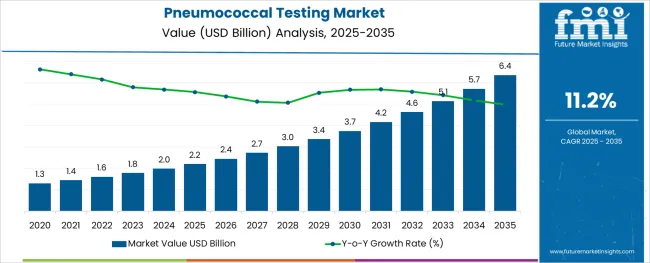

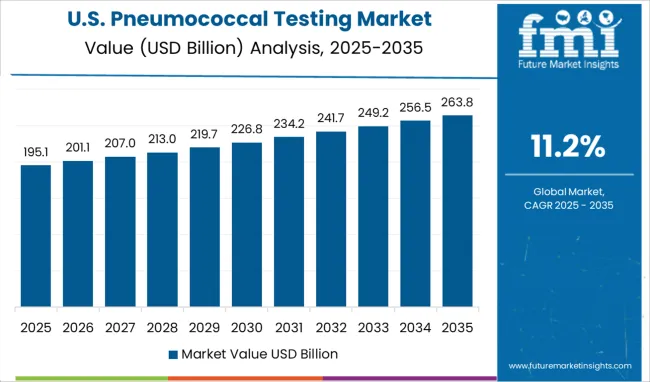

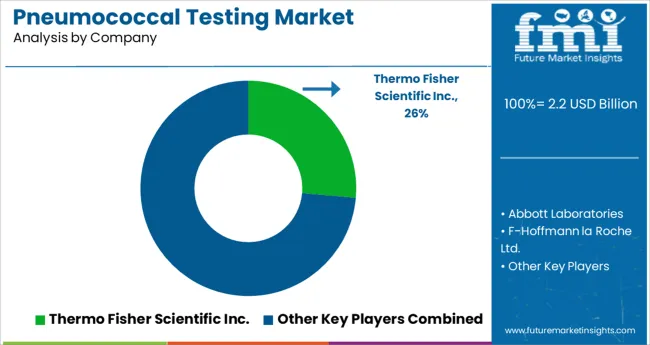

The Pneumococcal Testing Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 11.2% over the forecast period.

The pneumococcal testing market is witnessing steady expansion as healthcare providers focus on early detection of pneumococcal infections that contribute significantly to respiratory illnesses worldwide. Clinical awareness campaigns and immunization programs have emphasized the importance of rapid and accurate diagnosis to prevent disease progression.

Laboratories and diagnostic centers are increasingly adopting modern testing solutions that offer improved sensitivity and faster turnaround times. This market has further gained momentum due to the growing elderly population and the rising incidence of pneumococcal pneumonia among immunocompromised patients.

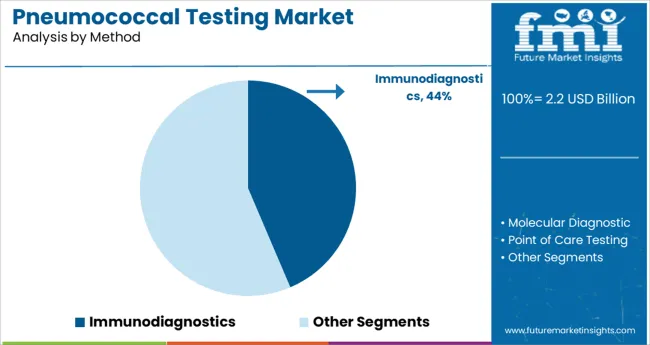

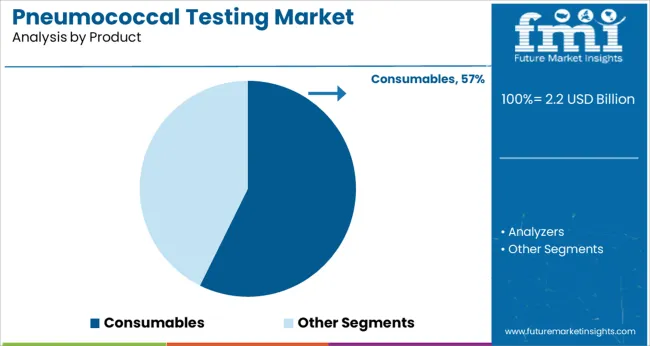

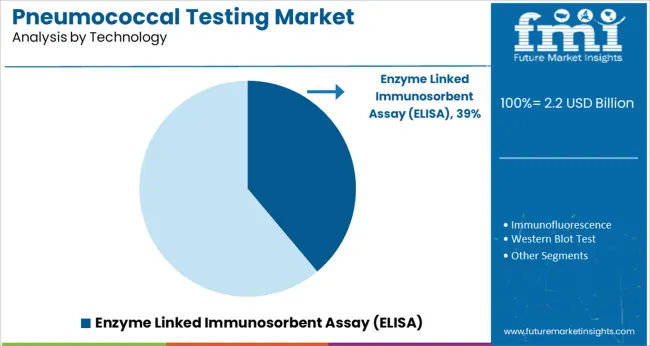

Developments in assay technologies and laboratory automation have enhanced test efficiency, supporting the broader use of pneumococcal diagnostics in both hospital and outpatient settings. Future growth will be fueled by continuous innovations in detection methods and the increasing need for scalable diagnostic solutions. Segmental growth is expected to be driven by Immunodiagnostics in method, Consumables in product, and Enzyme Linked Immunosorbent Assay (ELISA) in technology, reflecting evolving clinical demand and laboratory practices.

The market is segmented by Method, Product, Technology, and End User and region. By Method, the market is divided into Immunodiagnostics, Molecular Diagnostic, and Point of Care Testing. In terms of Product, the market is classified into Consumables and Analyzers.

Based on Technology, the market is segmented into Enzyme Linked Immunosorbent Assay (ELISA), Immunofluorescence, Western Blot Test, Nucleic Acid Sequence based Amplification, Immunohistochemistry, Polymerase Chain Reaction, and Others. By End User, the market is divided into Hospitals, Ambulatory Surgical Centers, and Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Immunodiagnostics segment is projected to contribute 43.6% of the pneumococcal testing market revenue in 2025, establishing itself as the dominant method. Growth of this segment is attributed to the ability of immunodiagnostic tests to provide reliable pathogen detection through antigen-antibody interactions. Laboratories have increasingly relied on these tests for their accuracy, scalability, and compatibility with automated systems.

Immunodiagnostics have become integral in screening patients across emergency departments, outpatient clinics, and routine health checkups. Moreover, the simplicity of these tests has supported their use in resource-limited settings where rapid detection is essential for timely clinical intervention.

As healthcare systems continue to prioritize fast and reliable testing for respiratory infections, the Immunodiagnostics segment is expected to sustain its market leadership.

The Consumables segment is expected to account for 57.3% of the pneumococcal testing market revenue in 2025, retaining its position as the leading product segment. Consumables such as reagents, assay kits, and test cartridges are critical components of pneumococcal testing workflows. Diagnostic laboratories have demonstrated a consistent need for these products due to the repeat nature of testing procedures and the demand for maintaining high-throughput operations.

Frequent replenishment of consumables ensures consistent test accuracy and system performance. Product development has also focused on enhancing the stability and ease of handling of these consumables to support better workflow management.

With growing diagnostic volumes and expanding test menus in healthcare laboratories, the Consumables segment is expected to remain the primary revenue contributor in the market.

The Enzyme Linked Immunosorbent Assay (ELISA) segment is projected to hold 38.9% of the pneumococcal testing market revenue in 2025, maintaining its leadership among technologies. ELISA has been widely adopted for its sensitivity and specificity in detecting pneumococcal antigens and antibodies. Clinical laboratories have favored ELISA for its ability to process multiple samples simultaneously, making it efficient for routine testing.

The technology’s compatibility with automation platforms has further improved laboratory throughput and minimized manual errors. In addition, ELISA kits have been continuously optimized for better reproducibility and reduced assay time.

As pneumococcal testing becomes a routine component of respiratory disease diagnosis, the Enzyme Linked Immunosorbent Assay (ELISA) segment is expected to remain a preferred choice for laboratories seeking scalable and accurate diagnostic solutions.

| Particulars | Details |

|---|---|

| H1, 2024 | 11.08% |

| H1, 2025 Projected | 11.21% |

| H1, 2025 Outlook | 11.11% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 10 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (+) 3 ↑ |

The comparative analysis and market growth rate of global pneumococcal testing market as studied by Future Market Insights, will show a negative BPS growth in H1-2025 outlook as compared to H1-2025 projected period by 10 BPS.

As per the FMI Analysis, the global pneumococcal testing market will observe an increased change in the Basis Point Share (BPS) by nearly 03 units in H1- 2025 (O) as compared to H1-2024.

This was majorly due to the prevalence of high pneumococcal carriage rate among adults and children, adoption of multi-locus sequence analysis (MLSA) for pathogen identification, and high diagnostic yield of pneumococcal testing, promoting this rise in the BPS value.

The key factors boosting the demand for pneumococcal testing are the development of novel biomarkers for rapid disease testing, and the structuring of detection methods for pneumococcal antigens.

Additionally, introduction of pneumococcal conjugate vaccines for invasive pneumococcal disease, and devising of immunization strategies that induce optimum immunogenicity and protection against invasive pneumococcal disease in the elderly have further promoted this surge in the BPS value.

Conversely, challenges linked with the accurate diagnosis of pneumococcal pneumonia will restrain the growth of pneumococcal testing market.

Sales of pneumococcal testing grew at a CAGR of 9.8% between 2020 and 2024.

The pneumonia testing market is developing at a decent rate as pneumonia is a serious disease in which testing aids to detect the disease sooner and further, they can be treated rapidly. Furthermore, the awareness level is rising gradually which leads to early diagnosis, thus promoting the development of pneumonia testing market.

The main clinical syndromes of pneumococcal disease are meningitis, bacteremia, and pneumonia. According to the Centers for Diseases Control and Prevention in 2020, reports that 150,000 hospitalizations occurred from pneumococcal pneumonia yearly in the USA

Pneumococci hold for about 30% of community-acquired pneumonia for adults. Bacteremia happens about 25-30% of pneumococcal pneumonia patients. The case-mortality rate is 5-7% and might be much higher amongst geriatric persons. This is expected to boost the demand for the market.

Considering this, FMI expects the global pneumococcal testing market to grow at a CAGR of 11.2% through 2035.

The high cost of testing and limited reimbursement for new or expensive diagnostic tests are the primary factors hampering the pneumococcal testing market growth.

Diagnostic tools for Legionella comprise antigen detection in urine, culture, immunohistochemistry or direct fluorescent antibody staining, serological testing, and polymerase chain reaction (PCR) testing.

Various commercially accessible urinary antigen tests for Legionella provide a quick diagnosis with high specificity. However, a 2020 study to evaluate the Legionella incidence and to understand the cost effectiveness of the test in Central Texas revealed that the projected cost of screening of population with Legionella urinary antigen testing was around USD 214,871.76 above 13 years, with a price per positive patient of USD 12,640.

Concerns and difficulties about reimbursement for expensive or new diagnostic tests may hinder innovation and are an important challenge to the market growth. Coverage for detection tests differs regionally, and given the absence of standards in determining coverage, this can present challenges for dissemination and development of a new diagnostic method.

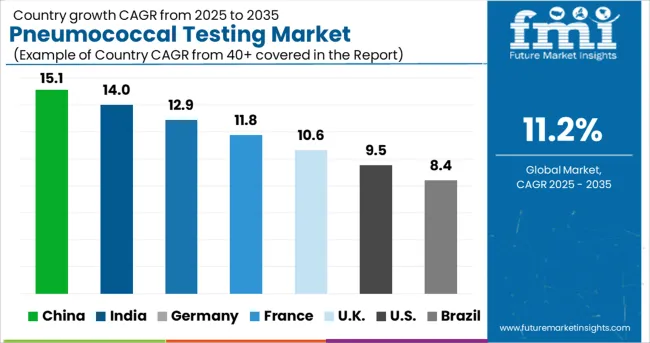

The USA is estimated to account for around 82.9% of the North America pneumococcal testing market in 2025.

USA is anticipated to dominate the pneumonia testing market owing to increasing popularity among the healthcare industry for POC tests, increasing geriatric population, and increasing growth of advanced PCR-based technologies.

For instance, as per the Centers for Disease Control and Prevention (CDC), pneumonia is an eighth primary cause for fatality in U.S. which further result into growth in awareness regarding the disease and further boosts the market.

Also, there are growing product approval and rising product launches that are boosting the overall market in the country. Moreover, with the growing healthcare expenditure and the availability of well-developed healthcare infrastructure is driving the growth of the market in USA.

Germany is estimated to account for 31.3% of the Europe pneumococcal testing market in 2025.

The development of the market in Germany is owing to the initiatives undertaken by the government regarding the growth of healthcare infrastructure, and availability of favorable regulations coupled with the high disease incidence levels in the country. Point-of-care testing is widely used in developed countries owing to high awareness as compared to the developing countries and improved reimbursement policies.

The pneumococcal testing market in China is estimated to be worth USD 2.2 Million in 2025 in the global market.

The key factors fueling the development of the market include growing technological advancement in point-of-care diagnostics devices coupled with rising adoption of inorganic development strategies like agreements and collaborations to produce novel devices. This is projected to drive the market development in China. In addition, rising prevalence of pneumonia and the growing demand for its diagnosis via testing is another key factor adding to the development of the pneumococcal testing market in China.

Demand for pneumococcal testing in India is expected to rise at around 13.7% CAGR over the forecast period.

The rising elderly population and the rising awareness concerning pneumococcal testing are some of the key factors that will drive the market development in the country. The rising geriatric population is more susceptible to pneumonia which is growing the demand for pneumococcal testing.

By method, point of care testing is anticipated to hold the maximum share of 43.0% in 2025, expanding at rate of nearly 11.7% during the forecast period.

POC testing is an innovative technology that is presently an ideal technique for diagnosing pneumonia. The rising adoption of POC testing is owing to growing cases of pneumonia, higher efficiency of POC testing and the rapid test results, growing its preference over other testing methods.

Thus, with the increasing prevalence of chronic diseases and huge customer base adopting the inexpensive and instant diagnostic tests, is boosting the point of care testing. The benefits of POC test to render accurate and rapid results is also aiding in encouraging the patient-centered healthcare at home care settings which leads to adoption of point of care testing and thus encouraging the development of pneumonia testing market.

By Product, analyzers will lead the market and is projected to account for 59.7% of the total market revenue share in 2025.

The several advantages offered by analyzers is increasing the demand for analyzers thus increasing the market share of this segment. The advantages offered by analyzers include optimized time-consuming analytical and testing processes, reliable diagnostic information, accurate and timely analysis of samples and improved patient and wellness care.

In terms of technology, Enzyme Linked Immunosorbent Assay (ELISA) segment in projected to account for 29.7% of the total market share in 2025.

Immunofluorescence, even though, has been the traditional laboratory method in various biological applications, this technology is high-priced and requires trained professionals. ELISA (Enzyme linked immunosorbent assay) has evolved as a substitute method, as it offers high specificity and sensitivity, and is easier to carry out in comparison to other methods for diagnosis of substances in the body.

By end user, hospitals segment is anticipated to hold the maximum share of 55.3% in 2025, expanding at rapid rate of 11.5% CAGR during the forecast period.

The hospital segment is anticipated to dominate due to the higher implementation of advanced diagnostic equipment in hospitals. Also, trends like growing adoption of robotic technology and automation in instruments that enhances the results of diagnostic tests is projected to drive the segment.

Moreover, favorable reimbursement policies for several diagnostic tests is also expected to support hospital segment retain its market share during the forecast period.

Companies operating in the pneumococcal testing market are competitive by nature, with a presence of few players. These players are involved in a number of strategic alliances.

The product launch and acquisition accelerates the manufacturer’s strategy to capitalize on the market share and capture the significant share of market. Some of the recent instances include:

| Attribute | Details |

|---|---|

| Forecast Period | 2020 to 2024 |

| Historical Data Available for | 2025 to 2035 |

| Market Analysis | million for Value |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, UK, France, Italy, Spain, BENELUX, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC Countries, Turkey, South Africa, Northern Africa |

| Key Segments Covered | Method, Product, Technology, End User and Region |

| Key Companies Profiled | Thermo Fisher Scientific Inc; Becton, Dickinson and Company; Abbott Laboratories; F-Hoffmann la Roche Ltd; Hologic, Inc.; bioMerieux; Bio-Rad Laboratories, Inc.; Meridian Biosciences; Quest Diagnostics; Quidel |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global pneumococcal testing market is estimated to be valued at USD 2.2 billion in 2025.

It is projected to reach USD 6.4 billion by 2035.

The market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types are immunodiagnostics, molecular diagnostic and point of care testing.

consumables segment is expected to dominate with a 57.3% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pneumococcal Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA