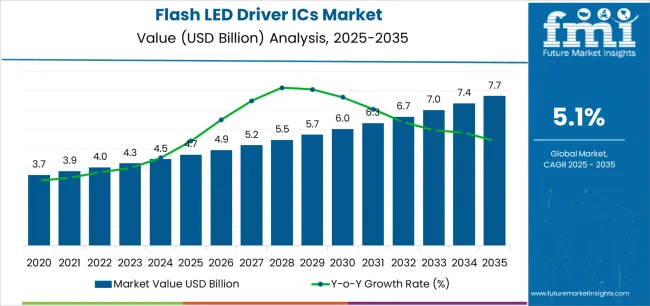

The global flash LED driver ICs market, valued at USD 4.7 billion in 2025, is projected to reach USD 7.8 billion by 2035, expanding at a CAGR of 5.1%, driven by increasing integration of high-performance camera modules in smartphones and automotive systems, rising adoption of LED-based flash technology for imaging and sensing applications, and continuous advancements in power efficiency and miniaturized semiconductor designs. The global flash LED driver ICs market is positioned for substantial expansion over the next decade, driven by proliferating smartphone camera capabilities, automotive lighting electrification, and the integration of advanced imaging systems requiring sophisticated flash illumination control across consumer electronics and professional applications. The market demonstrates robust fundamentals supported by multi-camera smartphone adoption, computational photography requirements, and the transition toward intelligent lighting systems that demand precise current regulation and thermal management capabilities in compact semiconductor packages.

Consumer electronics manufacturers are implementing advanced flash LED driver ICs to achieve 30-40% improvement in flash intensity control precision and energy efficiency compared to discrete component solutions, making these integrated circuits essential for premium smartphone differentiation and imaging performance optimization. The global push toward enhanced mobile photography experiences and automotive safety lighting accelerates demand for intelligent driver ICs that enable adaptive flash control, multi-LED management, and sophisticated timing sequences that synchronize with image sensor exposure cycles for optimal illumination quality.

The market faces headwinds from smartphone market saturation in developed regions, intense price competition in commodity driver IC segments, and supply chain constraints affecting semiconductor fabrication capacity allocation. The competitive landscape is characterized by ongoing innovation in multi-channel driver architectures, integration of advanced protection features, and regional semiconductor companies gaining market share through cost-competitive solutions and rapid response capabilities in high-growth Asian electronics manufacturing hubs.

The forecast period will witness accelerated adoption of high-current driver ICs supporting next-generation LED flash modules, enhanced thermal management features enabling sustained high-power operation, and intelligent control interfaces that integrate seamlessly with smartphone application processors and automotive lighting control units. Geographic expansion in China smartphone manufacturing ecosystems, Indian electronics assembly operations, and Southeast Asian consumer electronics production corridors will drive volume growth, while premium segments focused on automotive lighting and professional imaging equipment will support value expansion through technology differentiation and comprehensive technical support services.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4.7 billion |

| Market Forecast Value (2035) | USD 7.8 billion |

| Forecast CAGR (2025-2035) | 5.1% |

The flash LED driver ICs market grows by enabling smartphone manufacturers, automotive lighting suppliers, and consumer electronics producers to achieve superior flash illumination control and energy efficiency while meeting demanding performance requirements for advanced imaging systems and safety lighting applications. Electronics designers face mounting pressure to deliver enhanced camera capabilities and lighting performance, with integrated flash LED driver ICs typically providing 25-35% improvement in current regulation accuracy and thermal efficiency compared to discrete solutions, making these specialized semiconductors essential for premium product differentiation and regulatory compliance in automotive applications.

The computational photography revolution's need for precise flash timing and intensity control creates steady demand for sophisticated driver ICs that can synchronize multiple LED channels, execute complex flash sequences, and maintain consistent color temperature across varying ambient conditions and battery voltage levels. Multi-camera smartphone architectures requiring coordinated flash illumination for telephoto, wide-angle, and macro imaging systems drive adoption of intelligent driver solutions that manage power distribution and thermal constraints while maximizing flash performance.

Government regulations mandating advanced driver assistance systems and improved automotive lighting visibility accelerate adoption in automotive applications, where flash LED drivers enable adaptive lighting functions and emergency signaling capabilities. The global transition toward electric vehicles and autonomous driving systems creates new demand for intelligent lighting solutions requiring sophisticated driver ICs capable of dynamic beam pattern control and communication with vehicle control units. Commoditization pressures in mainstream smartphone segments and extended design-in cycles in automotive applications may limit near-term growth rates, while intense competition from Chinese semiconductor manufacturers creates pricing pressure on international suppliers serving cost-sensitive consumer electronics markets.

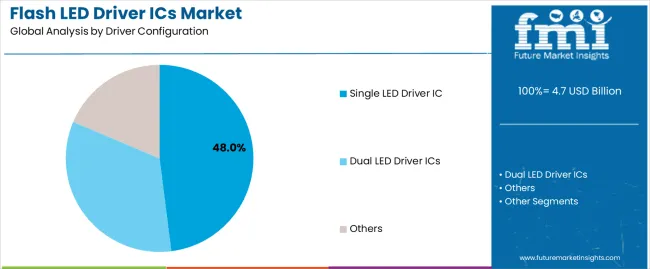

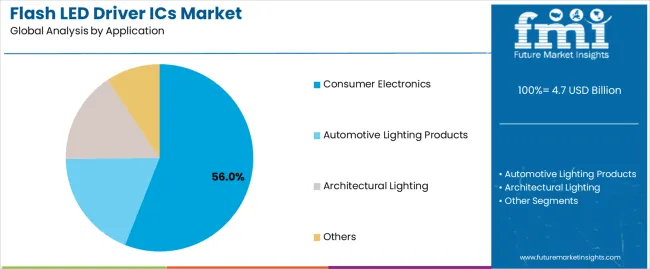

The market is segmented by driver configuration, application, and region. By driver configuration, the market is divided into single LED driver IC, dual LED driver ICs, and others. Based on application, the market is categorized into consumer electronics, automotive lighting products, architectural lighting, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

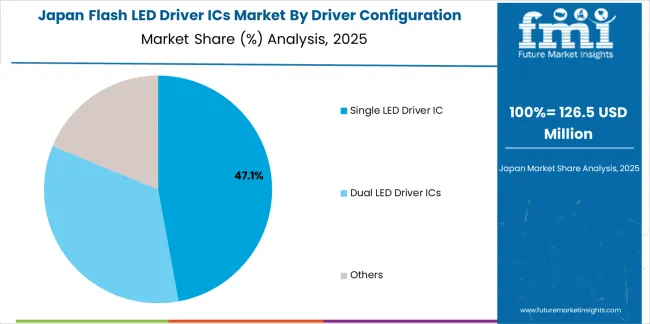

The single LED driver IC segment represents the dominant force in the market, capturing approximately 48.0% of total market share in 2025. This advanced category encompasses compact single-channel designs optimized for smartphone main cameras, action cameras, and portable lighting devices, delivering precise current regulation with minimal board space requirements and power consumption. The single LED driver segment's market leadership stems from its universal application in mainstream smartphones requiring basic flash functionality, cost-effectiveness that appeals to mid-range device manufacturers, and continuous miniaturization enabling integration in ultra-thin mobile devices.

The dual LED driver ICs segment maintains a substantial 35.0% market share, serving premium smartphones and automotive applications requiring dual-tone flash capability for color temperature optimization and enhanced illumination coverage through coordinated multi-LED operation. The others segment accounts for 17.0% market share, featuring multi-channel drivers supporting three or more LEDs for professional imaging equipment, specialized automotive lighting arrays, and architectural lighting installations requiring complex channel management.

Key advantages driving the single LED driver IC segment include:

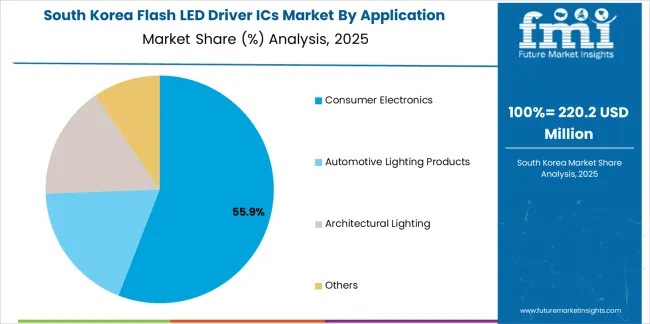

Consumer electronics dominates the market with approximately 56.0% market share in 2025, reflecting the critical role of flash illumination in smartphone imaging systems, tablet computers, and portable cameras requiring compact high-performance lighting solutions. The consumer electronics segment's market leadership is reinforced by massive smartphone production volumes exceeding 1.2 billion units annually, continuous camera capability enhancement driving multi-LED adoption, and expanding use cases including video recording illumination and computational photography applications.

The automotive lighting products segment represents 26.0% market share through integration in headlamp modules, daytime running lights, and advanced driver assistance system sensors requiring precise LED current control and thermal management. Architectural lighting applications account for 11.0% market share, encompassing accent lighting, display illumination, and decorative installations requiring flexible multi-channel control. Other applications hold 7.0% market share, including industrial machine vision, medical imaging equipment, and security camera illumination systems.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to imaging performance and lighting innovation. First, smartphone camera advancement creates increasing requirements for sophisticated flash control, with premium smartphone models incorporating three or more camera modules requiring coordinated flash illumination, driving demand for multi-channel driver ICs capable of precise timing synchronization and color temperature management across dual-tone LED arrays. Second, automotive lighting electrification mandates reliable LED drivers, with global automotive LED lighting adoption growing 12-16% annually as manufacturers transition from halogen systems to solid-state lighting requiring sophisticated current regulation and fault protection features for safety-critical applications. Third, computational photography expansion drives demand for intelligent flash control, with AI-enhanced camera systems requiring adaptive flash intensity adjustment and multi-frame flash sequences that optimize illumination for scene content and ambient conditions.

Market restraints include smartphone market maturation in developed regions, with replacement cycles extending to 3-4 years reducing overall device production growth and limiting incremental driver IC demand despite increasing LED counts per device. Semiconductor supply chain constraints affect production capacity allocation, with flash LED driver ICs competing for foundry capacity against higher-margin automotive and industrial semiconductors during periods of industry-wide capacity tightness. Price erosion in commodity driver segments creates margin pressure, particularly for single-channel devices serving mid-range smartphones where Chinese semiconductor suppliers offer cost-competitive alternatives to established international manufacturers.

Key trends indicate accelerated adoption in Chinese smartphone supply chains, where domestic semiconductor companies gain design wins through competitive pricing and local technical support. Technology advancement toward integrated protection features including overvoltage protection, thermal shutdown, and short-circuit detection eliminates external components and enhances system reliability. The market thesis could face disruption if smartphone camera systems transition to alternative illumination technologies including microLED arrays or if computational photography advances reduce dependence on hardware flash through improved low-light imaging algorithms that minimize flash usage requirements.

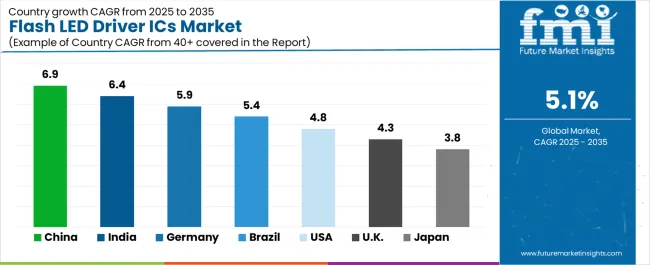

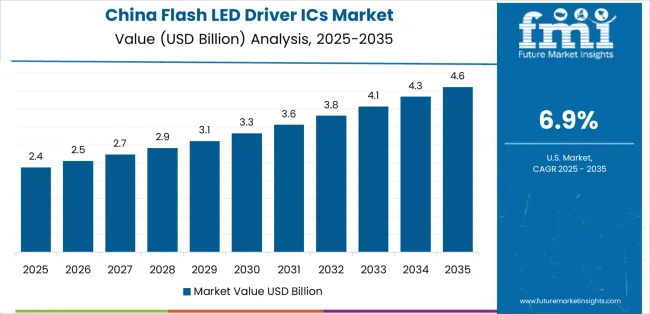

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

The market is gaining momentum worldwide, with China taking the lead thanks to massive smartphone manufacturing scale and domestic semiconductor industry expansion supporting local electronics supply chains. Close behind, India benefits from electronics manufacturing initiatives and growing smartphone assembly operations, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where automotive lighting innovation and premium electronics production strengthen its role in European semiconductor markets. Brazil demonstrates robust growth through expanding consumer electronics manufacturing and automotive production, signaling continued investment in local electronics assembly capabilities. The USA maintains steady expansion driven by automotive lighting innovation and semiconductor design leadership. Meanwhile, the UK and Japan continue to record consistent progress through automotive electronics advancement and specialized lighting applications. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the Flash LED Driver ICs Market with a CAGR of 6.9% through 2035. The country's leadership position stems from comprehensive smartphone manufacturing ecosystem dominance, rapidly expanding domestic semiconductor industry, and massive consumer electronics production volumes driving demand for cost-effective flash LED driver solutions. Growth is concentrated in major electronics manufacturing hubs, including Guangdong, Jiangsu, Zhejiang, and Shanghai, where smartphone assembly facilities, camera module manufacturers, and semiconductor design houses are implementing advanced driver IC solutions for competitive imaging capabilities. Distribution channels through electronics component distributors, smartphone ODM/OEM direct relationships, and semiconductor design service partnerships expand deployment across consumer electronics supply chains. The country's Made in China 2025 semiconductor initiative provides policy support for domestic IC industry development, including R&D incentives and supply chain localization programs.

Key market factors:

In the Karnataka, Tamil Nadu, Uttar Pradesh, and Maharashtra regions, the adoption of flash LED driver IC systems is accelerating across smartphone assembly operations, consumer electronics manufacturing facilities, and automotive lighting component production, driven by Production-Linked Incentive schemes and multinational electronics manufacturers establishing local operations. The market demonstrates strong growth momentum with a CAGR of 6.4% through 2035, linked to comprehensive electronics manufacturing expansion and increasing focus on domestic semiconductor ecosystem development. Indian electronics manufacturers are implementing cost-effective driver IC solutions to support competitive smartphone production while meeting imaging performance requirements for domestic and export markets. The country's National Policy on Electronics creates steady demand for semiconductor components, while increasing focus on automotive electronics localization drives adoption in automotive lighting applications.

Germany's advanced automotive and electronics sectors demonstrate sophisticated implementation of flash LED driver IC systems, with documented case studies showing 20-30% improvement in automotive lighting efficiency through intelligent LED driver integration. The country's automotive manufacturing infrastructure in major industrial regions, including Bavaria, Baden-Württemberg, North Rhine-Westphalia, and Lower Saxony, showcases integration of premium driver IC solutions with existing automotive lighting platforms, leveraging expertise in automotive electronics and stringent quality requirements. German automotive suppliers emphasize reliability standards and functional safety compliance, creating demand for high-performance driver ICs that support advanced lighting functions and meet automotive qualification requirements. The market maintains strong growth through focus on automotive lighting innovation and premium consumer electronics, with a CAGR of 5.9% through 2035.

Key development areas:

The Brazilian market leads in Latin American flash LED driver IC adoption based on expanding consumer electronics assembly operations and growing automotive production supporting local component sourcing initiatives. The country shows solid potential with a CAGR of 5.4% through 2035, driven by smartphone assembly expansion and automotive lighting localization programs across major manufacturing regions, including São Paulo, Paraná, Amazonas, and Minas Gerais. Brazilian electronics manufacturers are adopting driver IC solutions for competitive smartphone production capabilities, while automotive suppliers implement LED lighting systems requiring reliable driver electronics for domestic vehicle production. Technology deployment channels through electronics distributors, automotive electronics suppliers, and semiconductor representatives expand coverage across consumer electronics and automotive applications.

Leading market segments:

The USA market demonstrates mature implementation focused on automotive lighting innovation, premium smartphone development, and specialized imaging applications requiring advanced flash LED driver capabilities. The country shows steady potential with a CAGR of 4.8% through 2035, driven by semiconductor design leadership and automotive electronics advancement across major technology and manufacturing centers, including Silicon Valley, automotive corridors in Michigan, and electronics manufacturing operations in Texas and California. American semiconductor companies are developing next-generation driver ICs featuring intelligent control interfaces, advanced protection features, and optimized thermal management for premium automotive and consumer electronics applications. Technology deployment channels through semiconductor distributors, automotive electronics suppliers, and direct OEM relationships expand coverage across diverse application segments.

Leading market segments:

The UK market demonstrates steady implementation focused on automotive lighting development, consumer electronics design, and specialized lighting applications requiring reliable LED driver solutions. The country maintains consistent growth momentum with a CAGR of 4.3% through 2035, driven by automotive electronics expertise and premium consumer electronics development across major regions including Southeast England, Midlands, and Scotland. British automotive suppliers and electronics designers are implementing advanced driver IC solutions to support innovative lighting designs while meeting stringent automotive standards and consumer electronics performance requirements in premium product segments.

Key market characteristics:

Japan's market demonstrates mature implementation focused on automotive lighting leadership, precision consumer electronics, and specialized imaging applications, with documented integration of advanced driver features enabling superior lighting control and reliability. The country maintains steady growth momentum with a CAGR of 3.8% through 2035, driven by automotive electronics expertise and premium product positioning across major manufacturing regions, including Kanto, Chubu, Kansai, and Kyushu. Japanese automotive suppliers and electronics manufacturers showcase advanced deployment of driver IC solutions featuring comprehensive protection features, precise current regulation, and optimized thermal characteristics ensuring consistent performance in demanding automotive and consumer electronics environments.

Key market characteristics:

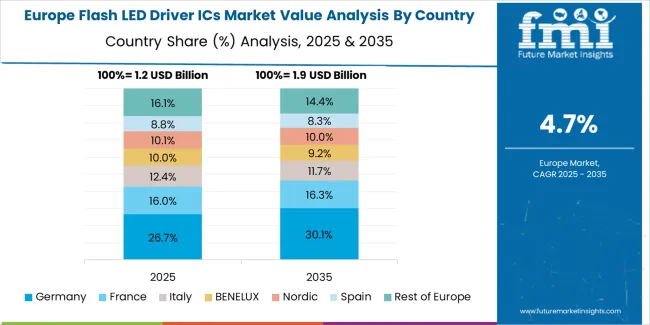

The flash LED driver ICs market in Europe is projected to grow from USD 1,740.8 Million in 2025 to USD 2,690.9 Million by 2035, registering a CAGR of 4.5% over the forecast period. Germany is expected to maintain its leadership position with a 32.8% market share in 2025, declining slightly to 31.5% by 2035, supported by its extensive automotive manufacturing infrastructure and major electronics centers, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia technology regions.

France follows with a 17.2% share in 2025, projected to reach 17.8% by 2035, driven by comprehensive automotive lighting innovation programs and consumer electronics design activities. The United Kingdom holds a 15.6% share in 2025, expected to decrease to 15.1% by 2035 due to market maturity and moderate electronics manufacturing growth. Italy commands a 11.9% share in both 2025 and 2035, backed by automotive lighting component production and specialty lighting applications. Spain accounts for 8.7% in 2025, rising to 9.2% by 2035 on automotive electronics expansion and consumer electronics assembly growth. The Netherlands maintains 5.3% in 2025, reaching 5.6% by 2035 on electronics design activity and semiconductor distribution operations. The Rest of Europe region is anticipated to hold 8.5% in 2025, expanding to 9.0% by 2035, attributed to increasing flash LED driver IC adoption in Nordic automotive electronics centers and emerging Central & Eastern European electronics manufacturing operations.

The Japanese flash LED driver ICs market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of automotive-grade driver solutions with existing vehicle lighting systems and premium consumer electronics platforms across automotive manufacturing facilities, electronics assembly operations, and imaging equipment production. Japan's focus on automotive safety and imaging performance drives demand for high-reliability driver ICs that support advanced adaptive lighting functions and sophisticated camera flash systems in premium automotive and consumer electronics applications. The market benefits from strong partnerships between international semiconductor providers and domestic automotive electronics manufacturers including Denso, Stanley Electric, and Koito Manufacturing, creating comprehensive service ecosystems that prioritize long-term supply stability and extensive qualification programs. Automotive and electronics manufacturing centers in Kanto, Chubu, Kansai, and other major production areas showcase advanced driver IC implementations where lighting systems achieve 99.9% reliability through rigorous qualification testing and comprehensive fault protection features.

The South Korean flash LED driver ICs market is characterized by strong international technology provider presence, with companies maintaining significant positions through comprehensive technical support and advanced product offerings for smartphone manufacturing and automotive lighting applications. The market demonstrates increasing focus on premium smartphone imaging capabilities and automotive electronics sophistication, as Korean electronics manufacturers increasingly demand advanced driver ICs that integrate with cutting-edge camera modules and automotive lighting systems deployed across major manufacturing operations. Regional semiconductor distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including Korean automotive qualification support and rapid design-in assistance for consumer electronics applications. The competitive landscape shows increasing collaboration between multinational semiconductor companies and Korean electronics manufacturers, creating hybrid service models that combine international product technology with local market responsiveness and technical expertise supporting rapid product development cycles.

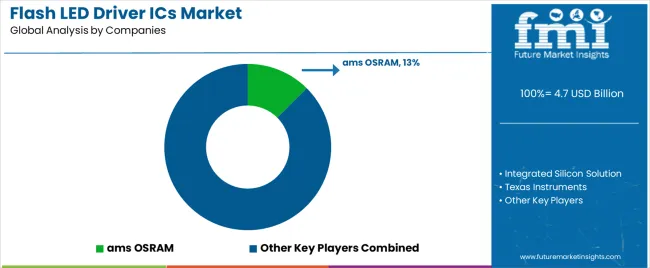

The market features approximately 35-45 meaningful players with moderate fragmentation, where the top three companies control roughly 28-35% of global market share through established design-in relationships with major smartphone manufacturers, comprehensive product portfolios covering multiple driver configurations, and strong technical support capabilities enabling rapid customer integration. Competition centers on current regulation accuracy, thermal efficiency, protection feature integration, and time-to-market support rather than price competition alone. ams OSRAM leads with approximately 12.5% market share through its comprehensive LED driver portfolio and strong automotive and consumer electronics customer relationships.

Market leaders include ams OSRAM, Texas Instruments, and STMicroelectronics, which maintain competitive advantages through extensive semiconductor fabrication capabilities, broad product ranges covering single-channel to multi-channel configurations, and deep integration with automotive qualification programs and smartphone ecosystem partnerships, creating comprehensive solution capabilities for consumer electronics and automotive applications. These companies leverage research and development capabilities in advanced current regulation techniques, intelligent thermal management, and miniaturized packaging technologies to defend market positions while expanding into emerging application segments including computational photography support, automotive adaptive lighting, and professional imaging equipment.

Challengers encompass Integrated Silicon Solution, Analog Devices, and Infineon Technologies, which compete through specialized product features, automotive market focus, and technical differentiation in high-current applications and multi-channel coordination capabilities. Product specialists, including Power Integrations, Rohm, and Macroblock, focus on specific application segments or driver configurations, offering differentiated capabilities in ultra-compact packaging, enhanced protection features, and application-specific optimization for automotive or consumer electronics requirements.

Regional players and emerging Chinese semiconductor manufacturers including Awinic Technology, Shanghai Orient-Chip Technology, and Wuxi ETEK Micro-Electronics create competitive pressure through cost advantages in domestic markets, rapid design-in support for local smartphone manufacturers, and growing technical capabilities that enable competitive alternatives to international suppliers. Market dynamics favor companies that combine reliable current regulation performance with comprehensive protection features, compact packaging enabling integration in space-constrained applications, and technical support resources that assist customers with thermal management optimization, PCB layout guidance, and rapid qualification support for accelerated time-to-market in fast-moving consumer electronics segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 billion |

| Driver Configuration | Single LED Driver IC, Dual LED Driver ICs, Others |

| Application | Consumer Electronics, Automotive Lighting Products, Architectural Lighting, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | ams OSRAM, Integrated Silicon Solution, Texas Instruments, Analog Devices, Infineon Technologies, Power Integrations, Rohm, STMicroelectronics, Macroblock, Bright Led Electronics Corp, Wuxi ETEK Micro-Electronics, ANGSemi Microelectronics, Awinic Technology, Kinetic Technologies, Broadchip Technology Group, SG Micro Corp, Shanghai Orient-Chip Technology, Nanjing Chipower Electronics, Shenzhen H&M Semiconductor, ZillTek Technology, Chiphomer Technology, Shanghai Shiningic Electronics |

| Additional Attributes | Dollar sales by driver configuration and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with semiconductor manufacturers and fabless design companies, integration requirements and thermal management specifications, compatibility with smartphone camera modules and automotive lighting systems, innovations in multi-channel driver architectures and intelligent control features, and development of specialized solutions with enhanced current regulation accuracy and protection capabilities. |

The global flash LED driver ICs market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the flash LED driver ICs market is projected to reach USD 7.7 billion by 2035.

The flash LED driver ICs market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in flash LED driver ICs market are single LED driver ic, dual LED driver ICs and others.

In terms of application, consumer electronics segment to command 56.0% share in the flash LED driver ICs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flash Point Tester Market Size and Share Forecast Outlook 2025 to 2035

Flash Calling Authentication Market Size and Share Forecast Outlook 2025 to 2035

Flash-based Arrays Market Insights - Trends & Growth Forecast 2025 to 2035

Flashpoint Analyzer Market

Flash Point Apparatus Market

All Flash Array Market Size and Share Forecast Outlook 2025 to 2035

Zoned Flash Market Analysis by Component, Drive Interface, End User, and Region Through 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

Universal Flash Storage Market Report - Growth & Forecast 2025 to 2035

Enterprise Flash Storage Market

Chemical Deflasher Market

LED and OLED lighting Products and Display Market Size and Share Forecast Outlook 2025 to 2035

LED Digital Speed Limit Sign Market Size and Share Forecast Outlook 2025 to 2035

LED Light Market Size and Share Forecast Outlook 2025 to 2035

LED Loading Dock Light Market Size and Share Forecast Outlook 2025 to 2035

LED Modules and Light Engines Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

LED Lamp Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA