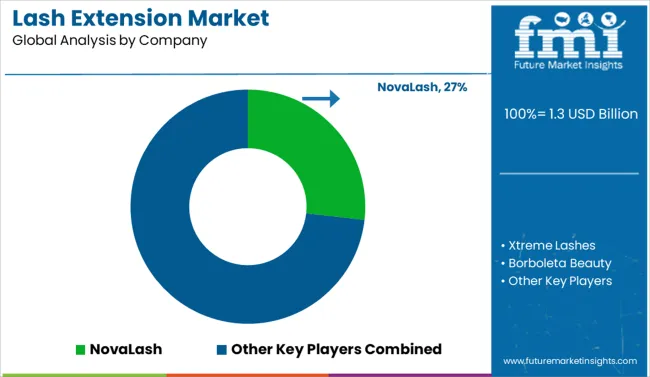

Demand for lash extensions in 2025 is rising rapidly due to the booming beauty services industry and influencer-driven aesthetics. NovaLash commands a significant share, leading with medical-grade adhesives and professional training academies. Xtreme Lashes and Borboleta Beauty follow closely, expanding their premium synthetic lash lines and global salon partnerships. Customizable volume fans and advanced retention formulas support sales of lash extension products from Sugarlash PRO and Lavish Lashes. BL Lashes and Lash Perfect are innovating with lightweight extensions and cruelty-free mink alternatives. Brands like RevitaLash and Misencil are enhancing growth serums alongside lash kits, attracting both salons and at-home users. Eyelash Excellence and Lash beLONG remain popular among licensed professionals for durability, comfort, and easy application techniques.

In late 2024, RevitaLash introduced Revitasome® Technology to its Advanced Eyelash Conditioner line, delivering time-release peptides and botanicals for enhanced lash strengthening and flexibility ideal for use with extensions or after lash treatments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Type | Mink, Human Hair, Silk, and Synthetic |

| Length | Up to 5 mm, 5mm -10 mm, More than 10 mm, and Medium (40 to 80 Inches) |

| Colour | Natural, Colored, and Twp Tone |

| Price | Low, Medium, and High |

| End-Use | Individual and Commercial |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NovaLash, Xtreme Lashes, Borboleta Beauty, Lavish Lashes, BL Lashes (Blink Lash), Sugarlash PRO, Lash Perfect, Lash Affair, RevitaLash, Minkys, Misencil, Eyelash Excellence, EYELASHCANADA, PremierLash, and Lash beLONG |

| Additional Attributes | Dollar sales by extension type and salon vs DIY use, demand dynamics across beauty salons and e‑commerce, regional trends in semi‑permanent versus cluster extensions, innovation in adhesive formulas and application tools, environmental impact of synthetic fibers, and emerging use cases in hybrid lash‑skin treatments. |

The global lash extension market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the lash extension market is projected to reach USD 2.7 billion by 2035.

The lash extension market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in lash extension market are mink, human hair, silk and synthetic.

In terms of length, up to 5 mm segment to command 41.2% share in the lash extension market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DIY Eyelash Extension Market Size and Share Forecast Outlook 2025 to 2035

Flash LED Driver ICs Market Size and Share Forecast Outlook 2025 to 2035

Flash Point Tester Market Size and Share Forecast Outlook 2025 to 2035

Flash Calling Authentication Market Size and Share Forecast Outlook 2025 to 2035

Flash-based Arrays Market Insights - Trends & Growth Forecast 2025 to 2035

Flashpoint Analyzer Market

Flash Point Apparatus Market

Splash Shield Market Size and Share Forecast Outlook 2025 to 2035

Arc Flash Risk Assessment Market Size and Share Forecast Outlook 2025 to 2035

All Flash Array Market Size and Share Forecast Outlook 2025 to 2035

Zoned Flash Market Analysis by Component, Drive Interface, End User, and Region Through 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

Heated Eyelash Curler Market Size and Share Forecast Outlook 2025 to 2035

Universal Flash Storage Market Report - Growth & Forecast 2025 to 2035

Enterprise Flash Storage Market

Chemical Deflasher Market

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Plant life Extensions (PLEX) and Plant Life Management (PLIM) for Nuclear Reactors Market

Hair Wig and Extension Market Analysis – Size, Share & Forecast 2025 to 2035

Pressure Monitoring Extension Tubing Sets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA