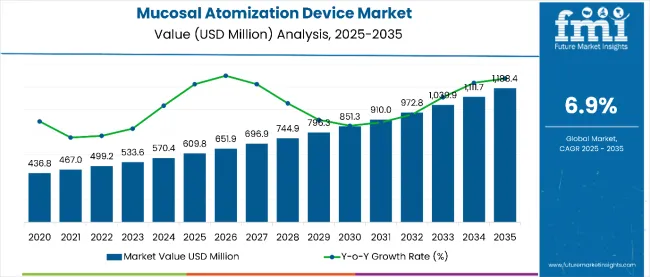

The mucosal atomization device market is estimated to be valued at USD 609.0 million in 2025. It is projected to reach USD 1,188.4 million by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 577.7 million over the forecast period. This reflects a 1.95 times growth at a compound annual growth rate of 6.9%.

The market's evolution is expected to be shaped by increasing prevalence of respiratory diseases, rising adoption of non-invasive drug delivery systems, and growing demand for pain-free medication administration, particularly where precise nasal drug delivery and emergency medicine applications are required.

By 2030, the market is expected to reach USD 851.3 million, representing USD 242.3 million in incremental value over the first half of the decade. The remaining USD 336.1 million will accrue in the second half, suggesting a moderately accelerated growth pattern. Product innovation in gas-propelled devices and electrical atomizers is gaining traction due to the technology's proven reliability and emerging IoT-enabled capabilities.

Companies such as Teleflex Incorporated and Becton, Dickinson and Company are advancing their competitive positions through investment in advanced atomization technologies and comprehensive product portfolios. Emergency medicine applications and chronic disease management trends are supporting expansion into hospital, ambulatory surgical center, and specialized clinic markets. Market performance will depend on device reliability, regulatory compliance, and clinical efficacy.

The market holds a growing share across its parent healthcare device markets. Within the drug delivery device market, it accounts for 2.1% due to its specialized applications. In the emergency medicine equipment segment, it commands a 4.8% share, supported by critical care requirements. It contributes nearly 3.5% to the respiratory care devices market and 2.9% to the pain management device category. In non-invasive medical devices, mucosal atomization devices hold around 1.7% share, driven by patient comfort benefits. Across the specialty medical device market, its share is close to 3.2%, owing to its use in anesthesia and emergency applications.

The market is undergoing a strategic transformation driven by rising demand for needle-free, rapid-onset drug delivery solutions in emergency and critical care settings. Advanced atomization technologies using gas-propelled systems, electrical mechanisms, and innovative spray patterns have enhanced medication dispersion, bioavailability, and clinical outcomes, making mucosal atomization devices viable alternatives to traditional injection methods. Manufacturers are introducing specialized formulations, including device-drug combinations and application-specific atomizers tailored for emergency medicine, anesthesia, and pediatric care. Strategic collaborations between medical device companies and pharmaceutical manufacturers have accelerated innovation in product development and clinical validation. Regulatory approvals and clinical evidence have widened healthcare provider acceptance across diverse medical specialties, reshaping traditional drug administration patterns.

| Metric | Value |

| Estimated Size (2025E) | USD 609.0 million |

| Projected Value (2035F) | USD 1,188.4 million |

| CAGR (2025 to 2035) | 6.9% |

Mucosal atomization devices' needle-free design, rapid drug absorption capabilities, and patient-friendly administration make them attractive solutions for healthcare providers seeking efficient, pain-free medication delivery in emergency, pediatric, and critical care environments. Their ability to bypass first-pass metabolism, deliver precise dosing, and provide a rapid onset of action appeals to medical professionals prioritizing patient comfort and clinical efficacy.

Growing prevalence of respiratory diseases, increasing emphasis on pain management alternatives, and expanding emergency medicine protocols are further propelling adoption, especially in hospital emergency departments, ambulatory surgery centers, and specialized treatment facilities. Rising healthcare expenditures, advancing atomization technologies, and regulatory approvals for new drug-device combinations are also enhancing product accessibility and clinical validation.

As patient comfort and non-invasive treatment trends accelerate across medical specialties and clinical efficiency becomes critical, the market outlook remains favorable. With healthcare providers and patients prioritizing needle-free alternatives, rapid drug delivery, and improved therapeutic outcomes, mucosal atomization devices are well-positioned to expand across various emergency medicine, anesthesia, and chronic disease management applications.

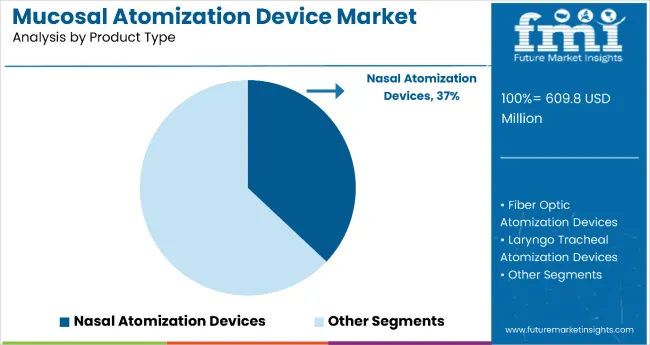

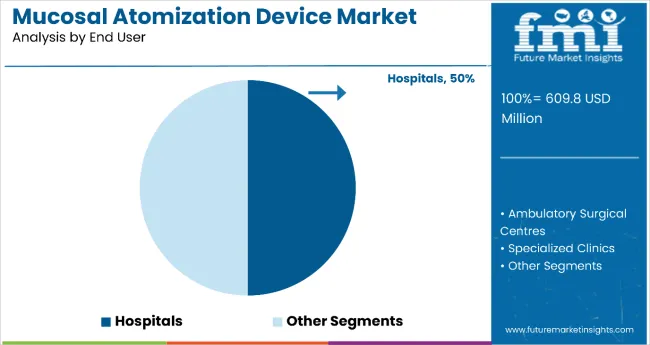

The market is segmented by product type, technology, end user, and region. By product type, the market is divided into nasal atomization devices, fiber optic atomization devices, laryngo-tracheal atomization devices, and bottle atomizers. By technology, the market is bifurcated into gas-propelled atomization devices and electrical atomization devices. By end user, the market is categorized into hospitals, ambulatory surgical centers, and specialized clinics. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The nasal atomization devices segment holds a dominant position with 37% of the market share in the product type category, owing to their widespread use in emergency medicine, respiratory treatments, and chronic disease management applications. Nasal atomization devices are widely used in hospital emergency departments and ambulatory care settings due to their rapid drug absorption through the nasal mucosa, ease of administration, and effectiveness in delivering medications such as naloxone, ketamine, and vasoconstrictors.

These devices enable healthcare providers to deliver precise medication dosing while maintaining patient comfort and avoiding invasive procedures, making them indispensable in pediatric care, geriatric treatments, and emergency response protocols. As demand for non-invasive drug delivery methods grows and emergency medicine protocols expand, nasal atomization devices are gaining preference across diverse clinical applications.

Manufacturers are investing in advanced spray pattern technologies, improved atomization mechanisms, and device-drug combination products to enhance efficacy, safety, and clinical outcomes. The segment is poised to expand further as global healthcare systems prioritize patient-centered care and needle-free medication administration formats.

Hospitals remain the core end-user segment with 50% of the market share in 2025, as emergency departments, operating rooms, and critical care units rely heavily on mucosal atomization devices for rapid medication administration, pain management, and anesthesia applications. The hospital segment's dominance stems from the devices' critical role in emergency medicine protocols, where rapid drug delivery can be life-saving, and their effectiveness in pediatric and geriatric care, where traditional injections may be problematic.

Hospital emergency departments depend heavily on nasal atomization for administering naloxone for overdose reversals, ketamine for sedation, and vasoconstrictors for bleeding control, making these devices essential in emergency care protocols. The institutional purchasing power of hospitals and their focus on patient safety and comfort drive consistent demand for high-quality atomization devices.

Ongoing emphasis on reducing needle-stick injuries, improving patient experience, and enhancing clinical efficiency are key trends driving the sustained relevance of mucosal atomization devices in hospital settings.

In 2025, global mucosal atomization device adoption grew by 18% year-on-year, with North America maintaining a 45% regional share. Applications include emergency medicine, anesthesia, pain management, and respiratory treatments. Manufacturers are introducing advanced gas-propelled systems and electrical atomizers that deliver superior drug dispersion and clinical outcomes. Needle-free formulations now support comprehensive emergency protocols. Patient comfort trends and clinical efficiency demands support healthcare providers' confidence. Technology providers increasingly supply ready-to-use device-drug combinations with integrated safety features to reduce administration complexity.

Emergency Medicine Applications Accelerate Mucosal Atomization Device Demand

Healthcare providers and emergency medical services are choosing mucosal atomization devices to achieve rapid drug onset, eliminate needle-stick risks, and improve patient compliance in critical care situations. In clinical testing, nasal atomization delivers drug absorption within 3-5 minutes compared to intramuscular injections at 15-20 minutes. Devices configured for emergency use maintain medication stability throughout extended storage periods and temperature variations. In ready-to-use formats, pre-loaded atomizers help reduce administration time while maintaining dosing accuracy by up to 95%. Emergency medicine applications are now being deployed for overdose reversals, increasing adoption in hospitals and emergency medical services. These advantages help explain why emergency department utilization of atomization devices rose 32% in 2024 across major healthcare systems.

Device Cost Pressures and Training Requirements Limit Adoption

Market expansion is constrained by higher device costs compared to traditional syringes, specialized training requirements, and limited medication formulations approved for atomization delivery. Device costs can range from $15 to $45 per unit, depending on complexity and regulatory approvals, impacting budget allocations and leading to adoption delays of up to 12% in cost-sensitive healthcare settings. Training protocols for proper device operation and safety procedures add 2 to 4 weeks to implementation timelines. Specialized storage conditions and limited shelf life extend inventory management costs by 20-25% compared to conventional injection supplies. Restricted medication formulations approved for nasal delivery limit clinical applications, especially for complex therapeutic protocols. These constraints limit widespread adoption in resource-limited healthcare environments, despite proven clinical benefits and safety improvements.

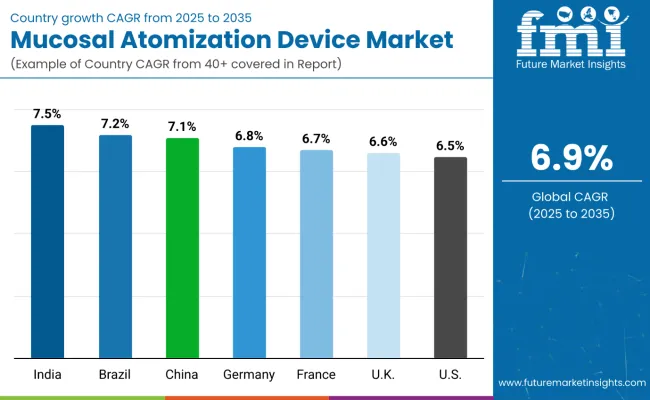

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 7.5% |

| Brazil | 7.2% |

| China | 7.1% |

| Germany | 6.8% |

| France | 6.7% |

| UK | 6.6% |

| USA | 6.5% |

In the mucosal atomization device market, India leads with the highest projected CAGR of 7.5% from 2025 to 2035, driven by expanding healthcare infrastructure and increasing chronic disease prevalence. Brazil follows with a CAGR of 7.2%, supported by government healthcare initiatives and medical device adoption. China shows strong growth at 7.1%, benefiting from favorable regulatory approvals and a large patient population. Germany, France, and the UK demonstrate consistent moderate growth at 6.8%, 6.7%, and 6.6% respectively, supported by advanced healthcare systems and emergency medicine protocols. The USA, with a CAGR of 6.5%, experiences steady expansion despite market maturity, driven by established emergency care infrastructure and clinical evidence supporting device efficacy. The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from mucosal atomization devices in India is projected to grow at a CAGR of 7.5% from 2025 to 2035, significantly exceeding the global average. Growth is fueled by expanding healthcare infrastructure, increasing prevalence of respiratory diseases, and government initiatives promoting advanced medical technologies across major urban centers, including Delhi, Mumbai, and Bangalore. Indian healthcare providers are increasingly adopting needle-free drug delivery systems as medical awareness rises and emergency care protocols modernize.

The mucosal atomization device market in Brazil is anticipated to expand at a CAGR of 7.2% from 2025 to 2035, exceeding the global rate by 0.3%. Growth is centered on public healthcare system modernization and emergency medicine protocol improvements in São Paulo, Rio de Janeiro, and Brasília regions. Government healthcare investments and medical device approval processes are supporting practical atomization device deployment across diverse clinical settings.

Sales of mucosal atomization devices in China are slated to flourish at a CAGR of 7.1% from 2025 to 2035, matching robust regional growth. Growth has been concentrated in urban hospital systems and emergency care expansion in the Beijing, Shanghai, and Guangzhou regions. Regulatory approvals and domestic manufacturing capabilities are shifting from imported devices toward local production and clinical integration. Healthcare modernization and emergency medicine standards have undergone significant enhancements, with a heightened focus on patient safety and treatment efficiency.

The demand for mucosal atomization devices in Germany is expected to increase at a CAGR of 6.8% from 2025 to 2035, slightly below the global average by 0.1%. Demand is driven by advanced emergency care protocols and medical device integration in Berlin, Munich, and Hamburg hospital systems. Healthcare providers and emergency medical services are increasingly adopting atomization technology for pediatric care and pain management applications.

Revenue from mucosal atomization devices in France is projected to rise at a CAGR of 6.7% from 2025 to 2035, supported by strong demand for emergency medicine applications and anesthesia protocols. Urban medical centers in Paris, Lyon, and Marseille are experiencing increased adoption of needle-free drug delivery systems for patient comfort and clinical efficiency improvements.

The mucosal atomization device market in the UK is expected to grow at a CAGR of 6.6% from 2025 to 2035, slightly below the global average. Growth is driven by the NHS's adoption of advanced drug delivery systems and emergency care modernization in the London, Manchester, and Edinburgh regions. Clinical evidence supporting patient outcomes and cost-effectiveness is expanding device utilization across diverse medical specialties.

The demand for mucosal atomization devices in the USA is projected to expand at a CAGR of 6.5% from 2025 to 2035, reflecting mature market conditions with steady growth. Growth is concentrated in emergency department protocol enhancements and ambulatory surgery centers across major metropolitan areas, including New York, Los Angeles, and Chicago. Established clinical guidelines and insurance coverage support sustained market development.

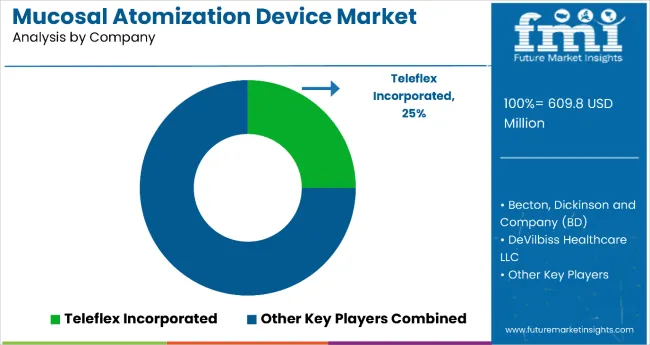

The atomization and drug delivery devices market is moderately consolidated, characterized by a blend of global medical device leaders and specialized niche innovators. Teleflex Incorporated dominates with approximately 25% market share, supported by its MADgic™ atomizer line widely adopted in emergency medicine, anesthesia, and critical care. The company’s leadership is reinforced by strong clinical validation, deep hospital partnerships, and integration into emergency care protocols.

Becton, Dickinson and Company (BD) maintains a significant presence through its comprehensive medical device portfolio, global logistics capabilities, and extensive relationships with healthcare systems, enabling seamless integration of atomization technology into clinical workflows. DeVilbiss Healthcare LLC continues to capitalize on its respiratory care expertise, offering reliable nebulization and pulmonary atomization systems suited for chronic and acute respiratory management. Cook Medical and Integra LifeSciences contribute differentiated value through advanced surgical and specialty device solutions, particularly in critical care and targeted therapeutic applications. Emerging players such as Kurve Therapeutics, Medica Holdings LLC, BVM Meditech Private Limited, Life-Assist Inc., and BTME Group Limited (Medtree) strengthen the market through innovation and regional reach.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 609.0 million |

| Product Type | Nasal Atomization Devices, Fiber Optic Atomization Devices, Laryngo-Tracheal Atomization Devices, Bottle Atomizers |

| Technology | Gas-Propelled Atomization Devices, Electrical Atomization Devices |

| End User | Hospitals, Ambulatory Surgical Centers, Specialized Clinics |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Oceania, Middle East & Africa |

| Countries Covered | United States, Germany, France, United Kingdom, China, Japan, India, Brazil, Canada, Australia and 40+ Countries |

| Key Companies Profiled | Teleflex Incorporated, DeVilbiss Healthcare LLC, Becton Dickinson and Company, Cook Medical, Integra LifeSciences, Medica Holdings LLC, Kurve Therapeutics, BVM Meditech Private Limited, Life-Assist Inc., BTME Group Limited (Medtree). |

| Additional Attributes | Dollar sales by product type and technology, regional adoption trends, competitive landscape, integration with anesthesia and respiratory therapies, adoption in hospitals and clinics, innovations in atomization technology and patient-friendly delivery systems |

The global mucosal atomization device market is estimated to be valued at USD 609.0 million in 2025.

The market size for mucosal atomization device is projected to reach USD 1,188.4 million by 2035.

The mucosal atomization device market is expected to grow at a 6.9% CAGR between 2025 and 2035.

Nasal atomization devices are projected to lead in the mucosal atomization device market with a 37% share in 2025.

In terms of end user, hospitals are projected to command 50% share in the mucosal atomization device market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

Submucosal Injections Market - Growth & Forecast 2025 to 2035

Submucosal Lifting Agent Market Segmentation based on Product Type, End Use, Application and Region: A Forecast for 2025 and 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

X-Ray Device Market Size and Share Forecast Outlook 2025 to 2035

Power Device Analyzer Market Growth – Trends & Forecast 2025 to 2035

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Mobile Device Management Market Analysis by Deployment Type, Solution, Business Size, Vertical, and Region Through 2035

Venous Device Market

Serial Device Servers Market

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA