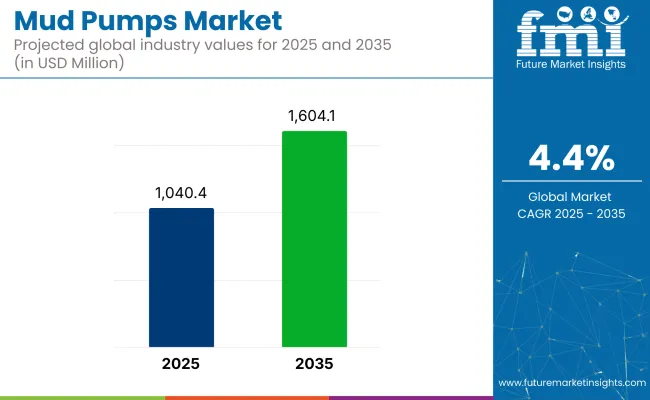

The mud pump market has been valued at USD 1,040.4 million in 2025 and is projected to reach USD 1,604.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.4% over the forecast period. Growth has been supported by increasing deployment in drilling and refractory pumping applications across the oil & gas, construction, and environmental sectors.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,040.4 million |

| Industry Value (2035F) | USD 1,604.1 million |

| CAGR (2025 to 2035) | 4.4% |

In March 2024, a new integrated mixing and pumping unit-the Mud Hog® Pump MPC 240-was launched by EZG Manufacturing. This model was designed to deliver up to 240 bags per hour and operate over a distance of 200 feet. The unit was engineered with an onboard water booster pump and flow meter to ensure consistent flow during fireproofing, grouting, and micro trench operations. According to EZG, the system was configured specifically to meet the material delivery needs of high-throughput masonry projects.

In early 2025, the GD 250HDD pump was introduced by GD Energy Products. It marked the company’s first model developed exclusively for horizontal directional drilling (HDD). The pump was designed to operate at lower speeds under high rod loads, thereby aligning with the requirements of HDD operations. The launch was confirmed by GD Energy Products as part of a broader effort to expand sludge-handling and drilling-specific pump portfolios.

Additionally, slurry-compatible centrifugal pumps have been developed by Flowrox over the past two years, as reported by industry analysts. These pumps were engineered using wear-resistant alloys and configured with mechanical seal options suited for abrasive slurries in wastewater and drilling mud applications.

Recent advancements in the market have been aligned with evolving industry standards related to uptime, emissions control, and serviceability. New models have been introduced with optimized fluid ends and IVT-compatible seal configurations to reduce maintenance downtime and prevent fugitive emissions. OEMs have increasingly emphasized modular designs featuring split-case and vertical access for simplified servicing.

Proprietary coatings and abrasion-resistant composites have been employed to extend maintenance intervals. Select manufacturers have integrated remote monitoring and condition-based diagnostics to facilitate predictive maintenance planning.

The continued expansion of well completion projects, infrastructure development, and environmental remediation initiatives worldwide is expected to sustain long-term demand. In particular, increased adoption of HDD and slurry-handling pumps across emerging markets is anticipated to support consistent market growth through 2035.

Triplex mud pumps accounted for 54% of the global market share in 2025 and are projected to grow at a CAGR of 4.6% through 2035. Their dominance was attributed to the optimal balance they provide between flow rate, pressure output, and operational stability in oil & gas drilling, geothermal exploration, and horizontal directional drilling (HDD) projects.

In 2025, triplex pumps were commonly deployed on both onshore and offshore rigs due to their simpler design, reduced pulsation, and lower maintenance requirements compared to duplex or quintuplex alternatives. OEMs focused on improving fluid end materials, liner wear life, and variable speed drive integration to extend operational efficiency under high-pressure cycles. Standardization of triplex units across drilling contractors and rig fleets contributed to streamlined part availability and technician familiarity, supporting widespread use in North America, the Middle East, and Asia-Pacific.

Pumps with a flow rate between 250 to 1000 gallons per minute (GPM) represented 38% of the global market in 2025 and are expected to grow at a CAGR of 4.5% through 2035. This range served as the operational sweet spot for mid-depth well drilling, geothermal boreholes, and water well construction. In 2025, modular rig systems, remote site drilling, and cost-optimized exploration projects favored equipment within this flow rate class due to manageable size, fuel efficiency, and transportability.

Manufacturers delivered units with high-pressure compatibility, automated monitoring systems, and fast liner changeout features to suit daily field conditions. Adoption was reinforced by increased shale drilling activity and infrastructure development in Africa, Latin America, and Southeast Asia, where portable systems operating in the 250-1000 GPM range met most productivity and mobility requirements.

High Maintenance Costs and Pump Failure Risks

One of the significant problems in the mud pumps market is the cost of maintenance and the time for operation due to the pump malfunction. Mud pumps get to experience abnormal circumstances such as crush pressures, abrasive drilling fluids, and wear and tear in continuous running that results in the piston, liner, and seal wearing and tearing off.

High costs and a big share of contract maintenance are the results of frequent repairs and part replacements, which adversely affect the effectiveness and the profitability of the drilling companies. Aside from that, the downtime of the equipment used in drilling, which arises from unexpected pump failures, could lead to the drilling expenses skyrocketing.

In order to sort out these issues, the manufacturers are setting their eyes on technologies that will boost abrasive-resistant materials, systems that provide real-time information about the pump, and artificial intelligence-powered predictive maintenance solutions to deliver reliability and cut back on maintenance costs.

Stringent Environmental Regulations on Drilling Fluids

Environmental concerns and stringent regulations on drilling fluid disposal and contamination risks pose challenges for mud pump operations. Government agencies such as the USA Environmental Protection Agency (EPA) and the European Environmental Bureau (EEB) impose strict rules on the use of drilling fluids, disposal of wastewater, and reduction of emissions from oil and gas drilling.

These regulations support the efforts for the installation of closed-loop mud systems. The designs of pumps that are energy-efficient and operate with low-emission drilling are also promoted, which consequently leads to an increase in compliance costs for drilling companies.

To confront these worries, the people in the industry are targeting the creation of non-toxic drilling fluids, high-efficiency designs of pumps, and better waste management technologies to reach the benchmarks set by sustainable development at the global level.

Advancements in Electric and Automated Mud Pump Systems

The alliance between electric and automatic drilling technologies is providing ground for new possibilities regarding next-generation mud pump systems. Electric tip pumps are an energy-efficient way of moving the gas through the diaphragm, causing less environmental impact and lowering operational costs than traditional diesel-powered systems.

As the oil and gas sector aims to lessen the amount of carbon that goes into the atmosphere and, at the same time, find the best ways of using fuel, electrically driven mud pumps are getting more and more common, especially in both onshore and offshore drilling.

Another part of the project will be the automation that will provide a remote connection to monitoring, with the use of artificial intelligence and the pump adjusting itself to the best working conditions. Sensor network control systems that are enabled by IoT will result in the online monitoring of pump pressure, flow rate, and operation, securing its unimpeded working and less mechanical wear. These are the creative steps that can improve safety, make things more efficient, and lessen downtime as they detect and remedy problems before they result in major failures.

In addition to that, the automated mud pump with the auto-pressure-safety system is on the way to be made. It is planned to circulate the proper drilling fluid in dynamically changing conditions to ensure drill-well stability reaches equilibrium. Along with the deep driving towards the digitalized oilfield, the time-honored data-oriented drilling venture investment is expected to further fast-track the proliferation of intelligent mud pumping systems.

Growing Demand for High-Pressure Pumps in Deepwater and Unconventional Drilling

The expansion in deepwater and ultra-deepwater, as well as the demand for drilling projects, offers chances to develop high-pressure mud pumps. The more projects reach striking depth and the more difficult knowledge of the geology at the site, the greater the necessity for superior pumps, pumps with higher horsepower, and improved fluid handling capabilities.

Projects in deep-water areas such as the Gulf of Mexico, North Sea, and offshore West Africa necessitate pumps that can endure extreme pressures while keeping the fluid circulating over longer depths. These environmentally sound pumps help in the conformance of borehole stability, the removal of unwanted cuttings, and support good well integrity even under the most challenging conditions.

Shale gas development and hydraulic fracturing (fracking) usage are examples of the recently expanded areas. There is a new request for high-pressure mud pumps able to convey abrasive proppants and high-viscosity drilling fluids. The need to optimize well count and limit environmental impact makes the precise control of fluid pressure key in unconventional activities.

Manufacturers are pushing the agenda of modular pump designs, ultra-high-pressure pumps, and hybrid drilling solutions, which have been a significant breakthrough in the performance level while enabling substantial energy savings. The next-generation mud pumps will be fitted with wear-resistant materials, advanced ceramic liners, and improved seals that will make these pumps more durable and require less maintenance.

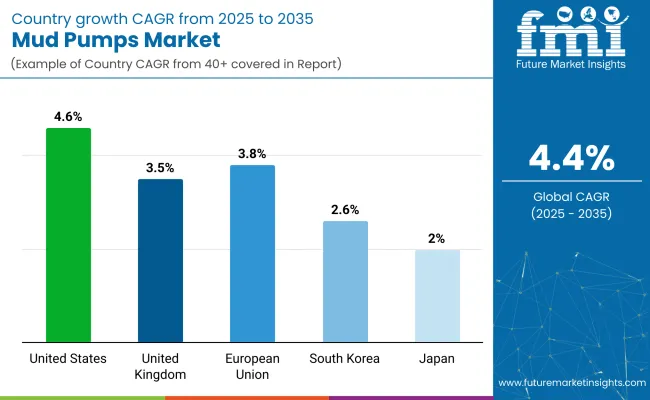

The mud pump market in the United States is on the path of remarkable growth, owing to the increasing oil and gas exploration activities, the surge in investments in shale drilling, and the deepwater drilling technology advancements. The expanding hydraulic fracturing (fracking) in leading oil basins like Permian, Bakken, and Eagle Ford is propelling the need for high-pressure and high-efficiency mud pumps.

Concerns regarding the environment have led to manufacturers working on low-emission, energy-efficient mud pumps, which, in turn, improve pump durability and optimize drilling efficiency. The rising adoption of horizontal drilling is also catalyzing investments in reciprocating and centrifugal mud pumps with better protective pressure control systems.

Developments in digital monitoring technologies are supporting online maintenance and simultaneous actual performance diagnostics that result in increased productivity in drilling activities.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

The UK mud pump market witnesses a slow yet steady growth owing to the offshore oil and gas activities in the North Sea, increased utilization of renewable drilling technologies, and the regulatory reform towards green energy extraction.

Although oil production in the North Sea is slightly decreasing, the projects of enhanced oil recovery (EOR) and deep-sea exploration are the main factors for the desire for high-efficiency mud pumps. Moreover, with investments in geothermal drilling, mud pumps have also recuperated from alternative energy projects over time.

The UK government’s target for net-zero emissions by 2050 has facilitated the innovation of low-energy and eco-friendly mud pump systems, including pumps designed for water-based drilling fluids that lessen the environmental impact.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.5% |

The European Union mud pump sector is on the rise owing to investments in offshore drilling of oil and gas, the demand for geothermal energy drilling, and environmental regulations that ensure sustainable extraction technology.

Norway, Germany, and the Netherlands are the three countries which are mainly targeting offshore exploration and extending lifetimes of oil fields, thus they are introducing high-performance mud pumps in a constant volume.

In addition, the growth of geothermal energy projects across Europe has triggered the demand for high-pressure mud pumps for deep drilling operations.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.8% |

The Japan mud pump market is increasing at a rather slow but steady speed with the help of geothermal energy development, construction, and tunneling projects, as well as advancements in pump efficiency. Mud pumps are integral to the drilling services of the geothermal sector, the new talent honed in oil and gas explorations activities have moved out of the oil sector into renewables, especially to areas where deep drilling technology is primordial.

Mud pump demand is also facilitated by the country’s commitment to the development of infrastructure projects that include subway systems and building construction, which, in turn, leads to tunneling processes being used for their realization. What is more, precision manufacturing that is associated with Japan’s cutting-edge technology has positively affected the development of high-efficiency, low-maintenance mud pumps.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.0% |

The South Korean mud pump market is an industry that is advancing slightly, largely due to offshore oil and gas exploration activities, the increasing finance in geothermal energy, and the advancement of tunneling infrastructure projects.

Offshore oil and gas activities in South Korea are growing, resulting in increased demand for high-pressure and corrosion-resistant mud pumps. In addition, the initiatives advanced by the government for the expansion of geothermal energy production affect the high number of mud pumps, which are used further in deep-well drilling applications.

The extensive tunneling and underground metro projects that are being carried out in places such as Seoul and Busan are the main reasons for the demand for mud pumps that can operate in those conditions smoothly.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.6% |

As the global market for mud pumps is experiencing steady growth due to increasing oil and gas exploration and drilling technology efficiency as well as the growing pumping systems performance, the mud pump market is witnessing an upbeat trend. They are an essential part of drilling, as they help in removing the cuttings while cooling the drill bits and, hence, prevent pressure deviation.

The market growth results from more investments in onshore and offshore drilling projects, increased usage of automated mud pump systems, and a combination of these two factors, high-pressure and high-volume pumps. The leaders of the market, which are mostly manufacturers, place stress on endurance, efficiency, and low maintenance costs, so they secure operating their machines in oil, geothermal, and mining applications.

Gardner Denver Inc.

An international company, Gardner Denver is a front runner in the production of pneumatic drill string retractors owing to its exceptional range of triplex and quintuplex pumps engineered specifically for the demanding needs of high-pressure drilling.

The PZ and GD series mud pumps are the brand’s assurance in terms of максимальная displacement, reduced downtime and increased operational efficiency. Gardner Denver is on the way to become the mud pump of the future by investing in wear-resistant materials and real-time condition monitoring, which will optimize drilling fluid management to boost the utilization of wells.

National Oilwell Varco Inc.

National Oilwell Varco (NOV) proves itself to be a strategic provider of long-lasting, high-yield mud pumps offering designated design features for deep-water drilling and other unconventional methods. The FG and 14-P series of the company have implemented modern hydraulic control systems that save energy and optimize fluid dynamics. NOV is heading in the direction of smart pump automation, which makes it possible for predictive maintenance and real-time performance tracking to be done for the oilfield operators.

CNPC Baoji Oilfield Machinery Co., Ltd.

CNPC Baoji is a superior pump manufacturing company focusing on high-power mud pumps such as BB HP and F series, which they sell to users of 8000m to 20000m polymer and sour mud drillstrings. Such OP and BP series are aimed at high-growth offshore and land drilling applications where they are able to offer high fluid flow efficiency, solid structure, and extended life cycle. CNPC Baoji is innovatively side cooling and loop-forbidden the lubrication of the pump, thereby proving itself as a handle in extreme drilling conditions for the long period.

Schlumberger Limited

For the intelligent mud pump solution here, you will find automatic adjustment of flow rate, real-time pressure monitoring, and AI-driven maintenance diagnostic systems integrated together. The DuraFlow and GeoFlex series from the company are two models designed to assist the management of drilling fluid, so that the efficiency can be expressed as being the highest and the downtime being the least. To make the drilling process more environmentally friendly, Schlumberger is busy developing quite low-emission, energy-efficient mud pumps to achieve the goal of reducing the carbon footprint in oilfield operations.

Weatherford International Plc.

Weatherford deals primarily with compact, energy-efficient mud pumps that are characterized by modular designs, which facilitate their integration into overall drilling systems. MP series mud pumps from the company are fitted with state-of-the-art pistons, improved the valve system, and noise reduction technology, thus providing a high-quality solution to the needs of the demanding environments. Weatherford is stepping up its automated pump control systems program, paving the way for real-time drilling optimization, thus enhancing the integrity of the well.

Flowserve Corporation

Flowserve is the front-line supplier of specialized high-pressure pumps, particularly for the oil and gas, geothermal, and fluid handling sectors. The two notable lines, Durco and Worthington, provide advantages like maximum flow, chemical resistance, and better sealing techniques while optimizing the life of the pumps and drilling fluid circulation. Flowserve is putting money into anti-corrosion coatings and digital monitoring systems that are a guarantee of sustained performance in high-pressure applications.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by Product Type, 2020 to 2035

Table 4: Global Market Volume (Units) Forecast by Product Type, 2020 to 2035

Table 5: Global Market Value (USD Million) Forecast by Driven System, 2020 to 2035

Table 6: Global Market Volume (Units) Forecast by Driven System, 2020 to 2035

Table 7: Global Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 8: Global Market Volume (Units) Forecast by Application, 2020 to 2035

Table 9: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 10: North America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 11: North America Market Value (USD Million) Forecast by Product Type, 2020 to 2035

Table 12: North America Market Volume (Units) Forecast by Product Type, 2020 to 2035

Table 13: North America Market Value (USD Million) Forecast by Driven System, 2020 to 2035

Table 14: North America Market Volume (Units) Forecast by Driven System, 2020 to 2035

Table 15: North America Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 16: North America Market Volume (Units) Forecast by Application, 2020 to 2035

Table 17: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 18: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 19: Latin America Market Value (USD Million) Forecast by Product Type, 2020 to 2035

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2020 to 2035

Table 21: Latin America Market Value (USD Million) Forecast by Driven System, 2020 to 2035

Table 22: Latin America Market Volume (Units) Forecast by Driven System, 2020 to 2035

Table 23: Latin America Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 24: Latin America Market Volume (Units) Forecast by Application, 2020 to 2035

Table 25: Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 26: Europe Market Volume (Units) Forecast by Country, 2020 to 2035

Table 27: Europe Market Value (USD Million) Forecast by Product Type, 2020 to 2035

Table 28: Europe Market Volume (Units) Forecast by Product Type, 2020 to 2035

Table 29: Europe Market Value (USD Million) Forecast by Driven System, 2020 to 2035

Table 30: Europe Market Volume (Units) Forecast by Driven System, 2020 to 2035

Table 31: Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 32: Europe Market Volume (Units) Forecast by Application, 2020 to 2035

Table 33: Asia Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

Table 35: Asia Pacific Market Value (USD Million) Forecast by Product Type, 2020 to 2035

Table 36: Asia Pacific Market Volume (Units) Forecast by Product Type, 2020 to 2035

Table 37: Asia Pacific Market Value (USD Million) Forecast by Driven System, 2020 to 2035

Table 38: Asia Pacific Market Volume (Units) Forecast by Driven System, 2020 to 2035

Table 39: Asia Pacific Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 40: Asia Pacific Market Volume (Units) Forecast by Application, 2020 to 2035

Table 41: MEA Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 42: MEA Market Volume (Units) Forecast by Country, 2020 to 2035

Table 43: MEA Market Value (USD Million) Forecast by Product Type, 2020 to 2035

Table 44: MEA Market Volume (Units) Forecast by Product Type, 2020 to 2035

Table 45: MEA Market Value (USD Million) Forecast by Driven System, 2020 to 2035

Table 46: MEA Market Volume (Units) Forecast by Driven System, 2020 to 2035

Table 47: MEA Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 48: MEA Market Volume (Units) Forecast by Application, 2020 to 2035

The global mud pump market is projected to reach USD 1,040.4 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.4% over the forecast period.

By 2035, the mud pump market is expected to reach USD 1,604.1 million.

The triplex mud pump segment is expected to dominate due to its higher efficiency, lower maintenance requirements, and widespread use in oil & gas drilling, mining, and construction applications.

Key players in the mud pump market include National Oilwell Varco, Schlumberger Limited, Weatherford International, Gardner Denver, and Honghua Group Limited.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.