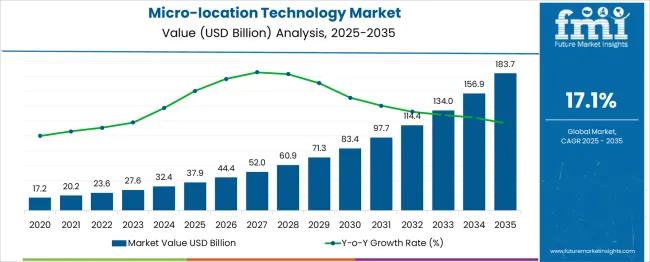

The global micro-location technology market is estimated to expand from USD 37.9 billion in 2025 to approximately USD 183.7 billion by 2035, recording an absolute increase of USD 45.8 billion over the forecast period. This translates into a total growth of 120.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 17.1 % between 2025 and 2035. The market size is expected to grow by nearly 2.21X during the same period, supported by increasing adoption of indoor positioning systems, rising demand for asset tracking solutions, and growing implementation of proximity marketing strategies across retail and enterprise environments.

Between 2025 and 2030, the micro-location technology market is projected to expand from USD 37.9 billion to USD 56.4 billion, resulting in a value increase of USD 18.5 billion, which represents 40.4% of the total forecast growth for the decade. This phase of growth will be shaped by rapid adoption of Bluetooth Low Energy (BLE) beacons, increasing implementation of Ultra-Wideband (UWB) technology in consumer devices, and growing demand for real-time location services in healthcare and manufacturing sectors. Technology providers are expanding their portfolios to address the growing need for precise indoor positioning and navigation solutions.

From 2030 to 2035, the market is forecast to grow from USD 56.42 billion to USD 83.7 billion, adding another USD 27.3 billion, which constitutes 59.6% of the ten-year expansion. This period is expected to be characterized by integration of artificial intelligence in location analytics, expansion of 5G networks enabling enhanced positioning accuracy, and development of hybrid positioning systems combining multiple technologies. The growing adoption of Industry 4.0 initiatives and smart building technologies will drive demand for sophisticated micro-location solutions with enhanced precision and reliability.

Between 2020 and 2025, the micro-location technology market experienced significant expansion, driven by digital transformation initiatives accelerated by the global pandemic and increasing focus on contactless technologies. The market developed as organizations recognized the critical need for precise indoor positioning to optimize operations, enhance safety protocols, and improve customer experiences. Enterprise adoption of location-based services began emphasizing the importance of real-time visibility in managing assets, people, and workflows within indoor environments.

| Metric | Value |

| Estimated Value in (2025E) | USD 37.9 billion |

| Forecast Value in (2035F) | USD 83.7 billion |

| Forecast CAGR (2025 to 2035) | 17.1% |

Market expansion is being supported by the fundamental transformation in how businesses optimize physical spaces and manage operational workflows. The convergence of IoT devices, advanced wireless technologies, and cloud computing has created an ecosystem where precise indoor positioning has evolved from a technological capability to a business necessity. Organizations across sectors are recognizing that centimeter-level accuracy in tracking and navigation represents a significant competitive advantage in operational efficiency, safety management, and customer engagement.

The retail sector's digital transformation is driving substantial demand for micro-location solutions that bridge online and offline shopping experiences. Retailers are leveraging proximity marketing to deliver personalized promotions based on customer location within stores, while indoor navigation helps shoppers find products efficiently. The technology enables detailed analytics on foot traffic patterns, dwell times, and conversion rates, providing insights that optimize store layouts and merchandising strategies. This data-driven approach to retail operations has become essential for competing with e-commerce platforms.

Healthcare institutions are emerging as major adopters, utilizing micro-location technology to address critical operational challenges. Hospitals deploy these systems to track medical equipment worth millions of dollars, reducing search times and ensuring availability of critical devices. Patient flow optimization through real-time location tracking improves care coordination and reduces wait times. Staff safety applications, particularly in emergency and psychiatric departments, use location-based panic buttons to summon immediate assistance, demonstrating the technology's role in creating safer healthcare environments.

The market is segmented by component, technology, deployment mode, application, end-use, and region. By component, the market is divided into hardware, software, and services (managed services and professional services). Based on technology, the market is categorized into Bluetooth Low Energy (BLE), Ultra-Wideband (UWB), Wi-Fi, RFID, near field communication (NFC), ZigBee, magnetic positioning, infrared, and others. In terms of deployment mode, the market is segmented into on-premise and cloud-based. By application, the market is classified into asset tracking & management, proximity marketing, indoor navigation, workflow optimization, emergency & security management, people tracking, augmented reality & gaming, and others. By end-use, the market is divided into retail, education, healthcare, BFSI, government and public sector, sports & entertainment, manufacturing, travel & hospitality, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

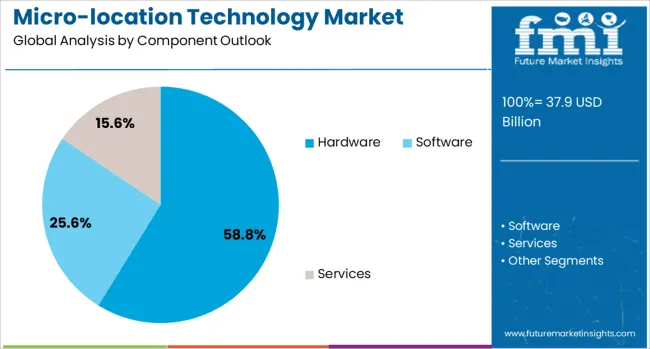

The hardware component is projected to account for 58.8% of the micro-location technology market in 2025, reflecting substantial infrastructure investments in beacons, sensors, tags, and readers required for establishing indoor positioning systems. Organizations are deploying thousands of BLE beacons across facilities to create dense positioning networks capable of delivering meter-level accuracy. The hardware segment benefits from continuous technological improvements, including extended battery life, reduced form factors, and enhanced durability for industrial environments.

This dominance stems from the foundational role hardware plays in enabling micro-location capabilities. Unlike software solutions that can be updated remotely, hardware deployment requires significant upfront investment and physical installation, creating higher barriers to entry and replacement cycles measured in years. The emergence of integrated hardware solutions combining multiple positioning technologies in single devices is driving upgrade cycles as organizations seek improved accuracy and reliability. Government regulations mandating indoor positioning for emergency services further accelerate hardware deployment across public and commercial buildings.

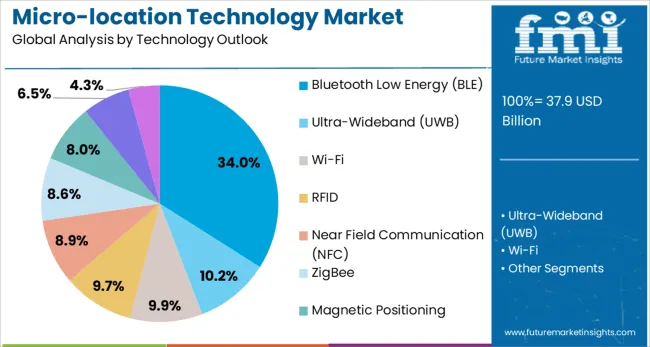

Bluetooth Low Energy technology is projected to represent 34% of micro-location technology demand in 2025, establishing its position as the most widely adopted indoor positioning technology. BLE's dominance stems from its optimal balance of accuracy, cost-effectiveness, and power efficiency, making it suitable for diverse applications from retail proximity marketing to industrial asset tracking. The near-universal presence of Bluetooth in smartphones eliminates the need for specialized devices, enabling seamless consumer engagement without app downloads through emerging standards like Google's Eddystone and Apple's iBeacon.

The technology's evolution continues to strengthen its market position, with Bluetooth 5.0 and subsequent versions offering improved range, speed, and broadcasting capacity. These enhancements enable more sophisticated applications, including direction finding and enhanced positioning accuracy. The low power consumption of BLE beacons, often operating for years on coin cell batteries, reduces maintenance requirements and total cost of ownership. As organizations prioritize scalable, cost-effective solutions for indoor positioning, BLE technology will continue to dominate market demand while complementing emerging technologies like UWB for applications requiring higher precision.

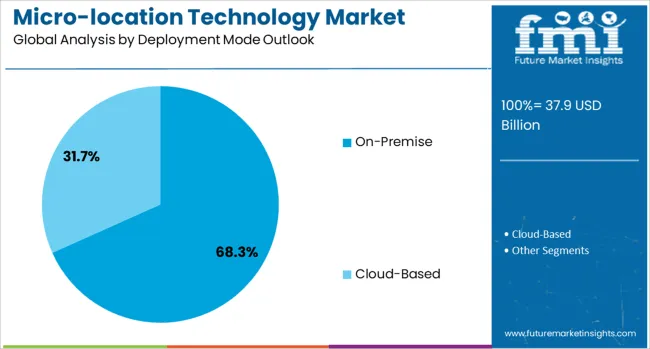

The on-premise deployment mode is forecasted to contribute 68.3% of the micro-location technology market in 2025, reflecting enterprise priorities for data security, system control, and integration with existing infrastructure. Organizations handling sensitive location data, particularly in healthcare, government, and financial services, prefer on-premise solutions to maintain complete control over data storage and processing. This deployment model enables customization to specific organizational requirements and seamless integration with legacy systems that may not be cloud-compatible.

On-premise deployment also addresses regulatory compliance requirements in industries with strict data residency and privacy regulations. The ability to process location data locally reduces latency for real-time applications critical in manufacturing and emergency response scenarios. While cloud-based solutions offer scalability advantages, many enterprises view the higher upfront investment in on-premise infrastructure as justified by enhanced security, customization capabilities, and elimination of ongoing subscription costs. The trend toward hybrid deployments, combining on-premise core systems with cloud-based analytics, is emerging as organizations seek to balance control with flexibility.

The micro-location technology market is advancing rapidly due to digital transformation initiatives across industries and growing demand for operational visibility in complex indoor environments. However, the market faces challenges including high initial deployment costs, privacy concerns regarding location tracking, and technical complexities in achieving consistent accuracy across diverse environments. Innovation in hybrid positioning systems and edge computing continues to influence technology development and market adoption patterns.

The incorporation of AI and machine learning algorithms is revolutionizing micro-location technology capabilities beyond simple positioning. Advanced analytics platforms process vast amounts of location data to identify patterns, predict behaviors, and optimize operations in real-time. Machine learning models improve positioning accuracy by adapting to environmental changes and learning from historical data patterns. Predictive analytics enable proactive maintenance of assets, optimization of traffic flows, and personalized customer experiences based on movement patterns and preferences.

The rollout of 5G networks is transforming micro-location technology capabilities through ultra-low latency and massive device connectivity. 5G's precise timing synchronization enables improved positioning accuracy, while network slicing allows dedicated resources for location services. Edge computing brings processing closer to data sources, reducing latency for real-time applications and enabling more sophisticated location-based services. This infrastructure evolution supports emerging applications like autonomous vehicles, augmented reality navigation, and real-time crowd management that require instantaneous position updates.

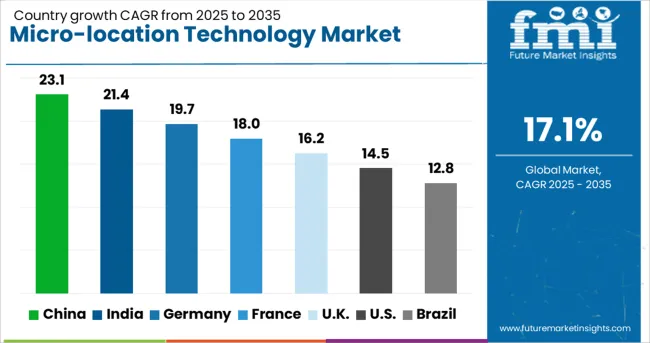

| Country | CAGR (2025-2035) |

| China | 23.1% |

| India | 21.4% |

| Germany | 19.7% |

| France | 18% |

| UK | 16.2% |

| USA | 14.5% |

| Brazil | 12.8% |

The micro-location technology market is experiencing dynamic growth globally, with China leading at a 23% CAGR through 2035, driven by massive smart city investments, rapid digitalization of retail and logistics sectors, and integration with existing digital ecosystems. India follows at 21.3%, supported by digital transformation initiatives, expanding smartphone penetration, and growing adoption in retail and healthcare sectors. Germany shows 19.6% growth, emphasizing Industry 4.0 applications and manufacturing optimization. France records 17.9%, focusing on retail innovation and cultural applications. The UK demonstrates 16.2% growth through financial services adoption and healthcare digitalization.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from micro-location technology in China is projected to exhibit exceptional growth with a CAGR of 23.1% through 2035, driven by government-backed smart city initiatives and rapid adoption across retail, logistics, and manufacturing sectors. The country's advanced digital infrastructure, including widespread 5G deployment and mobile payment ecosystems, creates ideal conditions for location-based services. Major technology companies including Alibaba, Tencent, and Baidu are investing heavily in indoor positioning capabilities to enhance their ecosystem offerings and create new revenue streams.

Revenue from micro-location technology in India is expanding at a CAGR of 21.4%, supported by the Digital India initiative, growing smartphone penetration exceeding 600 million users, and rapid expansion of organized retail and e-commerce sectors. The country's young demographic and increasing digital literacy are creating substantial demand for innovative location-based services. Indian startups are developing cost-effective solutions tailored to local market needs, while global technology providers are establishing development centers to serve both domestic and international markets.

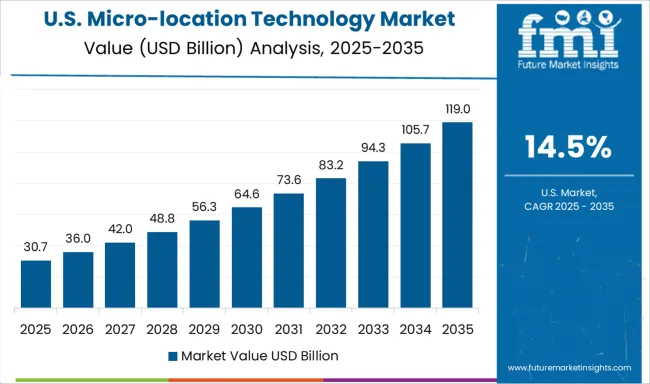

Demand for micro-location technology in the USA is projected to grow at a CAGR of 14.5%, supported by mature technology ecosystems, high enterprise IT spending, and continuous innovation from leading technology companies. American organizations are implementing sophisticated location intelligence platforms that combine positioning with analytics and automation. The market benefits from early adoption of emerging technologies like UWB in consumer devices and integration with enterprise systems for comprehensive operational visibility.

Revenue from micro-location technology in Germany is projected to grow at a CAGR of 19.7% through 2035, driven by the country's leadership in smart manufacturing and automotive innovation. German manufacturers are implementing precise positioning systems to maintain competitive advantages in quality, efficiency, and customization. The technology enables real-time tracking through complex production processes, supporting just-in-time manufacturing and mass customization strategies.

Revenue from micro-location technology in France is projected to grow at a CAGR of 18% through 2035, supported by diverse applications across retail, culture, and transportation sectors. French luxury brands are implementing sophisticated location-based experiences that enhance brand exclusivity while providing personalized services. The country's extensive cultural infrastructure provides unique opportunities for visitor engagement and heritage preservation through indoor positioning technologies.

Revenue from micro-location technology in the UK is projected to grow at a CAGR of 16.2% through 2035, supported by London's position as a global financial centre and the NHS's digital transformation agenda. Financial institutions are implementing sophisticated security and asset tracking systems, while hospitals are deploying location services to address operational challenges. Brexit-driven supply chain reorganization is accelerating adoption of tracking technologies for improved visibility and compliance.

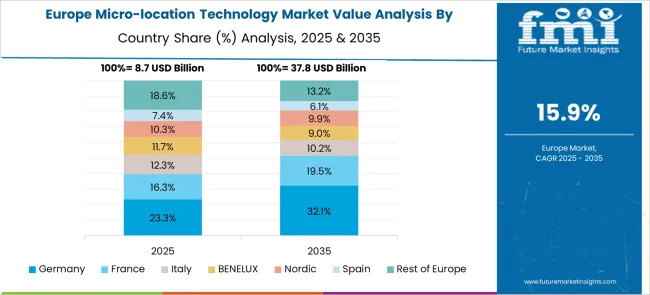

The micro-location technology market in Europe demonstrates strong growth across major economies with Germany showing exceptional momentum through its Industry 4.0 initiatives and manufacturing excellence, recording 19.6% CAGR as companies leverage precise positioning for production optimization, quality control, and worker safety in complex industrial environments. German automotive manufacturers are pioneering the integration of UWB technology for next-generation vehicle features, while the country's Mittelstand companies drive adoption of cost-effective BLE solutions for asset tracking and workflow optimization.

France represents significant growth at 18% CAGR, driven by balanced adoption across retail, cultural institutions, and transportation sectors, with luxury retailers in Paris implementing sophisticated proximity marketing systems and the Louvre and other major museums deploying indoor navigation to enhance visitor experiences while managing crowd flows. The UK exhibits robust expansion at 16.2% CAGR through strong adoption in financial services for secure asset tracking, retail sector transformation, and NHS digital initiatives implementing location services for equipment tracking and patient flow optimization.

Italy and Spain show growing implementation in retail and tourism sectors, leveraging micro-location technology to enhance visitor experiences at historical sites and shopping destinations. Nordic countries contribute through early adoption of smart building technologies and steady urban development projects incorporating indoor positioning. Eastern European markets display increasing potential as digital transformation accelerates and EU funding supports smart city initiatives. The Netherlands leads in logistics applications given its role as a European distribution hub, while Switzerland focuses on precision applications in healthcare and luxury retail sectors.

The micro-location technology market is characterized by intense competition among established technology giants, specialized positioning solution providers, and innovative startups. Companies are investing in research and development, strategic partnerships, technology acquisitions, and ecosystem development to deliver comprehensive, accurate, and scalable indoor positioning solutions. Technology differentiation, platform integration capabilities, and industry-specific expertise are central to strengthening market positions and capturing growth opportunities.

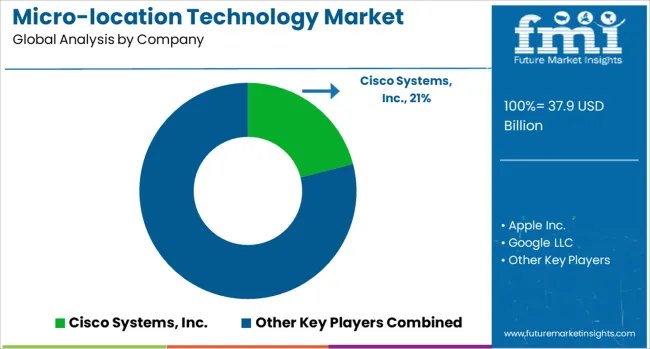

Cisco Systems, Inc. leads the market with a 21% global value share, leveraging its enterprise networking dominance to integrate location services with Wi-Fi infrastructure and IoT platforms. Apple Inc. drives consumer adoption through UWB integration in iPhones and AirTags, creating ecosystems for precise finding applications. Google LLC provides comprehensive location services through Google Maps Indoor, beacon platforms, and Android positioning APIs. HPE Aruba Networking combines Wi-Fi infrastructure with location services for enterprise customers.

Zebra Technologies Corporation specializes in enterprise asset tracking and RTLS solutions for healthcare, retail, and manufacturing sectors. Estimote, Inc. focuses on proximity marketing and beacon technology for retail applications. HERE Technologies provides mapping and location intelligence platforms for automotive and enterprise markets. Qualcomm Technologies, Inc. develops positioning chipsets and technologies enabling precise indoor location on mobile devices. Ubisense Group PLC offers industrial-grade RTLS for manufacturing and logistics applications.

Kontakt.io Inc. provides IoT and location solutions for healthcare, workplace, and industrial applications. Humatics specializes in millimeter-accurate micro-location systems for industrial automation. RUCKUS Networks, Inc. combines Wi-Fi infrastructure with location analytics. CenTrak focuses on healthcare-specific RTLS solutions. Siemens AG integrates location technology into industrial automation and smart building platforms.

| Items | Values |

| Quantitative Units (2025) | USD 37.9 billion |

| Component | Hardware, Software, Services (Managed Services, Professional Services) |

| Technology | Bluetooth Low Energy (BLE), Ultra-Wideband (UWB), Wi-Fi, RFID, Near Field Communication (NFC), ZigBee, Magnetic Positioning, Infrared, Others |

| Deployment Mode | On-Premise, Cloud-Based |

| Application | Asset Tracking & Management, Proximity Marketing, Indoor Navigation, Workflow Optimization, Emergency & Security Management, People Tracking, Augmented Reality & Gaming, Others |

| End-use | Retail, Education, Healthcare, BFSI, Government and Public Sector, Sports & Entertainment, Manufacturing, Travel & Hospitality, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Cisco Systems, Inc., Apple Inc., Google LLC, HPE Aruba Networking, Zebra Technologies Corporation, Estimote, Inc., HERE Technologies, Qualcomm Technologies, Inc., Ubisense Group PLC, Kontakt.io Inc., Humatics, RUCKUS Networks, Inc., Siemens AG. |

| Additional Attributes | Technology accuracy comparisons, integration with IoT platforms, privacy and security frameworks, ROI analysis by industry vertical, emerging use cases in autonomous systems, 5G impact on positioning accuracy, hybrid technology deployments |

The global micro-location technology market is estimated to be valued at USD 37.9 billion in 2025.

The market size for the micro-location technology market is projected to reach USD 183.7 billion by 2035.

The micro-location technology market is expected to grow at a 17.1% CAGR between 2025 and 2035.

The key product types in micro-location technology market are hardware, software, services, _managed services and _professional services .

In terms of technology outlook, bluetooth low energy (ble) segment to command 34.0% share in the micro-location technology market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA