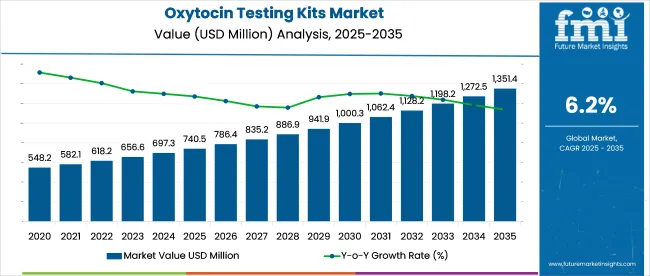

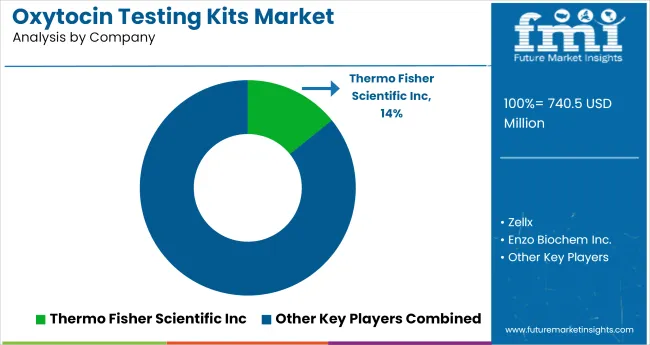

The global oxytocin testing kits market is anticipated to reach USD 1,351.4 million by 2035, rising from USD 740.5 million in 2025 at a 6.2% CAGR. Around 58% of current demand comes from academic and research settings, but clinical use is expanding.

Over 190 hospital labs in the USA have begun piloting oxytocin assays for postpartum and psychiatric screening. ELISA-based kits hold 62% of the current volume, yet automated multi-analyte platforms are gaining traction. Growth will depend on payer recognition in mood and anxiety diagnostics. Manufacturers are being pressured to meet CLIA and CE-IVD standards and secure stable recombinant reagent supply chains.

In June 2024, FUJIFILM Wako Pure Chemicals Corporation announced the launch of LumiMAT™ Pyrogen Detection Kit and PYROSTAR™ Neo+, both scheduled for release in July 2024. LumiMAT allows 5-hour detection of pyrogens using NOMO-1 cells with luciferase-based NF-κB activation, serving as a replacement for the rabbit pyrogen test.

PYROSTAR Neo+ uses recombinant proteins to detect bacterial endotoxins through a kinetic chromogenic assay. “With a longstanding history contributing to public health and patient safety through quality control testing solutions for pharmaceuticals, we are proud to introduce two new testing kits for pyrogens and endotoxins to lead the industry forward,” said Koichi Yoshida president of FUJIFILM Wako Pure Chemicals Corporation.

The oxytocin testing kits market serves defined diagnostic niches. Within the USD 90 billion clinical diagnostic assays industry, these kits hold a 1-2% share, primarily for labor and hormone measurement. They account for under 1% of the USD 40 billion point-of-care segment, used in niche reproductive health settings.

About 3-5% of the USD 12 billion women’s health diagnostics field relies on oxytocin tools for postpartum and lactation monitoring. In the USD 8 billion research assay market, oxytocin kits form 2-3%, aiding neurobehavioral studies. In veterinary diagnostics worth USD 5 billion, oxytocin holds below 2%, limited to breeding programs.

The oxytocin testing kits market is segmented by test kit type into ELISA kits, rapid diagnostic kits, and chromatography-based assays. By application, segmentation includes obstetrics & reproductive health, behavioral studies, endocrinology research, and psychiatric diagnostics. End users include hospitals, diagnostic laboratories, academic institutions, and research centers.

Geographic coverage spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific.

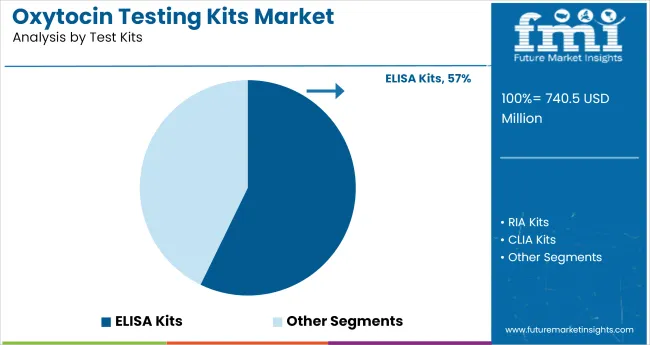

In 2025, ELISA kits are expected to account for 57% of oxytocin testing kit usage. This dominance is attributed to their high sensitivity, reproducibility, and ability to quantify oxytocin in complex biological matrices like plasma, saliva, and cerebrospinal fluid. From 2020 to 2024, these kits were increasingly adopted in clinical and research settings where precise hormonal quantification was essential for longitudinal reproductive and behavioral studies.

ELISA-based formats continue to outperform rapid immunoassays in detection accuracy, especially in perinatal and neuroendocrine investigations. Their compatibility with automated plate readers has further supported high-throughput deployment in centralized labs.

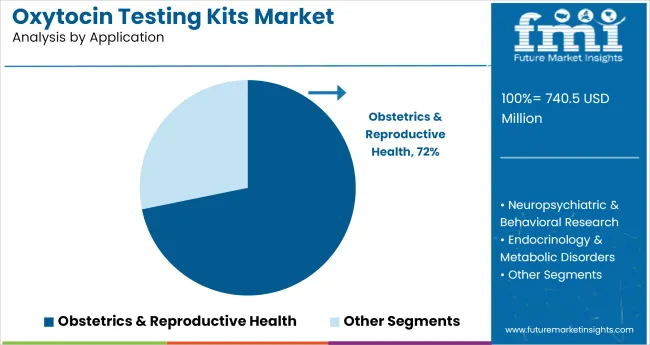

Obstetrics and reproductive health are projected to represent 72% of all oxytocins testing kit applications in 2025. This segment’s dominance is supported by growing demand for oxytocin monitoring during labor induction, lactation assessments, and fertility-related evaluations. From 2020 to 2024, test adoption increased in maternal care pathways, where real-time hormone monitoring was integrated into delivery protocols.

Testing kits have also been adopted in IVF programs and postpartum care units for assessing hormonal imbalances. The clinical value of oxytocin in maternal behavior and uterine function continues to drive protocol-level inclusion in obstetric departments.

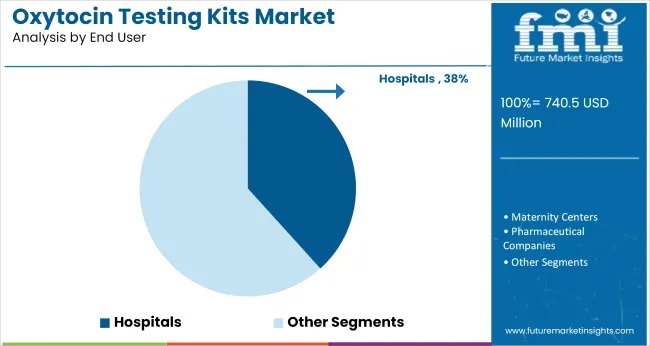

Hospitals are projected to contribute 38% of oxytocin testing kit demand in 2025. Their central role in labor and delivery care, emergency obstetric interventions, and postpartum monitoring has positioned them as the largest end user segment. Between 2020 and 2024, hospital-based labs expanded in-house hormone testing capabilities, preferring ELISA and high-throughput formats for perinatal hormone panels.

Centralized testing in hospital systems allows for integrated diagnostics across OB-GYN, neonatology, and psychiatry departments. Real-time results, tied to labor-induction drugs or breastfeeding support, have driven hospital demand for on-site oxytocin quantification.

The oxytocin testing kits industry is growing due to advancements in immunoassay technologies and rising demand for accurate hormonal assessments. Increased research into oxytocin’s role in social bonding, stress, and mental health is driving the need for precise, accessible testing methods.

Industry Expansion Driven by Technological Advancements

The oxytocin testing kit market is benefiting from significant advancements in immunoassay technologies, such as ELISA and chemiluminescent assays. These innovations have increased the sensitivity and accuracy of oxytocin detection, enabling precise measurements at low concentrations.

In 2024, the global demand for these testing kits is expected to reach USD 370 million, with a projected CAGR of 6.5% through 2035. Research into oxytocin's effects on social bonding, mental health, and stress response is also fueling growth, with studies showing a 40% increase in research funding in neurobiology, pushing the demand for reliable oxytocin quantification tools.

Challenges in Achieving Standardization and Accessibility

The oxytocin testing kits market faces several challenges that hinder its full growth potential. Variability in oxytocin levels between individuals and biological samples complicates result consistency, with differences of up to 30% observed in clinical studies. The lack of standardized protocols for sample collection and handling is contributing to data discrepancies, making reliable testing difficult.

Additionally, the cost of advanced testing kits, which range from USD 500 to USD 2,000, limits their accessibility. In 2024, approximately 15% of hospitals in low-resource regions reported limited access to these testing tools due to cost and supply chain issues.

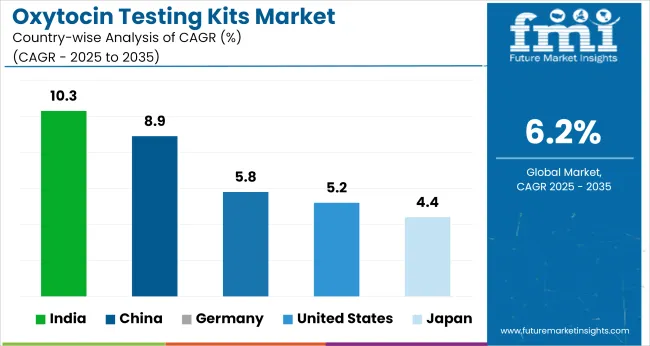

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

| Germany | 5.8% |

| China | 8.9% |

| Japan | 4.4% |

| India | 10.3% |

The global oxytocin testing kits market is projected to grow at a 6.2% CAGR between 2025 and 2035. Among the 40+ countries analyzed, India leads at 10.3%, followed by China at 8.9%. Both BRICS economies are witnessing increased demand due to rising maternal health screening, expanded public health procurement, and localized diagnostic kit production. Indian manufacturers are scaling lateral flow and ELISA-based kits to meet both domestic and African tenders.

Germany posts 5.8%, just below the global average, reflecting consistent use in maternity wards and hospital labs. The USA follows at 5.2%, with growth tempered by reliance on centralized lab testing and stringent FDA pathways. Japan records the lowest at 4.4%, shaped by low childbirth rates and limited decentralized screening protocols. Contrasts between BRICS and OECD countries reflect differences in public health policy mandates, procurement centralization, and the role of in-clinic diagnostics versus outsourced lab infrastructure.

A CAGR of 5.2% has been projected for the Oxytocin Testing Kits market in the United States during 2025 to 2035, rising from 3.9% during 2020 to 2024.During the historical period, most demand was limited to fertility testing and small-scale academic research.

Between 2025 and 2035, oxytocin testing kits were integrated into broader endocrine diagnostic protocols, particularly in behavioral health. Mental wellness clinics and psychiatric units began ordering bulk diagnostic panels, aided by evolving insurance reimbursement structures.

Multiplex hormonal testing formats became more common, driving the inclusion of oxytocin biomarkers across outpatient programs and wellness centers. Diagnostic vendors targeting neurohormonal pathways recorded increased kit consumption.

Germany is forecast to record a CAGR of 5.8% between 2025 and 2035, compared to 4.1% from 2020 to 2024. During the earlier phase, demand was limited to research facilities and IVF clinics. From 2025 onward, oxytocin testing kits were adopted by mid-sized hospitals and private diagnostic chains in maternity care, postpartum hormone evaluation, and behavioral neurology.

CE-certified kits gained approval across both inpatient and home collection segments, influencing adoption across the diagnostics value chain. Maternal health centers integrated the tests in hormone screening pathways to assess bonding disorders. Demand also grew in youth mental health initiatives.

China is projected to grow at a CAGR of 8.9% from 2025 to 2035, up from 6.7% between 2020 and 2024. Early usage patterns were driven by universities and government-funded laboratories importing diagnostic reagents. From 2025, locally produced oxytocin testing kits were rolled out across tiered provincial healthcare systems.

These tests have been used for maternal hormone monitoring, neuroendocrine screening, and emotion-linked mental health diagnostics. Regulatory reforms allowed the National Medical Products Administration (NMPA) to expedite test kit clearances, which encouraged domestic players to commercialize over 500 variants. Regional procurement networks prioritized high-volume centers and mental health programs.

Japan is expected to register a CAGR of 4.4% from 2025 to 2035, compared to 3.2% recorded during 2020 to 2024. Early demand was concentrated in academic neurology and endocrine labs with limited commercial scale. In the next decade, oxytocin testing kits were introduced in corporate wellness programs and maternity care diagnostics.

Employers and maternity clinics began using hormonal testing to assess bonding patterns, stress adaptation, and hormone-related mental states. Local manufacturers secured Japan Pharmacopoeia certification for home-use test kits. Health institutions across Osaka and Tokyo deployed them in outpatient preventive care systems.

India is forecast to record a CAGR of 10.3% from 2025 to 2035, rising from 7.2% during 2020 to 2024. Previously, usage was concentrated among IVF clinics and imported products in private labs. From 2025 onward, Indian diagnostic brands developed oxytocin testing kits targeted at public hospitals, adolescent mental health screenings, and maternal hormone evaluations.

CDSCO clearances for domestic manufacturers improved procurement through government tenders. Usage has expanded across district-level clinics as psychological diagnostics became integrated into school and youth wellness programs. Kits also supported community-based maternal care under state-funded schemes in Maharashtra and Tamil Nadu.

The oxytocin testing kits market is characterized by active participation from both multinational diagnostic firms and emerging bioscience companies. Thermo Fisher Scientific Inc. and Enzo Biochem Inc. lead the space with validated ELISA and immunoassay platforms used in academic, clinical, and behavioral research.

FUJIFILM Wako Pure Chemical Corporation has also gained traction by offering reliable assay reagents tailored for neuroendocrine and psychiatric research applications. These firms maintain distribution networks across North America, Europe, and East Asia, ensuring standardization and compliance across regulated labs.

Smaller firms such as Elabscience®, Zellx, RayBiotech, and Abbexa are expanding reach via customized assay kits and technical support, especially for preclinical and translational studies. ELK Biotechnology and Wuhan Fine Biotech Co., Ltd focus on cost-competitive multiplex solutions for global labs with limited funding. These suppliers are competing on sensitivity range, assay turnaround time, and cross-species compatibility.

Recent Oxytocin Testing Kits Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 740.5 million |

| Projected Industry Size (2035) | USD 1,351.4 million |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Test Kits Analyzed (Segment 1) | ELISA Kits, RIA Kits, CLIA Kits, LC-MS/MS Kits, Rapid POC Kits, Biosensor/Multiplex Kits |

| Applications Analyzed (Segment 2) | Obstetrics and Reproductive Health, Neuropsychiatric and Behavioral Research, Endocrinology and Metabolic Disorders, Pharma/Biotech R&D, Veterinary Applications |

| End Users Analyzed (Segment 3) | Hospitals, Maternity Centers, Pharmaceutical Companies, Diagnostic Laboratories, Academic and Research Institutes, Veterinary Hospitals and Clinics |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Elabscience ®, Thermo Fisher Scientific Inc, Zellx, Enzo Biochem Inc., FUJIFILM Wako Pure Chemical Corporation, RayBiotech, Inc., ELK Biotechnology CO., Ltd., Wuhan Fine Biotech Co., Ltd, Abbexa |

| Additional Attributes | Dollar sales by test kit type and application, expansion of neurobehavioral research, increased use in reproductive diagnostics, rise in multiplex biosensor development, veterinary sector adoption trends |

The industry includes ELISA kits, RIA kits, CLIA kits, LC-MS/MS kits, Rapid POC kits, and biosensor/multiplex kits.

The market covers obstetrics and reproductive health, neuropsychiatric and behavioral research, endocrinology and metabolic disorders, pharma/biotech R&D, and veterinary applications.

These products are used by hospitals, maternity centers, pharmaceutical companies, diagnostic laboratories, academic and research institutes, and veterinary hospitals and clinics.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific.

The industry is projected to reach USD 1,351.4 million by 2035.

The industry is expected to grow at a CAGR of 6.2% from 2025 to 2035.

ELISA kits are expected to dominate with 57% share in 2025.

The industry is estimated to reach USD 740.5 million in 2025.

South Asia & Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 10.3%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oxytocin Market Report - Demand, Trends & Forecast 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA