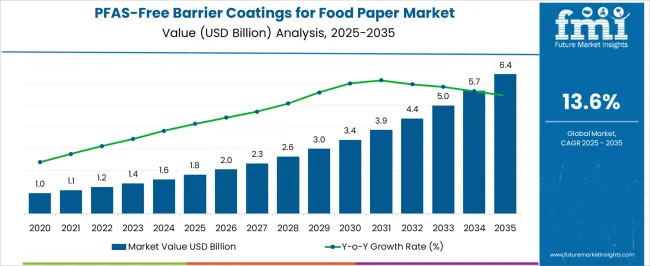

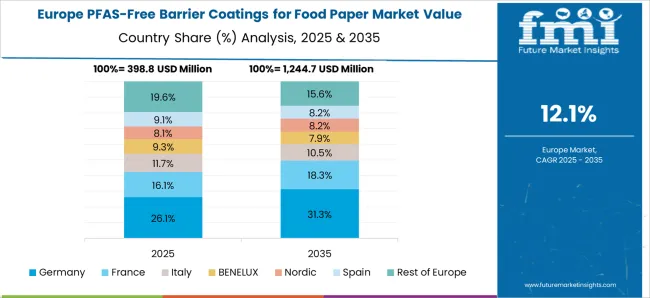

The global PFAS-free barrier coatings for food paper market is projected to grow from USD 1.8 billion in 2025 to approximately USD 6.4 billion by 2035, recording an absolute increase of USD 4.6 billion over the forecast period. This translates into a growth of 256% over the decade. The market is forecast to expand at a compound annual growth rate (CAGR) of 13.6%, with the overall market size projected to grow by nearly 3.6x by the end of the forecast period.

The market is growing due to a combination of regulatory, environmental, and consumer-driven factors. Governments worldwide are tightening restrictions on per- and polyfluoroalkyl substances (PFAS) because of their persistence in the environment and links to health concerns, prompting packaging producers to shift toward safer alternatives. At the same time, food service providers and quick-service restaurants (QSRs) are under pressure to adopt sustainable solutions that align with corporate ESG goals and consumer expectations. Advances in water- and bio-based coating technologies are improving performance, recyclability, and cost competitiveness, further accelerating market adoption across developed and emerging regions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.8 billion |

| Industry Value (2035F) | USD 6.4 billion |

| CAGR (2025 to 2035) | 13.6% |

Between 2025 and 2030, the market is projected to expand from USD 1.8 billion to USD 3.5 billion, adding approximately USD 1.7 billion. Growth in this first phase will be supported by stringent PFAS regulations across major markets and increasing adoption in foodservice packaging applications, driving widespread adoption across quick-service restaurants and food packaging manufacturers. Regulatory compliance requirements are emerging as major demand drivers, with companies seeking environmentally safe alternatives to traditional PFAS-containing barrier coatings while maintaining food safety standards and performance characteristics.

From 2030 to 2035, the market is expected to grow from USD 3.5 billion to USD 6.4 billion, a further increase of USD 2.9 billion. This second phase will be shaped by expanded implementations in specialty packaging applications, deeper penetration in frozen food packaging, and the development of advanced hybrid coating technologies optimized for specific food contact requirements. Technology refresh cycles will emphasize integrated barrier coating ecosystems, while regulatory developments will focus on harmonizing PFAS-free coating standards across global food packaging markets.

From 2020 to 2024, the market rose from USD 0.5 billion to USD 1.6 billion, propelled by heightened regulatory concerns over PFAS contamination in food packaging and accelerating commercialization activities by leading packaging manufacturers. Early regulatory enforcement in European markets and growing consumer awareness established the foundation for industry-wide adoption. Food packaging companies and coating manufacturers led early implementation, while foodservice operators began comprehensive PFAS-free coating evaluations, establishing the groundwork for the 2025 to 2035 expansion cycle.

Regulatory Pressure Drives PFAS-Free Innovation

Stringent regulatory frameworks across major markets are creating compelling compliance requirements for food packaging manufacturers to eliminate PFAS-containing barrier coatings. The USA leads regulatory enforcement with state-level bans in California and New York, while European Union directives mandate comprehensive PFAS restrictions across single-use food packaging applications. This regulatory pressure is driving systematic evaluation and adoption of PFAS-free coating technologies across foodservice packaging, retail food containers, and specialized food contact applications, creating sustained demand for environmentally compliant barrier coating systems and manufacturing capabilities.

Consumer Health Awareness Accelerates Market Adoption

Growing consumer awareness of PFAS health risks and environmental persistence is driving foodservice operators and retailers to proactively adopt PFAS-free packaging solutions. The "forever chemicals" designation and associated health concerns are creating consumer-driven demand for transparent, safe food packaging across quick-service restaurants, retail food chains, and specialty food applications. Consumer advocacy groups and environmental organizations are accelerating adoption of PFAS-free alternatives, creating compliance-driven demand across multiple food packaging sectors.

Technical Performance Improvements Enable Commercial Viability

Advanced biopolymer and mineral-based coating technologies are achieving performance parity with traditional PFAS-containing barriers while providing superior environmental profiles. Enhanced grease resistance, moisture barrier properties, and heat stability of modern PFAS-free coatings enable effective food contact applications without compromising packaging functionality. Manufacturing optimization and material science advances are driving demand for specialized PFAS-free coating applications and comprehensive food packaging solutions.

The market is segmented by coating type into biopolymer coatings, mineral-based coatings, waterborne polymer dispersions, and hybrid multilayer barrier coatings. By application, the market includes quick-service restaurant wraps & clamshells, bakery and confectionery packaging, frozen food boxes and trays, and beverage cups & lids. Distribution channel segmentation comprises direct supply to converters, foodservice distributors, and retail/private-label paper producers. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

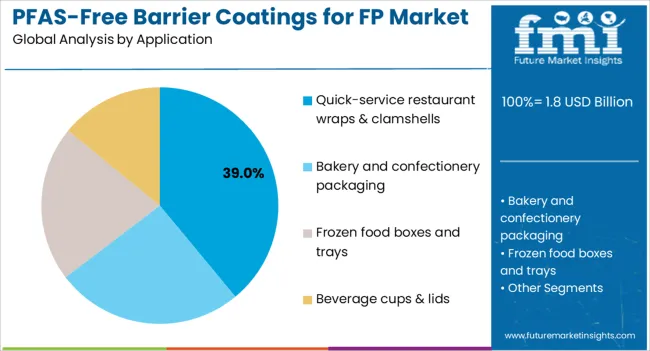

Quick-service restaurant wraps & clamshells applications are projected to command a dominant 39% share of the PFAS-free barrier coatings market by 2025, establishing their position as the primary application for PFAS-free coating technology. Their deployment in high-volume foodservice operations benefits from PFAS-free coatings' proven grease resistance and regulatory compliance characteristics, providing robust food packaging solutions for comprehensive QSR operations. These applications offer excellent barrier performance and consumer safety assurance, making them suitable for comprehensive quick-service restaurant packaging strategies.

The widespread adoption in QSR applications is driven by their efficiency in high-throughput food packaging operations and ability to provide reliable grease and moisture barriers without regulatory compliance concerns. Quick-service restaurant chains' commitment to environmental sustainability and food safety provides regulatory confidence and ecosystem support, facilitating enterprise adoption across diverse foodservice applications. While bakery packaging and frozen food applications serve important markets, QSR packaging offers the volume scalability, performance reliability, and cost-effectiveness necessary for mainstream deployment, positioning these applications as the cornerstone of PFAS-free coating adoption strategies for foodservice operators seeking both regulatory compliance and operational efficiency.

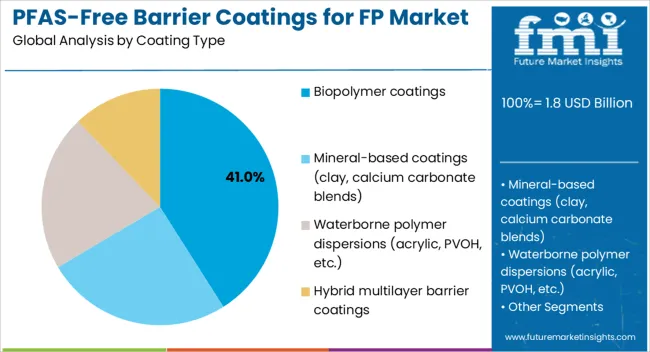

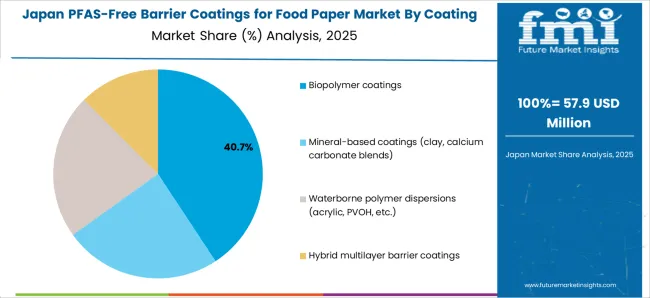

Biopolymer coatings technology is forecasted to capture 41% of the market in 2025, highlighting the technical advantages of this PFAS-free coating material for commercial food packaging applications. These coatings enable effective barrier protection against grease and moisture with excellent food contact safety characteristics, while providing manufacturing scalability for large-scale packaging production. Biopolymer-based barrier coatings offer superior environmental profile and biodegradability compared to traditional PFAS-containing alternatives.

Beyond environmental advantages, biopolymer coatings support sustainable manufacturing processes using renewable raw materials, enabling organizations to achieve competitive coating costs across multiple food packaging applications. Advanced biopolymer formulations allow optimization of barrier properties and processing characteristics, enabling organizations to tailor performance before full-scale production. Mineral-based coatings, accounting for 28% of the market, remain essential for applications requiring enhanced barrier properties, while waterborne polymer dispersions represent 22% of the market for specialized high-performance applications, reflecting the diverse coating technology requirements across different PFAS-free barrier coating applications.

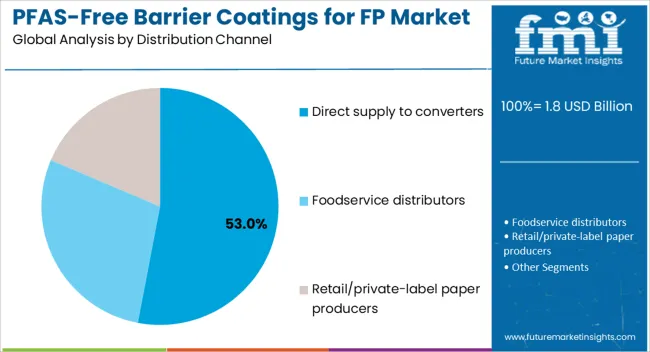

Direct supply to converters is projected to command a dominant 53% share of the PFAS-free barrier coatings distribution market by 2025, establishing their position as the primary channel for PFAS-free coating technology deployment. Their role in packaging manufacturing operations benefits from direct technical support and customized coating formulations, providing integrated barrier coating solutions for comprehensive food packaging production. These distribution relationships offer excellent technical collaboration and supply chain efficiency, making them suitable for comprehensive packaging converter coating strategies.

The widespread adoption of direct supply channels is driven by their effectiveness in providing technical expertise and customized coating solutions that address specific packaging converter requirements. Packaging converters' commitment to performance optimization and regulatory compliance provides supply chain confidence and technical support, facilitating enterprise adoption across diverse food packaging applications. While foodservice distributors and retail channels serve important market segments, direct converter supply offers the technical integration, performance customization, and supply chain reliability necessary for mainstream deployment, positioning this channel as the cornerstone of PFAS-free coating distribution strategies for converters seeking both technical excellence and operational efficiency.

Advanced Biopolymer Formulations Enhance Barrier Performance

Manufacturers are increasingly developing sophisticated biopolymer and hybrid coating formulations that significantly optimize grease resistance, moisture barrier properties, and manufacturing processability for commercial food packaging deployment. These advanced coating systems incorporate precise molecular modifications and functional additives that enhance barrier performance and processing stability, resulting in improved food protection and extended shelf life capabilities. Research institutions and coating manufacturers are collaborating to develop proprietary biopolymer formulations that address specific barrier requirements across different food applications, from high-grease resistance QSR packaging to moisture-sensitive bakery applications.

The evolution of biopolymer technology extends beyond performance optimization to encompass manufacturing cost reduction and raw material sustainability. Companies are implementing innovative synthesis methods that utilize renewable agricultural feedstocks and eliminate expensive processing steps, making PFAS-free coatings increasingly cost-competitive with traditional barrier alternatives. Advanced application techniques enable precise control over coating thickness and barrier uniformity, resulting in consistent performance across large-scale production runs. These developments provide comprehensive performance frameworks that enable competitive alternatives to PFAS-containing coatings across multiple food packaging applications, while establishing PFAS-free technology as a viable long-term food contact solution.

Regulatory Harmonization Accelerates Global Adoption

Advanced PFAS-free implementations increasingly incorporate comprehensive regulatory compliance capabilities, combining effective barrier protection with sophisticated food contact migration testing, regulatory documentation, and global compliance frameworks that optimize overall regulatory approval processes. These integrated systems utilize advanced testing protocols that validate coating safety and performance across multiple regulatory jurisdictions, ensuring consistent food contact approval while providing reliable barrier protection during diverse food contact scenarios. International regulatory harmonization enables PFAS-free coating systems to achieve streamlined approvals across multiple markets, generating operational efficiencies while supporting global food packaging standardization.

The regulatory integration extends to comprehensive documentation systems that combine PFAS-free certifications with food contact compliance records, creating optimized solutions for specific regulatory environments and food contact applications. Advanced compliance management platforms enable seamless regulatory submissions across different jurisdictions based on real-time regulatory updates, food contact requirements, and performance characteristics, maximizing approval efficiency while ensuring comprehensive food safety compliance. Regulatory consulting services provide comprehensive guidance and optimization capabilities that enable food packaging manufacturers to maximize PFAS-free adoption while minimizing regulatory approval risks. This integration enables organizations to build compliant food packaging ecosystems that address both performance requirements and regulatory sustainability mandates, while supporting the transition to comprehensively PFAS-free food contact materials.

Integrated Coating Application and Quality Control Systems

PFAS-free barrier coating manufacturers are developing comprehensive automated application systems that optimize coating formulation, substrate preparation, and coating application processes through advanced precision equipment, process control systems, and real-time quality monitoring tailored to specific barrier requirements and production volumes. These automated systems incorporate precision material handling equipment that ensures consistent coating preparation and substrate treatment, while advanced application technologies provide uniform coating characteristics across large-scale production runs. Machine learning algorithms analyze production data in real-time to identify optimal application parameters and predict barrier performance, enabling proactive adjustments that maintain consistent food contact safety.

Quality control automation extends throughout the entire coating process, from raw material inspection to final barrier testing and validation. Advanced inspection systems utilize infrared spectroscopy and barrier testing equipment to identify coating defects and performance variations during production, while automated testing equipment performs comprehensive grease resistance and moisture barrier characterization of finished packaging materials. Statistical process control systems provide continuous monitoring of key barrier indicators, enabling manufacturers to maintain tight performance specifications while maximizing production throughput. These comprehensive automation platforms enable systematic scaling of PFAS-free barrier coating production while minimizing manufacturing costs and maintaining stringent food contact safety standards throughout the production process, supporting the transition from pilot-scale development to commercial-scale deployment.

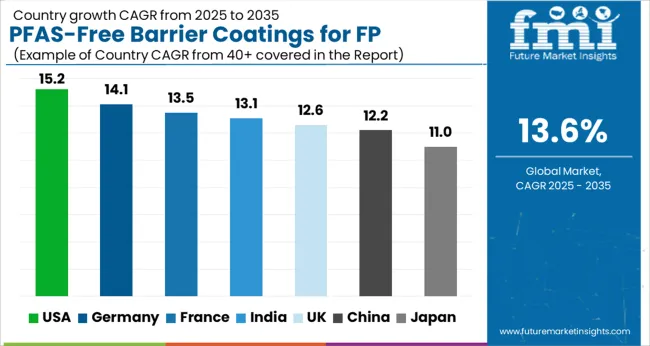

The USA's PFAS-free barrier coatings market is projected to grow at 15.2% CAGR through 2035, the highest globally. State-level PFAS bans in California and New York have established definitive regulatory frameworks for food packaging manufacturers and foodservice operators.

Federal regulatory developments supporting PFAS restrictions and comprehensive chemical safety initiatives are driving systematic implementation across food packaging manufacturers and quick-service restaurant chains. The country's leadership in food packaging innovation creates competitive advantages, accelerating proactive adoption across foodservice packaging, retail food containers, and specialty food contact applications.

Germany's PFAS-free barrier coatings market is expected to expand at 14.1% CAGR, supported by EU single-use packaging directives and comprehensive PFAS restriction frameworks under European chemical safety initiatives. The country's advanced manufacturing sector is implementing PFAS-free coating technologies to achieve regulatory compliance while maintaining food packaging performance standards. Government investment in packaging research and development is driving awareness of PFAS-free technology benefits across food packaging manufacturers and foodservice operators. Industry collaboration initiatives are accelerating adoption of sustainable coating systems for protecting food safety and environmental compliance.

French PFAS-free barrier coatings market is projected to grow at 13.5% CAGR, driven by early national PFAS bans and comprehensive food contact safety regulations. The country's foodservice sector is implementing PFAS-free packaging solutions to achieve regulatory compliance and consumer safety objectives. Government support for sustainable packaging development is driving development of French coating technology capabilities. Food safety requirements for restaurant and retail food packaging are accelerating adoption of PFAS-free systems for protecting consumer health and regulatory compliance.

India's PFAS-free barrier coatings market is expected to grow at 13.1% CAGR, supported by rapid quick-service restaurant expansion and emerging regulatory frameworks for food contact chemical safety. The country's expanding foodservice market is creating substantial demand for cost-effective barrier coating solutions that provide food safety assurance. Government initiatives supporting food packaging safety and environmental protection are creating awareness of PFAS-free benefits for public health protection. Growing consumer awareness is driving adoption of safe coating systems to ensure food contact safety and environmental sustainability.

The UK PFAS-free barrier coatings market is projected to expand at 12.6% CAGR, reflecting comprehensive retailer sustainability mandates and innovative food packaging applications. Retail food packaging systems are implementing PFAS-free coating technology for private label products and comprehensive environmental compliance solutions. Government initiatives supporting circular economy principles are creating opportunities for PFAS-free coatings in sustainable packaging applications across retail and foodservice sectors. Food packaging developers are implementing PFAS-free systems for commercial and retail applications requiring safe, effective barrier protection capabilities.

China's PFAS-free barrier coatings market is expected to grow at 12.2% CAGR, focused on large-scale paper-based foodservice packaging and emerging PFAS regulation development. Chinese food packaging manufacturers are implementing PFAS-free coating technology for expanding domestic foodservice markets and export applications. The country's manufacturing capabilities are supporting scale-up of cost-effective PFAS-free coating production. Government environmental initiatives are driving early adoption of environmentally safe coating technology across industrial and commercial applications.

Japan's PFAS-free barrier coatings market is projected to grow at 11.0% CAGR, driven by advanced convenience store packaging requirements and specialized food contact applications. Japanese convenience store chains are implementing PFAS-free coating technology for ready-to-eat food packaging and specialized food contact solutions. The country's precision manufacturing capabilities are supporting development of high-performance PFAS-free coating systems. Government support for food safety technology development is accelerating adoption of advanced coating systems across specialized applications and research initiatives.

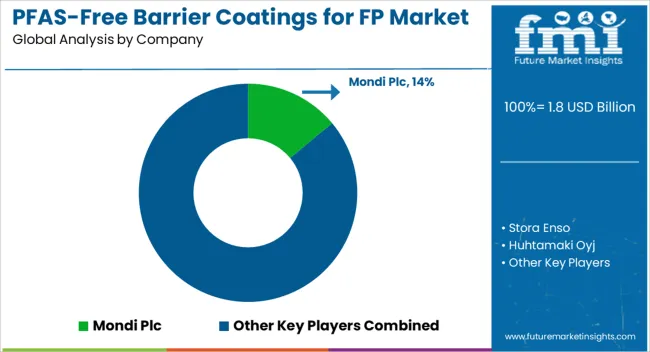

The PFAS-free barrier coatings for food paper market is rapidly evolving, characterized by intense competition between established packaging manufacturers, specialized coating technology providers, and integrated food packaging solution companies. With growing regulatory pressure over PFAS contamination and consumer safety concerns, organizations across all sectors are under pressure to implement environmentally compliant food packaging solutions that provide reliable barrier performance and regulatory assurance.

As a result, technology providers are prioritizing development of comprehensive PFAS-free coating platforms that combine advanced biopolymer formulations with scalable manufacturing capabilities, while also ensuring performance optimization and cost competitiveness across diverse food contact applications. Another area of innovation lies in integrated application systems and quality control technologies, where providers combine advanced coating formulations with tailored production processes, enabling organizations to execute systematic PFAS-free coating deployment while maintaining operational efficiency.

Mondi Plc is projected to lead the market with a 14% share in 2025, leveraging its comprehensive packaging manufacturing expertise and successful PFAS-free coating commercialization initiatives. The company's strength lies in its integrated approach, combining advanced coating technology development with large-scale manufacturing capabilities, technical consultation services, and ongoing support throughout deployment lifecycles. This holistic model has established strong partnerships with food packaging manufacturers and foodservice operators, reinforcing Mondi's leadership position and enabling the company to set industry standards for both PFAS-free coating technology and commercial food packaging adoption practices.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 billion |

| Coating Type | Biopolymer coatings, Mineral-based coatings, Waterborne polymer dispersions, Hybrid multilayer barrier coatings |

| Application | Quick-service restaurant wraps & clamshells, Bakery and confectionery packaging, Frozen food boxes and trays, Beverage cups & lids |

| Distribution Channel | Direct supply to converters, Foodservice distributors, Retail/private-label paper producers |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | USA, Germany, France, India, United Kingdom, China, Japan |

| Key Companies Profiled | Mondi Plc, Stora Enso, Huhtamaki Oyj, WestRock Company, Georgia-Pacific, UPM-Kymmene, Nippon Paper Industries, Sealed Air, Smurfit Kappa, Footprint LLC |

| Additional Attributes | Dollar sales by coating type and application segment, regional demand trends, competitive landscape, buyer preferences for grease-resistant versus water-resistant papers, integration with clean-label and sustainable packaging initiatives, innovations in bio-based coatings, solvent-free formulations, barrier performance optimization, compostability, and functional property enhancement for food safety and shelf-life extension |

The global PFAS-free barrier coatings for food paper market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the PFAS-free barrier coatings for food paper market is projected to reach USD 6.4 billion by 2035.

The PFAS-free barrier coatings for food paper market is expected to grow at a 13.6% CAGR between 2025 and 2035.

The key product types in PFAS-free barrier coatings for food paper market are biopolymer coatings, mineral-based coatings (clay, calcium carbonate blends), waterborne polymer dispersions (acrylic, pvoh, etc.) and hybrid multilayer barrier coatings.

In terms of application, quick-service restaurant wraps & clamshells segment to command 39.0% share in the PFAS-free barrier coatings for food paper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Barrier System Market Forecast Outlook 2025 to 2035

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

Barrier Material Market Size and Share Forecast Outlook 2025 to 2035

Barrier Shrink Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Insights for Barrier Shrink Bag Providers

Competitive Landscape of Barrier Packaging Providers

Barrier Film Market Trends & Industry Growth Forecast 2025 to 2035

Europe Barrier Packaging Market Growth – Demand & Forecast 2024-2034

Barrier Bags Market

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Key Players & Market Share in the Barrier Coated Paper Industry

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Korea Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Air Barrier Market Size and Share Forecast Outlook 2025 to 2035

Non-Barrier Bag Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Non-Barrier Bag Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA