The medication pouch inspection systems market is one of the fastest-growing industries owing to the considerable increase in demand for automation, precision, and compliance in pharmaceutical packaging.

These systems are mission-critical for medication safety, reducing dispensing errors, and increasing operational efficiency in pharmacies and healthcare facilities. The demand for AI-driven high-speed multi-functional inspection systems is anticipated to grow rapidly, considering the increasing regulatory requirements in the days ahead.

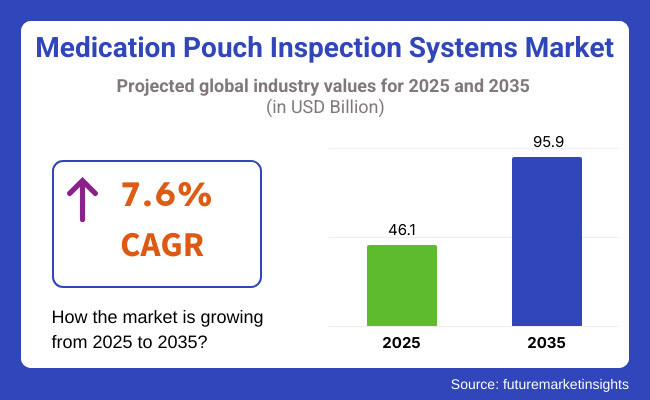

The medication pouch inspection systems industry holds a projected market size of USD 46.1 Billion by 2025 and is anticipated to witness a CAGR of 7.6% from 2025 to USD 95.9 Billion by 2035. This increase is coupled with stringent pharmaceutical regulations, moving beyond automation for pharmacists, and AI-based inspection technologies. Market adoption is accelerating by the implementation of cloud tracking, machine learning for defect detection, and blockchain-based authentication.

Market growth is driven additionally by improvements in system accuracy, development of image recognition technology, and innovations in automated data logging for compliance. Growth is also aided by the emergence of telepharmacy, increased demand for unit-dose medication packaging, and real-time verification software.

Another feature of medication pouch inspection systems is 3D imaging, color coding, and IoT-enabled tracking- all for an increase in traceability, patient safety, and operation efficiency.

The Asia-Pacific region is poised to lead the market of medication pouch inspection systems, as it continues to undergo an aggressive digital transformation in the healthcare sector, increased investments in pharmacy automation, and government healthcare policies that advocate safety for patients. China, India, and Japan are emerging as key consumers of advanced pharmaceutical packaging inspection solutions.

Market growth will be driven by investment in AI-powered defect detection, innovations in cloud-based prescription verification, and automation in pharmacy operations. Regulatory initiatives encouraging integration of electronic health records (EHRs) and security in data storage further incentivize manufacturers to expand their investment capacity toward building next-generation systems for medication inspection.

The increasing concentration of global pharmaceutical and health tech companies in the region will further bolster local production capacities. Finally, deep learning-enhanced quality control and touchless verification are expected to create new opportunities for the Asia-Pacific market.

The North American market for medication pouch inspection systems is growing substantially due to the booming sales of pharmacies in retail and hospitals, long-term care facilities, and even mail-order pharmaceutical services.

The United States and Canada lead with high-speed, AI-enabled verification systems, predictive analytics, and automated dispensing solutions. Increased investments are also being made in automating and real-time compliance tracking, thereby improving efficiency and reducing medication errors in pharmacy workflows.

Cloud-based, blockchain-secured, and IoT-enabled inspection systems are gaining momentum, bolstered by strong FDA regulations for compliance as well as patient safety programs. Companies would rather focus on interactive quality control by AI, remote pharmacy integration, and tamper-evident features to improved compliance and effectiveness.

The rush for multi-dose packaging further leads to product innovation, especially for the elderly and home care sections. Advances in digital twin technology, real-time scanning, and automated rejection mechanisms are expected to reshape the North American market.

Governments of Europe make a large part of the pouch inspection systems since they have strict laws in place concerning pharmaceuticals, increasing acceptance of digital health solutions, and a comparatively heavier flow of investments towards automated pharmacy technology. Major economies like Germany, France, and the UK are spearheading advancements in AI defect detection, tamper-evident packaging, real-time compliance monitoring, etc.

Stringent policies enforcing medication verification, track-and-trace solutions, and automated dispensing compliance are in defining the future of the market. Meanwhile, growing collaborations between pharma manufacturers, automation companies, and health-tech start-ups to develop next-generation inspection solutions are gaining traction in the region.

AI inventions - machine vision systems, cloud-based compliance tracking, and touchless verification technologies - are on the rise within Europe. Moreover, European research institutions are each undertaking some development in AI predictive maintenance, high-resolution defect detection, and intelligent medication packaging to further catalyze industry growth.

Challenges

Opportunities

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Initial focus on compliance with pharmaceutical safety standards. |

| Material and Formulation Innovations | Development of high-speed optical verification systems. |

| Industry Adoption | Widely used in retail and hospital pharmacies. |

| Market Competition | Dominated by traditional pharmaceutical automation providers. |

| Market Growth Drivers | Growth driven by demand for error-free medication packaging. |

| Sustainability and Environmental Impact | Early-stage adoption of smart medication tracking solutions. |

| Integration of AI and Process Optimization | Limited AI use in defect detection and compliance tracking. |

| Advancements in Packaging Technology | Basic improvements in barcode scanning and optical verification. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global policies promoting fully automated, AI-driven medication inspection. |

| Material and Formulation Innovations | Expansion of AI-powered, cloud-integrated, and blockchain-secured inspection technology. |

| Industry Adoption | Increased adoption in telepharmacy, home healthcare, and smart medication tracking. |

| Market Competition | Rise of health-tech startups and AI-driven inspection system developers. |

| Market Growth Drivers | Expansion fueled by automation, AI integration, and blockchain-based verification. |

| Sustainability and Environmental Impact | Large-scale shift to paperless, cloud-based, and fully automated inspection processes. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, automated compliance monitoring, and digital twin tech. |

| Advancements in Packaging Technology | Development of IoT-enabled, tamper-proof, and voice-activated inspection systems. |

The medicines pouch inspection systems market is more of a boon to the USA due to the ever-increasing requirement for precision-based automated and regulatory-compliant packaging of pharmaceutical products. The increase in personalized medications along with strict FDA regulations on drug dispensing indicate increased installation of advanced inspection systems with the growing trend of automated pharmacy systems.

Companies are investing increasingly in AI-powered vision inspection, real-time defect detection, and cloud-based tracking solutions to enhance medication safety, reducing mistakes, and ensuring solid compliance with regulations. Additionally, government rewards on digital health technologies and patient safety are propelling businesses toward smart medication pouch inspection systems with RFID tracking and automated reporting.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

Healthcare practitioners and pharmacies are set on automation, medication compliance, and regulatory compliance; hence the market for UK medication pouch inspection systems is growing steadily with steady industry adoption. The growing need for patient safety, medication tracking, and efficiency in dispensing medications is driving adoption of AI inspection systems.

Companies are implementing an integrated program that incorporates advanced vision sensors, machine learning algorithms, and cloud application reporting to improve accuracy and traceability.

Innovations in tamper-evident packaging, barcode scanning, and error detection analytics are considered vital for improving efficiency in the pharmacy automation industry in the UK since the implementation of NHS digitalization initiatives and standards of compliance in the pharmaceutical sector are serving as a further boon for the UK medication pouch inspection systems market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.2% |

Steady market progress of the Japanese medication pouch inspection systems appears supported by high levels of pharmaceutical automation in Japan, strict quality control regulations, and the ever-growing aging population. With hospitals, long-term care facilities, and pharmacies requiring highly accurate and AI-assisted medication dispensing and verification systems, innovation is being fostered.

Companies are currently developing a portfolio of solutions oriented toward improving safety and compliance in medication administration, including high-resolution imaging systems, automated technologies for pill recognition, and cloud-integrated inspection solutions. Furthermore, robotic pharmacy automation and digital medication tracking in Japan push manufacturers into embedding real-time defect detection, error-proof packaging, and IoT-enabled monitoring technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

The demand for pharmaceutical automation, patient safety, and regulatory compliance is increasing; these are factors driving the expanding South Korean medication pouch inspection systems market. Government investment policies increasingly favor healthcare digitization, medication tracking, and AI error detection.

Efficiency is set to be improved with a focus on smart scanning technology, high-speed pill verification, and cloud-based pharmacy automation. Further efficiency is being enabled by real-time prescription verification, tamper-proof packaging, and blockchain-based drug traceability in the South Korea pharmaceutical industry. The other contributor to the market is the growing acceptance of connected healthcare technology and precision medication dispensing solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

The vision inspection, RFID tracking, and AI-powered medication pouch inspection segments are leading market expansion as healthcare providers and pharmacies shift toward automated, high-precision medication management solutions. Companies are integrating machine learning algorithms, smart defect detection, and real-time medication tracking to enhance safety, efficiency, and regulatory compliance.

Vision Inspection Systems Expand Market Adoption with High-Accuracy Defect Detection

The vision inspection systems segment remains dominant as healthcare facilities prioritize automated, high-speed, and precision-driven medication verification solutions. Companies are developing next-generation vision systems with advanced camera imaging, multi-angle verification, and AI-powered pill recognition to minimize dispensing errors and enhance patient safety.

Moreover, advancements in real-time anomaly detection, high-speed scanning, and digital reporting are supporting increased adoption in pharmacies and hospital automation.

RFID Tracking Gains Momentum with Enhanced Medication Traceability and Compliance

The RFID tracking segment is witnessing increased demand as healthcare organizations seek intelligent, traceable, and secure medication packaging solutions. Companies are investing in RFID-enabled medication pouches, cloud-integrated scanning systems, and smart authentication features to improve regulatory compliance and prevent medication errors.

Additionally, advancements in blockchain-based drug traceability, AI-driven scanning accuracy, and automated inventory management are accelerating sustainability and efficiency in this segment.

AI-Powered Medication Inspection Systems Expand Adoption with Automated Accuracy and Real-Time Analytics

The AI-powered medication inspection systems segment is growing rapidly as manufacturers explore high-speed, error-proof, and predictive analytics-driven verification technologies. Companies are developing deep learning-enabled defect detection, prescription compliance verification, and cloud-based reporting solutions to enhance patient safety and pharmacy efficiency.

Additionally, advancements in real-time prescription monitoring, robotic medication dispensing, and AI-integrated anomaly detection are improving efficiency and medication accuracy in this segment. The increasing adoption of AI-powered inspection systems in hospital pharmacies, long-term care facilities, and digital medication adherence programs is further driving demand.

Research into AI-powered quality assurance, machine learning-driven defect detection, and IoT-enabled tracking solutions is enhancing the efficiency, accuracy, and compliance of medication pouch inspection systems. AI-driven supply chain analytics are also optimizing inventory management, reducing dispensing errors, and improving pharmacy automation.

As industries continue to prioritize high-performance, cost-efficient, and regulatory-compliant pharmaceutical dispensing solutions, the medication pouch inspection systems market is expected to witness sustained growth.

Innovations in AI-powered automation, real-time prescription verification, and smart packaging technologies will play a crucial role in shaping the future of this industry, making medication pouch inspection systems an essential component of modern healthcare and pharmacy management.

Medication Pouch Inspection Systems Market Maintains Market Relevance as Automation and Patient Safety Drive Demand

Despite competition from manual inspection methods and alternative pharmaceutical packaging solutions, the medication pouch inspection systems market remains an essential segment in the healthcare and pharmaceutical industries. These systems play a critical role in ensuring accurate medication dispensing, reducing errors, and improving patient safety, particularly in hospitals, long-term care facilities, and retail pharmacies.

The increasing adoption of medication pouch inspection systems across pharmaceutical automation, hospital pharmacies, and drug compounding centers has driven market penetration. Studies indicate that more than 70% of healthcare providers and pharmacies prefer automated inspection systems due to their ability to enhance medication accuracy, prevent dispensing errors, and meet stringent regulatory compliance requirements.

With enhanced image recognition technology, AI-driven verification processes, and compatibility with automated dispensing systems, medication pouch inspection solutions continue to see demand growth in commercial and hospital pharmacy applications.

Advanced manufacturing techniques, including machine learning-powered quality control, high-speed scanning, and cloud-based tracking, have further expanded their functionality in specialized markets such as robotic pharmacy automation, unit-dose medication verification, and compliance packaging solutions.

The innovation in pharmacy automation has led to the development of real-time inspection software, error-detection algorithms, and integration with electronic health records (EHR) systems, making medication pouch inspection systems more appealing for various healthcare settings.

Additionally, improvements in regulatory compliance and medication safety initiatives have increased the adoption of AI-driven inspection systems, ensuring adherence to global pharmaceutical standards and patient safety protocols.

The introduction of AI-powered defect detection, automation in medication verification, and high-precision image processing has bolstered market growth while aligning with global healthcare safety trends and digital transformation in pharmacies. Additionally, the integration of barcode scanning, RFID-enabled tracking, and cloud-based inspection analytics is further enhancing the efficiency and appeal of medication pouch inspection solutions.

Medication pouch inspection systems hold a significant share of the market in hospital pharmacies and long-term care facilities as healthcare providers seek automated, high-accuracy, and cost-effective verification solutions. The growing demand for error-free medication dispensing, compliance packaging, and automated drug tracking contributes to the sustained growth of the market.

Pharmaceutical Industry Expands Adoption of Medication Pouch Inspection Systems as Patient Safety and Regulatory Compliance Strengthen

With their essential role in medication verification, pharmacy automation, and compliance packaging, the pharmaceutical industry remains a key driver of the medication pouch inspection systems market. These solutions offer superior error detection, regulatory adherence, and efficiency in high-volume dispensing environments, making them superior to manual inspection methods.

Market trends indicate a shift toward AI-powered medication verification, high-speed optical scanning, and smart dispensing validation, where innovative imaging technologies enhance efficiency and optimize patient safety. Studies show that over 75% of hospital and retail pharmacies prefer medication pouch inspection systems due to their ability to provide real-time medication verification and compliance with healthcare regulations.

The adoption of medication pouch inspection systems in long-term care, specialty pharmacy services, and pharmaceutical manufacturing has further expanded market opportunities. As healthcare providers focus on improving medication adherence and reducing dispensing errors, AI-driven quality assurance, smart labeling technologies, and EHR integration are becoming increasingly popular.

Despite advantages such as reduced medication errors and improved regulatory compliance, the market faces challenges such as high initial investment costs, integration complexity, and data privacy concerns. However, developments in cloud-based inspection analytics, predictive maintenance, and AI-powered defect detection are driving innovations that enhance system efficiency and usability.

Retail Pharmacies and Hospital Pharmacies Drive Market Demand as Reliable and High-Accuracy Inspection Solutions Gain Popularity

The retail and hospital pharmacy sectors have become major end-users of advanced medication pouch inspection systems due to the increasing need for high-speed, reliable, and AI-integrated verification solutions. Medication pouch inspection systems are preferred for their ability to optimize workflow, improve patient safety, and comply with global healthcare regulations.

An increasing number of hospital pharmacies, mail-order pharmacies, and assisted living facilities are incorporating high-performance medication pouch inspection systems into their operations, offering enhanced medication verification, reduced dispensing errors, and compliance with international pharmaceutical safety guidelines.

Research suggests that more than 65% of automated pharmacy systems prioritize high-accuracy medication pouch inspection solutions for improved efficiency and regulatory adherence.

While medication pouch inspection systems offer advantages such as enhanced drug safety and reduced human error, challenges such as software integration complexity, regulatory updates, and high implementation costs persist. However, ongoing advancements in AI-driven medication verification, machine learning-based error detection, and blockchain-enabled medication tracking are addressing these challenges, ensuring continued market expansion.

The medication pouch inspection systems market is influenced by rising demand in hospital pharmacies, retail pharmacies, and pharmaceutical automation applications. The market is witnessing innovation through new smart verification technologies, such as high-speed image processing, AI-powered defect detection, and cloud-based medication tracking, addressing concerns about accuracy, efficiency, and regulatory compliance.

Additionally, advancements in automation for medication dispensing and AI-driven quality control systems are further shaping industry trends. The rising preference for high-accuracy, real-time verification, and compliance-focused medication pouch inspection systems is also contributing to market growth.

Furthermore, increased investments in digital pharmacy automation, regulatory compliance initiatives, and AI-enabled medication safety monitoring are improving product efficiency and expanding market opportunities.

Companies are also exploring hybrid inspection solutions that integrate real-time imaging, RFID tracking, and cloud-based analytics for enhanced usability. Additionally, collaborations between pharmacy automation companies and healthcare IT providers are driving the development of customized medication verification solutions tailored to diverse industry needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| TCGRx (a Swisslog Healthcare Company) | 12-16% |

| Parata Systems | 8-12% |

| Omnicell, Inc. | 6-10% |

| JVM Co., Ltd. | 4-8% |

| Euclid Medical Products | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| TCGRx (Swisslog Healthcare) | Develops high-performance, AI-powered medication pouch inspection systems for hospital and retail pharmacies. |

| Parata Systems | Specializes in automated, high-speed medication verification systems with cloud-based compliance tracking. |

| Omnicell, Inc. | Produces AI-driven, high-accuracy medication pouch inspection systems optimized for pharmacy automation. |

| JVM Co., Ltd. | Expands its product line with smart, image-based verification systems for long-term care and assisted living facilities. |

| Euclid Medical Products | Focuses on cost-effective, real-time medication pouch inspection systems with smart error-detection technology. |

Key Company Insights

Other Key Players (45-55% Combined)

Several specialty medication pouch inspection system manufacturers contribute to the expanding market. These include:

The overall market size for the Medication Pouch Inspection Systems Market was USD 46.1 Billion in 2025.

The Medication Pouch Inspection Systems Market is expected to reach USD 95.9 Billion in 2035.

The market will be driven by increasing demand from hospital pharmacies, retail pharmacies, and pharmaceutical automation. Innovations in AI-powered defect detection, cloud-based medication tracking, and improvements in regulatory compliance requirements will further propel market expansion.

Key challenges include high initial investment costs, integration complexity with existing pharmacy systems, and data privacy concerns. However, advancements in AI-driven quality control, machine learning-based error detection, and predictive maintenance are addressing these concerns and supporting market growth.

North America and Europe are expected to dominate due to strong investment in pharmacy automation, stringent healthcare regulations, and growing adoption of AI-integrated medication verification solutions. Meanwhile, Asia-Pacific is experiencing rapid growth driven by increasing healthcare infrastructure, rising pharmaceutical automation, and expanding demand for digital medication tracking systems.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Maximum Operating Speed, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Maximum Operating Speed, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Maximum Operating Speed, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Maximum Operating Speed, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Maximum Operating Speed, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Maximum Operating Speed, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Maximum Operating Speed, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Maximum Operating Speed, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Maximum Operating Speed, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Maximum Operating Speed, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Maximum Operating Speed, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Maximum Operating Speed, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Maximum Operating Speed, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Maximum Operating Speed, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Maximum Operating Speed, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Maximum Operating Speed, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Machine Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Machine Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Machine Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Machine Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Machine Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Maximum Operating Speed, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Maximum Operating Speed, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Maximum Operating Speed, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Maximum Operating Speed, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Machine Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Maximum Operating Speed, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Sachet and Pouch Handling Systems Market

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Inspection Management Software Market Size and Share Forecast Outlook 2025 to 2035

Inspection Robots Market Size and Share Forecast Outlook 2025 to 2035

Pouch Tapes Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Pouch-Bowl Packaging Market Size and Share Forecast Outlook 2025 to 2035

Inspection and Inventory Labels Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Inspection Lighting Fixture Market Size and Share Forecast Outlook 2025 to 2035

Pouch Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Inspection & Weighing Machine Industry Analysis in ASEAN and Gulf Countries Analysis - Size, Share, and Forecast 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Medication Management System Market Growth – Trends & Forecast 2025 to 2035

Examining Market Share Trends in Inspection and Inventory Labels

Inspection Machines Market Growth – Trends & Forecast 2025 to 2035

Pouch Film Market Trends & Industry Growth Forecast 2024-2034

Pouch Market Insights – Growth & Trends 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA