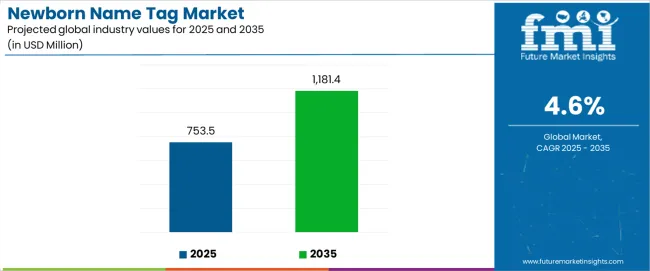

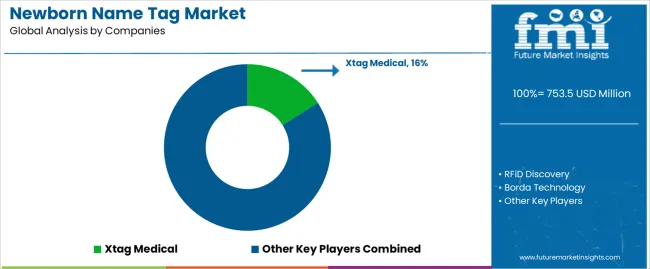

The newborn name tag industry, valued at USD 753.5 million in 2025 and forecast to reach USD 1181.4 million by 2035, reflects a decade-long growth trajectory with an absolute increase of USD 427.9 million and a CAGR of 4.6%. The historical adoption patterns leading into 2025 and the forecasted expansion toward 2035 reveal distinct top trends that shape the market’s evolution from conventional identification bands to advanced digital safety systems.

Historical adoption patterns show that traditional name tag solutions, primarily paper or plastic-based ID bands, dominated hospital maternity wards. These were low-cost, widely distributed, and relied on manual verification by nurses and staff. Demand was largely compliance-driven, tied to basic hospital protocols for infant identification. Limited technology integration meant minimal differentiation, and innovation remained slow before 2025. However, gradual concerns over misidentification incidents and regulatory scrutiny began to increase the adoption of tamper-resistant and water-resistant bands, forming the base for market expansion.

Forecast adoption patterns signal a shift toward technology-enabled safety and integration. Between 2025 and 2030, the emphasis will remain on widespread usage of high-performance traditional ID bands, but RFID-enabled name tags and barcode-based solutions will begin to see stronger adoption. Hospitals will focus on error prevention, ensuring that identification is not only secure but also seamlessly integrated into electronic health record (EHR) systems. This phase reflects the transition from manual checks to semi-automated verification, capturing 44% of forecast growth by 2030. From 2030 to 2035, the adoption pattern becomes more technology-intensive. RFID and NFC-based infant safety tags, with real-time location tracking, alarm systems for unauthorized movement, and compatibility with hospital IT systems, will dominate new installations. Specialized solutions will integrate with maternity ward workflows, including mother-infant pairing systems, biometric authentication, and automated data logging. Healthcare providers will increasingly view name tags not as stand-alone products but as nodes in a larger digital patient safety infrastructure. This phase accounts for 56% of total growth, signaling maturity and mass adoption of digital solutions.

The Newborn Name Tag market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the newborn name tag market progresses through its technology adoption phase, expanding from USD 753.5 million to USD 943.5 million with steady annual increments averaging 4.6% growth. This period showcases the transition from basic identification bands to advanced RFID-enabled systems with enhanced security capabilities and integrated quality control systems becoming mainstream features.

The 2025-2030 phase adds USD 190.0 million to market value, representing 44% of total decade expansion. Market maturation factors include standardization of hospital safety and maternity care protocols, declining component costs for specialized identification formulations, and increasing healthcare awareness of infant safety benefits reaching 95-98% identification accuracy in hospital and postpartum care applications. Competitive landscape evolution during this period features established medical device companies like Xtag Medical and rfiD Discovery expanding their identification portfolios while specialty manufacturers focus on advanced technology development and enhanced security capabilities.

From 2030 to 2035, market dynamics shift toward advanced technology integration and global healthcare expansion, with growth continuing from USD 943.5 million to USD 1181.4 million, adding USD 237.9 million or 56% of total expansion. This phase transition centers on specialized identification systems, integration with automated hospital networks, and deployment across diverse maternity and neonatal care scenarios, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from basic identification capability to comprehensive patient safety optimization systems and integration with electronic health record platforms.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 753.5 million |

| Market Forecast (2035) | USD 1181.4 million |

| Growth Rate | 4.6% CAGR |

| Leading Technology | Traditional ID Bands Product Type |

| Primary Application | Hospital Segment |

The newborn name tag market demonstrates strong fundamentals with traditional ID band systems capturing a dominant share through advanced patient identification and safety optimization capabilities. Hospital applications drive primary demand, supported by increasing patient safety protocols and maternity care technology requirements. Geographic expansion remains concentrated in developed markets with established healthcare infrastructure, while emerging economies show accelerating adoption rates driven by hospital modernization expansion and rising patient safety standards.

Market expansion rests on three fundamental shifts driving adoption across the hospital, maternity care, and healthcare safety sectors. First, patient safety protocol demand creates compelling operational advantages through identification bands that provide immediate infant identification and mother-baby matching without procedural delays, enabling healthcare providers to meet stringent safety standards while maintaining operational productivity and reducing identification errors. Second, hospital information system modernization accelerates as healthcare facilities worldwide seek advanced identification systems that complement traditional patient tracking processes, enabling precise identification and quality control that align with healthcare standards and patient safety regulations.

Third, postpartum care enhancement drives adoption from maternity facilities and birthing centers requiring effective identification solutions that minimize infant mix-up risks while maintaining operational productivity during admission and discharge operations. However, growth faces headwinds from cost sensitivity challenges that vary across healthcare providers regarding the procurement of rfID-enabled bands and specialty identification materials, which may limit adoption in budget-constrained environments. Technical limitations also persist regarding system compatibility and environmental conditions that may reduce effectiveness in diverse hospital technology environments, which affect identification performance and system integration.

The newborn name tag market represents a specialized yet critical patient safety opportunity driven by expanding global hospital births, maternity care infrastructure modernization, and the need for superior identification effectiveness in diverse healthcare applications. As healthcare providers worldwide seek to achieve 95-98% identification accuracy, reduce infant safety incidents, and integrate advanced identification systems with automated platforms, newborn name tags are evolving from basic identification bands to sophisticated safety solutions ensuring patient security and operational efficiency.

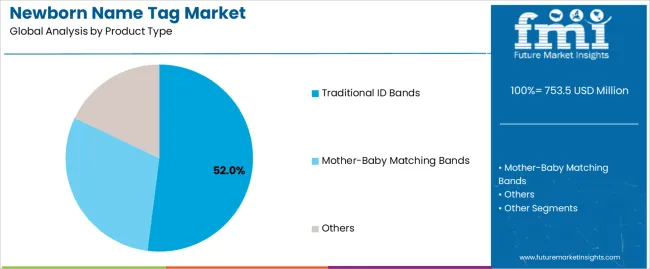

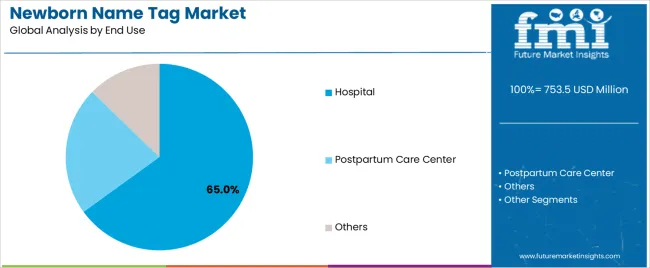

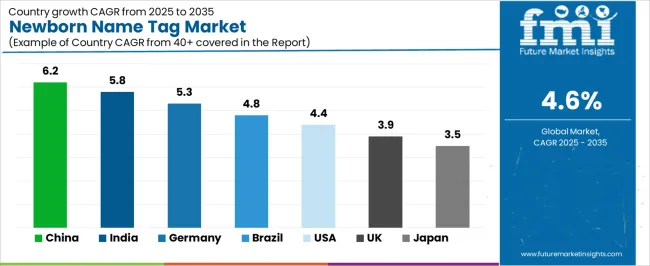

The newborn name tag market's growth trajectory from USD 753.5 million in 2025 to USD 1181.4 million by 2035 at a 4.6% CAGR reflects fundamental shifts in hospital safety requirements and patient identification optimization. Geographic expansion opportunities are particularly pronounced in China and India markets, while the dominance of traditional ID band systems (52.0% market share) and hospital applications (65.0% share) provides clear strategic focus areas.

Strengthening the dominant traditional ID band segment (52.0% market share) through enhanced material formulations, superior durability, and standardized identification systems. This pathway focuses on optimizing band materials, improving printing consistency, extending operational effectiveness to 95-98% readability rates, and developing specialized formulations for diverse applications. Market leadership consolidation through advanced material engineering and hospital integration enables premium positioning while defending competitive advantages against digital alternatives. Expected revenue pool: USD 65-88 million

Rapid hospital modernization and maternity care growth across China (6.2% CAGR) creates substantial expansion opportunities through local production capabilities and technology transfer partnerships. Growing birth rates and government patient safety initiatives drive sustained demand for advanced identification systems. Localization strategies reduce import costs, enable faster technical support, and position companies advantageously for hospital procurement programs while accessing growing domestic markets. Expected revenue pool: USD 58-78 million

Expansion within the dominant hospital segment (65.0% market share) through specialized formulations addressing healthcare safety standards and high-volume maternity requirements. This pathway encompasses automated identification systems, electronic health record integration, and compatibility with diverse hospital information processes. Premium positioning reflects superior identification performance and comprehensive healthcare compliance supporting modern maternity care operations. Expected revenue pool: USD 52-70 million

Strategic expansion into mother-baby matching band applications (35.0% market share) requires enhanced security capabilities and specialized identification formulations addressing maternity operational requirements. This pathway addresses labor and delivery unit safety, postpartum ward security, and neonatal intensive care unit identification with advanced technology engineering for demanding hospital environments. Premium pricing reflects specialized performance requirements and enhanced security standards. Expected revenue pool: USD 42-58 million

Development of specialized identification solutions for postpartum care center applications (25.0% share), addressing specific facility requirements and birthing center demands. This pathway encompasses standalone birthing facilities, maternity hotels, and postpartum recovery centers requiring identification capabilities for patient safety and operational management. Technology differentiation through tailored solutions enables diversified revenue streams while reducing dependency on single facility platforms. Expected revenue pool: USD 35-48 million

Expansion in high-growth India market (5.8% CAGR) through localized production capabilities and partnerships with domestic healthcare providers. This pathway encompasses technology transfer, local supply chain development, and cost-effective solutions for emerging market requirements. Market development through strategic partnerships enables competitive positioning while accessing rapidly expanding hospital and maternity care markets. Expected revenue pool: USD 28-38 million

Development of rfID-enabled identification systems addressing real-time tracking requirements and digital integration across hospital and maternity applications. This pathway encompasses wireless identification, location tracking capabilities, and comprehensive electronic system integration. Premium positioning reflects technology leadership and innovation expertise while enabling access to technology-focused procurement programs and smart hospital partnerships. Expected revenue pool: USD 22-32 million

Primary Classification: The newborn name tag market segments by product type into Traditional ID Bands, Mother-Baby Matching Bands, and Other categories, representing the evolution from basic identification bands to specialized safety solutions for comprehensive patient identification optimization.

Secondary Classification: End-use segmentation divides the newborn name tag market into Hospital, Postpartum Care Center, and Others sectors, reflecting distinct requirements for identification performance, security capacity, and patient safety standards.

Regional Classification: Geographic distribution covers China, India, Germany, Brazil, United States, United Kingdom, and Japan, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by hospital modernization expansion programs.

The segmentation structure reveals technology progression from standard identification band formulations toward specialized safety systems with enhanced security and automation capabilities, while application diversity spans from hospital maternity wards to specialized postpartum care facilities requiring precise identification solutions.

Market Position: Traditional ID band systems command the leading position in the Newborn Name Tag market with approximately 52.0% market share through proven identification features, including superior durability, clear printing capability, and operational optimization that enable healthcare providers to achieve optimal patient identification across diverse hospital and maternity care environments.

Value Drivers: The segment benefits from healthcare provider preference for reliable identification systems that provide consistent performance, reduced identification errors, and operational efficiency optimization without requiring significant technology infrastructure modifications. Established band features enable standardized application processes, identification consistency, and integration with existing hospital protocols, where material reliability and cost-effectiveness represent critical operational requirements.

Competitive Advantages: Traditional ID band systems differentiate through proven material durability, consistent identification characteristics, and compatibility with standard hospital systems that enhance operational effectiveness while maintaining optimal safety suitable for diverse maternity and neonatal applications.

Key market characteristics:

Mother-baby matching band systems maintain a significant 35.0% market share in the Newborn Name Tag market due to their specialized security properties and enhanced safety advantages. These systems appeal to healthcare providers requiring coordinated identification with tamper-evident features for mother-infant matching and infant abduction prevention applications. Market growth is driven by patient safety regulation expansion, emphasizing secure identification solutions and operational safety through optimized matching systems.

Other identification systems capture approximately 13.0% market share through specialized requirements in RFID-enabled tracking, temporary identification solutions, and advanced digital identification requiring technology capabilities for operational optimization and enhanced security control.

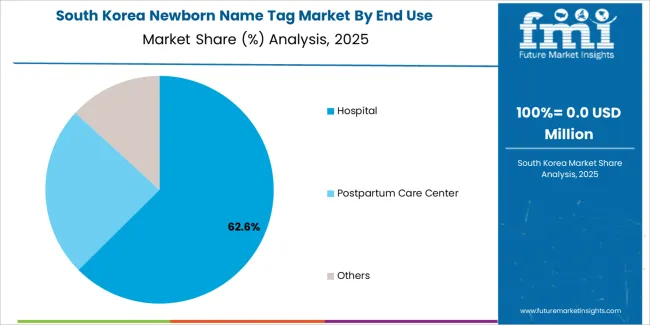

Market Context: Hospital applications dominate the Newborn Name Tag market with approximately 65.0% market share due to widespread adoption of identification systems and increasing focus on newborn safety, mother-baby matching, and patient identification management applications that minimize identification errors while maintaining healthcare safety standards.

Appeal Factors: Hospital administrators and maternity ward staff prioritize system reliability, identification accuracy, and integration with existing patient safety infrastructure that enables coordinated identification application across multiple delivery and postpartum care protocols. The segment benefits from substantial healthcare safety investment and modernization programs that emphasize the acquisition of identification systems for quality control and patient safety applications.

Growth Drivers: Hospital maternity ward expansion programs incorporate newborn identification bands as standard materials for patient safety operations, while increasing birth volumes increase demand for advanced identification capabilities that comply with healthcare safety standards and minimize identification incidents.

Market Challenges: Varying hospital safety standards and facility technology differences may limit system standardization across different healthcare facilities or operational scenarios.

Application dynamics include:

Postpartum care center applications capture approximately 25.0% market share through specialized identification requirements in standalone birthing facilities, maternity recovery centers, and postpartum service facilities. These facilities demand reliable identification systems capable of operating in smaller-scale environments while providing effective patient safety and mother-infant matching capabilities.

Others applications account for approximately 10.0% market share, including home birth services, mobile birthing units, and specialty neonatal transport requiring identification capabilities for patient safety and tracking optimization.

Growth Accelerators: Hospital patient safety expansion drives primary adoption as newborn identification bands provide infant safety capabilities that enable healthcare providers to meet stringent patient safety standards without excessive operational delays, supporting maternity care operations and hospital missions that require precise patient identification applications. Maternity care quality improvement accelerates market expansion as facilities seek effective identification systems that minimize infant mix-up incidents while maintaining operational effectiveness during labor, delivery, and postpartum care scenarios. Healthcare safety spending increases worldwide, creating sustained demand for identification systems that complement traditional patient tracking processes and provide operational flexibility in complex hospital environments.

Growth Inhibitors: Cost sensitivity challenges vary across healthcare providers regarding the procurement of identification bands and specialty materials, which may limit operational flexibility and market penetration in regions with budget constraints or cost-sensitive healthcare operations. Technical compatibility limitations persist regarding system integration and technology infrastructure that may reduce effectiveness in facilities with legacy hospital information systems or limited IT capabilities, affecting identification tracking and data management. Market fragmentation across multiple hospital protocols and maternity care standards creates compatibility concerns between different identification suppliers and existing patient safety infrastructure.

Market Evolution Patterns: Adoption accelerates in large hospital systems and premium maternity facilities where safety requirements justify identification system costs, with geographic concentration in developed markets transitioning toward mainstream adoption in emerging economies driven by hospital modernization expansion and patient safety standard development. Technology development focuses on enhanced identification materials, improved rfID integration, and connectivity with electronic health record systems that optimize patient safety and operational effectiveness. The newborn name tag market could face disruption if alternative identification technologies or digital tracking systems significantly limit the deployment of band-based identification in hospital or maternity applications, though the material's unique combination of reliability, cost-effectiveness, and ease of use continues to make it essential in critical patient safety applications.

The Newborn Name Tag market demonstrates varied regional dynamics with Growth Leaders including China (6.2% CAGR) and India (5.8% CAGR) driving expansion through hospital maternity capacity additions and healthcare infrastructure programs. Steady Performers encompass Germany (5.3% CAGR) and Brazil (4.8% CAGR), benefiting from established healthcare industries and advanced patient safety adoption. Mature Markets feature the United States (4.4% CAGR), United Kingdom (3.9% CAGR), and Japan (3.5% CAGR), where specialized hospital applications and patient safety technology integration support consistent growth patterns.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| Brazil | 4.8% |

| United States | 4.4% |

| United Kingdom | 3.9% |

| Japan | 3.5% |

Regional synthesis reveals China and India markets leading adoption through hospital maternity ward expansion and healthcare infrastructure development, while Germany and Brazil maintain steady expansion supported by patient safety technology advancement and hospital standardization requirements. North American and European markets show moderate growth driven by hospital safety applications and identification technology integration trends.

The China market emphasizes advanced identification features, including precision printing control and integration with comprehensive hospital platforms that manage patient safety quality, efficiency optimization, and cost control applications through unified monitoring systems. The country demonstrates strongest growth at 6.2% CAGR, driven by hospital modernization initiatives, increasing birth volumes in urban centers, and government patient safety mandates that support identification system integration. Chinese hospital administrators and maternity care providers prioritize operational effectiveness with newborn identification bands delivering consistent patient safety performance through standardized material formulation and hospital adaptation capabilities.

Technology deployment channels include major maternity hospitals, specialized medical device distributors, and healthcare procurement programs that support professional applications for complex hospital maternity operations and patient safety applications. Hospital information system integration capabilities with established electronic health record platforms expand market appeal across diverse operational requirements seeking safety and reliability benefits.

Performance Metrics:

India demonstrates robust market development with a 5.8% CAGR, driven by rapid hospital infrastructure development, expanding maternity care capacity, and government initiatives supporting patient safety standards across major cities including Mumbai, Delhi, Bangalore, and Chennai. Hospital maternity ward modernization and patient identification requirements drive primary demand, while growing private hospital chains and government healthcare facilities create diversified application opportunities. Government Ayushman Bharat healthcare coverage expansion and National Health Mission maternal health programs support sustained expansion through improved safety protocol implementation and facility upgrades.

The convergence of rising birth rates in urban areas, increasing hospital delivery percentages, and healthcare quality improvement initiatives positions India as a key emerging market for newborn identification solutions. Growing awareness of patient safety standards and infant abduction prevention drives adoption of standardized identification systems. Rising healthcare expenditure and hospital accreditation requirements enable greater implementation of comprehensive patient safety protocols requiring identification bands.

Market Characteristics:

Germany's advanced healthcare market demonstrates sophisticated newborn identification deployment with documented operational effectiveness in hospital maternity applications and patient safety facilities through integration with existing hospital information systems and care infrastructure. The country leverages engineering expertise in medical devices and hospital systems integration to maintain strong growth at 5.3% CAGR. Medical centers in Berlin, Munich, Hamburg, and Frankfurt showcase premium installations where identification systems integrate with comprehensive hospital platforms and patient safety management systems to optimize maternity care outcomes and identification accuracy.

German medical device suppliers prioritize system reliability and EU Medical Device Regulation compliance in identification band development, creating demand for premium identification systems with advanced features, including rfID integration capabilities and standardized patient safety protocols. The newborn name tag market benefits from established healthcare infrastructure and consistent investment in patient safety technologies that provide long-term quality benefits and compliance with international healthcare and safety standards.

Market Intelligence Brief:

Brazil maintains steady expansion at 4.8% CAGR through growing hospital delivery rates, expanding maternity care infrastructure, and government support for patient safety improvement across major metropolitan regions including São Paulo, Rio de Janeiro, and Brasília. The Unified Health System (SUS) procurement programs and private hospital sector expansion drive identification band adoption for maternity and neonatal patient safety applications. Regional healthcare development initiatives and infrastructure investment support consistent market growth, while maternal health program modernization creates additional demand opportunities across diverse healthcare segments.

The country's focus on reducing maternal and infant mortality through improved hospital safety and patient identification supports sustained market momentum. Growing middle class population with increased access to private hospital maternity services expands the addressable market for premium identification solutions. Medical device localization initiatives and partnerships with international suppliers enhance supply chain reliability and cost competitiveness for healthcare providers.

Strategic Market Indicators:

The USA market emphasizes advanced identification features and patient safety innovation at 4.4% CAGR, driven by hospital maternity excellence, Joint Commission safety requirements, and comprehensive healthcare quality initiatives. American hospital administrators and maternity care staff prioritize operational effectiveness with newborn identification bands delivering consistent patient safety performance through advanced material validation, regulatory compliance, and hospital system integration capabilities. The newborn name tag market benefits from robust healthcare regulatory framework and extensive patient safety research infrastructure supporting continuous product innovation and quality improvement.

Technology deployment occurs through major hospital systems, specialized maternity centers, and integrated healthcare delivery networks that emphasize evidence-based safety practices and outcomes optimization. Strong reimbursement frameworks and hospital quality incentive programs support adoption of standardized identification systems. The mature healthcare market demonstrates steady demand driven by approximately 3.6 million annual births and stringent patient safety accreditation requirements necessitating comprehensive identification protocols.

Performance Metrics:

The UK market holds steady growth at 3.9% CAGR, driven by National Health Service maternity safety initiatives, specialty birthing centers, and patient identification modernization programs. British maternity facilities implement standardized identification systems to enhance patient safety and support care delivery that aligns with NHS quality standards and National Patient Safety Agency guidelines. Market expansion benefits from centralized procurement frameworks that emphasize clinical safety, cost-effectiveness, and standardization across the integrated healthcare system.

The NHS Maternity Transformation Programme's focus on safer maternity care supports sustained investment in patient identification technologies and safety protocols. Regional maternity networks coordinate care delivery and safety system adoption across community midwifery, birthing centers, and hospital maternity units. Growing emphasis on patient safety incident reduction and standardized identification influences procurement criteria favoring clinically validated systems with demonstrated error prevention capabilities.

Strategic Market Indicators:

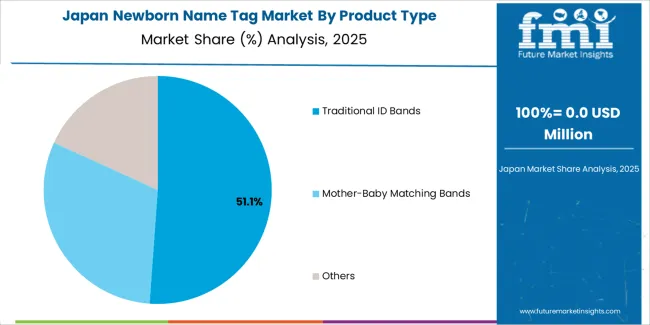

Japan demonstrates moderate market development with a 3.5% CAGR, distinguished by healthcare providers' preference for high-quality identification systems that integrate seamlessly with existing hospital protocols and provide reliable long-term performance in specialized maternity applications. The newborn name tag market prioritizes advanced features, including precision printing quality, superior material durability, and integration with comprehensive hospital platforms that reflect Japanese healthcare industry expectations for technological sophistication and safety excellence. Stringent quality standards through the Ministry of Health, Labor and Welfare regulations ensure rigorous validation and clinical safety.

High-specification maternity and neonatal applications drive demand, supported by advanced medical device quality control and hospital safety initiatives. Japanese healthcare providers emphasize material safety, consistent identification performance, and comprehensive documentation that aligns with demanding medical standards. The focus on premium quality applications, meticulous safety protocols, and zero-defect objectives supports stable growth despite mature market conditions and declining birth rates.

Market Characteristics:

The Newborn Name Tag market in Europe is projected to grow from USD 211.0 million in 2025 to USD 330.8 million by 2035, registering a CAGR of 4.6% over the forecast period. Germany is expected to maintain its leadership position with a 36.0% market share in 2025, declining slightly to 35.6% by 2035, supported by its advanced maternity healthcare infrastructure and major hospital maternity centers in Berlin, Munich, and Hamburg.

United Kingdom follows with a 26.0% share in 2025, projected to reach 26.3% by 2035, driven by comprehensive NHS maternity safety programs and patient identification standardization initiatives. France holds a 19.0% share in 2025, expected to reach 19.2% by 2035 through specialized maternity applications and hospital safety innovation programs. Italy commands an 11.0% share, while Spain accounts for 5.0% in 2025. The Rest of Europe region is anticipated to maintain 3.0% in both 2025 and 2035, reflecting steady adoption in Nordic countries and Central & Eastern European maternity facilities implementing patient safety modernization programs.

In Japan, the Newborn Name Tag market prioritizes traditional ID band systems, which capture the dominant share of hospital maternity and neonatal care installations due to their advanced features, including precision printing clarity and seamless integration with existing patient safety infrastructure. Japanese healthcare providers emphasize reliability, quality assurance, and long-term performance consistency, creating demand for traditional systems that provide dependable identification capabilities and standardized material performance based on hospital requirements and safety protocols. Mother-baby matching bands and rfID-enabled systems maintain secondary positions primarily in specialized high-security applications and university hospital installations where comprehensive tracking functionality meets operational requirements without compromising cost-effectiveness.

Market Characteristics:

In South Korea, the newborn name tag market structure favors international medical device companies, including Xtag Medical, rfiD Discovery, and CenTrak, which maintain significant positions through comprehensive product portfolios and established healthcare networks supporting both hospital maternity and postpartum care installations. These providers offer integrated solutions combining advanced identification band systems with professional implementation services and ongoing technical support that appeal to Korean healthcare administrators seeking reliable patient safety systems. Local medical device distributors and healthcare service providers capture moderate market share by providing localized clinical support capabilities and competitive pricing for standard maternity facility installations, while domestic manufacturers focus on specialized applications and cost-effective solutions tailored to Korean healthcare characteristics and hospital standards.

Channel Insights:

The Newborn Name Tag market operates with moderate concentration, featuring approximately 12-16 meaningful participants, where leading companies control roughly 48-53% of the global market share through established hospital relationships and comprehensive patient safety portfolios. Competition emphasizes product reliability, regulatory compliance, and hospital system integration rather than price-based rivalry. The leading company, Xtag Medical, commands approximately 16.0% market share through its comprehensive identification band product line and extensive hospital maternity presence.

Market Leaders encompass Xtag Medical, rfiD Discovery, and Borda Technology, which maintain competitive advantages through extensive patient safety expertise, global hospital distribution networks, and comprehensive system integration capabilities that create healthcare provider switching costs and support premium pricing. These companies leverage decades of medical identification technology experience and ongoing product development investments to develop advanced identification systems with precision printing control and patient safety monitoring features.

Technology Innovators include Reflex Systems, CenTrak, and LonSolutions, which compete through specialized rfID technology focus and innovative real-time tracking interfaces that appeal to hospitals seeking advanced identification capabilities and operational flexibility. These companies differentiate through rapid technology development cycles and specialized maternity ward and neonatal application focus.

Regional Specialists feature companies like Litum and RTLS Communications, which focus on specific geographic markets and specialized applications, including rfID-based tracking systems and integrated patient safety solutions. Market dynamics favor participants that combine reliable identification materials with advanced technology capabilities, including real-time location tracking and automatic safety alert optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 753.5 Million |

| Product Type | Traditional ID Bands, Mother-Baby Matching Bands, Others |

| End Use | Hospital, Postpartum Care Center, Others |

| Regions Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Key Companies Profiled | Xtag Medical, rfiD Discovery, Borda Technology, Reflex Systems, CenTrak, LonSolutions, Litum, RTLS Communications |

| Additional Attributes | Dollar sales by product type and end-use categories, regional adoption trends across China, India, and Germany, competitive landscape with medical device manufacturers and patient safety suppliers, hospital preferences for identification reliability and system compatibility, integration with hospital information platforms and electronic health record systems, innovations in rfID-enabled identification formulations and material durability, and development of standardized patient safety solutions with enhanced performance and operational optimization capabilities. |

The global newborn name tag market is estimated to be valued at USD 753.5 million in 2025.

The market size for the newborn name tag market is projected to reach USD 1,181.4 million by 2035.

The newborn name tag market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in newborn name tag market are traditional id bands, mother-baby matching bands and others.

In terms of end use, hospital segment to command 65.0% share in the newborn name tag market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enamel Remineralization and White Spot Lesion Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Enameled Cookware Market Growth – Size, Trends & Forecast 2024-2034

Domain Name System (DNS) Firewall Market

Porcelain Enamel Coatings Market Size and Share Forecast Outlook 2025 to 2035

United States Ornamental Fish Market Analysis - Trends, Growth & Forecast 2025 to 2035

Tags Market Insights - Growth & Demand 2025 to 2035

Tagatose Market Analysis by Application, Sweetness Profile, Industry Demand, and Regional Forecast from 2025 to 2035

Metagenomics Market Trends - Industry Analysis & Forecast 2025 to 2035

Outage Management System Market Insights – Forecast 2025-2035

Voltage Tester Market Size and Share Forecast Outlook 2025 to 2035

Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Voltage Regulator For Advanced Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Voltage Detector Market Size and Share Forecast Outlook 2025 to 2035

Voltage Transducer Market Size and Share Forecast Outlook 2025 to 2035

Voltage Controlled Oscillators Market Size and Share Forecast Outlook 2025 to 2035

Postage Stamp Paper Market Size, Share & Forecast 2025 to 2035

Global Vintage Packaging Market Growth – Trends & Forecast 2024-2034

Market Share Breakdown of Heritage Tourism Service Providers

Global Heritage Tourism Market Analysis by Experience Type, by End User, and by Region - Forecast for 2025 to 2035

NFC Tag ICs Market Analysis by Memory, Connection, Application, Industry and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA