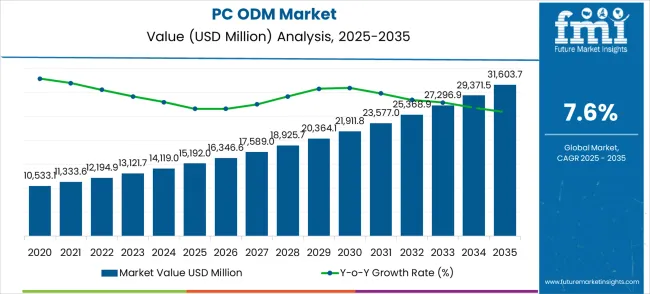

The PC ODM (Original Design Manufacturer) market begins its decade journey from a USD 15,192.0 million foundation in 2025, setting the stage for substantial expansion ahead. The first half of the decade witnesses steady momentum building, with market value climbing from USD 16,346.6 million in 2026 to USD 23,577.0 million by 2030. This initial phase reflects growing demand for customized computing solutions and increasing outsourcing trends across global technology companies.

The latter half will witness accelerated growth dynamics, propelling the market from USD 25,368.9 million in 2031 to reach USD 31,603.7 million by 2035. Dollar additions during the 2030-2035 period outpace those of the earlier period, with annual increments averaging USD 1,605.7 million, compared to USD 1,677.2 million in the first phase. This progression represents a 108.1% total value increase over the forecast decade.

Market maturation factors include expanding gaming laptop demand, enterprise digital transformation initiatives, and industrial PC modernization requirements. The 7.6% compound annual growth rate positions participants to capitalize on USD 16,411.7 million in additional market value creation. This trajectory signals robust opportunities for design innovation, manufacturing optimization, and end-user solution providers across the global electronics landscape.

Market expansion unfolds through two distinct growth periods with different competitive characteristics for each phase. The 2025-2030 foundation period delivers USD 8,385.0 million in value additions, representing 55.2% growth from the baseline. Market dynamics during this phase center on technology platform standardization, supply chain optimization, and end-user customization acceleration across notebook and desktop segments.

The 2030-2035 acceleration period generates USD 8,026.7 million in incremental value, reflecting 34.0% growth from the 2030 position. This phase exhibits mature market characteristics with enhanced competition, product differentiation strategies, and geographic expansion initiatives. Dollar contributions shift from foundational manufacturing development to market share optimization and technological advancement in specialized computing solutions.

The competitive landscape evolves from early market development to established player positioning. The first period emphasizes manufacturing capability building and client relationship establishment. The second period witnesses intensified competition for premium market segments and expansion of geographical territories. Market maturation factors include standardized design requirements, automated production integration capabilities, and cross-industry application development across gaming, enterprise, and industrial computing sectors.

| Metric | Value |

|---|---|

| Market Value (2025) → | USD 15,192 million |

| Market Forecast (2035) ↑ | USD 31,603.7 million |

| Growth Rate ★ | 7.6% CAGR |

| Leading Product Type → | Notebook PCs |

| Primary Source → | Consumer PC |

Market expansion rests on three fundamental shifts driving technology demand acceleration:

The growth faces headwinds from supply chain disruptions and component shortage challenges. Economic uncertainty affects enterprise IT spending decisions and consumer purchasing power. Geopolitical tensions create supply chain risks and manufacturing location constraints for global ODM operations.

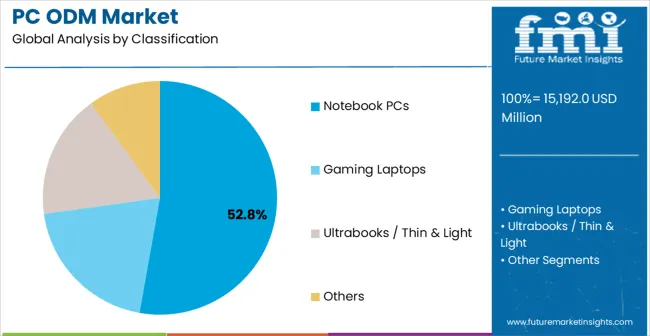

Market Position: Notebook PCs establish clear market leadership through versatility advantages and broad application suitability across consumer, enterprise, and educational segments. Portable computing systems enable flexible work arrangements and remote productivity requirements. Advanced design capabilities accommodate diverse performance requirements while maintaining cost competitiveness compared to desktop alternatives.

Value Drivers: Processor advancement enables enhanced performance within compact form factors while maintaining battery efficiency. Display technology improvements provide superior visual experiences and reduce power consumption requirements. Modular design approaches enable customization for specific client requirements while maintaining manufacturing efficiency and cost optimization.

Competitive Advantages: Notebook platforms offer design flexibility compared to standardized desktop form factors requiring extensive customization. Supply chain optimization reduces component costs through volume purchasing and manufacturing scale economies. Technology integration capabilities enable incorporation of latest processor, memory, and connectivity technologies within established design frameworks.

Market Challenges: Component supply chain disruptions create availability constraints and cost pressures affecting profitability margins. Design complexity increases engineering requirements and development timeframes for new product introductions. Competition from tablet and hybrid devices creates market share pressure in certain consumer segments requiring differentiated positioning strategies.

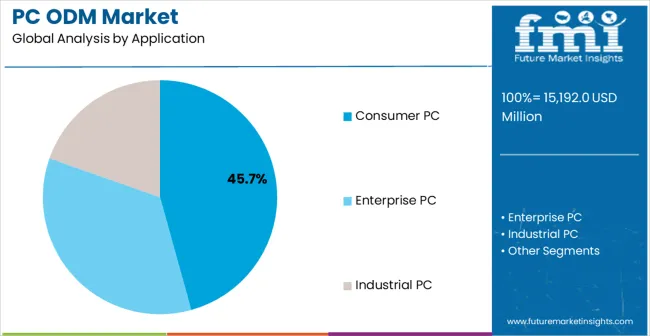

Strategic Market Importance: Consumer PC applications represent the primary demand driver for customized computing solutions across diverse user requirements and price points. Gaming enthusiasts, content creators, and general productivity users require specialized configurations optimized for specific applications. Market demand reflects growing preference for personalized computing experiences and performance optimization tailored to individual usage patterns.

Market Dynamics Q&A:

Business Logic: Consumer market prioritizes value optimization and performance customization, making ODM solutions essential for meeting diverse requirements efficiently. Cost competitiveness occurs through manufacturing scale and supply chain optimization. Brand differentiation requires customized solutions that reflect specific user requirements and application optimization.

Forward-looking Implications: Gaming market expansion creates opportunities for specialized high-performance computing solutions with advanced cooling and graphics capabilities. Content creation growth demands workstation-class performance in portable form factors. Digital lifestyle integration requires connectivity and multimedia capabilities optimized for diverse consumer applications.

Growth Accelerators: Digital transformation initiatives drive demand for customized computing solutions across enterprise and consumer segments worldwide. Gaming market expansion creates critical needs for specialized hardware configurations and thermal management solutions optimized for high-performance applications.

Remote work adoption mandates portable computing solutions with enhanced connectivity and productivity features. Supply chain optimization requirements encourage outsourcing to specialized manufacturers with established component relationships and manufacturing expertise. Technology refresh cycles accelerate due to processor advancement and software requirement evolution demanding regular hardware upgrades.

Growth Inhibitors: Component supply chain disruptions create availability constraints and cost pressures affecting manufacturing schedules and profitability margins. Geopolitical tensions introduce supply chain risks and manufacturing location restrictions for global operations.

Economic uncertainty affects enterprise IT spending decisions and consumer purchasing power reducing market demand. Standardization trends in certain market segments reduce customization requirements and ODM value proposition. Regulatory compliance requirements increase operational complexity and costs for international manufacturing operations.

Market Evolution Patterns: Artificial intelligence integration enables enhanced user experiences and productivity features requiring specialized hardware configurations. Sustainability initiatives drive development of environmentally friendly manufacturing processes and energy-efficient product designs. Modular design approaches enable rapid customization and reduced development timeframes for new client requirements.

Edge computing trends create demand for specialized industrial PC solutions with enhanced processing capabilities and connectivity features. 5G integration requirements necessitate advanced antenna design and connectivity optimization for mobile computing platforms.

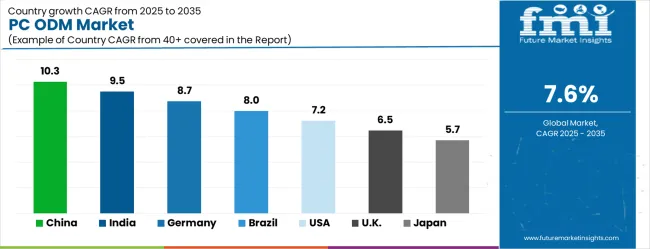

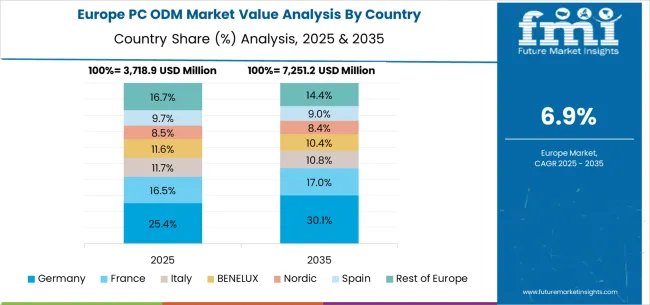

Global market dynamics reveal distinct performance tiers reflecting regional manufacturing capabilities and technology adoption levels. Growth Leaders including China (10.3% CAGR) and India (9.5% CAGR) demonstrate expanding technology ecosystems with strong ODM manufacturing adoption, while Germany (8.7% CAGR) represents European precision engineering excellence.

Steady Performers such as Brazil (8.0% CAGR) and the United States (7.2% CAGR) show consistent demand growth aligned with digital transformation and gaming market requirements. Mature Markets including the United Kingdom (6.5% CAGR) and Japan (5.7% CAGR) display moderate growth rates reflecting established market penetration and technology advancement focus.

Regional synthesis indicates Asia Pacific dominance through manufacturing concentration and export production capabilities. European markets emphasize quality standards and specialized applications. North American demand reflects enterprise modernization and gaming market development initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 10.3 |

| India | 9.5 |

| Germany | 8.7 |

| Brazil | 8.0 |

| USA | 7.2 |

| UK | 6.5 |

| Japan | 5.7 |

China establishes market leadership through comprehensive manufacturing ecosystem dominance across consumer electronics, enterprise computing, and gaming hardware production. A 10.3% CAGR value reflects extensive manufacturing capacity and export-oriented technology production requirements driving consistent demand for ODM services. Growth metrics demonstrate technological advancement supported by government digitization initiatives and manufacturing upgrade mandates.

Market dynamics center on 5G technology adoption creating new computing device requirements for enhanced connectivity and processing capabilities. State-owned enterprise modernization drives adoption of customized computing solutions for operational efficiency improvement. Export market leadership necessitates advanced manufacturing capabilities and quality standards adherence through documented performance specifications.

Manufacturing concentration in major technology production hubs creates significant demand density for ODM services and specialized computing solutions. Industrial development policies include advanced electronics requirements for comprehensive technology self-sufficiency initiatives. Foreign technology partnerships bring international design standards requiring sophisticated ODM capabilities.

Strategic Market Indicators:

India demonstrates robust growth potential through rapidly expanding technology manufacturing capabilities and comprehensive government promotion of domestic electronics production under various digital initiatives. A 9.5% CAGR reflects increasing manufacturing sophistication and widespread technology adoption across consumer and enterprise segments. Technology sector growth under government initiatives creates consistent demand for customized computing solutions across diverse applications.

Consumer electronics demand drives significant primary demand through growing middle class purchasing power and digital lifestyle adoption. Government digitization mandates actively promote technology device adoption for enhanced productivity and connectivity. Educational technology initiatives substantially increase computing device requirements across institutions requiring cost-effective solutions.

Market activity centers on comprehensive manufacturing capability development bringing international production standards and best practices to domestic facilities. Foreign direct investment in electronics manufacturing introduces advanced ODM requirements for competitive advantage. Skill development initiatives include extensive training programs for advanced electronics manufacturing and quality control procedures.

Market Intelligence Brief:

Germany maintains market leadership through exceptional engineering excellence and established precision manufacturing traditions across diverse technology sectors. An 8.7% CAGR demonstrates sustained market demand supported by advanced industrial automation capabilities and specialized computing requirements. Automotive industry technology integration creates consistent demand for rugged computing solutions across manufacturing and embedded applications.

Industrial equipment manufacturing sector requires extensively certified computing specifications for export compliance and international quality standards adherence. Engineering services sector utilizes specialized computing solutions for advanced design applications and testing requirements. Quality standard development significantly influences global manufacturing practices requiring advanced computing technology adoption.

Advanced manufacturing research initiatives continuously develop innovative applications for specialized computing platforms across emerging industrial sectors. Export market leadership necessitates comprehensive quality documentation supporting international sales and regulatory compliance requirements. Automotive supplier network requires consistent computing performance for precision manufacturing and automation applications.

Performance Metrics:

Brazil represents significant emerging market growth potential, achieving an 8.0% CAGR through comprehensive industrial development initiatives and technology sector expansion across domestic and regional markets. The market reflects increasing manufacturing sophistication and widespread technology adoption driven by government policies promoting domestic electronics production capabilities. Gaming market growth creates substantial demand for specialized computing solutions across consumer segments.

Consumer electronics adoption drives primary market demand through expanding middle class purchasing power and digital lifestyle integration requirements. Industrial modernization sector expansion creates substantial opportunities for specialized computing applications and automation solutions. Educational technology initiatives significantly increase computing device volumes requiring cost-effective customized solutions.

Market development faces challenges including currency volatility affecting imported component costs and supply chain complexity impacting manufacturing schedules. Infrastructure development projects support technology sector growth requiring advanced computing capabilities and specialized applications. Regional market integration facilitates improved access for ODM services and technical support.

Strategic Market Considerations:

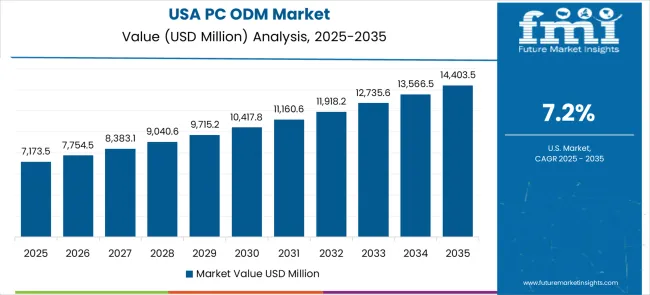

The United States market demonstrates steady and sustained growth with a 7.2% CAGR through comprehensive technology sector revitalization and strategic domestic manufacturing initiatives bringing production capabilities to regional facilities. The market reflects established technology innovation base with significant enterprise modernization trends and advanced computing adoption. Gaming industry leadership creates substantial demand for high-performance computing solutions meeting specialized requirements.

Enterprise digital transformation drives primary market demand through cloud computing adoption and hybrid work environment requirements. Defense technology sector maintains consistent demand for ruggedized computing solutions and specialized security requirements. Technology innovation leadership creates opportunities for cutting-edge computing platform development and advanced application optimization.

Manufacturing competitiveness initiatives encourage substantial investment in domestic electronics production and advanced ODM capabilities. Cybersecurity requirements mandate specialized computing solutions with enhanced security features and compliance capabilities. Technology export competitiveness requires international standard adherence and comprehensive quality documentation.

Market Dynamics:

The United Kingdom demonstrates market stability through comprehensive industrial modernization and strategic advanced technology initiatives across key sectors. A 6.5% CAGR market value reflects established technology base with strong emphasis on innovation and specialized computing applications. Financial services technology requirements create substantial demand for high-performance computing solutions in trading and analytics applications.

Enterprise technology modernization requires advanced computing solutions for digital transformation and productivity enhancement initiatives. Creative industries utilize specialized computing platforms for content creation and multimedia production requirements. Post-Brexit manufacturing policies emphasize domestic technology capability development and advanced electronics production.

Brexit-related considerations create opportunities for domestic technology manufacturing growth requiring specialized ODM capabilities and technical expertise. Government technology initiatives actively support advanced computing adoption and innovation development. Cybersecurity focus creates demand for specialized secure computing solutions and compliance-ready platforms.

Current Market Observations:

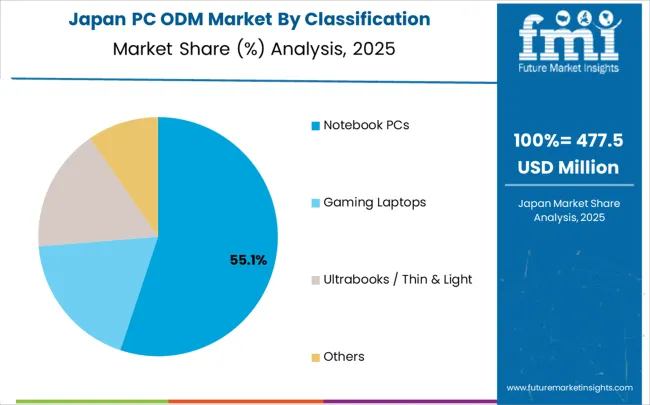

Japan maintains technological leadership through exceptional precision manufacturing excellence and comprehensive technology innovation across diverse computing sectors. A 5.7% CAGR market value reflects mature market with established advanced computing adoption and sophisticated manufacturing capabilities. Electronics industry leadership creates consistent demand for cutting-edge computing platform development and specialized applications.

Industrial automation manufacturing sector requires precision computing solutions for robotics and control system applications ensuring reliable performance. Gaming industry utilizes advanced computing platforms for console development and specialized gaming hardware requirements. Technology export leadership necessitates advanced manufacturing capabilities and quality standard compliance.

Manufacturing technology innovation includes precision computing requirements for international production facilities and technology transfer programs. Research and development initiatives continuously advance computing platform technologies and application innovation. Supplier network development creates substantial opportunities for advanced ODM integration and specialized computing solutions.

Market Status Indicators:

Market structure reflects moderate concentration with established global players maintaining significant market positions while regional competitors serve specialized segments. Competition style emphasizes technological differentiation, manufacturing capability development, and geographic market coverage expansion. Industry dynamics favor companies combining design innovation with comprehensive manufacturing expertise and supply chain optimization.

Tier 1 - Global Market Leaders: Foxconn, Quanta Computer, and Pegatron dominate through comprehensive manufacturing portfolios, global production networks, and advanced technological capabilities. Competitive advantages include research and development resources, established client relationships, and manufacturing scale economies. Market positions reflect quality reputation and technical expertise across diverse computing applications.

Tier 2 - Specialized Technology Providers: Companies like Compal Electronics, Wistron Corporation, and Inventec Corporation focus on specific product segments or regional markets through specialized manufacturing offerings. Competitive advantages include application expertise, technical service capabilities, and manufacturing efficiency focus. Market positioning emphasizes specialization and client relationship development.

Tier 3 - Regional and Emerging Competitors: Companies including Huaqin, Longcheer Technology, Wingtech, and Clevo serve specific markets and specialized applications. Competitive advantages include cost competitiveness, regional manufacturing capabilities, and customization flexibility. Market participation focuses on emerging segments and specialized client requirements.

Competitive dynamics between tiers involve technology advancement competition, manufacturing capability development, and geographic expansion initiatives. Tier 1 companies compete through innovation and global reach while Tier 2 and 3 companies emphasize specialization and cost competitiveness.

The PC ODM market is central to technology innovation, manufacturing efficiency, digital transformation, and global electronics supply chain optimization. With increasing demands for customization, rapid technology evolution, and supply chain resilience, the sector faces pressure to balance cost efficiency, design innovation, and sustainable manufacturing practices. Coordinated action from governments, industry bodies, OEMs/technology players, suppliers, and investors is essential to transition toward technologically advanced, environmentally sustainable, and globally competitive PC ODM ecosystems.

| Item | Value |

|---|---|

| Quantitative Units | USD 15,192.0 million |

| Product Type | Notebook PCs, Gaming Laptops, Ultrabooks/Thin & Light, Others |

| Application | Consumer PC, Enterprise PC, Industrial PC |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, Brazil, Chile, Kingdom of Saudi Arabia, GCC Countries, Turkey, South Africa |

| Key Companies Profiled | Foxconn, Quanta Computer, Pegatron, Compal Electronics, Wistron Corporation, Inventec Corporation, Huaqin, Longcheer Technology, Wingtech, Clevo, ASUSTek Computer, MSI |

| Additional Attributes | Dollar sales by product categories, regional demand trends across Asia Pacific, North America, and Europe, competitive landscape with manufacturer descriptions, adoption patterns across consumer and enterprise segments, integration with advanced technologies and AI capabilities, innovations in manufacturing processes and supply chain optimization, and development of specialized computing solutions with enhanced performance characteristics |

The global PC ODM market is estimated to be valued at USD 15,192.0 million in 2025.

The market size for the PC ODM market is projected to reach USD 31,603.7 million by 2035.

The PC ODM market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in PC ODM market are notebook pcs, gaming laptops, ultrabooks / thin & light and others.

In terms of application, consumer PC segment to command 45.7% share in the PC ODM market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PCB Inspection Microscope Market Size and Share Forecast Outlook 2025 to 2035

PC Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

PCB Design Software Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

PCSK9 Inhibitor Market Forecast Outlook 2025 to 2035

PCB Vision Inspection Equipment for SMT Market Size and Share Forecast Outlook 2025 to 2035

PCR Tire Building Machine Market Size and Share Forecast Outlook 2025 to 2035

PCR Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

PCB Connector Market Size and Share Forecast Outlook 2025 to 2035

PCR Plate Sealer Market Size and Share Forecast Outlook 2025 to 2035

PCIe Market Trends - Growth & Forecast 2025 to 2035

PCB Design Software Market Analysis by Component, Deployment, Application, and Region Through 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

PCR Bottles Market Growth - Demand, Innovations & Outlook 2024 to 2034

PCR Pouches Market

Upcycled Pet Ingredients Size and Share Forecast Outlook 2025 to 2035

Upcycled Vegetable Snacks Market Size and Share Forecast Outlook 2025 to 2035

Upcycled Banana Flour Market Size, Growth, and Forecast 2025 to 2035

qPCR Instruments Market Analysis - Growth, Trends & Forecast 2025 to 2035

Upcycled Cosmetic Ingredients Market Insights & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA