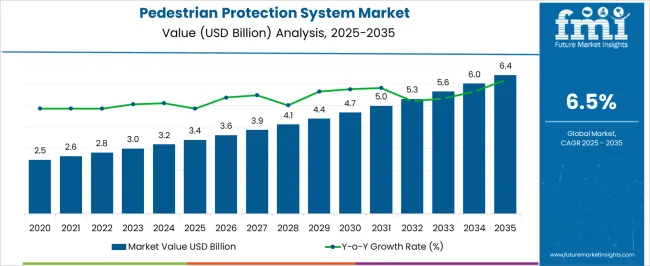

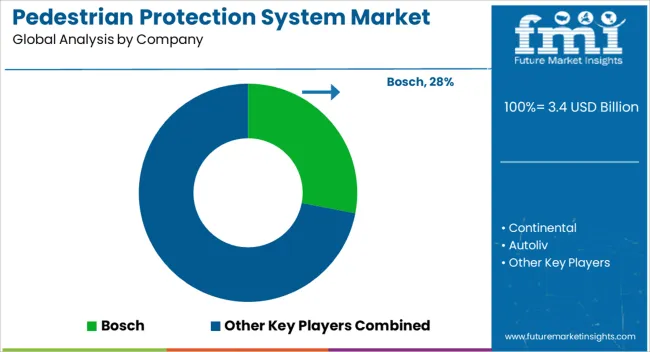

The Pedestrian Protection System Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Pedestrian Protection System Market Estimated Value in (2025 E) | USD 3.4 billion |

| Pedestrian Protection System Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The Pedestrian Protection System market is witnessing steady expansion, driven by the rising focus on automotive safety and regulatory mandates targeting reduction of pedestrian fatalities. The current market scenario reflects increased adoption of active safety technologies, particularly in regions enforcing stringent vehicle safety standards and crash test regulations. Growth is being propelled by the integration of advanced sensor technologies, AI-based detection algorithms, and automated braking systems, which collectively enhance pedestrian safety outcomes.

Rising consumer awareness and demand for safer vehicles are further stimulating the market, particularly in the electric and premium vehicle segments. The future outlook is shaped by the continuous development of connected and intelligent vehicle ecosystems, including advanced driver-assistance systems.

Additionally, investment in vehicle safety testing, autonomous driving research, and urban mobility infrastructure is providing opportunities for Pedestrian Protection System providers to expand their offerings As urban populations grow and vehicle-pedestrian interactions increase, the market is expected to witness sustained demand for reliable, software-enhanced pedestrian protection solutions.

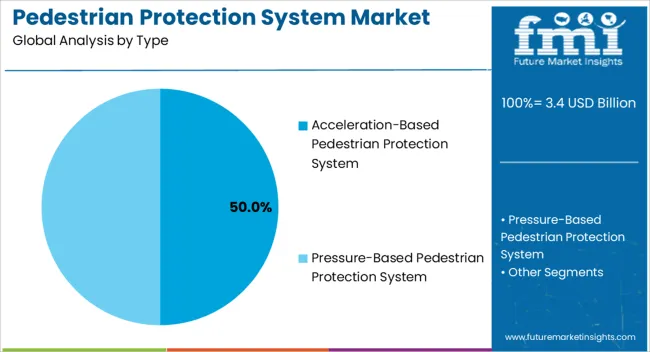

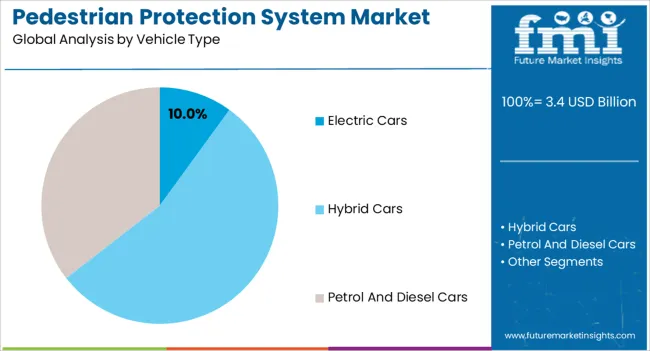

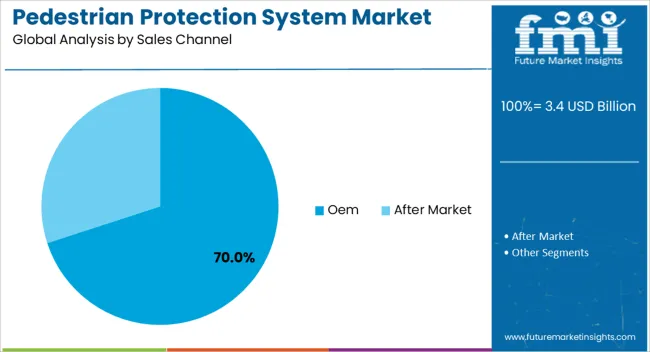

The pedestrian protection system market is segmented by type, vehicle type, sales channel, and geographic regions. By type, pedestrian protection system market is divided into Acceleration-Based Pedestrian Protection System and Pressure-Based Pedestrian Protection System. In terms of vehicle type, pedestrian protection system market is classified into Electric Cars, Hybrid Cars, and Petrol And Diesel Cars. Based on sales channel, pedestrian protection system market is segmented into Oem and After Market. Regionally, the pedestrian protection system industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Acceleration-Based Pedestrian Protection System type is projected to hold 50.00% of the Pedestrian Protection System market revenue share in 2025, making it the leading type segment. This dominance is being attributed to its capability to detect pedestrian impact scenarios in real time and trigger automated protective measures effectively. Adoption has been facilitated by advancements in sensor sensitivity, faster data processing, and integration with vehicle safety networks, which collectively minimize injury severity in case of collisions.

The high performance of acceleration-based systems in crash simulations and real-world tests has reinforced their preference among vehicle manufacturers and regulatory authorities. Their compatibility with existing braking and airbag systems allows widespread deployment without extensive redesign, enhancing cost efficiency.

Additionally, the ability to upgrade system software without altering hardware provides long-term value to both manufacturers and end users With rising safety expectations and regulatory compliance requirements, the Acceleration-Based Pedestrian Protection System segment is expected to maintain its leading position in the market.

The Electric Cars vehicle type is anticipated to account for 10.00% of the Pedestrian Protection System market revenue in 2025, representing the largest share among vehicle types. This leadership is being driven by the quiet operation of electric cars, which increases the likelihood of pedestrian-vehicle collisions, thereby necessitating advanced protection systems.

The segment has benefited from regulatory incentives promoting electric vehicle adoption, which in turn encourages integration of active safety features as standard. Advanced software-defined pedestrian detection systems are being embedded during vehicle production to ensure compliance with safety regulations and consumer expectations.

Additionally, the rapid growth of electric vehicle fleets, particularly in urban and metropolitan areas, has created strong demand for pedestrian protection solutions that can be integrated seamlessly with autonomous and semi-autonomous driving technologies As the electric mobility segment continues to expand, the demand for reliable and responsive pedestrian protection systems in this vehicle type is expected to remain robust, supporting overall market growth.

The OEM sales channel is expected to capture 70.00% of the Pedestrian Protection System market revenue in 2025, establishing it as the dominant sales route. This leadership is being attributed to the direct integration of pedestrian protection systems during the manufacturing process, which ensures compliance with safety regulations and quality standards.

OEM adoption allows seamless integration of sensors, control units, and software into vehicle platforms, enhancing performance and reliability while reducing post-sale retrofitting requirements. Additionally, OEM partnerships facilitate alignment with global safety mandates and crash test requirements, increasing the system’s credibility and acceptance in the market.

The cost-effectiveness of factory-installed systems, along with the assurance of warranty and support, encourages automakers to prefer OEM channels over aftermarket options As vehicle safety expectations rise globally, the OEM channel is expected to continue dominating sales, offering manufacturers and consumers a trusted and standardized approach to pedestrian protection while supporting the market’s steady growth trajectory.

A pedestrian protection system uses sensors, cameras, and a control unit to detect whether the vehicle is about to collide with the pedestrians. The pedestrian protection system was in the research and development before being incorporated in cars and luxury vehicles. Currently, it is getting deployed in vehicles after clearing all the regulation tests.

The major advantage of deploying a pedestrian protection system is that it offers a more comfortable zone for pedestrians, and reduces loss of lives as well as risk of injury. In 2005, Jaguar was the first company to design a pedestrian protection system. Automotive manufactures and technology providers are keen on creating a new safety solution that will fulfill all legal requirements and ensure pedestrian protection.

Technology providers are investing in research and development to make vehicles comfortable, safe, and economical. Technological advancements play a significant role in the creation of pedestrian protection systems that have the potential to reduce injuries and save lives. The level of reliability in the technology will affect the adoption rate of pedestrian protection systems.

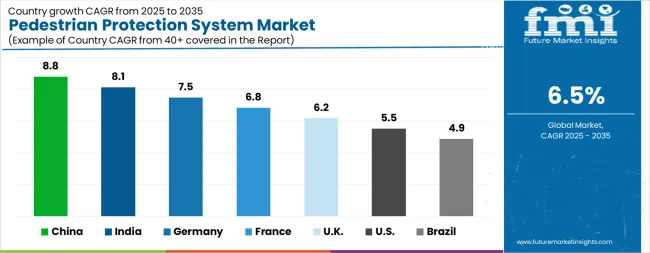

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The Pedestrian Protection System Market is expected to register a CAGR of 6.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.8%, followed by China at 8.2%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.6%, yet still underscores a broadly positive trajectory for the global Pedestrian Protection System Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.5%. The USA Pedestrian Protection System Market is estimated to be valued at USD 1.2 billion in 2025 and is anticipated to reach a valuation of USD 2.0 billion by 2035. Sales are projected to rise at a CAGR of 5.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 176.7 million and USD 118.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Type | Acceleration-Based Pedestrian Protection System and Pressure-Based Pedestrian Protection System |

| Vehicle Type | Electric Cars, Hybrid Cars, and Petrol And Diesel Cars |

| Sales Channel | Oem and After Market |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Continental, Autoliv, ZF, and Denso |

The global pedestrian protection system market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the pedestrian protection system market is projected to reach USD 6.4 billion by 2035.

The pedestrian protection system market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in pedestrian protection system market are acceleration-based pedestrian protection system and pressure-based pedestrian protection system.

In terms of vehicle type, electric cars segment to command 10.0% share in the pedestrian protection system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pedestrian Access Control System Market Size and Share Forecast Outlook 2025 to 2035

Flu Protection Kits Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Teleprotection Market Growth – Trends & Forecast 2025 to 2035

ESD Protection Devices Market Insights – Trends & Demand 2023-2033

Head Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fall Protection Market Size and Share Forecast Outlook 2025 to 2035

CBRN Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

DDoS Protection Market Size and Share Forecast Outlook 2025 to 2035

DDoS Protection & Mitigation Security Market Growth - Trends & Forecast through 2034

Data Protection as a Service (DPaaS) Market

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Systems for Industrial Cooking Market Growth - Trends & Forecast 2025 to 2035

Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Brand Protection Tools Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Brand Protection Tools Providers

Market Share Breakdown of Paint Protection Film Manufacturers

Hernia Protection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Seismic Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA