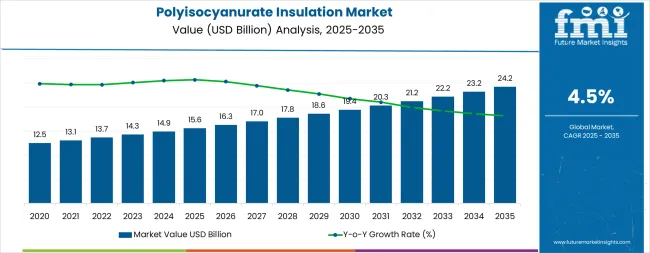

The global polyisocyanurate insulation market is valued at USD 15.6 billion in 2025 and is slated to reach USD 24.2 billion by 2035, recording an absolute increase of USD 8.7 billion over the forecast period. This translates into a total growth of 55.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.5% between 2025 and 2035. The overall market size is expected to grow by nearly 1.56X during the same period, supported by increasing demand for energy-efficient building solutions, growing adoption of stringent building codes and green building certifications, and rising focus on thermal performance improvement across diverse construction applications.

Between 2025 and 2030, the market is projected to expand from USD 15.6 billion to USD 19.4 billion, resulting in a value increase of USD 3.8 billion, which represents 43.7% of the total forecast growth for the decade. This phase of development will be shaped by increasing building code enforcement, rising adoption of energy-efficient construction practices, and growing demand for high-performance insulation materials in commercial roofing and retrofit applications. Building material manufacturers are expanding their polyisocyanurate production capabilities to address the growing demand for green building solutions and enhanced thermal performance products.

| Metric | Value |

|---|---|

| Estimated Value (2025E) | USD 15.6 billion |

| Forecast Value (2035F) | USD 24.2 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

From 2030 to 2035, the market is forecast to grow from USD 19.4 billion to USD 24.2 billion, adding another USD 4.9 billion, which constitutes 56.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of bio-circular content formulations, the integration of TCPP-free flame retardant systems, and the development of high-R-value products for net-zero building applications. The growing adoption of near-zero-energy building standards and renovation wave programs will drive demand for polyisocyanurate insulation with enhanced environmental profiles and minimal thermal bridging characteristics.

Between 2020 and 2025, the market experienced robust growth, driven by increasing focus on building energy efficiency and growing recognition of polyisocyanurate as superior thermal insulation with high R-value per inch. The market developed as construction professionals recognized the potential for polyisocyanurate insulation to reduce heating and cooling costs while meeting increasingly stringent building codes. Technological advancement in foam formulations and lamination technologies began focusing the critical importance of maintaining dimensional stability and fire resistance in high-performance insulation products.

Market expansion is being supported by the increasing global focus on building energy efficiency and the corresponding need for high-performance insulation materials that can deliver superior thermal resistance while maintaining structural integrity across various construction applications. Modern building professionals are increasingly focused on implementing insulation solutions that can reduce energy consumption, minimize environmental impact, and provide long-term performance in commercial and residential buildings. Polyisocyanurate insulation's proven ability to deliver industry-leading R-values, lightweight installation, and moisture resistance make it essential for contemporary building design and energy retrofit solutions.

The growing focus on green building certifications and net-zero construction is driving demand for polyisocyanurate insulation that can support LEED, BREEAM, and passive house standards through enhanced thermal performance and reduced carbon footprint. Building material manufacturers' preference for insulation products that combine thermal efficiency with fire resistance and dimensional stability is creating opportunities for innovative polyisocyanurate implementations. The rising influence of building code regulations and energy performance mandates is also contributing to increased adoption of polyisocyanurate insulation that can provide compliant solutions for roof assemblies, wall systems, and below-grade applications without excessive thickness or weight penalties.

The polyisocyanurate insulation market is poised for ecofriendly growth and transformation. As building owners, architects, and contractors across both developed and emerging markets seek insulation solutions that are energy-efficient, code-compliant, cost-effective, and environmentally responsible, polyisocyanurate is gaining prominence not just for commercial roofing but as strategic material in façade systems, cold storage, and industrial applications.

Rising construction activity in Asia Pacific, renovation wave programs in Europe, and code-driven retrofits in North America amplify demand, while manufacturers are innovating in bio-based polyols, halogen-free flame retardants, and digital production technologies.

Pathways like environmental compliance, ultra-high-R formulations, and automation-led efficiency promise strong margin uplift, especially in mature markets. Geographic expansion and localization will capture volume, particularly where cold-chain infrastructure and modern logistics facilities are expanding rapidly. Regulatory pressures around energy codes, fire safety, and chemical restrictions give structural support.

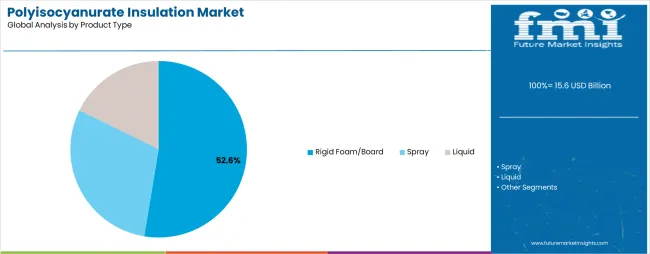

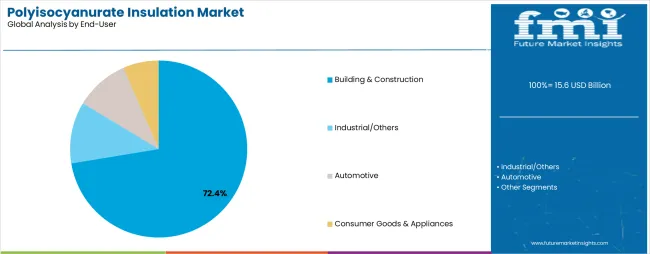

The market is segmented by product type, application, end-user, and region. By product type, the market is divided into rigid foam/board, spray, and liquid. By application, it covers thermal, acoustic, and hybrid (thermal+acoustic). Based on end-user, the market is categorized into building & construction, industrial/others, automotive, and consumer goods & appliances. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The rigid foam/board segment is projected to account for 52.6% of the market in 2025, reaffirming its position as the leading product category. Building professionals increasingly utilize rigid polyisocyanurate boards for their superior thermal resistance per inch, dimensional stability, and ease of installation in commercial roofing, wall systems, and below-grade applications. Rigid foam technology's advanced performance capabilities and consistent quality output directly address the construction industry requirements for reliable thermal performance and long-term durability in building envelope assemblies.

This product segment forms the foundation of modern building insulation systems, as it represents the material with the greatest thermal efficiency and established market demand across multiple construction categories and application types. Manufacturer investments in enhanced lamination technologies and facer systems continue to strengthen adoption among building professionals. With construction companies prioritizing R-value optimization, fire resistance, and installation efficiency, rigid polyisocyanurate boards align with both code compliance objectives and project performance requirements, making them the central component of comprehensive building envelope strategies.

Building & construction is projected to represent 72.4% of polyisocyanurate insulation demand in 2025, underscoring its critical role as the primary end-user category for thermal insulation applications in commercial, residential, and institutional buildings. Construction companies prefer polyisocyanurate insulation for its exceptional thermal performance, lightweight characteristics, and ability to meet stringent building codes while reducing energy consumption and operational costs. Positioned as essential material for modern energy-efficient construction, polyisocyanurate offers both performance advantages and economic benefits.

The segment is supported by continuous innovation in building envelope design and the growing availability of specialized insulation systems that enable net-zero construction with optimized wall and roof assemblies. Building material manufacturers are investing in production capacity expansion to support large-volume construction projects and green building certifications. As energy code requirements become more stringent and deep retrofit demand increases, building & construction will continue to dominate the end-user market while supporting advanced insulation implementations and ecofriendly building strategies.

The market is advancing rapidly due to increasing building energy code enforcement and growing adoption of high-performance insulation materials that provide superior thermal resistance with minimal thickness across diverse construction applications. The expansion of energy efficiency mandates, green building certification programs, and net-zero construction targets is enabling building professionals to specify polyisocyanurate insulation with confidence in long-term performance and code compliance. Code-tight retrofits in commercial buildings, renovation wave programs in Europe, and tax-advantaged energy upgrades in North America are driving constant demand for High-R-value insulation solutions.

The market faces challenges, including raw material price volatility affecting MDI and polyol costs, regulatory concerns regarding certain flame retardant systems, and competition from alternative insulation technologies including mineral wool and extruded polystyrene. The transition away from halogenated flame retardants in some markets requires reformulation investments and performance validation. Quality control requirements for dimensional stability, compressive strength, and long-term thermal resistance necessitate advanced manufacturing capabilities and rigorous testing protocols.

Innovation in bio-circular content integration, TCPP-free flame retardant systems, and automated continuous lamination technologies continues to influence product development and market expansion patterns. Carlisle Construction Materials' launch of Polyiso Eco with 5% bio-circular content demonstrates industry commitment to sustainable chemistry, while GAF's introduction of TCPP-free EnergyGuard NH polyiso at standard pricing addresses regulatory concerns without cost penalties. These technologies improve environmental profiles while enabling new applications in health-conscious building segments and chemically-sensitive environments.

The growing focus on renovation and retrofit is driving manufacturers to develop specialized products for re-roofing, façade upgrades, and thermal bridge mitigation. Prefabricated panel systems with integrated facers and edge profiles support offsite construction and continuous insulation requirements. Advanced formulations achieving R-7+ per inch enable thin-profile solutions for space-constrained applications while maintaining code-required thermal performance. Regional manufacturing expansion in high-growth Asian markets reduces logistics costs and improves supply chain resilience, supporting local construction industry growth and cold-chain infrastructure development.

| Country | CAGR (2025-2035) |

|---|---|

| India | 5.6% |

| China | 5.3% |

| Germany | 4.9% |

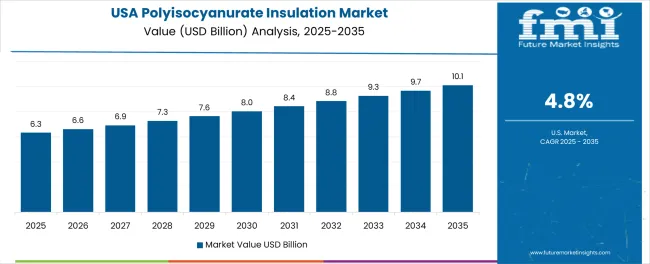

| USA | 4.8% |

| UK | 4.6% |

| France | 4.4% |

| Canada | 4.2% |

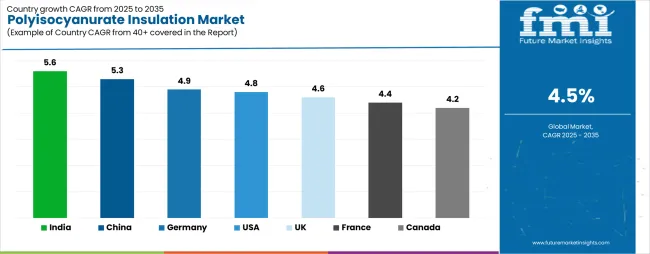

The market is experiencing strong growth globally, with India leading at a 5.6% CAGR through 2035, driven by fast growth in commercial real estate and temperature-controlled warehousing. China follows at 5.3%, supported by cold-chain expansion and modern logistics parks with rising green building certifications. Germany shows growth at 4.9%, prioritizing Renovation Wave funding and high-spec façade/roof systems. The USA records 4.8%, focusing on code-tight retrofits and commercial roofing. The UK demonstrates 4.6% growth, prioritizing social housing upgrades. France exhibits 4.4% growth, supported by RE2020-driven newbuild intensity. Canada shows 4.2% growth, prioritizing net-zero codes and cold-climate performance.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

India is projected to exhibit exceptional growth with a CAGR of 5.6% through 2035, driven by fast growth in commercial real estate, temperature-controlled warehousing, and modern logistics infrastructure supported by government urbanization initiatives. The country's rapid cold-chain development and increasing focus on energy-efficient building design are creating substantial demand for high-performance insulation solutions. Major construction companies and material suppliers are establishing comprehensive distribution capabilities to serve both metropolitan centers and emerging commercial corridors.

China is expanding at a CAGR of 5.3%, supported by the country's cold-chain expansion, modern logistics park development, and increasing adoption of green building certifications in commercial and industrial construction. The country's comprehensive infrastructure investment and growing focus on energy efficiency are driving demand for advanced insulation technologies. International material suppliers and domestic manufacturers are establishing extensive production and distribution capabilities to address growing demand for thermal insulation products.

Germany is expanding at a CAGR of 4.9%, supported by the country's Renovation Wave funding programs, high-specification façade and roof systems in industrial construction, and strong focus on energy efficiency in building retrofits. The nation's leadership in building energy standards and comprehensive renovation initiatives are driving sophisticated insulation capabilities throughout the construction sector. Leading manufacturers and material suppliers are investing extensively in advanced product development to serve both new construction and deep retrofit markets.

The USA is growing at a CAGR of 4.8%, driven by code-tight retrofits, commercial roofing re-covers, and tax-advantaged energy upgrade programs including 179D deductions. The country's mature commercial real estate market and strong focus on building performance are supporting demand for proven insulation technologies across major metropolitan markets. Manufacturers and roofing contractors are establishing comprehensive service capabilities to support both new construction and retrofit applications.

The UK is expanding at a CAGR of 4.6%, supported by social housing upgrade programs, non-domestic Part L improvements, and growing focus on building energy performance in both residential and commercial sectors. The country's focus on decarbonization and building stock improvement are driving demand for high-efficiency insulation solutions. Material suppliers are establishing comprehensive distribution to serve both social housing providers and commercial contractors throughout England, Scotland, and Wales.

France is growing at a CAGR of 4.4%, driven by RE2020 enforcement requiring enhanced insulation intensity in newbuild construction and public sector renovation programs targeting existing building stock. The country's ambitious carbon reduction targets and comprehensive building regulation framework are driving demand for ecofriendly insulation technologies. Manufacturers are investing in local production to serve both residential and commercial construction markets.

Canada is expanding at a CAGR of 4.2%, supported by net-zero building codes in leading provinces, cold-climate envelope performance requirements, and growing focus on energy efficiency in both residential and commercial construction. The country's extreme climate conditions and progressive building standards are driving demand for high-thermal-resistance insulation solutions. Manufacturers are establishing regional distribution to serve major urban markets including Toronto, Vancouver, and Montreal.

The polyisocyanurate insulation market in Europe is projected to grow from USD 5.9 billion in 2025 to USD 9.0 billion by 2035, registering a CAGR of 4.3% over the forecast period. Germany is expected to maintain its leadership position with a 25.5% market share in 2025, declining slightly to 25.2% by 2035, supported by its deep-retrofit funding programs, high-performance roof and façade specifications in industrial and logistics builds, and comprehensive building energy efficiency framework.

France follows with a 15.5% share in 2025, projected to reach 15.8% by 2035, driven by RE2020 enforcement and public-sector renovation pipelines, robust demand for polyisocyanurate insulation in newbuild residential construction, combined with growing focus on carbon intensity reduction and bio-based material integration. The United Kingdom holds a 16.0% share in 2025, expected to decrease to 15.8% by 2035, supported by social housing upgrades and non-domestic Part L improvements but facing challenges from post-Brexit supply chain adjustments and market consolidation pressures. Italy commands an 11.0% share in 2025, projected to reach 10.8% by 2035, while Spain accounts for 8.5% in 2025, expected to reach 9.0% by 2035. Nordic countries collectively represent 7.5% in 2025, growing to 7.8% by 2035. The Rest of Europe region, including BENELUX, Central and Eastern Europe, and others, is anticipated to ease from 16.0% share in 2025 to 15.6% by 2035, attributed to faster scaling in core Western EU markets while CEE modernization steadily advances across Poland, Czech Republic, and Baltic states.

The market is characterized by competition among established building material manufacturers, specialized insulation producers, and integrated roofing system suppliers. Companies are investing in advanced formulation research, production capacity expansion, environmental compliance initiatives, and comprehensive product portfolios to deliver consistent, high-performance, and code-compliant polyisocyanurate insulation solutions. Innovation in bio-circular content, halogen-free flame retardants, and automated manufacturing processes is central to strengthening market position and competitive advantage.

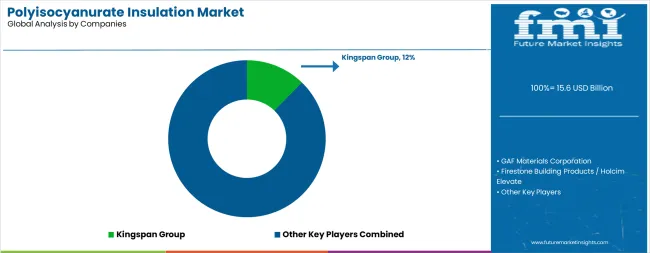

Kingspan Group leads the market with a 12.5% share, offering comprehensive insulation solutions with focus on thermal performance, sustainable chemistry, and integrated building envelope systems. GAF Materials Corporation provides specialized commercial roofing products with focus on TCPP-free formulations and warranty programs. Firestone Building Products delivers innovative roofing and insulation systems with focus on single-ply membrane integration. Carlisle Construction Materials specializes in high-performance polyiso boards with bio-circular content and comprehensive roofing accessories. Soprema Group focuses on European markets with focus on renovation applications and technical support. Atlas Roofing Corporation offers cost-competitive polyiso products for residential and commercial roofing markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 15.6 billion |

| Product Type | Rigid Foam/Board, Spray, Liquid |

| Application | Thermal, Acoustic, Hybrid (Thermal+Acoustic) |

| End-User | Building & Construction, Industrial/Others, Automotive, Consumer Goods & Appliances |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, Italy, Spain, China, India, Japan, Australia and 40+ countries |

| Key Companies Profiled | Kingspan Group, GAF Materials Corporation, Firestone Building Products, Carlisle Construction Materials, Soprema Group, and Atlas Roofing Corporation |

| Additional Attributes | Dollar sales by product type and end-user category, regional demand trends, competitive landscape, technological advancements in foam formulations, environmental compliance developments, bio-circular content integration, and building code evolution |

The global polyisocyanurate insulation market is estimated to be valued at USD 15.6 billion in 2025.

The market size for the polyisocyanurate insulation market is projected to reach USD 24.2 billion by 2035.

The polyisocyanurate insulation market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in polyisocyanurate insulation market are rigid foam/board, spray and liquid.

In terms of end-user, building & construction segment to command 72.4% share in the polyisocyanurate insulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Polyisocyanurate Insulation in EU Size and Share Forecast Outlook 2025 to 2035

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Insulation Coatings Market Size and Share Forecast Outlook 2025 to 2035

Insulation Boards Market Size and Share Forecast Outlook 2025 to 2035

Insulation Testing Instrument Market Size and Share Forecast Outlook 2025 to 2035

OEM Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cork Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Wool Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Market Growth - Trends & Forecast 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

Market Leaders & Share in the Pipe Insulation Products Industry

Tank Insulation Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA