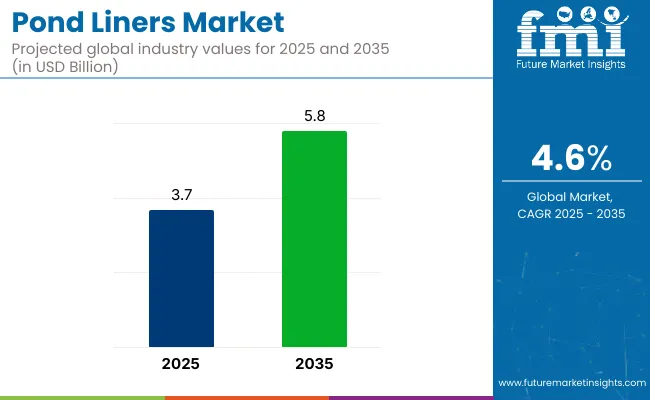

In 2025, the pond liners industry is valued at USD 3.7 billion and is projected to grow to USD 5.8 billion by 2035, reflecting a CAGR of 4.6%. The industry is experiencing steady growth, driven by expanding applications in various industries such as agriculture, water management, and environmental protection.

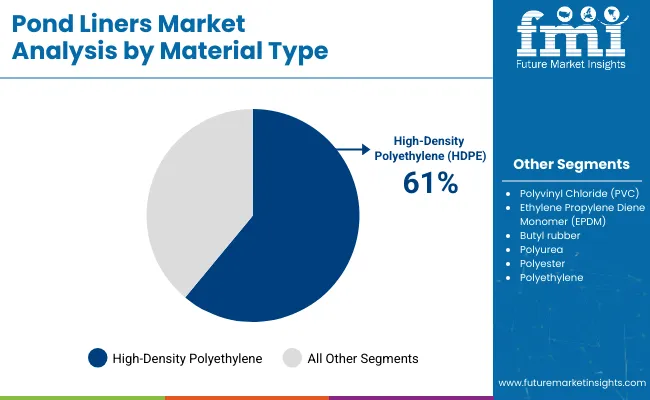

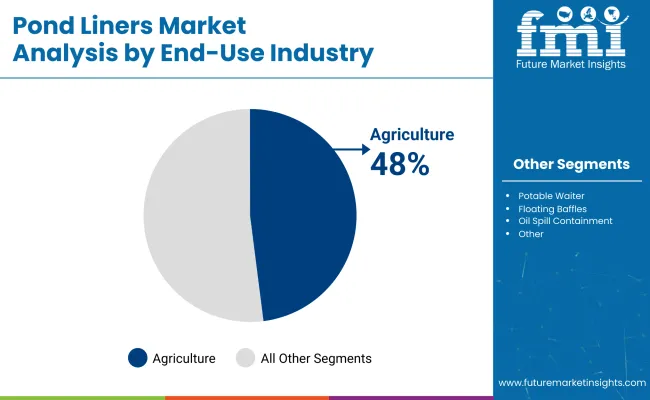

High-Density Polyethylene (HDPE) is expected to maintain its dominance in the material segment, accounting for 61% of the industry share in 2025. The agriculture sector is the largest end-use industry, holding a 48% share of total demand. The rising adoption of pond liners in water management and oil spill containment is further boosting industry growth.

In February 2025, COMANCO Environmental Corporation launched an extensive pond liner rehabilitation project at a Florida site, focusing on gypsum stack pond areas. The initiative involves the installation of 80 mil high-density polyethylene (HDPE) liners to improve environmental containment and enhance eco-friendly practices. The project includes the use of advanced engineering techniques, such as the deployment of five miles of dual-contained HDPE pipe.

The industry holds a specific share in various parent markets. Within the waterproofing materials market, the pond liners market contributes approximately 3-5%, as it focuses on specialized applications like ponds and water containment. In the geosynthetics market, it accounts for around 7-10%, driven by the use of geotextiles and other synthetic materials for water management and containment.

In the agricultural film market, the pond liners sector holds about 2-4%, as pond liners are sometimes used for irrigation purposes. Within the construction materials market, the share is estimated at 1-3%, as pond liners are used in construction for water retention and landscaping. In the landscaping products market, pond liners make up about 6-8%, due to their popularity in garden and recreational pond designs.

The industry is mainly driven by material type and end-use industries. HDPE is expected to dominate in the material segment, while agriculture will continue to lead in end-use applications.

High-Density Polyethylene (HDPE) is projected to lead the material segment, holding 61% of the share in 2025.

Agriculture is the largest end-use industry for pond liners, accounting for 48% of industry demand in 2025. Pond liners in agriculture are crucial for water containment, improving irrigation efficiency, and maintaining soil stability.

The industry is growing steadily, fueled by rising demand from agriculture, water management, and environmental protection. However, challenges such as fluctuating raw material prices and regulatory hurdles are hindering further expansion.

Rising demand for eco-friendly water containment solutions

The demand for pond liners is rising due to the increasing need for efficient water management, especially in agriculture. As the focus on water conservation and eco-friendly irrigation systems intensifies, pond liners, particularly HDPE-based solutions, are being preferred for their durability, UV resistance, and cost-effectiveness. These liners play a major role in preserving water resources, making them important in regions facing water scarcity. The shift toward eco-friendly farming practices will continue to drive growth in the industry.

Raw material price fluctuations and regulatory challenges

The industry faces challenges due to price volatility in key raw materials such as HDPE, PVC, and EPDM. This price fluctuation impacts manufacturing costs, which in turn affect industry pricing. Additionally, increasing environmental regulations on production processes and disposal practices are raising operational costs for manufacturers. While these challenges present barriers to growth, large players with better economies of scale are better equipped to handle these pressures, continuing to drive industry growth.

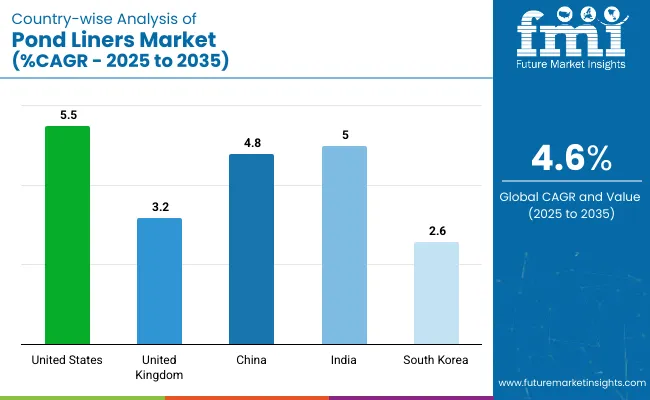

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.5% |

| United Kingdom | 3.2% |

| China | 4.8% |

| India | 5% |

| South Korea | 2.6% |

In the global context, OECD countries, including the United States and the United Kingdom, are witnessing steady growth. The United States, projected to grow at a CAGR of 5.5% from 2025 to 2035, is driven by agricultural and environmental demands. The agricultural sector’s adoption of pond liners for efficient water management plays a key role, with companies like GSE Environmental LLC and BTL Liners which produce durable, UV-resistant HDPE liners.

In the United Kingdom, expected to grow at 3.2% CAGR, eco-conscious consumer demand and government regulations on water management are driving growth. Companies like Reef Industries and Stephens Industries are innovating eco-friendly solutions, primarily catering to the agricultural sector.

In the BRICS group, India is projected to grow at 5% CAGR, driven by the agricultural sector’s focus on water conservation and efficient irrigation. Companies like Emmbi Industries Limited are expanding their product offerings to meet the growing demand. China, with a projected CAGR of 4.8%, is driven by water conservation initiatives.

Companies like HongXiang New Geo-Material Co. Ltd and Huadun Snowflake are ramping up production. In ASEAN, South Korea shows steady growth at 2.6% CAGR, supported by government initiatives and the need for efficient water management.

The report covers in-depth analysis of 40+ countries. The top five countries are highlighted below.

The United States pond liners market is projected to grow at a CAGR of 5.5% through 2035, driven by agricultural and environmental demands. The agriculture sector, particularly, is adopting pond liners for efficient water management and irrigation practices. Companies like GSE Environmental LLC and BTL Liners produce durable, UV-resistant HDPE liners suitable for agriculture and water containment. These advancements are boosting growth.

The UK pond liners market is expected to grow at a CAGR of 3.2% through 2035, driven by eco-conscious consumers and government regulations on water management. The agriculture sector has farmers adopting pond liners for efficient irrigation. Companies like Reef Industries and Stephens Industries are innovating eco-friendly, high-performance liners. Government initiatives and environmental protection priorities further drive the adoption, ensuring continued industry expansion.

China’s pond liners market is expected to grow at a CAGR of 4.8% through 2035, driven by a focus on water conservation. The agricultural sector is adopting pond liners to manage water resources efficiently, while industrial use, such as oil spill containment, is also rising. Companies like HongXiang New Geo-Material Co. Ltd and Huadun Snowflake are ramping up production to meet growing demand. Government policies encouraging healthy farming practices are expected to continue driving the growth forward.

India’s pond liners market is projected to grow at a CAGR of 5% through 2035, primarily driven by the agricultural sector’s focus on efficient water management. Pond liners help reduce water loss, supporting improved irrigation systems. Companies like Emmbi Industries Limited are expanding their product offerings to meet demand in both rural and urban areas. With India’s modernization of farming practices, demand for efficient water containment and conservation solutions is expected to rise steadily.

South Korea’s pond liners market is projected to grow at a CAGR of 2.6% through 2035, supported by the agriculture sector’s need for efficient irrigation and water management. The government’s focus on water conservation systems for residential and industrial applications is further accelerating demand. The demand in both agricultural and industrial sectors is expected to grow steadily, driven by efficient water containment needs.

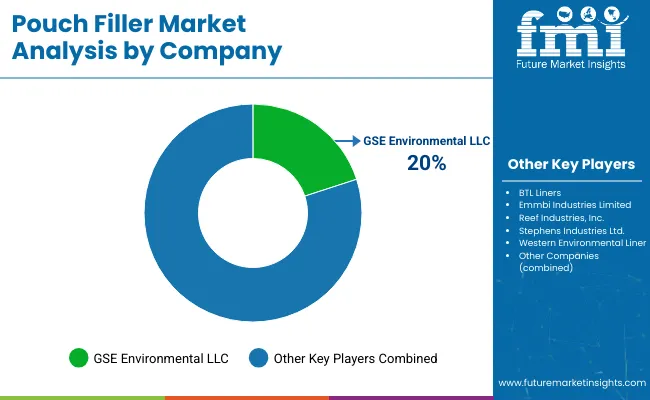

Leading: GSE Environmental LLC, 20% share

The pond liner market is characterized by a mix of dominant players and emerging companies that leverage various strategies to strengthen their position. Top suppliers such as Aquascape, Inc., BTL Liners, and CARLISLE® Construction Materials Ltd. focus on product innovation and research and development (R&D) to maintain competitiveness.

For instance, BTL Liners has expanded its product offerings by incorporating eco-friendly materials, catering to the growing demand for ecofriendly solutions. Additionally, companies like Industrial & Environmental Concepts, Inc. and Mypondliner are actively investing in technological advancements to improve product durability and efficiency.

The industry, while large, is somewhat fragmented due to the presence of both established suppliers and smaller, regional players such as Fab-Seal Industrial Liners, Inc. and DLM Plastics. Entry barriers are moderate, with new players needing to overcome challenges like the high cost of raw materials and the need for extensive distribution networks. Consolidation is gradually taking place.

Recent Pond Liners Industry News

| Report Attributes | Details |

|---|---|

| Current Total Size (2025) | USD 3.7 billion |

| Projected Market Size (2035) | USD 5.8 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and kilotons for volume |

| Material Types Analyzed | High-Density Polyethylene (HDPE), Polyvinyl Chloride (PVC), Ethylene Propylene Diene Monomer (EPDM), Butyl Rubber, Polyurea, Polyester, Polyethylene |

| End-Use Industry Segmentation | Agriculture, Potable Water, Floating Baffles, Oil Spill Containment, Other Applications |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Market | Aquascape, Inc., Industrial & Environmental Concepts, Inc., BTL Liners, Fab-Seal Industrial Liners, Inc., Mypondliner, DLM Plastics, Tarp PVC, CARLISLE® Construction Materials Ltd., and Inspired By Water Ltd. |

| Additional Attributes | Dollar sales by material type, end-use industry, and region, growing adoption in agricultural applications, trends in green pond liner materials, regional growth in oil spill containment and potable water industries, increasing demand in industrial and environmental applications. |

High-Density Polyethylene (HDPE), Polyvinyl Chloride (PVC), Ethylene Propylene Diene Monomer (EPDM), butyl rubber, polyurea, polyester, and polyethylene.

Agriculture, potable water, floating baffles, oil spill containment, and other applications.

North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa.

The global pond liners industry is projected to reach USD 5.8 billion by 2035.

The industry is expected to be valued at USD 3.7 billion in 2025.

HDPE (High-Density Polyethylene) will lead the material segment, capturing 61% of the industry share in 2025.

Agriculture will hold the largest industry share, accounting for 48% of demand in 2025.

India is expected to have the highest growth rate, with a projected CAGR of 6.3% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Correspondence Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Axial Spondyloarthritis Management Market Analysis by Types, End-User, Drug Class, and Region through 2035

Ankylosing Spondylitis Treatment Market – Growth & Forecast 2022-2032

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Box Liners Companies

Pan Liners Market

Tray Liners Market

Panty Liners Market

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Carton Liners Market Size and Share Forecast Outlook 2025 to 2035

Cheese Liners Market

Medical Liners Market Size and Share Forecast Outlook 2025 to 2035

Bladder Liners Market Growth – Trends & Forecast 2025 to 2035

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Understanding Market Share Trends in Foam Cap Liners

Commodity Liners Market Size and Share Forecast Outlook 2025 to 2035

Patient Recliners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA